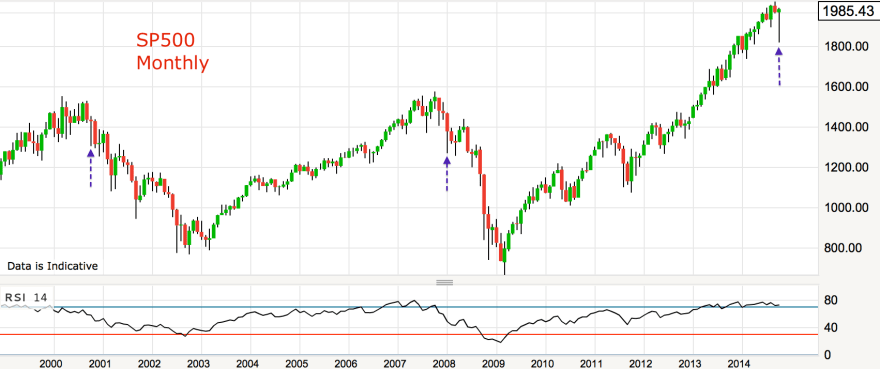

Yesterday produced a topping candle in US stock indices, but was it the topping candle?

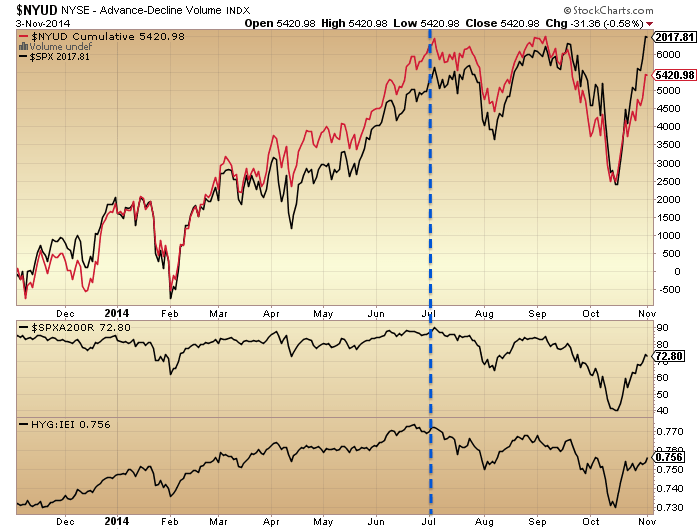

The SP500 closed with a marginal 0.04% gain but advance-decline volume was 1:2 (Urban Camel). It was the 2nd-worst breadth day ever when the S&P 500 was up and so near a 52-week high (Jason Goepfert).

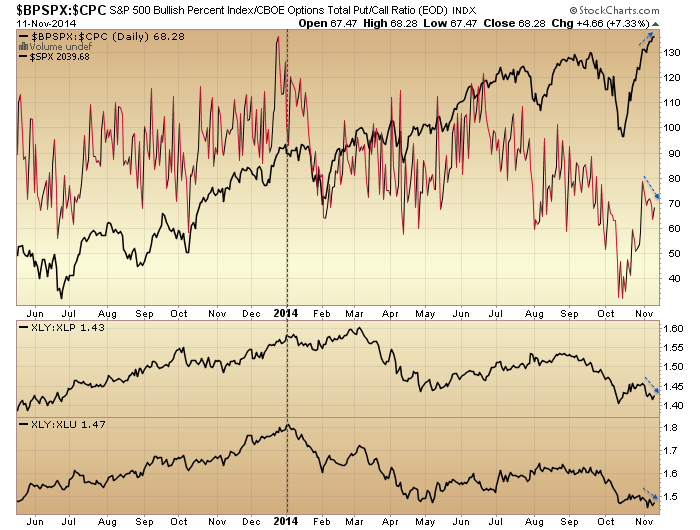

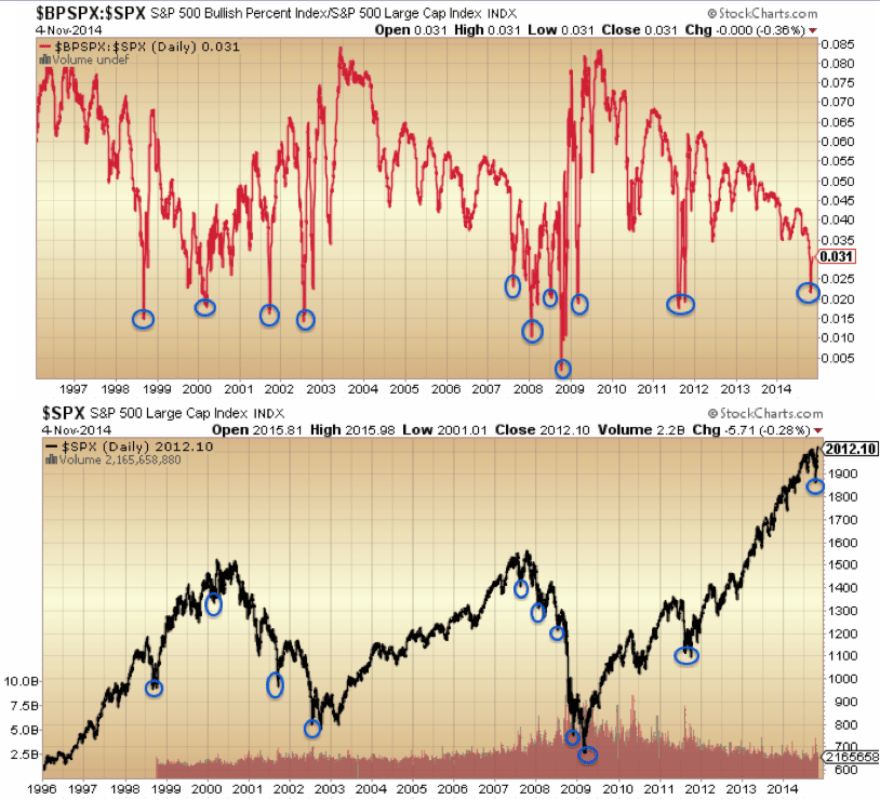

ISEE put/call closed over 230 for the second day in a row, suggesting major contrarian lop-sidedness. Previous instances in 2014 marked below reveal they occurred near tops but tended to be markers of subsequent sideways churn.

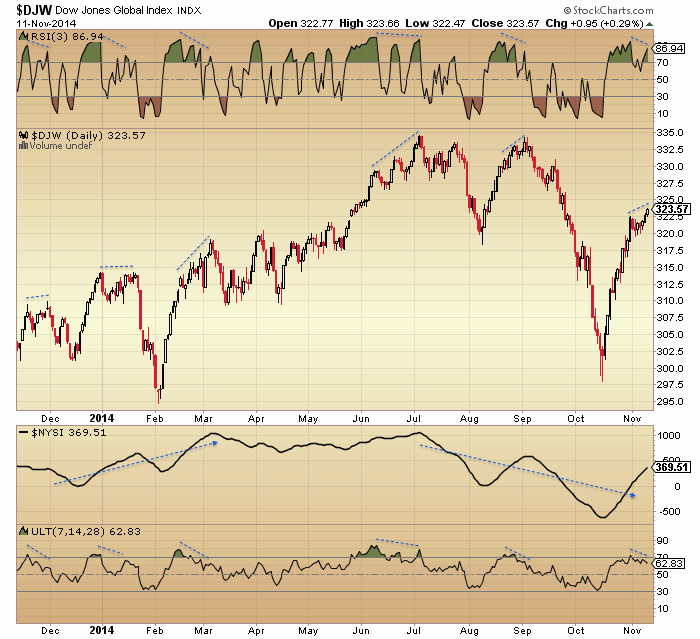

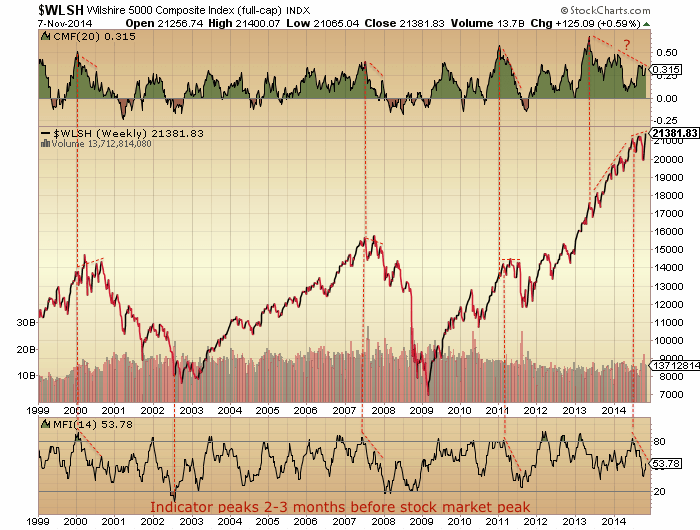

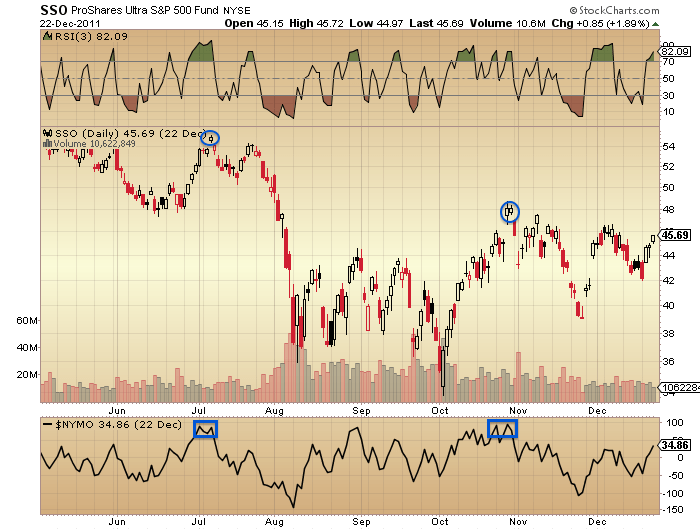

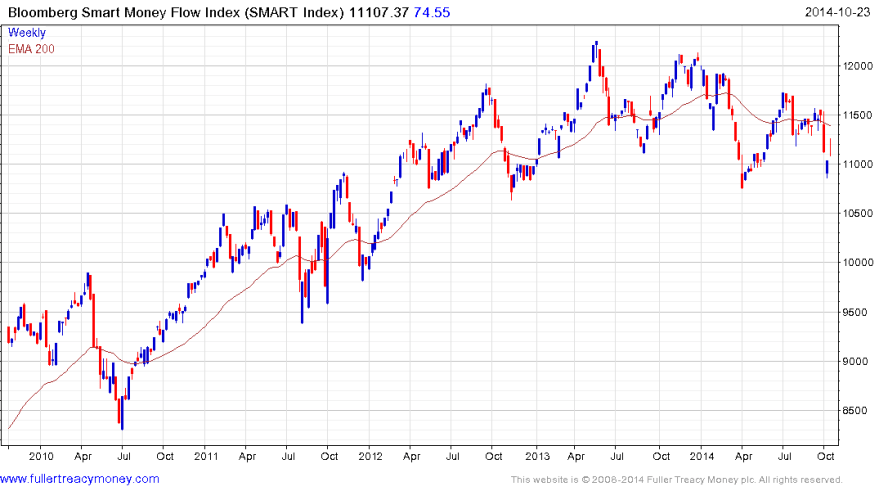

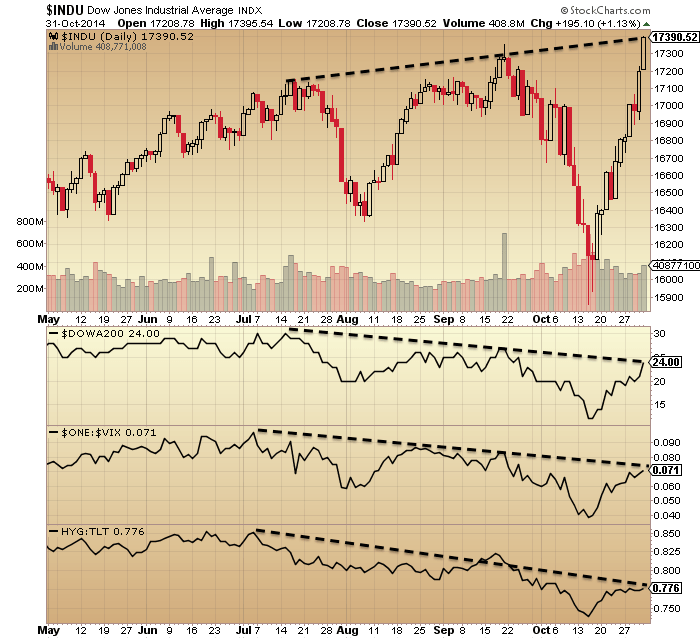

That chart also shows the RSI divergence which ought to eventually lead to a leg down.

That chart also shows the RSI divergence which ought to eventually lead to a leg down.

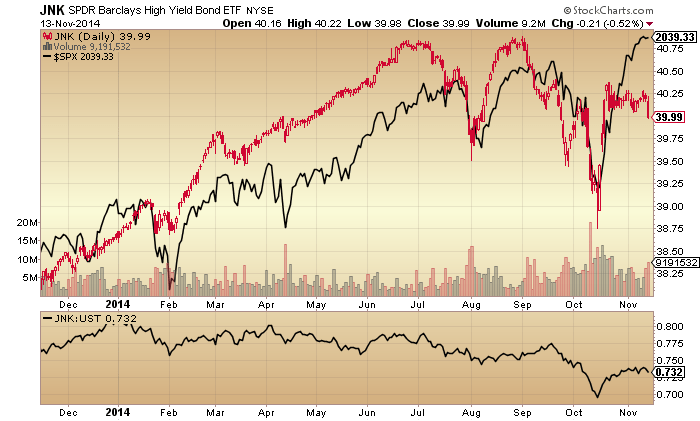

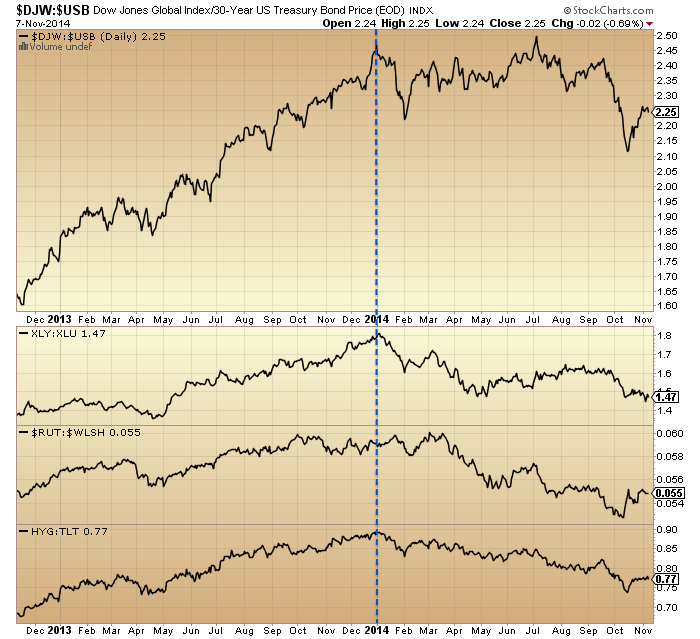

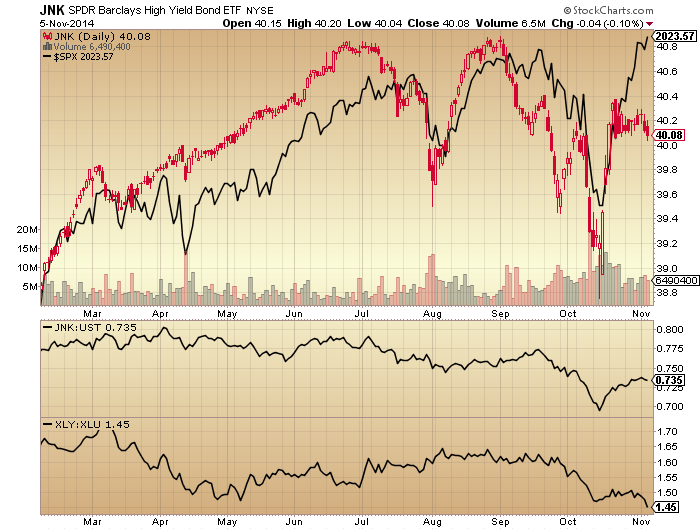

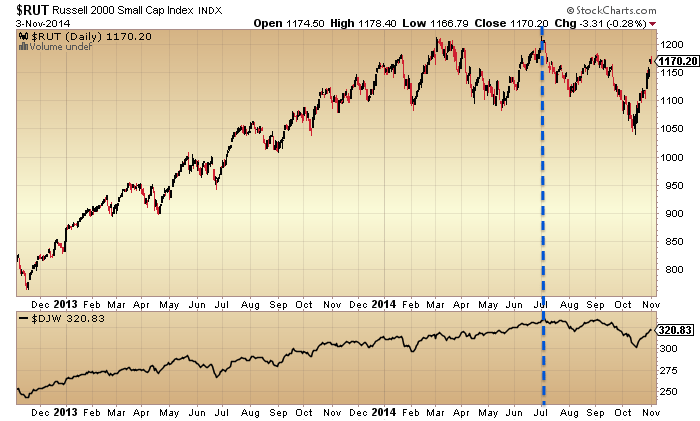

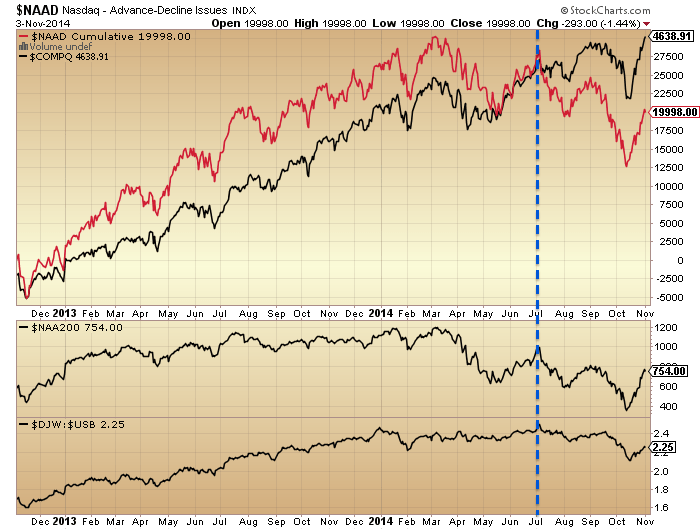

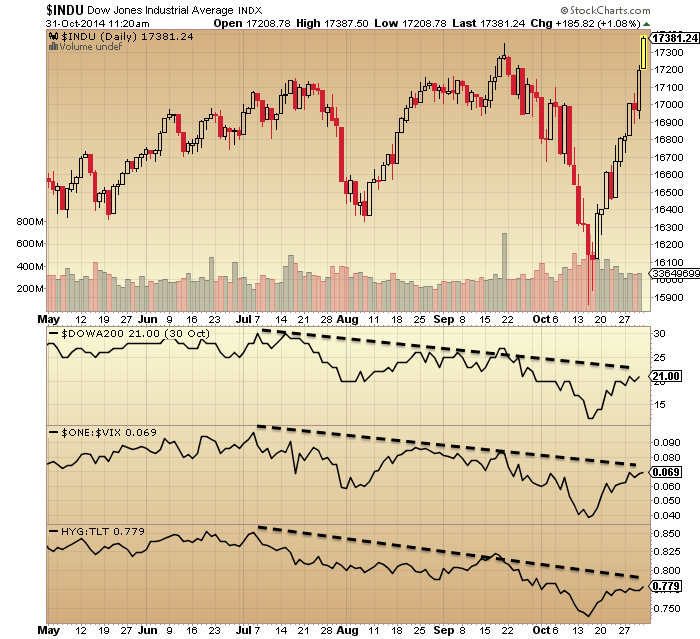

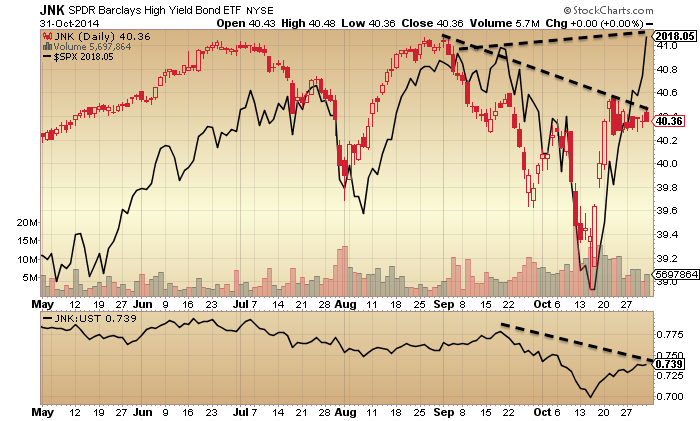

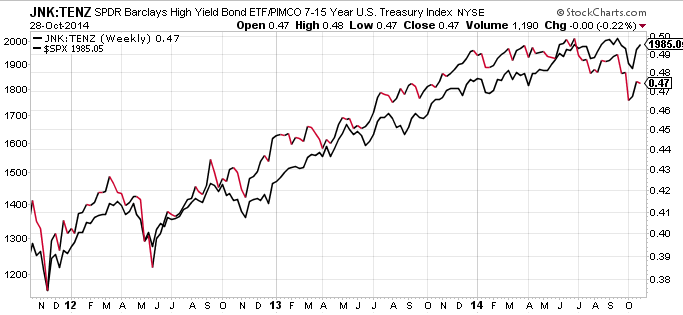

Small caps and junk bonds had the biggest down days yesterday, both risk-off flags which argue a notable drop in large caps should follow sooner rather than later.

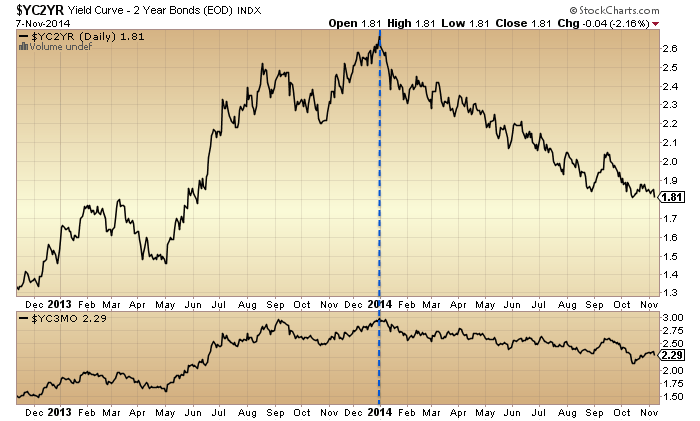

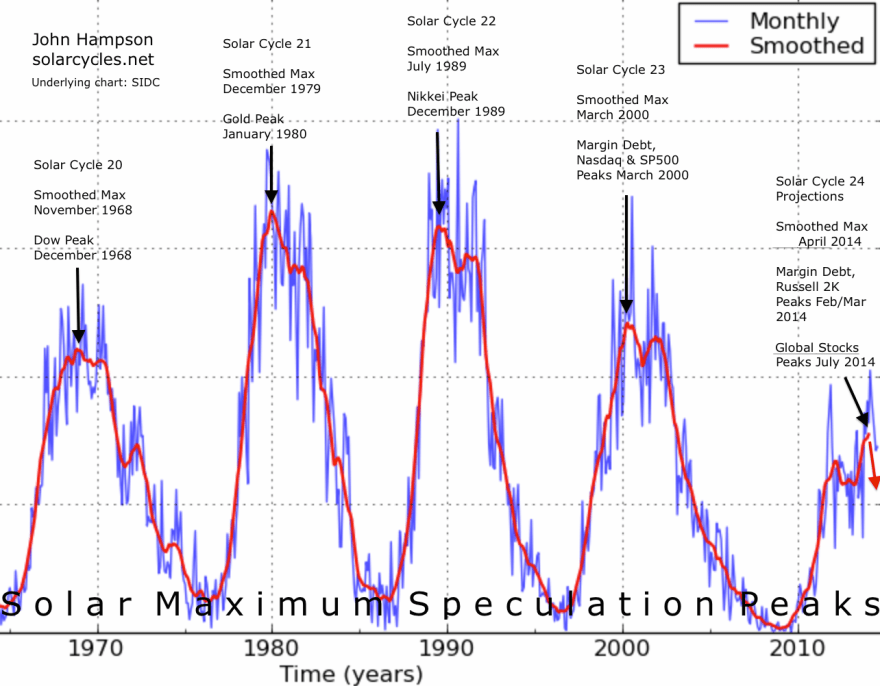

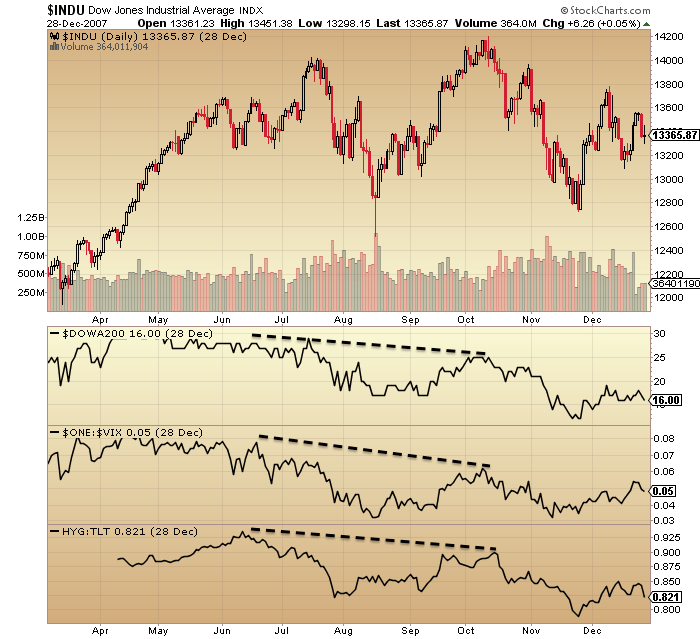

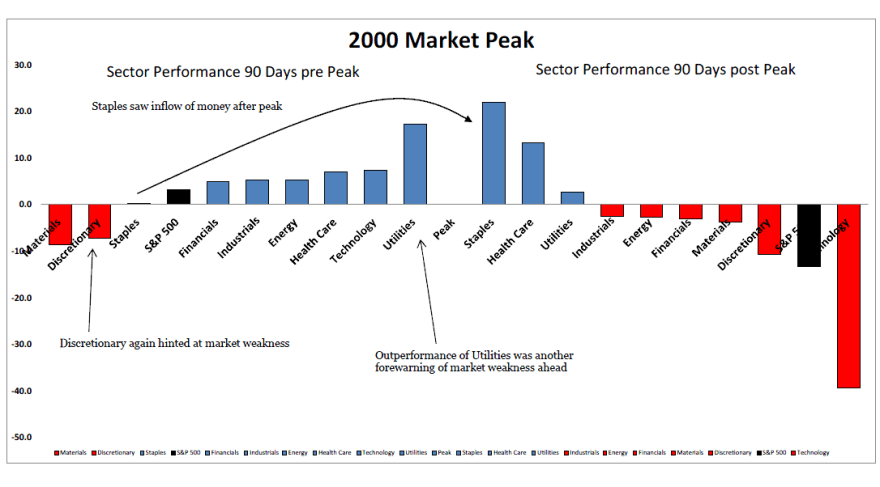

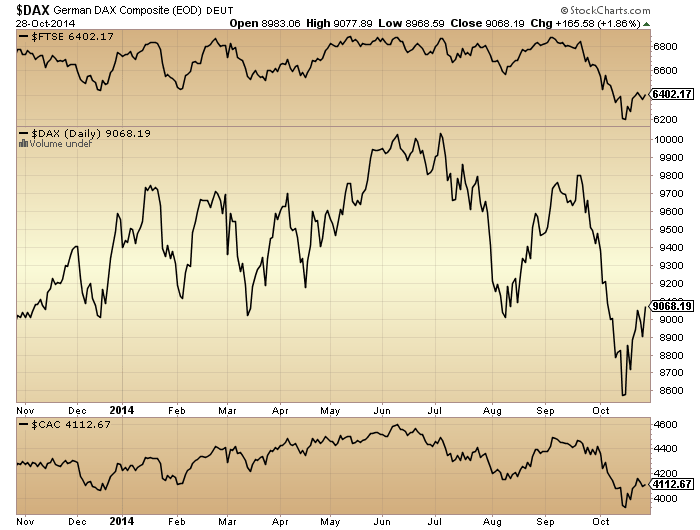

European indices moved further to the precipice in European hours yesterday. At this point European indices and US small caps topped out by June 2014, and most other major global indices in September, just leaving US large caps, the Sensex and the Nikkei as the notable indices still to peak. Drawing on previous major tops (2007, 2000, 1989, 1968) stock indices peaked out within 4 months of each other. Therefore, if I am correct in my assessment of where we stand then those remaining indices should top out without delay and this fits with the picture painted by most indicators: November ought to end as a down month.

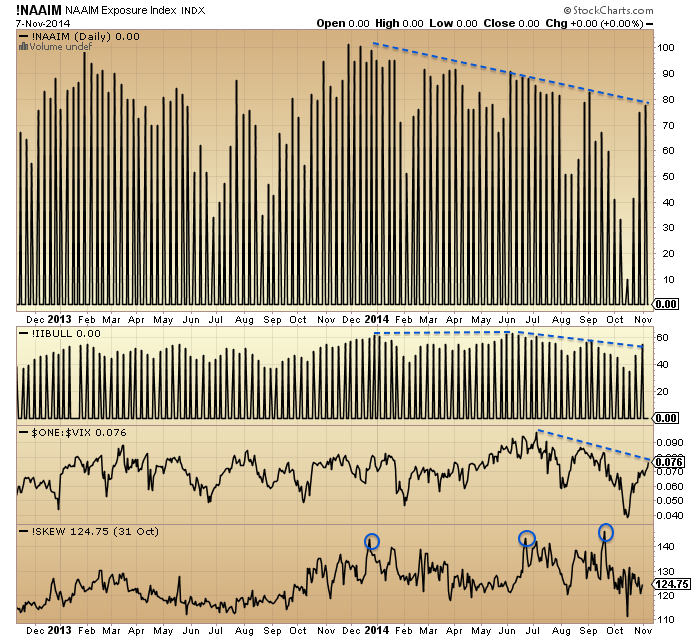

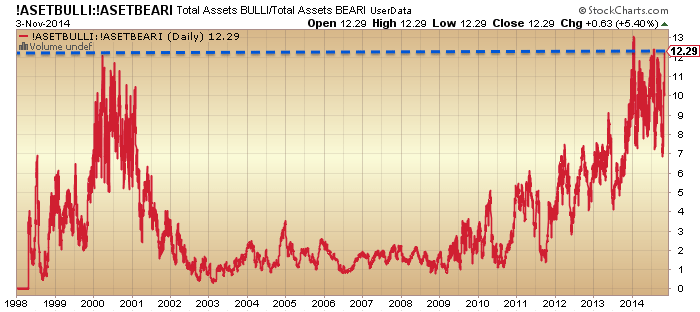

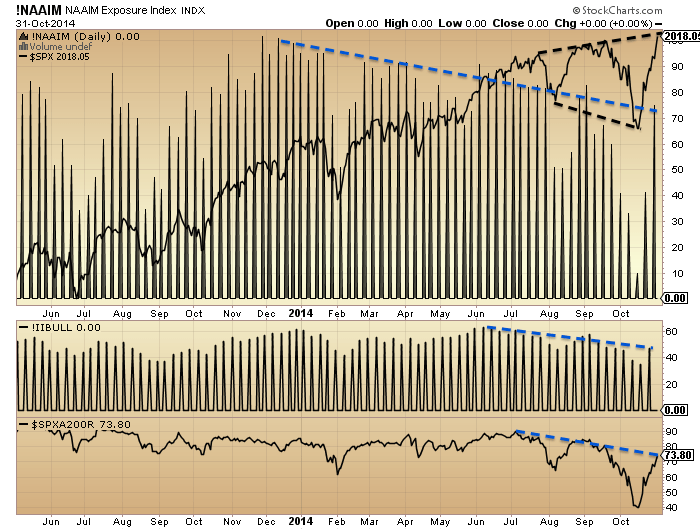

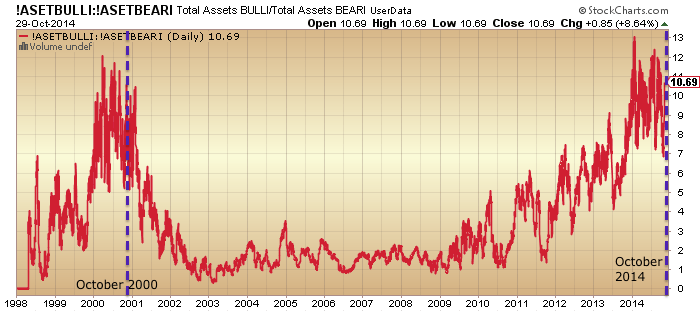

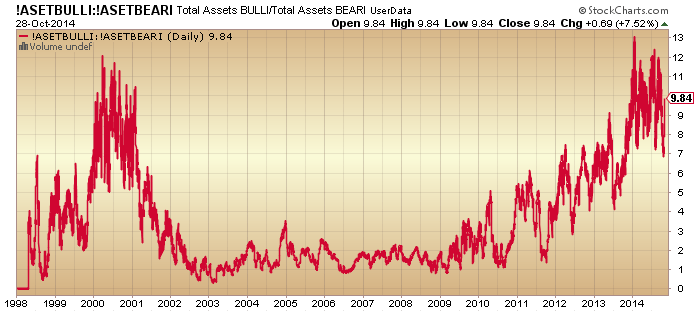

Rydex allocations hit the highest ever level yesterday aside from mid-January 2014, which suggests a top in equities should occur:

Here is the comparison of the 2000 topping process, confirming that Rydex spikes to extremes typically marked tops:

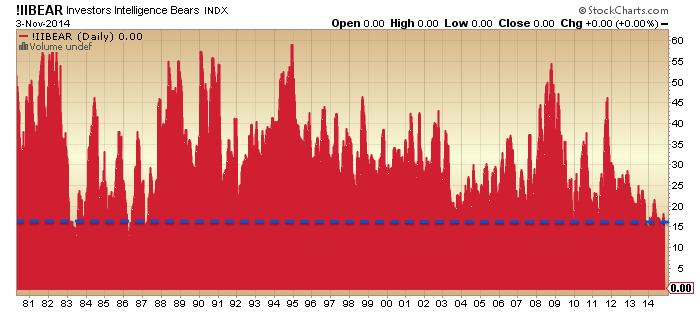

Combining the current extreme readings in II and AAII sentiment, these are the mirrors from history:

Source: Dana Lyons

1987 marked an important top. January 2011 was an early warning of an important top. 2003-2004 was ‘healthier’ froth that sometimes occurs during early bull market progress, so I suggest that cluster is less relevant here.

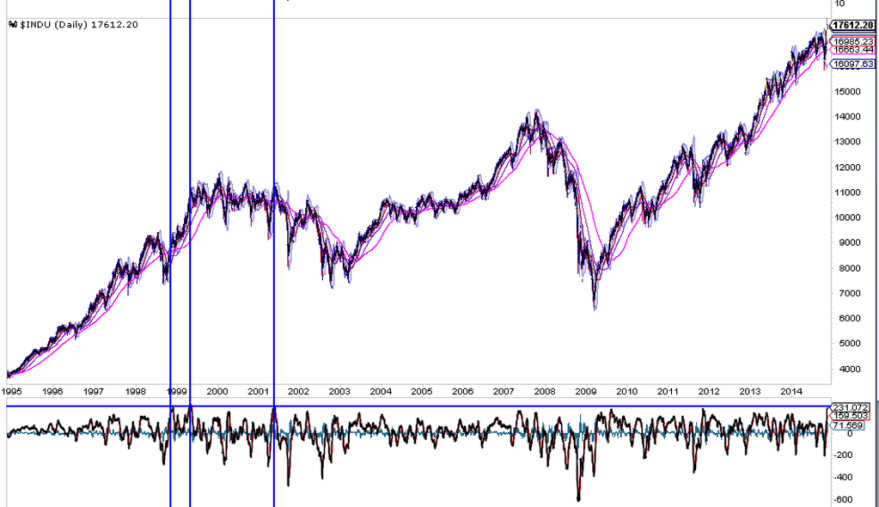

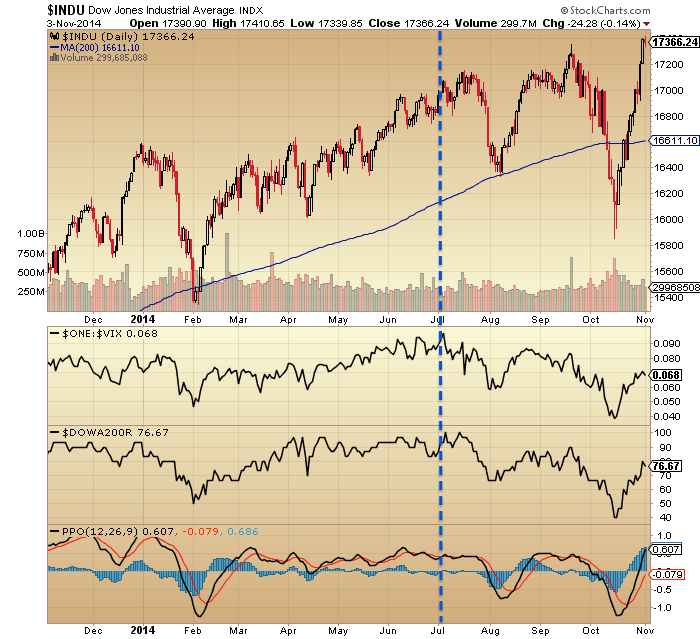

MACD on the Dow produced a reading only seen 3 times before. All were pullback signals on the short term, but different results in the medium term.

Source: Northman

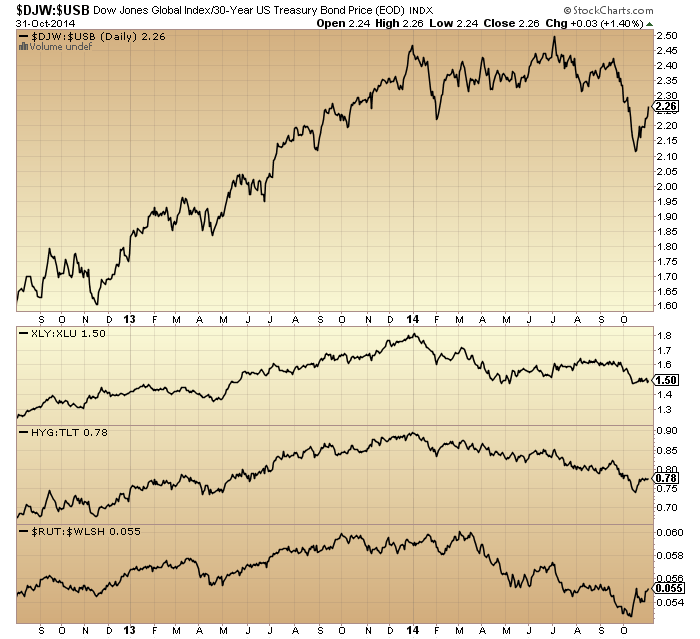

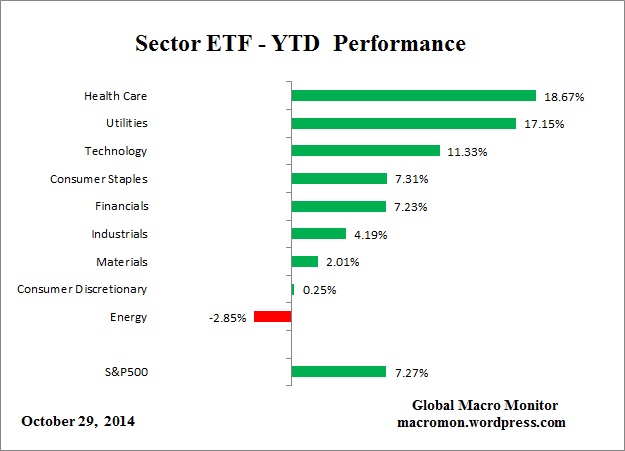

Four headwinds for US equities: a) monetary trends point to a weakening ahead in the US economy relative to Japan and the Eurozone (chart below), b) QE support has ended, c) the rising US dollar and falling oil prices have resulted in a cutting-in-half of earnings and revenue forecasts for US Q4, d) the US stock market is the most expensive in the world of all major countries (table below).

Source: Moneymovesmarkets

Source: Telegraph / ZeroHedge

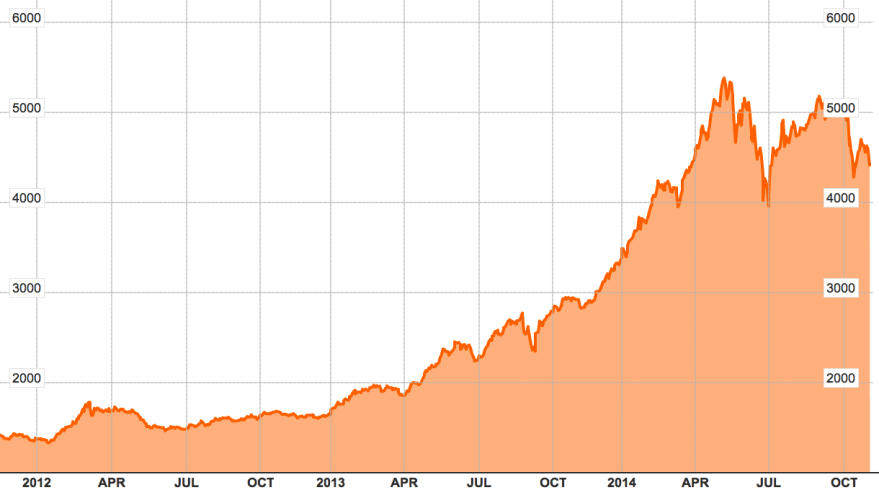

If we could argue that until now a relatively stronger economy in the US coupled with the relatively most aggressive / supportive central bank made for outperformance in US stocks (shown below relative to the rest of the world equities) then that fundamental case looks to be reversing here.

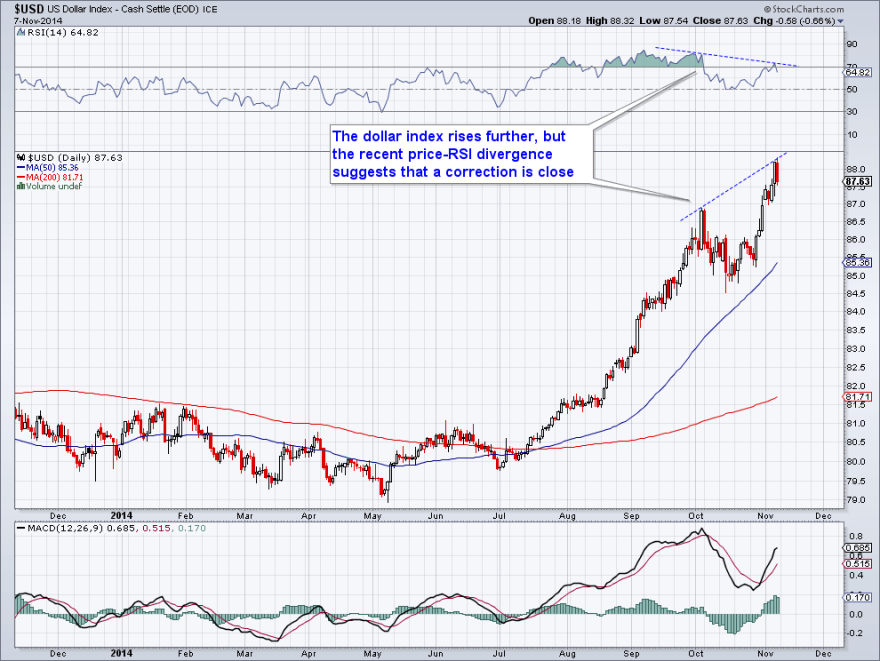

The case for the US dollar to reverse too is added to with the below contrarian Euro positioning and sentiment.

Source: Nautilus

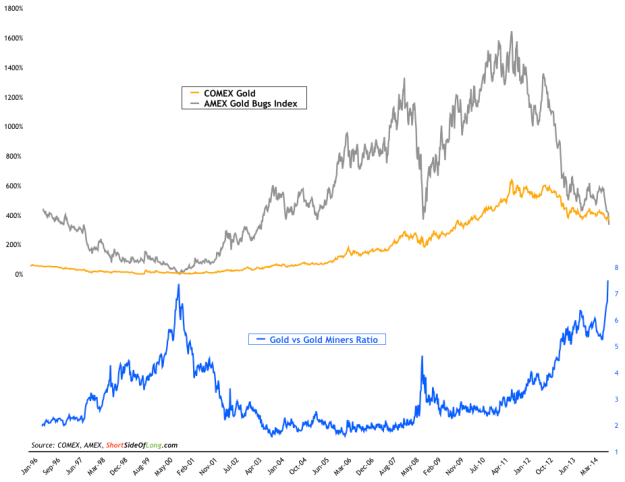

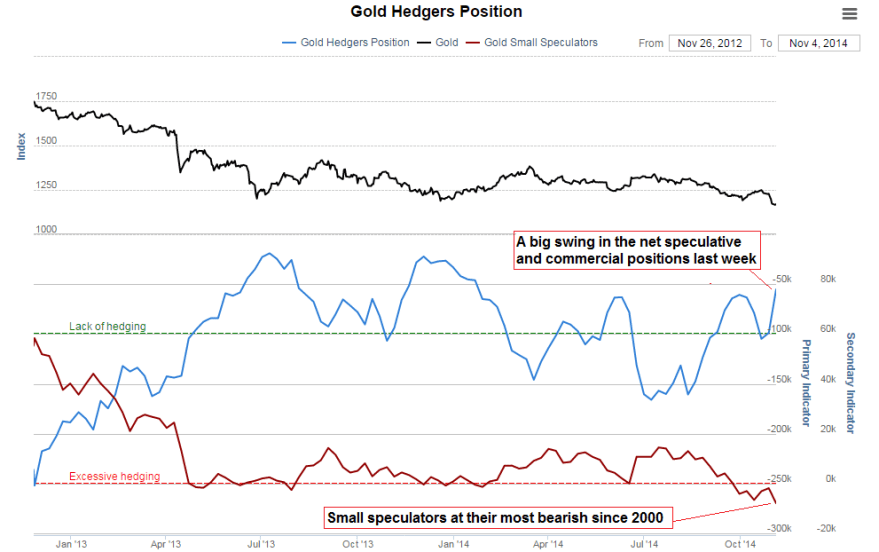

And this would fit with a reversal in gold which looks to be basing. Here is another angle on gold that suggests we are at a similar point to the secular bottom in gold at the end of 2000.

Source: Sentimentrader

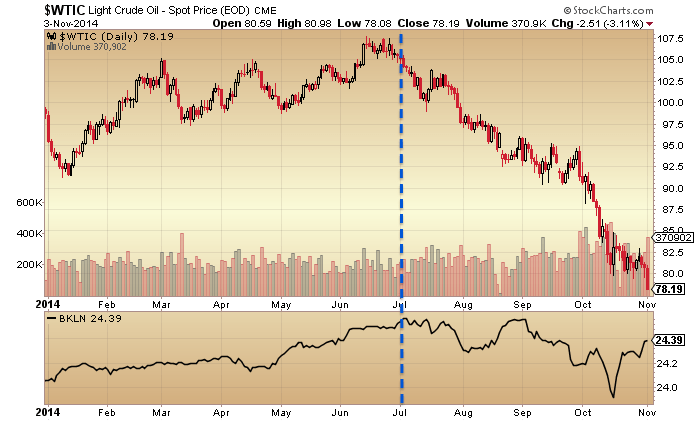

Drawing in other evidence from previous posts, there is a compelling case for a major cross-asset reversal here, out of the USD and into gold and out of equities, particularly US equities.

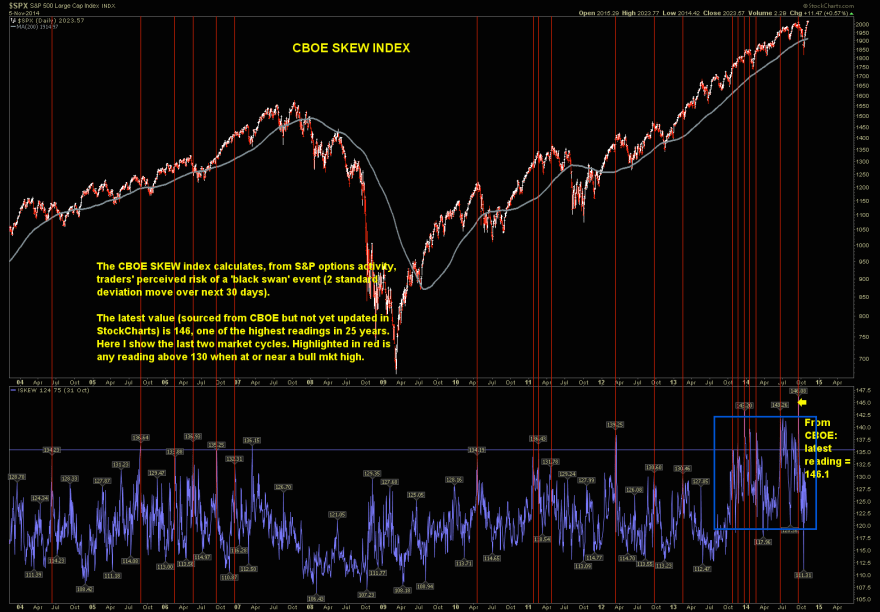

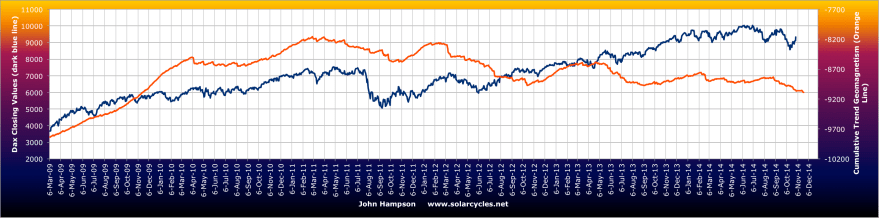

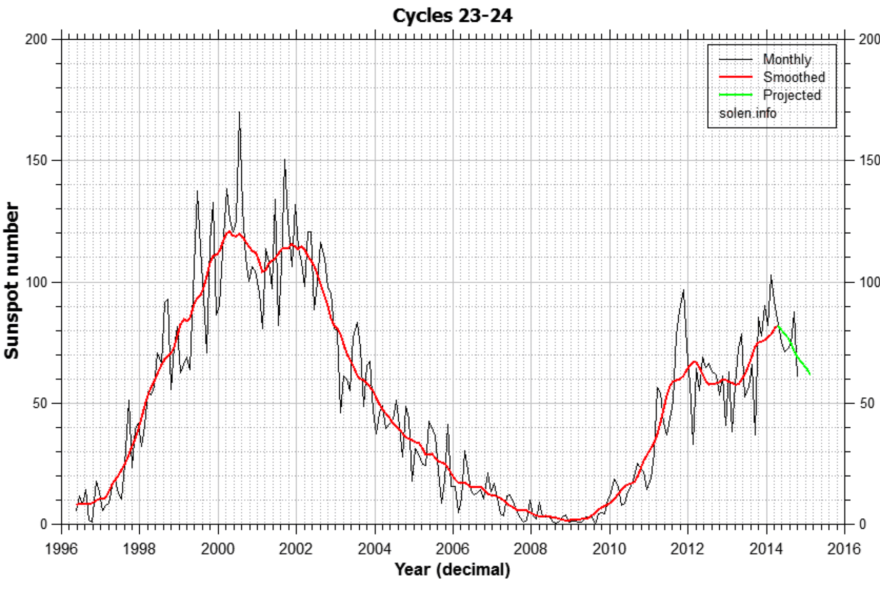

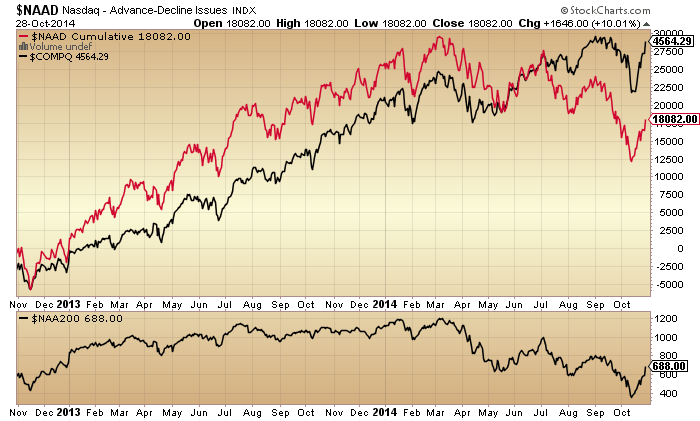

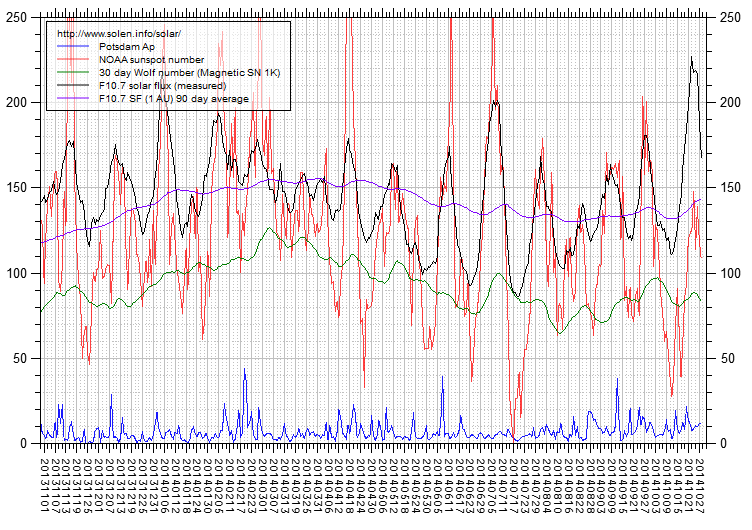

In the very short term, yesterday’s US equities intraday reversal candle together with the Rydex spike, junk bonds drop and very precarious European indices technicals set up the potential for a follow through to the downside either today / early next week. My case is that this is the last peak in the topping process and if so we should see at least one large voluminous down-day over the next several sessions. If instead we churn sideways in a range for the remainder of November then support would grow for an end-of-year peak, but with every man and his dog expecting positive Nov/Dec seasonality to take stocks higher the stage is set for the opposite, particularly as actual geomagnetism (the underlying source of seasonality) is trending downwards currently.