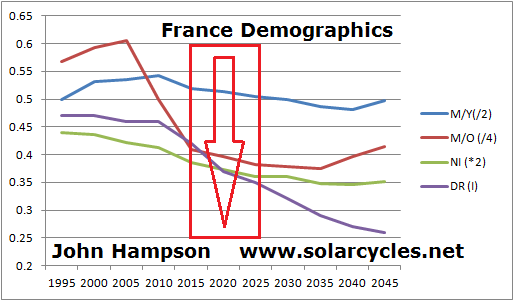

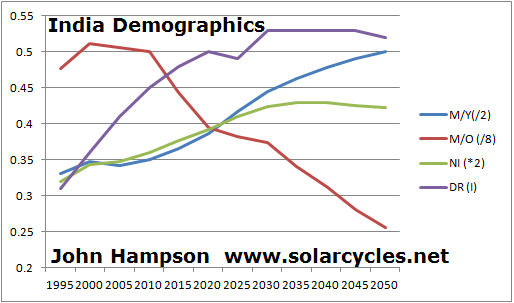

Over the next 10 years there are certain countries (largely emerging markets) with demographic tailwinds which should enable strong equity bull markets (as per my conclusions here), whilst the majority of the G10 face demographic headwinds, which may not only offer poorer returns but potentially even losses in secular bear markets, like Japan 90-00. So I want to put greater focus on the site going forward on my pick of those with tailwinds.

Out of the 24 I studied, South Africa, Nigeria, Poland, Russia, India, Turkey, Brazil, Malaysia and Indonesia had the best demographics looking foward. Out of these I have chosen Brazil, India and Malaysia to track on my site. I selected them because of relatively low corruption, sufficiently diversified economies, and healthy reserves versus debt. Brazil has an advanced tech sector, good oil supplies and one of the richest biodiversities. Equally important was having access to them on my trading platforms and having access to the data for their respective indices. I would have liked to have added one of Poland or Turkey to make even better geographic diversification, however data for both is not readily available. I plan to still invest in one or the other – most likely Turkey – but will limit the modelling on my site to Brazil, India and Malaysia.

Of course having positive demographic trends does not make for guaranteed good returns. Political and economic mismanagement, conflict, regional crises, large natural disasters and a number of black swans are all possible. But all three countries are fairly established and large economies, on the cusp of leaving emerging to becoming developed, and my plan is to spread my risk by investing in all, with the addition of Turkey or Poland, in case one stumbles.

So, I have compiled data for the last 4 years: sufficient to judge lunar and geomagnetic responsiveness, whilst balanced against time demands. Here is the geomagnetic model for the last 4 years versus Brazil, India and Malaysia stock indices:

All three demonstrate fairly good relations with the geomagnetic model. It is tentative of course, but none are so out of sync with the model as to render its use redundant, and this is largely to be expected as geomagnetism should affect sentiment globally. The geomagnetic forecast and models will be updated tomorrow as usual, so these three will now join the updates.

I then studied returns in relation to lunar phase oscillation over the last four years and here is the summary:

All three countries demonstrated higher returns within the lunar positive period (buy on the 4th day after a full moon, sell on the 4th day after a new moon) compared to the lunar negative period (buy on the 4th day after a new moon, sell on the 4th day after a full moon). The least powerful differential was found in Malaysia, yet in the Dichev and Janes study which covered a longer timespan, they found the Malaysia KLCI to be one of the most sensitive to the lunar oscillation. Dichev and Janes did not include India or Brazil in their study, but the results in the table above suggest fairly potent lunar oscillation, with India particularly impressive. I therefore (again tentatively) suggest trade-timing using lunar oscillation should work in these countries.

In conclusion, the Brazilian Bovespa, Indian Sensex and Malaysian KLCI have demographic tailwinds looking out over the next 10 years, which should add to the probability of strong secular equity bulls in these countries. They also compare more favourably to other positive-demographic countries, such as Nigeria, Russia and South Africa in terms of lower corruption, unemployment or more economic diversification. Collectively, they provide sufficient risk diversification and geographic diversification, to which I will be adding Turkey or Poland. However, due to data availability, my tracking on the solarcycles.net will be limited to Brazil, India and Malaysia, and all three demonstrate sensitivity to geomagnetism and lunar phasing, which should provide two tools with which to improve trading returns in these indices.