The breakout in equities is likely to become a fake-out or short final up leg, based on historical indicator patterns. Breadth and strength have negatively diverged:

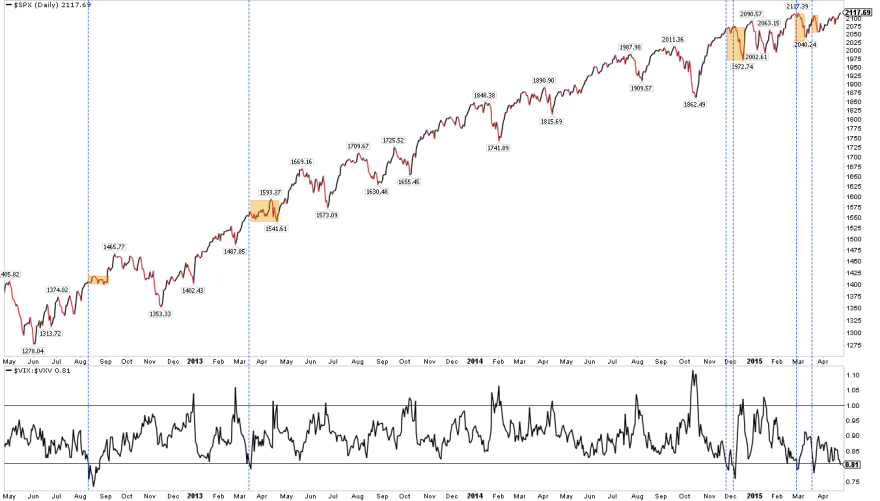

Volatility relativity also suggests a correction or consolidation should now come to pass:

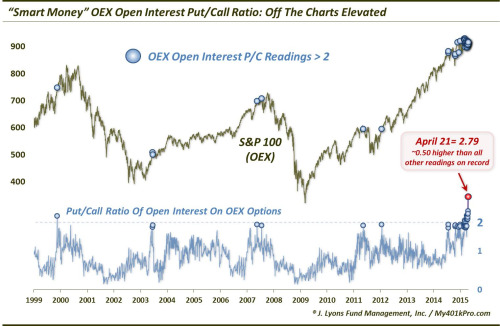

‘Smart money’ bearishness is off the scale:

US economic data surprises remains deeply negative. Two updates from this week:

Source: Sober Look

Blended earnings for Q1 are so far better than expected: -2.8% versus -4.6%, but of course still shrinking. Blended revenues are worst than expected -3.5% versus -2.6%. ECRI leading indicators have improved but are still negative.

On the bullish side, leverage has been on the increase again.

And real narrow money indicators point to economic improvement ahead.

There are two scenarios currently in my mind. My first and highest probability scenario is as per the first several charts above plus all the charts in my last post, namely that stocks are right at the end of a major topping process, and under the hood they already topped. That means last week’s apparent price breakout will quickly fail. I have smallish short Dow and long gold positions aligned to this, looking to build on reversal and momentum.

My secondary or outsider scenario is that US stocks have yet to join Chinese and German stock indices in a parabolic blow off ending pattern, fuelled by potential improvement in economic fortunes/prospects into summer-end. This would be similar to the lag of the Sep 1929 stocks max versus April 1928 solar max, a kind of maximum outsider in the historic range. Should this appear to be occurring I would step aside and continue to try to identify the top.

Ultimately, as things stand right now, I consider all the key supports for the bull have been removed. Earnings, economic data, smart money, allocations, sentiment, valuations, solar max, geomagnetism. We are left with dumb money on leverage, plus expectations that both the economy and earnings will recover in the remainder of 2015. We might consider the latter is key: whether data does improve again – and maybe it is. However, recall the evidence shows that the stock market leads the economy rather than the other way round. The wealth effect of the stock market. The question then is what will cause participants to pull the plug on equities? We are now in a phase of ultra-complacency where most traders can see nothing that would cause that to happen. Yet that ultra-complacency makes us at highest risk of the collapse.

A final chart: the collection of countries now paying negative returns on government bonds. Swiss 10-year bonds are amazingly now paying a guaranteed negative return. It should be clear that when money is being invested in a bond paying an assured loss for several years then it is because deflation, recession and relatively larger losses in other asset classes are expected. Either that, or investors are making a foolish mistake. So who has it right, stocks or bonds? Smart money flows, valuations, allocations and sentiment all continue to show the bubble is in stocks, not bonds. Bonds and commodities are accurately reflecting the harsh reality of current global demographics, trade, and economics, whilst equities have become a ponzi scheme divorced from fundamentals.

Source: Emma Masterson

Reblogged this on thedarklordblog.

Thank you much John. Super analysis as always. The last table Paying to Lend is really helpful and eye opening. thanks,

Good information and charts John – Thanks!

Update from Richard Duncan:

Liquidity Gauge Warning: After mid-year, Look Out!

April 25, 2015

Liquidity determines which way asset prices move. When there is excess liquidity, the price of stocks, bonds and property tends to rise. When liquidity is negative, the price of those assets tends to fall. After two years of excess liquidity – and rapidly appreciating asset prices – liquidity will turn negative in the second half of this year AND REMIAN NEGATIVE FOR THE NEXT FIVE YEARS!

This approaching liquidity drain is not only likely to cause a significant selloff in the financial markets, it is also likely to push the economy back into recession. http://www.richardduncaneconomics.com/liquidity-gauge-warning-after-mid-year-look-out/?utm_source=feedburner&utm_medium=email&utm_campaign=Feed%3A+RichardDuncan+%28Richard+Duncan+Economics+%29

John; great article.

I have several reasons to suspect week 16 was significant.

1) Lunar inversions; the december apo-peri inversion gave the December cit. In April I have a declination inversion; both strong.

2) IMF; the IMF is driven by tidal force on the sun. 4 planets are involved : Jupiter,Venus,Mercury and earth. In February we had the earth Jupiter conjunction. But Venus has more than double Earths pull. April 25th saw the heliocentric Venus Jupiter conjunction. This is by far the strongest pull this year, with a peak in IMF. Surprisingly this coincides with Earth crossing the solar sector boundary. This reverses IMF’s polarity. This confluence alone is a major event.

3) Trading planets. Mars was at perihelion December 3rd. Venus and Mercury were at perihelion April 18/19. This is synchronous with the tidal inversions.

4) Venus is out of bounds and Mercury will follow soon. Mars will do this in June. This correlates with increased volatility.

5) The current 135 degree (or 3/8 as Gann would say) angle on Saturn/Uranus has 3 passings : December 3rd 2014, May 4th 2015, October 22nd 2015. This also confirms the above.

6) the full moon cycle. This cycle takes 412 days and gives 3 to 4 new moons at perigee and 3 to 4 full moons at perigee. Perigee amplifies the impact of both moons. The new moon at perigee is a favorable period for markets. It started in January and ends in ……. April!. Last year we saw the same pattern with the October decline during the full moon at perigee period. Last year the apo peri cycle was still positive for markets. Since December this has changed.

It’s remarkable that 6 different techniques all give December and April.

Seems to me the things that kept the market from falling : lunar inversions, IMF, full moon cycle, trading planets, all end in April. The increase in volatility – that produced noisy intraday ath’s in a consolidating market – signifies the importance of this turn.

My Gann timing on the october low gave april 22 as a very significant date (7th in one major angle). We are now 206 days after the September/October decline in 2014. 206 is 180 degrees in the full moon cycle. October 15th + 206 cd’s gives may 9th. Venus and Mercury reach peaks in out of bounds positions may 10th.

April 19 earth quake near Japan, April 22nd Vulcano eruption in Chile, April 25th massive quake hitting Nepal. This coincides with the superior earth-mecury conjunction of april 10th. Acoording to Richard Nolle the impact is felt 2 weeks later +/- 3 days; from april 21st to april 27th.

The October decline started at first quarter; heading into the full moon and ended at last quarter. First quarter April 27th, last quarter may 11. My harmonic timing system gave a regular low may 7th, the day mercury is max east.

Ah; gravity. Yes, gravity gave the high this weekend. Monday the high and then down into the ma 9/10th weekend. We will see 3 legs down with a retrace up around the FOMC meeting and after that further down. Still convinced we are headed for a 2017 low. So will this be a massive decline? No, don’t think so. But this could be the start of the bear market.

Please notice I didn’t need central banks to explain this move.

Cheers,

André

Should read : week 17; typo.

A little exercise in HC astro.

Venus and Jupiter are conjunct in Leo. Leo is a fire/yang sign; active! This gives even more weight to this event.

Mercury joins in Leo today. HC Mercury in Leo correlates with cit.

The tightening Jupiter-Saturn square (also supporting unrest in Earth’s crest (3rd quake in Nepal today) Gets heavily activated by Mars; square Jupiter and opposite Saturn. Even Mercury trines Saturn. This all with just a few orb. And all the while Saturn stays close to a conjunction with the Galactic Center.

Should be an explosive mix. We’ll see.

Thank you for your analysis.

Thanks for a thoughtful post John.

This sentence is key in my opinion:

‘However, recall the evidence shows that the stock market leads the economy rather than the other way round.’

I would add that the credit cycle leads the economic cycle. Nothing to do with corporate earnings at all, they are a lagging indicator, much like jobs.

Interesting that government bond yields fell on Friday, even as the stock market rose, usually a bit of a tell.

We will see, good luck everyone.

Thanks John and Andre, very kind of you to share with everyone…n

Thanks for this summary, John and also to Andre’ for the astro forecast.

I did not expect much more than SPX 2070, but its 103 points up to SPX 2220 for primary wave 3 top. Within a month probable. Corrective wave 4 then down not more than 400 points with as little as 290 more likely. That can be anywhere between 3 to 9 months duration (not in a straight line, or even well behaved). Thats all for klingon bears for now. Then P5 impulse formation commences with 700 points to emulate.That can take 2 years. Then the bull cycle from 2009 will end at between 8 and 9 years of age. The next bear cycle should be no more than 3 years, 5 at a push. If you still counting the days, day by day then you got a lot more to go. Any bear jumpers still with accounts should not get excited by minor waves, although they are day trading food, they are not for position holders. It should be clear by now that nothing works, does not even help.

I thank you, I thank you

Good Day

Peter_on thx very much for your contribution. It would help if you would explain ‘why’ you make those prognosese.

‘That can take 2 years. Then the bull cycle from 2009 will end at between 8 and 9 years of age. The next bear cycle should be no more than 3 years, 5 at a push. ‘

No way we go 8-9 years from 09.

Lunar Chord 7 D:

Degree of illumination: negative full moon coming

Declination: post far N, equ. cross on Thursday, positive

Distance: apogee Wednesday, weak Wed to Fri

Depth of tide: falling all week, negative

De Planets: generally supportive, except Saturn opp on May 23

Direction of price: trend is friend to bulls

De Element: Metal month, metal chops paper (shares are paper)

Above tide data should read tide rising all week. This changes Chord to more bullish outlook for the week.

Peter,

thought provoking post,

have made a note of that one.

The journey to nearby top must complete this minor 3 and negotiate a minor corrective 4th. Thats a potential exercise in even more frustration. I hold some long with nearby fixed stop and go fishing

Yes yes

Good Day

JOHN,

The breakout in equities is likely to become a fake-out or short final up leg.

SO YOU KEEP SAYING and so she keeps rising!!

what I find interesting is just how few posters now contribute to this blog, all those bears either been wiped out after following johns bearish slant and still calling for a fall after 16 months now!!!!!!! or they have joined the free party and gone long.

some of us do not post for our own reasons

I have shown the tools I use and since 3/26

they have triggered long in indexes

and I have no need like some other traders to post against

John’s work.

Robbie,

I find that interesting as well. Bear markets kill both ways. Bears get wiped out by being early. Bulls get wiped out because there are no more bears. Its a paradox.

John: “We are left with dumb money on leverage, plus expectations that both the economy and earnings will recover in the remainder of 2015. ”

Like MOST here I’m a staunch fan of your work here and for which I’m very grateful.

However we aren’t ‘just’ left with the 2 things you mention. The 300 Pound Gorilla in the room is the CBs collective ability to usurp financial control and use ‘free money’ which has no accountability to distort markets beyond, at least my, wildest imagination.

I don’t really know how you can ‘quantify’ their involvement but I suspect (like our dear Nicolas) that we need to include their ‘contribution’ in the equation to get a better handle on what might happen next.

Otherwise we are constantly ‘wrong’…which is painful & Not just monetarily.

Don’t sweat about the CBs Purvez.

They are both irrelevant and impotent.

When this thing gets going, no one will be able to stop it.

The bull will die of its own accord.

Another possibility is CB selling the shares they have accumulated which if done at once could reverse all of the price gains quickly.

I don’t think purvez is saying that CB help the market in the long term, but that we have not factored in their impact, good or bad, for the short term “remainder of 2015”.

GM, John H has already shown us in great detail and very eloquently that the bull is dead from the neck down. However the head still keeps bobbing upwards!!

I’ve been thinking about ‘how’ the CBs are keeping the markets afloat….and here is a hypothesis.

Currently there are a number of groups of large investors:

– Mutual Funds

– Hedge Funds

– Large Banks

– MMs

Most managers in the first 2 groups recognise that valuations are high. Now lets say one of them decides it’s time to cash in and starts unloading with a smallish package. The CBs pick up on this activity and start flooding the market with buy orders to overwhelm this initial small package AND make the market rise just a bit.

Now that manager is in a quandry. Does he sell more in the wake of a rising market or ride with it? Since most are incentivised by performance the answer is easy. ‘Ride with it’.

Hence the CBs ONLY have to control the market ‘at the margin’ to prevent a fall.

So the ONLY way this market will fall is if there is some panic event (a Lehman moment) when everyone tries to unload and that overwhelms the CBs attempts to control at the margin.

Such an event could be geo-political, although the market seems impervious to those these days

OR

A financial crisis. The Alhambra blog continues to demonstrate abnormal behaviour in the ‘money’/’dollar’ markets (I don’t profess to understand all of it) and implies that this is due to liquidity problems.

So my guess is that the ‘panic’ will come from the financial section.

This is ALL guess work but a bloke’s got to pass his time in some way while this boring churn higher continues.

I’d be very interested in others opinions/guesses here please. Thx.

Something like that makes sense to me. Certain large players using high leverage on ZIRP to manipulate sufficiently the margins. I can’t explain the recovery from October last year. Those falls should have been it, by all ‘normal’ analysis. I am loathe to join calls for ‘manipulation’ because historically they have been wrong, but I find the last 6 months very hard to explain without some inference.

Historically, major tops didn’t have a trigger (beyond the usual neg divergences, etc). They occurred, and then later we got the trouble arising. Everyone is on one side of the boat, I figure we just need a critical mass of players shifting across, and we have a host of reasons for them to do so (earnings, economic data, valuations, technical health) to protect their own self-interest.

purvez, I just don’t agree with the notion that CBs are buying to keep markets afloat (other than in Japan), and I think the US markets are just going through their normal topping process, which can take up to 12 months of mostly sideways churn, with marginal new highs.

As Jeff Snyder has mentioned, the credit cycle has turned, banks are tightening, irrespective of the CBs, and they control the spigot that keeps asset prices up. Equities are always the last asset class to realise the jig is up, it’s the same this time.

It will end soon.

Thanks John.

Please dont take this as a harse critisim but in numerous articles you have mentioned that your primary expectation was steep falls into april which have not materialised. You mentioned then that if that did not happen then next window would be July top.

This article has your primary expectation as a false breakout in the face of new highs in leverage. I dont mean to provoke argument andyou know I a fan of your site but we all need to keep eachother honest and would welcome a reason why the July top has invalidated.

Duncan

As always… excellent observations, commentary & charts from our host.

“what do you think ?”

_______________________________________________________________

Here is what I think:

This chart shows that gold stocks are the most over-sold and under-valued relative to gold – ever.

So I think that Nicolas and ilk are utter fool to say that accumulating gold stocks here is a bad idea, (especially given NEM’s stellar Qtr 1 earnings with more to come from others).

The other chart puts into perspective the actions on Friday of our contra-indicator, Nicolas the bag holder, when he loaded his bag full of Amazon at an EXTREMELY RARE “6-Sigma”, extremely over bought, extremely over-valued price. The volume was HUGE and obviously the smart money was unloading their shares to the mindless, greedy fools that chase pops and tops.

One can see that a 6 sigma event equates to the 99.99966% probability that Amazon’s price topped on Friday.

What I think is that the same “this time is different”, ignorant, greedy, fools that ALWAYS appear at the tops to become the bag holders have arrived yet again.

We are lucky to have them as they ring the bell at tops.

_______________________________________________________________

Nicolas

April 24, 2015

I just bought AMZN at 448.48$. It’s a nice addition to my portfolio.

I think AMZN is still VERY CHEAP and should go higher.

what do you think ?

_______________________________________________________________

Nicolas

April 24, 2015

I just bought AMZN at 448.48$. It’s a nice addition to my portfolio.

I think AMZN is still VERY CHEAP and should go higher.

what do you think ?

____________________________________________________________

I think bag holders always appear at tops… and we’re lucky to have fools that ring a bell at the top. Thank you very much.

I think the following charts reflect just how foolish loading the bag at $448.48 on Amazon was.

A “6 SIGMA” event guarantees that AMZN price just topped… a 99.99966% certainty on strong volume as “smart money” feverishly unloads hand over fist to greedy, foolish “pops and tops” chasers.

Thanks for the update John.

I said in the last thread that I would comment on USERX. I am not going to spell it out and make it ridiculously simple because I now have decided that people need to do some thinking for themselves. I am however prepared to show pieces of the puzzle that continues to unfold right before our eyes.

Exerts of extreme signficance from Jeff Kern’s last 321 update:

“The 3/24/15 XXed Out 92-96 index “buy” signal often marks a high and that has been the high-to-date at USERX 5.59. The subsequent 5-day run down often marks a low and it did on 3/31/15 at USERX 5.28”

“The prior run pattern high of USERX 5.59 and its low of USERX 5.28 are supposed to be technically/psychologically significant. Jeff does not enjoy reporting that a Double Sell index pattern has occurred. A simultaneous Double Sell index situation absolutely “should” mark a significant technical moment….”

http://stockcharts.com/h-sc/ui?s=USERX&p=D&b=5&g=0&id=p38997111499

Cheers

Sorry that should be “excerpts”…..Usually turn off pre-emptive txt.

To answer a few comments. You know my approach: draw together as many angles as I see effect the markets and make a case. In that way I try to make it as objective as possible, but no-one can avoid some degree of subjectivism.

By Jan 2014 I had 20+ different angles all making a clear case for a bull market peak, and together something compelling. Here: https://solarcycles.net/2014/01/13/us-equities-bull-market-peak-new-bear-market-at-hand/

Ever since that case has endured and been added to. So I have remained a bear whilst they persist and I can’t change that – unless the large part of those angles change their readings. I trust most of you still reading see it the same way: there has been a strong case for an orthodox stock market peak persisting, so whilst I have been wrong with price, the analysis has still been ‘sound’.

The solar max is unorthodox as a trading discipline, so always needed cross-referencing. It looks compelling that around mid-2014 we got the speculative peak together with the sun peak (last post). Critically we saw all those different stock market topping indicators form along with the sun reaching its peak, which provided the cross-reference as we went along.

But why have stocks not topped out nominally after July last year? I find this very hard to answer, and so I am guilty of shifting my forecasts since then. I have continually believed they must be on the cusp of declines and will remain in that difficult position until they finally do.

Is it central banks policy trumps all? I still think this is the mantra for this mania rather than the fuel. QE and ZIRP are just typing numbers into a computer, corrupting the money mechanism. The world economy remains in deep trouble due to the twin forces of demographics and debt. CBs have surely worsened the problems with that choice of action, rather than improved them. It’s not hard to imagine stocks declining and the mantra switching to ‘despite all CB actions and massively increased debt, economy still crap, CBs impotent’.

As things stand, I still have a strong case for all-change around the solar max, making the sun the agent not the CBs. But the switch to nominal bear market has to occur soon. If it doesn’t and we are still in a bull market by the end of 2015 then I would throw in the towel both on the sun and the old stock market rules (tops signalled by valuations, sentiment, allocations, leverage, negative divergences, etc) and accept that ‘this time is different’ really was the case this time.

John H, I was one of the ones calling for an additional element to your analysis and this one sentence from your comment is I believe the ‘element’ that we collectively need to find a way of quantifying.

John H : “QE and ZIRP are just typing numbers into a computer, corrupting the money mechanism.”

I would however like to re-iterate what others have already said. Our comments are not intended as criticisms and you have made both your position and your case admirably clear. We remain indebted to you for your valuable in depth analysis and for this site which I believe is ‘unique’ in its range of information provided by yourself as well as knowledgeable and varied participants who are largely respectful of each others views.

So THANKS VERY MUCH.

Thank you purvez

I don’t really understand why some feel the need to draw conclusions around who doesn’t post any longer and being wiped out. I don’t suppose many follow the advice of others on the Internet when it comes to their hard earned cash? At least I hope not!

From my time here I have seen that we are all wrong quite often regardless of the process we use and this is unavoidable in life.

Just be careful and learn. Protect yourselves at all times and take responsibility for your own decisions.

J

Perhaps the mistake all along has been assuming that financial instability equates always, every time, to equity prices going down.

Financial instability can also bring on uncontrolled movement to the upside, particularly if the foundation of a market — the currency — is being actively managed.

Since July 2014 — your precise timing for a top — the markets have shifted dramatically, but in most cases it has been straight to the upside.

The effects of this can be just as destructive. See Argentina and Venezuela.

Nice analysis Jackie S. I like your train of thought very much. Provides a perspective that I had not considered.

Thanks for that.

Ignoring demographics and typing numbers into a computer…sounds like “programming”. Ha Ha.

John, we need to look at climate some more, veered away from it lately in your posts. The sun is at best an observatory of the physics at work, much like climate.

The two are pillars in the pyramid I keep trying to think of a way to express this, but picture a sine wave compressed like a spring, when compression is gone, stored energy is released and compression is gone.

The CB’s have released money supply as stored energy to distort moving averages, volume. If there was a way to hypothesize what the markets would look like today if no QE had been done but ZIRP was allowed. Would we be at market top like the sun prognosticates in a classic compressed (spring/sine-wave) market cycle pre-QE or an elongated one that takes 8-10 years to peak (assuming you subject some years as not part of the new higher highs, but just relaxing the stored energy per unit (per dollar )

Food for thought John…the spring also applies to weaker phases of the solar cycle…

For those gold price watchers, did Martin Armstrong give something away in a recent blog comment:

‘In fact, there are people now starting to say gold is dead since it has declined in the face of monetization by the Fed and the ECB. The wider view is the gold rally was all hype and it will never rally. This too is what I warned MUST take place BEFORE you get the low. We had to “shake the tree” and get them all out.’

It may be just my grammar obsession (and MA is hardly the most accurate typer), but he uses the past tense ‘We had to shake the tree’.

He sold a report on gold and silver a while back, so he won’t publicly confirm his opinion on when gold hits its bottom, but maybe it already has? Allan, maybe your mate agrees with you? 😉

Time will tell.

GM, I saw it and thought exactly the same. In fact noticed last week that MA had not been trashing gold for nearly a month?

Prior he was regularly, like every few days, issuing warnings that gold was likely going to collapse. Not so anymore.

Maybe, just maybe, he is noticing the same things?

GM I struggle to comprehend MA because I think he uses dictation software and doesn’t bother to correct the obvious mistakes these things make.

Also once he gets on his Soap Box about his own case and politicians being all lawyers my eyes glaze over.

My main reason for sticking with him is every so often he’ll come up with a concept/idea which makes me sit up and think ….hmmm.

Me too purvez.

He grasps more about markets than most; capital flows, cycles etc.

I feel sorry for the guy too, banged up for years without ever having been found guilty, just because he pissed off the powers-that-be. He has guts these days, and a mission I support: seeing the world through the collapse of socialism and (we hope) out the other side.

Yes that is something worth being around him for.

I have a feeling the DAX correction may be over and we can start the journey back to 12400 this week. Greece could still spoil the day though. Todays rise is great but need a bit more confirmation as its been a volatile week.

Picked up some SPY MAY 15 2015 212.00 PUTS

Following Newt’s tutoring I’m waiting for the NYAD to turn lower before jumping on. Looking at the NYAD chart here :

http://stockcharts.com/freecharts/gallery.html?$NYAD

you can see 5 clear waves from the Mid Dec lows. Doesn’t get more ‘cleaner’ than that. So I’m expecting the next down to go quite a waaay down.

I tweeked Souljester’s chart a little bit, buy over the 13, sell under the 13

http://stockcharts.com/h-sc/ui?s=$NYAD&p=D&yr=0&mn=7&dy=0&id=p44883089207

Great calls geno!

Hi all ! Are you ready for another good week for the markets ? Shanghai up another 3%. New records this morning on US indices.

Good post today by John. Interesting analysis but as some posters have said, it’s still missing the elephant in the room, which is central banks.

You can talk all you want about valuations but at the end of the day if central banks are buying stocks and bonds, there’s nothing we can do other than join the party.

regards.

Why is IBB down? Are CB selling?

Ooh, Nic, you forgot to mention gold today?

Odd that.

😉

I’m not so sure about all this advice giving going on here. I think people should be more careful. Telling others about what moves you are making is fine but offering broad unsolicited advice is not right.

if somebody had taken a posters advice and bought IBB back on march 20th they would still be down 14 points more than a month later.

Well, it depends on who’s giving the advice. I think most people on this board who followed my recommendations are very happy with the results.

As I said, I don’t want to brag, but my focus on central banks has been very helpful in predicting the markets.

People who shorted gold late last week must have had their @sses handed to them today……..

geno0010, any analysis or targets for having May puts? Are you expecting a pullback, major drop? Thx

Hi ! If you’re interested, I’m not predicting any major drop in the short term. So, don’t buy puts.

Regards

Vix at a level that has produced market tops, nasdaq up/down vulume indicator I use has rolled over, put/call ratio is in oversold territory, tick showing less demand (more supply coming into market), and the lunar cycle is weak into the full moon. Lunar cycle was exhibiting strength into Friday because it was in Leo, now it moves to Capricorn which is historically weaker.

I’m gaming the Swing Trend Indicator which is still on full buy, so might not be a good idea!

There were a few comments about the new high in margin borrowing. Following margin borrowing levels is kinda cute and old fashioned but there is no way to really measure the amount of leverage in this current environment. There are so many people that have pledged securities as security for real estate, business and other personal loans. These accounts have grown much faster than margin loans and currently dwarf margin levels by many times.

Securities based lending by uninformed people may be talked about in the near future the same way that sub prime mortgages were in ’08.

John,

I’ve been watching the SP500 lately, along with the other US indexes. I just posted an Elliottwave Analysis, along with a Cycles Analysis (new software) and also some ground-breaking analysis for planetary software. They all point to the same thing.

http://www.worldcyclesinstitute.com/us-market-topping/

Appreciate your comments for or against. (I’ve been watching this ending diagonal for awhile now, waiting for it to break).

John does not do Elliott and with this type of so-called analysis I would not disagree with how misleading it can be. Where is your bigger picture? Where are the series of 3’s? Where is your MACD histogram to confirm? Nothing but another amateur. Makes me want to spit. Go read some genuine books.

Yes I am grumpy. I cannot go fishing until next weekend. Bug…

Good Day

Haha… first time with the amateur status after so many years! Thanks! Brings back memories.

Coupled with EW with Cycles and Planetary analysis, if you read. You can drill down for the “3s” – they’re way too obvious and I included them in previous posts.

Each to his own. Just trying to help.

Interesting: I am looking to “Sell in May and go away”.

Peter_ please may I request that you be ‘grumpy’ elsewhere. I asked you a simple question about all the prognoses you gave earlier but you didn’t bother to respond. Yet you feel ‘comfortable’ in being rude to someone who has done more than you have bothered to do.

We would respectfully request that you find the web site ‘daneric’.something and go play with like minded people there.

Thanks ever so much for complying.

OK ponse get this – Elliott theory is all over my posts along with my contempt for those who bang on with their thing when it is clear that what they have in their kitbag is not working for a long time. To brush aside certain long established and proven methods and then want to be spoon fed because you are too arrogant to stoop into the required learning process does not endear me.

Thanks for reading this this now kindly read it again until the message sinks in.

Yes I an grumpy, so ponse away

Good Day

I hope John won’t mind me linking to a blog post of mine regarding (you’ve guessed it) gold and its miners, and cycles:

http://screwtapefiles.blogspot.co.uk/2015/04/martin-armstrongs-tense.html

Peter_ 🙂 Wasn’t critisising your EW just your ‘rudeness’. Your EW would always be welcome absent your rude behaviour.

Peter_ sorry meant to say that the reason I wasn’t critisising your EW is because I can’t see it anywhere in your posts. Just lots of ‘this will happen’ stuff without any supporting evidence.

Grumph, ok P a little. Take SPX see Primary wave 2 was 400 points, see Major wave 1 clearance over Primary 1, see extension of Primary 3. Are you with me?

I am not going to wait for you. You know the guideline of when wave 3 extends? Yes, expect wave 5 to emulate wave 1. Now you are getting the bigger picture. See Major 4 was the recent dip that killed the not so nifty bears, yes this is Major 5 of Primary 3 and lo – this is Intermediate 5 and drill down you see within the fake triangle that this is minor 3. What comes after wave 3? Wake up! Its not that difficult. You can factor the probability of sharp or complex and that improves with pracxtice like everything else. Spend a few hamburgers on some classic tombs of the theory and practice and start practicing. Now I need a drink. So endeth your fishing trip.

Thank you, Good Day

Hello Peter.

Thanks for sharing your thoughts.

I don’t do EW, but noticed a pattern, what are your thoughts please?

http://screencast.com/t/S9Ba39ED

I was addressing my query to Peter Temple, not the rude Peter!

Hi GM,

IMHO you’re essentially correct. Your 1-2 wave should be higher up (they retrace 62%, so it’s the first retrace). The rest is fairly close. It did a double bottom at the end of 5 down. I’m long GLD which looks similar, but I’m suggesting this is a second wave and will retrace about 62% of the entire wave you posted and then rollover into a larger 3rd wave down.

(It’s paying off today.)

A 3rd wave down!

I don’t like you any more 😉

Thanks for the feedback.

You’re going to have to stand in my “not like” line. Sorry for the length.

Mama mia! Touter leading the blind. Stop giving Elliott a bad name. Plenty free sites with guidance for you two. Just totally awful. I would say unworthy, but its worse with incorrect and mono-form wave notation just for starters. Now I feel ill.

Good Day

I see a guy name Prechter has exactly the same count tonight. We amateurs obviously have a lot to learn.

Get well soon, Peter.

Peter – WI fishing opener this weekend, MN opener next weekend. All the fishing you can handle bro.

You’re ALL class Peter_

“The arrogance of some people makes even their virtues appear vices”

Well the SPX triangle breakout comes in around 2110ish, so if this level holds may have to sell those puts.

GM, good post always fun to parse the “Forecaster” formerly known as MA. Harry S. Dent, Jr. is my favorite because he isn’t afraid to have unwavering opinions based upon demographic trends. BTW he is currently recommending buying puts on SPY QQQ, holding cash or Gold, and avoiding real estate: new retirees selling and their children don’t have the income to afford current prices.

Great post GM. Like it a lot 🙂

For me, the best bit is the play on ‘tense’, and the apostrophe. I’m weird I know!

Thanks.

Does anyone have info. on a Neptune event that has market effects. Supposedly one is happening soon that has 2/3 predictive value.

In other words, 2/3 of time a certain price effect results in association with this Neptune event.

i laughed at nicolas’ response to allan that referenced uranus

but neptune?, man that is way out there. Somethings fishy somewhere.

Don’t laugh, there is supposed to be a cit this week based upon Neptune.

Another glorious day for the bulls and those that short glitter. all is rainbows and unicorns. cash out refi’s to buy stocks the way central banks do and sell your sister to buy more biotechs and tech stocks at ATHs. buy the dip buy the dip.

like celadon CLDN. dropped from 20 to 10 in the last 30 days…load the boat and watch her sink under $3 today. buy MOAR

i hope to take my apple call spreads from me Friday for 150% gain so I can add to my long gold spreads and spy put spreads. also eyeing some overleveraged OIL and Gas names. aapl is the ONLY name in the game to keep the QQQs, Nasdaq, DOW and sp500 from falling off a cliff.

any one check out my fear ratio post at the end of John’s last update? I’d be interest in some feedback on the buy/sell signals from the chart I posted.

Stock markets are just a raging casino:

http://www.newsmax.com/Finance/InvestingAnalysis/Stockman-markets-China-McDonalds/2015/04/24/id/640595/

SPX new ath portends sub-minuette iv, not to encroach sub-minuette i (being high of 30th March). You know already? Where from?

And as you know, this is minuette (iii), minor 3, Intermediate 3 (true), Major 5, Primary 3. And so the crystal clears for every Merlin.

I thank, I thank you

Good fishing

Can you not go fishing because you don’t have a boat?

Instead of messing up this page with your charts why not do like this?…

http://barestbodkins.blogspot.com/

Think I’ll pick some of these up tomorrow

BWLD May 2015 170.000 put

Nice charts Peter Temple… I have the same count. I can post the chart if interested. Where I would disagree is with citing Prechter’s count as if that would give any credibility to it. As having been around watching the markets since the early 80s… despite his large following and the disinformation to the contrary, Prechter made a lot of very bad calls. And as far as Puetz, aka “Putz”, his calls were remarkably terrible back at K-1 (Kitco forum in the early days). So bad he was laughed off the discussion board – I was not one who criticized him, but his calls were egregiously bad.

William, i for one would certainly like to see your chart. I don’t know anything about waves but i’m never too old (or conceited) to try to learn

Specie, R2K is leading the SPX, so I’ll post the IWM: today completed a wave ii black and ready to tumble breaking down below the multi-month ending diagonal pattern… (BKX closed the day with a bearish inverted Hammer).

Next I’ll update my dollar chart posted last week.

Key Resistance: 127.13

Key Support: 123.82

This should give you a feel for where gold is headed – Gold always bottoms before the dollar peaks as it has.

USD Index: c finishes wave ii (black) as a flat correction. The price is now immediately vulnerable to more downside below 97.28.

Key Resistance: 97.28, 98.42

Key Support: 96.32

interesting chart. thx william…elliotwave.com has been looking for a terminal wave 5 diagonal in the dow and looks like it may have hit on the nasdaq today.

i think i like the opportunity in the russel better because they have less opportunity for balance sheet manipulation, obtaining billions in low interest debt to perform stock buybacks and jerry rig eps.

instead of adding to my spy put spreads, i will throw on a russel spread

ms market has announced over $1 trillion in stock buybacks so far in 2015. prior to the 2008-9 crash it was 963 billion and market dropped 56%

have you seen aapls debt load they have added? not bearish as i’m long the call spreads, but nearly all fortune 500 companies are loading the boat with cheap debt and buying back stock at all time highs to pad their stock bonuses. criminal imho. trillions that could have been spent on infrastructure, r & D, jobs, …all going to evaporate

Yeah, I saw yours, William,

We’re on different pages re gold, but I’m not expecting this wave up to be huge, just a counter. Nice to have someone here who is into EW. (and yeah, I hear you re: Prechter … lol … I have problems with some of his counts … OK, maybe more than some.

Nice first wave down to now. I think we’re on our way!

Puetz really isn’t an analyst, I don’t think (at least anymore) but he’s done a whack of science around cycles.

Dollar bear market beginning (due to Crude???) and large cap rally starting all over again?

http://www.thestreet.com/story/13127402/1/the-end-of-this-dollar-rally-could-be-a-boon-for-large-cap-stocks.html

US Dollar index topped on 3/13/2015 and Crude bottomed on 3/18/2015 and both have been trending opposite ever since. Which came first the chicken or the egg. Does Crude lead the USD or does the USD lead Crude? Large Cap stock investors want to know given current “market conditions”.

John Hampson – Thanks for painting the forest.

Lunar Chord:

Price down today may be blip so as to not steal the Fed Mtg. thunder.

Tides, moon phase, distance, and declination are 2 +, 2 -.

Seasonals esp. last three days April, first day May (Friday) are consistently bullish.

Entered short SPXU today when price stalled out mid morning for 1/2% paper gain. Will exit short tomorrow as I believe Fed will deliver the required massage the market needs to continue rally into at least Friday.

Is this a urban legend or are the Chinese and Indian consumers beginning to sell gold jewelry to speculate in the equity markets?

This post :

http://www.alhambrapartners.com/2015/04/27/just-another-hedge-fund/

from the Algambra site is worth a read, in my view, as it provides a neat solution to getting the Fed out of its own boxed in corner and resolves the TBTF issue. There is a graphic in there that I particularly like for its ability to explain the 2 different aspects of money vs wholesale finance.

bb

Trying to time these markets using technical, cyclical or astrological methods and tools is like trying to buy meat from a butcher whose finger is always on the scale. There is always this distortion at play, the butcher here being the Fed (and other central banks).

One day, someone will shout “The emperor is wearing no clothes,” or to use a similar analogy, Dorothy will pull back the curtain to reveal the wizard as an impotent old man, and all those people who thought the wizard was in full control will realize it was just an illusion. What both of these metaphors have in common is the understanding that the central bankers only have power because we invest them with our belief.

How do you predict such a psychological event? It may very well align with some technical readings or wave structure, but psychic events are unpredictable. I believe it will be the loss of faith in the omnipotence of the central bankers that will either precipitate the next financial crisis or more likely, be the end result of such a crisis (when it hits full panic mode after everyone can see their utter helplessness). You would have to be a little smart and a little lucky to time such an event.

Our resident contra-indicator, Nicolas, marked the exact top of Amazon yesterday when the smart money was frenetically liquidating on heavy volume to the foolish, greedy bag holders.

Nicolas was sitting on a loss by the close yesterday and no doubt has buyer’s remorse today with an even bigger loss.

Yesterday was a “6 Sigma” event where price was guaranteed to fall based on a 99.99966% probability.

Grab your popcorn, we have a study of “Pride before the Fall” before us.

Wiser, there is no way you can state with any certainty that the Apr 26 52-week high marks the exact top for AMZN. The stock has gained +50% in just three months and profit taking or a correction should not be unsurprising.

The real question is if it should have gone up by 50% in just three months in the first place. From my perspective, I think analysts and big money investors are now viewing this company from a different perspective and something akin to the company’s ability to instantly turn on a profit spigot at will if it chooses to do so. I confess I do not fully understand their business model but I am beginning to appreciate their strategy more over time.

Obviously you don’t understand what a “6 Sigma” event is… to your disadvantage.

eh? that’s not obvious to me. How can you make pronouncements about whether another person understands something without asking them about it first? I don’t see where Steve mentioned anything one way or the other about 6 Sigma, so how can you make presumptions about what Steve knows or doesn’t know. And what relevance does that have to the discussion anyway?

Our resident “genius”, pima canyon, comes to the defense of another “genius”, Steve, stating/asking the question,

_____________________________________________________________

“eh? that’s not obvious to me. How can you make pronouncements about whether another person understands something without asking them about it first? I don’t see where Steve mentioned anything one way or the other about 6 Sigma, so how can you make presumptions about what Steve knows or doesn’t know. And what relevance does that have to the discussion anyway?

pima, if the “relevance” is not glaringly obvious to you, I won’t waste my time explaining since you wouldn’t get it anyway.

______________________________________________

Steve replied,

“Wiser, there is no way you can state with any certainty that the Apr 26 52-week high marks the exact top for AMZN. The stock has gained +50% in just three months and profit taking or a correction should not be unsurprising.”

Steve seems to be confused as well… if as he states, “profit taking or a correction should not be unsurprising” then why on Earth would our resident contra-indicator, Nicolas, buy at precisely the time that “profit taking would not be surprising” after such a large run-up in price?

Only a fool would defend someone buying a top after such a large “50% in just three months” advance.

________________________________________________________________

For anyone else, that already understood the relevance of my post, here is what the contra-indicator wrote:

Nicolas

April 24, 2015

I just bought AMZN at 448.48$. It’s a nice addition to my portfolio.

I think AMZN is still very cheap and should go higher.

what do you think ?

________________________________________

So in response the “What do you think?” I wrote what I thought above…

Here’s an update to that response:

Why only a fool would buy at such a top… after such a large run-up in such a short period of time:

Again, the stock is extremely over bought… this chart, like the other should ring the alarm bell to warn anyone from buying such an over-priced stock!

The 6-Sigma (a 99.99966% probability that price would move NOT HIGHER… BUT LOWER or a 6σ probability of 99.9999998027% probability that price would move lower!

And yet these two fools noted above do not see the relevance of my elicited “What do you think” reply.

Does any of these fools still think loading the bag at $444.48 was a good idea given today’s big red candle on an up day in the market?

A tout attack on a blog is not easy to detect. The motive is financial gain from attracting clicks for advertising and subscriptions at the perp’s site, and anything else in the way of money extraction that can follow.

Often the perp is assisted by another one or more anonymous posters and these pseudonyms engage others and give support to the perp. This is designed to draw attention. Giveaways can be newbies arriving within a short time span and their combined strong defense against any non adoring posters or attention competitors. It is difficult to be sure, so just be careful.

Thanks for the in frmation Peter_. Do you, by chance, hear voices?

Caveat inspectoris. (Viewer beware)

geno, Valley —- 🙂 🙂

William, thank you for your charts. I especially like the dollar chart and your comment about gold always bottoming before the dollar tops. I’ve always felt that was the case but it’s nice to hear it from another source.

2014 economists and market strategists were unanimous that rates were going higher – so long term treasuries outperformed everything on a risk adjusted basis.

2015 everybody is unanimous about the dollar strengthening – so i expect the dollar to collapse more than anyone thinks is in the realm of possibilities, and gold, silver, oil and especially the chinese yuan to benefit.

Specie… here’s my chart from March 18th. If interested, I can provide you with an updated near term chart.

3x leveraged Crude ETN (UWTI) is up 80% since.

Longer term view (there is a cycle playing out that can be discussed).

I love this chart! Does it predict a drop in gold and strong oil rally now?

No, actually gold precedes moves in commodities… gold and oil can move higher together (or lower) as is often the case. It is just that one outperforms the other swinging the ratio to extremes. It is at these extremes that one can buy a highly leveraged ETF (and as in the example of UWTI’s 80% profit since mid march), to make good profits.

Instead of a stock crash Commodity Inflation may be what is starting. Take a look at the Australian Dollar today. When Crude goes up the USD drops against most currencies and in the current economic environment that means rising multi-national stocks.

If Crude goes up then so will Ethanol and Corn. The major Grains are setting for major Elliot 3rd waves higher.

Long dax at 11830 small stakes. Target 12100 this time next week. Dax firmly remains a buy the dip market with strong support near 11700 so ill be adding further there if it does get there.

Weak day for the DAX but no doubt buyers will soon step in as the market offers more value than US markets. My year end target still remains 14000 based on the mildly optimistic case the Greeks drag out another year remaining in the Euro.

Closed may puts for 30% gain

Closed SPXU for quick gain.

geno, Valley congrats on your trades. Good calls.

Gracias Purvez.

The trick will be how to trade after Fed minutes Wednesday until early May. Lunar Chord is tied bullish/bearish with seasonals being the tie breaker. Guess I will go long 15 minutes before the Fed minutes and stay long until early May. The second week of May is the first bearish time according to LC.

Treat to be in GDXJ last two days. Wonder if it will sell off again after Fed minutes?

looks like the BTK is taking out it’s reaction low

market days don’t get much better than this

yesterday and so far today

biowrecks down 2+% while miners up 2+%

This market! Yesterday was a beautiful reversal outside day as well as short and medium term sell signal. So of course the market is up. The IBB topped similarly with a reversal (but not an outside day), opened even lower the next day and turned up. It turned out to be a 1-2 and the sharp sell-off continued a day later and has possibly started a larger 3 after making a larger 2. These straws keep failing me.

Kent, I agree, the whipsaws are vicious at the moment. Feel like a rag doll being pummelled at the moment.

I am not buying that short covering rally in gold. I expect it to drift down after FED. Same applies to crude. For SPX, maybe one more high before correction to 1980.

Final top in stocks in August/September.

Based on what, please?

The “market conditions” of here and now; not the “market conditions” of a year ago; the USD goes down then large cap stocks go up….

Richard, they’ve been going up in tandem. Any reason why they wouldn’t go down the same way?

The new “market conditions” is that a higher dollar hurts the multi-nationals foreign revenue. This was brought to the fore front in the recent quarterly reports of many companies. From here, the USD must go down for multi-national’s stocks to go up.

It’s not quite that simple Richard, but a lower $ helps.

This is a counter trend rally in the Euro imv,

I thought the Euro was due a short term rebound, as posted,

as $ sentiment had reached incredibly bullish levels.

We are still most likely still in the early stages of a multi year

major $ rally.

two biggest bubbles, biowrecks and dollar, both parabolics, both took out reaction lows today

given the leverage in the markets, the ramifications should be felt soon

Operators know that for every poster there are on average over 300 viewers that do not post. Higher profile blogs can attract millions. Viewers are looking for free tips that work. Find a free source of such reliable tips, pass these off as your own, give a few out for free and then make your marks pay. This is an exponentially increasing business model, because it is lucrative. The majority of the viewers have this free reliable tip finding scam business as purpose or future intention. It takes degree level forensic psychology education and related practice to detect the pros. But tip giving pros don’t work for free unless they are well retired, middle aged, and just cannot stop themselves. They give freebie reliable tips without realizing that more harm than good will ensue. Unless they are also into forensic psychology.

Fortunately for this blog, but otherwise for any scamsters there is scant, nay zilch in the way of reliable. You can try to seed some future crops, but that’s about all the hope you got here.

Peter_, would you be a buyer of gold silver miners at this time?

With a one year time horizon.

So you’re saying we shouldn’t post trades because people will steal them and re-sell them?

I’ll never make you pay Peter_, I’m nice like that! All my analysis is free, has been, always will be. I make enough money.

The $ is not a bubble Specie imv,

very clear reasons why the $ is in demand

on a multi year basis.

On IBB I would not go near it,

however it’s still up nearly 55% on a

12 month basis and up over 13% YTD.

If IBB went negative YTD then maybe you can

begin drawing bearish conclusions for wider US

equity markets.

How about these names?. at which point should we draw a bearish conclusion? check out after hours on those reporting. NFLX, AMZN were the exception, not the rule.

$TWTR $WYNN $SSYS $BWLD $GPRO $X all down, CELD ….even aapl after blow out earnings sold off today and had added over $40billion in debt. there is little liquidity in the market. any significant black swan event will create a tremendous down draft.

Scott, with APPL a little like IBB no conclusions

can be drawn from minor % moves.

APPL, nearly 60% up on 1 year and 18% YTD.

Market likes symmetry. from the top of the market in 2000 to 2007 was 1987 trading days. another 1987 trading days occurred this week since 2007. in 2000, market tops occurred 60 days apart from Jan 14 – March 10 2000.

We had a top on March 2nd and we are now marking a second top 30 days later with the FED dance likely to trigger a terminating end diagonal top before the Bradley turn date of May 10th.

left and right stocks are melting down quickly on poor news. I sold my 128/133 call spreads in aapl for a tidy profit at 133.50 today. added puts spreads to my current position in IWM and SPY out 6-8 weeks. with the fear ratio touching 1.24 VXV/VIX, I anticipate a 5-7% pull back from May 10th-May 29th.

here’s another beauty for today : Home Loan Servicing Solutions, Ltd.

HLSS. 71mm shares outstanding. Yesterday. $17.00. today…. 67 cents. maybe now that they are delisted, can we consider HLSS bearish? $1.2billion market cap erased overnight

IMHO, market hasn’t been this dangerous since in nearly a decade maybe since 2000. Pensions funds are severely underfunded. worse than they were after the 2009 bottom despite bond and global stock market run-ups to ATHS

Chicago will be the next major city to go bankrupt. lots of minor ones in between. The average pension fund in Chicago is funded at less than 40%.

Liquidity is absent in bonds and stocks, unless of course you take a 20-60% haircut. then you have liquidity.

Is WYNN in a bear market yet? from over $200 – $116. I anticipate a sell off in may/june, then the buy the dip gang led by Nicolas will nearly retake ATHs before a complete meltdown August-November.

Scott – They held an asset sale and distributed the proceeds to shareholders, approximately $16.613/share. It just didn’t drop 96% in a day.

“Home Loan Servicing Solutions, Ltd. (“HLSS” or the “Company”) (HLSS) announced today that its Board of Directors has declared a liquidating distribution in the aggregate amount of approximately $1.2 billion or $16.613 per share (the “Distribution Amount”). The Distribution Amount represents the net proceeds received by the Company in connection with the sale of substantially all of the Company’s assets pursuant to the Stock and Asset Purchase Agreement with New Residential Investment Corp. entered into and consummated on April 6, 2015, less a cash reserve in the amount of $50 million.”

The peeps today were just waiting for their dividend.

Our resident “genius”, pima canyon, comes to the defense of another “genius”, Steve, stating/asking the question,

_____________________________________________________________

“eh? that’s not obvious to me. How can you make pronouncements about whether another person understands something without asking them about it first? I don’t see where Steve mentioned anything one way or the other about 6 Sigma, so how can you make presumptions about what Steve knows or doesn’t know. And what relevance does that have to the discussion anyway?

pima, if the “relevance” is not glaringly obvious to you, I won’t waste my time explaining since you wouldn’t get it anyway.

______________________________________________

Steve replied,

“Wiser, there is no way you can state with any certainty that the Apr 26 52-week high marks the exact top for AMZN. The stock has gained +50% in just three months and profit taking or a correction should not be unsurprising.”

Steve seems to be confused as well… if as he states, “profit taking or a correction should not be unsurprising” then why on Earth would our resident contra-indicator, Nicolas, buy at precisely the time that “profit taking would not be surprising” after such a large run-up in price?

Only a fool would defend someone buying a top after such a large “50% in just three months” advance.

________________________________________________________________

For anyone else, that already understood the relevance of my post, here is what the contra-indicator wrote:

Nicolas

April 24, 2015

I just bought AMZN at 448.48$. It’s a nice addition to my portfolio.

I think AMZN is still very cheap and should go higher.

what do you think ?

________________________________________

So in response the “What do you think?” I wrote what I thought above…

Here’s an update to that response:

Why only a fool would buy at such a top… after such a large run-up in such a short period of time:

Again, the stock is extremely over bought… this chart, like the other should ring the alarm bell to warn anyone from buying such an over-priced stock!

The 6-Sigma (a 99.99966% probability that price would move NOT HIGHER… BUT LOWER or a 6σ probability of 99.9999998027% probability that price would move lower!

And yet these two fools noted above do not see the relevance of my elicited “What do you think” reply.

Does any of these fools still think loading the bag at $444.48 was a good idea given today’s big red candle on an up day in the market?

I mean after all… “Where is the relevance?” Just buy AMZN on Friday’s surge in price – just turn a blind eye to history! As I said, we are lucky to have such contra-indicators as they sound the alarm for shorting opportunities and/or going long when they’re dissing over sold value plays such as the gold stocks in early November.

Not to mention the fact that it appears to be the tail of a fifth wave, and that the larger ‘c’ wave, which this high is the tail of, is exactly the same length as the ‘a” wave, or that the major indices seem to have topped, most particularly the Nasdaq, which AMZN is a part of … Nope … can’t say with any amount of certainty … 🙂

I won’t even get into cycles, cause there seem to be a number of fairly evenly spaced tops in this chart, which is really cool – thanks, William.

Exactamundo Peter!

Since you commented, the cycle I referred to has to do with the line segments of the Golden Ratio… in this case the sqrt{5}}{2} = 1.6180339887.

Sqrt{5} = 2.236 or 2.236 year cycle. This is the cycle of the Gold:Oil Ratio that correlates to tops in the ratio and bottoms in Oil. On that long-term chart I posted, there are 14 ratio tops during the period from 1983 to 2015…

Spell checker dropped part of the equation…

“sqrt{5}}{2} = 1.6180339887” should have read:

Nice call, hope you bought some putties!!!

“The $ is not a bubble Specie imv,

very clear reasons why the $ is in demand

on a multi year basis.”

Of course one reason that the dollar could be said to be in a bubble is the very crowded (on a historical basis) long trade all with the same expectation that the Fed will taper its 4.5 trillion balance sheet while it raises rates (for the reason that markets are normalizing and the economy is getting stronger)… that despite printing trillions that everyone can hold hands while skipping down fairytale road merrily singing Kumbaya… with no repercussions to be held accountable to.

The fact that just about everyone and his brother believes this utter nonsense is one of the “surprise” or “disappointment” factors that will act as a catalyst for gold to rise and for the crowded long-dollar trade to fall.

As soon as these “geniuses” figure out the Fed is trapped (and has been for a long time), that the Fed will punt on its June rate hike expectations just as the did the last FOMC, then the dollar will sell off.

Meanwhile, we have to patiently wait for these ignoramuses to catch a clue.

The ~$4.5 Trillion FRB Balance Sheet, the fantasy crowd ignores, and to which I refer:

Climbing up 9 Billion in the last 4 consecutive weeks:

The ~$4.5 Trillion FRB Balance Sheet, the fantasy crowd ignores, and to which I refer:

Climbing up over $9 Billion in the last 4 consecutive weeks:

In today’s market action, we saw AAPL fall over a percent after opening at a new all-timer in the wake of its earnings and then reversing to end down over a percent, creating a potential “double top.”

FB and LNKD both fell over a percent.

NFLX, GRPN, TSLA, and GOOG all fell less than a percent.

TWTR was splattered for 18% after its earnings were mistakenly leaked early in the final hour of today’s session, and yes, they lost at the “beat the number” game of lowering the expectations before hand and then releasing a better than expected number afterwards.

The catalyst for the stock market to decline tomorrow could simply be that it runs out of buyers. After all, just about everyone and his brother are expecting the FOMC statement to be dovish and supportive of higher stock prices.

My expectation continues to be (as it was for the last FOMC meeting that the Fed would punt on its April rate hike) that it will too on its June rate hike expectation pushing any potential rate hike out to later this year. But the key here is that when too many people have already made this bet in the short run, then it could be a disappointment when there are no fire works to the upside tomorrow in the stock market.

The S&Ps and Dollar Fantasy crowd appears to be poised to throw a party tomorrow on the expected dovishness…. with so many many bulls leaning long and expecting the Fed to coo tomorrow, this could be a set up for the S&Ps to selloff imo.

As updated from a while ago, after breaking Key Support at 96.32, the dollar has passed the Point of Recognition today… 96.92 becomes critical key resistance for this count to be valid.

The expectation is that Dollar Bugs will see more painful downside with brief periods of consolidation.

Likewise, no surprise, my Euro fx count:

I wrote a week or so ago that I thought EUR/USD would most likely target the 1.14 area.

Good call! Congrats to you. Keep them coming.

STI still on Full Buy – They saved the trigger sell today

Looks like John’s blog being hijacked.

Next step for the hijackers is to siphon interest to their place.

Classic. Who wants to be the next mark?

Peter_ Would you like to come to my place?

300 viewers and the posters on this site are wondering what you are talking about? This is about intellectual exploration pure and simple.

One of the many great joys of this forum is the mutual respect with which participants treat each other. I was therefore quite surprised by William W’s somewhat vitriolic response to Steve and pimaCanyon. Would have been far easier to have explained what you meant by sigma 6 and why that was a ‘near certainty’.

Equally Peter_ responses to a number of comments included unnecessary, in my opinion, negative personal verbiage.

Of course it’s John H’s site and he is the final arbiter of ‘whats right’ but I, as a participant, have a small stake and for one would not like to see this deteriorate further.

Thx

Well said, Purvez.

OK P, maybe just for you – you are just a little too close to the unknown to avoid being hit. Friendly words to the innocent would be pause, think a little broader, and otherwise back off when you do not understand what is happening. Bottom line – beware of becoming an innocent victim beyond this blog, because if you become one you would be only one of many before you. Meanwhile let me prod and poke because I am not your potential problem. If you can pause, think a little broader etc.

PS – but you can tell me if you think I’ve blown my cover.

PPS – you will find my calling card at the otherwise blank space (bar google scripts if you allow them) at http://barestbodkins.blogspot.com/

Otherwise have more of your happy days

I thank you, I thank you

Good Day

A number of people, including myself,

called the Euro higher two weeks ago, so not

sure why some posters appear to be so overexcited.

For me this is a counter trend move as Euro area macro does not support a higher Euro at this point.

On the FED, either one symbolic rate rise in 2015

or they do nothing, that has been my view since

the beginning of this year – would assume it’s shared

by many others.

The looming UK GE is far more exciting than markets

for me atm, 8 days to the vote!.

Phil I’m in the same camp as far as this being a counter trend on the USD. However William W’s target on one of his charts looks about right to me for the USD Index.

I’m resident in the UK, although currently back in my birth country until mid June for some ‘granny minding’. However I have reached a point where I’d rather have NO politicians meddling in my affairs.

Only way the UK election becomes exciting for me is if UKIP end up holding the balance of power then it becomes interesting about which sides want power more than hate them. Hehehe. A bloke can dream eh?

purvez, I am not a UKIP supporter, however Farage

is the only UK politician who has discussed the deficit

with a semblance of truth.

I also support an in/out referendum on EU membership

and agree with overseas aid being cut while we run such

a huge budget deficit.

On defence I would like the UK to cut towards 1% of GDP

along the lines of Germany, we spend approx 2% currently.

We need to accept a new reduced role.

The case for a Trident replacement is also week for me

as the UK could not make any decision on the potential

use of nuclear weapons without US say so.

I would spend more on M15 and M16 budgets to protect

our population at home.

One and only politics related post from me – apologies

about the general off topic nature.

I am not disputing that WW made a good call btw,

just highlighting that a number of others posted similar

thoughts a couple of weeks ago.

I primarily read John’s blog to hear different views,

so a variety of different views is interesting.

Phil I agree this is not the venue for UK politics so I’ll finish by saying I don’t support anyone but like Farage’s idea of putting Britain first and getting out of the EU.

Promise no more UK politics posts here.

Long dax again at 11705. Final top up for the moment. Should be good support at these levels. Expect a rebound to 12000 area shortly. Draghi will have to act quick to stop the appreciation of the Euro or the european recovery will falter even more.

Wow big drop. Completely overdone in my opinion. Picture starting to look less optimistic for the Dax unfortunately. Johns waterfall scenario could be starting but need to see similar sort of action in US indices to confirm

Bunds getting crushed today.

Hope you had a tight stop Krish. I think there is a difference between the Fed and the ECB in the way they are each able to interact with the market. The former appears to have a more direct route to the Stock Market but given the ‘many’ markets in Europe the latter may be more handicapped.

Just some thoughts.

i’m not sure why i keep getting told that the dollar is not in a bubble.

I’ve been around long enough to know that biowrecks and the u.s. dollar are both bubbles that will burst leaving a lot of pain and bewilderment.

the rate of increase, the universal bullishness, the ignorance of fundamentals all confirm that they are bubbles waiting to burst.

Should be lots of fun.

Specie, I think if you take a long-term look at the dollar you’ll see it’s been far higher than where it is today. So at least from that perspective, it doesn’t appear to be a bubble…in the least.

Agree, i see this as wave 4 (sharp) of the bull run, top at least 107 and can run much further in an extended 5th. FWIW in this world of non-influential anti-dollar sentiment.

Specie, the US remains the best of a bad bunch imv,

that is why I think the current $ action is a pause in a longer

term trend.

People have different views, most of us have also seen multiple

cycles.

If you think the $ is a bubble, great stick to that view,

my view is different.

Hi all ! There’s talk of a QE program coming in China. That should help going forward. I recommend to increase exposure to AAPL and QQQ on this small pullback. There’s nothing to worry about: GDP is weak, Chinese economy looks fragile and earnings have not been great so far. So, all this is great news for stocks as central banks should continue to support the markets.

What about the Dax? It’s looking much weaker than other indices and looks like my bullish argument was maybe overdone. Need a 900 point rise to reach previous highs and I don’t see that happening very quickly after today’s action.

LOL deja vu two weeks later… clearly learned nothing.

Asking the one which will give you the answer you want to hear, talking about Draghi Greece nonsense, completely ignoring the charts and the pattern buying the “dips”. Your posts are showing the psychology of a newbie with no clue.

Do you remember what I wrote to you?- obviously not:))

“Next is strong impulse C lower with target 11400-11200”

I am trying to help you and I am telling you again learn to read the charts. Since 2011 it was easy but this period is in a few months over and you will get killed if you continue this way.

I have been burnt trying to read the charts in the past. Everytime the charts show a sell signal I follow only to see a huge rally and the signal proven wrong. This time is looks right. what do your charts say after the drop to this area? Must have a retrace before further falls or a full recovery?

this should be only a correction and we should see another higher high… than a huge correction to 10k probably

as I wrote two weeks ago no need to hurry when you can buy cheaper

“that despite printing trillions that everyone can hold hands while skipping down fairytale road merrily singing Kumbaya… with no repercussions to be held accountable to.” Quote from William Wiser.

Nicolas, i agree that CB QE and share purchases is game changing and am bullish on SM from here because of the equity for debt system that seems to be in place. Although a short term gold bull, see longer term not so good due to tech innovations making AU more of a commodity.

This being said with aging demo, falling real incomes with which to buy equities, etc. wouldn’t the only area that makes any sense be EEM FXI PIN where at least they have rising middle class? And how will your thesis stand up if CB become net sellers and no one else is left to buy? Stocks could lose 80% and not be overpriced on historical norms.

One thing I cant explain is a weak GDP leading to a rise in oil price. Anyone have an explanation?

Partly at least a Dollar effect, Krish. Plus just an oversold bounce. There does look to be another leg down…..all as per EW of course.

Sorry should have qualified that….all as per MY EW count.

Looks like. I would expect US indices to print new highs quite soon if dollar weakness continues. If it reverses we should get a rally in European indices.

Port disruptions and the USD strength took 1.25% from GDP.

i hope you’re keeping track of the timestamps on these posts.

i think you nailed the exact top of Crapple just like you did for IBB

or the bottom for gold for that matter

and don’t try to tell me that you’re serious about these posts

i know you are being facetious and trying to fool and entertain everyone

you’re timing is amazing

I’ve never had so much fun reading posts in a forum

Looks like market setting up for run to another ATH beginning with Fed dovish statement. This should not last long and sell off will begin next week.

Looks like it’s point us toward 2133.

geno, Valley, I would like to propose the following alternative count since the late Feb high:

3 waver down to 11/12 Mar – wA

3 waver up to 23 Mar – wa of wB

3 waver down to 26 Mar – wb of wB

5 waver up to 27 Apr – wc of wB tto complete an expanded flat.

So now we are starting wC down which should be a 5 waver. My target is at least 11/12 Mar low but probably a bit lower. At that point we re-evaluate. I have a bigger down wave count too

Yeah, I would look for the .618 extension for the C wave though. SP-500 like the 3 wave to extend, not equal.

1.618 extension (.618 extension was a typo, my apologies.)

I have zero brain cells for EW. Sounds right. Lot of room on downside in next few weeks imo. Worried today could be a three day sell off of some size if Fed disappoints. Worried because I will probably go long at the announcement based upon seasonal patterns.

M2 velocity still flat on its back – amazing.

http://research.stlouisfed.org/fred2/series/M2V

It is starting to look like Delta stocks L-2 will be a high instead of a low this October (no Inversion). The Dollar down until then and energy up to then means rising stocks until then given current “market conditions”. Note that the USD was recently at all time greatest net shorts by Commercials and, thereby, at all time greatest net longs of foreign currencies.

Hi Valley ! Yes, this is my argument. Central banks directly buying stocks and companies borrowing at 0% to buy back their shares is really a game changer.

Of course, if central banks begin to raise rates and stop buying assets, everything will go down quickly.

I’ve been a big bear on gold but to be honest I don’t know what to think anymore. Central banks could short gold if it gets too high, but at the same time if commodities rebound gold should go along with the ride.

regards

Nicolas, Newt was right about you all the time. You are one very ‘clever’ dude.

Your ‘apparent’ CBs wins all stance was ‘correct’ for its time and place but the fact that you understand it’s ability to change moves you from ‘one tract mind’ to ‘clever’ in a single swoop.

I’m about to start paying more attention to your posts. Not saying will follow everything you say but certainly much more attention.

🙂

Krish, the DAX needs to be viewed within the context of

the Euro surely.

ECB QE is tiny within the context of Euro area QE,

delivering a lower Euro was the rational.

Yes I haven’t looked at this too well. I will try and exit my dax positions at break even and reassess.

Krish, do you have an alternative exit plan if it continues to deteriorate?

Within the context of Euro area GDP, that should have read.

This Northern Hemisphere Summer could be one of Commodity Inflation with stock sector rotation to commodities and large cap stocks (multi-nationals) as the Dollar falls. This would support a Rising Wedge for US major stock indexes to this Fall.

Today, Sun Spot numbers are rapidly going to Zero. With QEs being the “gift that keeps on giving” it may be the final “gift” of QEs to Commodities this Summer as the final move up in major stock indexes to “The Top” and crash to follow.

Right hear and now what is the least expected? The ATH in stocks and a crash? No. What is “least expected” is Commodity Inflation.

Today, Crude is breaking out to the upside of its recent two week consolation.