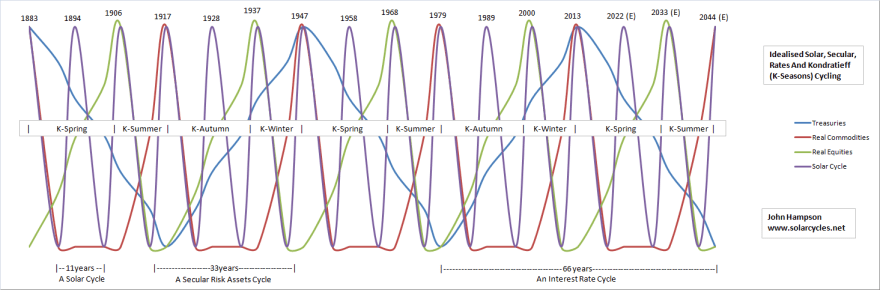

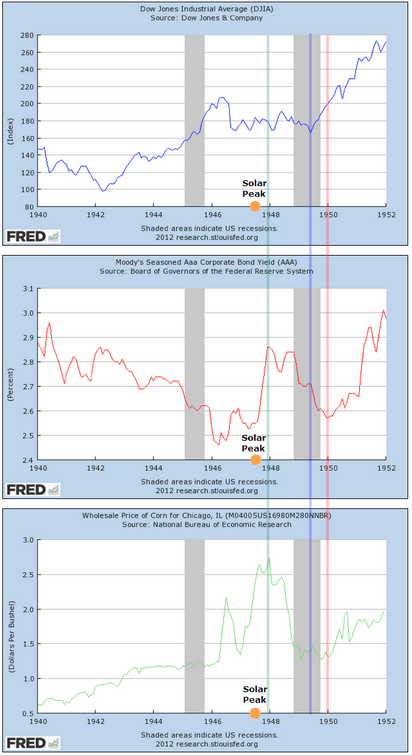

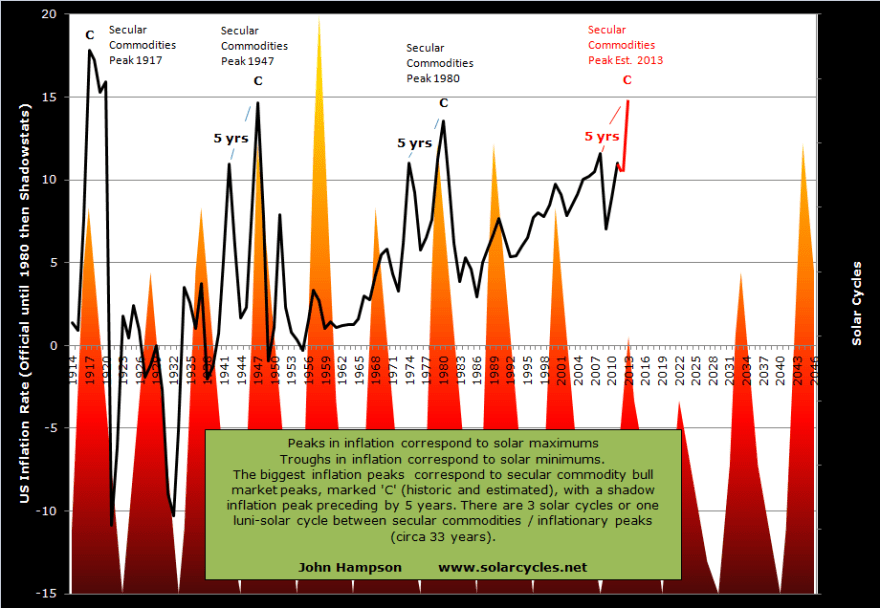

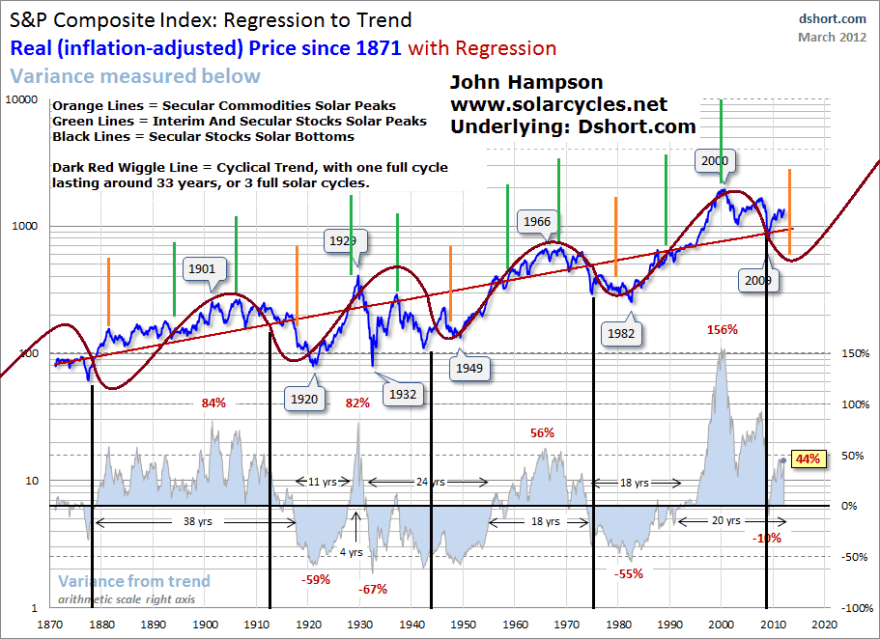

I maintain the late 1940s is our closest historical mirror, as per this chart:

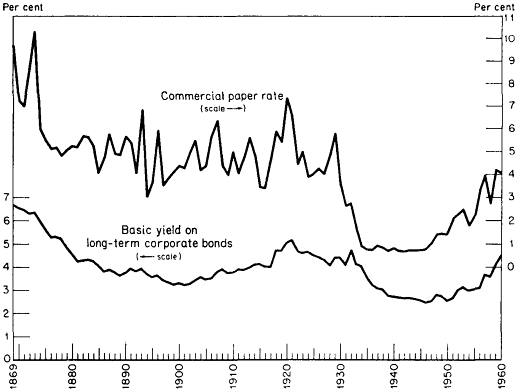

Then, as now, they had a problem with money velocity. But it reversed course and took off as of 1946.

Source: Hoisington

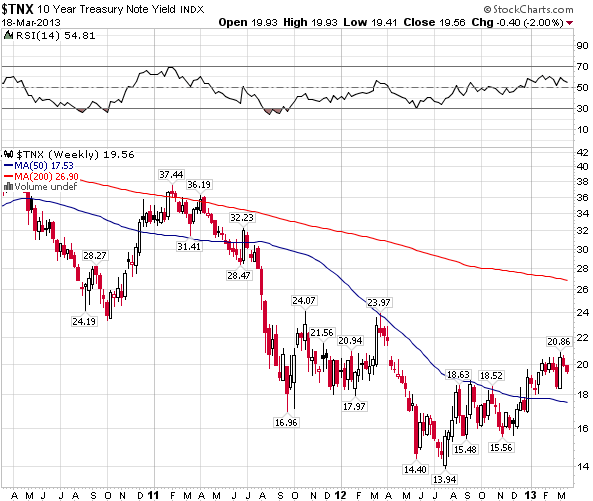

Yields also reversed course as of 1946.

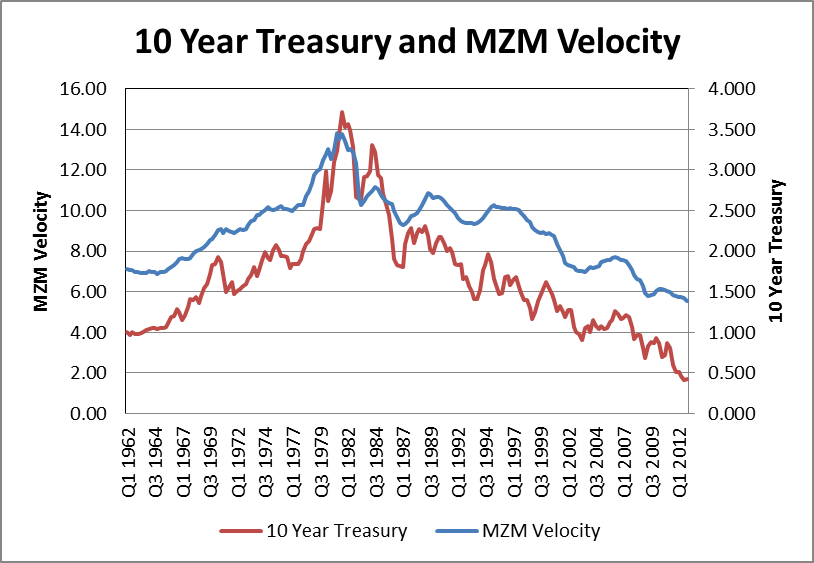

As per my last post on money velocity, there is a historical relationship between the two. Here we see it clearly:

Essentially, expectations of rates, inflation and growth determine the path of yields and velocity. In 1945, like now, there were very low expectations in these three areas due to excessive post-war government debt, government controls and growth that would not stick. But then in 1946 yields and velocity began to increase and inflation took off and peaked in 1947. The picture changed.

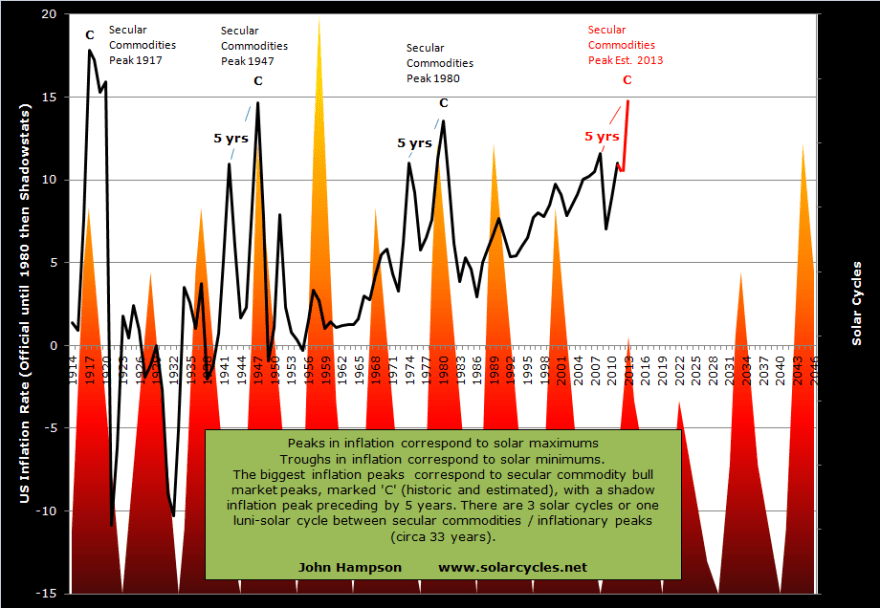

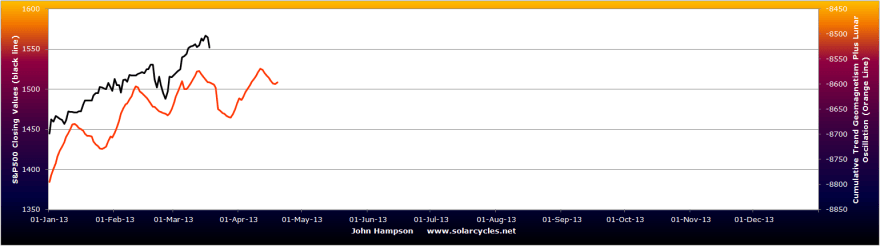

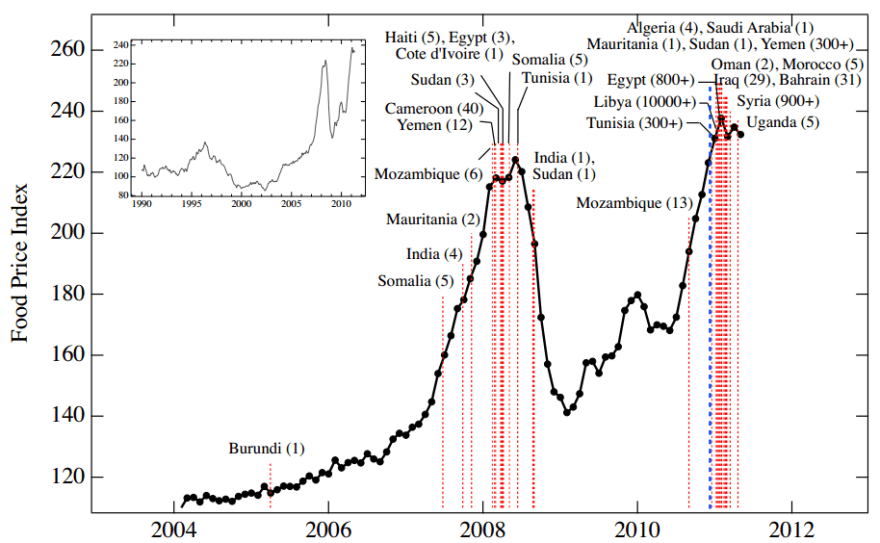

In my recent post on money velocity I showed a selection of charts that show a current potential bottoming out of both velocity and yields, though only tentative at this stage. If this is the case, then we could also be set to see inflation take off and potentially reach a peak within a year in line with the historical mirror. If the solar peak is ahead later in 2013, this is a very good fit with 1947 which was also a solar maximum.

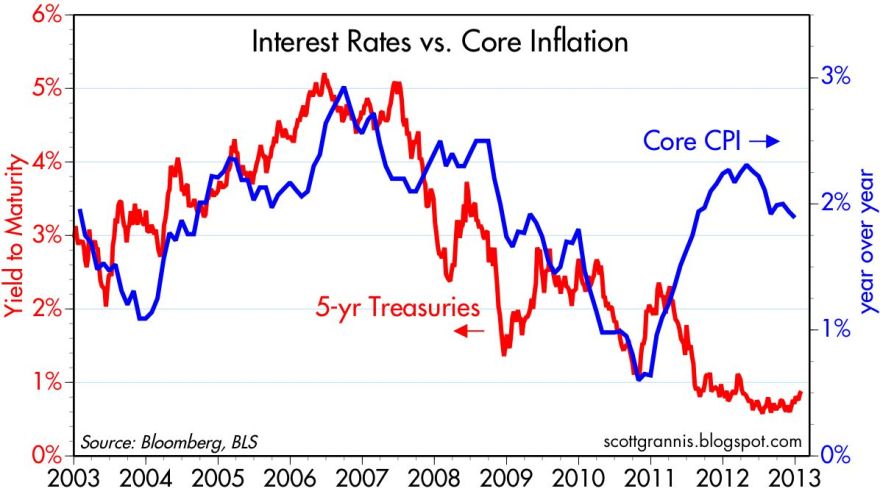

Here are 5 year treasury yields versus core inflation (excludes food and energy). We can see yields are overdue a catch up. Money is parked in bonds paying a negative real return. The divergence captures a lag in belief and sentiment that is overdue a reversal.

Source: Scott Grannis

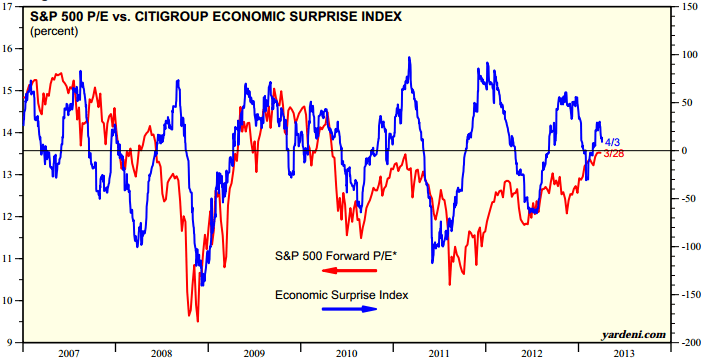

Yes the Fed is manipulating this market, but it is not the difference since 2011 – it was doing this before. Rather it is the mired perception of unsustainable growth. However, since mid-2012 we have seen a sustained positive picture in leading indicators that still persists at the time of writing. Unless leading indicators turn down again sharply soon, then I give good odds to a belated change in perception, a belief in growth, that should generate an upturn in yields, velocity and inflation.

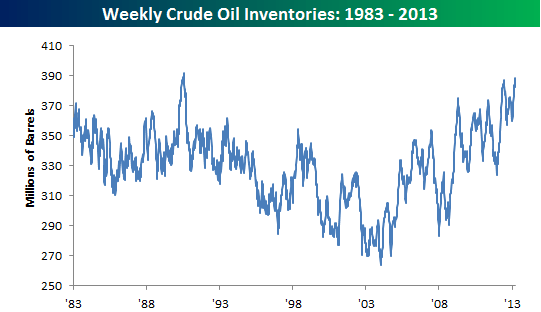

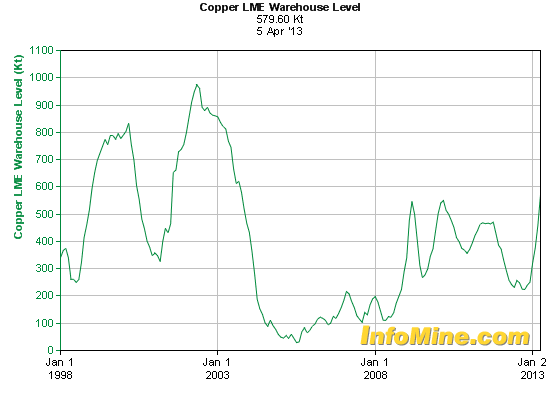

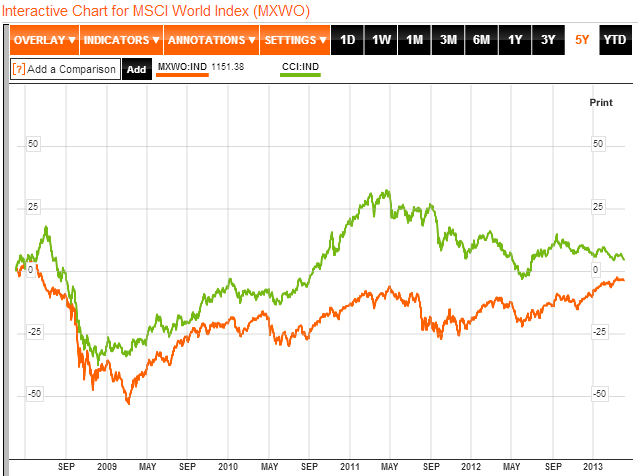

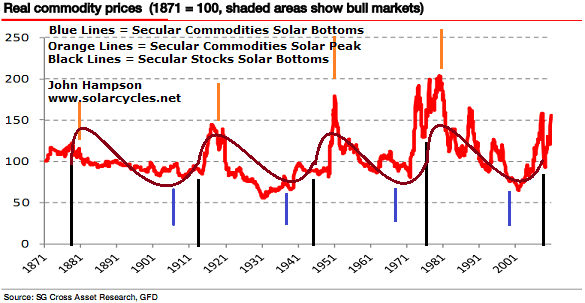

What would that mean for commodities and stocks? Using the late 1940s historical mirror, we can see that commodities were the beneficiary, with corn and copper charted here:

Both accelerated as of the turn up in yields and velocity of 1946, and had made the bulk of their parabolic rises within a year. Oats and wheat performed similarly, crude oil escalated in price by 50% from 1946 to 1947, and the CCI index as a whole made its peak by late 1947.

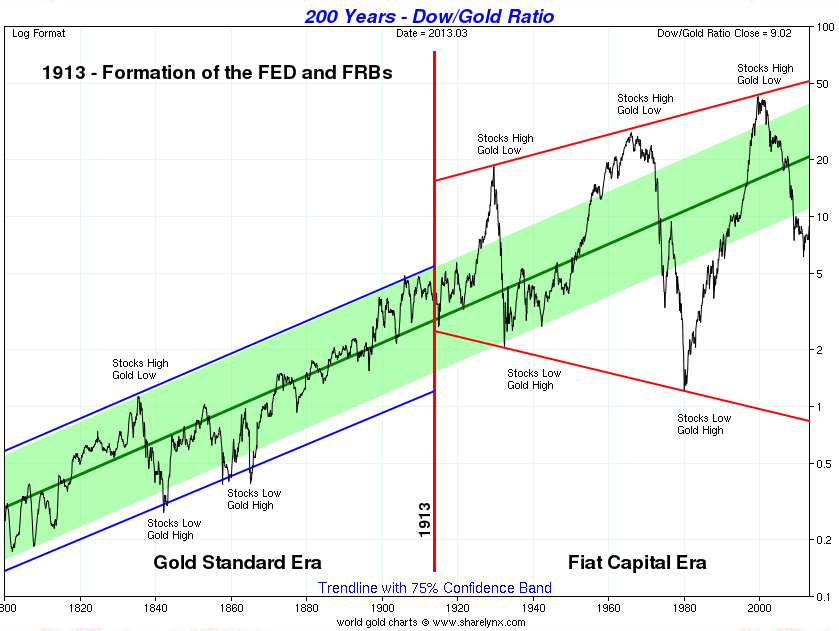

If we turn to the Dow-gold ratio, we can see that by 1947 the ratio was already in an uptrend, because stocks had been on a tear, much like now.

Source: Macrotrends

Here is the Dow Jones chart from the period in question:

Stocks rose fairly steeply into a 1946 peak. That stocks perform well in an environment of low rates and low growth was in evidence then, as it has been into 2013. In 1946 stocks made a pullback and then traded sideways, before the secular stocks bull momentum ‘go’ point as of 1949. So whilst stocks consolidated around 1947, commodities esclatated.

But let’s not get too carried away with the historical rhyme. Back in 1946 in the US, price controls, that had been implemented during the world war, were lifted, which along with weather-related bad harvests, helped drive up commodity prices. There are no such price controls today. The government also abolished the buying rate it had set for treasury bills, which helped free yields. In short, the government took several measures at the time to reduce its controls over the economy. Clearly there is a chime with today: the US government has supressed yields and taken controls over the economy in terms of ZIRP and QE and other policy actions. What we do not yet see is the relinquishing of such controls. However, if the US government were to announce it was stepping back from QE or eyeing an end to zero interest rates in the future, then this could have the same effect as in 1946 of yields rising, which would be accompanied by velocity, and inflation could then logically follow. Perhaps then an end to QE would not be a nail in the coffin for gold, but the opposite.

What 1946/7 and 2012/13 do have in common is the solar maximum. If you subscribe to the theory that sunspots drive human excitement and this manifests itself as speculation, buying and inflation, then we have another angle. This alone should encourage money velocity, bullish policy actions, and drive money into pro-risk.

Now if you don’t buy into the solar idea, or maybe the solar maximum passed already in Feb 2012, and you don’t buy into the historical correlation with the late 1940s either, the we nonetheless still have an unsustainable situation of negative real rates and yields, and money supply and velocity at opposite historical extremes. Unless the system is broken, then at some point growth is going to stick and accelerate, and these extremes will mean revert. Is it broken? Is the US the new Japan? Unable going forward to get growth and inflation to entrench? As it is by far the largest contributor to world GDP, this would be felt globally for some time. Well, the US was keen to avoid Japan’s errors, i.e. being slow to react to deflation until it was set in. It was aggressive in response to the 2008 crisis. We also have an exponential trend in technological evolution, which at an even faster rate of paradigm shifts going forward, should be the fuel for a new secular stocks bull. The US remains a world leader in technology. Plus, through natural gas disoveries and shale oil the US has its own ample energy resources again to power growth, which Japan lacked. So time will tell, but there are reasons to believe that the US can make a normal transition into a new K-spring, and so likewise the global economy.

I suggest the natural cleansing cycle, a regular secular bear, a K-winter, has worked through within normal parameters, and we are in the realm of a secular transition. Unless you do believe the system / the US is broken, then a new cycle of growth should be emerging, and yields and velocity should be undergoing a reversal. As that occurs, it would be normal to see the fresh circulating of the parked money bring about inflation, and for commodities to enjoy another leg up. If you draw in solar cycles (assuming the solar max is ahead not behind) and the 1946/7 historical mirror to this, then the prediction is refined further: we should see stocks pull back and give way to commodities outperforming, for yields and velocity and inflaton to rise up, all around now. The Dow-gold ratio having bottomed should not be the death knell for gold, but instead reflects the environment being positive for equities as it was into 1946, and such a pullback on equities (as occurred then) would be a buying opportunity for a forthcoming momentum ‘go’ point in stocks.

In the worst case scenario, the current status quo would persist for some years longer. Yields and rates and velocity would remain trapped at ultra low levels as sustained, entrenched growth remains elusive. Therefore, I continue to watch leading indicators closely. I believe that if they can remain positive and healthy into mid-2013 then we would have a long enough run behind us to change perception, and this should inspire the moves I am imagining.