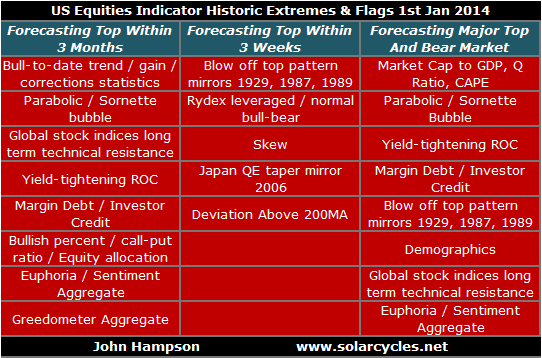

First, a compilation of indicators and flags warning of a major market top in US equities:

Bull Market History Statistics

Dow is up more than 5% five consecutive years now and a sixth such year has not happened before in history.

A 5-year bull trend only occurred once before, in the 1990s, and was followed by 3 down years.

Last 2 years rally in US stock indices has been made up of less than 20% earnings growth and more than 80% multiple expansion. The last 2 such occurrences in history were 1985:1986 (leading into 1987 crash) and 1997:1998 (leading into 1999 real Dow peak)

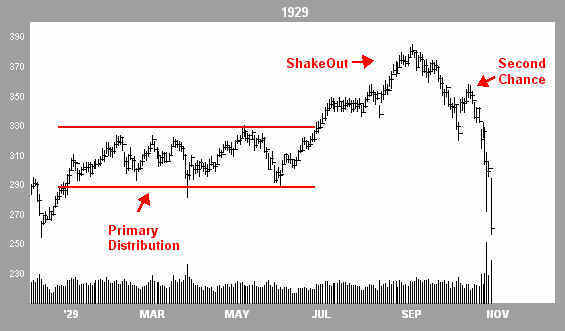

Compound annual growth rate in equities since 2009 was only exceeded in 1929, 1937, 1987 and 2000, all of which led to steep market declines

Valuations

Crestmont P/E is the 3rd highest in history after 2000 (market peak) and 1929 (market peak), and in 97th percentile

The 2nd highest market capitalistation to GDP valuation outside of 2000 (market peak)

The 3rd highest Q ratio valuation in the last 100 years outside of 1929 (market peak) and 2000 (market peak)

The 3rd highest CAPE valuation in the last 100 years outside of 1929 (market peak) and 2000 (market peak)

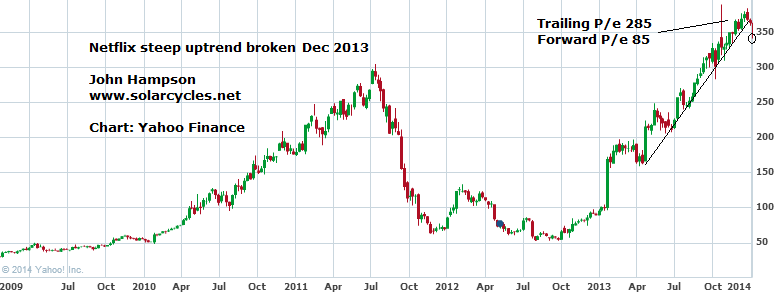

Russell 2000 trailing p/e ratio 88; Amazon trailing p/e 1440; Facebook trailing p/e 148; Twitter reached $40bn market cap with zero profits

Earnings guidance for US Q4 most negative on record

Technical Indicators

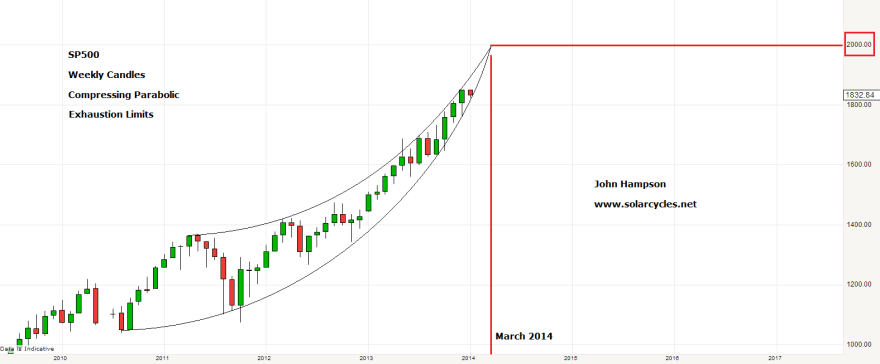

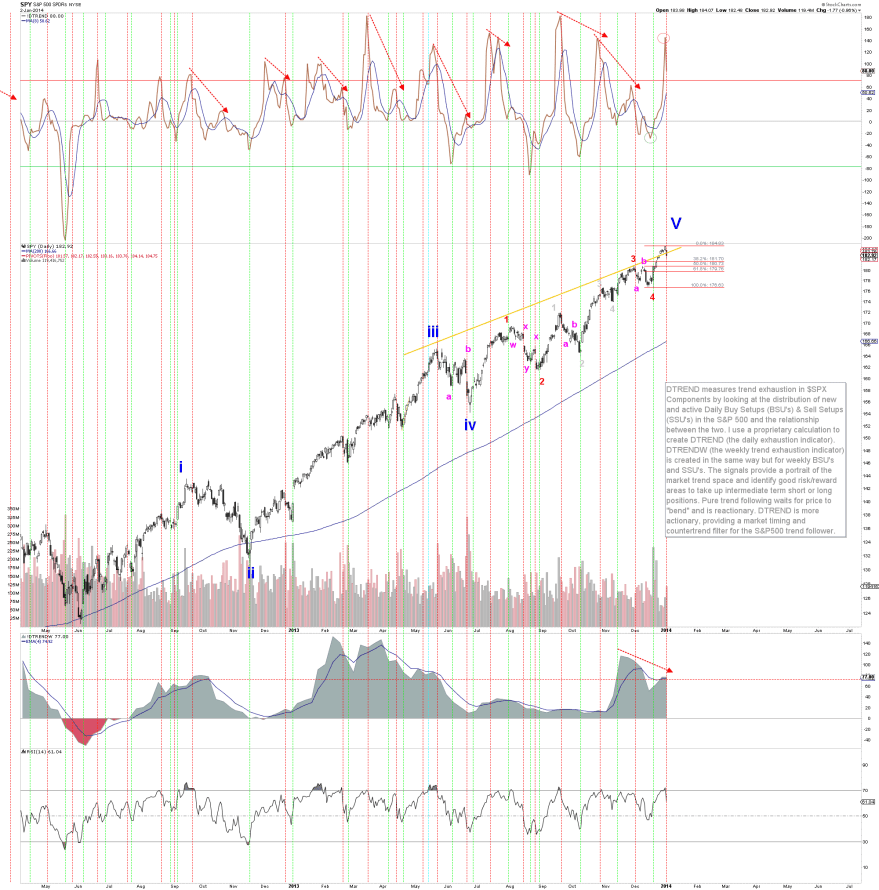

US stock indices are in an unsustainable compressing parabolic / Sornette bubble price formation

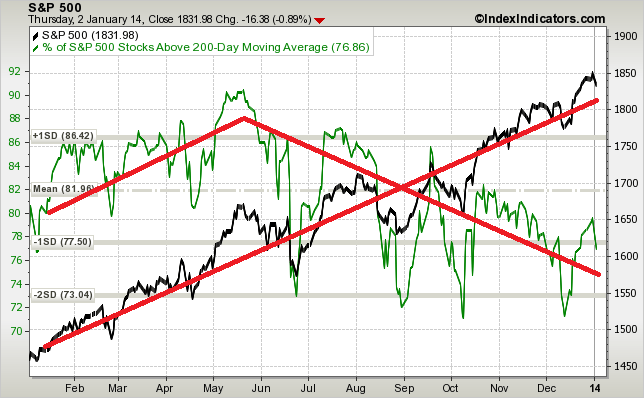

6 month breadth divergence on US indices in the percentage stocks above 200MA

Declining breadth in the number of countries participating in world equities rally

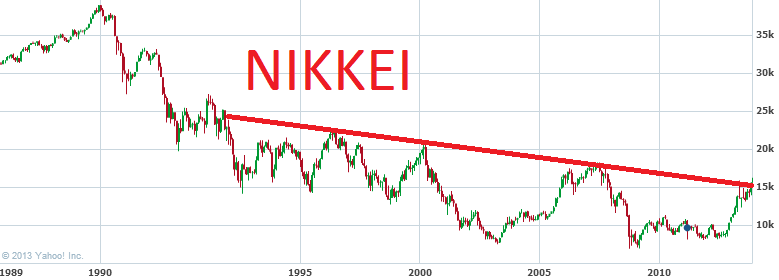

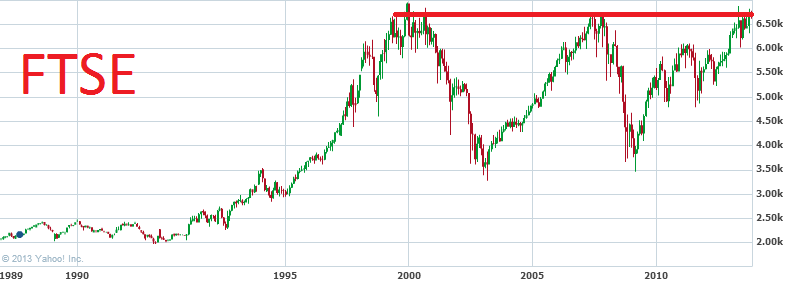

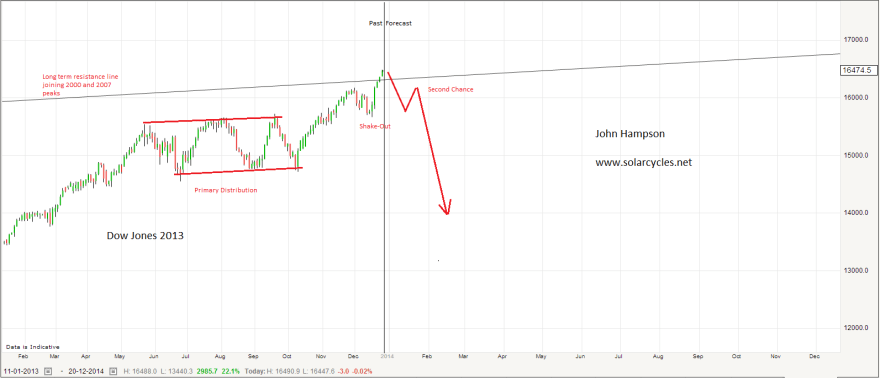

Dow, FTSE and Nikkei are all at long term resistance levels (connecting 2000 and 2007 peaks)

Treasury Bond Yields Rate Of Change over last 12 months is at a level that previously led to market tops in 2000 and 2007

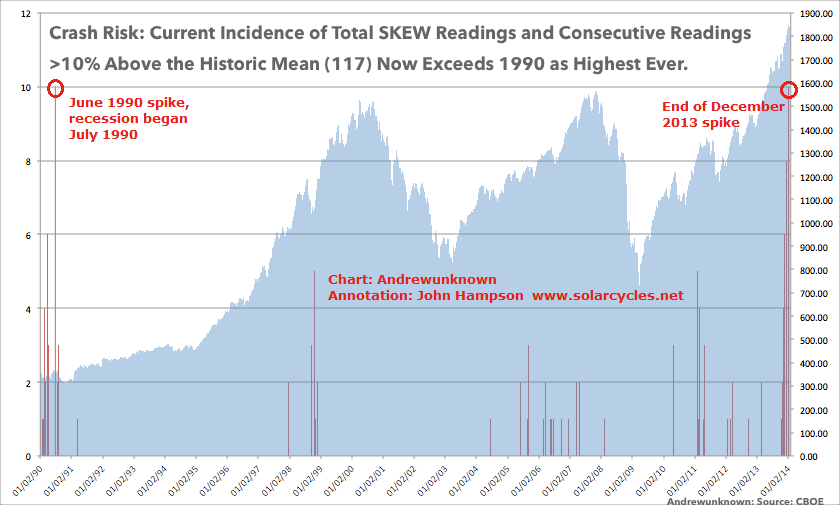

Second highest Skew reading ever (protection against outsized move)

Cluster of extreme Skew readings not seen since June 1990 before recession began July 1990

Put/Call Ratio 10 day average is at an extreme that previously marked significant corrections, including May 2010 flash crash

SP500 distance above 100MA is the highest of all time

Sentiment/Euphoria

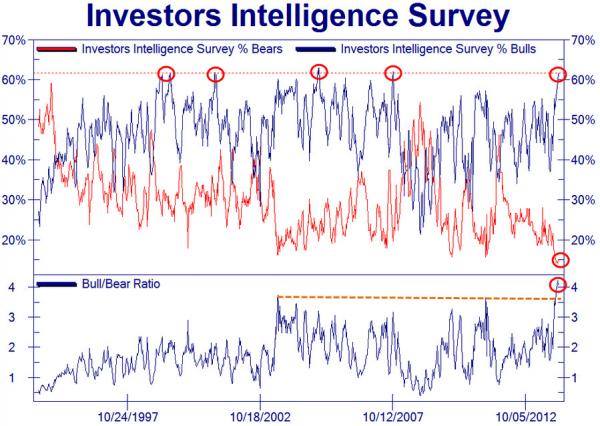

Investor Intelligence percentage bulls are at 2007 levels (market peak)

Investor Intelligence percentage bears and bull-bear spread are both at 1987 levels (market crash)

NAAIM survey sentiment is in the 98th percentile = extreme optimism

Citigroup Panic/Euphoria model is now 2 months above the Euphoria threshold

Credit Suisse Risk Appetite US model is into Euphoria

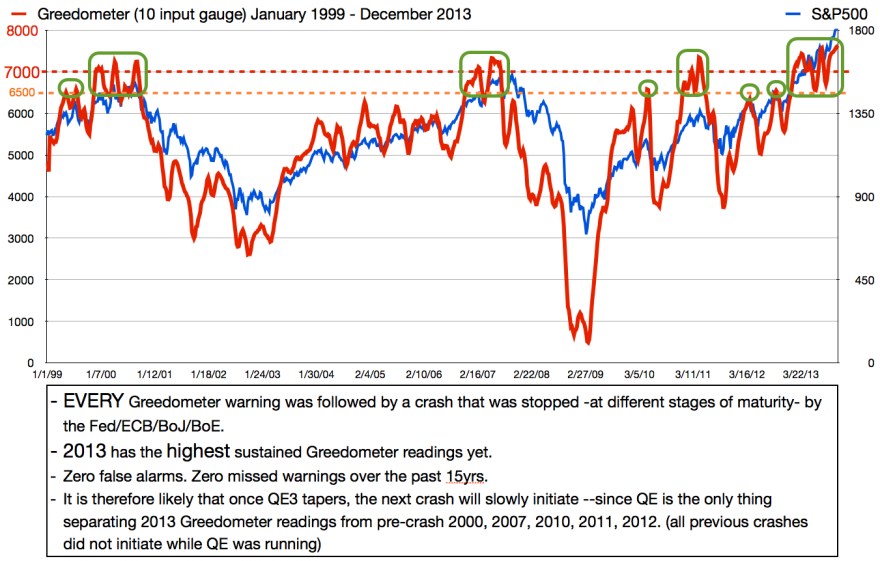

Greedometer aggregate of macroeconomic, fundamental and technical data is at a record level exceeding the 2000 and 2007 market peaks

Equities Exposure And Leverage

US household exposure to equities has risen to the same levels as the 2007 top

Fund manager allocation to global equities is at levels that previously led to a market peak or correction

Rydex bull-bear and levergaged bull-bear ratios are at an all-time record

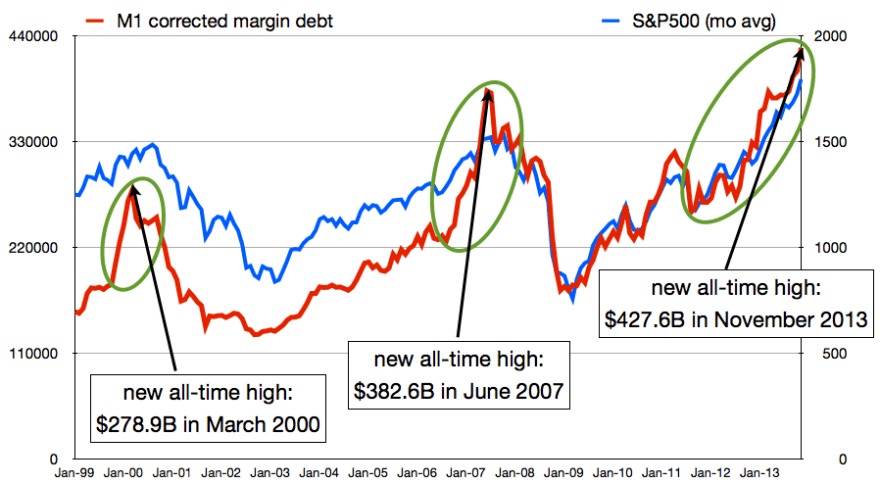

Margin Debt has escalated to 2.5% of GDP, only exceeded at the 2000 market peak

Investor Credit balances are at an all-time record negative

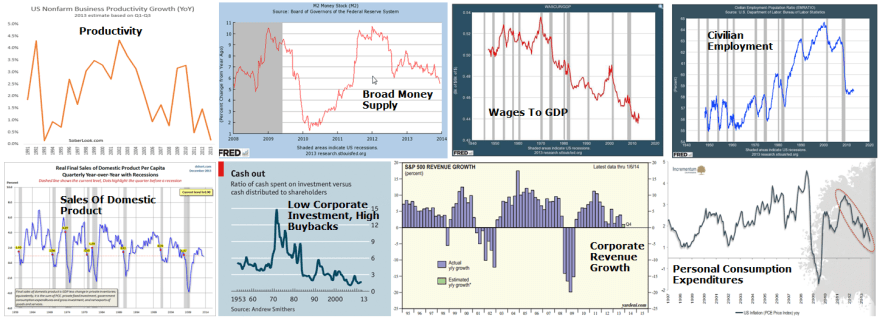

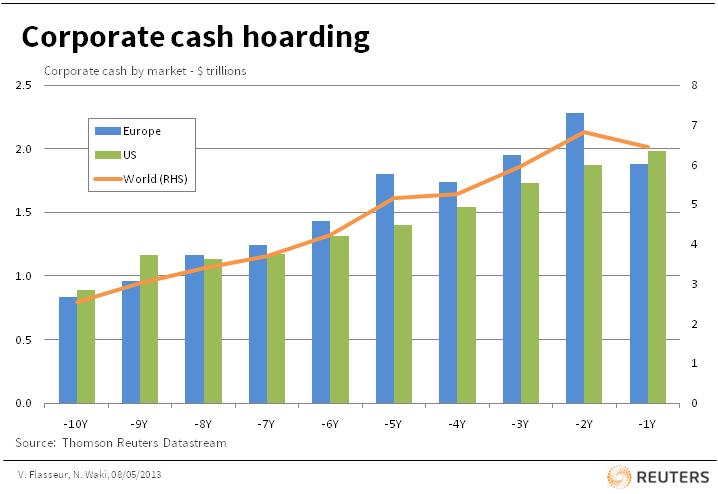

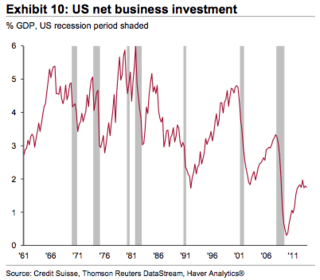

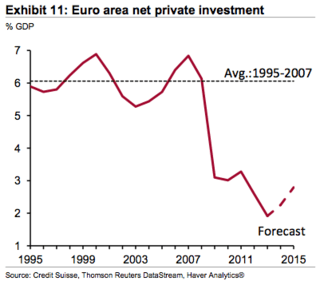

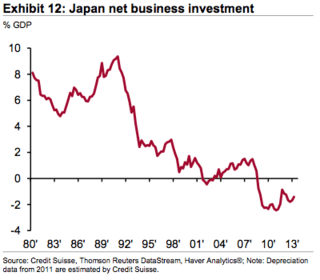

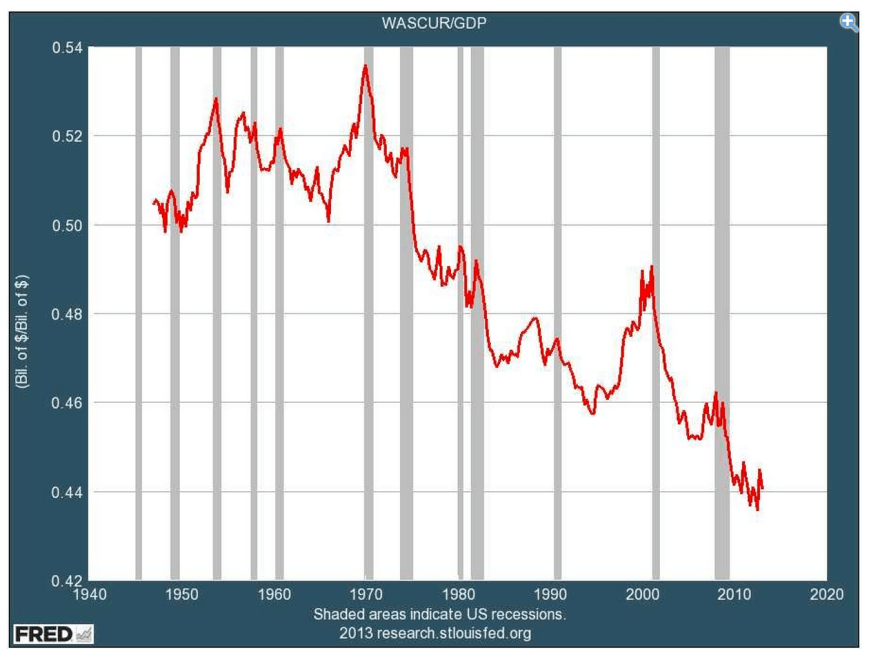

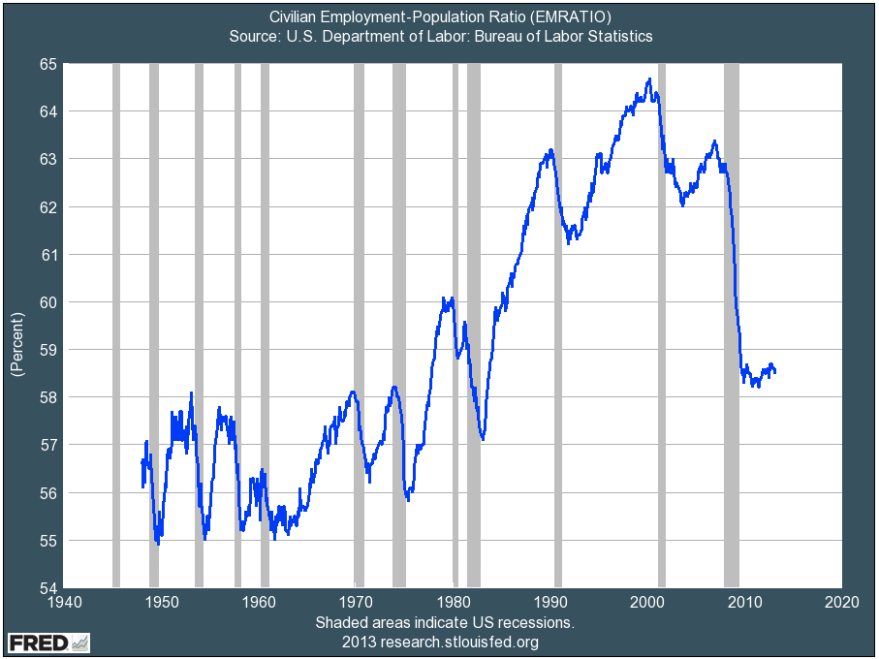

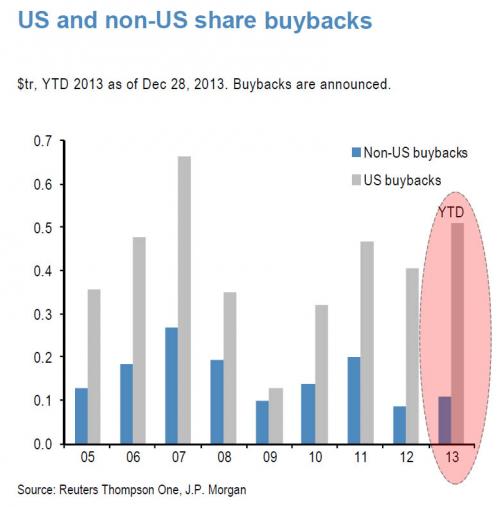

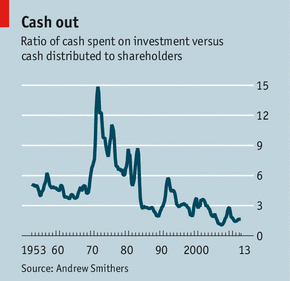

Second, the US economy is in trouble (click to view larger):

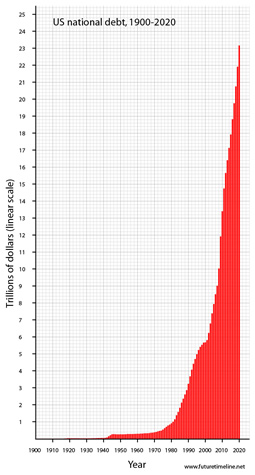

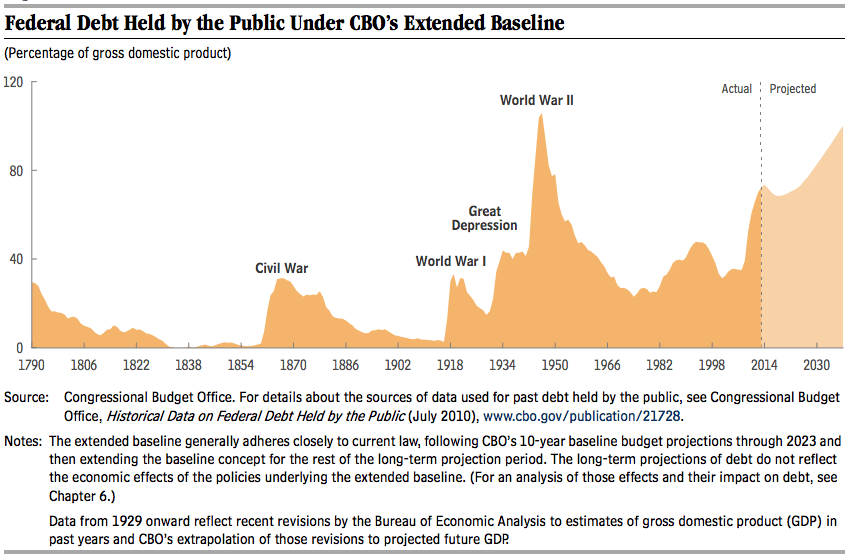

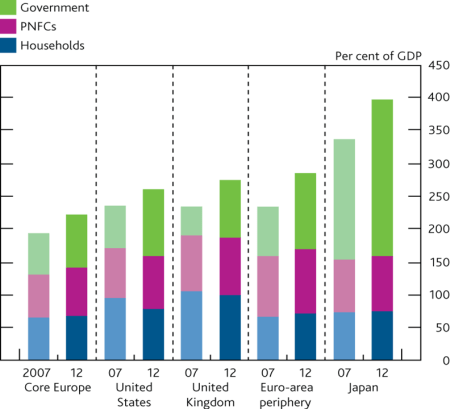

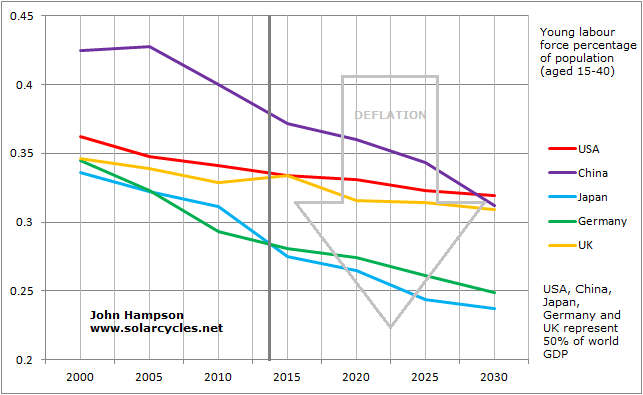

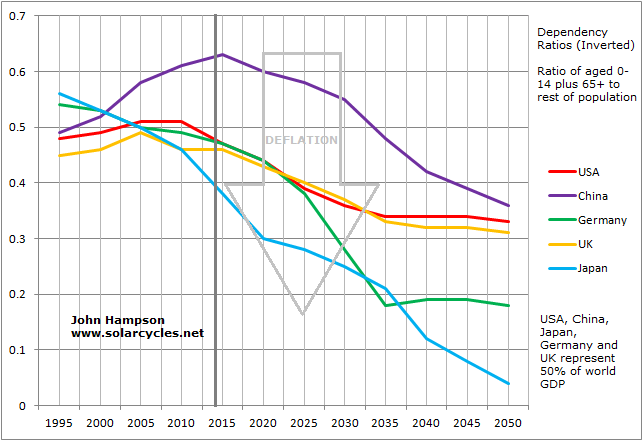

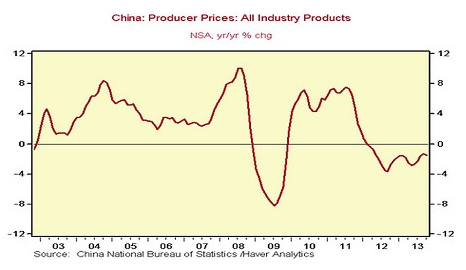

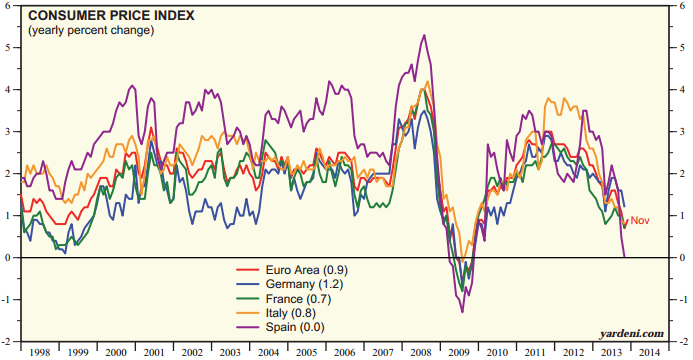

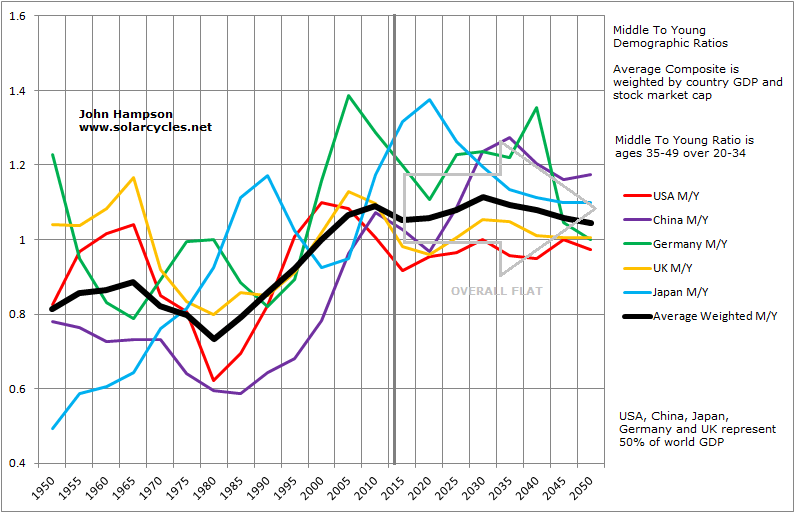

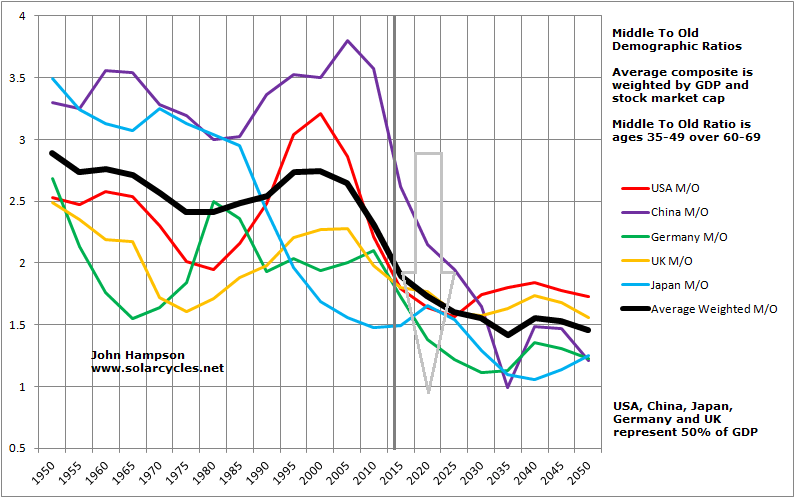

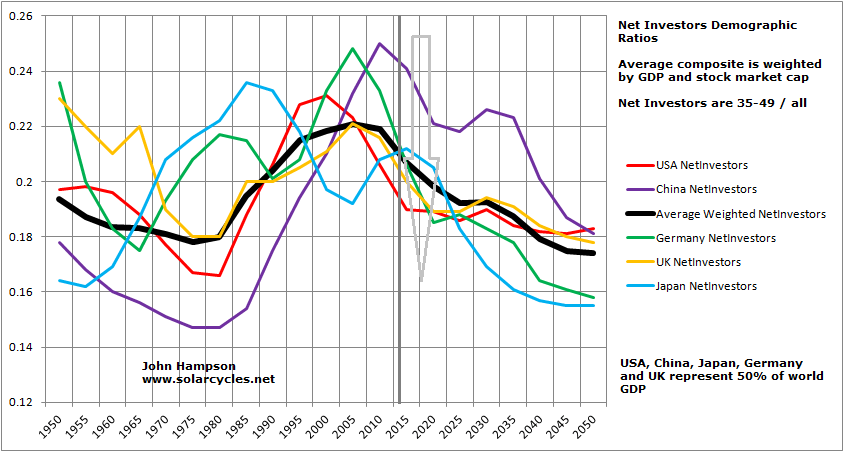

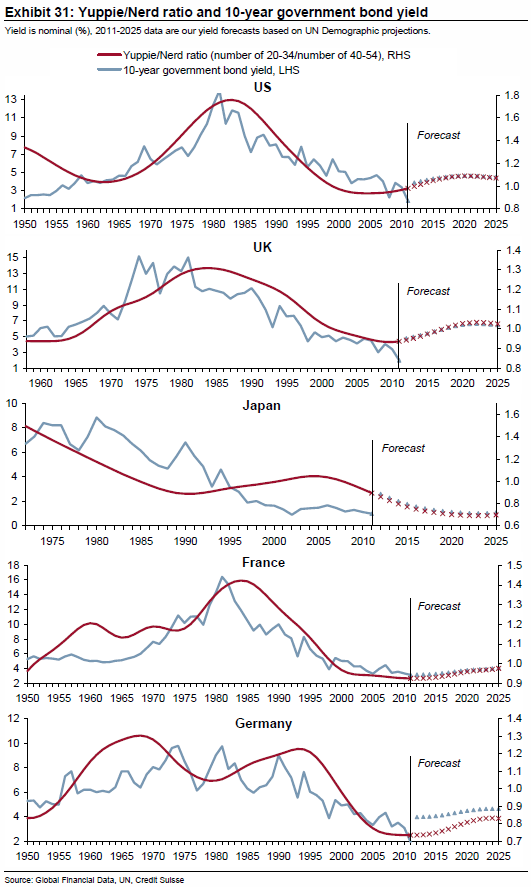

Third, this is reflective of both the record levels of debt and unprecedented collective demographic downtrends which are now in place in US, Europe and China and are deflationary, recessionary and equities-bearish.

Fourth, equity markets have historically made major peaks at the turn of the year:

Market peaks at the turn of the year correlate with the seasonal yearly lows of geomagnetism, which inversely correlates with market sentiment. Market crashes in October (also shown above) correlate with the seasonal yearly highs of geomagnetic disturbance, and there is a close fit in the full yearly seasonality of global stock indices to the annual pattern of geomagnetism (inverted):

Market peaks at the turn of the year correlate with the seasonal yearly lows of geomagnetism, which inversely correlates with market sentiment. Market crashes in October (also shown above) correlate with the seasonal yearly highs of geomagnetic disturbance, and there is a close fit in the full yearly seasonality of global stock indices to the annual pattern of geomagnetism (inverted):

Most analysts are unaware of this underlying cause of stock market seasonality. Geomagnetic activity is demonstrated to make people more irritable and aggressive, and can affect melatonin synthesis and blood pressure. There is a correlation between geomagnetic storms and depression in humans. Here is a chart showing daily geomagnetic disturbance versus the SP500 over the last 5 years:

Most analysts are unaware of this underlying cause of stock market seasonality. Geomagnetic activity is demonstrated to make people more irritable and aggressive, and can affect melatonin synthesis and blood pressure. There is a correlation between geomagnetic storms and depression in humans. Here is a chart showing daily geomagnetic disturbance versus the SP500 over the last 5 years:

The bigger the geomagnetic disturbance, the bigger the spike. By turning this into a trend line we see the ebb and flow of the SP500 correlates with the ebb and flow of actual geomagnetism, with the only exceptions marked in blue:

The bigger the geomagnetic disturbance, the bigger the spike. By turning this into a trend line we see the ebb and flow of the SP500 correlates with the ebb and flow of actual geomagnetism, with the only exceptions marked in blue:

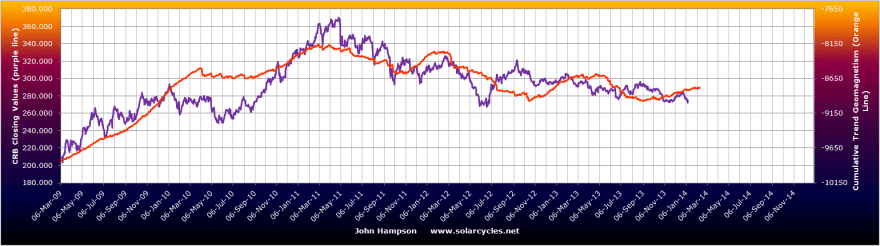

The correlations of the Singapore STI stock index and the TR CRB commodities index to the geomagnetic guide are closer still, which demonstrates the link between geomagnetism, sentiment and risk asset performance:

The correlations of the Singapore STI stock index and the TR CRB commodities index to the geomagnetic guide are closer still, which demonstrates the link between geomagnetism, sentiment and risk asset performance:

Fifth, major speculative peaks have historically occurred at the solar maximum, which is occurring now.

Fifth, major speculative peaks have historically occurred at the solar maximum, which is occurring now.

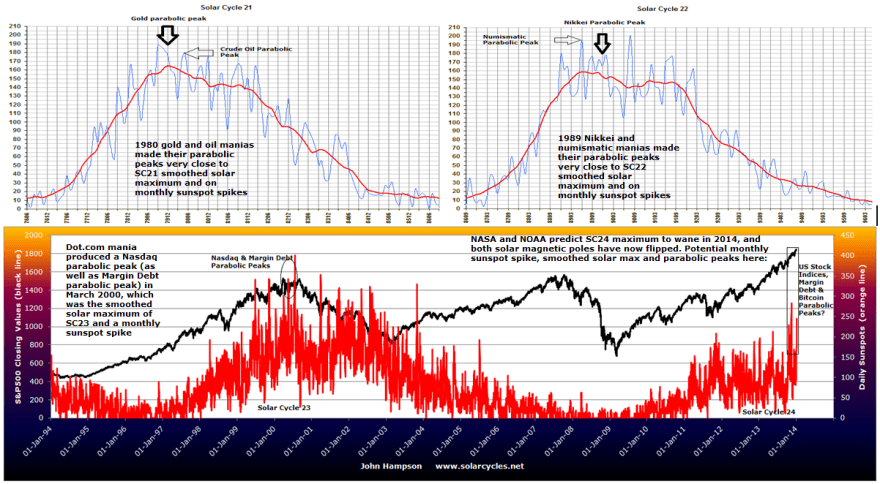

Peaks in solar sunspot activity occur on average every 11 years and have historically correlated with human excitement peaks in the form of protest, war, growth-flation and major speculative parabolic peaks. Again there is biological evidence for this in elevations in oral temperature, pulse rate, blood pressure, and respiration rate, and again few analysts are aware of this critical influence.

The majority of the famous secular speculative parabolic peaks in history took place on monthly sunspot spikes close to the smoothed solar maximum:

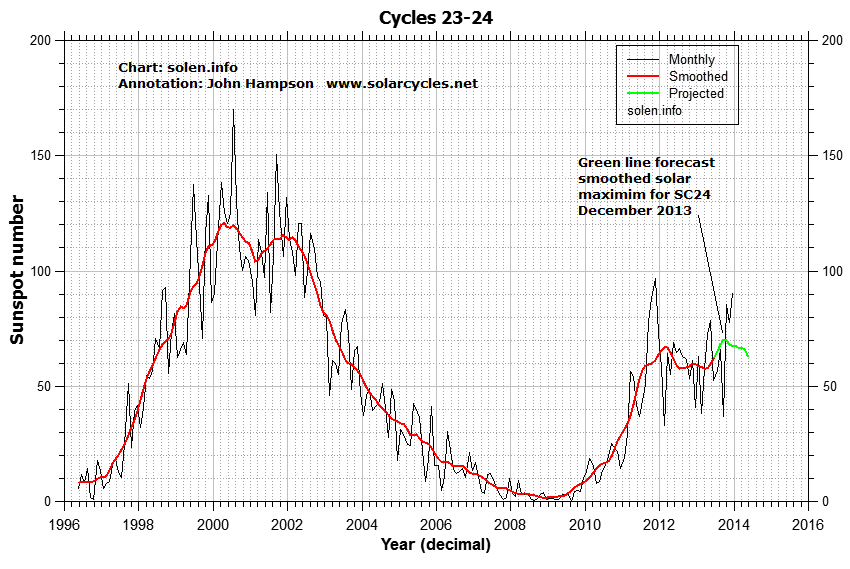

We see a spiking in sunspots from late 2013 currently taking place, and this is predicted to mark the smoothed solar maximum and the high of this solar cycle:

We see a spiking in sunspots from late 2013 currently taking place, and this is predicted to mark the smoothed solar maximum and the high of this solar cycle:

The evidence for a peak in speculation can be seen at the top of this article, in the congregation of extremes in sentiment, leverage, technical and valuation indicators.

The evidence for a peak in speculation can be seen at the top of this article, in the congregation of extremes in sentiment, leverage, technical and valuation indicators.

Sixth, drawing all together, there is a case for the US stock market having peaked on the 31st December 2013.

A) We see a wide range of indicators and flags, ranging from valuations to sentiment to leverage to technicals, all pointing to a major peak, right at hand. B) The assumption that the US economy will return to normality this year is one of hope, neither reflected in the data nor in the demographic/debt backdrop. C) Historically major peaks often occurred around the turn of the year, with a cluster falling exactly on the last trading day of the year, and this reflects the annual seasonal peak which is caused by the seasonality of geomagnetism. D) Historically, major speculative parabolic peaks have terminated at the solar maximum on a monthly sunspot spike, which is likely occurring now in Dec 2013 / Jan 2014.

Specifically, where solar maxima have fallen near the turn of the year, speculative parabolics have tended to terminate on the last trading day of the year, in line with the seasonal peak. The real highs of FTSE 31 Dec 1999, Dow 31 Dec 1999, Nikkei 29 Dec 1989, and Dow 31 Dec 1968 were all such occurrences. This is a dual confluence of peak sunspots and peak inverted geomagnetism.