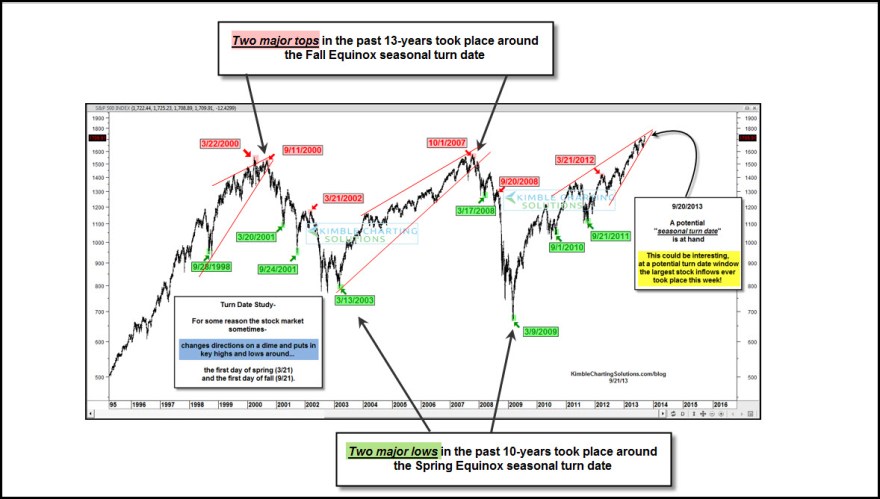

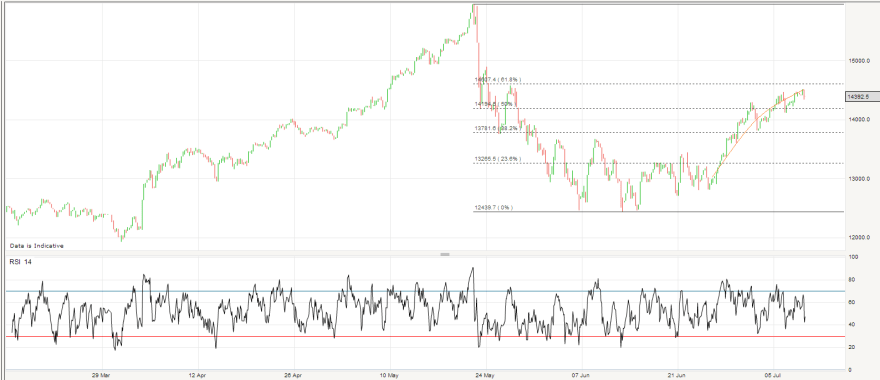

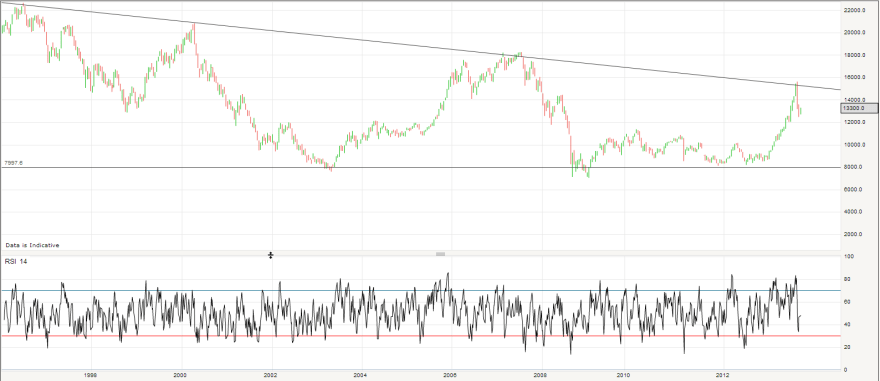

Last week, stock indices largely printed bearish shooting star candles (on a weekly view, up into and on FOMC output then reversal of gains Thu and Fri), which also looks like a potential lunar inversion, and a potential important Equinox reversal too. The Equinox was 22 September to be precise, and Gann found this date/event often marked major tops in history (on or very close). Chris Kimble has also produced this (hat tip Gary) below, and notes last week produced an all-time record for inflows into equity funds worldwide:

Source: Chris Kimble

As various stock indices were at important breakout levels, and ended Friday retesting those levels (having jumped above then fallen around the FOMC), then a breakdown in the first part of this week would make things look more bearish, because we would have a shooting star fake-out and more of a trend supporting lunar / equinox reversal.

Chris Puplava pointed out overbought signals as other reasons for a pullback (although he still sees no threat to the ongoing bull market). I have added vertical lines to his summary picture to view more clearly what happened to the SP500 on previous occurences, namely sharp uptrends gave way to more sideways ranges:

Underlying Source: Chris Puplava

Underlying Source: Chris Puplava

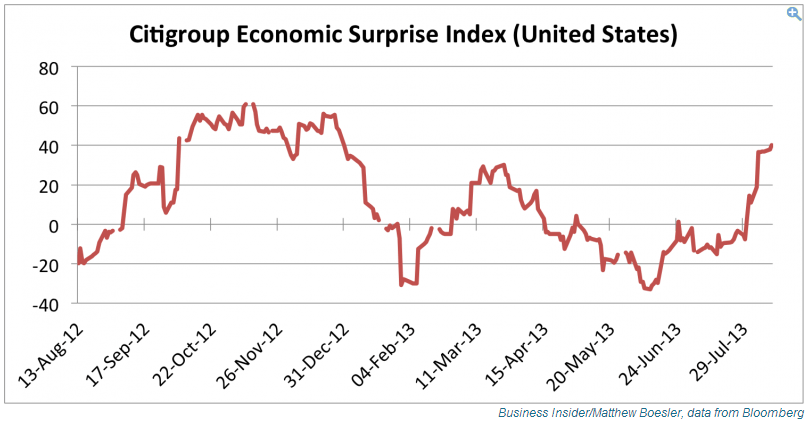

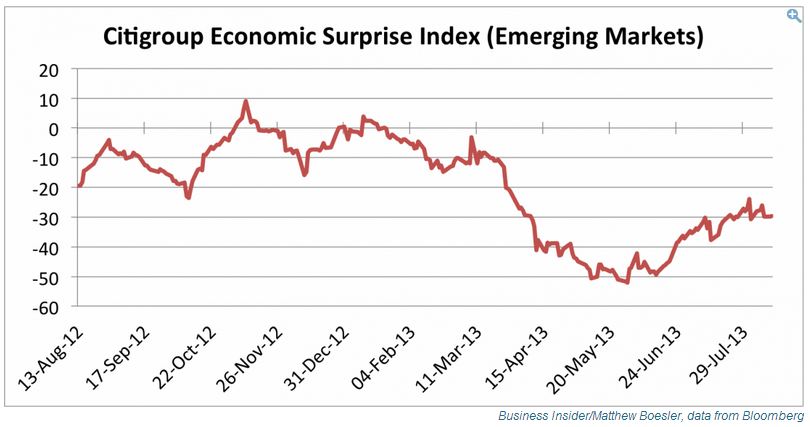

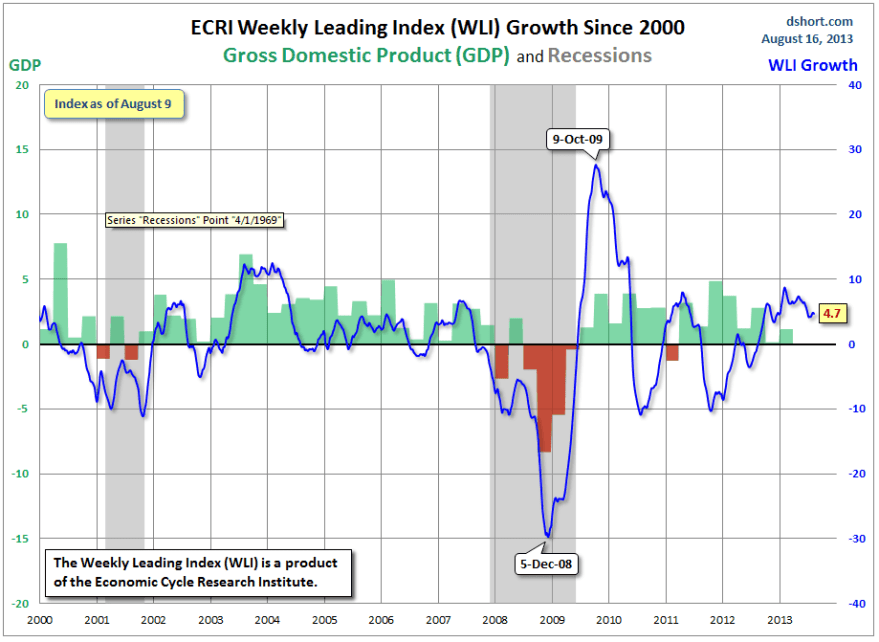

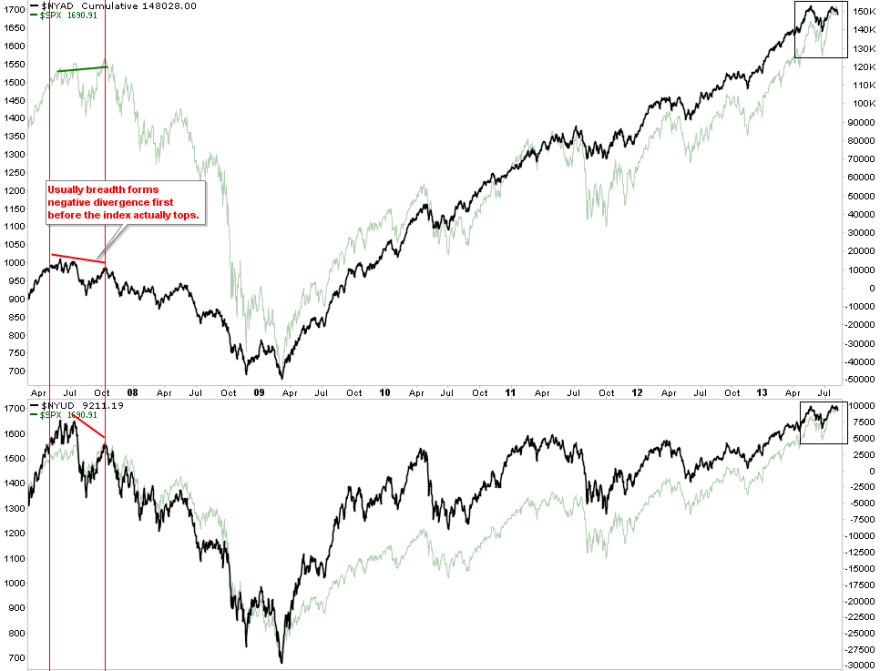

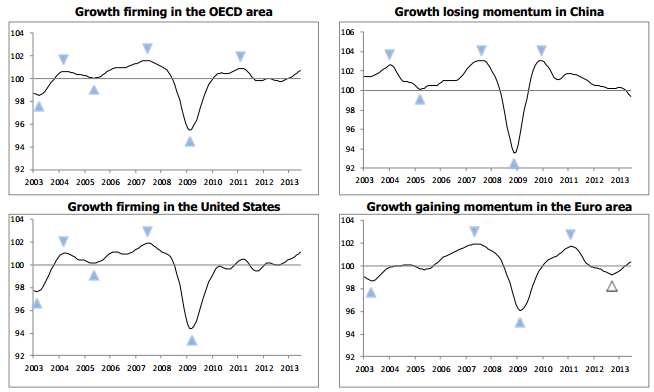

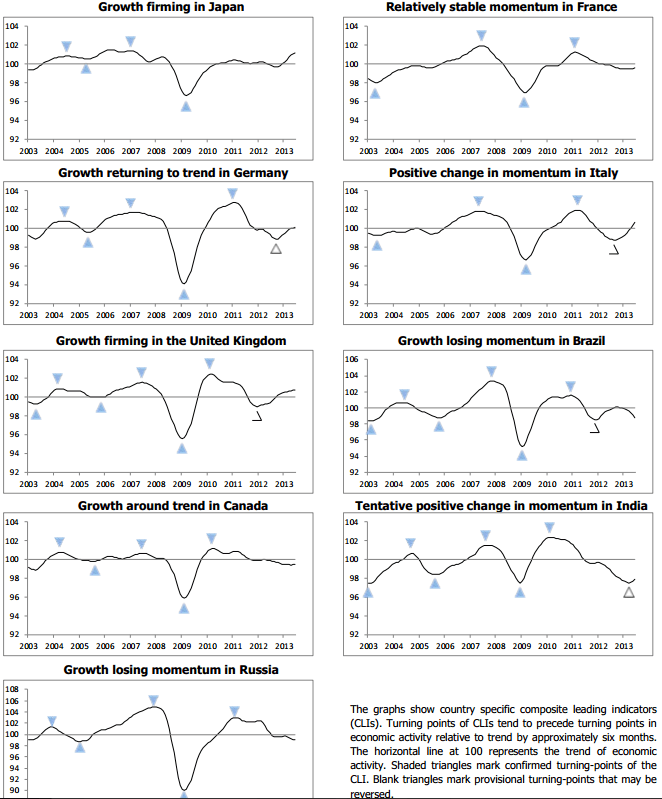

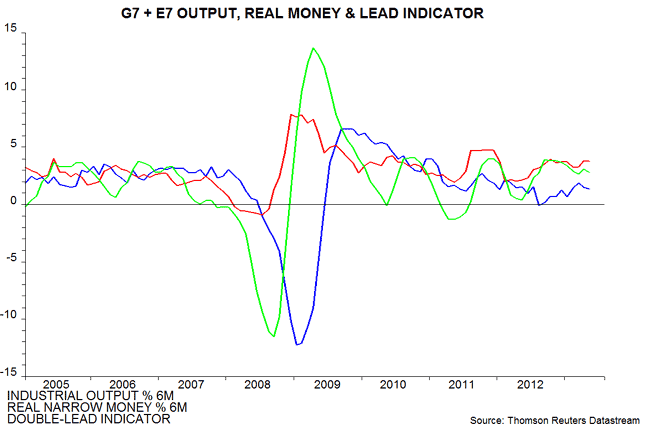

Leading indicators remain overall positive. For example, US CB and ECRI leading indicators were both good readings last week. This is supportive for stocks. On the flip side, we have seen some breadth divergences, which would be one topping process sign, and we know margin debt is at lofty levels.

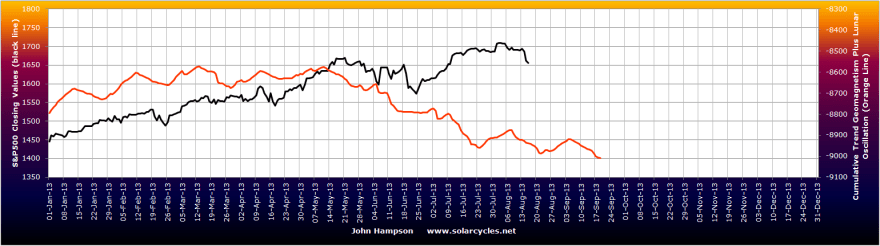

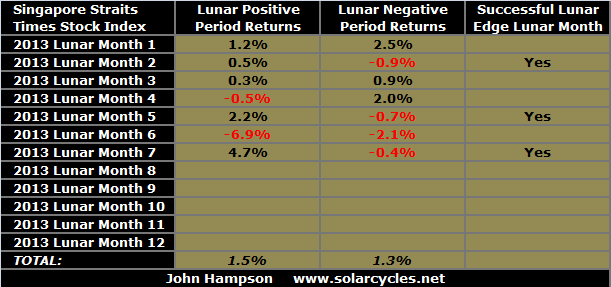

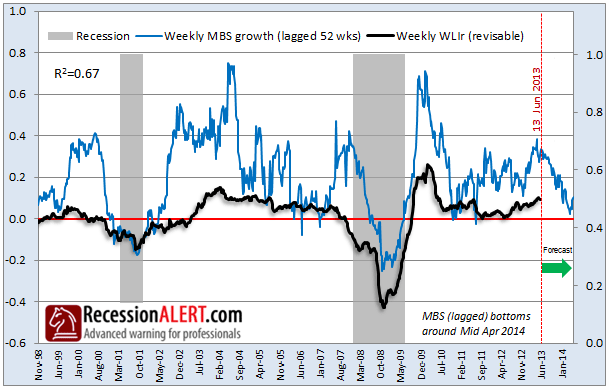

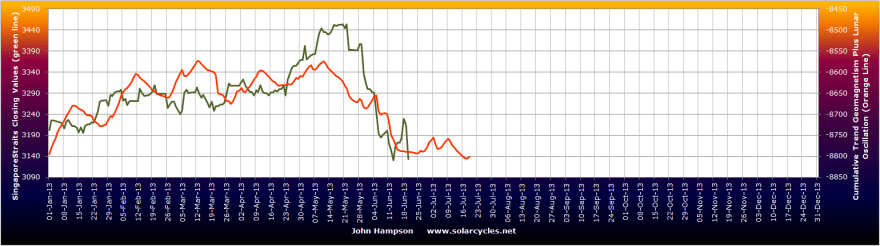

Here is the latest geomagnetism forecast (with lunar oscillation). Overall flattish, but with a slight upward bias. I noted previously that the lunar positive fortnight from today plus the relatively benign geomagnetism could make me long-biased. However, if we have seen a lunar inversion then we could see down rather than up this week, which would negate that edge.

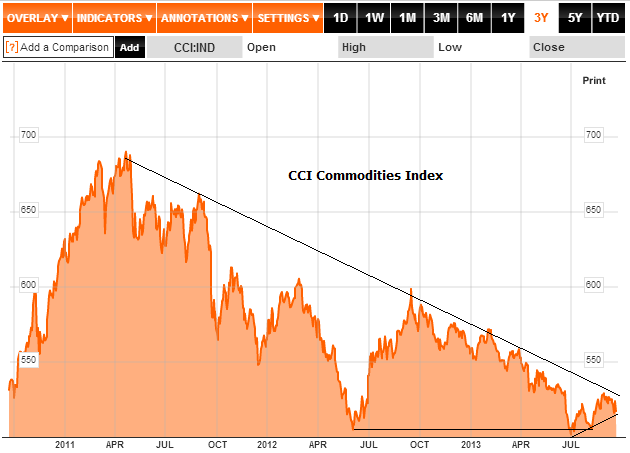

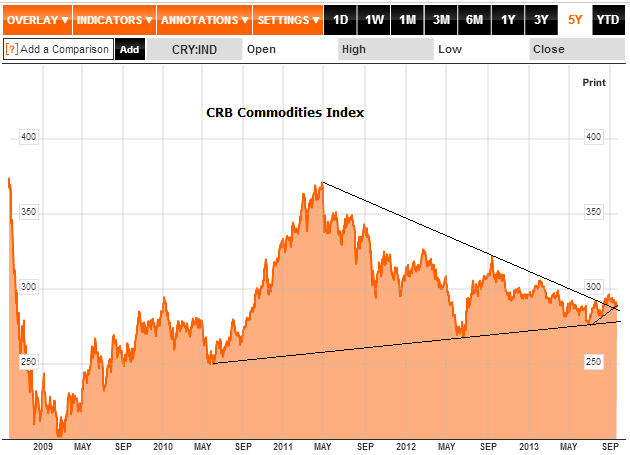

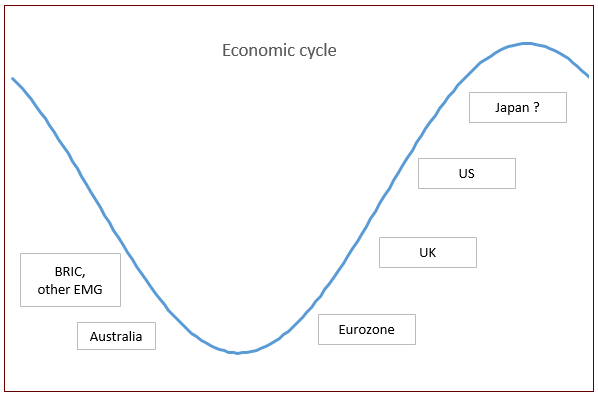

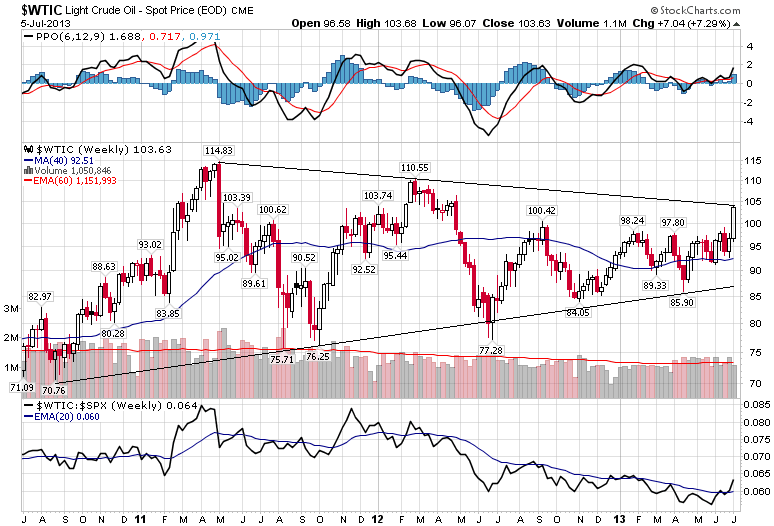

Let me bring in commodities. When stocks retreated in July/August we saw commodities gain interest, which was also a potential sign of a topping process in stocks, as historically we have seen commodities rally last as (and after) stocks top out. Since then we have seen money flow back the other way. This is how we stand on the CCI and CRB commodity indices:

Let me bring in commodities. When stocks retreated in July/August we saw commodities gain interest, which was also a potential sign of a topping process in stocks, as historically we have seen commodities rally last as (and after) stocks top out. Since then we have seen money flow back the other way. This is how we stand on the CCI and CRB commodity indices:

Hopefully it is evident from the two charts combined that commodities have the potential to break into a bull rally here. However, it is just potential, and time is of the essence. If the CRB is to break upwards then it has to make the current backtest of the breakout stick, and pull upwards from here.

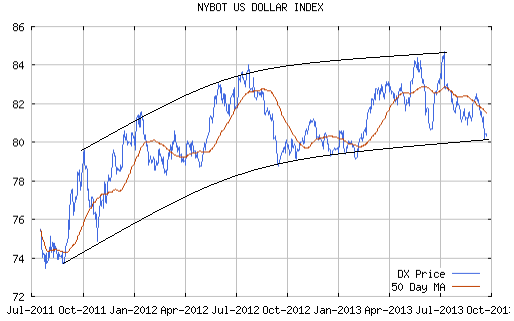

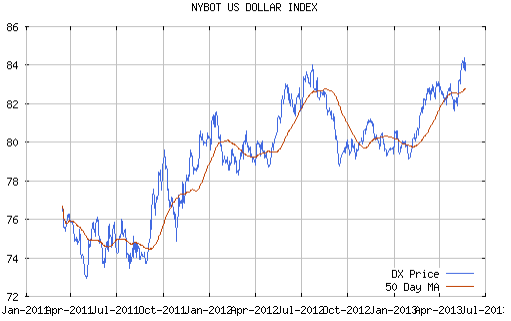

Here is the US dollar index. See how it has arched over and is now threatening breakdown. A bearish break would benefit commodities and provide one ingredient for that potential rally.

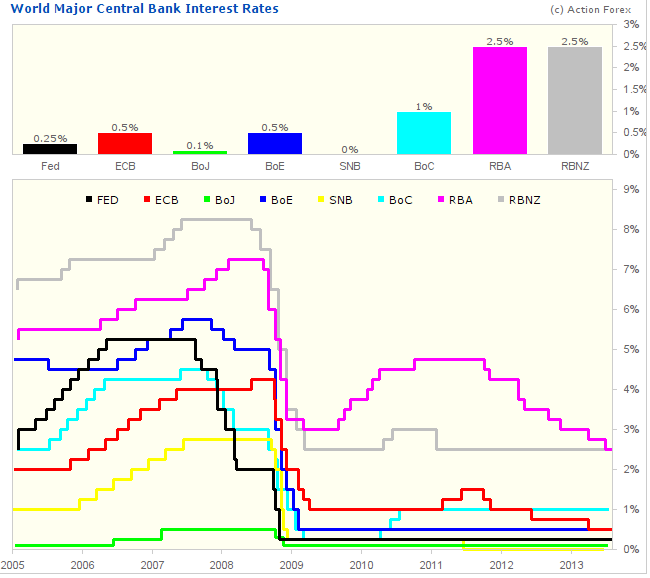

Also, here is a chart from Chris Carolan showing how the Euro has the potential to escalate against the USD based on relative central bank money printing:

http://spiralcalendar.com/wp-content/uploads/2013/09/092213eurbal.gif

As the Euro is the biggest component of the US Dollar index, that then is a possible breakdown catalyst.

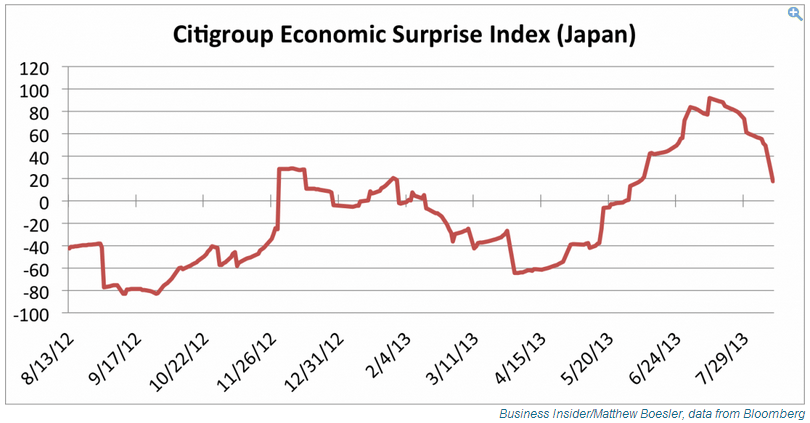

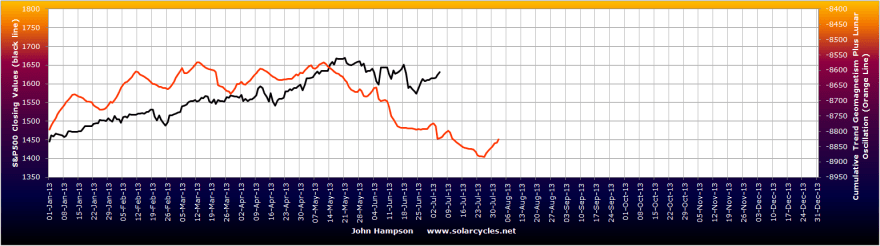

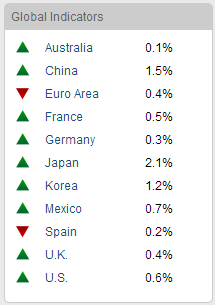

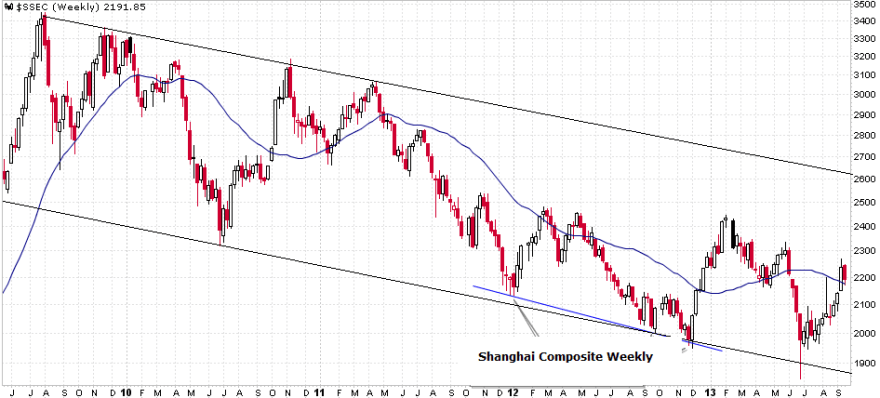

Another factor for commodities is China, as their biggest consumer. Today’s Markit manufacturing PMI came in at 51.2, a 6-month high for China. The stock market has also picked up the last two months and has the potential to run up to the top of this channel:

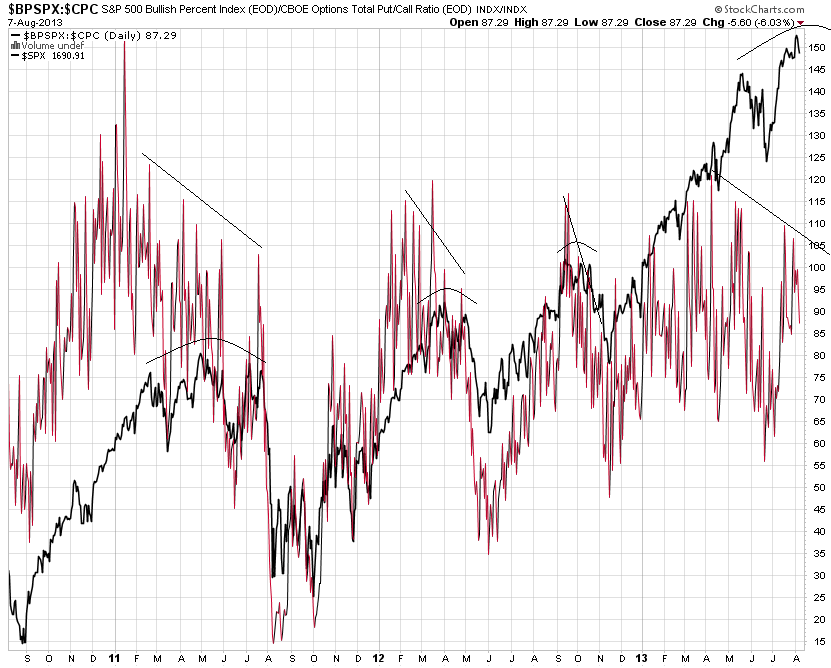

Underlying Source: Cobra / Stockcharts

Underlying Source: Cobra / Stockcharts

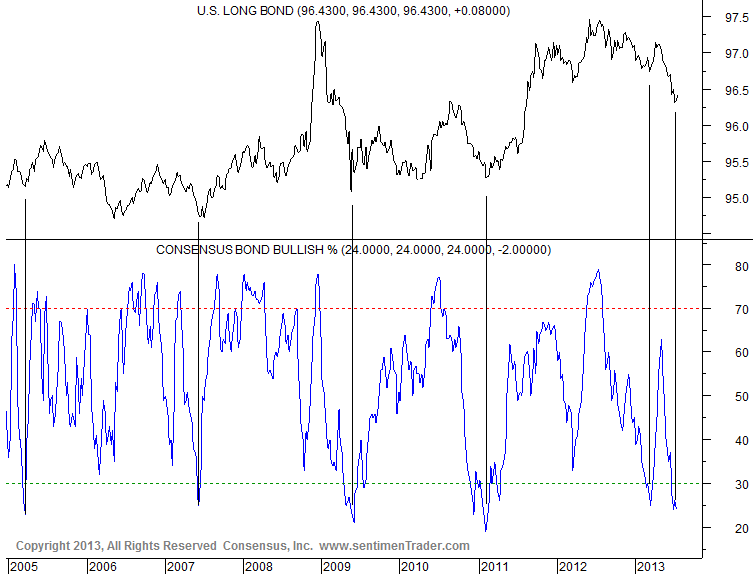

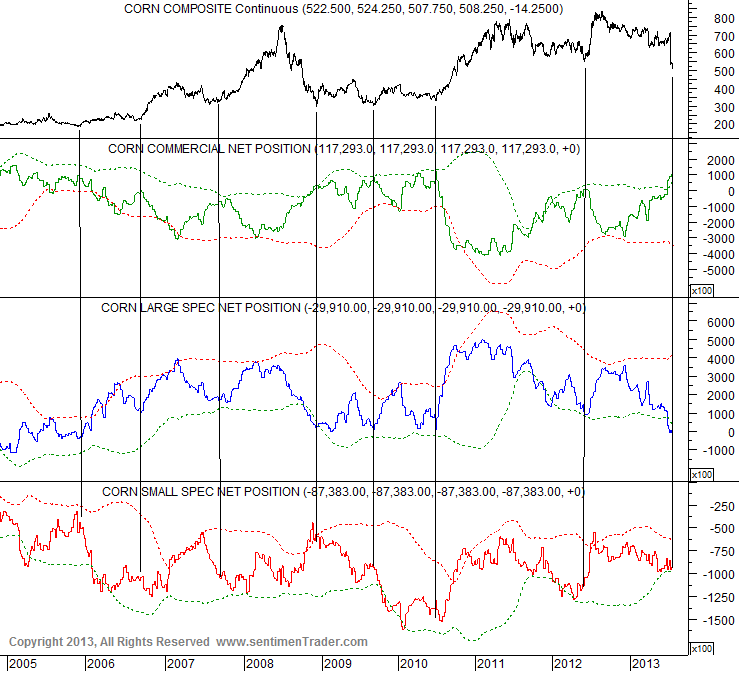

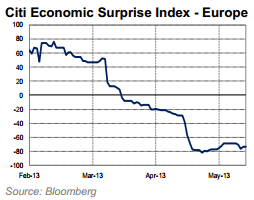

The most bearish assets (in terms of public opinion) of the current period are corn, wheat, oats, soybean oil and coffee – all agricultural commodities. The volatiility index for stocks (Vix), and treasury bonds, are down with them at bearish extremes. So, if we are to see a mean reversion – which is likely, but the timing is the difficult part – then it would be into commodities and out of stocks (Vix rises).

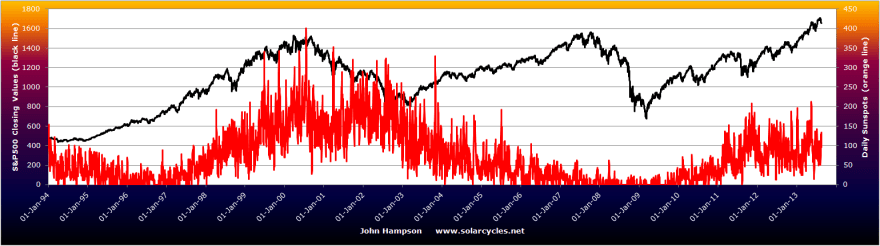

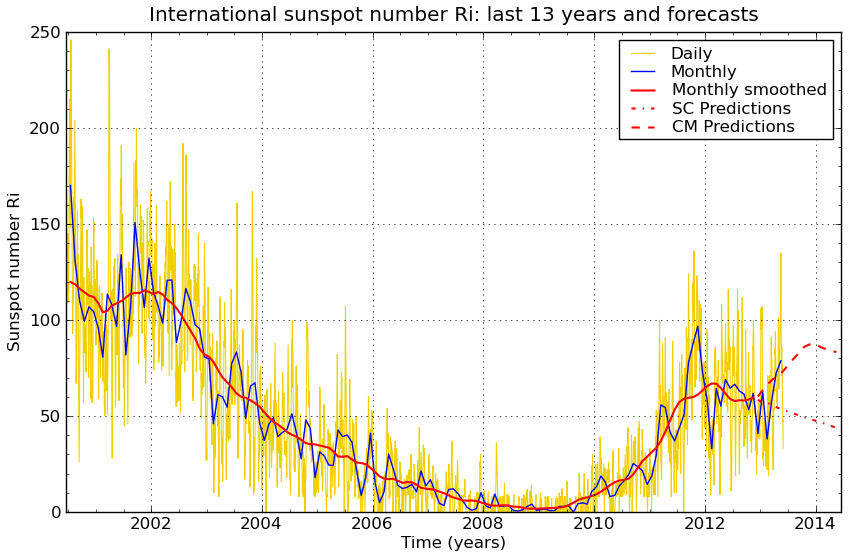

Lastly on commodities, my solar maximum correlations remain potentially in play, if the smoothed solar maximum is ahead of us. Sunspots are back up to the 100-mark currently so the sun is showing some life again, and certain analysts predict another sunspot peak ahead around the turn of the year. I have established that experts typically agree on the solar maximum once the solar magnetic flip is complete on both poles. The sun’s north pole switched polarity in May 2012, but the south pole flip is still ahead and likely within the next few months. So we should know for sure by Q1 2014. Either an end of year sunspots rally will produce a new smoothed maximum for SC24, before the final polar flip, or the pole will flip and Feb 2012 will be cemented as the solar max. By my research, a commodities rally over the next 6 months to a new index peak would fit with the former, not the latter.

In summary, the research for this post has produced a bias against stocks and pro commodities. As you know I am long commodities so disclaimer as always. However, I was also net long equities and have taken some profits on the long side. If stocks rally to new highs this week, and on good breadth, then much of the bearish case would be negated. If commodities sag further into the end of September, the rally potential in the commodity indices would fade.