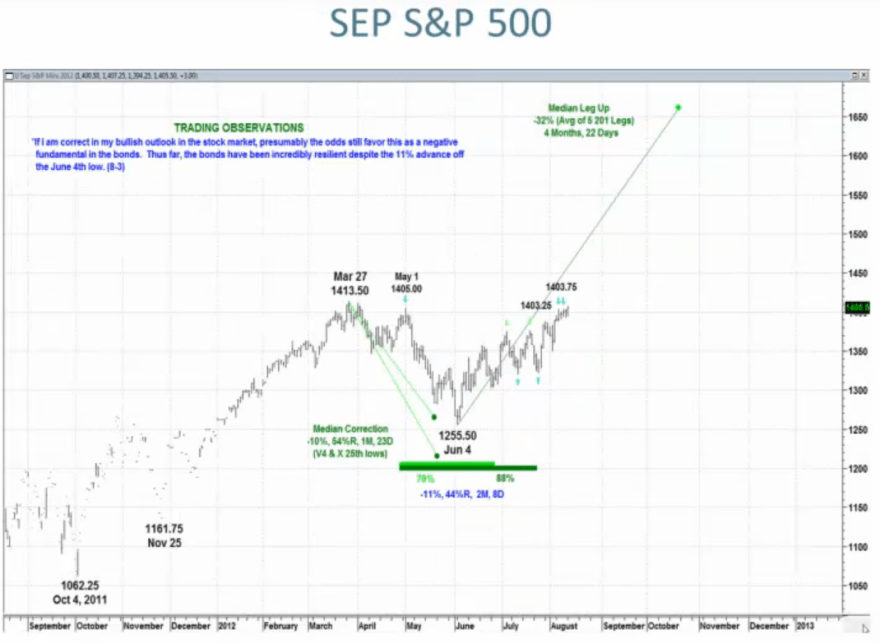

These are Gann Global’s projections using Gann methodology (mirrors in time, historical rhymes). Stocks to melt up into October 2012:

Commodities to make a parabolic move to new highs into late 2013:

Gold to climb back to its previous highs by this September / October:

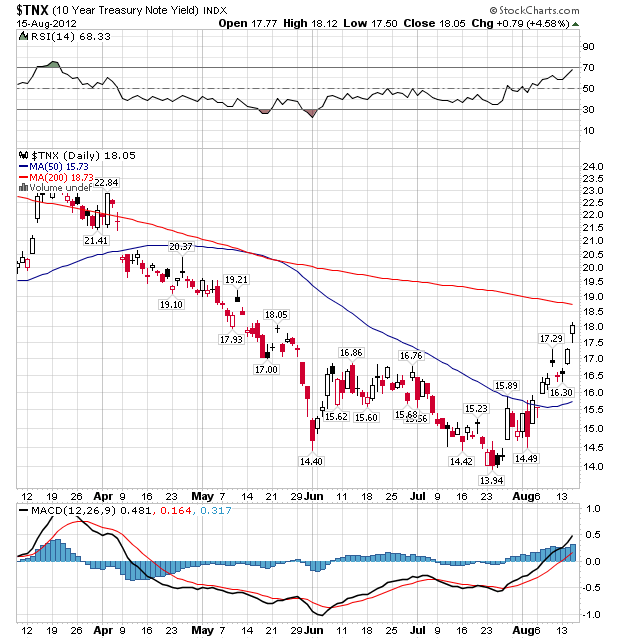

They also forecast that grains will now make a consolidation and retreat a little before advancing again to new highs, plus that treasuries have begun a new sustaining declining trend. This week’s action in treasuries and yields has the hallmarks of a significant trend change, but let’s not forget the Fed continue to tinker with this market.

Source: Stockcharts

In short, Gann Global are largely in agreement with my own predictions, and the other analysts that I read and respect are generally also more with than against. Marc Faber predicts that stocks may run up here to 1450-1500 before turning in the Fall/Autumn. Chris Ciovacco believes stocks are technically bullish and highlights the risk of a melt up. The Puplava brothers at PFS point to the rotation into pro-risk sectors, the lack of recession evidence, the intermediate term indicators for precious metals and the pick up in economic surprises as supportive for another pro-risk rally. Scott Grannis suggests the divergence between stocks and treasury yields is now being resolved in favour of stocks, and that the key risk is that we see better economic outcomes ahead than priced into treasuries. Tiho’s continued bearishness aside, I largely have those that I respect in tune with my own forecasts, and clearly I don’t consider that a contrarian alignment.

There are several crunch points in the remainder of August which will help determine overall momentum pro-risk or pro-safety. The resolution of the large multi-month triangle on gold. ECB intervention and/or Fed announcement of action at the Jackson Hole meeting 31 August. Whether the Euro can base here above 1.20, and by association pull the US dollar back. Whether leading indicators can pick up and fill in the missing macro support for pro-risk, and in particular whether China can either pick up or deliver stimulus, reflected in the key resistance tests shown below for Hong Kong and China stocks.

Source: Chris Kimble

In the very short term I remain as per my last post – holding my positions until the end of this week, into the new moon. At the time of writing stocks have made little movement since my last post. Chris Puplava highlights today’s Philly Fed news as a likely mover, expected to the upside. Rob Hanna’s study suggests that these last few days of tight range historically resolve to the upside. I personally believe that with the Nasdaq, Apple, SP500 and Dow all within touching distance of their previous 2012 highs, they will go tag those highs. If that were to occur, then we would be looking at the bears’ last stand. However, there is a weekly Demark sell signal on the SP500 and with lunar down pressure erupting as of next week, I am open to the possibility that stocks may consolidate before attacking those highs. But let’s see the action today and tomorrow. As before, I will notify if I take some profits.

I figure you may be interested in a list of all my current open positions:

Long FTSE

Long Dax

Long Hang Seng

Long Nikkei

Long Nasdaq

Long SP500

Long Market Vectors Gold Miners ETF

Long Gold

Long Silver

Long Crude Oil

Long Natural Gas

Long ETC Agriculture (general soft commodities ETF)

Long ETC Wheat

Long Chicago Wheat

Long Coffee Arabica

Long London Cocoa

Long New York Cocoa

Long NY Cotton

Long NY Orange Juice

Long Oats

Long Ultrashort 20+ Yr Treasury Bond ETF (i.e. short treasuries)

In a nutshell, I have significant long positions in precious metals, energy and agricultural commodities, as well as global stock indices. I have a smaller position in short treasuries. I expect to peel out of stock indices first, expecting them to top in late 2012 / the turn of 2013, and then to peel out of commodities into a parabolic finale into mid 2013. I expect to hold short treasuries for the longer term.

Precious metals are the key laggard in my account currently, but I expect them to eventually become the best performer, looking out into 2013.

Natural Gas was for a long time the dog of the account, and my aggregate position is still under water, but in 2012, having exhausted buyer interest, it finally turned as it reached historic extreme cheapness versus oil and the stocks of gas started to come back towards historical averages (second chart below):

Source: Trading Charts

Source: EIA

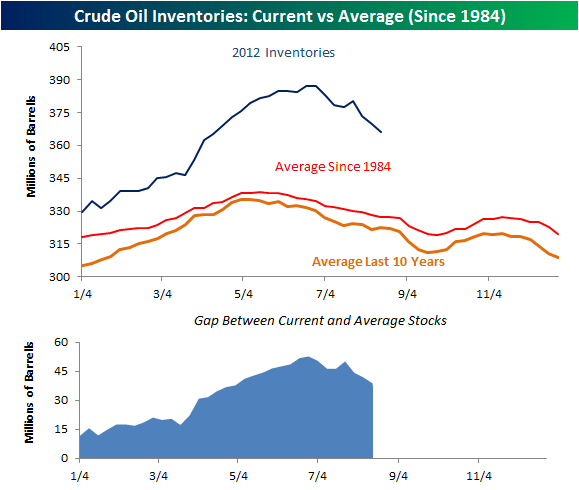

Crude oil inventories have also begun to move back towards the historical average range and together with the shortage in emergency supplies this has given oil a rewnewed thrust in recent sessions:

Source: Bespoke

And lastly, the climate stats for July have been released and show global temperatures for July on land coming in at the 3rd hottest July since records began, and the hottest in the Northern Hemisphere since records began, continuing to support soft commodity prices:

Source: NOAA

This is a great update John. I have really enjoyed reading it. I also consider humbled to be mentioned, as I do not think I am wordy like so many other market professionals up there. I merely run a small blog.

I would just like to state that my biggest position in the portfolio is long Silver and minor long Agriculture, but you are right regarding the negativity towards the stock market, as I hold mild shorts there to hedge myself (only cyclical overbought sectors like Tech and Discretionary). I also have a small Transports short as there is a major divergence in the Dow Theory.

So overall, I do expect a slowdown globally, but I am neutralised with my NAV, as I still believe in the commodity bull market blow off top to come sometime down the track. And my NAV is also lagging as stocks hang onto gains for the time being and PMs remain dead quite for now.

Finally, I see you are heavily long sided yourself, with risk on basis and shorting safe haven assets like Treasuries – rightfully so as bonds are a major bubble (just the question is if this is THE top). Therefore, I want to wish you the best of luck with your account and hope you make a fortune. I really mean that!

Good luck.

Thanks

John, do you follow some of the important ratios between asset classes like the CRB Index / 30Yr Bond or S&P / 30Yr Bond. There seems to be some good relative strength behind commodities as the CRB/Bond ratio has pushed up above a downward trendline (could pullback for a retest as support). The S&P ratio is also heading towards a key ratio resistance with bonds and it’ll be interesting to see if it can break it. I’m also keeping an eye on the Chinese SSE Comp as 2050 could be an important imo.

If there is an exodus out of bonds and into other asset classes there could be one big move ahead according to Martin Armstrong….when will it be though…..

Thanks for those pointers – I do follow some long term key asset ratios.

Hi John

Do you have stops on all your positions?

regards

bobc

No stops, they’re not for me. That’s not to say I wouldn’t ever cut a loss, but I don’t consider the markets so black and white. I trade the medium term using long term anchors and looking to the short term for clues. If the short term starts to cast doubt on my longer term outlook I would adjust my overall aggregate position accordingly. So for me it’s constantly about shaping my overall aggregate position. Currently though I am attacking what I believe to be a commodities secular conclusion into next year. I am therefore more long exposed than usual, anticipating a kind of once-in-a-decade opportunity, and playing for it.

on February 29, … to see the decrease in the level of 1790 geçmiştik

I have seen the level of 1526 on May 16, …

Try on these two price aralıgı …

Generally experienced decline and 50% to 62.5% yükseliin% 37.5 levels would be a rotation.

Bottom level ensues usually continues to decline geçilmezse this level 62.5% is attempted.

50% of the 37.5% under seviyemiz 1598-1625-1691 is 62.5%.

Currently 1625 working …

Levels of Ascension 1658-1691 … light.

If this is going to be Gold if the Ascension of levels … people ears off 2000

I have seen the level of 144 days after date of 29 February and we have this level of the ascension in 1563.

1663 makes a rating between 1626 and with a boga market considering that …

125% 150% up to 200% 1642-1658-seviyemiz 1689 stop …

SPX 1650 by October? really?

So says Gann method. Strikes me as a little too high, but I subscribe to an overthrow in the final stage of the cyclical bull as has historically occurred. Laslo Birinyi forecasts termination at SPX 2100 in H2 2013 – too high and too late in my view. Barry Bannister 1600 the by end of 2012 – that’s more like it in my view. But both going for a melt-up overthrow. To me there is a clear route to a melt up – 1. stock indices break above their March highs into clear air whilst 2. leading indicators pick up.

Hi John, When did you go long on these assets? Like June 1st or before or after?

Between 9 May and 18 May 2012 I was buying up oil, PMs, miners, agri, stock indices and shorting treasuries, and captured all that on this blog. However, this was in addition to existing positions and I was last on the attack in the Aug-Sept 2011 window on the long side in stocks and commodities on my previous blog Amalgamator. I peeled out of a lot of those stocks longs in Q1 2012 but I have kept a core commodities long position as the secular bull has progressed.

Just wondering, how does this correlate with your Commodity bearmarket in your timeline ??

Commodities to make their secular peak next year and then enter a new secular bear market (secular bear markets being overall sideways).

Excellent trading. John. Well done!

My interpretation of “SPY:TLT” says we are in Impulse wave 3 so I suspect a good trader like you will sit tight on your positions for a bit longer, especially TBT.

Thanks Edwin

Hi John, I love reading your posts and I’m a bit late onto this one due to a holiday this month. Do you subscribe to the possibility of some market weakness now that the new moon is behind us ans we head towards the full moon at the end of August – 29th Aug I believe. I would imagine some selling this week into the full moon with an opportunity for longs in the next 7-10 days pehaps? This has been one grind up so far but I’d anticipate a slight reset before we melt up into the US elections.

Great work…… keep it up!

Thanks Jonathan, I’ll cover that in today’s post.

John… sorry, I have another question for you. You tend to hold DAX positions rather than FTSE positions. Is their any reason for this? Is this down to the over-heavy financials/oil in the FTSE or do you simply have another reason for preferring the German index? Cheers, Jon

Largely due to the FTSE being fairly international and commodities heavy whilst the Dax is more a pure play on the German powerhouse.

John (Eggbeangame) Hope your keeping well.

If you could only hold two postions over the coming 6-12months what would you put you chips on?

Just interested where you see the best risk/reward on your secular coms conclusion.

Hi TC! Just two, and assuming you wouldn’t allow a broad commodities ETF, I’d choose silver and cocoa. Silver and gold wouldn’t be diversified enough in this mini portfolio, and I expect silver to leverage gold into the climax. Cocoa as a soft pick that’s about 80% below its 1970s inflation adjusted peak.

What a great question and a great answer. I am big fan of Silver and Agricultural commodities right now. With a run up in grains, right now I’d chose Softs too.