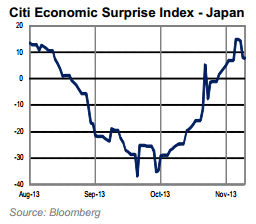

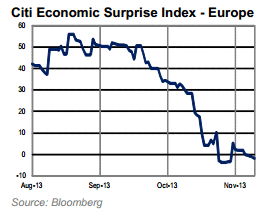

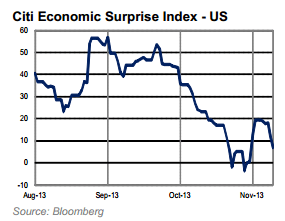

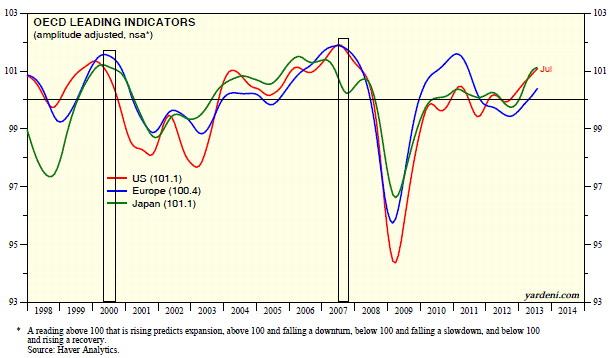

Here are the latest economic surprises indices for the major nations:

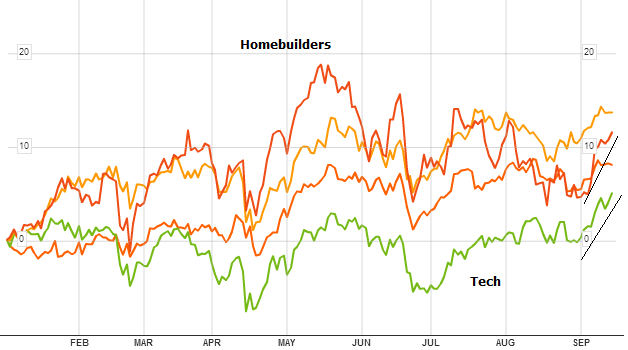

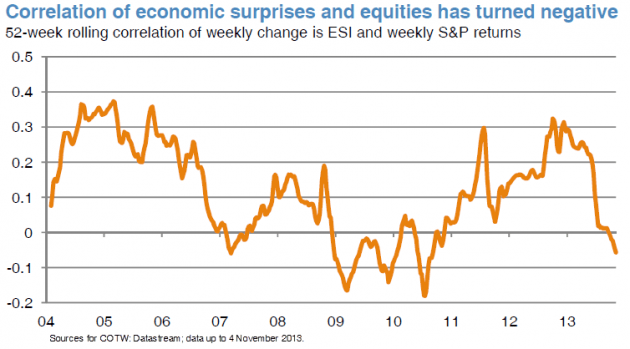

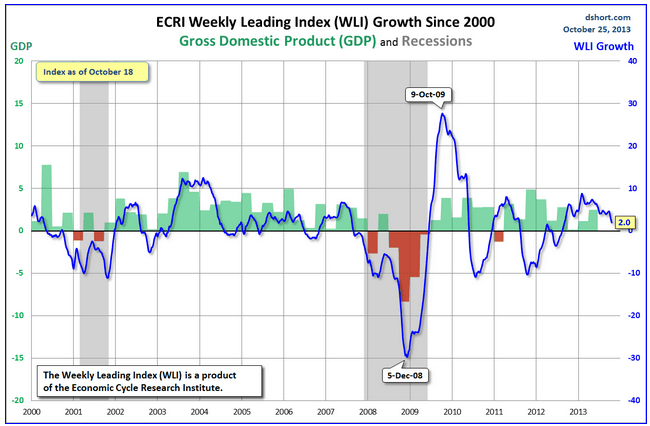

Japan aside, economic surprises for most of the majors topped out as we turned into September. Historically there has been a fairly good correlation between economic surprises and stock market returns, but the correlation has deteriorated throughout 2013 and turned negative:

Source: JP Morgan

Is there anything about that period from early 2009 to mid 2010 where correlations also were anomalously negative? My take is that by March 2009 most of the major stock indices were at p/e 10 or below, and thereafter we saw a period of post-panic bargain hunting at historic cheapness, despite and regardless of continued disappointing economic data. That doesn’t apply at today’s valuations.

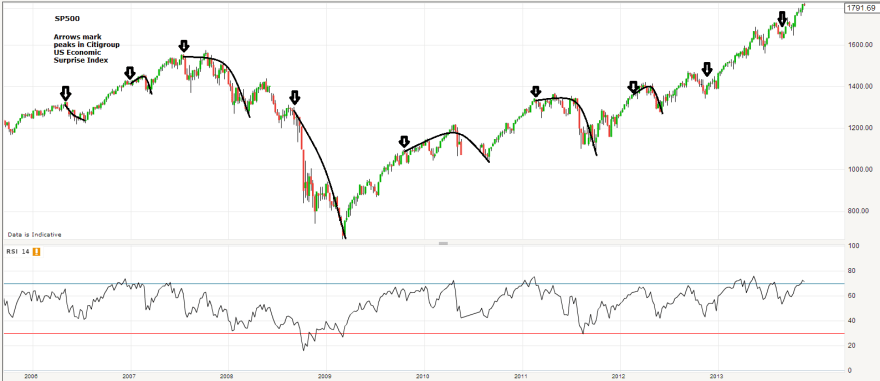

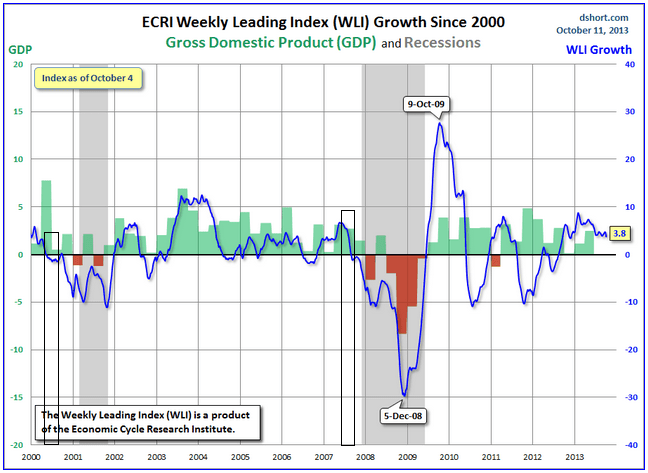

Here’s another look:

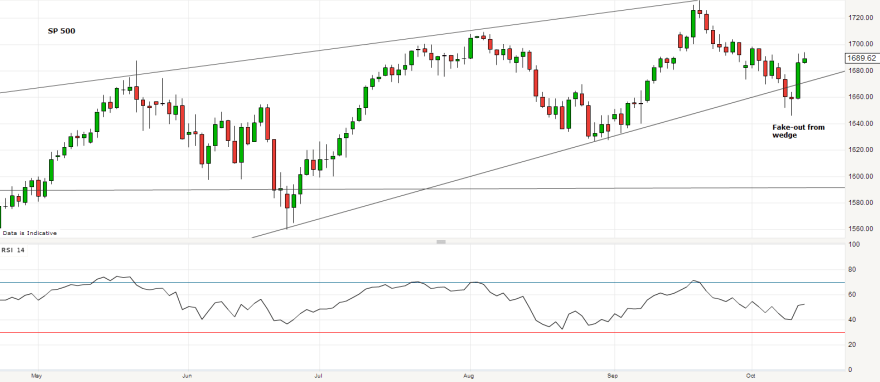

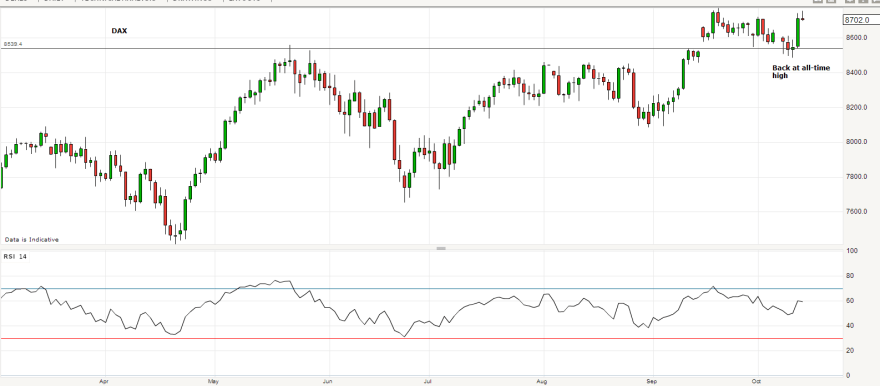

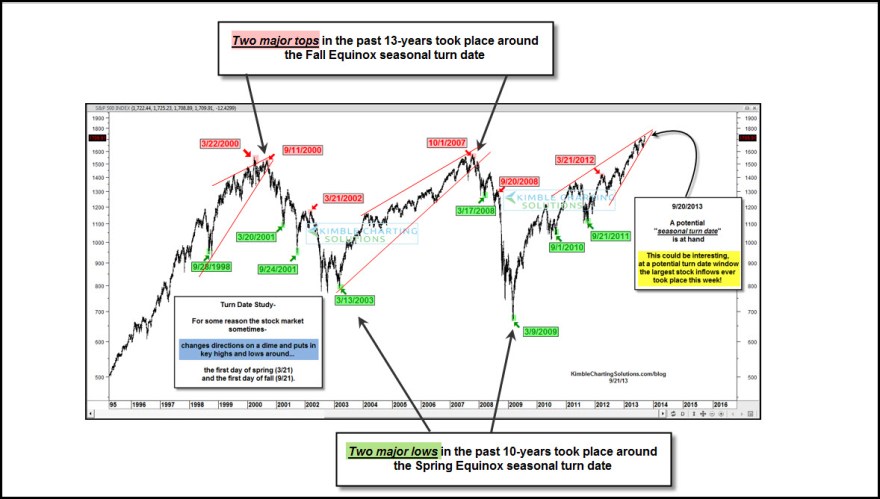

I’ve charted the peaks in US economic surprises versus the SP500. It can be seen that from 2006 to 2012, trend reversals in economic surprises reliably brought about corrections in the SP500, but sometimes with the stock market eeking out a marginal new high and then rolling over. But since the end of 2012 the two economic surprises peaks have been largely ignored by the market.

I’ve charted the peaks in US economic surprises versus the SP500. It can be seen that from 2006 to 2012, trend reversals in economic surprises reliably brought about corrections in the SP500, but sometimes with the stock market eeking out a marginal new high and then rolling over. But since the end of 2012 the two economic surprises peaks have been largely ignored by the market.

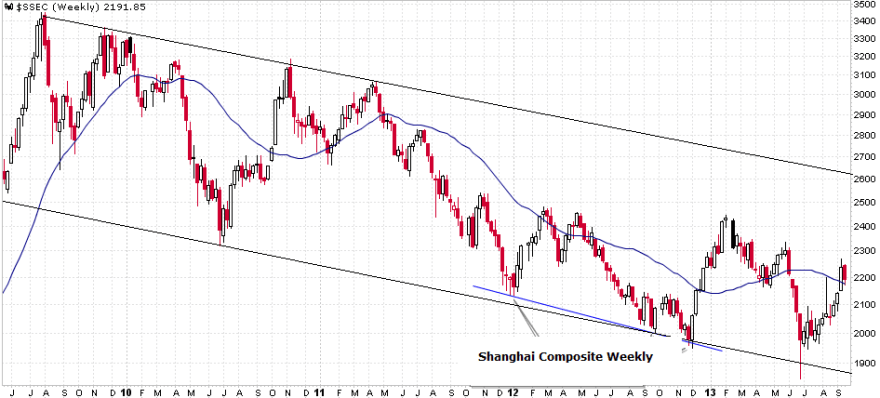

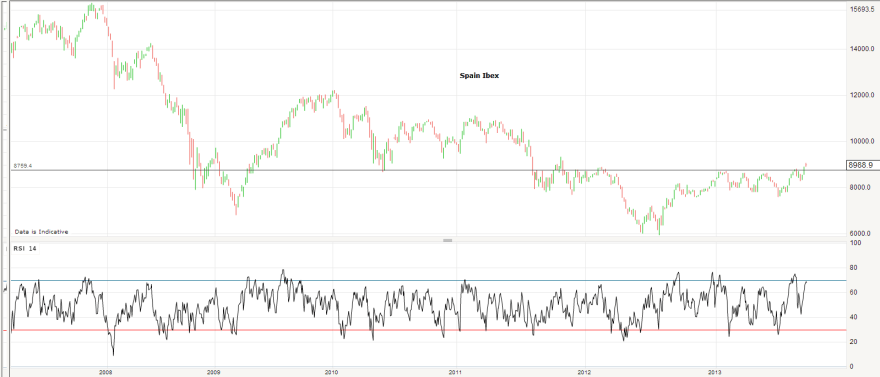

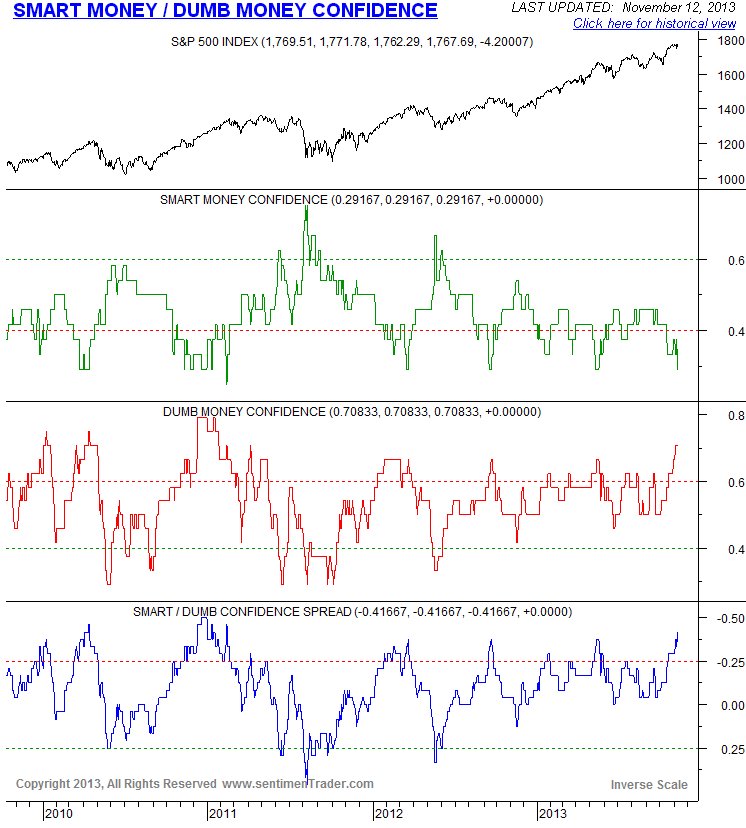

There have been other notable divergences since the turn of the year.

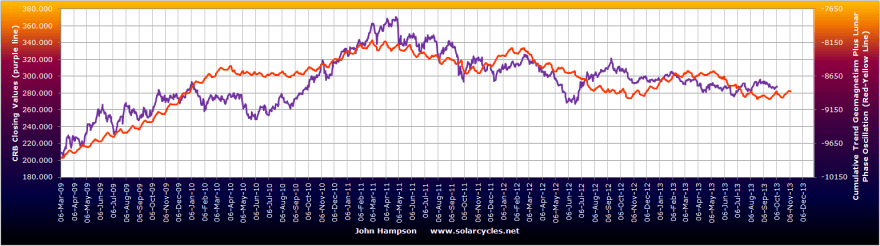

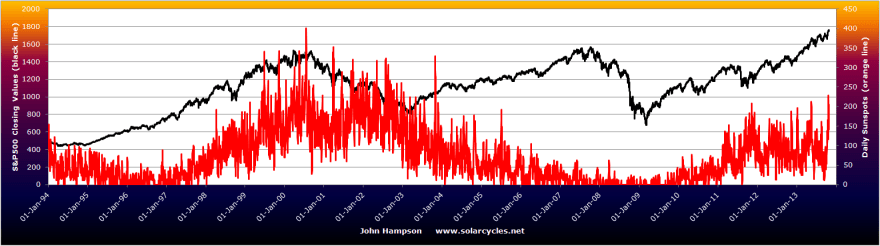

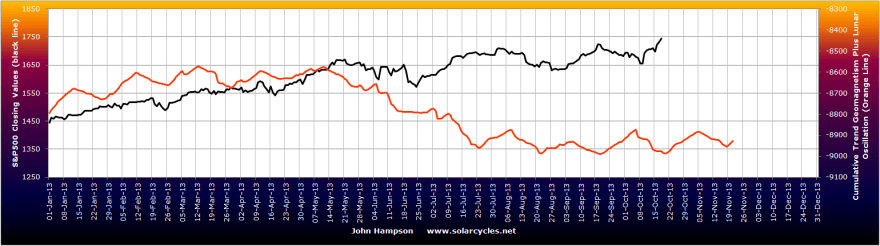

Equities have diverged from geomagnetism:

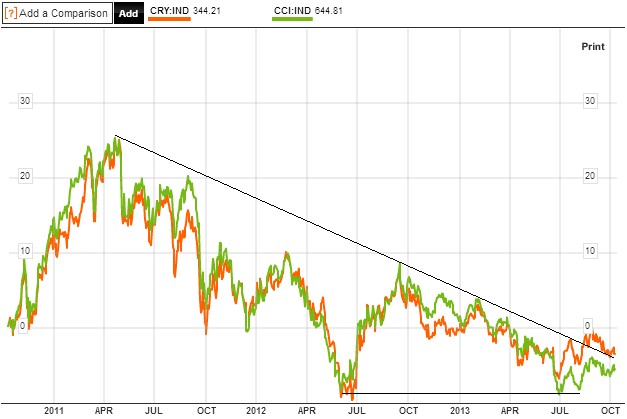

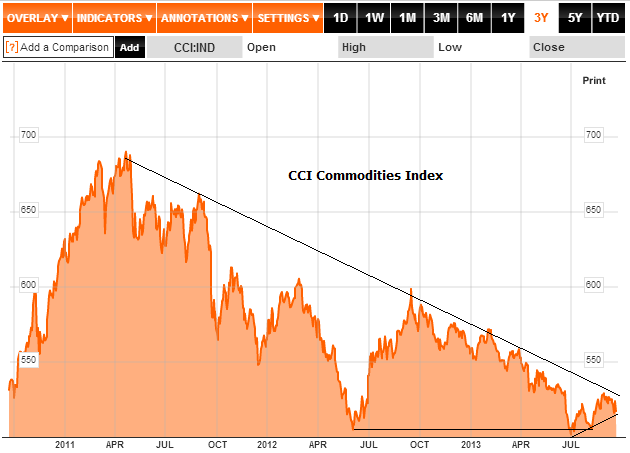

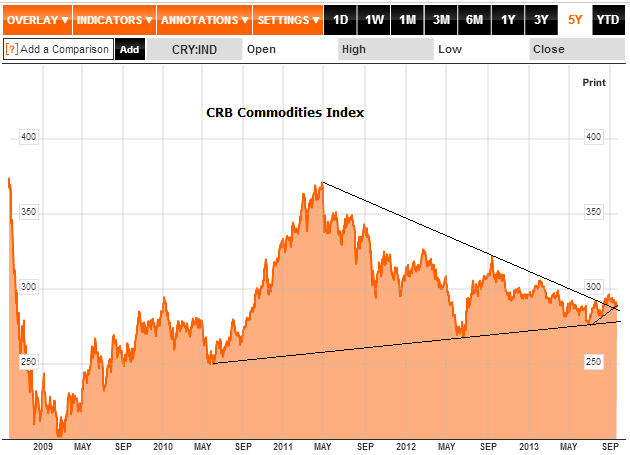

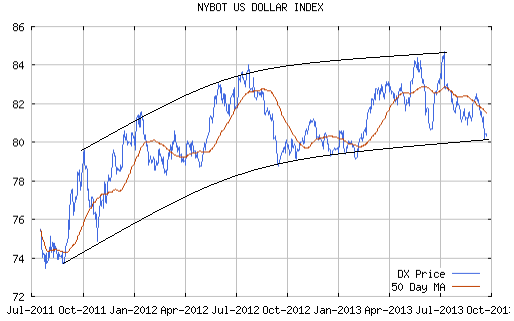

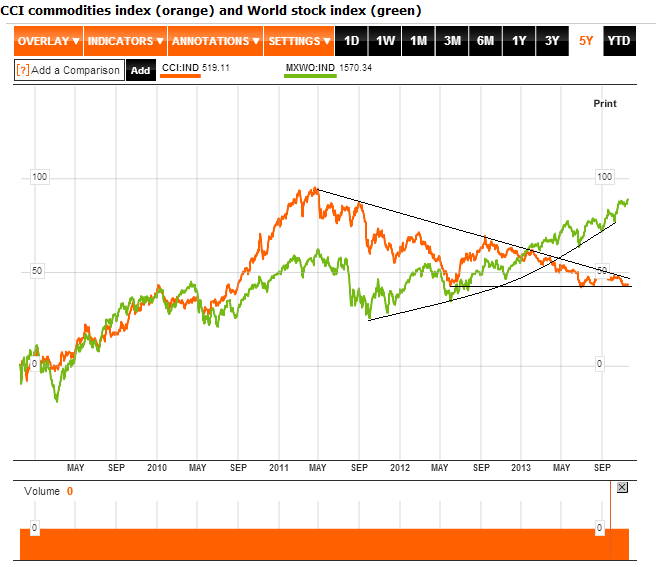

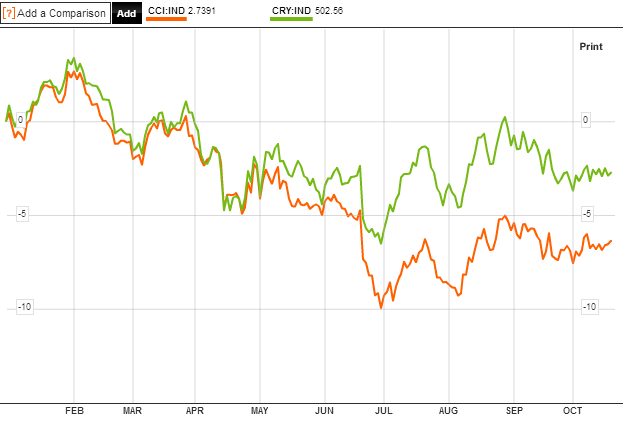

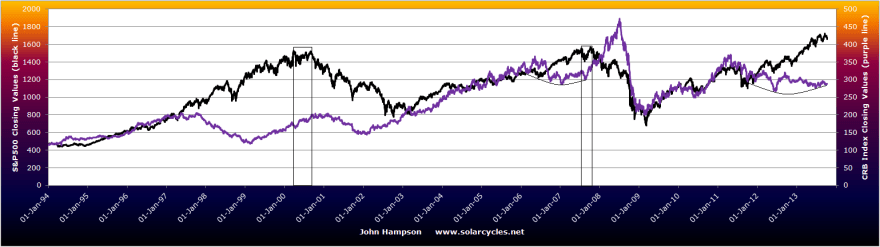

Junk bonds, which have historically correlated with equities fairly well under ‘risk-on/off’ sentiment, have parted ways with stocks and are actually down for the year. Commodities likewise:

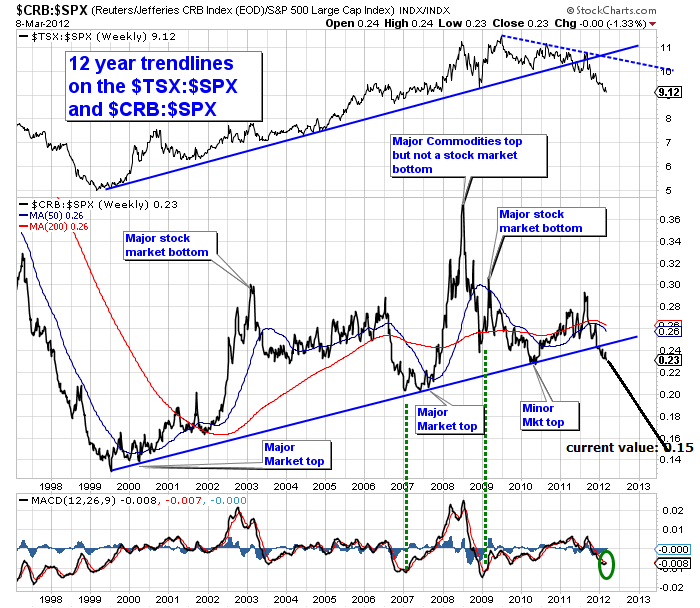

I have extended this commodities:stocks ratio chart from early 2012 to the current level in November 2013, showing the degree to which stocks are now valued versus commodities:

Down to 0.15, very close to the level reached at the 2000 equities peak.

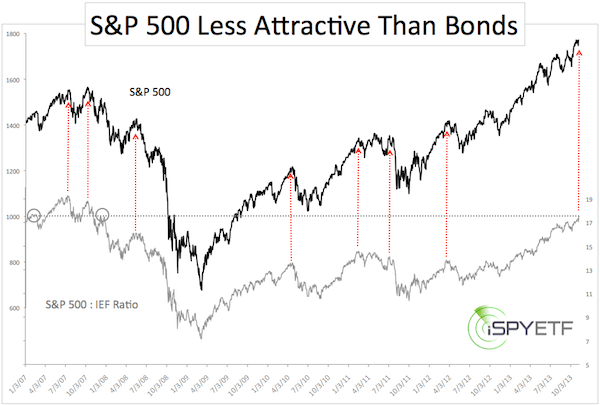

Versus bonds, equities have also made a sharp run up in relative valuation this year:

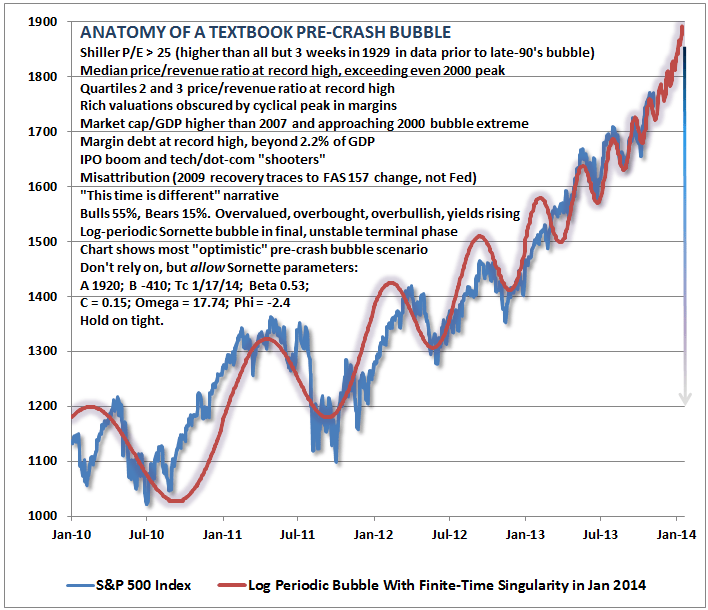

If this is the solar maximum at the end of 2013, then it would be normal, by history, for the secular asset class of the time to be bid up in a speculative finale, diverging from normal correlations and leaving models behind, in a final overthrow. If this is occurring with equities (perhaps disinflation has killed off commodities), then the above charts would be evidence for that, and we are left trying to look for clues as to how much further, both in time and price, the speculative finale has to run. If it isn’t equities, but rather commodities that are bound for a speculative finale (as they would rather befit the ‘secular’ asset class leading into this solar peak), then the above charts are warnings that the rug could be pulled from under equities at any time.

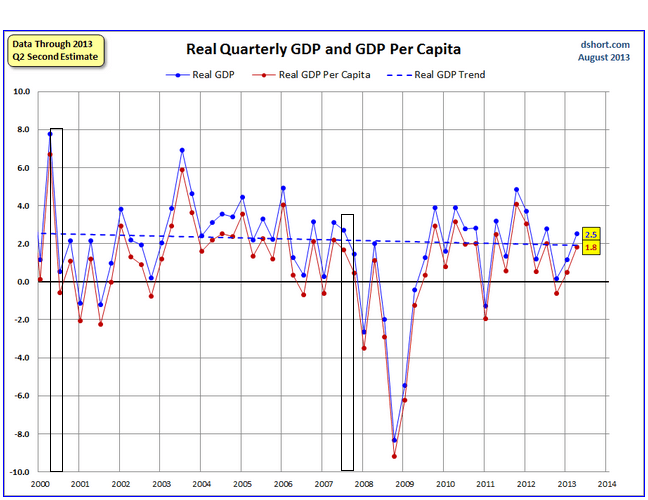

Right now, the balance of evidence suggests that it is stocks being bid up to a speculative finale, if my solar thesis is correct. Even without solar, we see various evidence for that, in my last post and this. See how margin debt has accelerated over the last 12 months, as it did prior to the last 2 major stocks peaks:

Source: Dshort

And now look at the decline in trading volumes:

There are fewer and fewer participants in the market chasing it higher, and the margin debt and credit account levels (last post) suggest increasing leverage to do so. Unless more people and institutions come to the market, then that is a recipe for a steep decline or crash ahead. By demographics, those additional participants are unlikely to materialise. Recall that demographic trends in the US were up into around 2000 and have since been downward, continuing this decade. I suggest that is what we are seeing in the trading volumes ‘mountain’ above.

In summary, I believe the equities bull is on borrowed time and that risk-reward is stacking up on the short side. But it comes down to how much further in price and time stocks can extend first. If solar-inspired speculation is at work then parabolic becomes more possible. If on the other hand equities are to make a topping ‘process’ rather than a parabolic, then by normal measures this has not started in a meaningful way so should at least extend for several months and postpone a major decline until 2014. If commodities are to become the speculative target then they should take off as late cyclicals whilst stocks make a topping process. This remains theory only, and deflationary demographics are a headwind to this occurring, so I have my doubts.

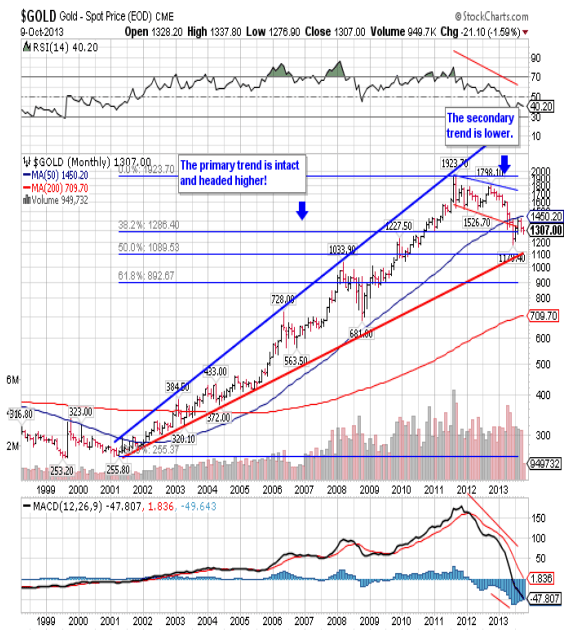

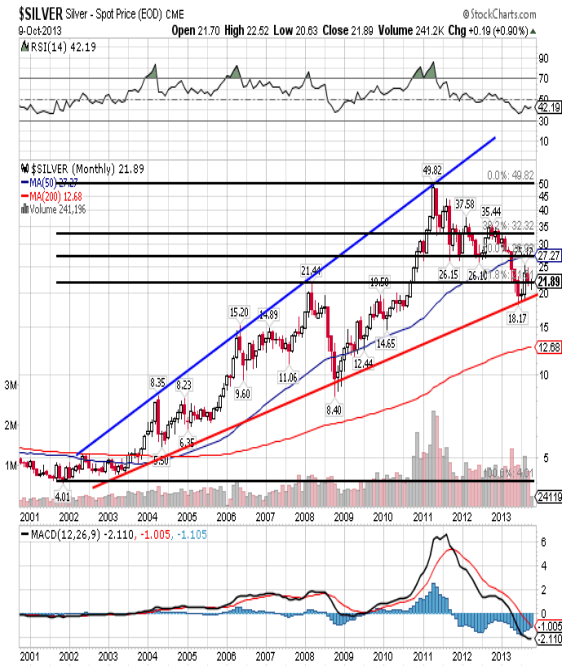

On that note, if we look at when gold really took off in the past, it was under conditions of negative real treasury yields. Rises in yields over the last 12 months, together with shrinking inflation, have taken real yields positive and are a problem for gold. Deflationary winds, due to demographics, threaten to take inflation yet lower, whilst treasury yields by late 2012 had reached historic extreme lows, suggesting renewed downside may be limited. So, if I could speculate how fortunes could be reversed in gold, it would be either the world tips into deflation and gold performs more ‘uniquely’ (gold’s performance under deflation is limited in history, but I suggest it ought to perform as the default go-to asset under such conditions when all others are unattractive) – or – central banks take renewed action against the disinflation in progress by increasing rather than decreasing stimulus, e.g. the ECB launches QE and the Fed maintains QE rather than tapers.

Seventh, margin debt. We see a similar overthrow rally in margin debt recently as per the 2000 and 2007 tops, and again margin debt was in a clear downtrend by the end of the topping ranges so should look for the same to occur

Seventh, margin debt. We see a similar overthrow rally in margin debt recently as per the 2000 and 2007 tops, and again margin debt was in a clear downtrend by the end of the topping ranges so should look for the same to occur In short my message is this. If this is a topping process in equities, then we should see a further leg up ahead where the bulk of these indicators have moved into clear downtrends. We have certain topping signals already in place, but the rest should fall into place ahead if this is a topping range. It means a golden opportunity to go short would be following a further leg up in stocks against the backdrop of these remaining indicators having turned. If this is not a top in equities, but a consolidation before further gains, then we should break free from the range, and the topping indicators in place one-by-one cease to be.

In short my message is this. If this is a topping process in equities, then we should see a further leg up ahead where the bulk of these indicators have moved into clear downtrends. We have certain topping signals already in place, but the rest should fall into place ahead if this is a topping range. It means a golden opportunity to go short would be following a further leg up in stocks against the backdrop of these remaining indicators having turned. If this is not a top in equities, but a consolidation before further gains, then we should break free from the range, and the topping indicators in place one-by-one cease to be.