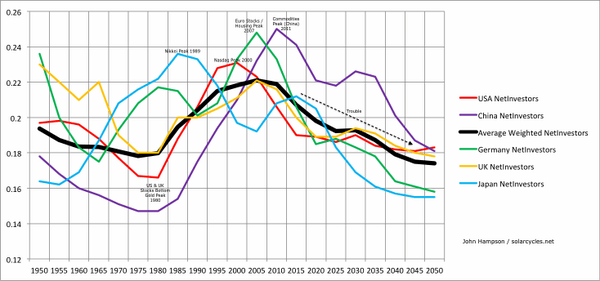

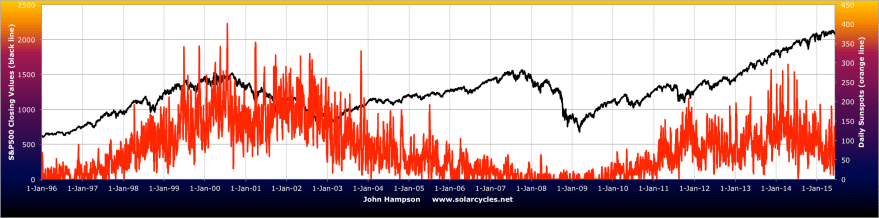

Financial markets are the function of swells and shrinkages in buyers and leverage, brought about principally by demographics and sunspot cycles, additionally with the latter influencing the former.

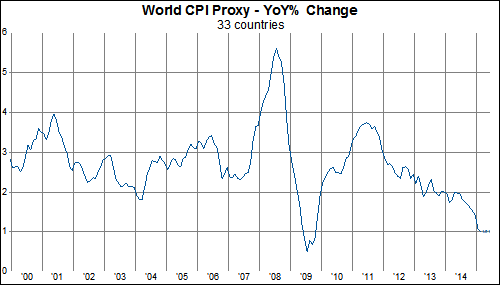

The big theme in demographics over the last half century has been that the major nations have largely experienced similar swells and shrinkages in key age groups due to the post WW2 baby boom. As a swell of young adults they produced inflation in the 60s and 70s, which then turned into a middle-aged swell producing stock market and real estate booms post 1980.

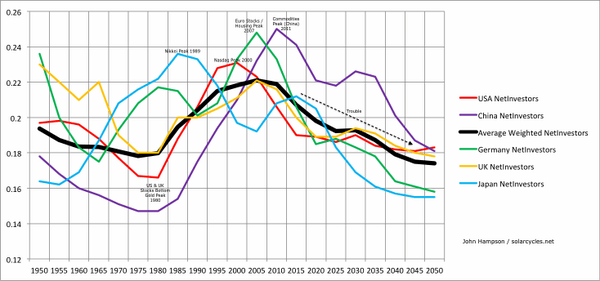

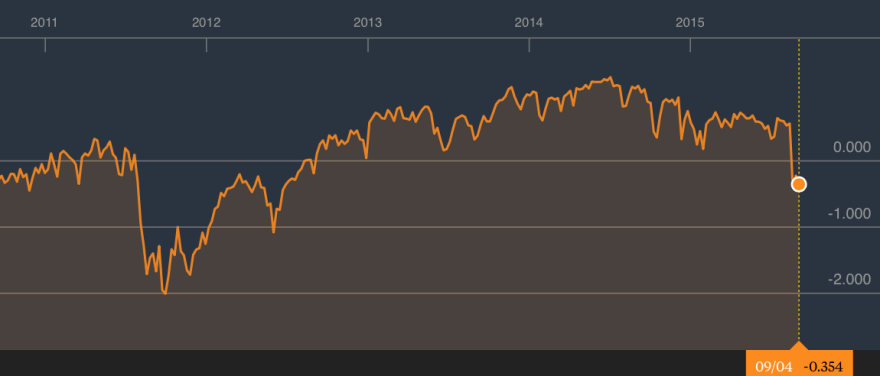

This chart shows the ratio of middle-aged to all population in the major nations. This ratio experienced a major peak in each of the countries between 1989 and 2011 producing the according stock market and commodity major peaks.

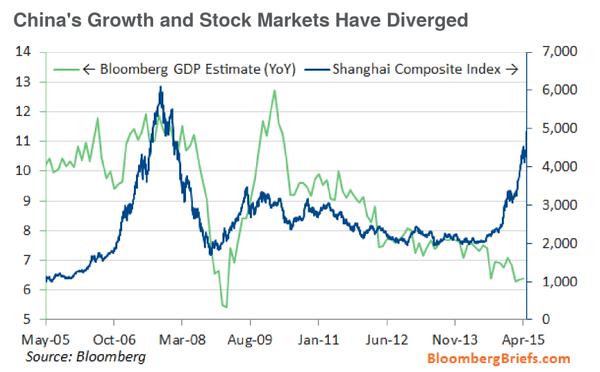

First Japan’s demographics peaked out, producing the Nikkei and Japanese real estate tops. Then the US peaked in 2000 with the resultant biggest ever stock market mania. Next UK and Germany peaked out with the 2007 stock market and real estate peak. Finally, China peaked out and as the world’s biggest consumer of commodities, the commodities index accordingly delivered a major top.

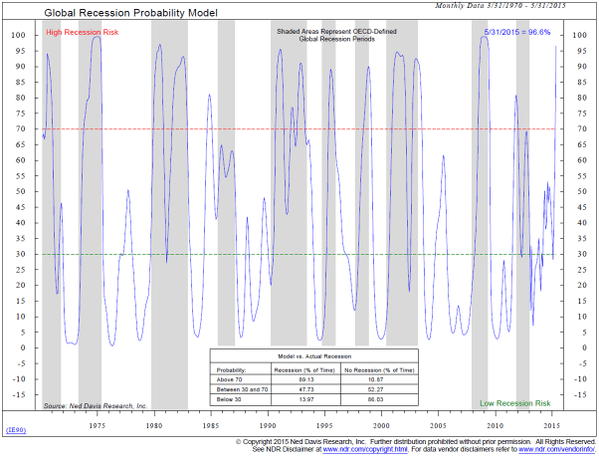

Since then demographics are united in a downtrend, which is the main reason why 6 years post financial crisis we still have ZIRP, QE and easing as the dominant central bank policies worldwide, and why the world economy is under such deflationary and recessionary pressures. Ultra low rates helped give rise to the stock market mania of 2013-2015, but otherwise we have to turn to solar cycles not demographics for the driver.

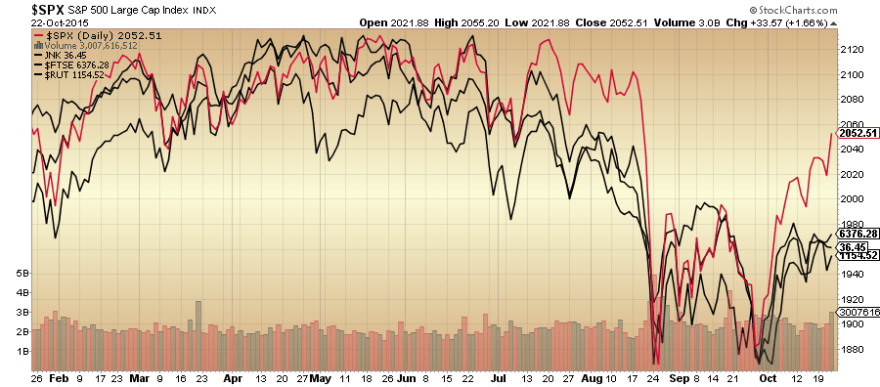

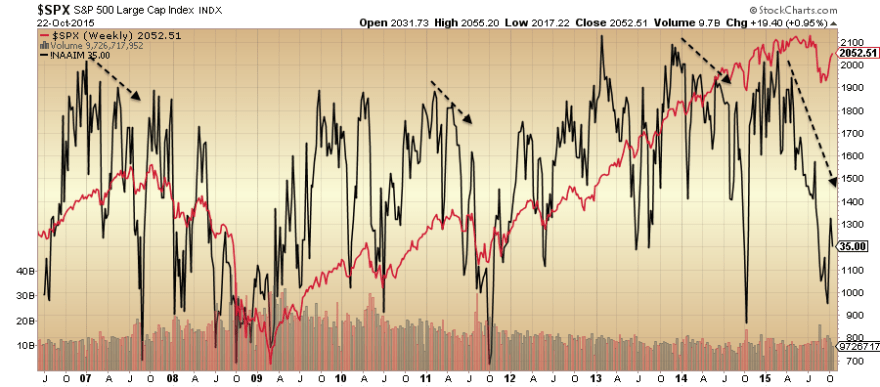

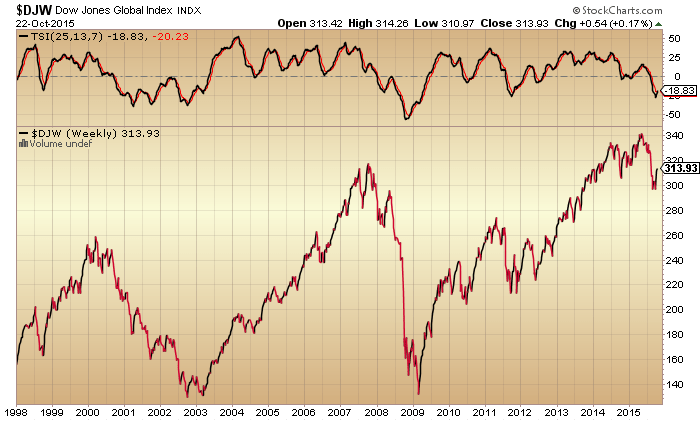

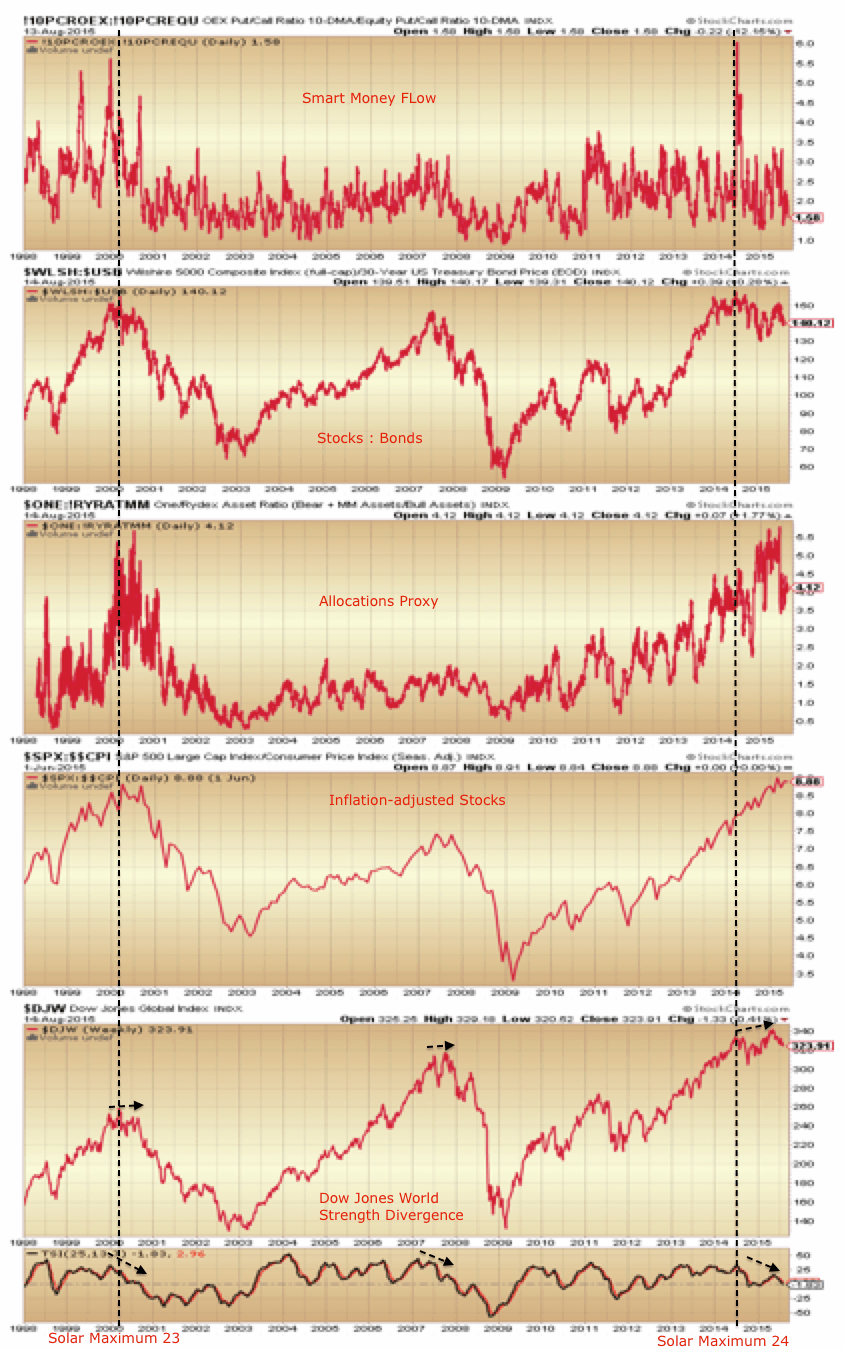

Each of the sunspot maxima in the era of globalised, free markets produced a peak speculative mania. Between July 2014 and May 2015 we saw commodities, junk bonds, leverage, breadth and stocks peak out, following the smoothed solar max of April 2014.

That lag is not dissimilar to that in 1929: a slight overthrow beyond the solar max. In both instances breadth peaked out at the same time as the solar max but nominal stock prices didn’t top out until a year later.

Drawing on Q ratio valuation for the big picture we can see that solar maxima typically produced high extremes in valuation which then mean reverted. Meanwhile, low extremes corresponded to major commodity or gold peaks.

Draw together both the solar cycles and demographics above and we get the projection of the black arrow, namely that stocks should wash out to undervaluation levels by around 2025, the next solar max, and gold should rise into a major peak then. What’s key is that there is no demographic relief in any of the major nations between now and 2025 nor a solar maximum (they are roughly every 11 years). Therefore, I expect a long bear market in stocks in this window, like these examples from history:

If I was to narrow the projection a little further, then the solar minimum of around 2018-19 is likely to mark the first major bottom within that. That means a bear from now of around 3 years, similar to those historic cases above. After that stocks ought to continue to languish, perhaps sideways Japan-1990s-style, whilst gold rises to dizzying heights to a peak circa 2025. But that time frame is a little to long to be anything more than speculative, so let’s keep the focus on the first major cyclical move, which I consider to be a bear from May this year to last some time and take valuations sub-mean.

The question mark is over central bank response. They won’t stand by and watch this occur but are likely to turn to increasingly unorthodox measures. The reason demographics and solar cycles work is because the markets are globalised, free, instant voting machines that therefore capture major collective trends. If central banks ban shorting, restrict capital flows out of the country, penalise people for not investing in government bonds, penalise savings, or other such policies then the markets environment will become more distorted and we will have to adjust accordingly. So far, however, central bank distortive measures haven’t been able to override the collective demographic trends, as evidenced here in global inflation and economic trade.

Source: Gavekal

All that stands between outright global deflation and recession is the wealth effect of the stock market. So let’s turn to that.

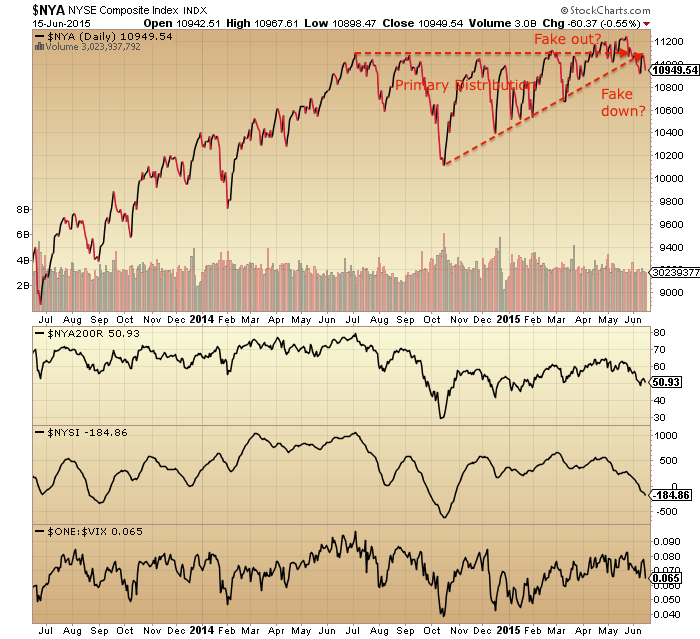

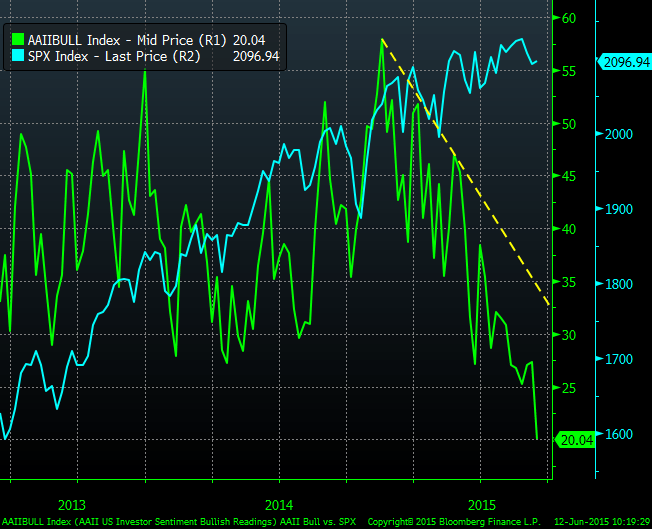

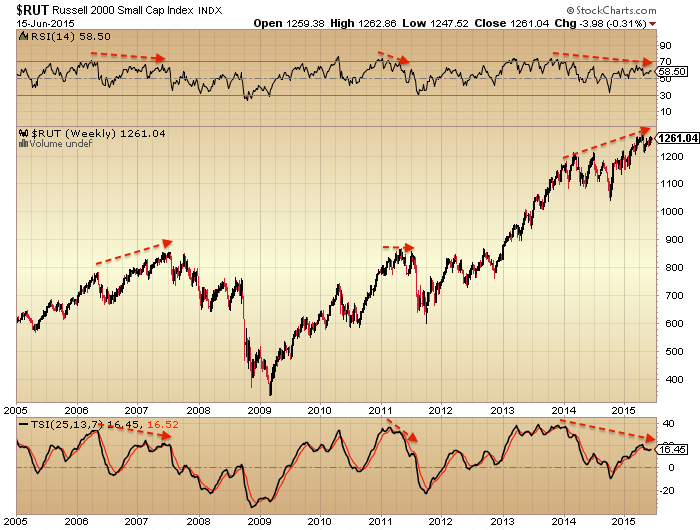

In 2014 we saw around 40 different topping indicators aggregate in the US stock market. From mid-2014 we saw multiple divergences in breadth and risk, whilst commodities and emerging markets broke down. In 2015 developed nation stock prices arched over, topped in May and snapped in August. Now, we see washout levels in commodities, emerging markets and various stock market measures such as sentiment, breadth and risk.

In the big picture, US stock market valuations have declined from their peak but are still highly levitated.

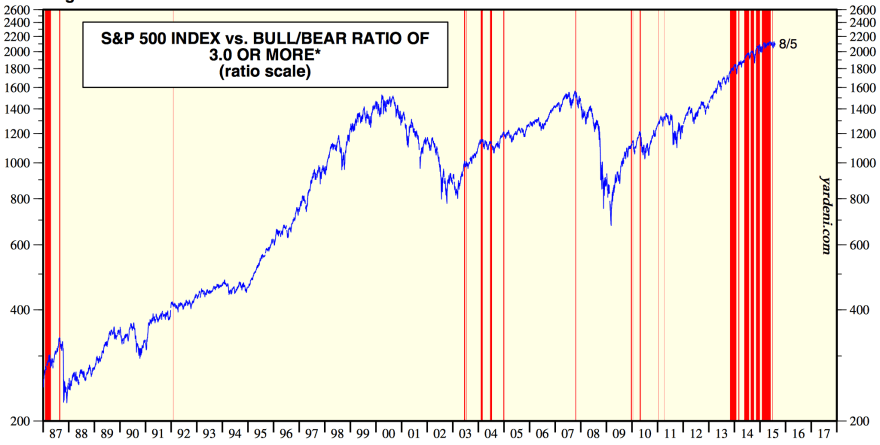

II sentiment and Rydex allocations either show a major unrepairable pop of the stock market bubble, or a healthy washout from which stocks can now in due course resume bullishly.

Source: Yardeni

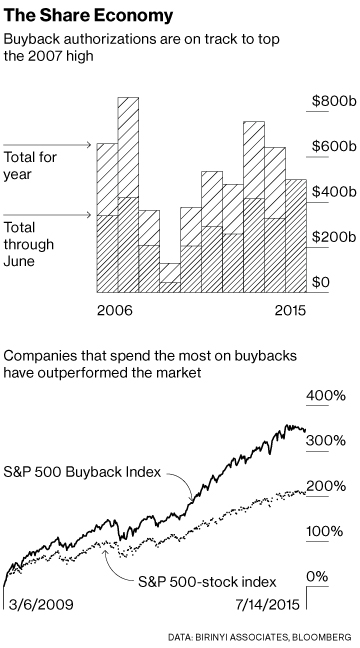

It’s clear that the mania or the last 2 years depicted in these two indicators is about as crazy as it gets and odds are much higher that that recent bursting of the bubble is likely to have ushered in a period of mean reversion. Effectively it has broken the collective complacency and the record leverage deployed in the markets is now likely to shy away from its peak. Without the demographic tailwind, leverage has been the main fuel for this bull, through both margin debt and buybacks-via-borrowing.

Regarding buybacks, this fuel source is likely to continue through the end of this year as companies execute their purchase plans. We can see how something similar transpired in 2007.

At some point, the leverage in the system will unwind in a disorderly way, producing a crash. What I am wondering is whether this may occur again once both buybacks and margin debt are declining in a more united way together (like in 2008), which would likely be once 2016 hits. Just speculation.

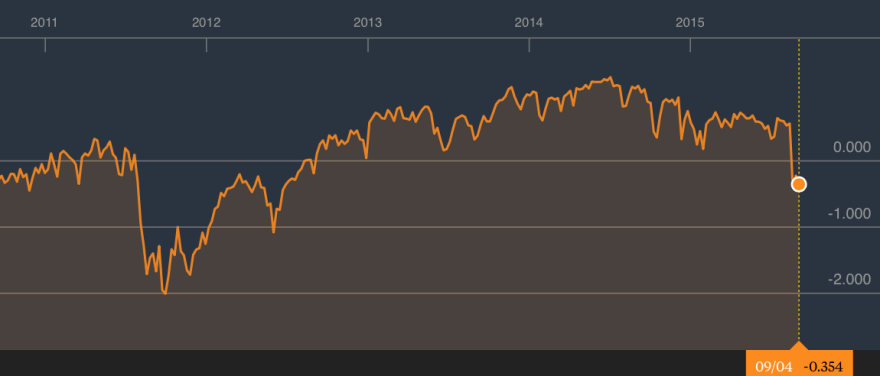

In the meantime, the August breakdown in stocks has likely done enough damage to cement the bear and kick off the negative feedback looping that will produce escalating trouble from here on. ECRI leading indicators and Bloomberg financial conditions have both slipped negative.

Source: Bloomberg

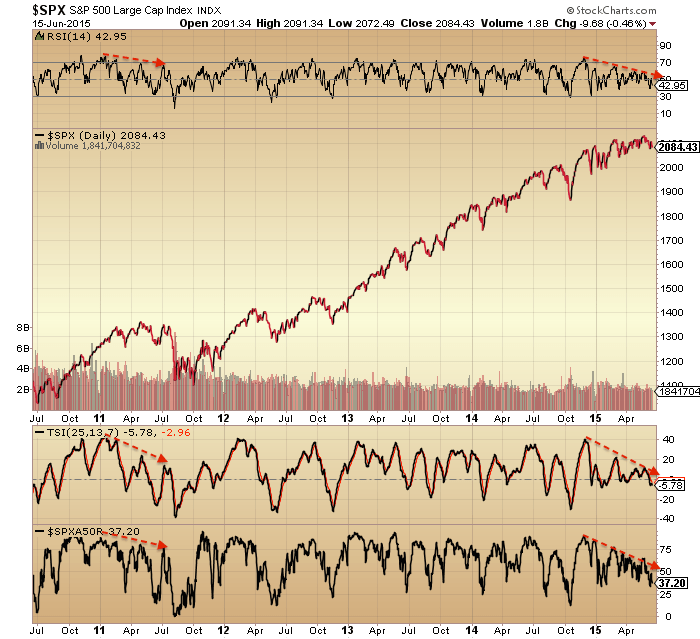

Turning to the near term, this is how the SP500 looks:

Prices are consolidating after the August drop. Breadth, Trin and volatility show similar washout readings to 2011. Nonetheless, the historic pattern is that stocks ought to retest the August lows and at that point bulls should be looking for positive divergences. An absence thereof likely spells lower prices which in turn increases the odds we are in a bear market.

If we are in a bear market then this doesn’t prevent ripping rallies. In fact they are common. What’s important is to see a pattern of lower highs and lower lows. So, should we push upwards from the current oversold/overbearish short term readings then we should stop short of the August breakdown point. Should we break downwards we should take out the October low and initiate the lower low pattern. On a longer term view, the bear market should very gradually eliminate the dip buyers, until all hope is truly lost.

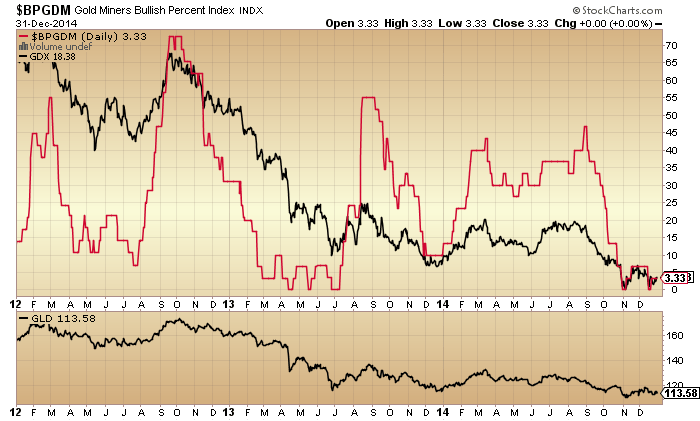

My tactics then are: hold short (Biotech, R2K, Dow), add short if we go higher, wait for August lows retest, check for positive divergences and bottoming pattern to judge whether to take profits. Cross market to gold, I am long and holding, looking for gold to cement its higher low than July and build out its rally. Were gold to break down to new lows, then it would be a warning.

Lastly, a note on washed out emerging market stocks and non-precious metal commodities. Oil has dropped from $100 to sub $40 in a short time and emerging market equity valuations are historically very low. Are they a buy?

My perspective is that we have experienced something similar to 2006-8 whereby markets crumbled in order. Then, real estate fell first, then equities then commodities. This time, commodities and emerging markets fell earlier than developed equities. When developed equities have eventually truly washed out then there may be attractive risk-reward on emerging and commodities. But between now and then I expect a bear market and global recession, which would keep the pressure on both asset classes.