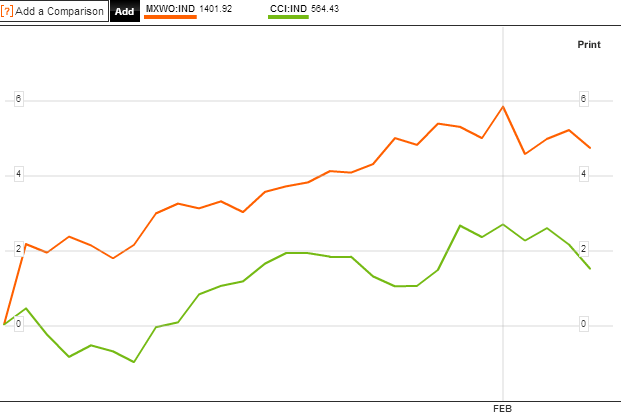

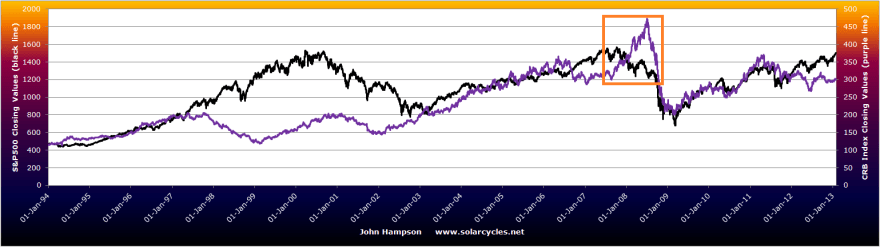

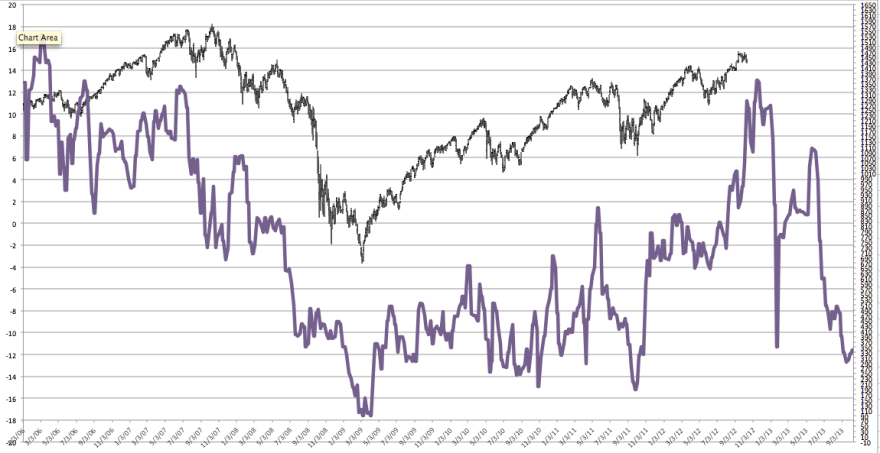

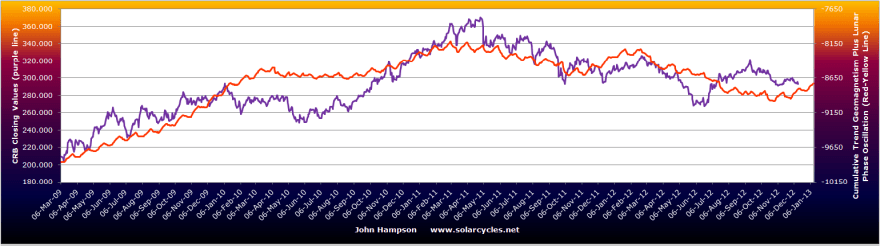

Mixed fortunes within asset classes heading into the weekend, but a summary chart below showing MSCI world equities and the CCI equally weighted commodities index reveals a general pullback began at the turn of February, which could mean the January swing top predicted by the 5 models in alignment could still be validated.

Treasury yields also peaked at the same time, the turn of February, adding to the case.

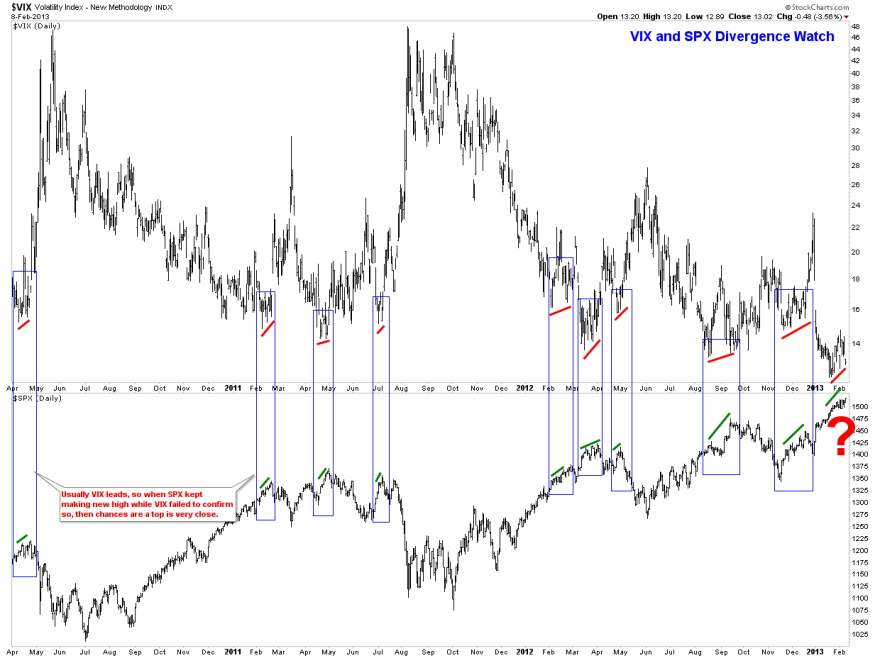

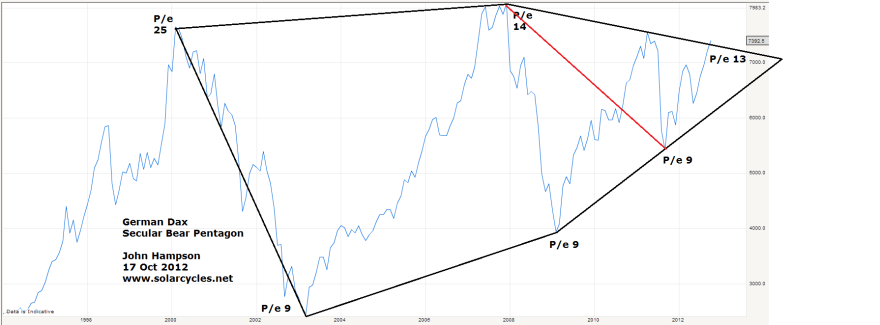

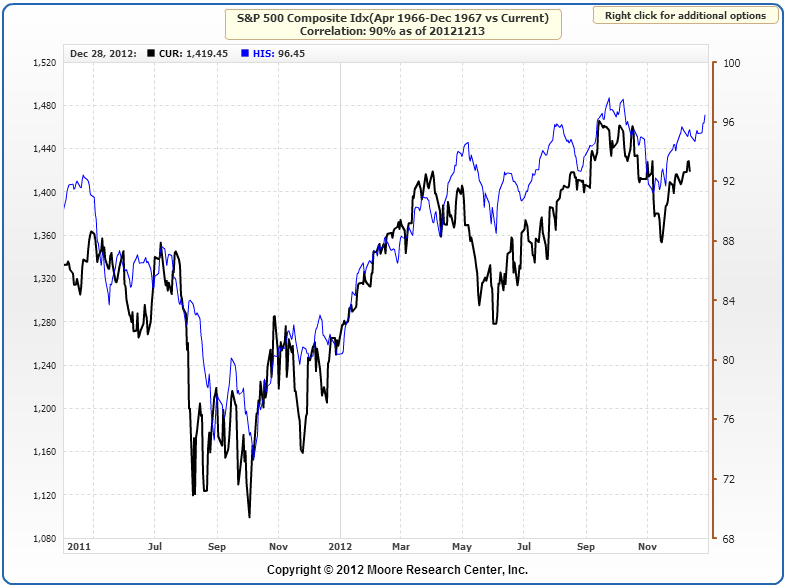

If we look solely at US stock indices, however, it would appear that they just broke upwards out of a range on Friday, which is normally technically bullish. However, the Dax made a similar range breakout in late January only to then reversed it, and there are some clues that the same could occur here, such as the Vix divergence below:

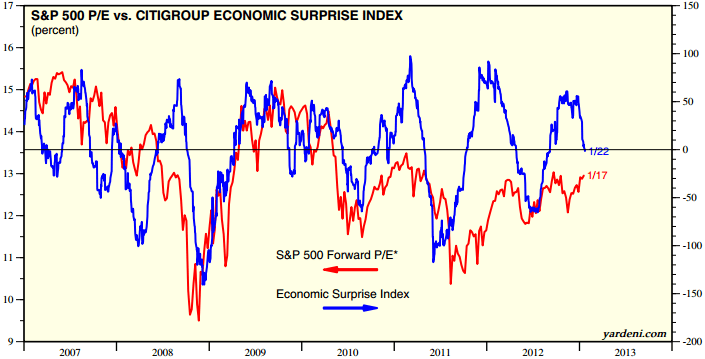

US earnings, so far coming in at a 64% beat rate coupled with a 63% revenue beat rate, have been providing a tailwind. However, economic surprises have been weakening, and also suggest a pullback should occur:

Note how surprises have turned negative, and that the last two times that occurred, equities made a swing top.

Note how surprises have turned negative, and that the last two times that occurred, equities made a swing top.

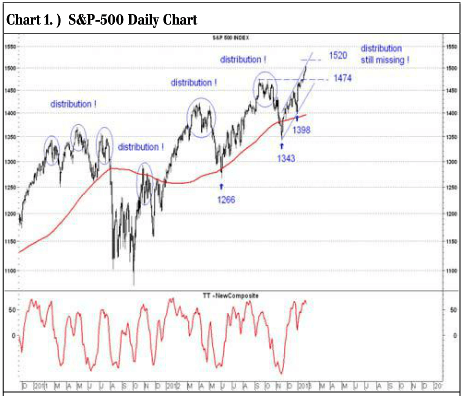

We also see some frothiness extremes in certain sentiment readings for US equities and also in equity fund flows. In short, I see more reasons for US equities to turn down here and pullback, rather than fulfill their breakout, and so join other pro-risk in consolidation or correction. I maintain that any pullback will be followed by a return to the highs and likely a higher high, which will mark a cyclical top if accompanied by negative divergences in breadth, leading indicators and so on, likely by mid-year 2013.

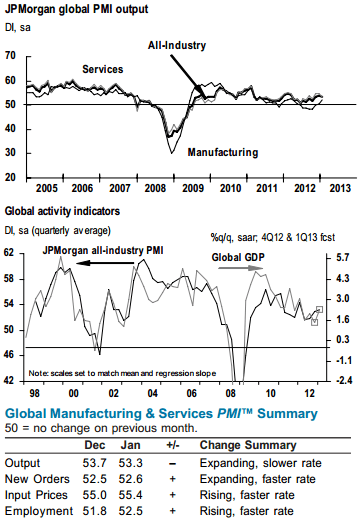

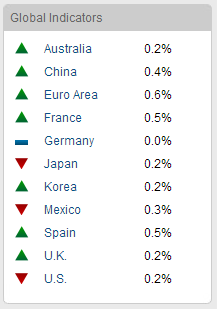

In terms of leading indicators, the global picture is still fairly healthy. Here is the latest combined global PMI (manufacturing and services) reading:

To add to that, ECRI’s leading indicators for the US also show strength:

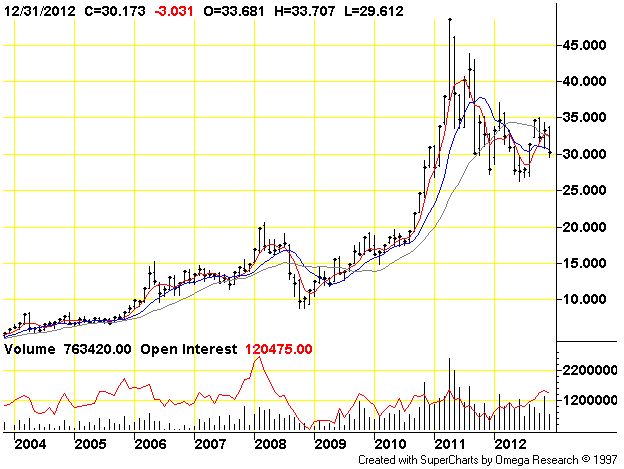

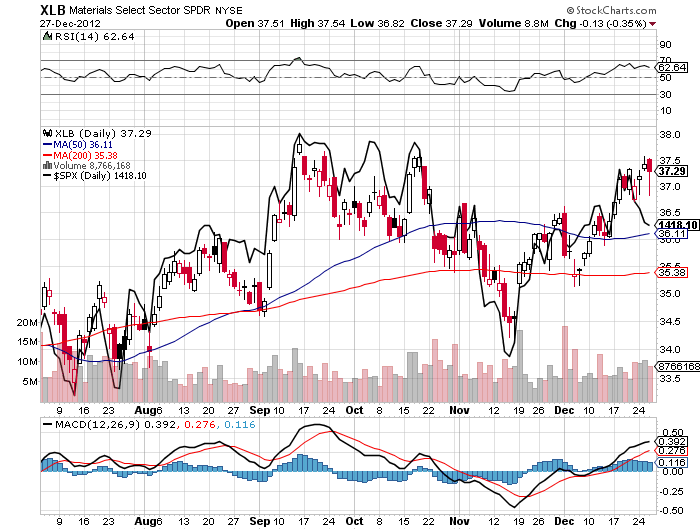

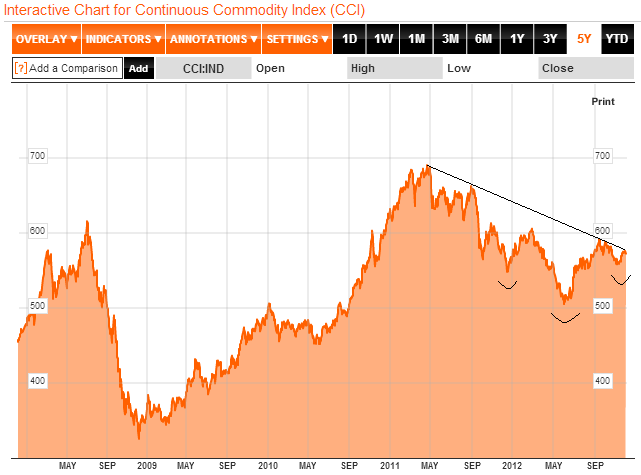

Copper, which is generally a bellweather for the global economy, may have broken out:

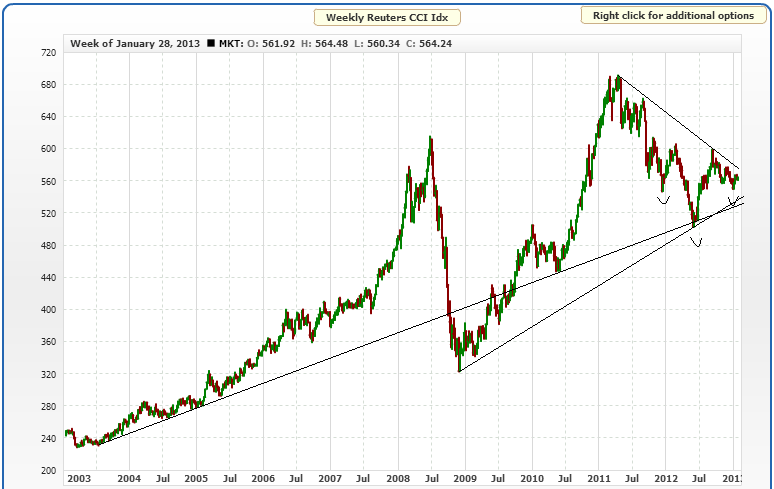

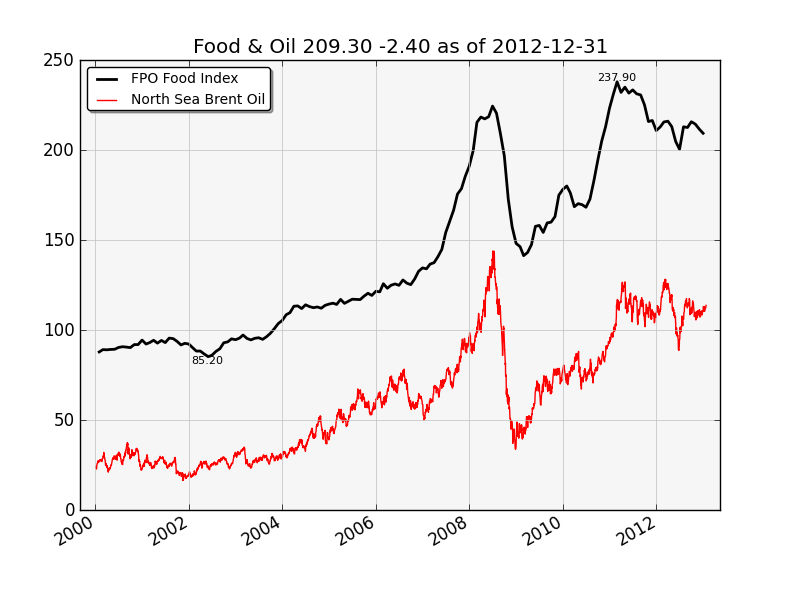

Which brings me to a chart provided by Rob Bowden showing many commodities may be poised for such upward thrust out of large triangles, with equities largely having broken out.

Source: Rob Bowden

There are no guarantees commodities can break out here but the scenarios shown would largely reflect my own views – equities pull back to the nose in a final shallow cyclical bear, and commodities make a secular finale acceleration up and out.

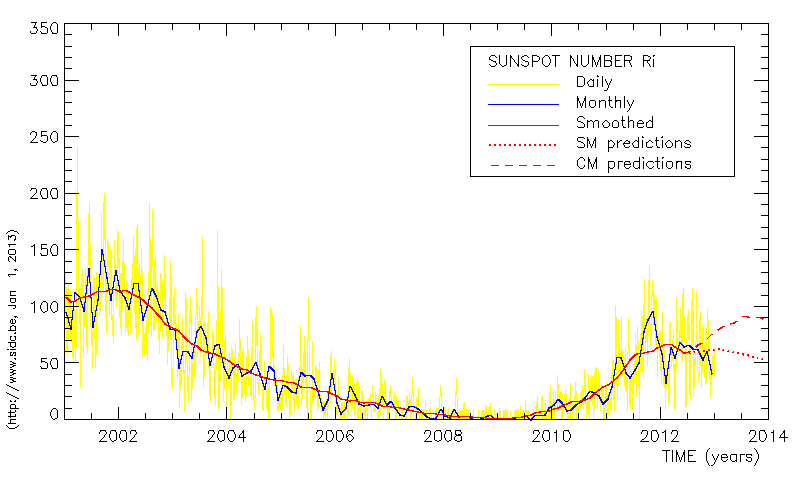

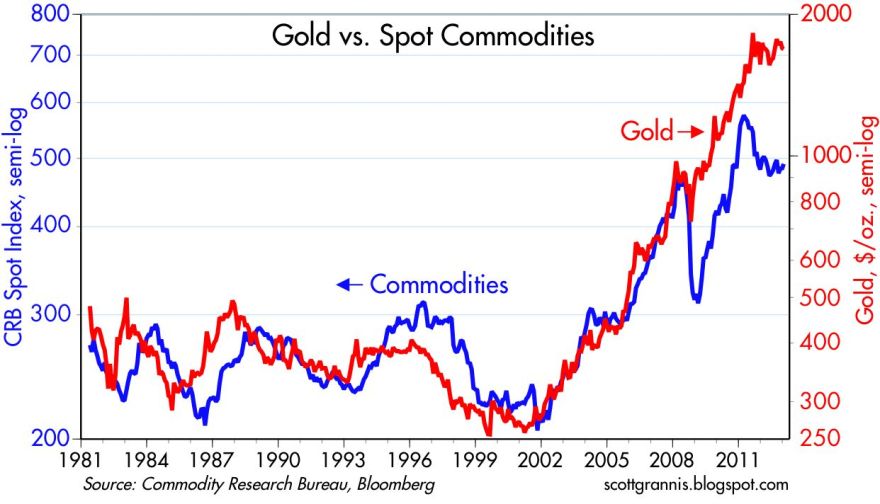

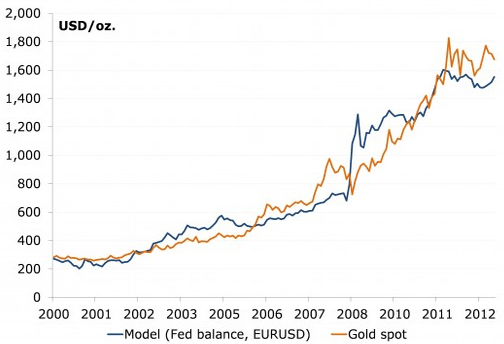

The caveat would be if my primary scenario is incorrect (secular commodities peak and solar peak ahead), and the alternative scenario is correct (secular commodities peak and solar peak passed). NASA’s updated forecast this month continues to point to a solar peak circa September 2013, and I maintain that the probability lies with the primary scenario for now. One or the other is likely to be validated soon by action in gold, which remains tantalisingly undecided, shown here:

Into the nose of the triangle, it remains above the 200MA, which has largely supported the secular bull, but it remains perilously close to dropping out of the triangle and beneath that key MA. Sentiment is fairly depressed for both gold and gold miners which should be fuel for an up-move. But I do wonder whether we might see a lunge to the downside to flush out weak hands before an upwards break. We’ll see.

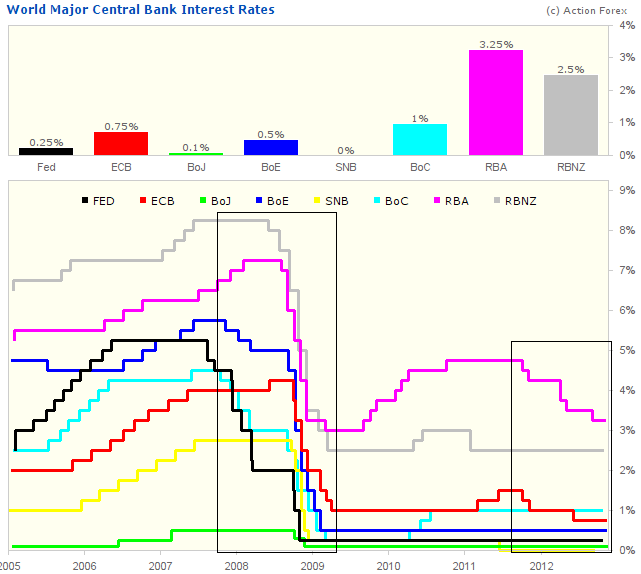

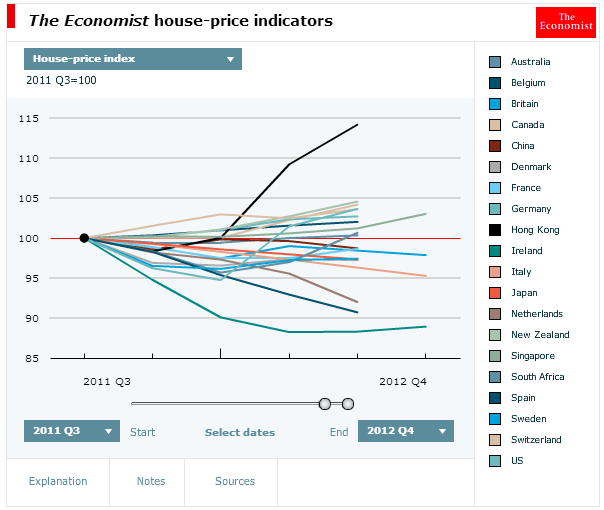

Lastly, here is a summary of global house prices. It’s a busy graphic but the overall theme is that in late 2011 and early 2012 we saw what appears to be a turning point for global real estate, with a pick up since then in markets such as Hong Kong, US, Switzerland, South Africa, New Zealand and Canada. Various European countries remain in downtrends but may turn out to be the laggards in a change in trend.

This would fit with an overall transition from K-winter to K-spring. A bottoming out in real estate and a new secular equities bull emerging in due course. One last push in commodities, before money begins a secular move out of treasury bonds and commodities and into equities and real estate.

This would fit with an overall transition from K-winter to K-spring. A bottoming out in real estate and a new secular equities bull emerging in due course. One last push in commodities, before money begins a secular move out of treasury bonds and commodities and into equities and real estate.