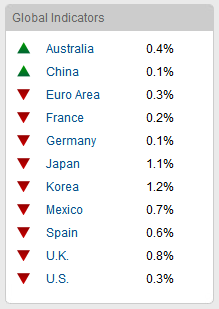

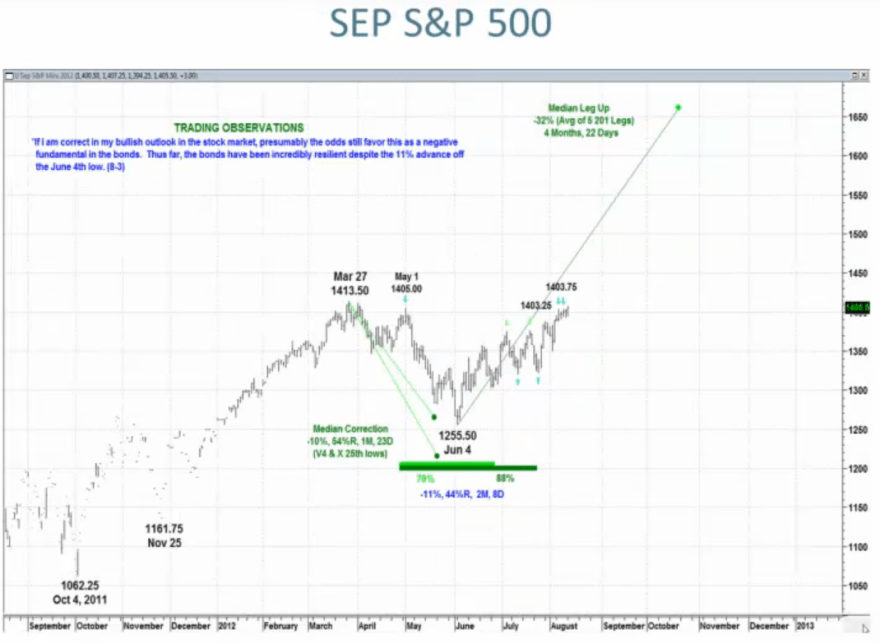

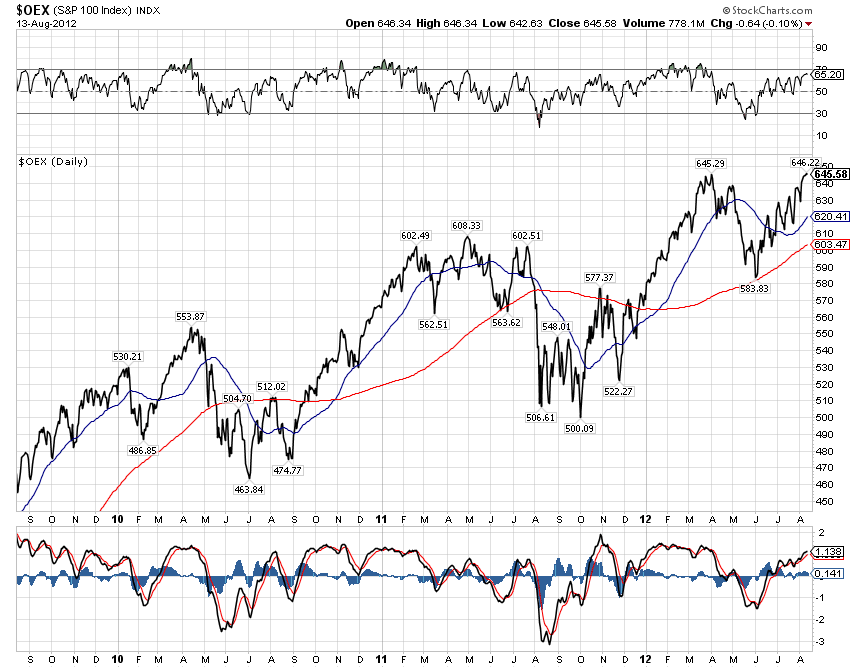

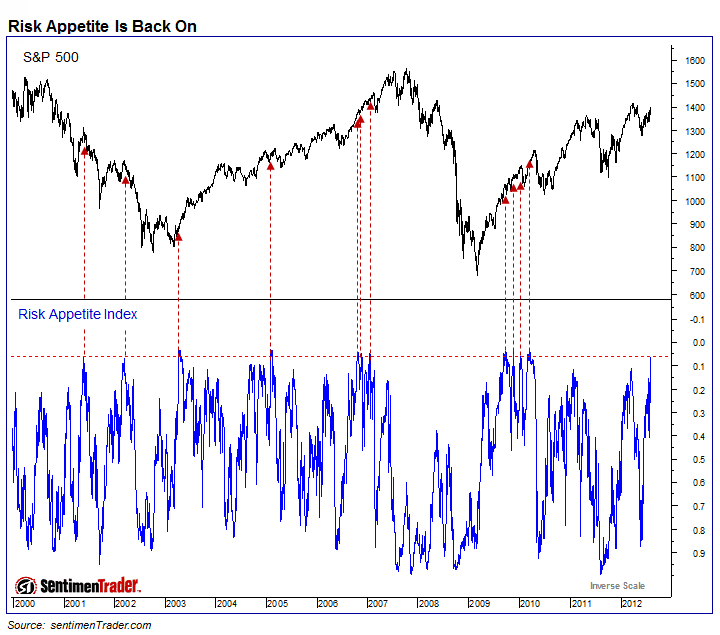

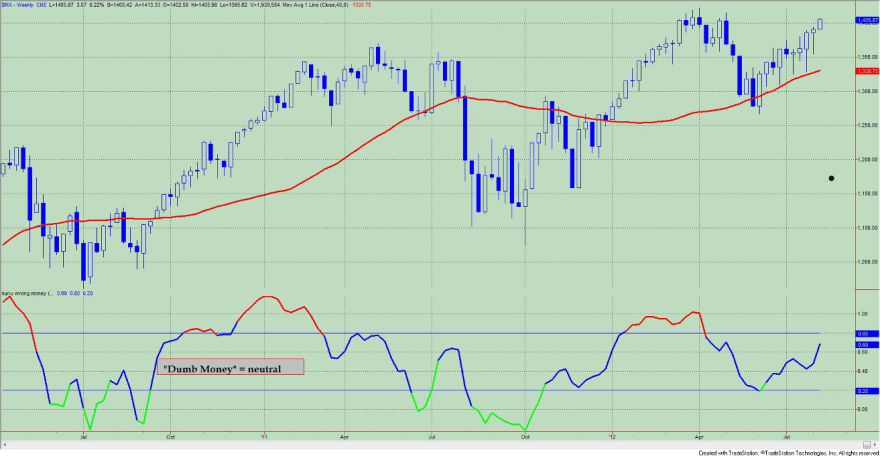

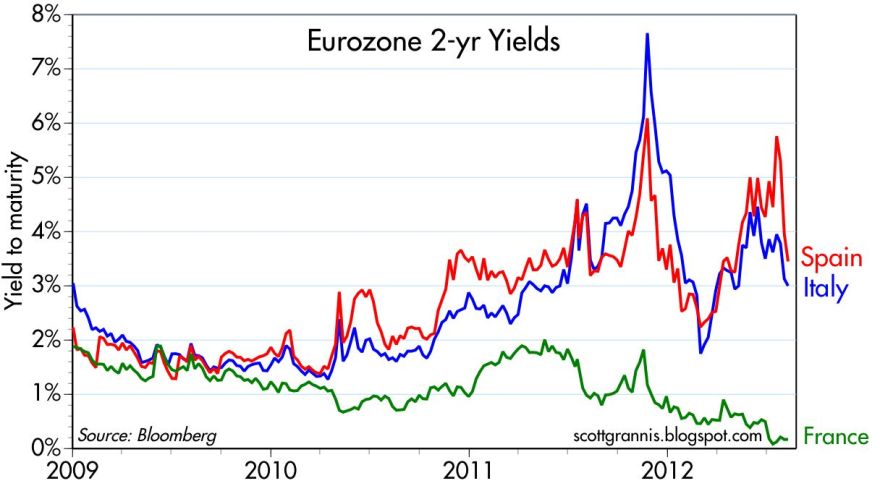

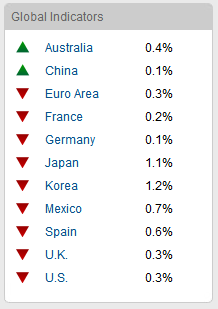

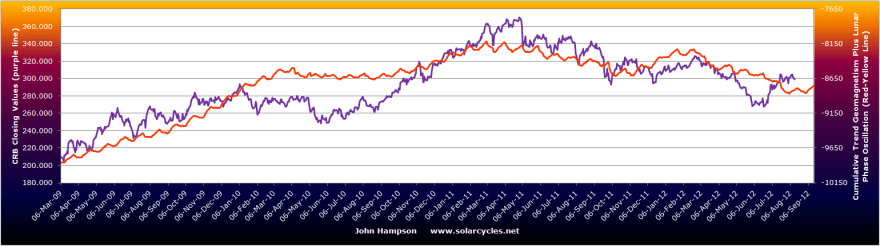

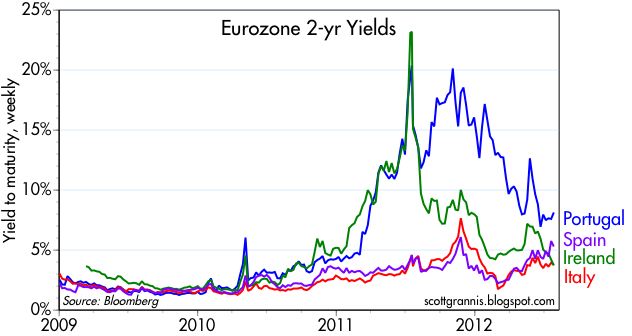

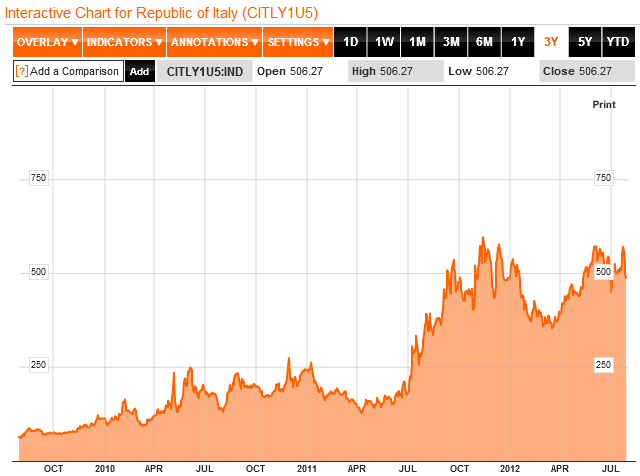

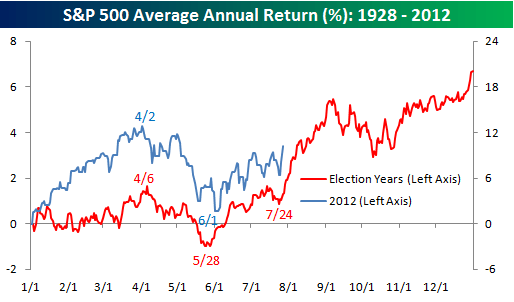

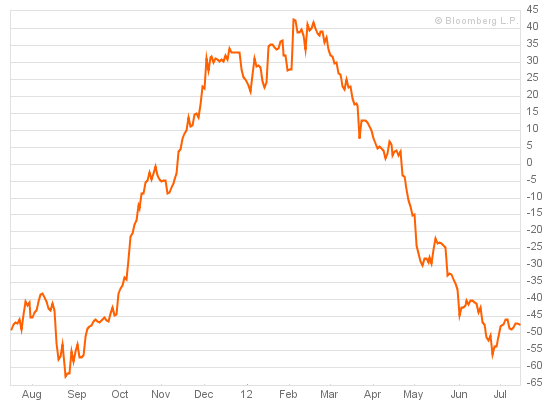

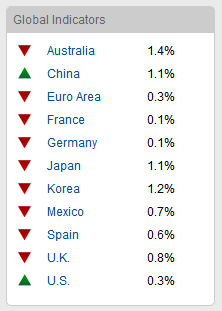

A brief macro and technical update first. Euro debt continues to ease on the whole. Economic Surprises for G10 and emerging markets continue to trend upwards. Leading indicators continue to be the problem area, with a mixed to negative picture, but tentative signs of improvement: ECRI leading indicators in a 6 week uptrend to break even, and CB Eurozone leading indicators in a 3 month uptrend also to breakeven. China and its local trading partners remain a particular problem area, reflected in the continued Shanghai index downtrend. Western stock indices and commodities remain in bullish trends, having consolidated their recent gains just below key resistance levels for US indices and precious metals. Some overbought/overbullish readings in both commodities and stocks had been reached, but not the kind of comprehensive and extreme readings to signal a top. I therefore maintain that this is a pause before a breakout, supported by presidential, secular and solar cycles, and have maintained all my long positions. The full moon is this Friday, which is also the Jackson Hole Fed meeting. Whilst the latest Fed minutes suggested a greater likelihood of QE, Jackson Hole is not a policy meeting (a FOMC) so we may get no action plans, just more supportive words. The usual lunar oscillation would see the consolidation / correction persist into this Friday and a sell-off on disappointment is not out of the question. As of next week though lunar positive pressure should re-emerge and I expect stocks and commodities to break upwards.

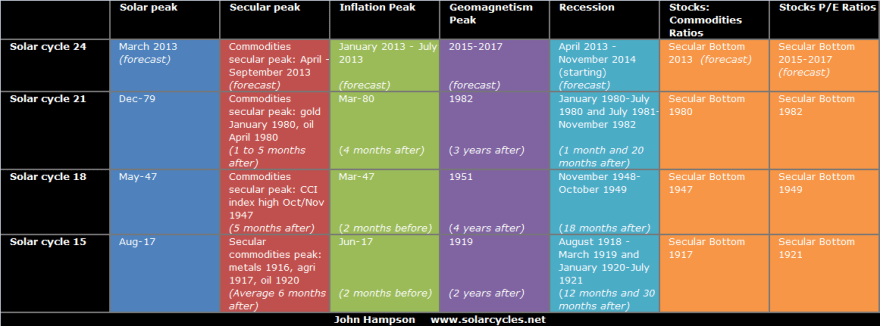

The anchoring of this expectation is in secular / solar cycling. I expect stocks to overthrow and make their cyclical bull peak, whilst commodities accelerate and make their parabolic secular finale. The stocks peak should occur before the secular commodities peak – with stocks foretelling recession by 6 months or so, and commodities (oil and food) playing a key part in tipping the world into recession. Here is the timetable again:

Bear in mind the forecast for the solar peak – currently March 2013 – could change, and also that the forecasts along the top row are ranges based on the last 3 solar cycles but we could potentially print slight outliers to these ranges.

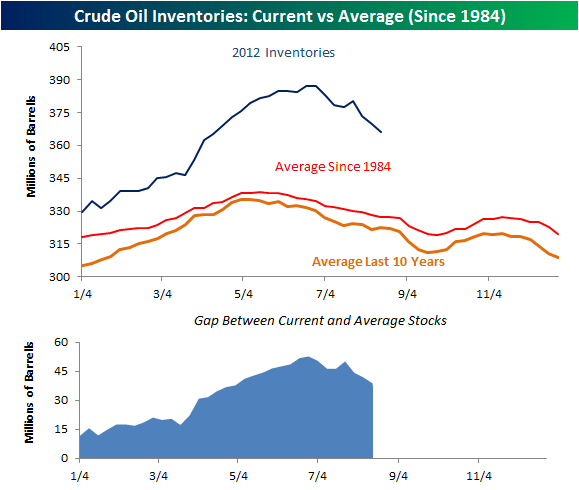

Growthflation, speculation and revolution/war have been three key themes into solar peaks. I therefore expect leading indicators to pick up in H2 2012, enabled by the global central banks recent easing / stimulus and a natutral upswing in growth. I expect inflation to pick up, and this should be the case as soft commodities took off in June 2012 and this typically feeds through to the food price index 6 months later. I expect speculation, particularly in commodities, to accelerate, and for there to be a supply side push in commodities, not just from climate/weather but also from war-related disruption. At some point commodities should de-couple from stocks.

Looking back to 2007/2008, the last time commodities de-coupled from stocks, and also 1979-1980, the last secular commodities conclusion where commodities de-coupled from stocks, there are similar themes. In 2007/8, climate disruption, perceived supply threat (peak oil, geopolitical), the intercorrelation of commodity prices (food switched to biofuels, oil being key input in food process, precious metals hedge for inflation) and an upward spiral of speculation drove commodities to peaks beyond the fundamentals. In 1979/1980, the Iranian revolution, Iran-Iraq war, curtailment of oil supplies, and a spiral of speculation (particularly in silver) did likewise. In both cases, the parabolic rises began from conditions of easy money, inflation and growth – emerging markets increased demand for food played a role in 2007/8 and increased global oil demand a role in the 1970s. So if we are to see a parabolic conclusion in commodities in 2013, as I expect, then we should see leading indicators pick up in H2 2012 and provide the ‘positive’ backdrop against which commodities can begin a parabolic climb, then coupled with other factors, namely climate a supply-side push on agri (as we are seeing), revolution/protest/war disrupting energy supply (such as the Iran situation boiling), and then the intercorrelated factors. These intercorrelated factors would be increased inflation from commodities rising inspiring more money into commodities as a hedge, increased energy prices pushing up food prices, precious metals rising as a hedge, switching between commodities in line with price rises then bringing up the laggards too, and lastly a spiral of speculation which should take over from everything else into the peak. I might also draw in 2011 whereby we also saw food price acceleration and revolution both driving up commodities into short term parabolic moves, as expected rising into the solar maximum, but also noting that the food price acceleration was a key factor in bringing about protest and that the subsequent region disruption then drove up oil prices. So once again, an interconnected spiral.

For the ‘purest’ solar-secular peak, commodities and inflation would peak close to the solar maximum, projected to be March 2013. The economy should tip into a recession following that. Working backwards, stocks could therefore start to turn down as of October 2012, whilst commodities make their parabolic move. Commodities should begin to truly accelerate as of 6 months before the peak – roughly Sept 2012 – and make their mania move as of 6 weeks before the peak. However, note this is only an idealised timeline – the table above provides the reality. Still, it gives us a guide. If stocks can break up to new highs soon, then I am looking for an overthrow move to extremes of overbought and overbullish together with negative divergences and a topping process (a messy up and down range period) into this Autumn/Fall to provide a suitable coming together of timing and technical indicators to exit equity longs. Whilst that occurs, commodities should take over as the outpeforming class.

The greatest thorn in the side of these projections is the weakness in China. As the world’s largest commodity consumer, a hard landing here would surely de-rail a broad acceleration in commodities. Is China decelerating to a hard landing? I suggest it isn’t. Leading indicators point to a mild upswing in H2 2012. If China were to add further stimulus or easing to this, it may provide the necessary conditions for commodities to make their move, together with the other factors that I listed above. One analyst that I read believes that China has the ability to push the economy once more, but getting less bang-for-buck each time that would likely be the last before a true recession. If that were so, that would fit well with commodities making their grand finale before recession 2013-14 and also a new secular commodities bear erupting (as China derails for a while from breakneck growth).