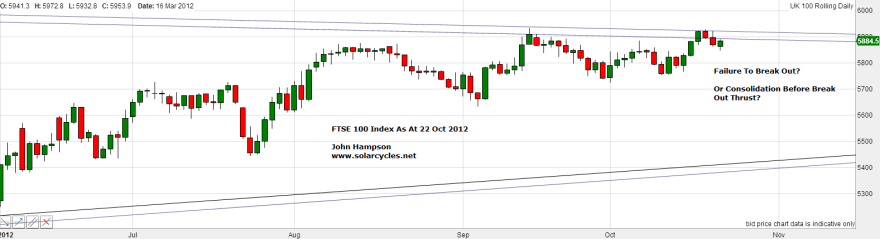

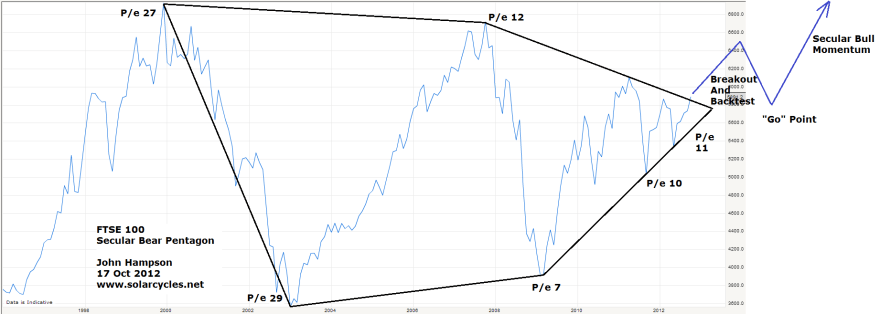

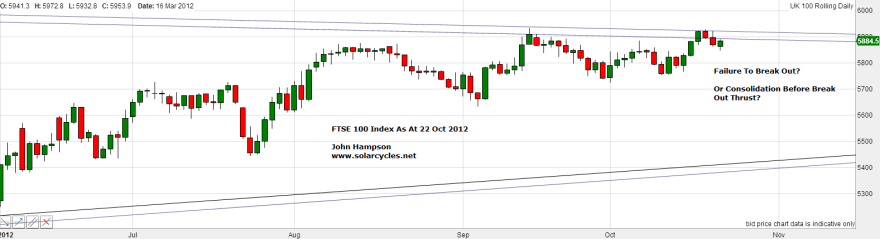

This is how some of the key stock indices currently stand. The FTSE 100 is trying to break out of a long term triangle.

On the nearer term view, however, it has been turned away at declining resistance. The question is whether this is a fifth failure since the cyclical bull began in 2009, or whether it is consolidating before it finally breaks through.

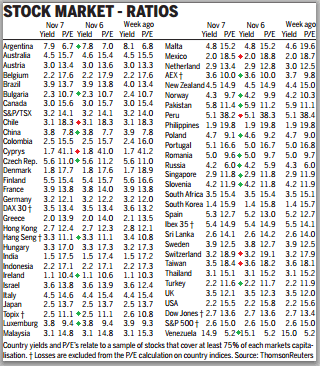

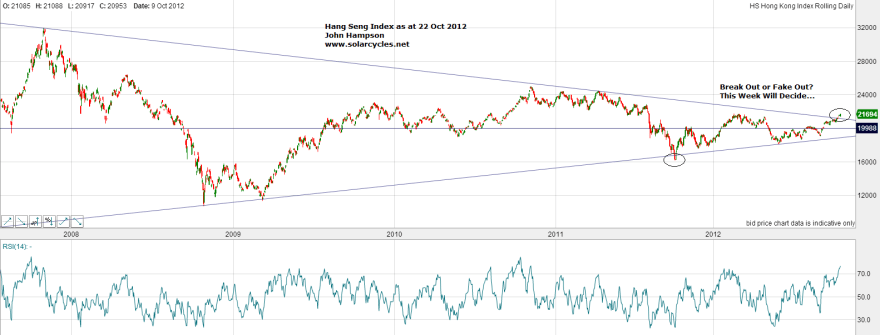

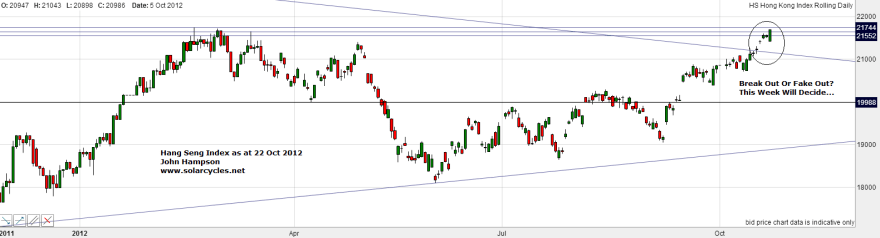

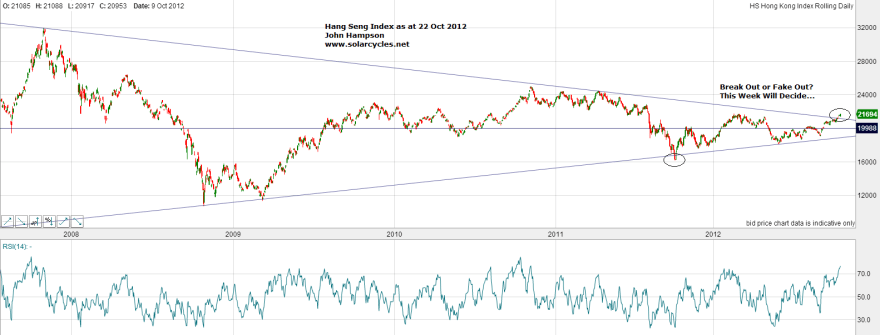

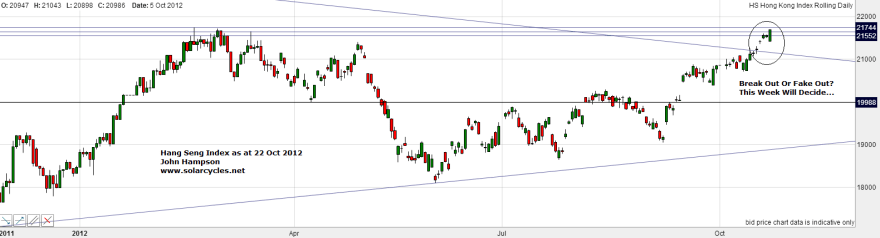

The Hang Seng, meanwhile, has now broken out of its similar long term triangle, and it is breaking out on a p/e of 11, which is historically relatively cheap. Unless it is pulled back in this week then that break would be validated.

On the nearer term view, it can be seen that it is now up against another resistance level: the March 2012 highs. So if it is to be pulled back into that long term triangle range, then here is a level to be repelled at. Two things to keep an eye on therefore.

The German Dax is also into a zone of importance. Below is the horizontal support of the March 2012 highs which it appears to have successfully backtested, whilst above is the cyclical bull high-to-date resistance (from 2011) around 7500. It additionally has the support of a rising channel to potentially take the index up to that resistance level. A break of either support would turn things more bearish.

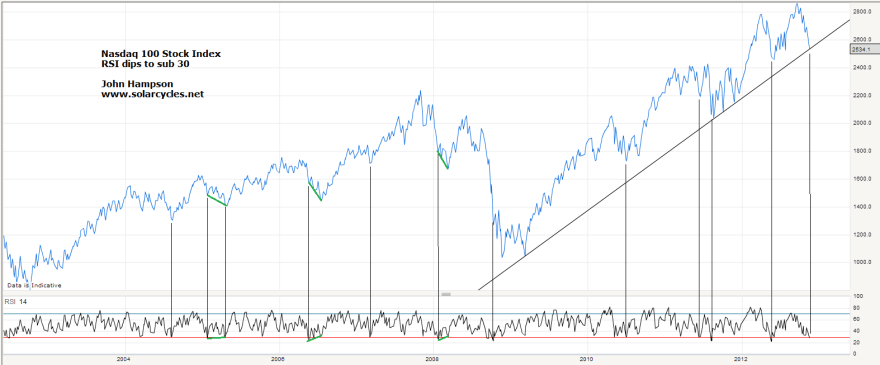

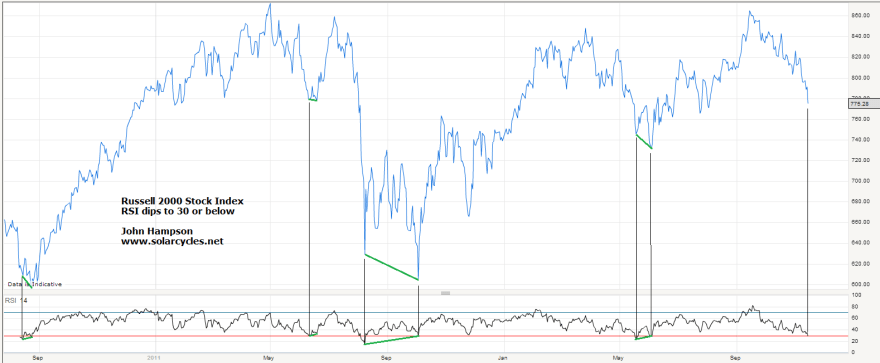

Meanwhile, the Nasdaq in the US is in a different place. Unlike the indices above, the Nasdaq reached far above its 2011 highs already, early in 2012. It since then rose above those 2012 highs (in March) to higher highs (in September) but has failed to hold above. The chart below shows that this could be meaningful.

The near term action since September has produced a little series of lower highs and lower lows, which suggests a new bearish trend. On the flip side, the index is nearing oversold, approaching RSI 30.

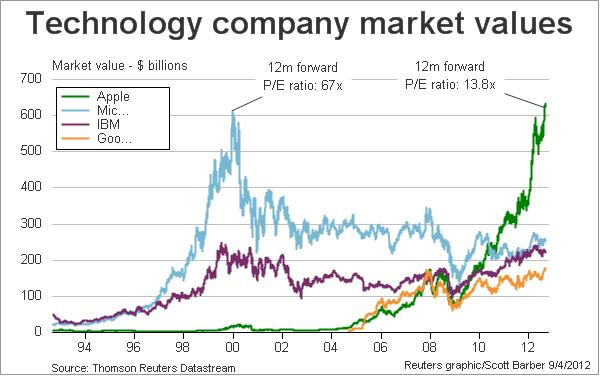

Clearly the Nasdaq has some way to fall before dropping out of the bottom of its cyclical bull channel and officially into a new bear market, but we should not need to wait for that to be able to judge whether the cyclical bull has topped out. One topping signal would be a major distribution day near the top, and we saw that on Friday. Another would be that cyclical stocks such as Techs break down first and money roates into defensive stocks. Techs are the weakest sector currently. US earnings are now overall flat year-on-year, which actually beats expectations (which were for shrinkage), but tech stock reports particularly have disappointed.

So the question is, are we seeing the first part of a topping process, with techs leading us down first, or are we just seeing some current weakness particular to tech stocks and their poor earnings (overall US earnings are so far flat, which actually beats expectations), with some knock on effect from the Nasdaq index onto other indices? With different indices around the world in different positions, it’s not clear, but there are some other common characteristics to cyclical stocks bull tops, so let’s review:

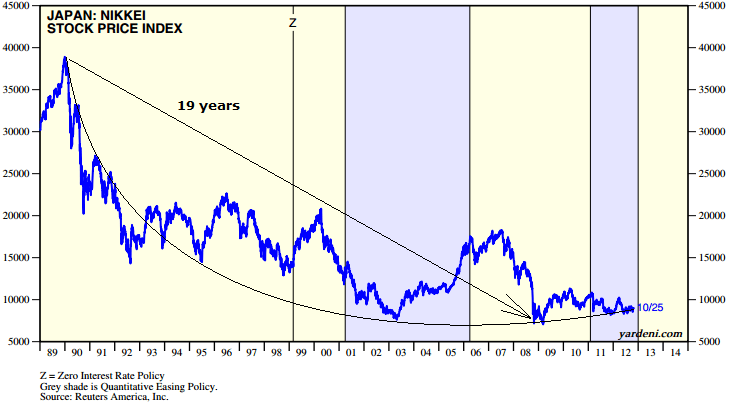

1. A topping process, normally months, with reversals of reversals of reversals in a range

This chart shows the last two cyclical bull market tops highlighted. Both topping processes lasted around a year, and within the boxed ranges there are both double tops and double bottoms, reflecting the reversals of reversals in a range criteria. If we are seeing a top on the SP500 currently, then we should see this play out into next year, with some sideways volatility to make a topping process. That should allow the 200MA to catch up and then the market can slice through it to begin a new cyclical bear. Could the topping process have begun in March this year at the lower peak? If so, we should still see more up/down oscillation as the market gradually rolls over.

Source: Ed Yardeni

2. Evidence of overbought and overbullish extremes (such as RSI and sentiment surveys)

I’ve done some checks on this and the evidence isn’t very compelling that this actually correlates with a cyclical bull top, namely because of the sideways ranging. These indicators can flash at the start of a topping process, as an up move rolls over into ranging, but thereafter don’t hold persistently.

3. Breadth divergence (such as new highs / new lows and advance-declines)

Cobra’s chart here shows how at the 2007 cyclical bull top for the SP500 price made a higher high whilst advance-declines made a negative divergence. This shows narrower participation compared to a healthy rally which is based on broad participation.

Source: Cobra / Stockcharts

Chris Puplava’s chart here shows that in the run up to the previous cyclical bull top of 2000 shares hitting new lows in the NYSE (SP500 and Dow) exceeded those hitting new highs, which again is a signal of a narrowing rally.

Source: Chris Puplava

This is how things stand today. NYSE (SP500 and Dow) advance-declines are still in an uptrend. For topping evidence, we would want to see a pullback in stocks and this ratio, followed by a new high or double top in stocks where the ratio negatively diverges.

Source: Stockcharts

And this chart is a cominbation of Nasdaq new highs – new lows and NYSE new highs – new lows. Again, we don’t see divergence yet, so would want the same as above – pullback then push up with negative divergence.

Source: Humble Student / Stockcharts

4. Cyclical sectors topping out before the index top and money flow into defensives

Leading into a cyclical bull top, money normally rotates out of cyclical sectors such as technology, consumer discretionary and materials into defensives such as healthcare, utilities and consumer staples. This is because the economy is turning down or forecast to turn down and these sensitive sectors therefore become less attractive. Below we can see that into the 2007 top, two cyclical sectors topped out several months before, whilst one remained strong, but the two were sufficient a clue for a top.

Source: Chris Puplava

Fast forward to today and this is how things stand. SP500 cyclicals have overall been in an uptrend since August and do not show that negative divergence.

Source: Stockcharts

Comparing three defensive sectors to three cyclical sectors below, we don’t yet see defensives outperforming and cyclicals falling away.

XLV Healthcare, XLU Utilities, XLP Consumer Staples

XLY Consumer Discretionary, XLF Financials, XLB Materials

Source: Stockcharts

However, the biggest faller has been tech, and that is a cyclical sector. So, as things stand, I would want to see a couple of other cyclical sectors join tech in underperformance relative to the wider indices, to add weight to a top.

5. Major distribution days near the highs

We got one on Friday so that’s a warning flag.

And in the wider environment:

4. Yield curve flat or negative

5. Tightening of rates through rising yields

6. Excessive inflation

7. Rolling over of leading indicators and recession model alerts

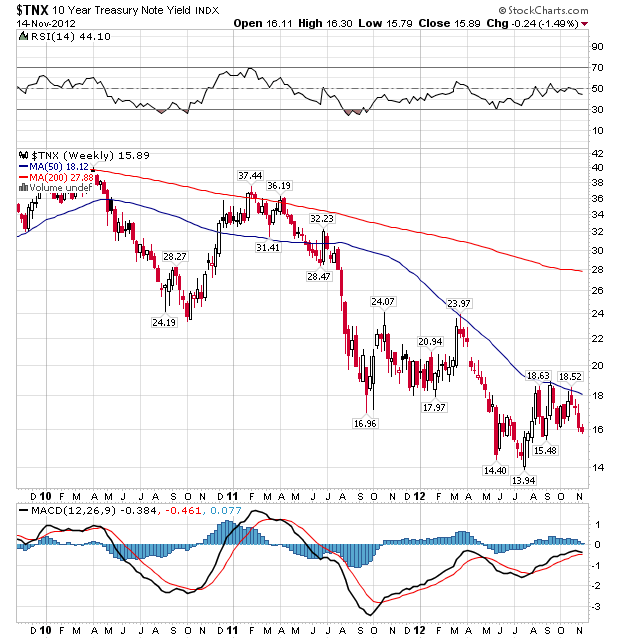

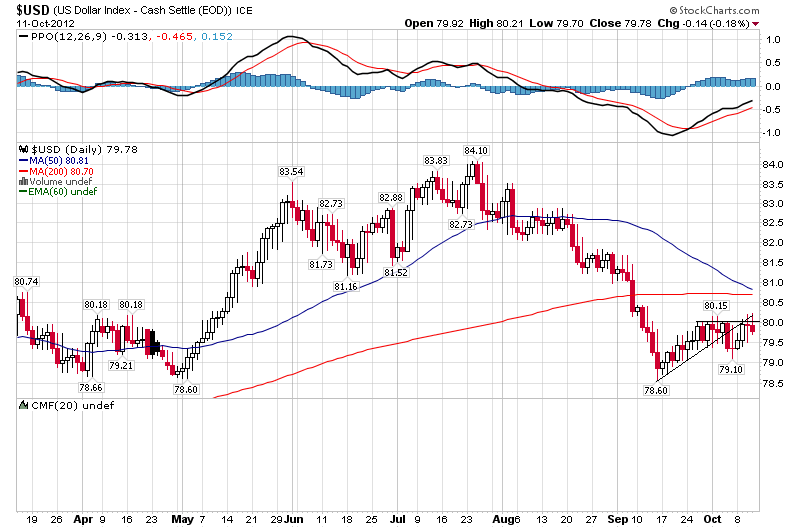

The below chart captures 4. and 5.

Source: Scott Grannis

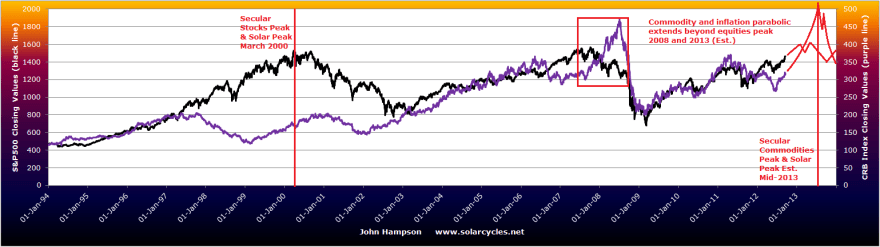

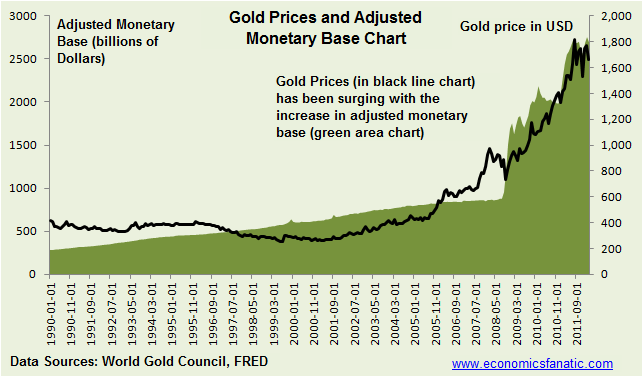

Cyclical stocks bulls have historically ended with inflationary and speculative froth, money pouring out of safety and pushing up yields, inflationary pressure and natural tightening tipping us over into recession, and indicators of forthcoming recesssion in evidence before the speculation tops. Is this time different due to Fed intervention in the bond market? I don’t believe it affects the overall mechanism, but perhaps means yields will peak lower than otherwise. I still foresee this excessive speculation and inflation playing out, as per my previous Forecast 2013 posts. Thus far we see a little inflationary froth through grain prices, but little else excessive.

Regarding leading indicators rolling over, a glance at the US ECRI WLI shows an indicator performing quite differently to the last two cyclical bull tops (leading into the grey banded recessions). What we would need to see is this indicator start to roll over and break into the negative. This coming Friday’s WLI reading is forecast to slip to 5.82, so there is a potential seedling for a trend change. But we would need to see a few weeks of increasingly lower readings to be consistent with previous tops.

Source: Dshort

The Citigroup economic surprises index for the US is also in a strong uptrend, and its correlation with the SP500 is shown. Again, it would need to reverse trend for a few weeks and break into the negative to be consistent with previous tops. More often than not, this indicator leads a trend chane ahead of stocks topping or bottoming.

Source: Ed Yardeni

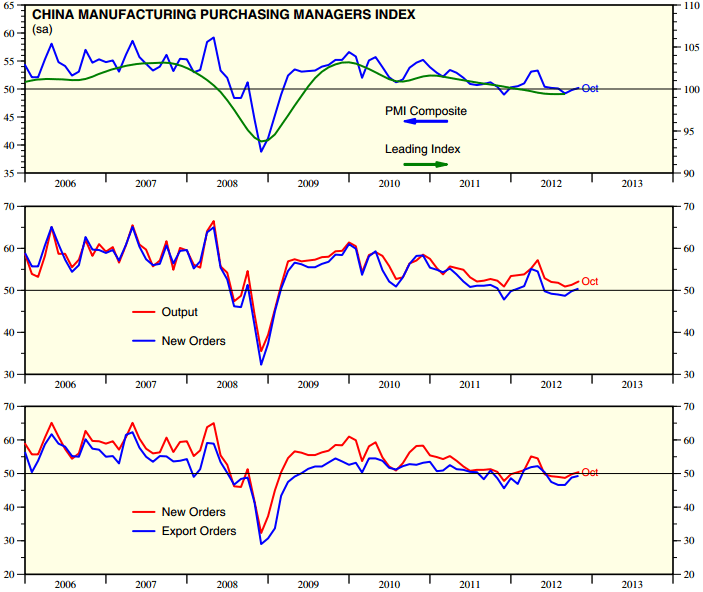

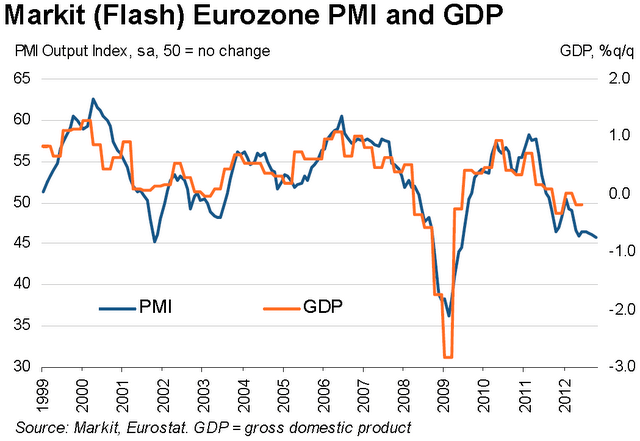

Turning to the global picture, Conference Board leading indicator latest readings for Germany and Australia this week both came in negative and worse than last month. This is in contrast to the recent general improvement since August in global leading indicators. Once again, we should see a trend change in global indicators back to the negative over several weeks, to be consistent with previous equities tops, i.e. leading indicators should roll over before the definitive top in stocks.

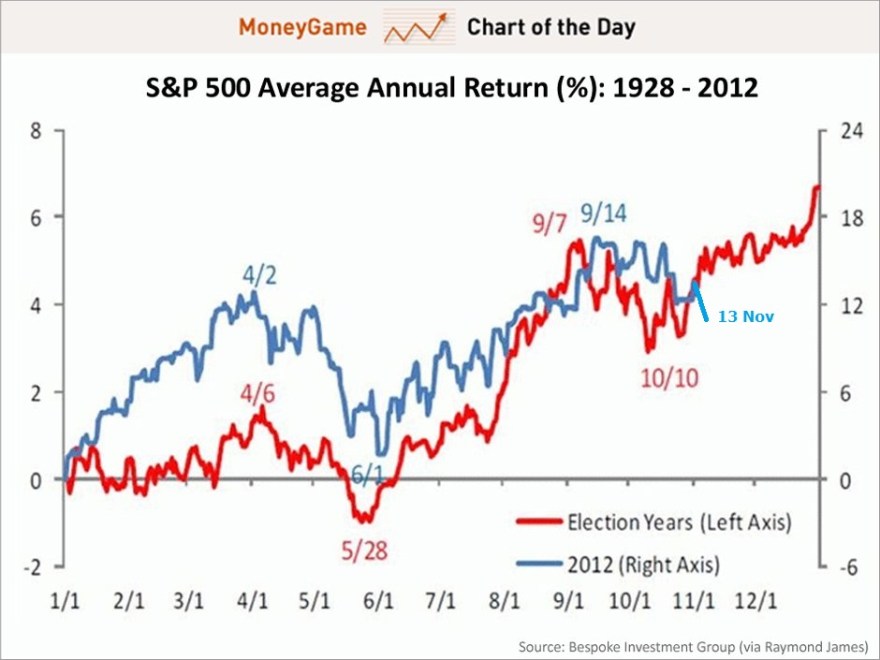

So let me sum up. There are several potential cyclical stocks bull topping signs: techs underperforming, the Nasdaq breaking technically and a major distribution day near the highs. However, this could as yet be a ‘theme’ to US earnings season, namely disappointing tech stocks sell off, infecting other indices, in seasonally weak mid-October, before the cyclical bull continues. To differentiate between the two we should see more bull topping indicators aligning, if this is to be a top, and the whole process should last a while yet. Following the current down move we should see another up move, and perhaps repeat that down-up oscillation one or more times again lasting into the end of this year. In support of this, Tom Demark’s latest forecast is for the SP500 to make a move up again to peak out at 1478-1485 in the next 10-12 trading days and for that to be the high for this year. That would fit with Presidential seasonality being strong into and around the US election.

Should we get that move up, then we should expect to see some negative divergences if this is indeed a topping process, such as narrower participation or economic indicators weakening or underperformance of cyclicals. Should that occur then I will use that strength to sell out of some or all of my stock indices positions.

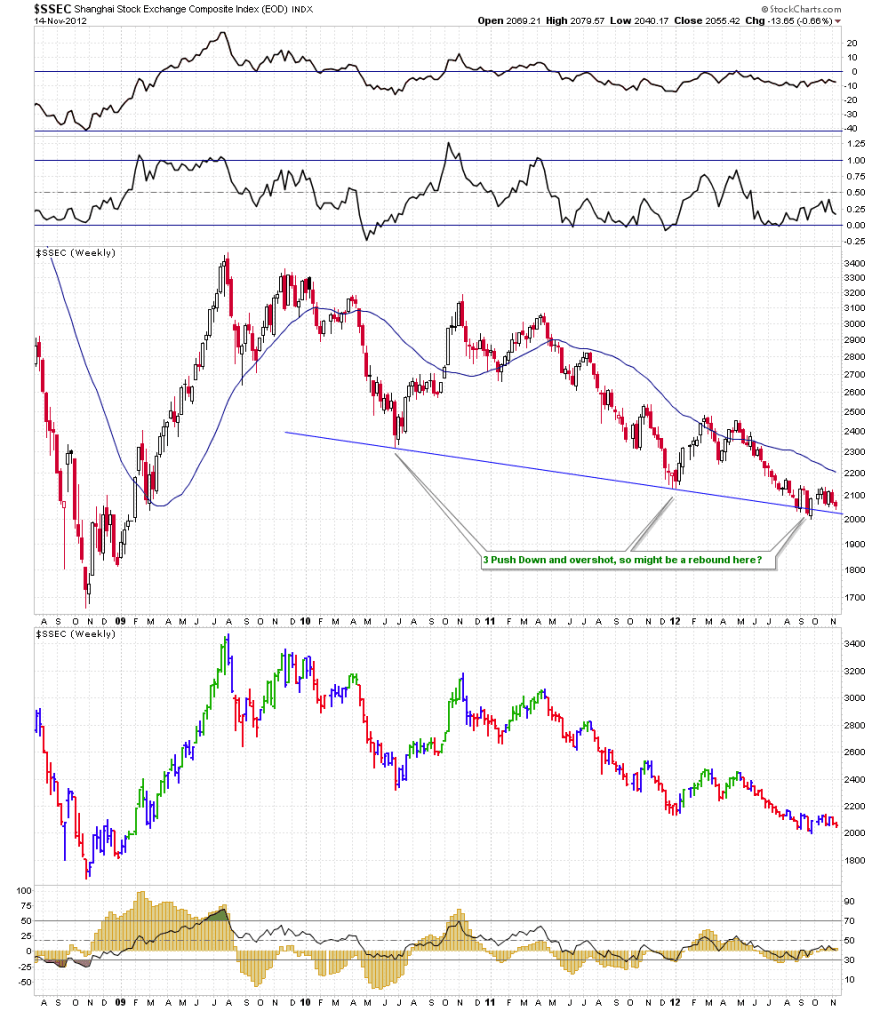

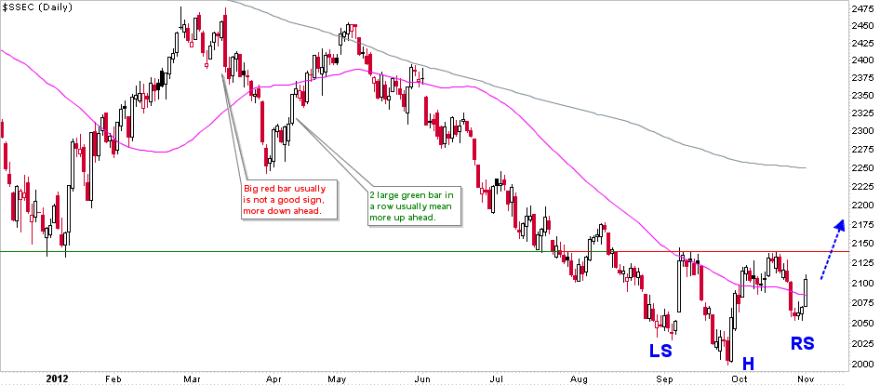

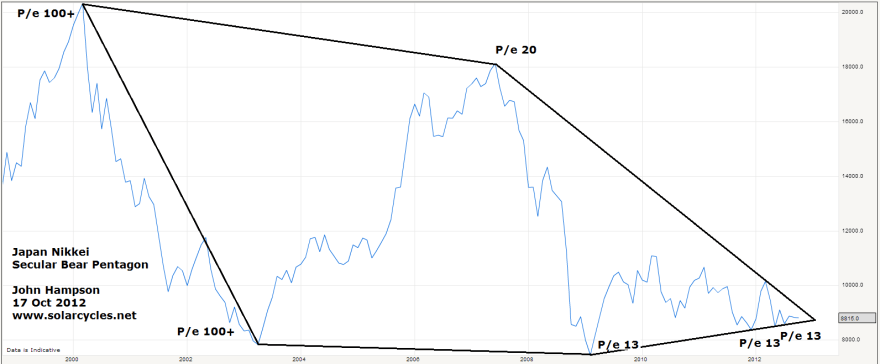

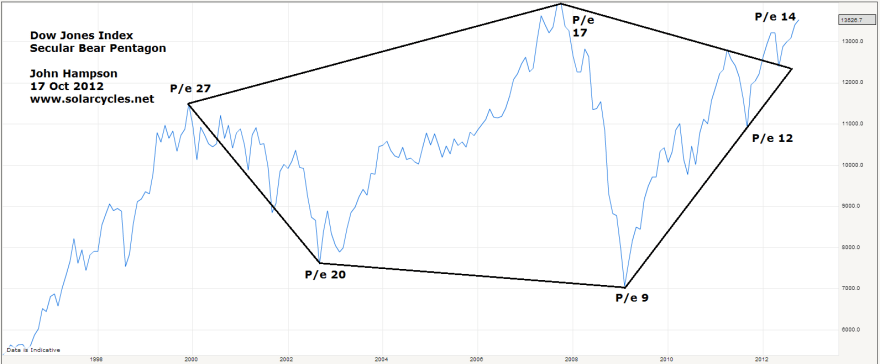

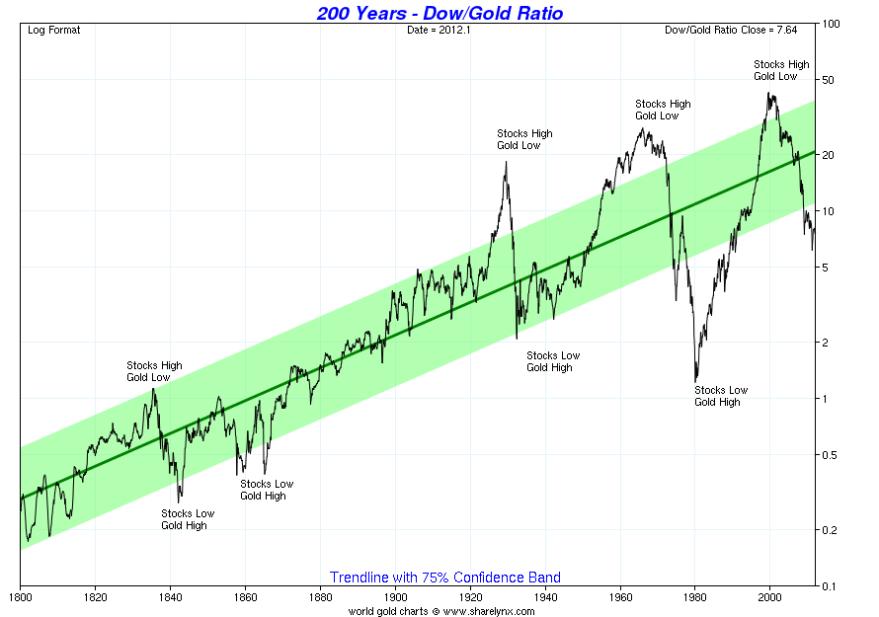

It is curious to see the Hang Seng breaking out and the Shanghai attempting to bottom whilst the Nasdaq is potentially peaking. How might that resolve? Well, my overall message is that a market top should take some months yet to fully form, so there is no rush for everything to align. Solar and secular history suggests equities should top first and then commodities should make their blow off top. It is therefore appropriate that we see some strength or at least stabilisation in China, as a key demand source for commodities. US indices are also amongst the most expensive by p/e whilst China is in single digits. It would therefore fit if the US indices were to roll over first.

A gradual topping process over a few months (rather than a swift decline) should also enable sufficient speculative froth to produce the inflationary finale whereby commodities make a secular final parabolic and bond yields escalate.

So, I sit on my positions for now. I await a renewed up move in pro-risk after this coming weekend’s full moon and into the US elections, targetting Tom Demark’s range. There I will look for further evidence of a topping process to judge whether to sell out of equities.