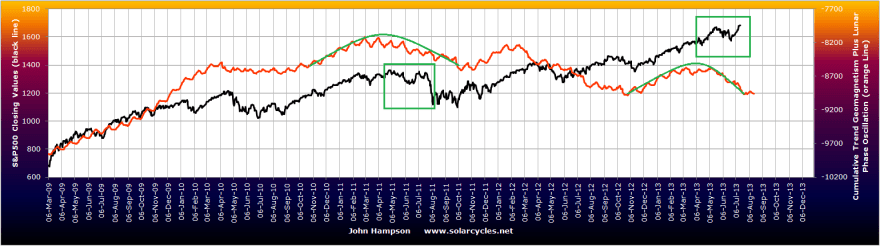

The SP500 followed the Russell 2000 and Nasdaq to new highs, on good breadth with healthy leading sectors. A marginal new high is normal in a topping process, but we would expect to see some kind of warning flags developing in terms of leading indicators if not in internals. We would also expect any new high to still be within an overall topping range, so not to run away too far. Here is one such topping model:

Source: Zevcapitalresearch

So might stocks get pulled back soon? Earnings reports are just getting going so too soon to assess beat rates, but earnings season usually produces a bullish or bearish theme. Geomagnetism continues to disturb and diverge from performance in some key stock markets. I have highlighted a historic rhyme below, which would be consistent with a topping process and then a fall in earnest in US equities:

I have updated all models on the site this morning.

ECRI leading indicators for the US have changed trend:

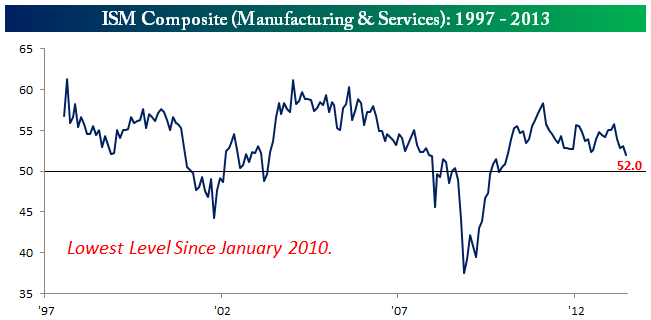

And the ISM manufacturing and services composite is also trending down:

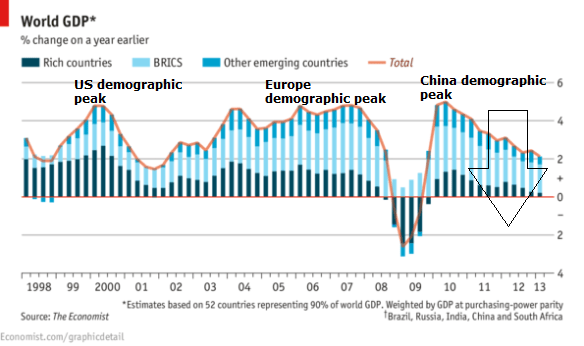

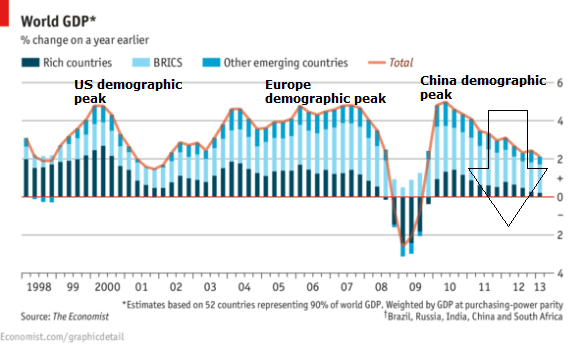

World GDP is also in a steadily weakening trend, which is in line with my expectations based on the confluence of negative demographic trends now in place between US, Europe and China. I have marked their respective demographic peaks to illustrate:

Because of the demographics, my primary expectation is that the economic data will indeed continue to weaken and in due course topple the stock market. The alternative would be that the collective efforts of central banks are sufficient to prop up the global economy to a sufficient degree to maintain the low-growth-low-rates environment which is positive for equities. So all eyes on the leading indicators.

The US stock market is now in the top 3 most expensive by CAPE globally. Again from my demographic work, high price-earnings valuations can go higher if demographic trends are positive. However, the US is in a period of negative demographic trend so the expensive valuation is an anomaly that should be corrected in due course.

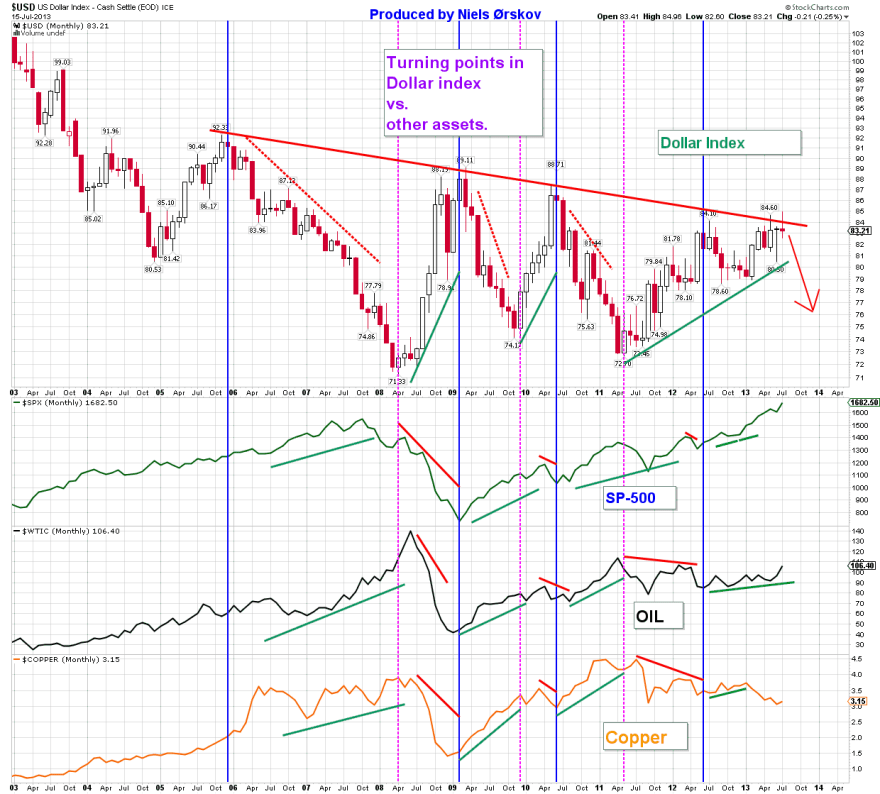

Crude oil has continued its upward trend and cemented its breakout. Gold and silver look to have carved out bottoms, though still tentative. The CCI commodities index has now been in a two week uptrend. So still early developments for commodities, but I maintain there is a greater likelihood of the historically typical process of commodities starting to outperform whilst equities make a multi-month topping process (with bonds already having topped), and eventually commodities topping last as they help tip the economy into recession. Another possible development in support of this would be if the US dollar broke down from its recent uptrend following Bernanke’s softer QE stance that came out last week. A chart by Niels here:

Source: Niels Orskov / Stockcharts

Source: Niels Orskov / Stockcharts

So as things stand, I maintain my overall expectation that stocks are in the first half of a multi-month topping process, with a marginal new high being carved out currently that should soon be turned back down. Commodities should outperform here forwards. Leading indicators should weaken sufficiently to prevent further advance in equities, but not too drastically to sink commodities. Moving into 2014 commodities should peak as they suck the remaining life out of the global economy, which is already vulnerable due to collective demographics of the major nations. Whether they can do this around the time of the solar maximum, as per history, remains to be seen, as the experts continue to diverge on forecasting when the solar maximum will be or was. The sunspot trend remains messy for now.

Trading-wise, if equities can rally a little higher here whilst we see a little more leading indicator or earnings degredation come to light, I will take off some more from the long side and add on the short side. Meanwhile I continue to sit on my ample commodities long positions.

Sorry but do not believe there is a top ;). We are in break out mood. QE is taking hold. Hyperinflation or new stock market bubble here we go… Soon all regular folks will be buying stocks again. =)

Or we collapse =). No way to know. Just use that horizontal line and trade. =). Interesting stuff as always though.

Lots of potential breadth and momentum divergences developing on the weekly SP-500 chart. eg. NH-NL, stocks above 50MA, stocks above 200MA, MACD, RSI.

CPI as PPI, similar to end 2007, not so higher this time, aheaded to a new recession>http://advisorperspectives.com/dshort/charts/inflation/headline-core-comps.html?CPI-headline-core-since-2000.gif

A top right now may be premature. I agree with John’s excellent solar cycle work, that a US recession/depression will follow the current solar peak. Just not for another 12-18 months. The EU economy/banks seem in worse shape than the US. If the EU/Germany make policy decisions this fall to scare more capital out of Europe, that capital will flow to the least ugly sister in the world, the US stock market. As Robert said when the small global investors are “all in”, that’s when we look for a top.

Economist Big Mac Index shows world capital slowly flowing into the dollar.

http://www.economist.com/content/big-mac-index?fsrc=scn/tw/te/dc/tr/bigmac

Great analysis as always. However, I am starting to struggle with the idea that commodities can outperform and go parabolic at a time when the BRICS are entering economic slowdown. Some economists say Chinese GDP could slow to well under 7% expansion soon. Russian GDP used to growth on average by 6-8% in the 2000s, now it’s slowed to 2% or so. There just doesn’t seem to be any spark to set off an inflationary parabola for commodities. 2008 and 2011 seem more like the double peak finale of the 2000s commodities supercycle.

Certainly is interesting for how long Stocks and Commodities will run separated tracks. But monthly presents the patterns they have had since 1995.

http://stockcharts.com/h-sc/ui?s=$SPX&p=M&b=5&g=0&id=p10885789118&a=251788917&r=1374058208206&cmd=print

Hi all,

I’m watching and waiting hence no new post. What looked like another blow to precious metals following Bernanke’s mid-week speech has been largely reversed yesterday and today, and what looked like a breakout in the Dow and Nikkei yesterday has been reversed overnight and could yet be a fakeout. But all still in the balance, so watching and waiting. Plus full moon coming Monday and end of lunar neg period next week so loosing the neg influence.

Pete, I agree a commodities parabolic based on economic demand looks highly improbable. But it could be speculative, with geopolitical driving oil and climate driving agri (jan-jun 6th hottest on record on land). Speculation, conflict and temperature peaks are all associated with solar peaks. I could buy the opposite idea of a deflationary drag on commodities coming to pass, but the recent break out in oil, possible bottoms in coffee and sugar, reversal in the USD all give the former greater credibility.

Thought you might be interested in this article John.

Thanks for all you do.

http://www.reuters.com/article/2013/07/19/derivatives-gold-idUSL1N0FP1CB20130719

Hi John

Thanks as always for your on -going constructive analysis , and other posters with their various links .

You ( and most other posters) will be familiar with the Martin Armstrong web site and ( in the bigger picture ) , his Economic Confidence Model .

His most recent post below refers :

http://armstrongeconomics.com/2013/07/19/ecm-872013-turning-point/

The model has a coming turning point on the 7th August 2013 , with a “softening” of markets into September 2014.Thereafter a significant surge into October 2015 before a more dramatic collapse .

In the near term , this could well correlate to your thoughts of a commodities “revival” whilst the general equities slide —before this again reverses.!!

Bernanke seems likely to want to leave the Fed Reserve in Jan 2014 , with a legacy of “steering the ship thru troubled waters “, but leaving his successor and the Fed Board to do more of the same and extending Qe3/Qe4 as necessary .This might fit with your thoughts , and Martin Armstrongs model .the Fed Board to do more of the same of extending QE3/ QE4 as is necessary .

So I could see the Fed “backing off” with intervention for a while ( hence allowing markets to take a breather ) , before turning up the after burners again (

I don’t think MA would concur Maplelegion.

A rise in commodities would require a a rise in inflationary expectations.

As you must know he is an avowed deflationist with capital inflows into the US keeping their $ high and gold not reaching a final low until 2015.

Also with China struggling and the consumer of 40% of hard commodities it is hard to see where the demand will come from to increase prices.

Regarding oil, record backwardation should give way to a large decline near term.

http://www.mcoscillator.com/learning_center/weekly_chart/

Yes, backwardation is like overbought, blowoff, extreme bullishness, etc. They can all last a long time ( and bankrupt you ) before the break occurs.

Bear in mind that Gold has been in backwardation too, and now the price is more than 30% below its 2011 peak. If this Oil backwardation leads to a fall in prices, expect Russia to enter a recession. Stagnant revenues from a stable Oil price have done enough damage, by slowing Russia’s economy way below its trend growth rate.

I found an article which talks about China’s economy risking deflation in the coming years. Some economists are even seriously considering whether China will see it’s economy actually shrink at some point. The Chinese hard landing might not be so improbable. In this article I’ve linked, note how Japan and Lost Decade are now terms being associated with China. Watch this space.

http://www.telegraph.co.uk/finance/china-business/10191759/China-risks-deflation-trap-as-true-GDP-crumbles.html

Dear John and Friends,

I’m probably coming “a bit late to the party”, not having followed all the discussion going on here incessantly! Hope I’m not “re-inventing the wheel”!

But I like to go back to the “basics”, therefore I have studied Philosophy as well as Economics and Politics.

Doesn’t the “Commodities Bubble” controversy boil down to the question of whether GOLD is a commodity or “real money”–or perhaps actually both.

A commodity is something you need for use, and generally “use” is different for different people, depending on their activities. But, of course, there are some commodities which everybody needs, like air and water.

Food stuffs or oil, for instance, are not like that because there are always alternatives: If you can’t find (or afford) one kind of food stuff, like meat, you take another. The Chinese, for instance, can live on rice alone, it seems (my experience). If you can’t afford oil for cooking you take wood; if you can’t afford a car, you take a bicycle, etc.

But air and water you can’t replace.

Gold (and Silver) seem in the ultimate crisis situation to me a little like air and water: They are irreplaceable because of transportability (not like e.g. land, works of art), universal acceptance (not like e.g. credit cards or (fiat) money or even diamonds), stability (not like e.g. water, air, paper money or bank accounts), hideability (e.g. against theft, confiscation or taxation).

And they can be readily exchanged for any other commodity. You can even “buy” air or water with them by e.g. moving to a different location, which generally costs “money”.

Therefore THEY are the “real money” and the ultimate “commodity”, especially in a crisis situation like today–NO MATTER WHETHER IT IS “RECESSIVE” or “INFLATORY”!

Therefore, as long as there is no reasonable incentive (“return” or “interest”) for people to accept “fiat money” over Gold or Silver and no punishment (taxation or penalty) against it, they will prefer Gold or Silver as a storage place for their readily transportable and transferable wealth.

Thus if interest rates are artificially held low and a crisis situation is at hand or even only expected, there is no doubt that the “price” of Gold and Silver will rise, no matter what the other commodities do. — In an atmosphere where even (especially!) the governments are explicitly exploiting their own citizens in the name of “law and order”!

Of course, the more (fiat) money that is printed, the more will flow into all “hard” investments. And what is “harder” than Gold or Silver? The “price” of them in fiat money is simply a correlative of the trust people have in the stability of fiat money and NOT vice versa. So only “speculators” (like us!) are interested in the “price” of Gold! For people who “need” it (the security etc. it affords), a rise in “price” is only a reconfirmation of its INHERENT value.

But that is not a normal “Bubble” (a bubble “bursts”!), and that is why the price of Gold and Silver are always in a long-term “uptrend”!

By the way, my new Blog is now open. At the moment mainly Gold and Silver investments are interesting:

http://blog.100-percent-stockmarket-winners.com .

Thanks,

locan.BBS

(Dr. phil. Lorenz Funderburk)

Can you please go spam somewhere else. Reason this blog has been great is because of lack of it.

Previously low Solar activity in late 1920’ies and late 1960’ies was followed by decline in stocks. Grey line(from 1960 and forward) is inflation adjusted and it makes the adjustment more significant.

The problem always is: how confident can we be in something that has been observed only a couple of times?

A while back I saw an article pointing out that since 2009 the S&P 500 has had over 90% correlation with…. the price of beer in Iceland.

That shows how careful we have to be with correlations found in small data sets.

The second problem is, how to trade that information? When the solar cycle peaked in 1928, the market first doubled before it went down.

John et. al, been mentioned before, but we need to watch out for this. Stock market may not have sank after June 22, but professionals have been selling while retail mom and pop investors have been scooping up. I don’t think the status quo of indicies is reflective of the direction things are headed right now. I’m out completely.

http://www.zerohedge.com/news/2013-07-24/real-great-rotation

Hi wxguru,

True, the retail investors have been buying stocks this year, but it is still nowhere near the amount of selling they have been doing since mid-2008. See this chart: http://2.bp.blogspot.com/-i2yu8AMfov4/UezQJYsvu1I/AAAAAAAARGE/v1z1crX2xDU/s1280/Global+Equity+Fund+Flows.png

In fact, it will take a lot more retail buying just to compensate for the selling they have done in 2011 and 2012.

After a regular bear market it generally takes about 4 years for small investors to come back. But after a +50% decline it typically takes up to 8 years for small investors to overcome the trauma.

Danny

2008 + 8 = 2016 – makes sense, so mom and pop are cloaked shorts? I dunno. Zero hedge had a good point today about another index showing what I have thought all along – depression ongoing. Don’t think we need to wait until 2014.75.

Just as a reminder to all GDP formula changing soon, so it’ll be more b.s. like CPI.

The mom and pop investors are not the kind of investors that go short. They simply sold some of their stocks mutual funds in 2008 and in 2011-2012 and moved the money into bond funds.

These investors will not come back to stocks until they feel good about the economy. And that’s not the case, see: http://wallstcheatsheet.com/stocks/do-americans-believe-in-the-economic-recovery.html/?a=viewall

Do we really think that mom and pop investors are already back in the stocks market when they feel so bad about the economy? Mom and pop investors are not contrarians.

On a scale of 1 to 10, most pessimistic to most optimistic, I think the small investors are currently at 3.

That’s why we see skeptical and cynical tones everywhere, never mind massive street protests. The old adage to buy “blood in the streets” applies here.

Hi all, I am on a trip so limited access. I updated all the models late on Tuesday.

Hi wxguru,

I am with you, have been mostly in cash for months anticipating a significant top and then bottom (based on 17.6 year stock market cycle). Top in here IMHO and awaiting the fall into Sept/Oct. Cyclical bull runs last approx 4.4 years.

Thanks for the link showing distribution from institutions to retail, the set up is perfect.

Hi Danny – retail need to keep getting its fingers burnt by stocks until they won’t touch them with a barge pole, we need stocks to be as hated as gold/miners are right now i.e. we need some value before we start a new 17.6 year bull market.

Regards,

Kerry

Hi Kerry. Everything is possible. But I think we already reached that “don’t touch stocks with a pole” point four years ago. If we look at the comments on the article that wxguru cites or at the comments on any yahoo article that spells doom for the market, then there is almost universal agreement with it. There is cheers, exactly the opposite of what is typically seen when all “mom and pop” investors are on board. That’s also the reason why this year is being described as one of the most hated rallies.

I still remember the kind of comments you would see in 2001 when an article was making the case that beloved Cisco or Microsoft had further to fall.

I think gold stocks, even after their recent fall, are still getting more love than the overall stock market does right now. Look at the comments in articles about gold stocks. Many readers will disagree that it has further to fall. That’s not the picture of gold being very hated by the public.

John,be good in your updates to also follow this chart more? Y of Y seems July is slowest for ‘orders’. But a good chart nevertheless.

http://www.zerohedge.com/news/2013-07-25/about-us-recession

China slowdown imported from other economies yet not see much in press link the two?

Great posts wxguru, many thanks.

In a similar vein the latest McClellan weekly update may be of interest:

http://www.mcoscillator.com/learning_center/weekly_chart/is_shrinking_arctic_ice_a_bad_thing/

On a slightly different tack the chaps at the Fleet Street Letter note that both the one and the three month GOFOs (Gold Forward Offered Rate) turned negative a short while ago. Doesn’t often happen and is apparently indicative of a shortage of the physical; hence the implication as John notes of a bottoming process. Apologies if this is old hat.

Hope the move went well John,

Many thanks once again

Rufus

wxguru, the change to measuring US GDP, taking place on 31st July, extends to data all the way back to 1929 and takes research and development into account. Is it really a bad thing for statistics offices to update how they measure the economy, taking more modern engines of GDP growth into account? It’ll mean they can include what were called intangibles, which do generate income. Things like music, films, books, anything which generates some form of economic activity.

Onto other stuff: latest leading indicators, such as non-financial money supply indicate Europe will exit recession by year’s end. UK economy expands 0.6% in Q2. BoE head Mark Carney set to use forward guidance in all BoE inflation reports from August onwards. Means BoE might set a target rate of unemployment which, when reached, will lead to a rise in interest rates, just as the Fed intends in the US.

I do not think it will be a bad thing. I just see the markets becoming more reactive in a surprising way for the short term as algorithms react to the change. Perception by folks of the type of growth in GDP will take awhile to adjust as will policies by governing bodies.

Wanted to share this:

Full Moon ‘disturbs a good night’s sleep’

http://www.bbc.co.uk/news/health-23405941

@Pete – Exit recession by formal definition, then dip right back in. Sorry couldn’t resist.

Trip ends tomorrow. Normal service will resume later this week.

You were missed, John – hope all is well.