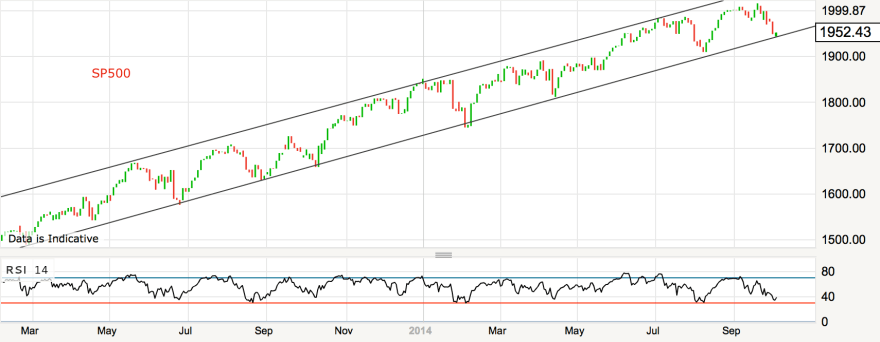

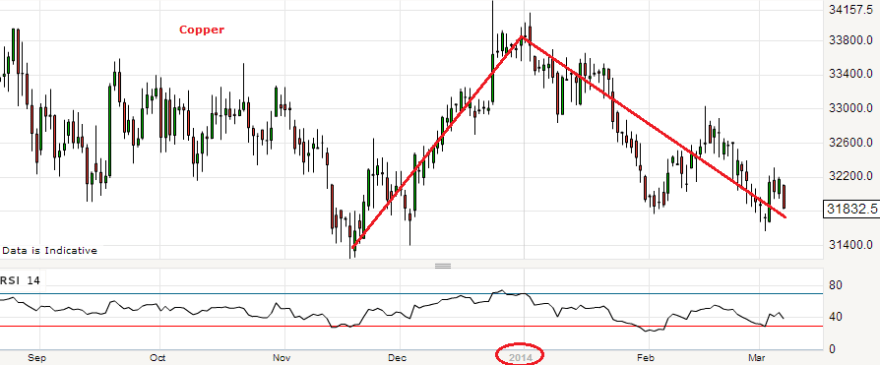

Tuesday’s selling to a lower low delivered the missing positive RSI divergence on the SP500 and out of that we saw a strong rally on Wednesday.

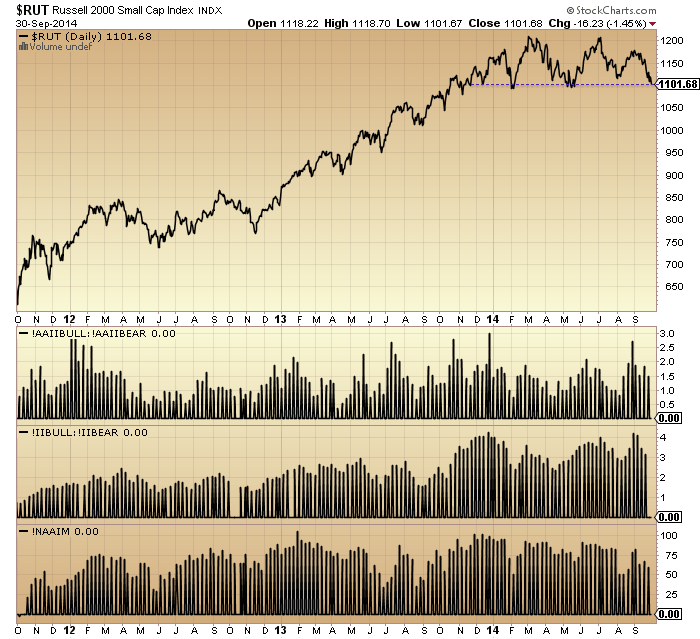

It was a necessary stick save for the bulls at key support in most indices, particularly the Russell 2000. So we are back to: is this another v-correction or just a save before a true breakdown?

There were clues behind the scenes yesterday.

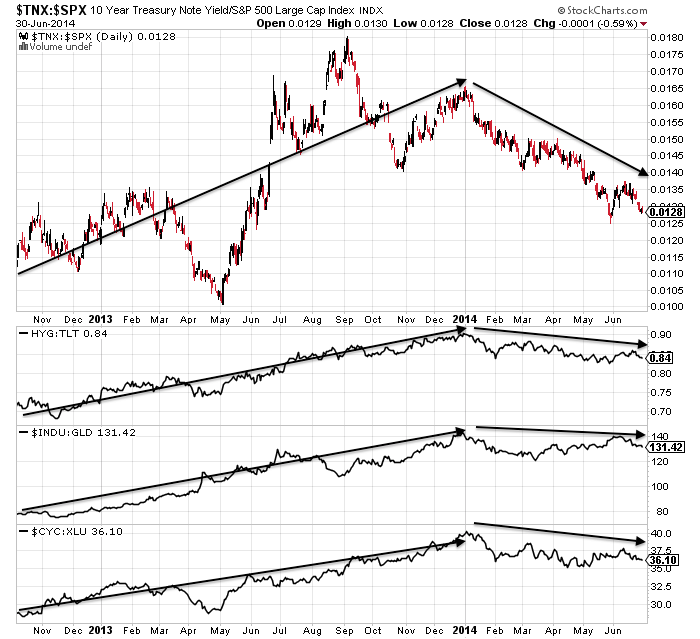

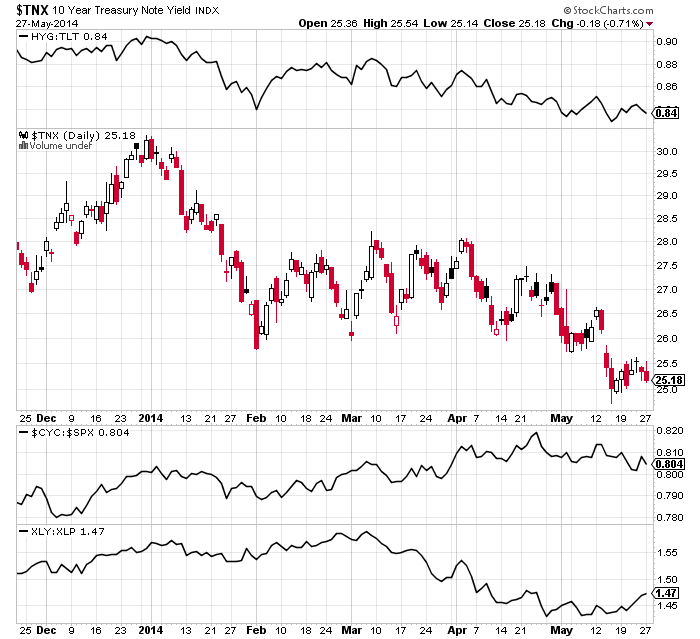

The best performing sectors in the rally were the defensives: utilities and healthcare.

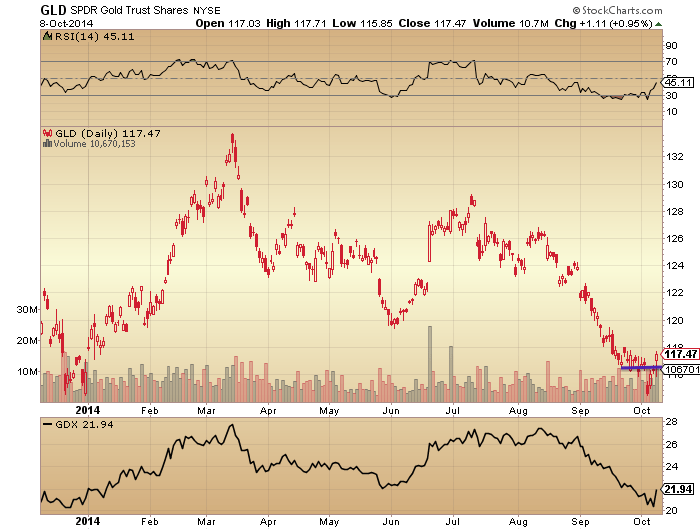

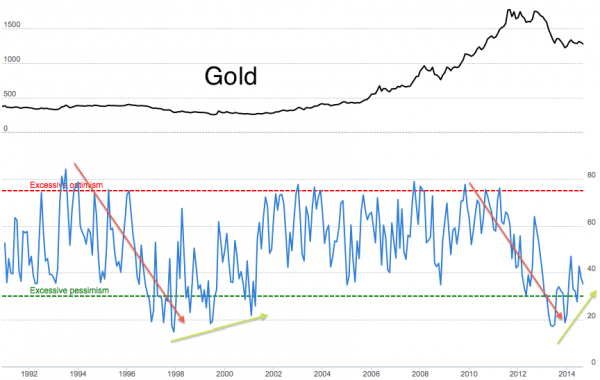

Gold and gold miners rallied and appear to be turning last week’s breakdown into a fake-down.

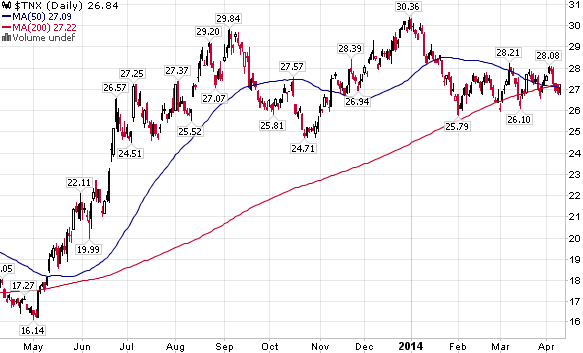

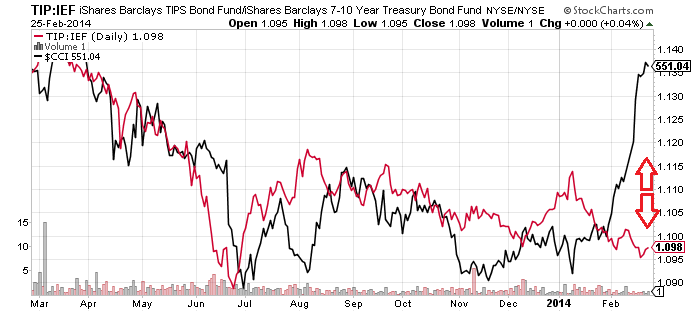

Treasuries also rallied, so either risk or defensives have it wrong.

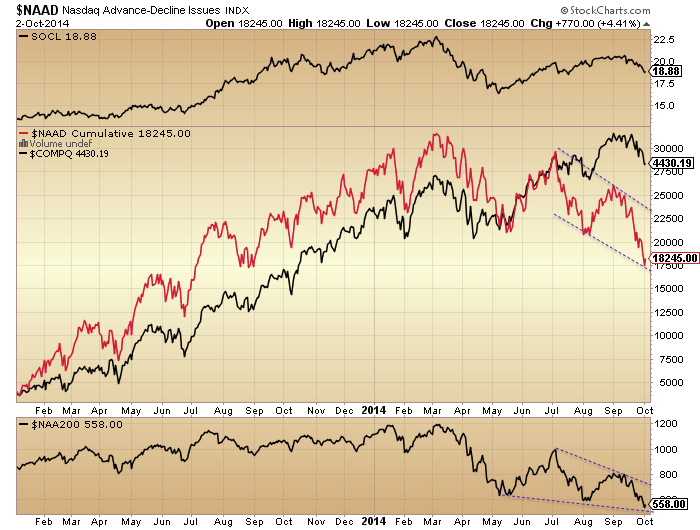

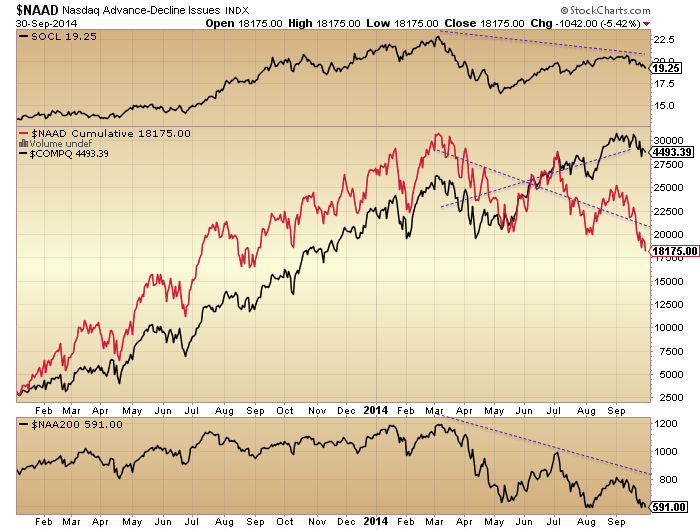

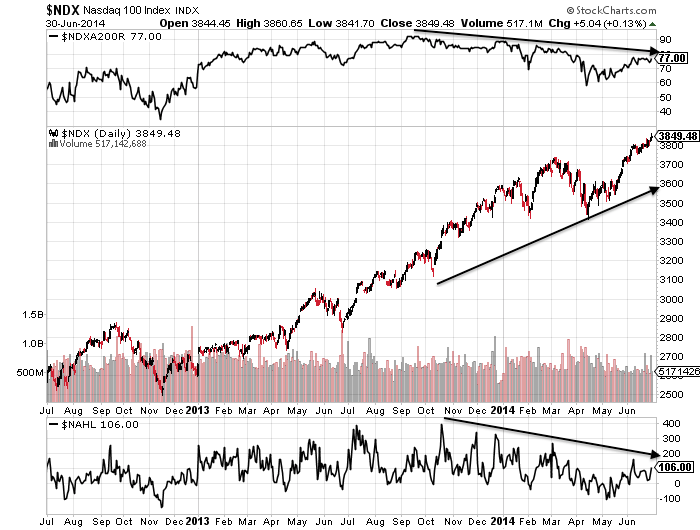

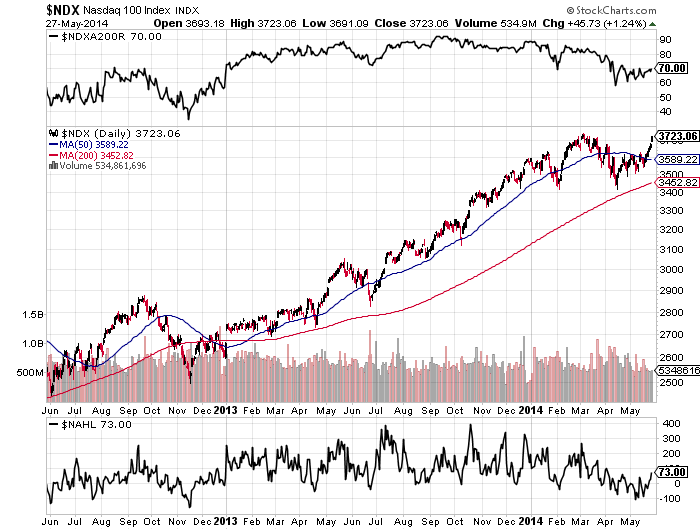

Breadth weakened rather than strengthened, casting doubt that equities have it right.

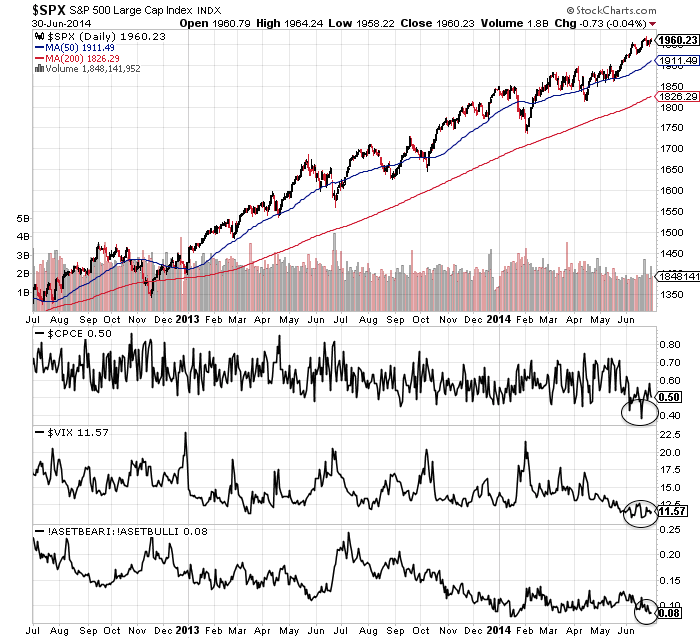

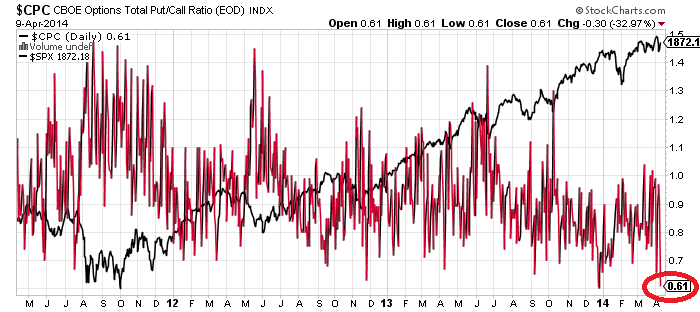

The above chart shows Vix remains divergent too.

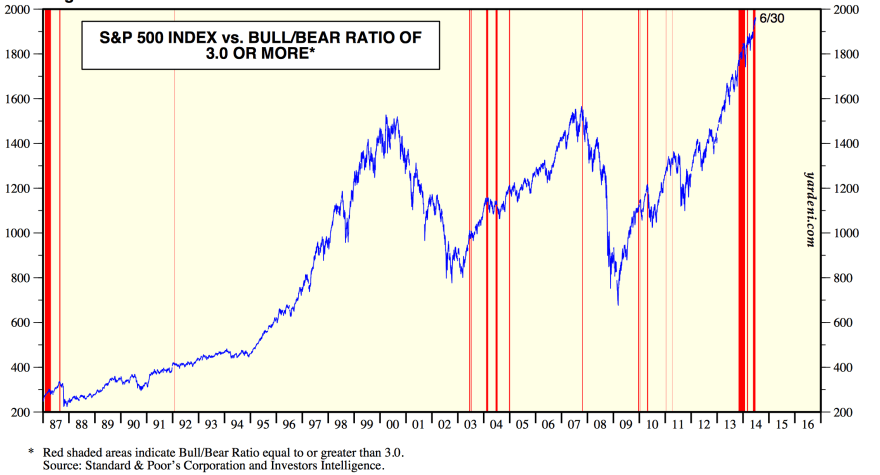

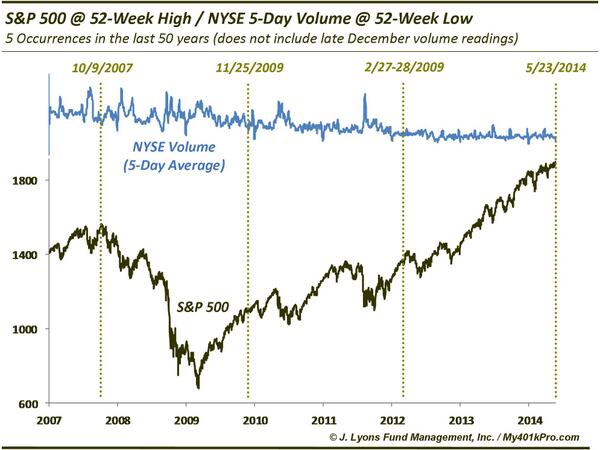

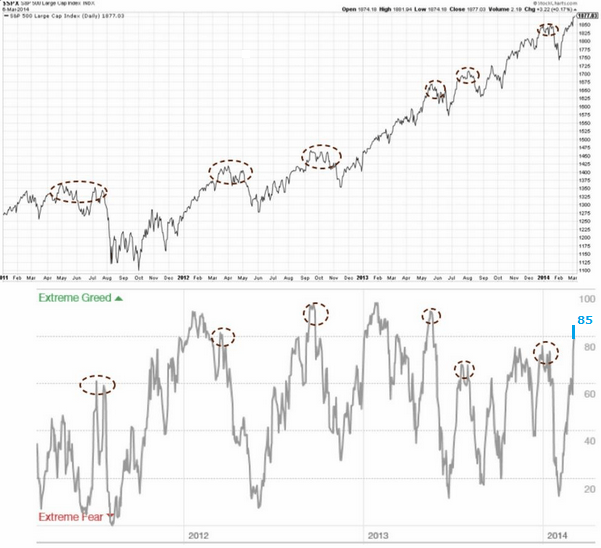

Investor Intelligence % Bears are at 14.1 this week, still at the historic extreme, so there has been nothing remotely resembling a washout. Complacency rules.

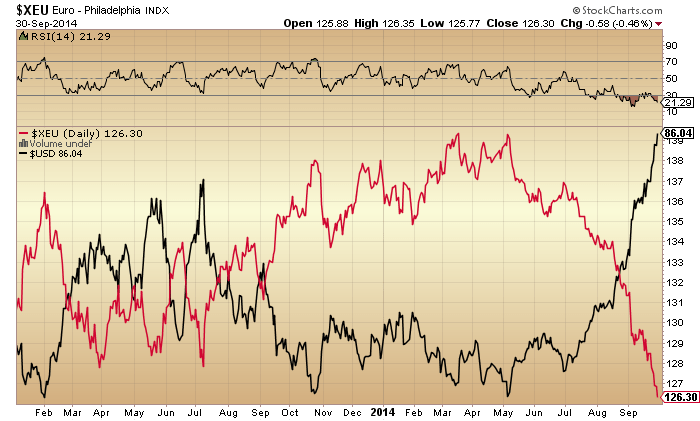

The US dollar’s parabolic has broken.

Lastly, to respond to the point that this chart may be cherry picking the RUT as it fits time-wise:

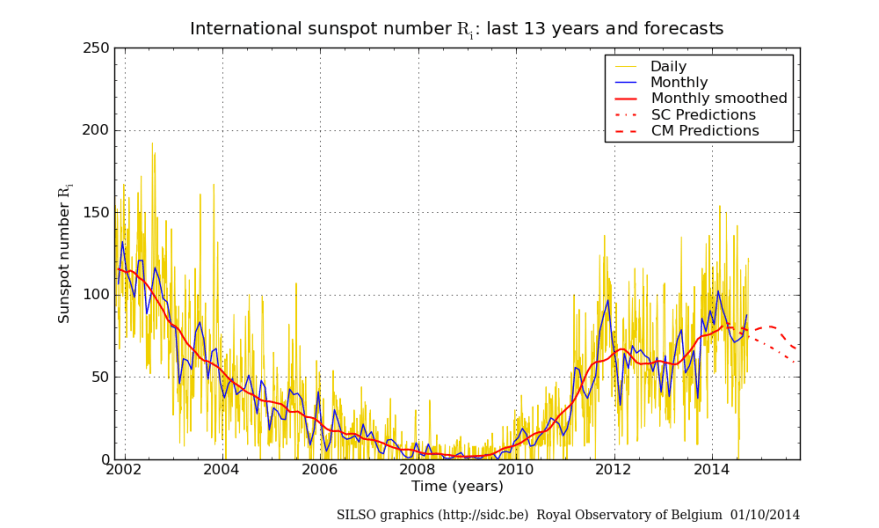

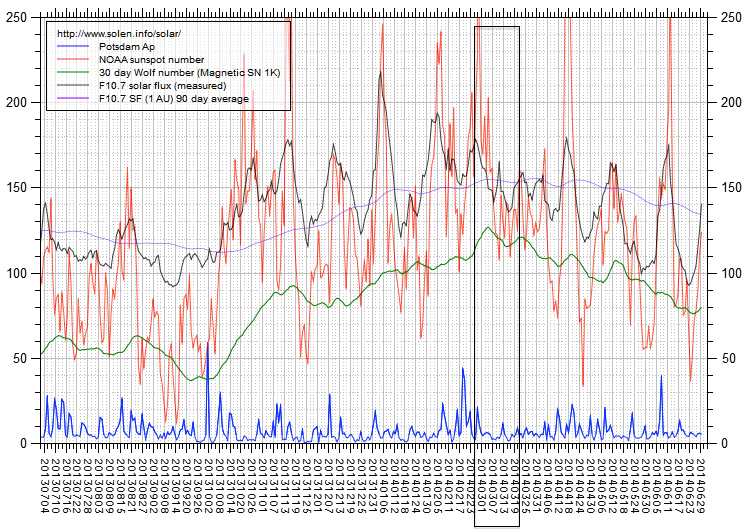

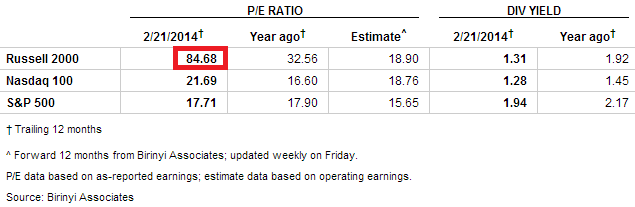

My case is that the RUT was the speculative target as evidenced by the p/e, hence the epicentre with RUT and margin debt right at the smoothed solar max. However, the point is that all stock indices should top out close to the solar max, without any cherry picking. So, the last solar max peak looks like this:

March 2000 = Smoothed solar max

December 1999 = FTSE peak

January 2000 = Dow peak

March 2000 = Margin debt peak; Hang Seng peak; Dax peak; Nasdaq peak; SP500 peak; Russell 2000 peak

April 2000 = Nikkei peak

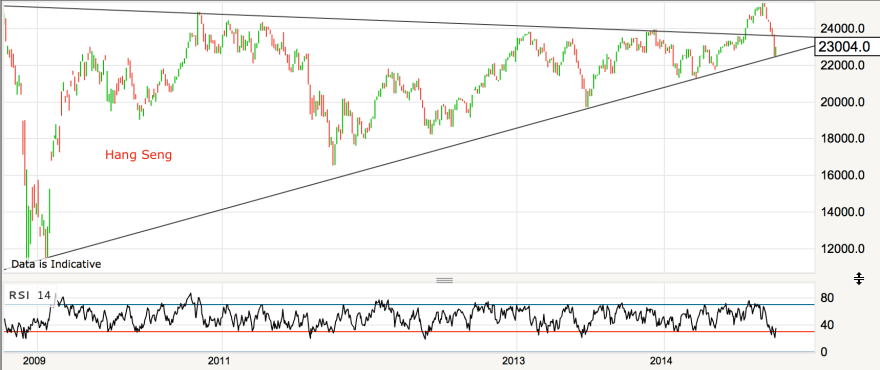

So, the epicentre was March, and all major global indices topped out within 4 months of this. Now, if you assume here in 2014 the smoothed solar max was March and that all stock indices have now topped out (for which there is a strong case), it looks like this:

March 2014 = Smoothed solar max

February 2014 = Margin debt peak

March 2014 = Russell 2000 peak

May 2014 = FTSE peak

July 2014 = Dax peak

September 2014 = Hang Seng peak, Nikkei peak, SP500 peak, Nasdaq peak, Dow peak

So, the epicentre was March and all major global indices topped out within 6 months.

However, this can’t be validated until we are sure that the smoothed solar max was then and that stock indices do not make new highs from here. Nonetheless, with every month that passes odds are that this is correct and that stocks were on borrowed time since March.

To sum up, by the looking under the hood, the probability is that yesterday’s rally in stocks is quickly reversed again. This could happen as soon as today, or perhaps more upside can be squeezed out into the end of this week. But the signals point to ultimate failure, which means the stick save at support is just a temporary reprieve for the bulls. To those who think yesterday’s save means waterfall declines aren’t going to happen this year, understand that this was a crucial save at the final support on the RUT: it was unlikely to break without a fight. Traders have become conditioned to buy the V-bounce at support over the last 18 months, but the clues are that this time should fail, as covered in recent posts. 6 of the top 10 biggest Dow down days occurred in the window right ahead:

19 Oct 1987

26 Oct 1987

28&29 Oct 1929

6 Nov 1929

15 Oct 2008

And I believe this picture nicely sums up the Q4 2014 scene: