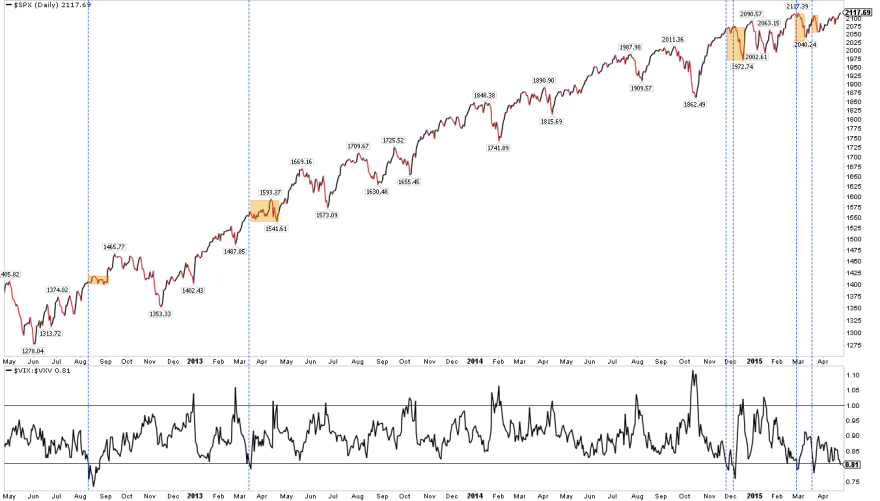

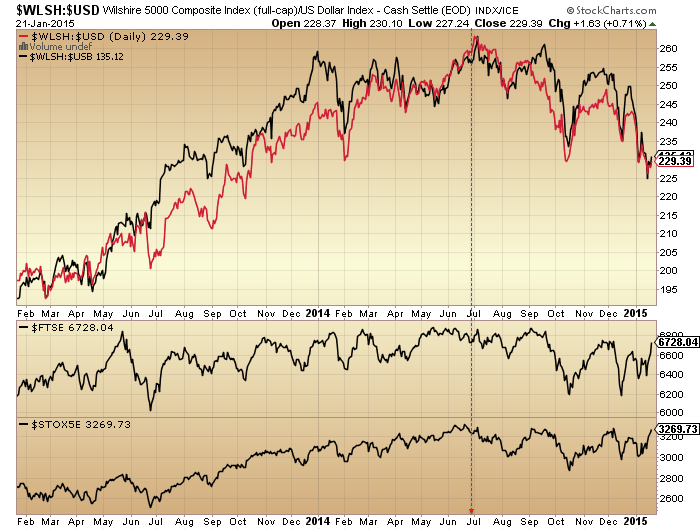

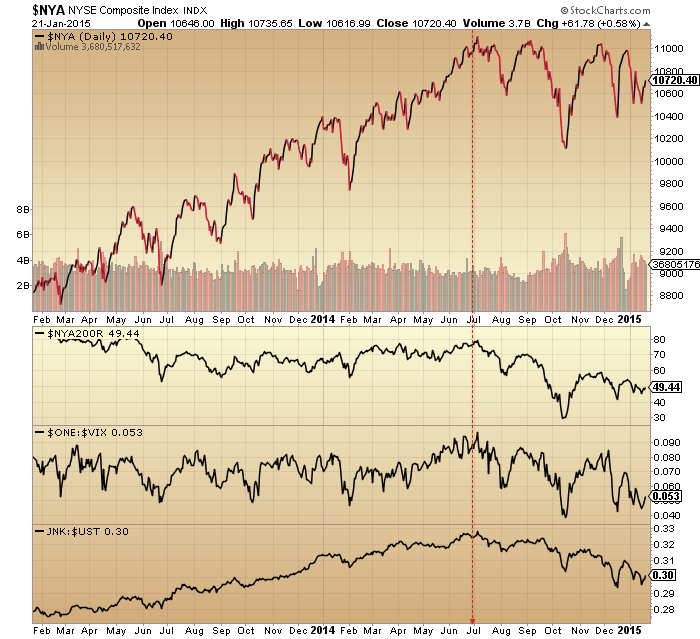

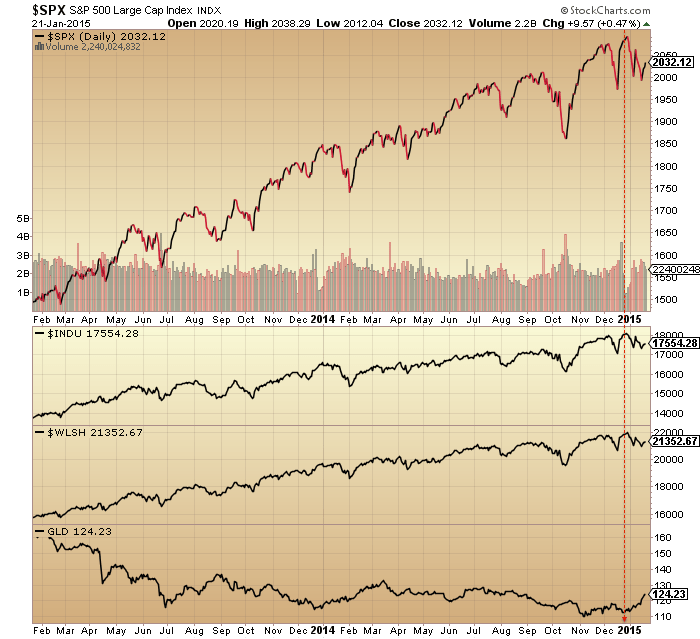

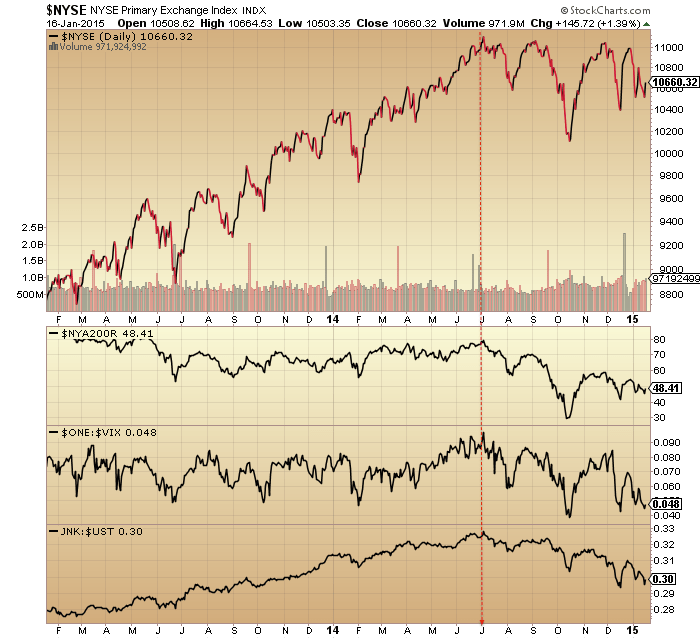

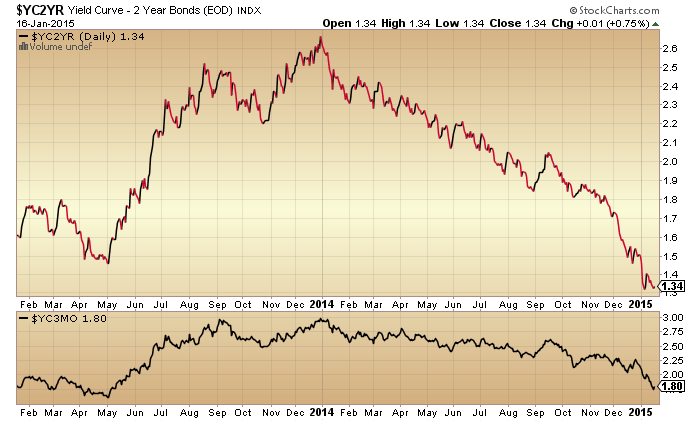

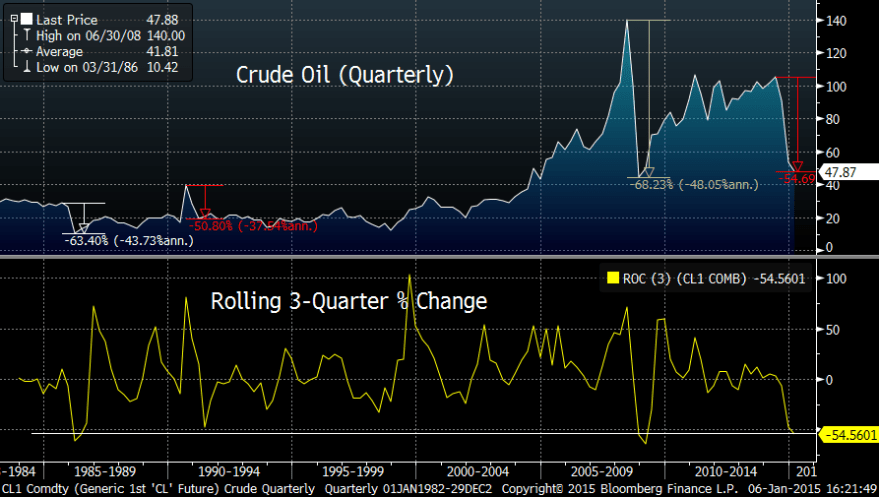

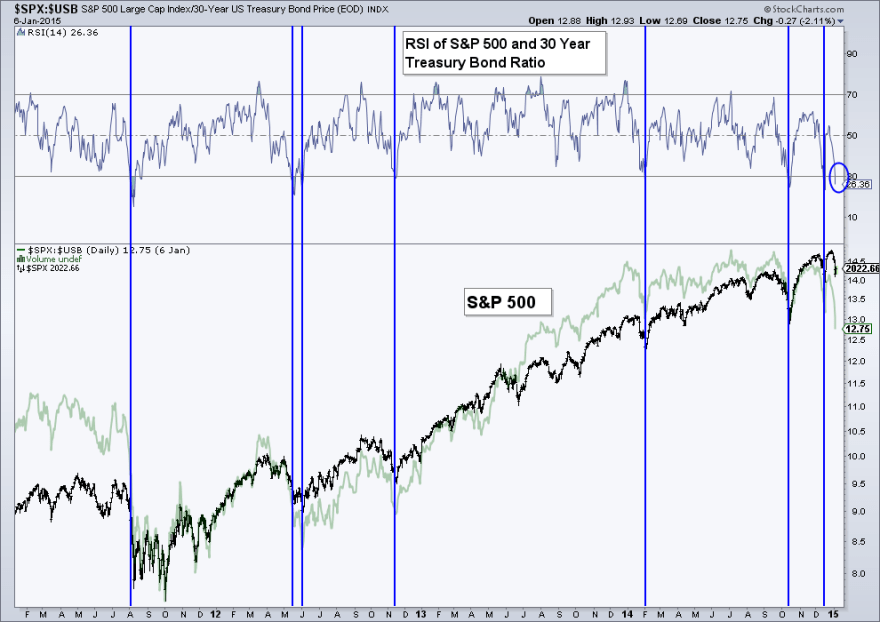

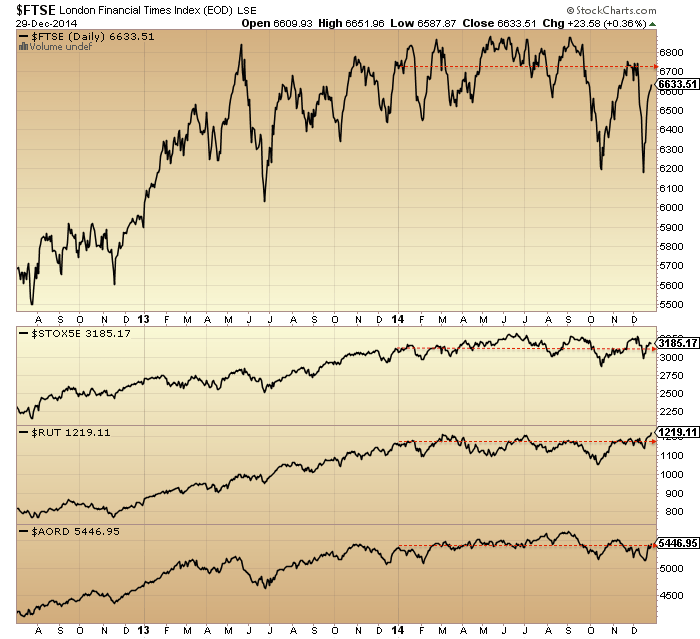

US Stocks:dollar, stocks:bonds, junk bonds and volatility (inverted) all peaked out mid-2014 with the solar maximum.

Source: Stockcharts

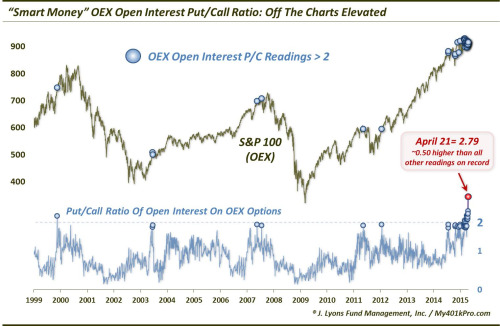

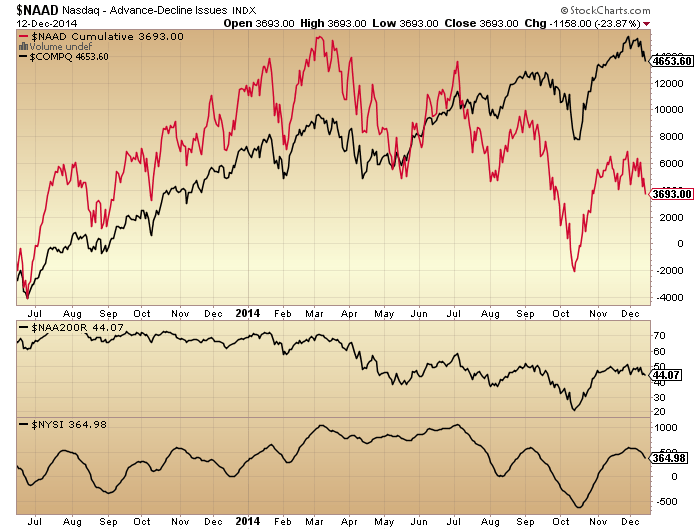

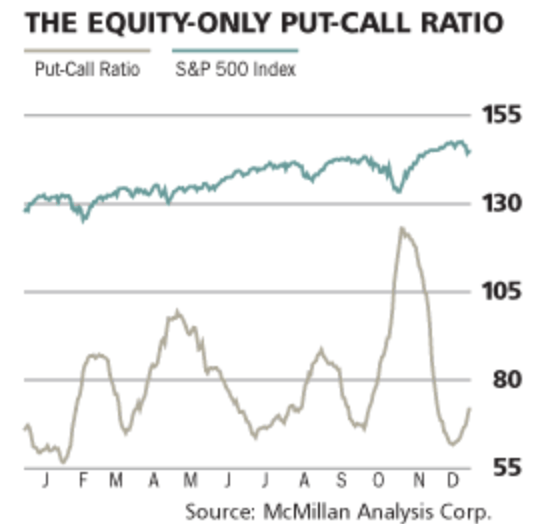

Crude oil, put/call, breadth and bullish percent did likewise.

Sornette’s bubble end flagged then too.

Source: FinancialCrisisObservatory

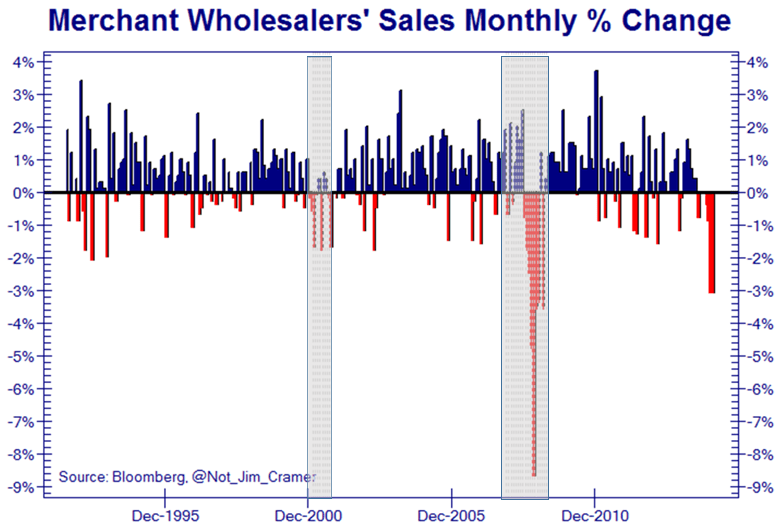

Global business activity peaked out at the same time.

Source: Thenextrecession

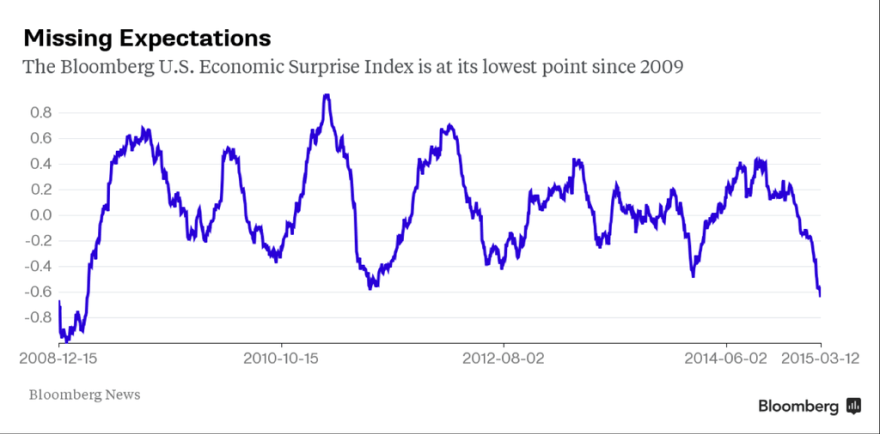

And economic surprises.

Source: Not_Jim_Cramer

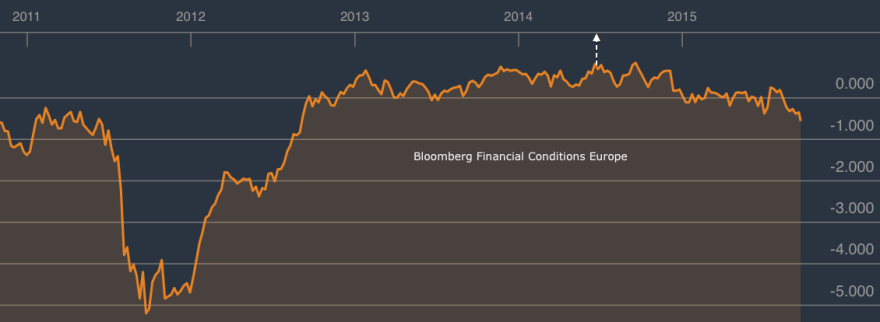

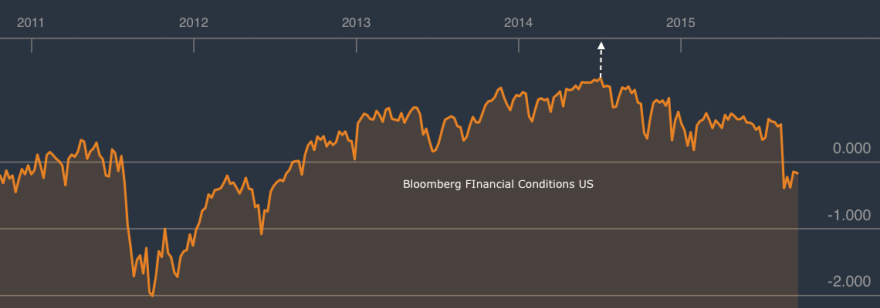

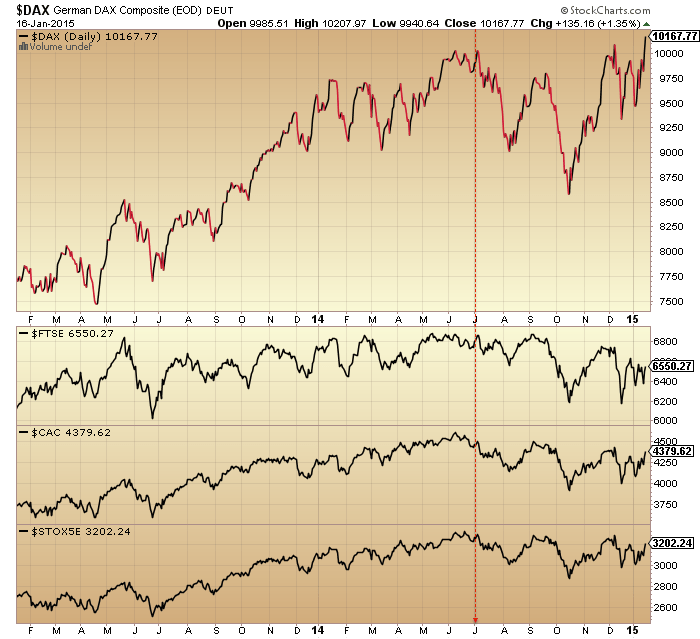

So did financial conditions, Europe and US.

Source: Bloomberg

And geomagnetism has played a key role in these developments, intensifying since mid-2014.

With united demographic downtrends in the major nations, solar history suggests markets and economy should tumble down to the next solar minimum.

Source: NOAA

Source: Tarassov

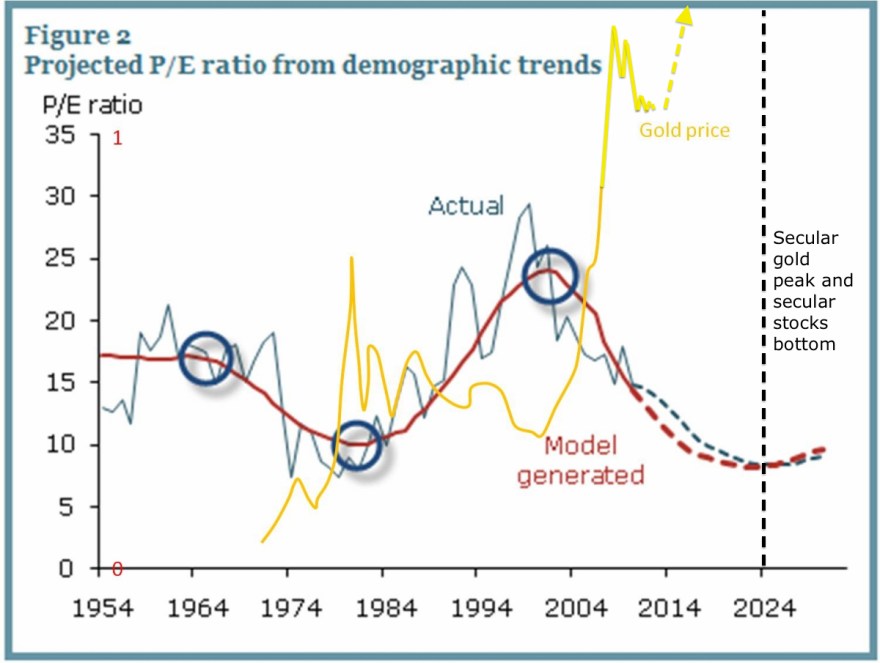

Drawing demographics, solar cycles and valuation together we get this:

It fits all three and that’s what makes it fairly compelling.

The mid-2014 peak we see in many indicators and assets is unrecognised by most. They see the August 2015 drops as the first drop in a topping process or a wave 4 in EW, both meaning we head back up. But the drops into last October fit better with this, with a secondary and final peak then forming in May 2015. The nominal price action has been uniquely confusing in this major peak, but the clues are provided by those under the hood and cross asset indicators.

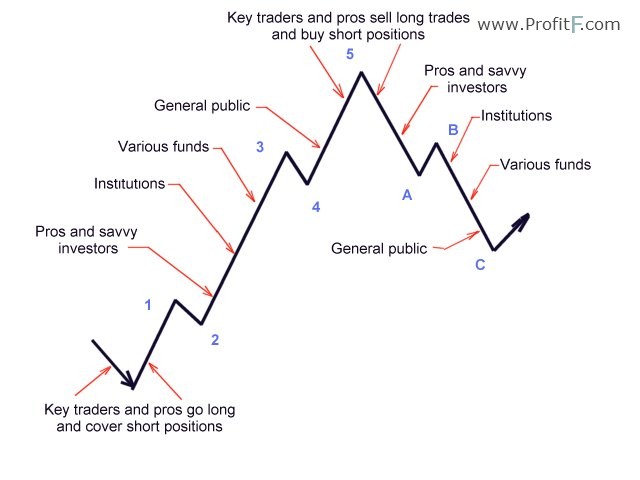

What resonates with me about Elliott Waves is the waves of mass crowd psychology. We see this phenomenon playing out in solar cycles, lunar oscillation, demographics and valuation. But the weakness of Elliott Waves is that on any chart at any time multiple different counts can be produced and are then refined with time to make the count always ‘right’ with hindsight. I simply don’t see evidence that Elliott Waves are reliable market predictors (emphasis on the reliable), but the general underlying idea is very much in play in overall price action, something like this:

Source: ProfitF

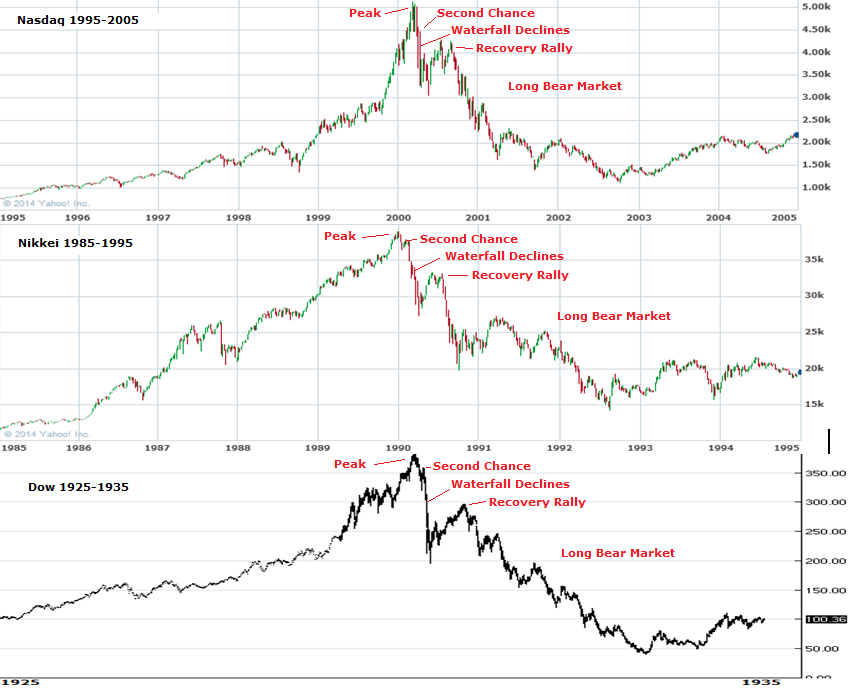

We all know an up trend rarely ends abruptly but instead typically peaks, reverses a while and next heads back up. Then, typically, the move either fails before the previous peak, double peaks with it, or makes a marginal higher high but on negative divergences, before the trend reversal takes off in earnest. All akin to turning a tanker at sea: it takes some time. Whatsmore, the last move up is typically the stage on which the retail money makes its usual late and painful act.

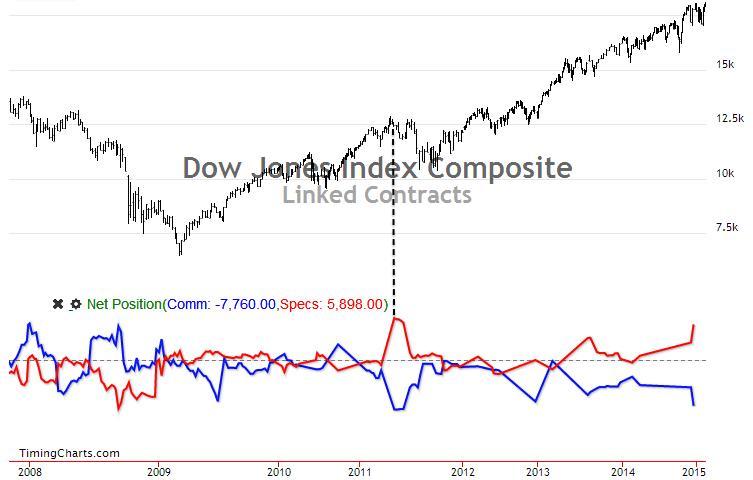

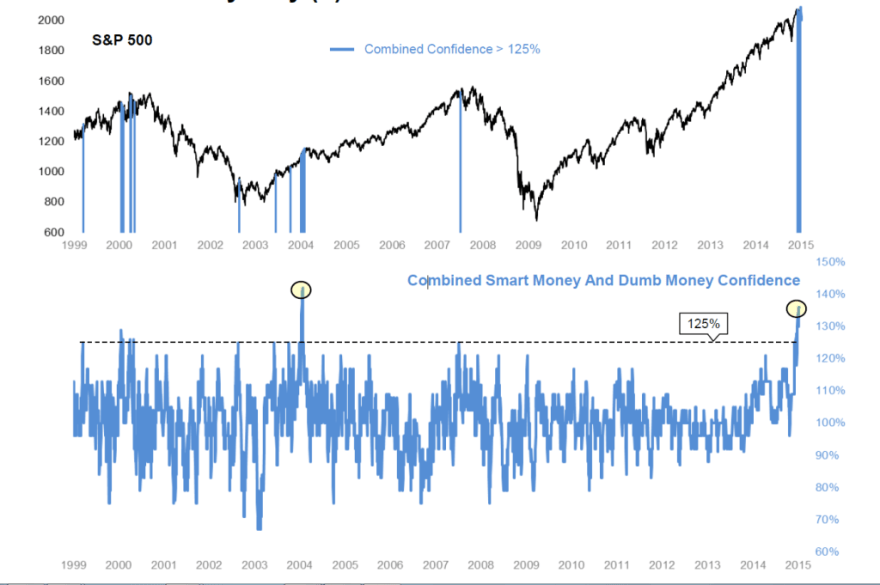

Between last July and this May we saw smart money flows weaken, dumb money indicators hit new highs, leverage jump to a new record and stock market internals notably diverge. All evidence of a wave 5, a secondary peak, or the terminal rally after the primary distribution, whatever you want to call it:

That second chance peak is now looking fairly potent on Biotech:

The point is that topping processes share similar characteristics which reflect how humans work. A peak takes time to form with some back and forth, some telltale signs in those leaving early and those joining late, and some health warnings.

The point is that topping processes share similar characteristics which reflect how humans work. A peak takes time to form with some back and forth, some telltale signs in those leaving early and those joining late, and some health warnings.

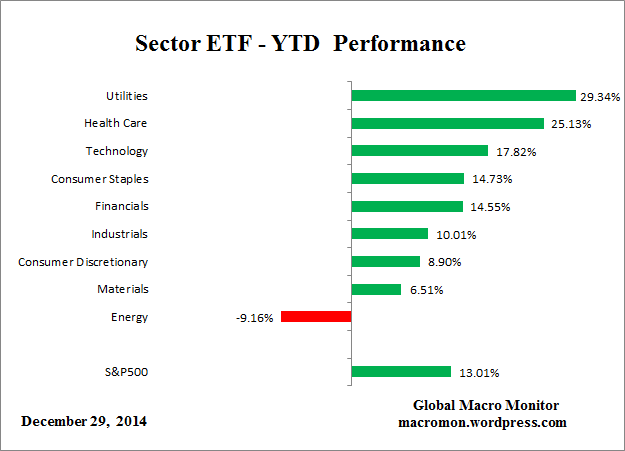

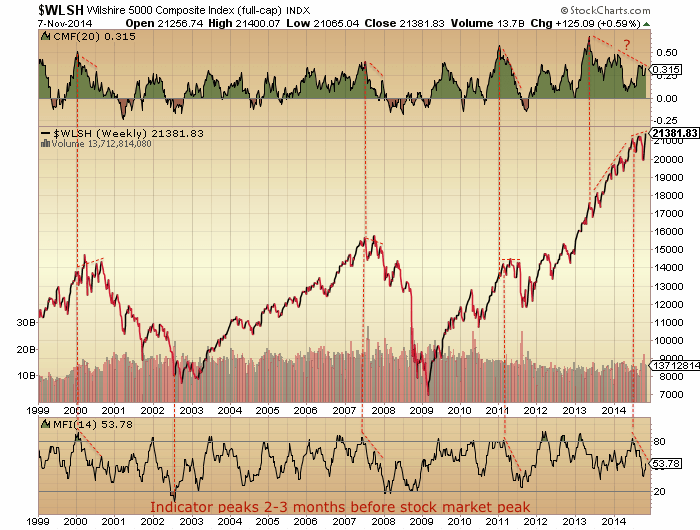

Finally, let’s recall that this has been the second biggest mania of all time, as measured by valuations, leverage, allocation and sentiment. The second major error analysts are currently making (to go with the failure to see the topping process began last July) is to see charts like this one as contrarian bullish:

Source: Yardeni

The jamming of the indicator at record highs last year highlights the mania that was in play. The subsequent crash is the mania bursting. The low reading is bearish, not bullish. It will take some time to recover, maybe even years. Given how ultra saturated the market was in terms of allocations, leverage and sentiment, it is unrealistic to think that the market will now go make new highs. Some of the dumb money was wiped out in the August falls, some more is selling on every move up to get out at break even.

The most bullish outcome is that the market gradually digests the falls and range trades whilst all the excesses of 2014 are gradually mopped up. But, there is no precedent for this in history. From 2014’s valuations, leverage, sentiment and allocations levels we have only seen devastating bear markets in the past. The post solar max and demographic environment add to this likelihood.

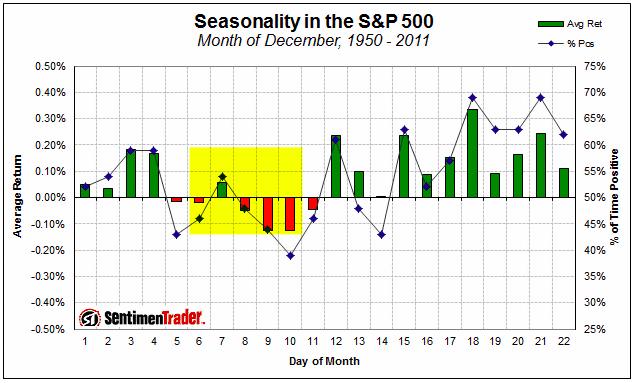

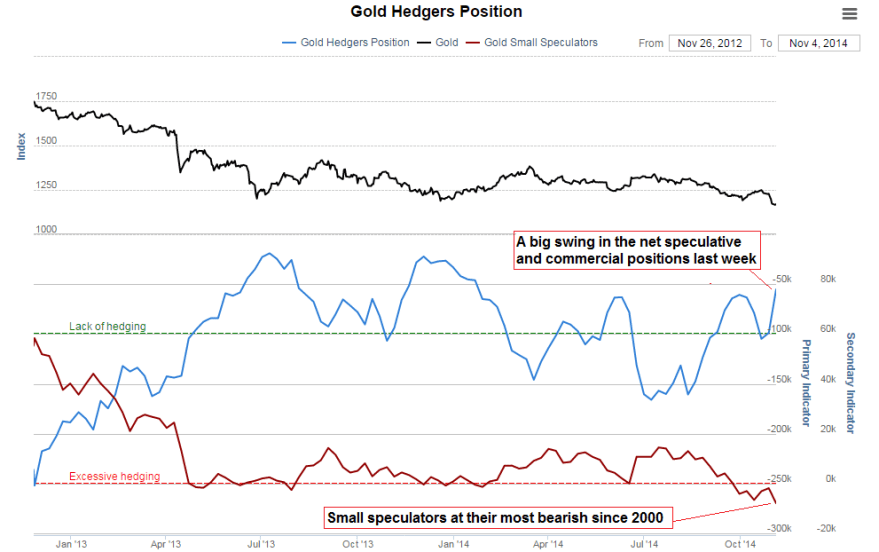

Gold looks to be completing its basing. Global stocks are now retesting their August lows. Clearly, if gold takes off here and stocks decisively break down beneath their August lows then the mood will properly change. The most bullish outcome I consider is that stocks range trade and recover some whilst the 200MA gradually arches over, as bear markets often aren’t in a rush, more of a slow bleed. However, written into the record leverage, is a period or periods of panic selling. Biotech is in an ideal technical set up for that to now occur. DAX and RUT look post second chance, which in past major peaks led to waterfall selling. So maybe we fall apart rapidly here – or, my bullish scenario – we hold up (without exceeding the highs) into the end of the year and fall apart in early 2016. Every man and his dog thinks that stocks are going to bottom out and resume bullish in October in line with seasonality so it seems likely that something else occurs. I think actual (rather than seasonal) geomagnetism is likely to play a role in this, so I am watching developments. I favour the falling apart option but you know my positions disclosure. Trades-wise I’ve been increasing shorts and adding to gold on the basing evidence, and adding stops to all of it. I’m going to carry on with this strategy unless the market bounces on positive divergences and shows evidence of a renewed move up for the bulls.