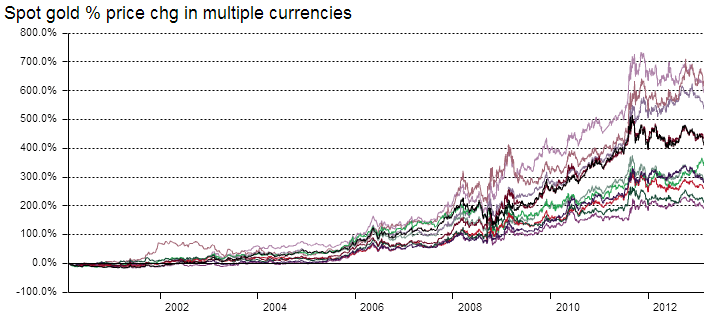

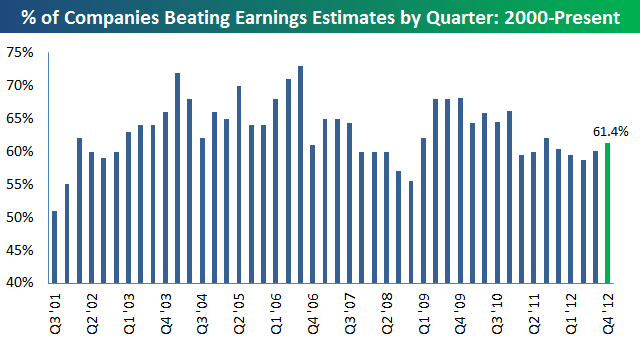

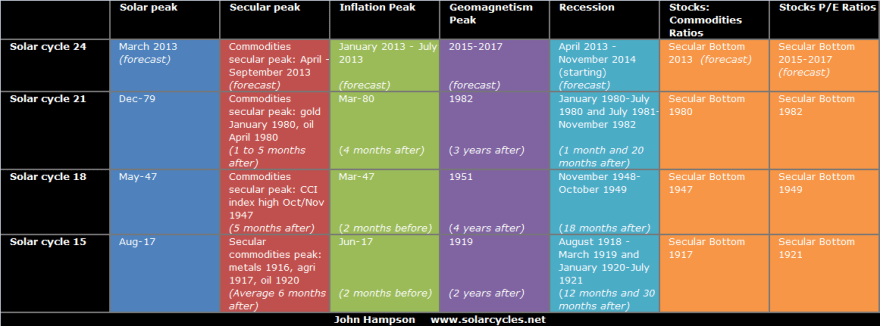

One third of the year left to go. As of a couple of weeks ago the SP500 was up 12% for the year, whilst the average hedge fund was up just 4.6%, with just 11% of hedge funds exceeding the SP500 return of 12%. 2011 was also a tough year for hedge funds, compared to previous years. In my personal experience, 2011 and 2012 have seen certain reliable analysts calling it wrong, some usually reliable indicators pointing different ways rather than in alignment, up/down moves of shorter length, and some degree of disconnect between some usually connected assets. In my opinion, this is all due to the transition period that we are in, from K-winter (gold, bonds) to K-spring (stocks, real estate), bringing about come confusion in assets, indicators and analyst calls. The transition is gradual – the nominal bottom in stocks and real estate likely already occurred, the inflation-adjusted low likely ahead, the secular bottom in treasuries is perhaps occuring right now, the secular top in commodities I project next year. A messy, gradual transition rather than a clean switch.

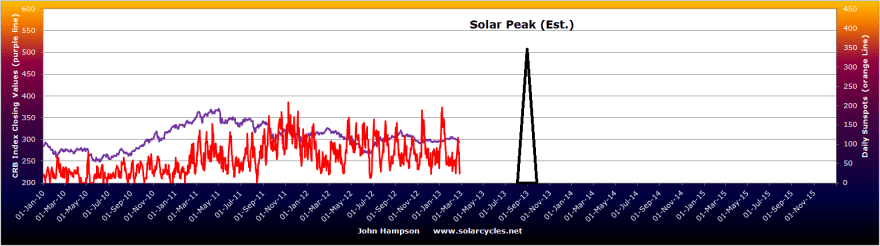

I have found 2011 and 2012 trickier than previous years for those reasons listed above. Having to go against analysts that I respect, having to choose between indicators, having to make sense of assets going different ways. Ultimately, secular and solar anchoring has seen me through I believe, and will continue to do so. I am currently 20% up for the year. My target, as every year, is 40%, which makes me behind target with 3 months to go. Usually I try to steer myself to towards the year-end target as best I can (over-exposing and under-exposing, bigger and smaller risks). I achieved my 40% in 2008, 9 and 10 in that manner, but fell short trying last year, making only 15%. This year I don’t have the same approach, because I am looking out to what I project to be the secular peak in commodities in 2013, a potential opportunity for parabolic gains. My plan then is to maintain my bulk long commodities positions into 2013, rather than trying to partially close down and trade shorter term into year end. If my projections are correct, then commodities should continue to rise in Q4 2012. What I consider most important to my year end tally is calling when to exit equity longs. At some point I want to exit the bulk of those, and that may be before year end 2012.

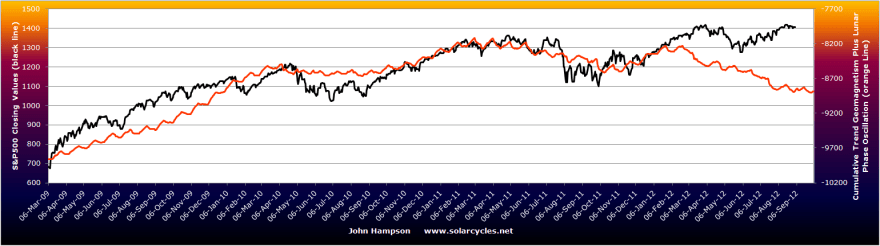

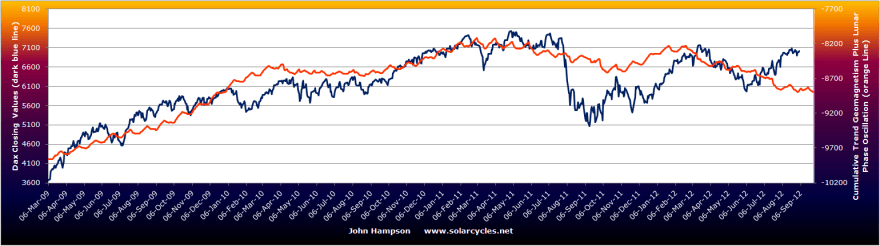

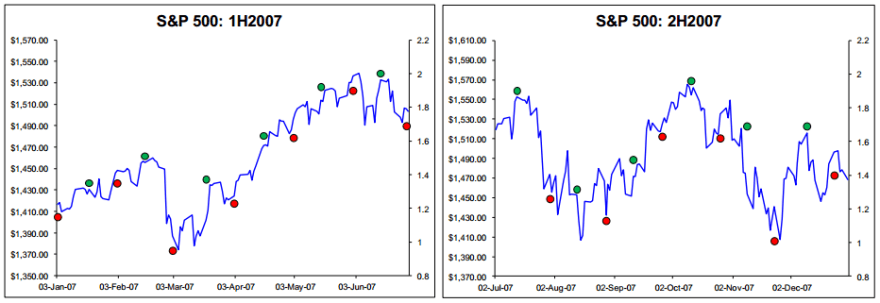

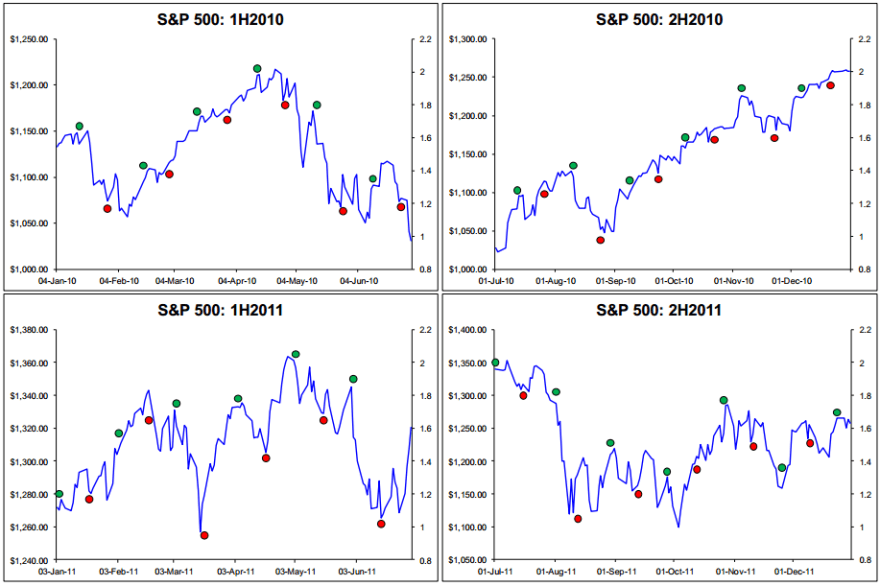

On Friday at Jackson Hole, Bernanke added weight and justification to his easing bias, whilst falling short of committing to it. The reaction was pro-risk, and US stock indices still look like they are in a bull flag preparing for a break out over the year’s highs, as shown below. Currently, we are back up to the top of that flag. I have also marked the new and full moons. We saw one lunar inversion at the beginning of July, but otherwise the typical lunar oscillation has been in play. On Friday we made a bottom with the full moon and can now potentially make a high around the new moon of Sept 16.

The potential is there, both by technical picture and lunar phase, for stocks to break out. If they can break out then a melt-up would be likely, providing great returns for equities longs. We have the ECB meeting on Thursday this week, with the potential for interest rate cut and bond buying programme announcement, and we have the FOMC on the 13th September with the potential to announce QE3 or some other novel measures. Of course, both provide the potential for disappointment too. A lack of action could lead to a siginificant sell off. Also on the flip side we currently have a geomagnetic storm in progress and more geomagnetism is predicted for today and tomorrow.

The Dow and Nasdaq are in similar positions, but a quick look at the Dow Transports shows a more precarious position. Dow theory says this is a negative divergence. Let’s see if the Transports can catch up here, or alternatively breakdown.

Source: TSP Talk

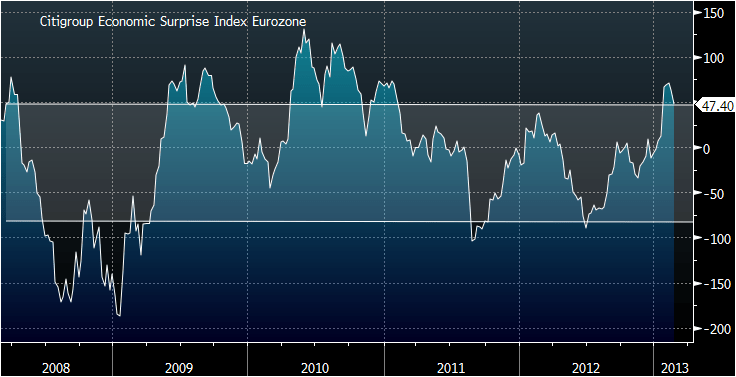

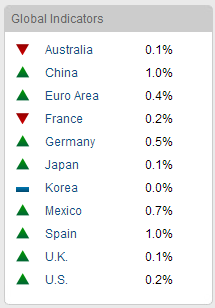

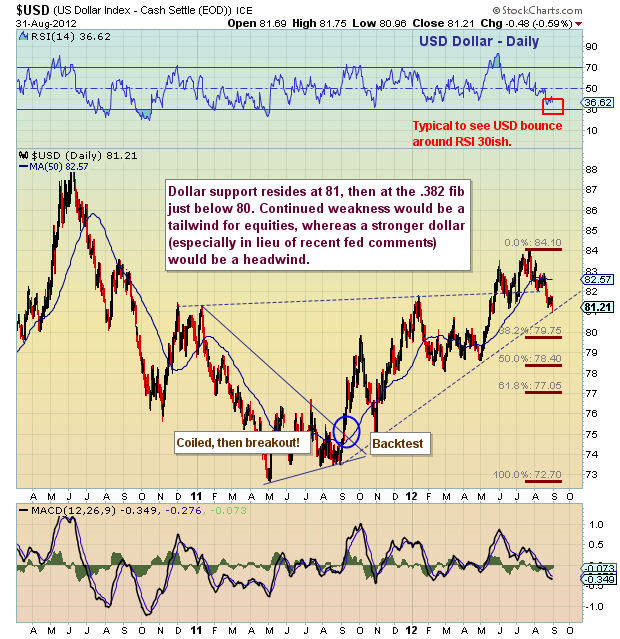

Sticking with the USA, economic surprises continue to rise in an uptrend, ECRI leading indicators turned positive on Friday, and Presidential seasonality suggests upside into November. The US economy continues to perform better than most in the world and that should mean support for the US dollar.

Source: See It Market

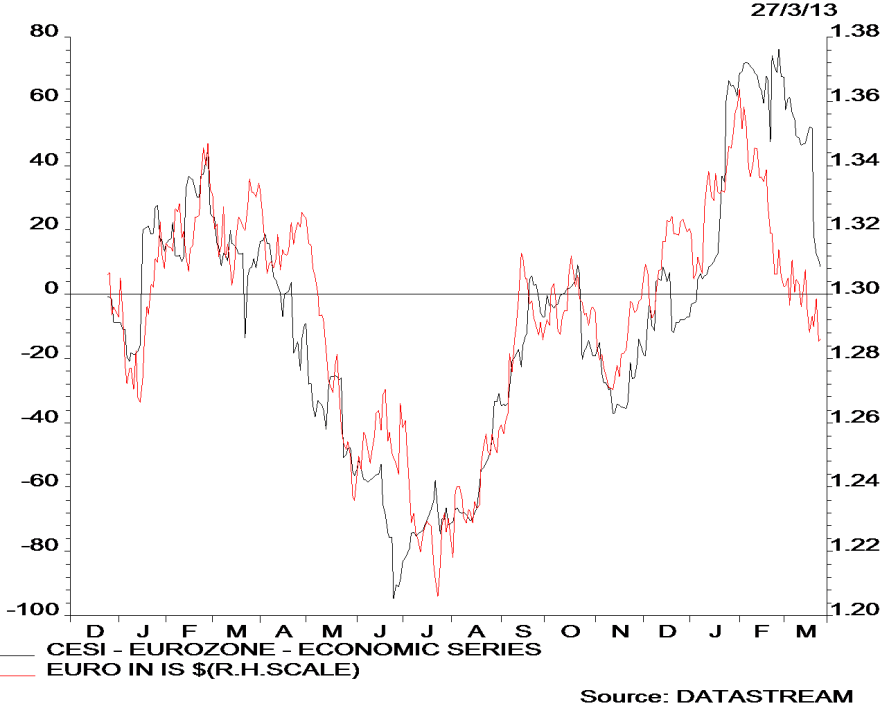

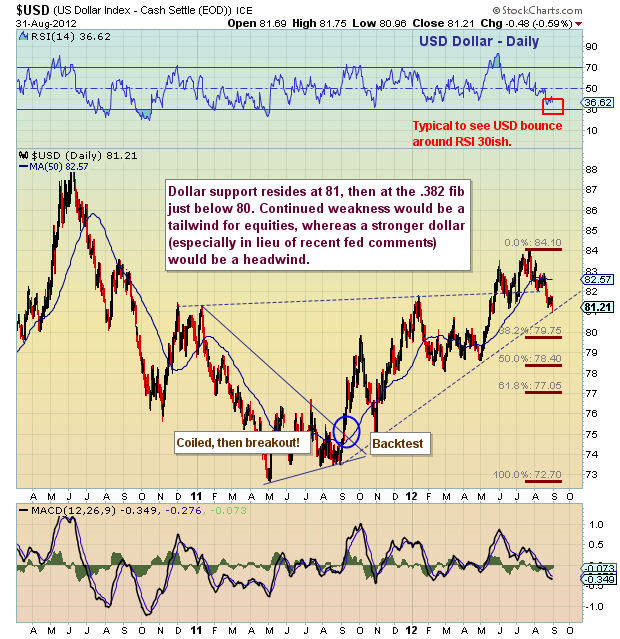

As can be seen above, the US dollar is now at support and an important junction. I suggest that the FOMC outputs next week could influence which way this goes. A lack of QE should mean support for the US dollar due to the better US economic data. However, QE3 should rally the Euro at the expense of the dollar, and the technical chart for the Euro provides weight for that occurring:

Source: Chris Kimble

Source: Chris Kimble

For my projections of an overthrow in equities in the final part of 2012 and then a parabolic finale in commodities in 2013, announcement of QE3 would really seal the deal I believe. Money would pour into pro-risk and commodities would benefit from the weakening dollar. Let’s see.

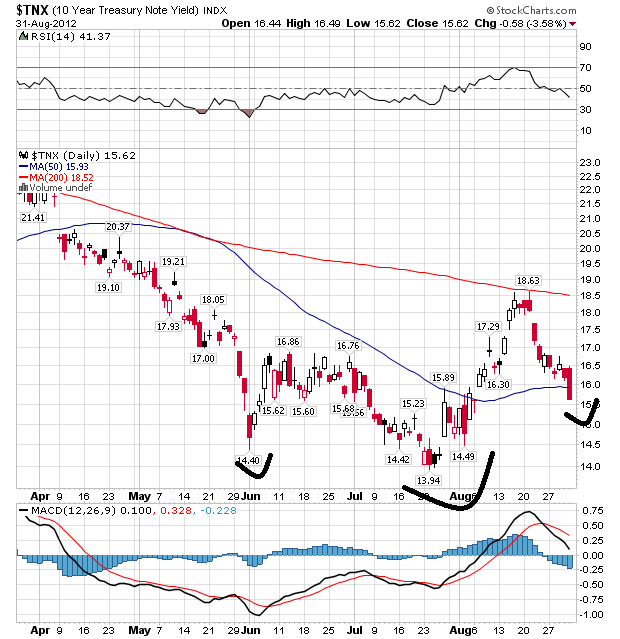

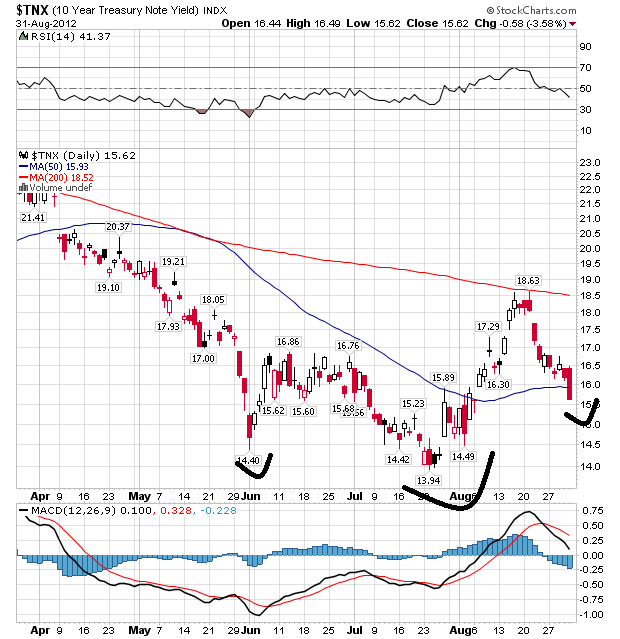

A look at treasuries shows us that the stronger hints of QE have reversed yields in the short term but also set up a potential inverse head and shoulders.

Underlying source: Stockcharts

Both QE1 and QE2 led to prolonged periods of rising treasury yields, after the initial move the other way, as money poured out of bonds into pro-risk. So again, QE3 would likely provide further fuel for pro-risk. It is on my mind that previous cyclical stocks bulls ended with treasury yields rising to levels where interest rates stifled the economy. Whilst we have the kind of ultra low rate levels here that echo the 1940s, I would still expect them to rise into the end of the cyclical bull to some degree. Currently, they are moving the other way, so let’s see if this large H&S now plays out.

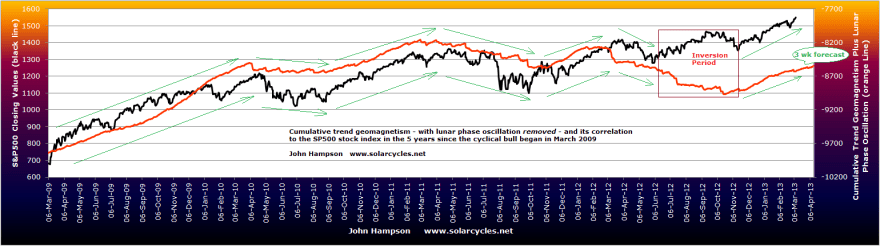

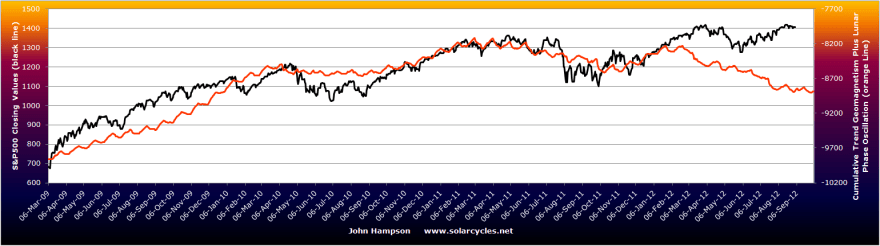

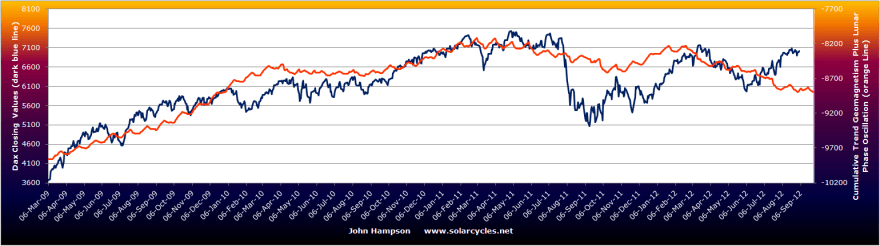

Ed Yardeni produced a chart showing the SP500 has diverged from its fundamentals since June this year. My geomagnetic-lunar model charts also show stocks going opposite ways since June (all models updated this morning).

Source: Yardeni

Source: Yardeni

Together that would ordinarily provide a good cross-reference for a short. However, speculation increases into the solar peak, and as per my Peak v Peak page, at the last solar peak we saw stocks break away from the geomagnetic model for some time before returning to it post solar peak. It is not something measurable, but I can point to each secular parabolic peak in stocks and commodities occurring close to the solar maximums as evidence that this occurs. I therefore look at the divergences in Yardeni’s and my own models and suggest this may be occurring.

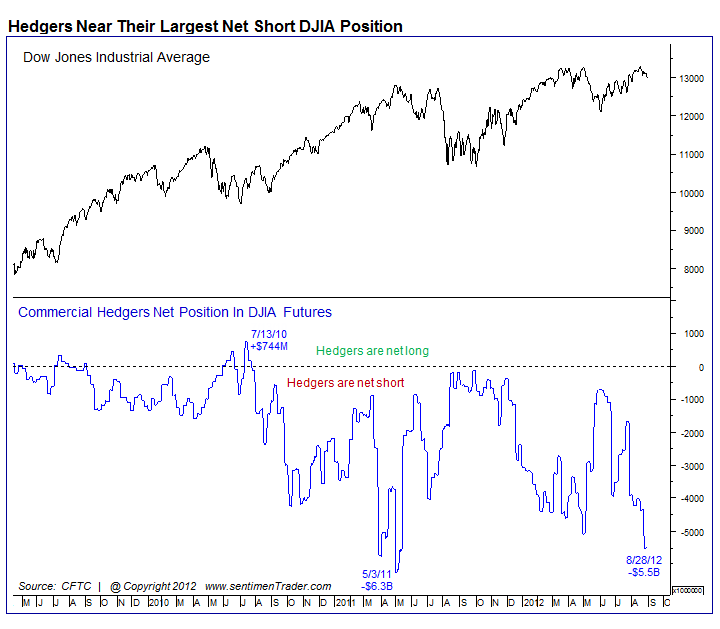

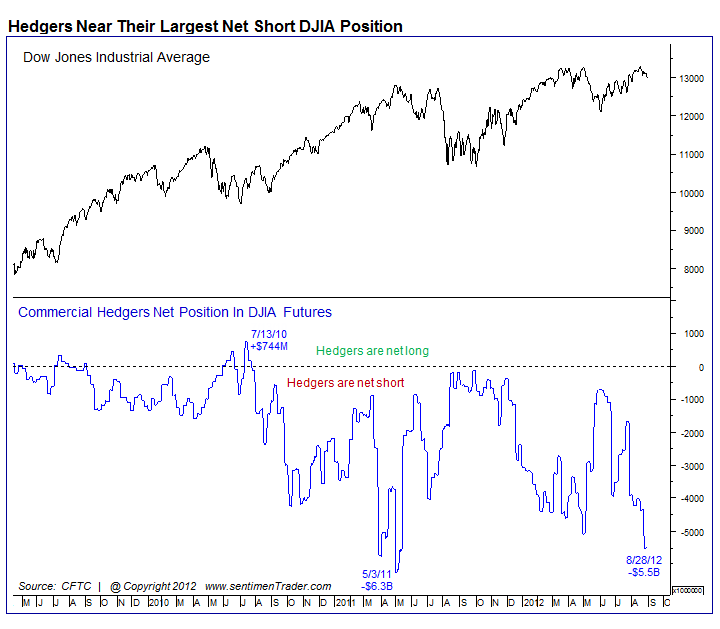

Sentimentrader have produced two new charts that add weight however to the bear case:

Source: Sentimentrader

Hopefully those two charts are self-explanatory. As per my last post though, Technical US Stock Indices, there is evidence supporting the bullish case too. And so we return to my opening comments about indicators pointing opposite ways.

Looking wider, we continue to see poor technical performance in emerging market stock indices. There is a significant divergence in European and US indices versus Asia and Latin America, reflecting the weak leading indicators in those regions. On the plus side, economic surprises for emerging markets continue to rise in an uptrend:

Source: Bloomberg

Source: Bloomberg

So are the economies of China and Korea and Japan (and Germany) to improve? If not, can US leading indicators really continue to trend upwards without being infected? All eyes on the next round of global leading indicators these next two weeks from OECD and Conference Board.

Euro debt accuteness remains contained and well off its highs of H1 2012, so for now that remains supportive for stocks. The US fiscal cliff looms at the end of 2012, and once the US election is out of the way, presidential seasonality is no longer supportive. The ruling party has the option to implement unpopular policies in the first two years. It may therefore choose fiscal policy which increases recession risk. I maintain the projection of global recession 2013-2014 as per solar/secular history, and this could be one factor, together with parabolic commodity prices and bond yields rising. China may also de-rail to provide a backdrop to a new secular commodities bear starting next year. The question remains whether China can remain strong enough to fulfil the commodities secular peak before that occurs.

In summary, I am looking for my exit point for stock indices longs (not commodities), as by time I believe this could occur any time as of now into early 2013. The technical picture is mixed and indicators are mixed, but US stock indices are within touching distance of a breakout to new highs. For now I am going to stay put, and await ECB and FOMC decisions this week and next, along with the latest global leading indicator data. Market tops are usually a process, so more evidence should build whilst stocks range trade, if this is to be a major top.

Crude has accelerated this last week with good momentum, but now encounters resistance. It does not have fundamental support from stockpiles, as they continue to be above seasonal average, but I suggest it is the global growth story that is the main reason for the advance.

Crude has accelerated this last week with good momentum, but now encounters resistance. It does not have fundamental support from stockpiles, as they continue to be above seasonal average, but I suggest it is the global growth story that is the main reason for the advance.