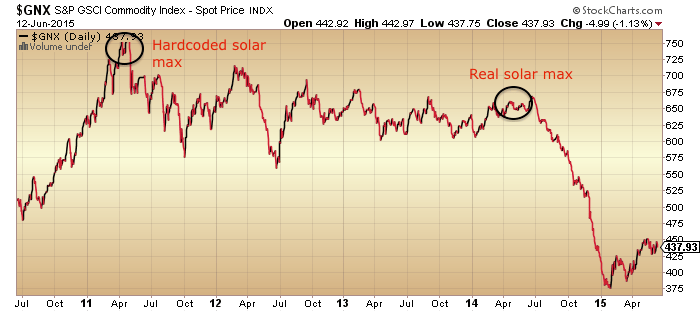

Let’s now draw in the solar cycle. Here are US equity valuations by Q ratio versus solar maxima over the last century. A relation becomes apparent with secular lows and highs.

Source: D Short

We can see three that don’t fit so well. The 1929 stocks peak extended over a year beyond the SC16 peak, stocks sailed through the 1957 solar max and whilst the SC22 peak wasn’t so significant for US stocks it turned out the secular peak for the Nikkei.

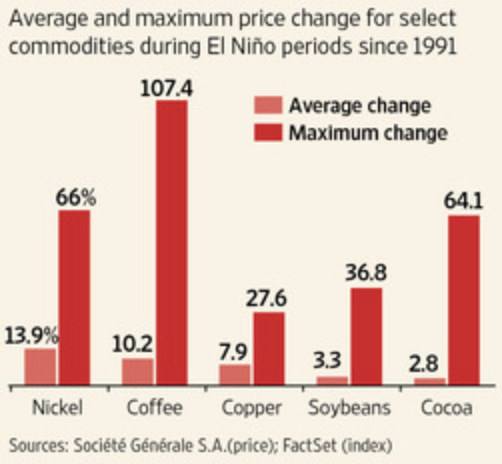

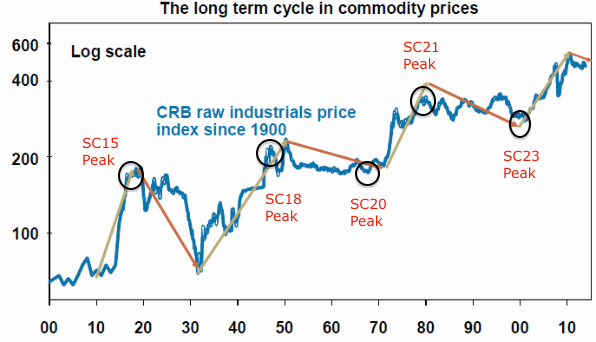

Now for the three secular ‘lows’ on the above chart (SC15, 18 and 21) we can cross reference to long term commodity prices and see that they instead marked secular highs in hard assets. Similarly, the secular stocks highs of SC23 and SC20 maxima marked secular commodities lows.

Solar science reveals peaks in human excitement at solar maxima (e.g. clusters of war). In the financial markets this appears to translate as peaks in speculation (and in the economy in peak activity). Therefore, it appears that the asset in favour at the time is bid up to a secular peak and subsequent pop around the solar max (with the rare exception, as with any indicator or discipline). So what would make the favoured asset stocks rather than commodities or vice versa?

Solar science reveals peaks in human excitement at solar maxima (e.g. clusters of war). In the financial markets this appears to translate as peaks in speculation (and in the economy in peak activity). Therefore, it appears that the asset in favour at the time is bid up to a secular peak and subsequent pop around the solar max (with the rare exception, as with any indicator or discipline). So what would make the favoured asset stocks rather than commodities or vice versa?

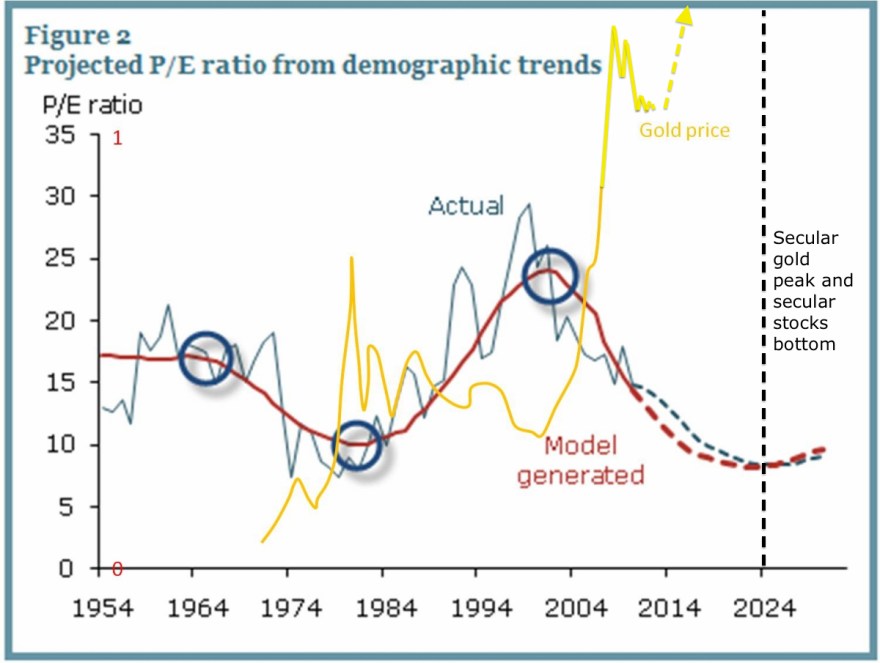

The evidence suggests it is demographics, namely that secular = demographic. The chart below reveals equity valuations tracking US demographics and gold moving in opposite directions. Therefore we see a secular peak in gold at the demographic low and a secular peak in stocks at the demographic high.

The picture is enhanced when we discover that solar cycles influence birth rates, which may account for why demographic peaks often tie in with solar peaks.

The chart below shows how Japanese demographics peaked out first in the late 1980s, which explains why Japanese equities made their secular peak at the 1989 solar max whilst other major nation stock markets continued to advance under positive demographics.

The current relevance of the chart is that the global demographic composite is definitively negative, and this is echoed in other demographic variants. Together they spell recessionary and deflationary pressures, which we are seeing in reality. But they also should be sinking equities and launching gold, which we are not (currently) seeing. More on that shortly.

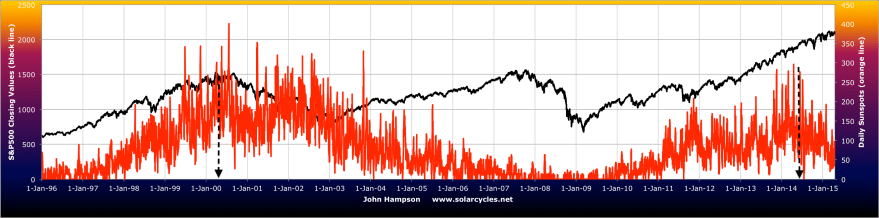

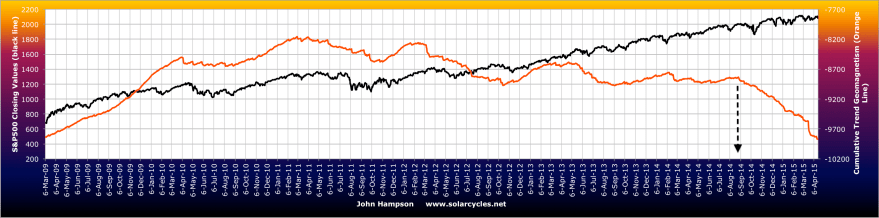

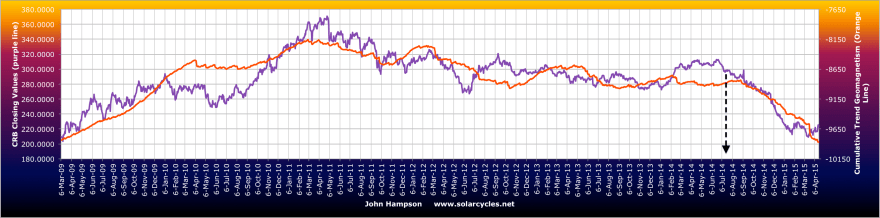

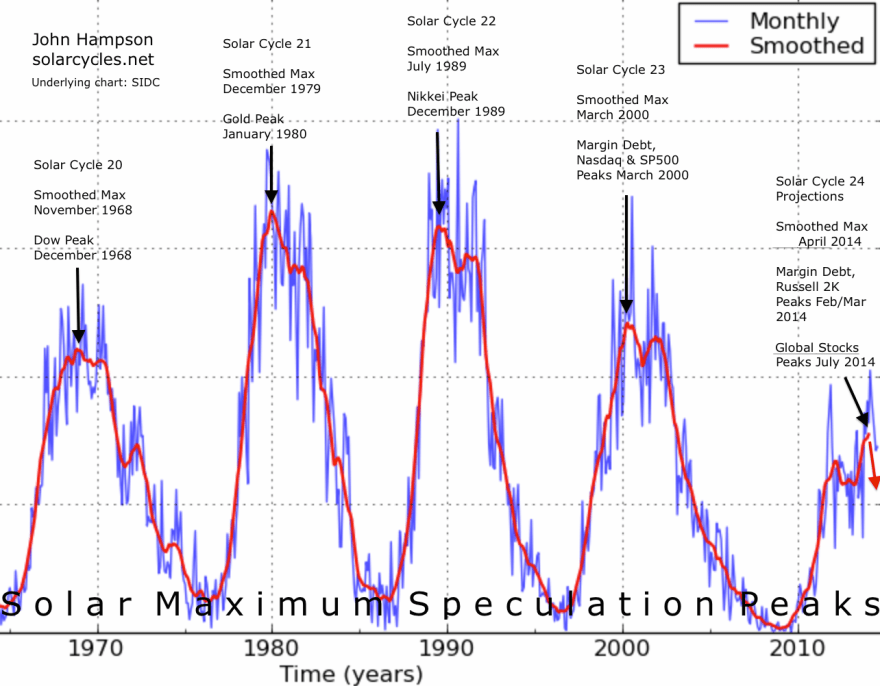

Solar cycles are long cycles, but armed with the above information we got the chance for a real time test with the SC24 max, which now appears to have been centred around April 2014 (smoothed max).

Two things were anomalous about the SC24 max. It was lower intensity (less sunspots overall) and it took longer to form (including a higher second peak).

The average duration between solar maxima is 11 years 1 month, but the SC24 max didn’t form until 14 years 1 month after the SC23 max, which makes it an outlier. Is this relevant? Well, a major commodities peak occurred in April 2011, exactly 11 years 1 month after the SC23 max.

Tangent for a moment. Here is the influence of the lunar phase cycle on the markets: it makes for a fortnightly oscillation with distinct measurable returns over time.

The most plausible explanation is the influence of nocturnal illumination levels on evolving humans. Yet, the influence is still present despite living under artificial lighting for several generations. Therefore it would appear to be hardcoded to some degree: we oscillate internally with the moon cycle, to some extent. Might the solar cycle also be to some degree hardcoded? If so, that could be a factor in the major speculative commodities peak (and associated major stocks low) in 2011, i.e. human excitement to some degree peaked into the anticipated/internalised solar max.

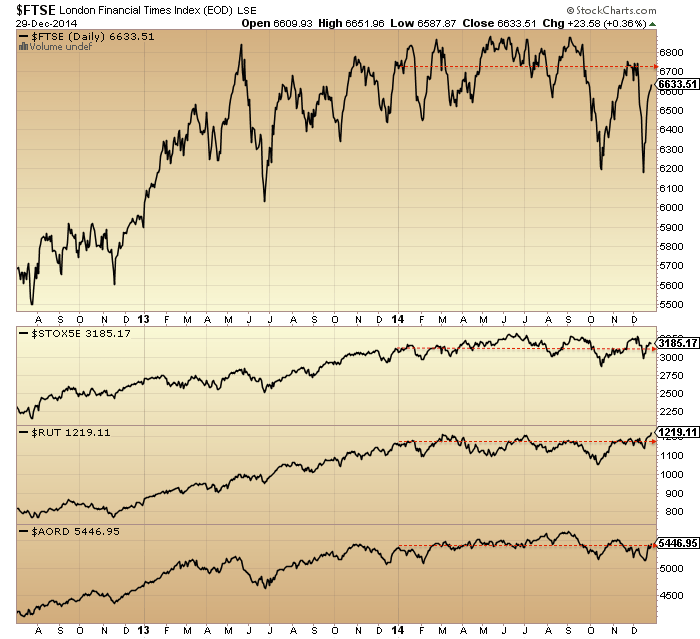

Source: Stockcharts

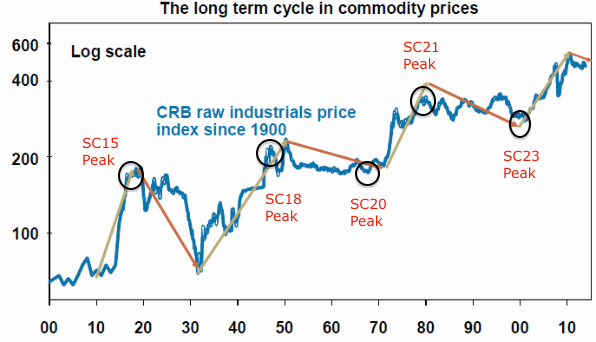

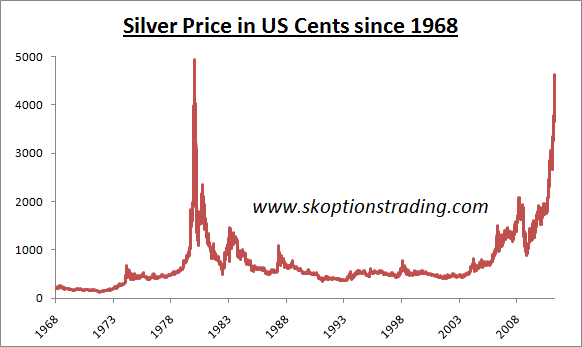

The case for that increases if we look at ‘leveraged’ commodity silver. The same kind of parabolic blow off as in 1980 occurred.

It would make the secular commodities bull 2000-2011 a mirror of the 1968-1980 bull, namely one solar cycle in length and set against a secular stocks bear, and both in keeping with demographic trends of the time. The implication would then be that commodities are now in a secular bear and stocks are in a new secular bull.

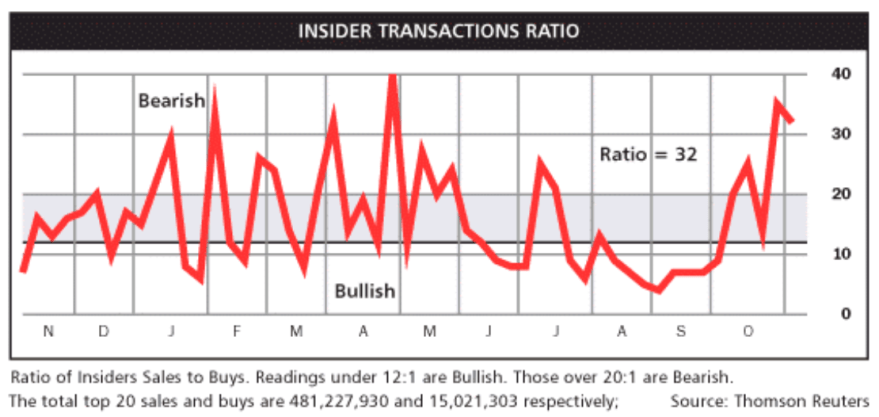

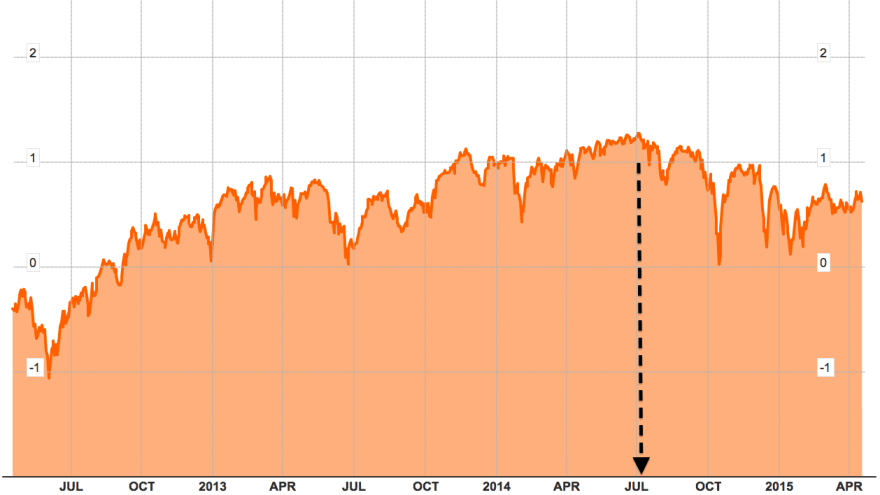

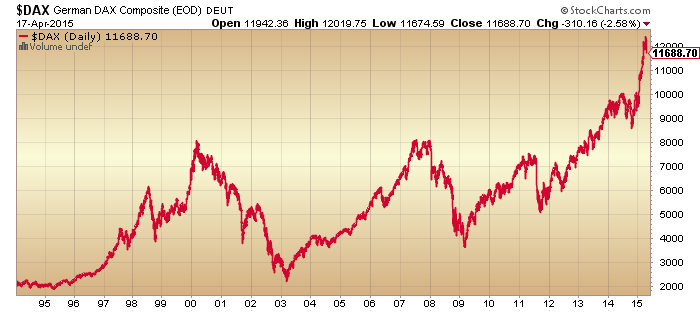

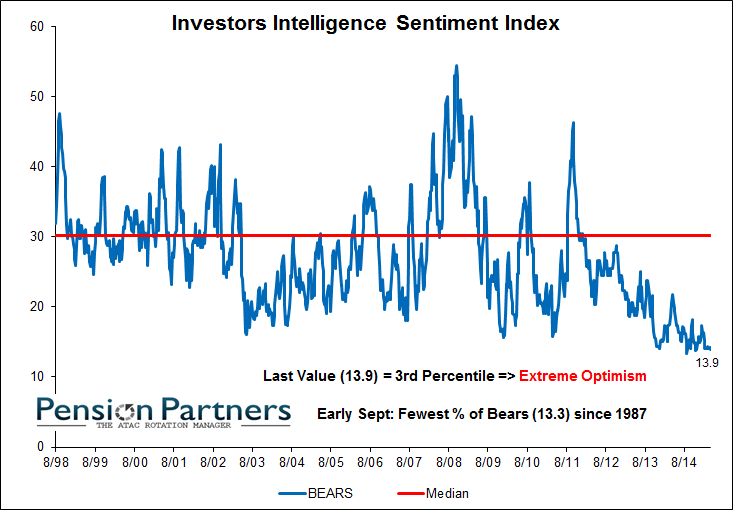

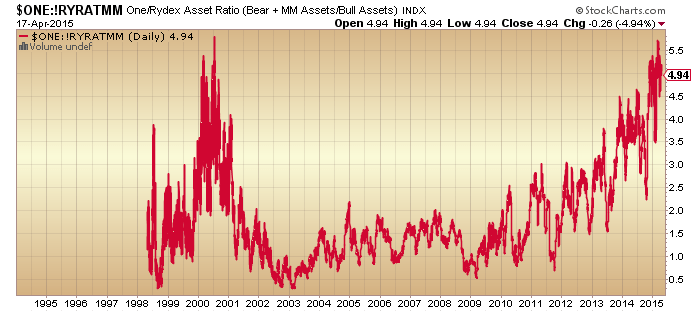

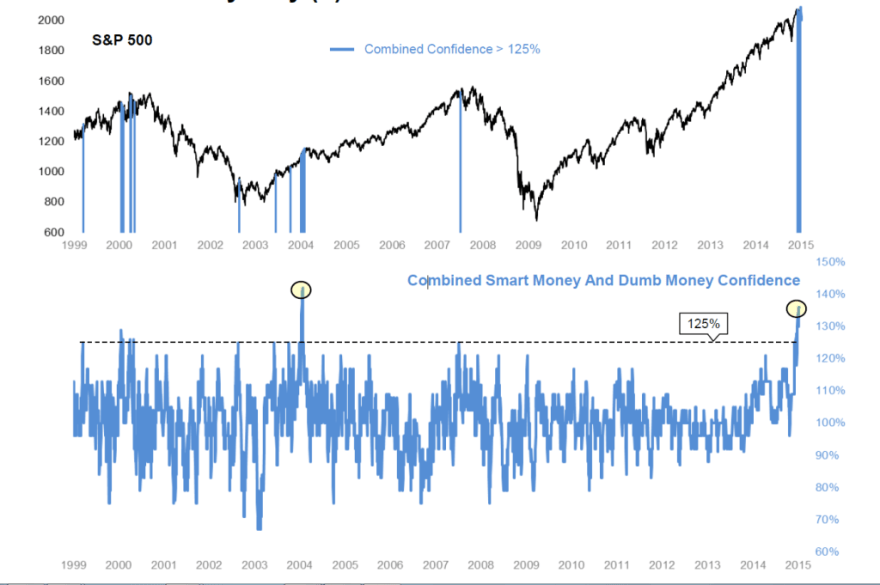

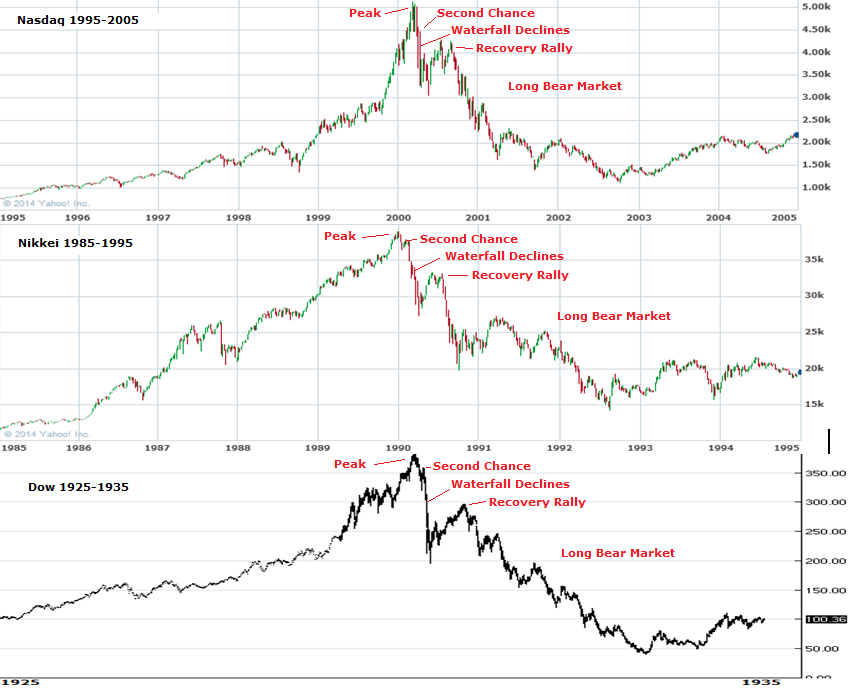

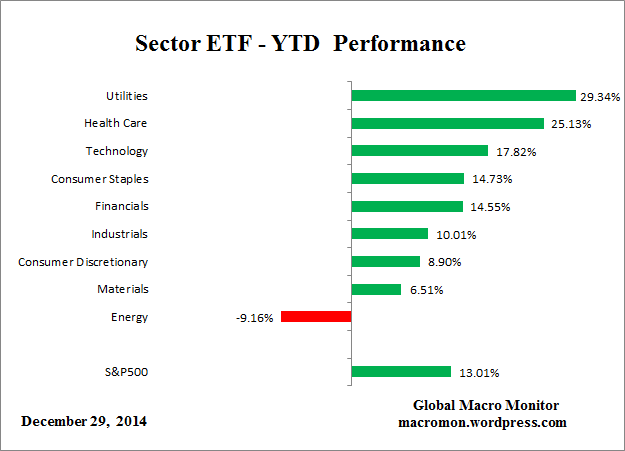

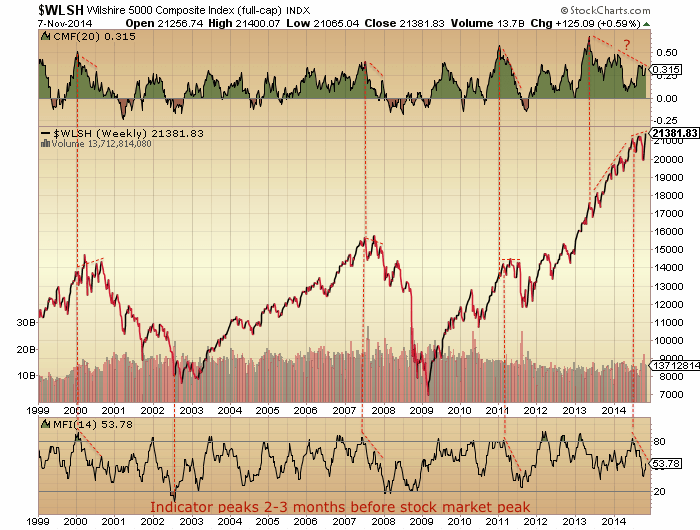

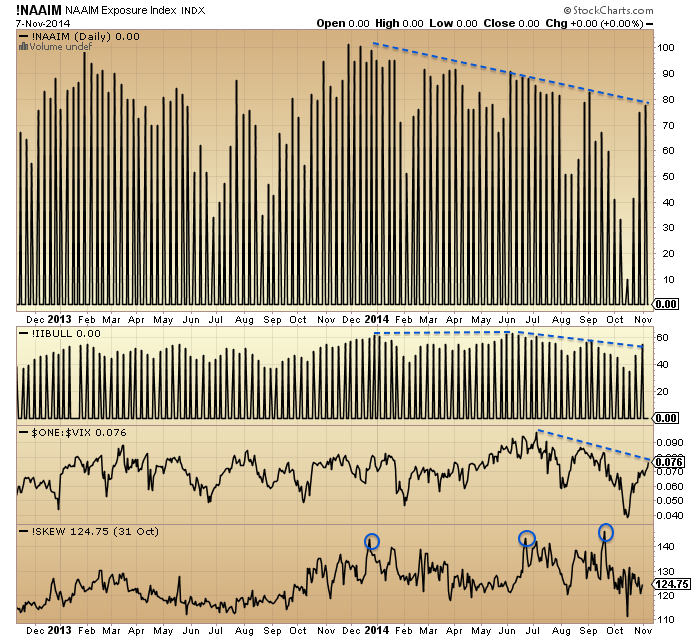

But let’s now look at the real experienced solar max of April 2014. From 2011 to 2014 stocks rallied strongly and since the start of 2013 displayed characteristics of a mania. A snapshot at April 2014 reveals many typical signs of a major market peak: extremes in valuation, sentiment, allocations and leverage; record negative earnings guidance and economic surprises all negative in the major nations; divergences in money flows and various risk-off measures; outperformance of defensive sectors and bonds; etc. At the time I gathered together 40 indicators all with different angles on a telltale top in stocks. Really, the evidence could not have been better for a speculative mania into the solar max.

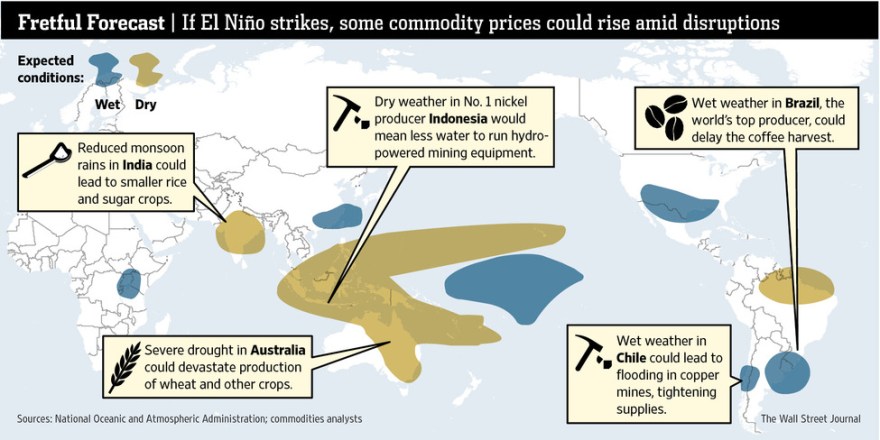

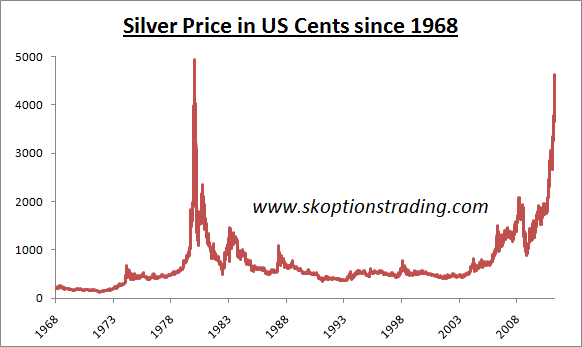

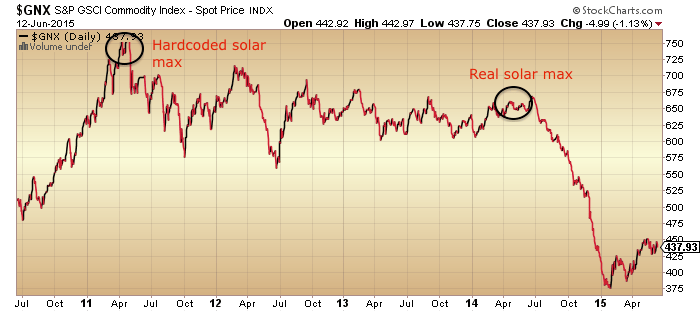

However, as we passed through the real solar max, it was commodities that fell again, rather than stocks. An oil-heavy commodity index, used for emphasis, shown here:

Source: Stockcharts

Indeed, by the end of March 2014 large speculators had amassed an all-time record long position in the CRB commodities index, suspiciously right at the solar max. So we have a potential case here for commodities to have effectively made a double secular peak between the ‘average’ and ‘real’ solar maxima.

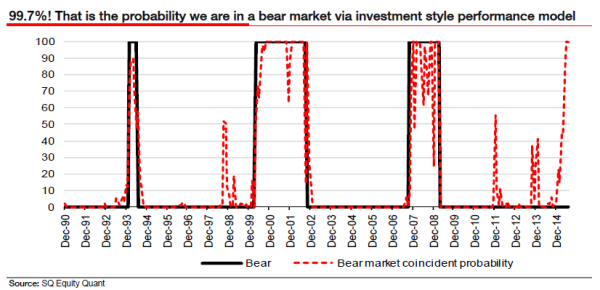

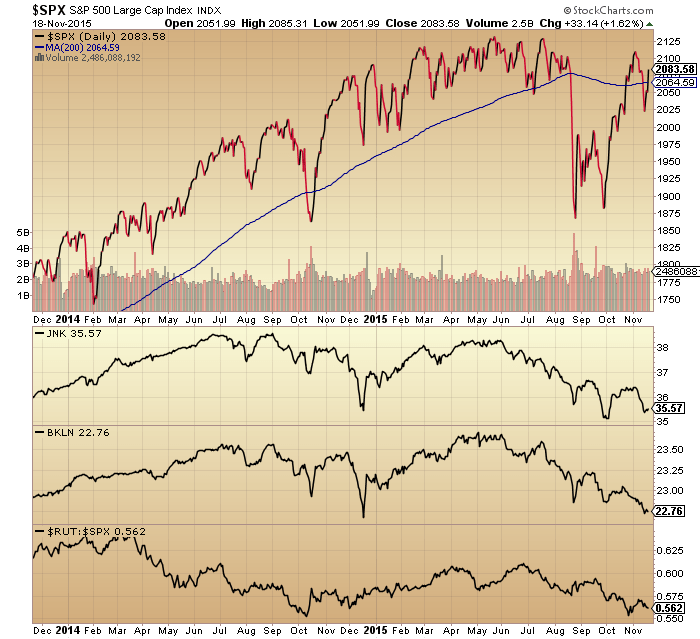

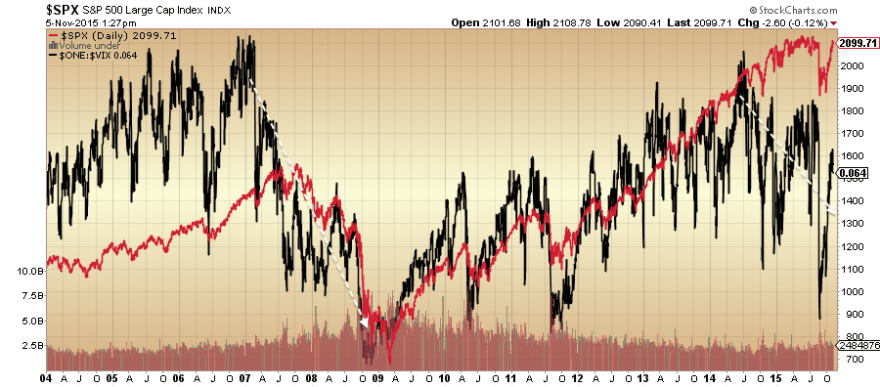

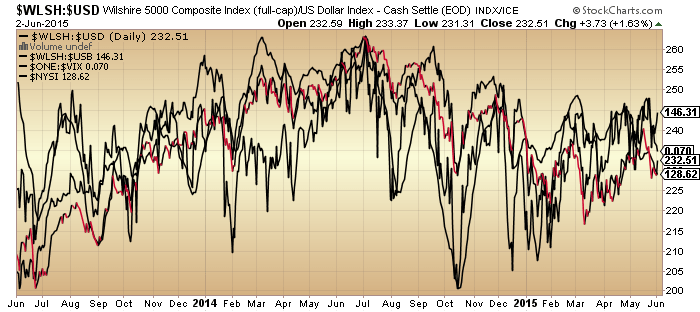

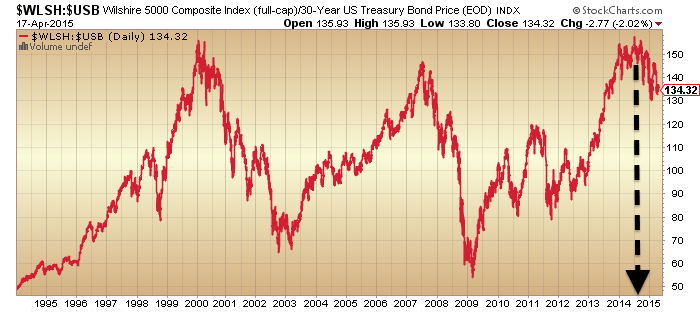

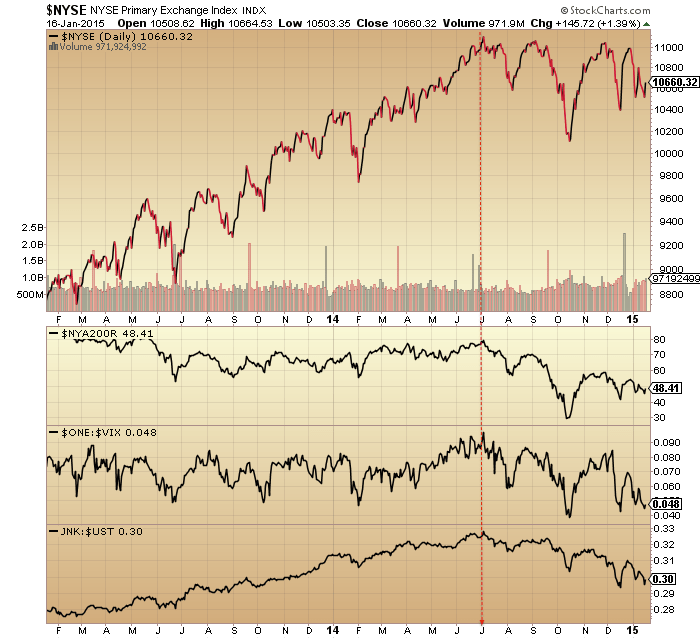

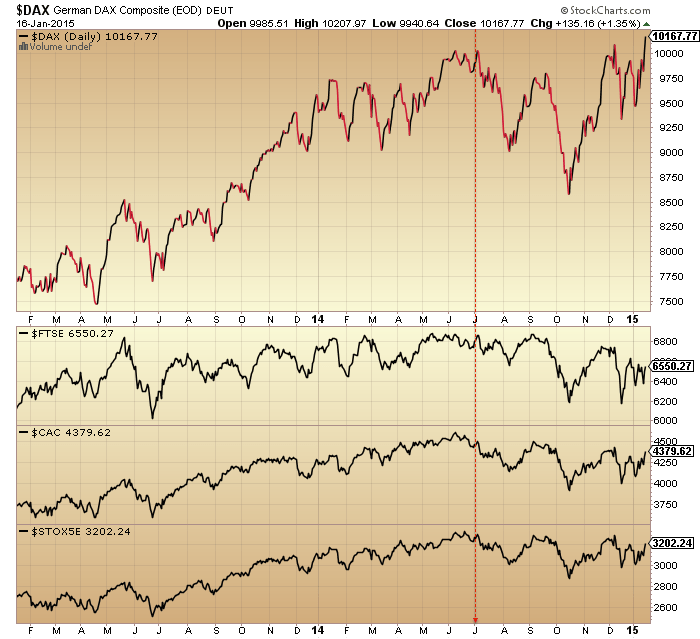

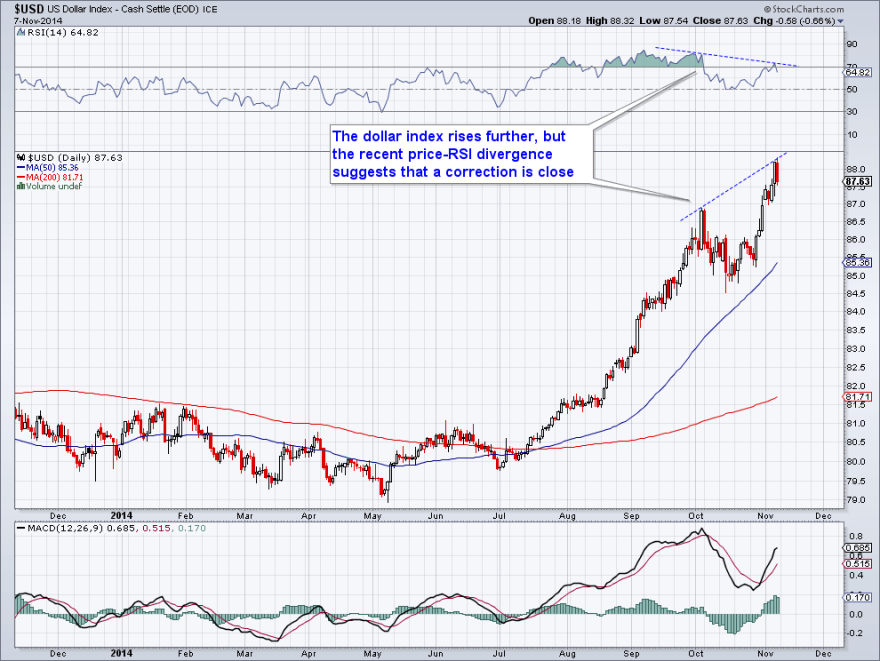

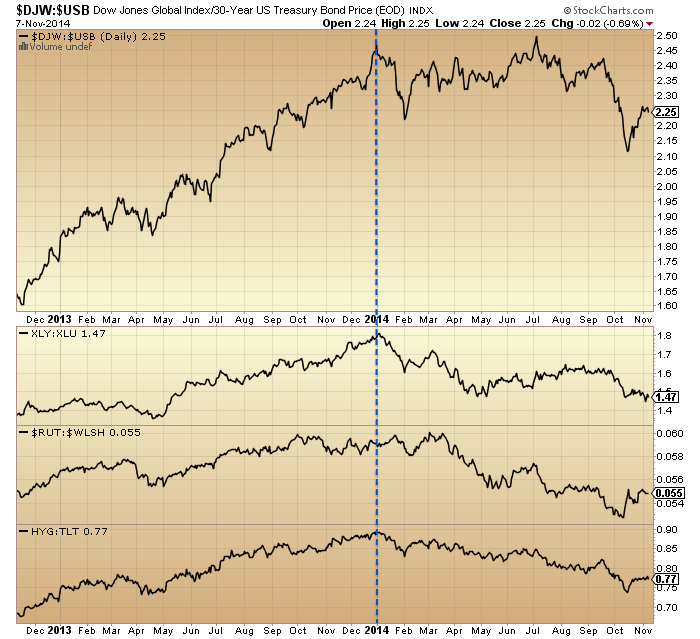

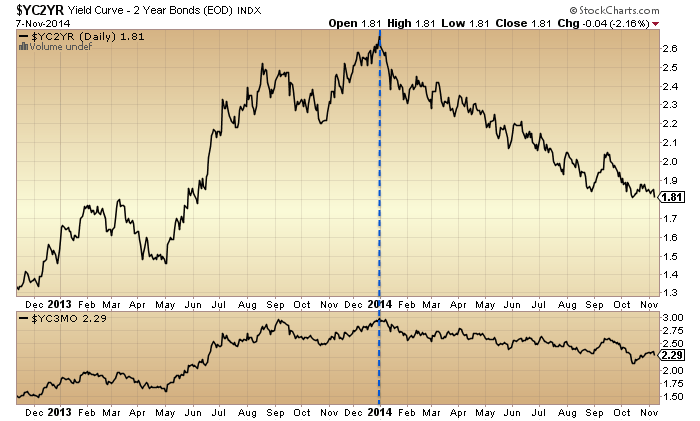

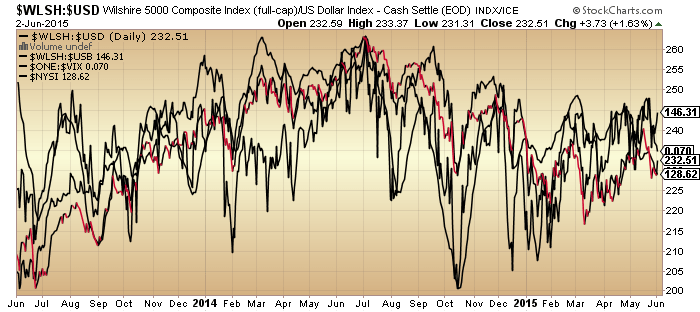

But… things get more complicated when we look under the hood at equities. Stocks:dollar, stocks:bonds, volatility, breadth and various other measures not only resemble previous major peaks but occurred together very close to the real solar max.

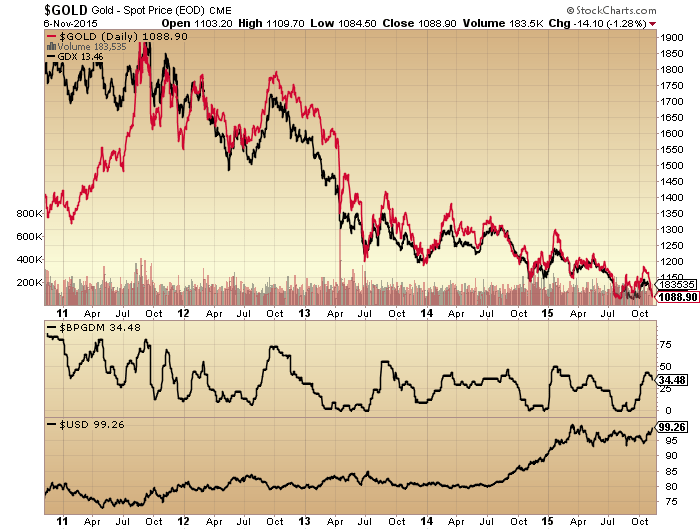

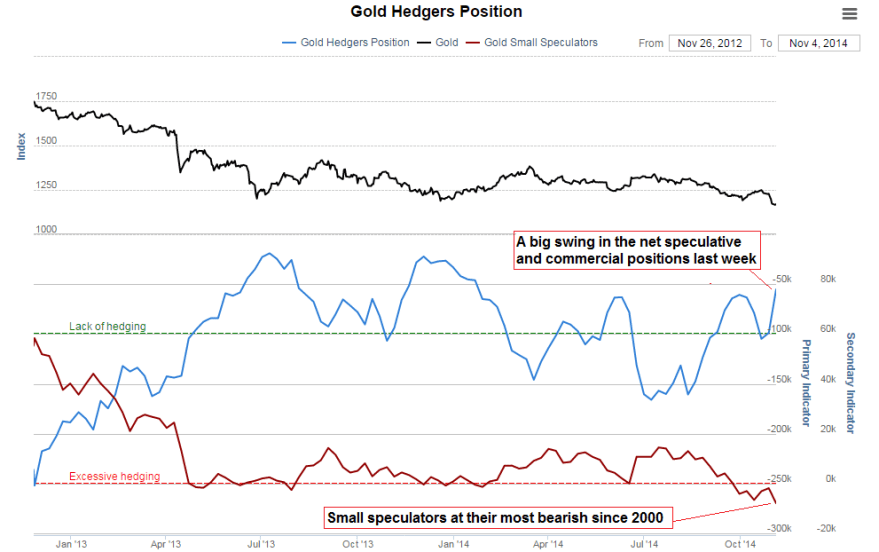

We are now waiting to see whether these will be repaired or whether nominal equity prices now fall in line. If the latter, then we have the evidence that speculation in equities peaked at the real solar max. At the same time, gold has been forming a technical bottom in recent months together supported by washout sentiment and allocation levels, which after a 4 year bear suggest it is ripe to break into a new bull. Which brings us back to demographic trends being aligned to stocks declining and gold rising: this angle on what happened would argue that the anomaly in hardcoded/real solar max produced a second speculative peak against demographic trends and in stocks, only for demographic trends to now reassert themselves (stocks complete the secular bear, as suggested in the last post, whilst gold goes to new highs).

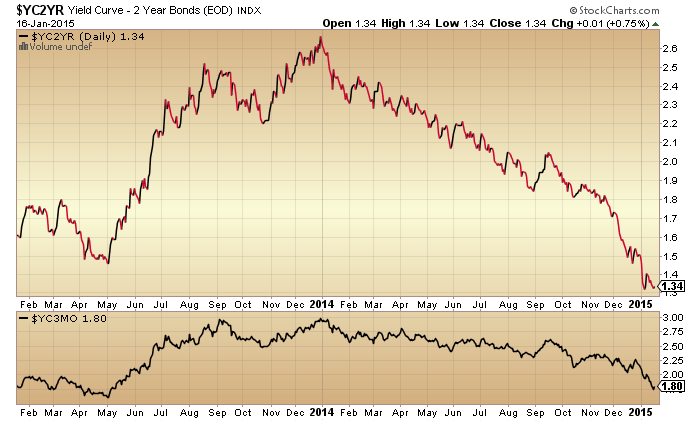

As alluded to in the last post, the closest fit historically to the current time was the peak of 1937: a solar maximum and speculative peak against a backdrop of low rates and easy conditions. Equities peaked out at high valuation (see Q ratio chart at top of page for SC17), following a front-running of prices to an expected return to normal growth that didn’t materialise. If there was any doubt this isn’t being repeated today, take a look at how analysts continually expected bond yields to rise over the last several years. Reality (demographics) has persistently denied them.

Source: Mike Sankowski

Source: Mike Sankowski

In 1937, both equities and commodities rallied into the solar max of April and both topped out around then, falling sharply for the next 12 months with both deflation and recession occurring.

Stocks didn’t make a real (inflation adjusted or valuation) bottom until 5 years later.

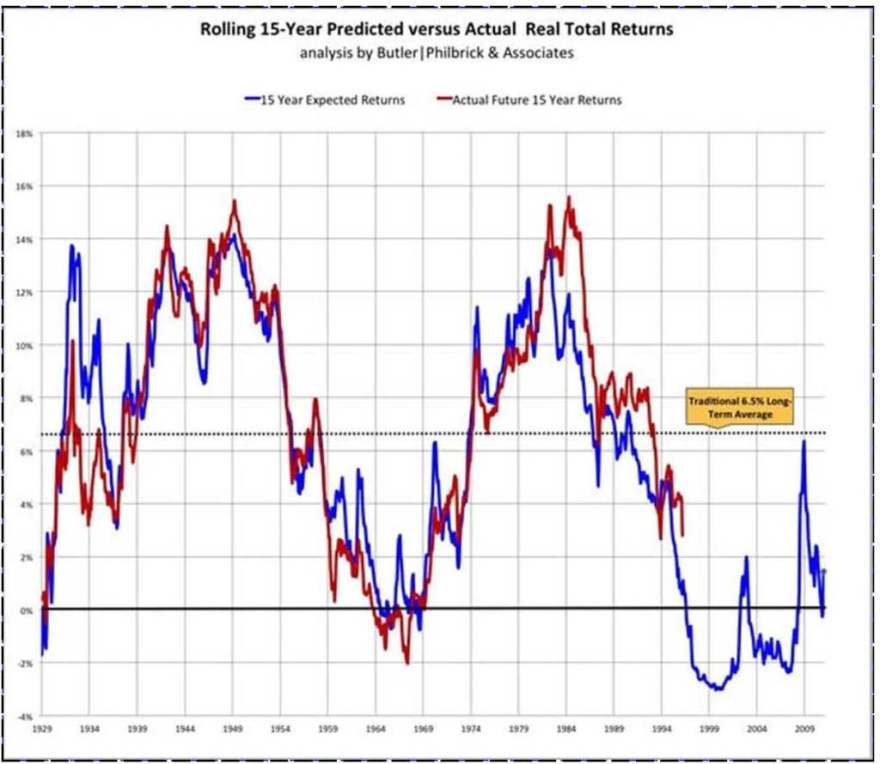

Which brings me back to the unfinished business in equities and the prediction by both demographics and valuations:

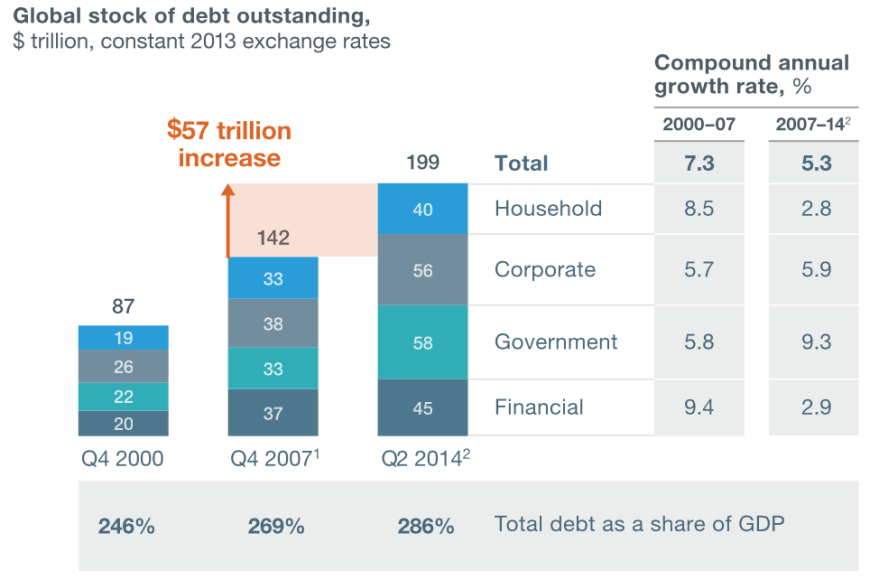

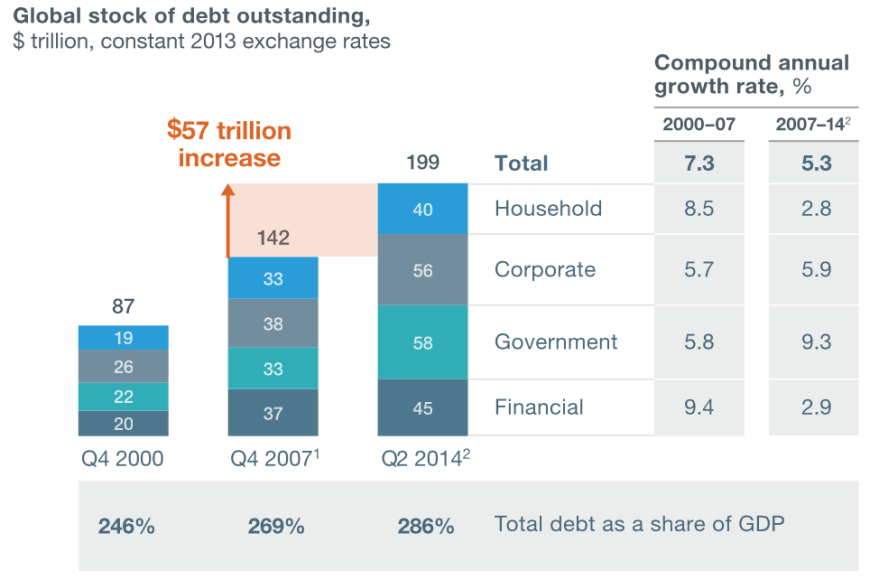

In summary, from all the topping indicators in equities, stocks should now break into a bear market, tipping the fragile world economy fully into both deflation and recession. There should be a feedback looping between the two, taking stocks down to much more appropriate washout valuation levels, whilst crises breed crises again in the economy. As in 1937, it should kick off under easy monetary conditions, limiting the toolkit of central banks, but also as then, central banks will likely resort to unorthodox (and probably ruthless) tactics. Systemic breakdown is a real risk again, with debt levels greater than in the Great Recession (hat tip Sinuhet).

Source: McKinsey

Commodities (particularly industrial) should sink again too, but likely for shorter and shallower (in line with demographic pressures, as per 1937, and understanding their existing slide since 2011). However, I expect gold to break away and rally as real money. It’s not an easy call due to the limited history of gold free-floating and performing under deflationary conditions. But ultimately I maintain it is the anti-demographic ultimate safe haven, and should regain favour particularly as central banks are currently doing their best to corrupt the money mechanism with QE and ZIRP.

If I’m wrong? Well, this is where we get to the ultimate conundrum. If stocks are instead in a new secular bull (and commodities made their secular peak in 2011, doubled down in 2014) then the appropriate investments/trades are really the opposite of if they are on the cusp of a new devastating bear in an ongoing secular bear. Long stocks and short gold versus short stocks and long gold. I have been able to make cases for both in the last two posts, but I have also shown the flaws in both.

Ultimately it’s a game of probabilities. When all crunched together I see it as most likely that 40 topping indicators and an under-the-hood peak around the smoothed solar max of last year should produce an imminent meaningful correction in stocks unless those divergences start to be repaired. That would be the telling clue. Fitting with that I see gold’s technical basing as likely to produce a meaningful rally. From there I would expect to see serious troublespots emerging in the global economy (defaults, etc) and the meaningful correction in equities turn into a fully fledged bear. However, if the secular stocks bull scenario were to turn out true, then indicators should point to a recovery in equities before we hit such problems.

I have to end on a sobering note. If we do see a global bear market and recession here, then the damage will be immense. No capacity to reduce rates, QE proven to be a failure, record debt levels and increasing under deflation, and no demographic upturn in sight for some time. Accordingly, central bank response would have to get tough, such as penalising any saving, imposing capital flow controls or protectionism. The potential for civil unrest, war or systemic breakdown would increase. The outlook would be very uncertain but surely bleak for the majority of people for the period ahead. It would really be in mankind’s interest for the new secular stocks bull scenario to be true. However, both the debt and demographic problems that we now face can both be traced back to the second world war. They have been a long time growing and attempts to conceal or water down their impact cannot go on indefinitely. Printing money to buy your own debt is normally the end game, so it’s not realistic to expect ‘muddle through’ can keep going. It comes down to the complications of gauging how the end game plays out.