So it’s been range trading but with an upward bias for the markets into the coming weekend’s Greek elections. Greek stocks got a 10% pop yesterday on unofficial polls pointing to the pro-austerity party winning. Natural Gas also advanced over 10% – the two biggest dogs of recent times sharing a bumper day together.

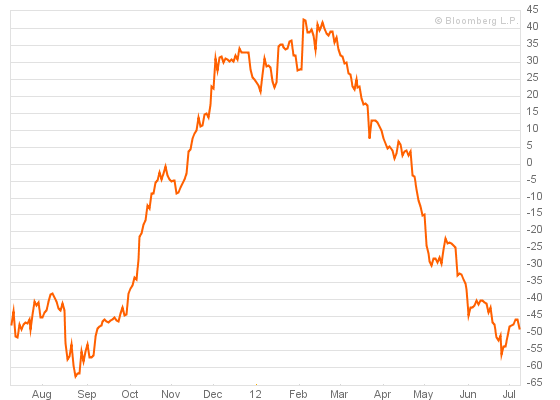

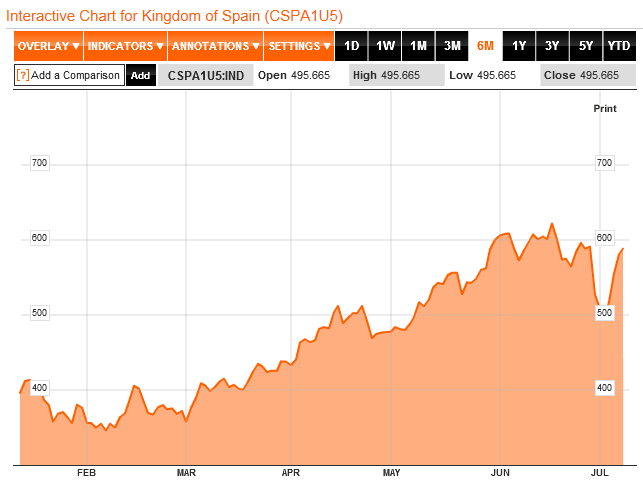

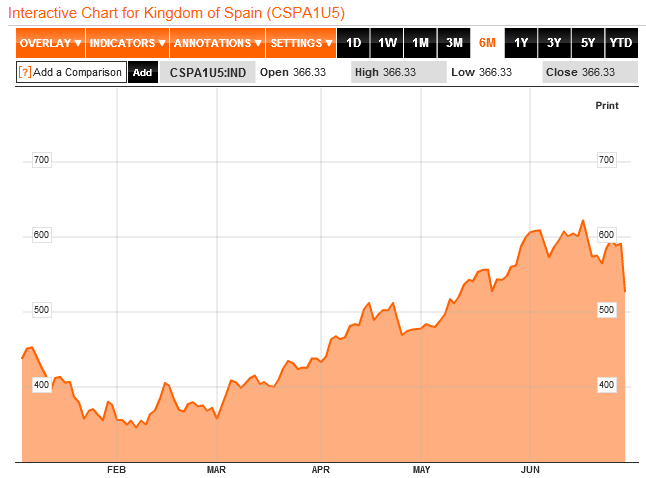

Economic Surprises continue in their downtrend. The latest leading indicator readings for the UK came in positive and Korea just slightly negative – the global picture continues to be mixed at best. Italy and Spain CDSs continue to flirt with records. The UK government announced measures to improve credit. Now we see what the FOMC delivers next Wednesday. I don’t expect QE, because the US economy is doing relatively OK and it would likely only serve to push up asset prices rather than boost the economy, but I do expect a Twist extension, or something similar, as letting Twist expire and doing nothing would amount to tightening. I expect they will downgrade their wording on the economy and recommit to doing more if things worsen.

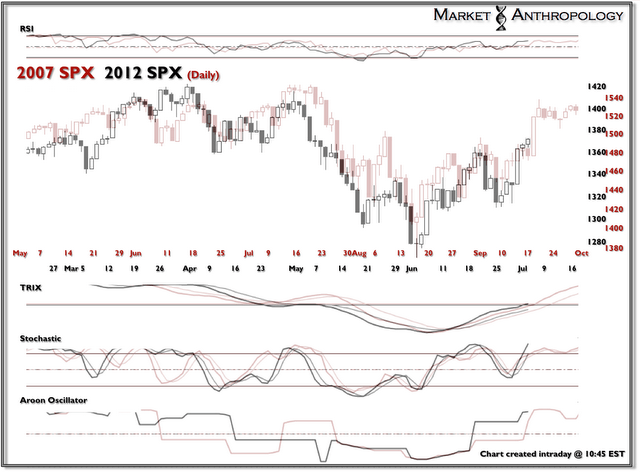

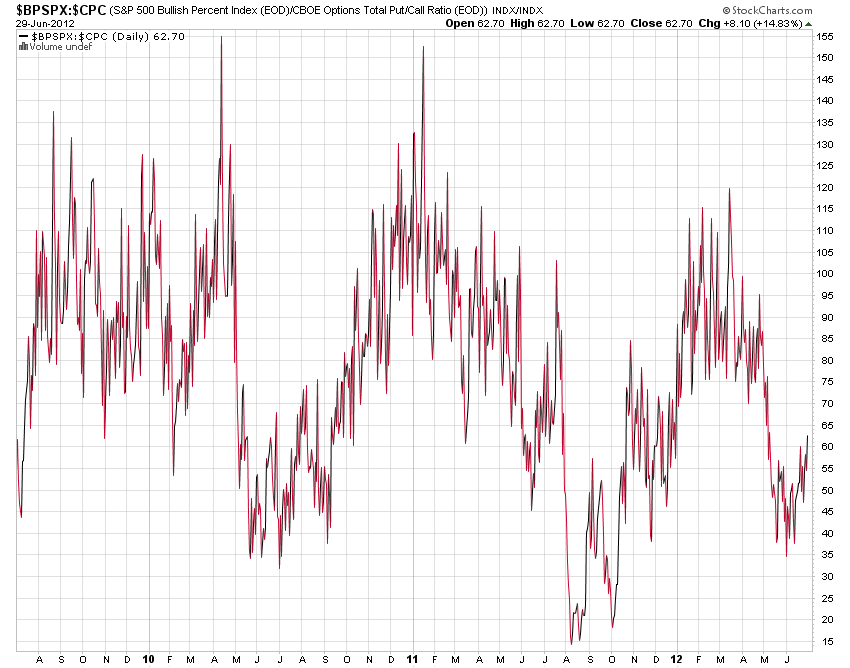

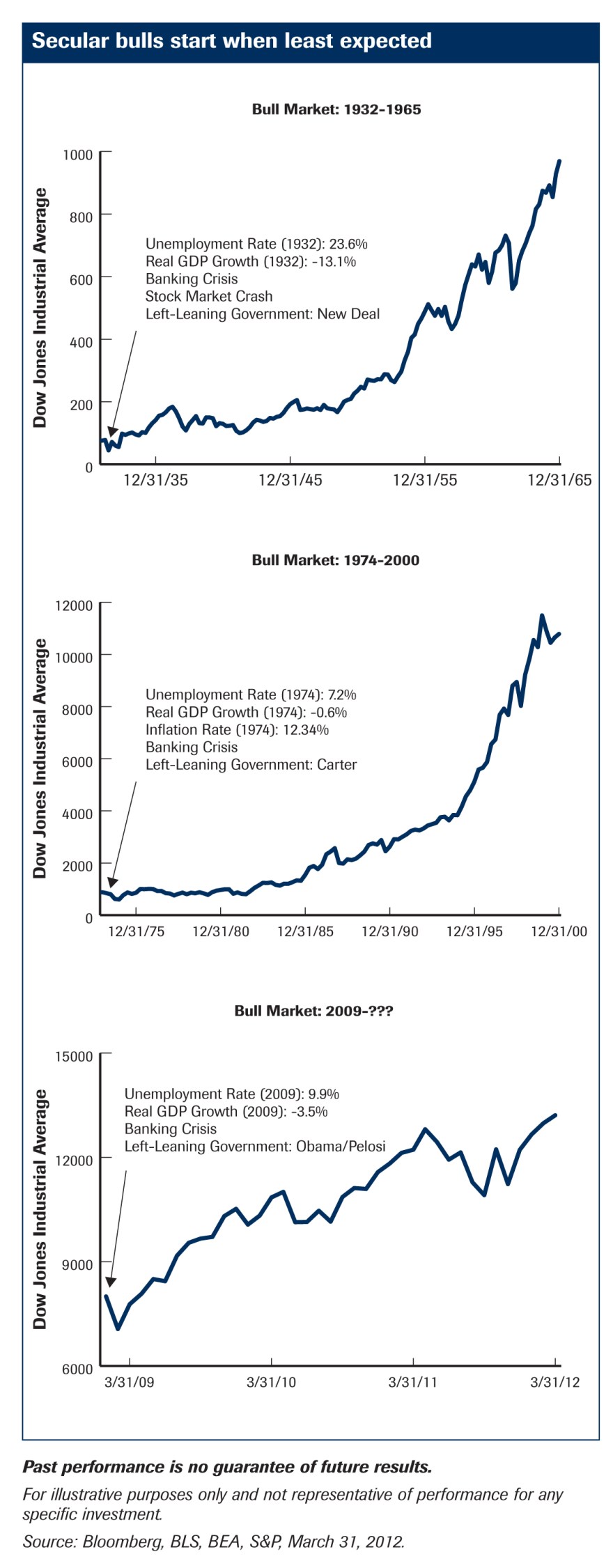

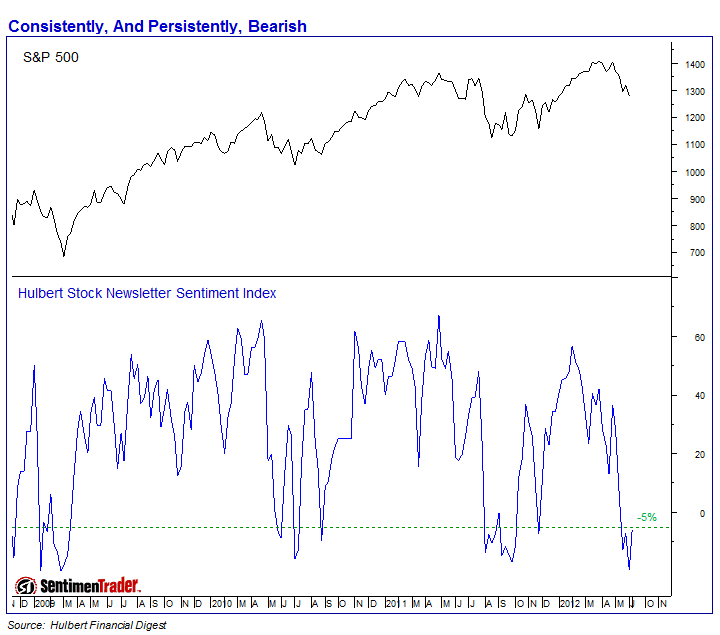

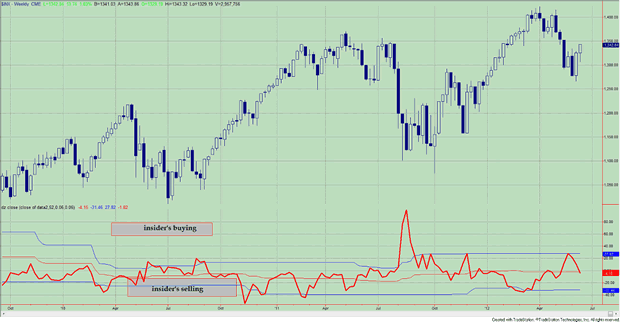

If the Greek pro-austerity party wins and the FOMC delivers something similar to my expectations, I expect that to be enough to rally pro-risk. Stocks, commodities and the Euro continue to display oversold/overbearish readings, so mean reversion remains the most likely. If something less pro-risk friendly occurs in the next week, and we see falls in pro-risk, then I expect the pro-risk rally just to be postponed a little. TSP Talk highlight some historic rhymes that reflect the two scenarios of rally-now or rally-later:

Source all: TSP Talk / Decision Point

Everyone can see the inverse Head and Shoulders on the stock indices currently, which by textbook would see us break up and rally significantly in the coming week, but a couple of historic rhymes also show that a drop and higher low could come to pass over the next few weeks before a rally.

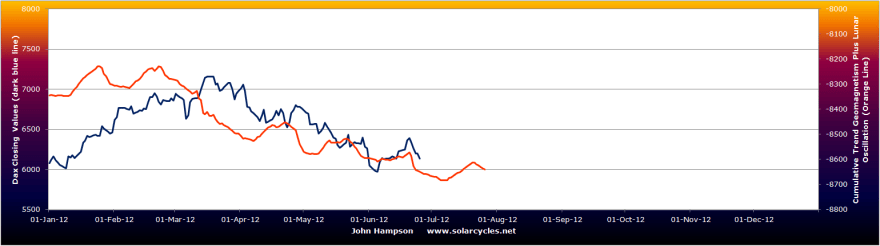

I have trimmed back my pro-risk positions very lightly today, taking profits on some of those that picked the bottom, but leaving the vast bulk in tact. The Greek elections and FOMC are uncertain. The new moon occurs Tuesday but geomagnetism is expected to lead into it. It feels a bit more of a lottery than usual, but nevertheless, I remain heavily long pro-risk expecting that we will see (i) a mean reversion rally away from oversold/overbearish (whether that has already begun or needs another low ahead first) and then (ii) a commodities secular bull rally conclusion from here into next year’s solar maximum together with an accompanying rally in stocks that ends before commodities make their final mania.

So how might my secular expectations from here come good?

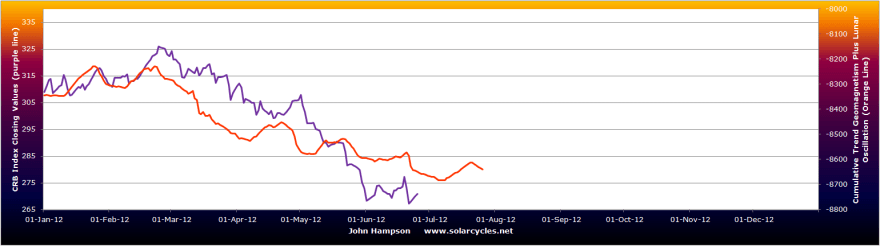

First, a natural pick up in growth and inflation, as per action into previous solar maxima. Speculation in commodities will be the key driver of the inflation side. Evidence of a pick up in leading indicators and economic surprises, particularly in the US and China, would confirm a pick up in growth and encourage that speculation into commodities, but as yet we don’t see that.

Second, co-ordinated global policy responses in easing and stimulating would also provide the push in growth and inflation. This process appears to be underway with recent intervention in China, Australia, UK and others. How quick and how comprehensive the global action is from here, remains to be seen. The European debt accuteness needs further action, as the Spanish bank programme failed to satisfy. Some kind of action by the Fed is expected, and most likely needed, to satisfy the markets.

I continue to expect we will see a combination of the natural pick up in growth (very supportive monetary and fiscal conditions worldwide, oil and commoditiy prices recently receding) together with a series of global policy reponses, so both elements, but for now this remains tentative.

Thirdly, a supply-side push on commodities. Into solar maxima we historically have seen war, protest and revolution. As sunspots rose in early 2011 we saw the Middle-East and African uprisings and UK protests. As sunspots are rising again currently we are seeing an increase in protests in Russia and fighting and protesting in Syria. Iran remains a potential flashpoint as a key supplier of oil. A perceived supply disruption would push oil prices and by association food prices. Again, this remains just potential for now, but there is also a possible supply-side push in food, without oil’s input. In the first half of 2010 we saw several months of global temperatures being at all-time records, whilst soft commodity prices remained fairly depressed. The result was a major rally in food prices in the second half of 2010 as those record temperatures devastated plantings and harvests. Here in 2012, food prices are again currently depressed, and although global temperatures weren’t extreme in January-March, in April we saw the second highest ever global temperatures for that month on land, and May’s stats, just released, reveal that May was the hottest May ever on land.

Source: NOAA

The result is current drought and excessive dryness in US, Argentina, Russia, Korea and Australia. If we see another couple of months of such extremes, I expect food prices to surge again in the second half of 2012. Recall that global stockpiles remain low, but record plantings depressed prices. If these plantings are decimated by dryness and drought, then the critical stockpiles come back into focus. Food and gold prices reveal a close correlation, so a push in food would likely be accompanied by a push in gold, as an inflation hedge.

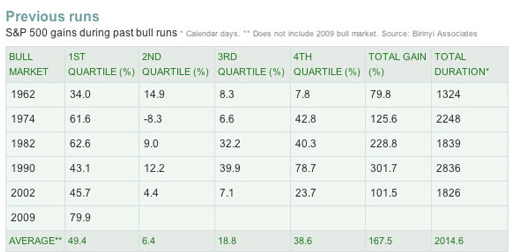

Fourth is the secular position for equities. Recall that my charts comparing historical secular stocks bears reveal that at this point stocks are unlikely to see much lower in nominal terms again, and that we should be looking upwards to stocks, not down. We should see a rally in stocks here, which is also supported by presidential cycle seasonality, but which ends before the commodities final mania ends. There is an interesting situation with European equities, whereby they have reached their secular bear valuation buy signals at this point.

This table is from Goldman Sachs taken in mid-May, showing the cyclically-adjusted P/E ratios for key countries:

Source: Goldman Sachs

Historically, a secular bear ends when CAPE reaches below 10. You buy at that point and are rewarded for the next 10 years with an average return of around 15-20%. Furthermore, very good buy opportunities have arisen when FYPE (forward earnings valuation) exceeds CAPE. As you can see, Spanish and Italian stocks are well below 10 and the FYPE exceeds the CAPE too.

For reference, the lowest CAPE historically that we have ever seen was 3, reached by both Thailand and Korea. Guess what? Greece has now beaten that with a CAPE of sub 2. So, with some confidence we can say that buying Greek, Spanish and Italian equities at this point is likely to pay off handsomely over the next 10 years, but clearly the risk is for more downside before the upside eurupts.

Here is the chart again showing that the p/e for Germany is back at the last secular lows.

Source: SG

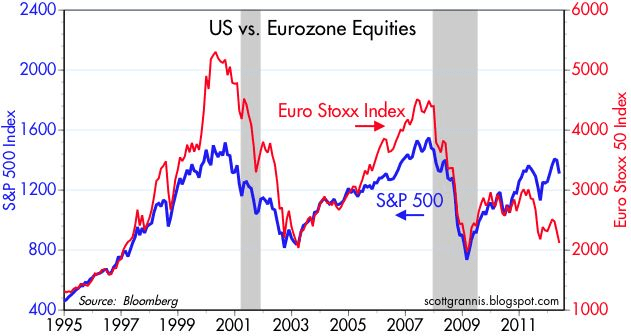

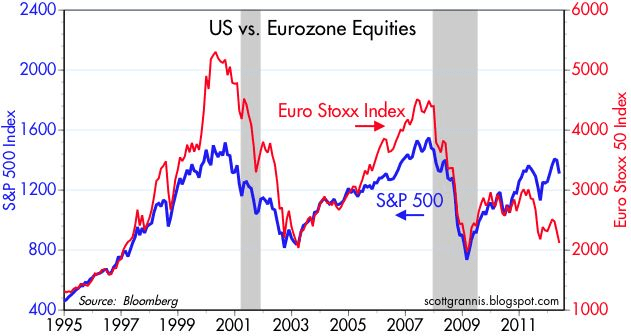

Here we can see the Eurostoxx index has made a third major low in this secular bear market. 3 major lows have defined historic secular bear markets, before a new secular bull erupts.

Source: Scott Grannis

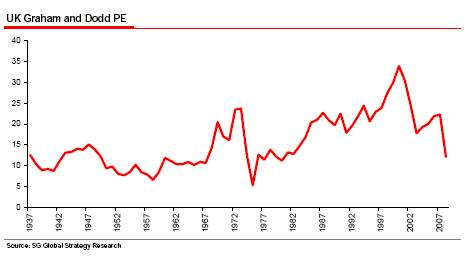

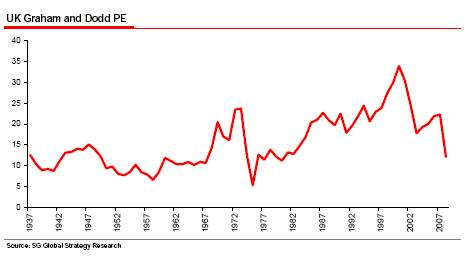

Here is the UK cyclically-adjusted P/E. It is also back to where it was at the similar point in the last secular bear (around 1979). I note that it made its nominal low in the middle of the last secular bear, which looks a little different to the equivalent US chart which made its p/e low at the end.

Source: SG

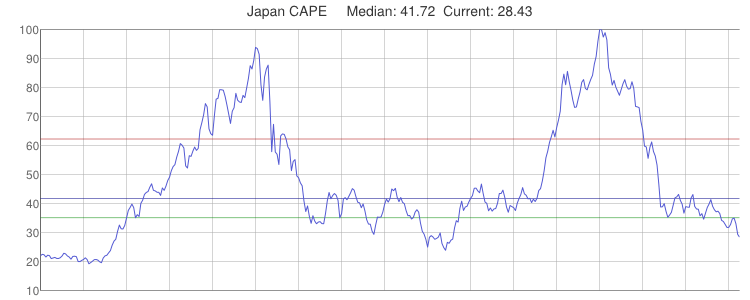

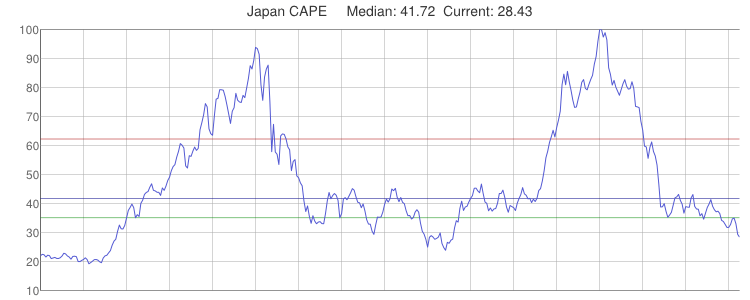

Of course not all stock indices around the globe will peform the same. Not all stock indices will end this secular bear market with CAPE under 10. Here is Japan’s chart:

Source: Vector Grader

In the last secular bear, Japan’s ending CAPE was around 20. This may be accounted for by it being a leading index then, going on to its amazing peak in 1989.

Is the US the leading index now? Could we have bottomed with the US at CAPE 20 and European stocks in single digits? Well I think not yet, but we are getting close. I believe some other major indices need to drop beneath CAPE 10, not just the PIIGS, but we can see the likes of the UK and Brazil are close. I believe that more comprehensive drop beneath CAPE 10 will occur with a bear and recession following next year’s commodities finale. But the likes of Spain and Italy are so cheap now that I wonder whether they may now go on to outperform, and not look back. It’s either that, or they go on to join that club of the cheapest CAPEs ever. Clearly we need some more enduring and satisfying policy responses in Europe to enable them to rally sustainably, but at the same time once we have those in place, European stocks are likely to be much higher.

In summary, I think the message is clear that we are reaching towards the end of the secular stocks bear in terms of valuations. I don’t believe we need to see US stocks halve in order to reach under CAPE 10, as we can see from the range of ending CAPEs in the last secular bear. I expect that once we see the likes of Germany, Brazil and China under CAPE 10 we are done, and I expect that point to come next year or the year after, in a cyclical bear following a commodities mania conclusion linked to 2013’s solar maximum.