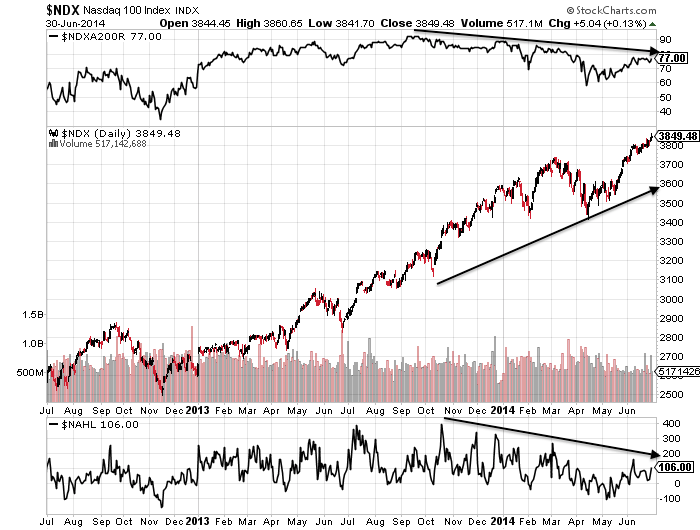

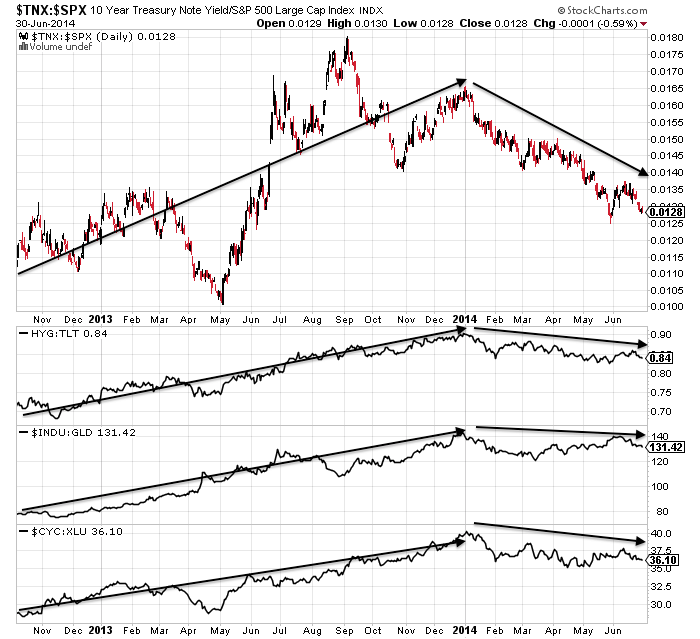

By the end of 2013 we saw various divergences emerge that warned of a potential trend change ahead, and still do:

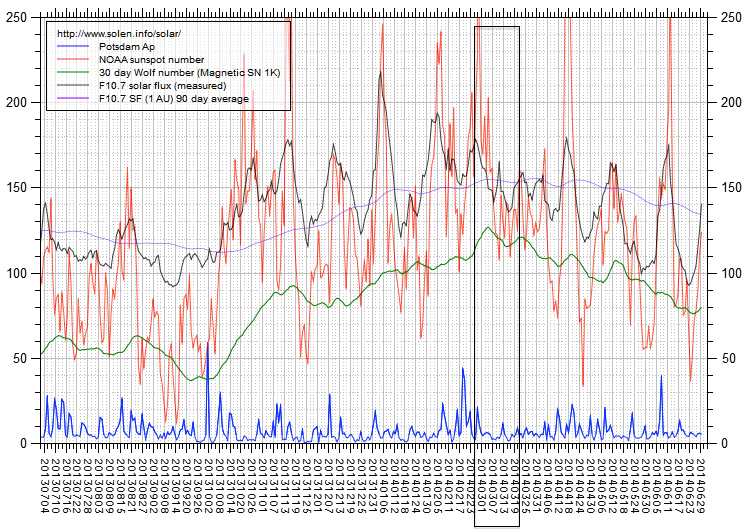

The first major peak point occurred at the turn of the year, around the 2 Jan new moon and at the inverted seasonal geomagnetism peak (i.e twin optimism peaks), as these charts show:

The first major peak point occurred at the turn of the year, around the 2 Jan new moon and at the inverted seasonal geomagnetism peak (i.e twin optimism peaks), as these charts show:

There were inversions at this point in different assets and sectors, and the Nikkei peaked-to-date 31 Dec. Various risk-off, defensive and late cyclical assets and sectors have been the dominant money flow targets since then.

There were inversions at this point in different assets and sectors, and the Nikkei peaked-to-date 31 Dec. Various risk-off, defensive and late cyclical assets and sectors have been the dominant money flow targets since then.

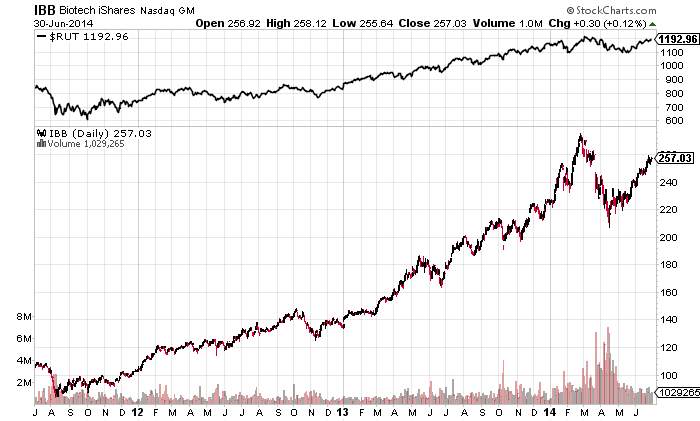

The second major peak was the central peak: where the solar maximum, margin debt and the speculative-targets of RUT, IBB and COMPQ likely made aligned tops, close to the 2 Mar new moon optimism peak:

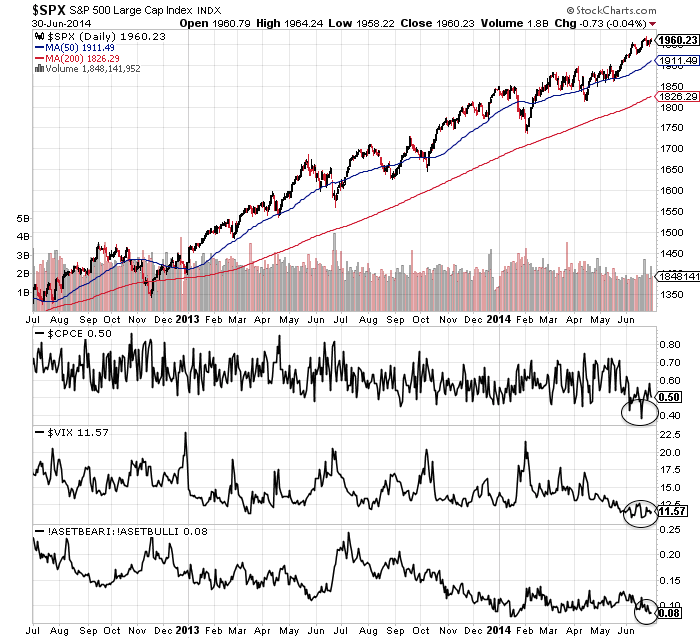

The third peak, I believe, occurred at the end of June, close to the 27 June new moon optimism peak and the mid-year inverted geomagnetism seasonal peak (again, twin optimism peaks), to complete the topping process:

Indicators showing the three peaks:

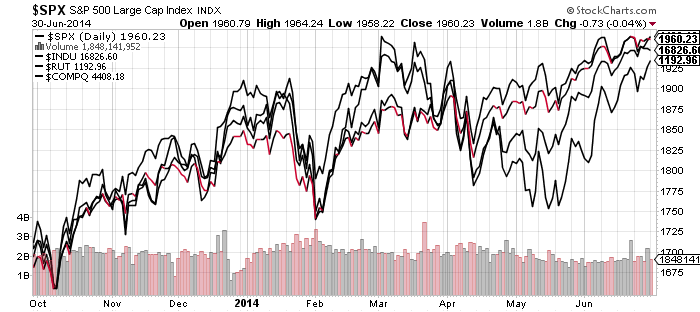

The four main US indices aggregated also show the three peaks:

The four main US indices aggregated also show the three peaks:

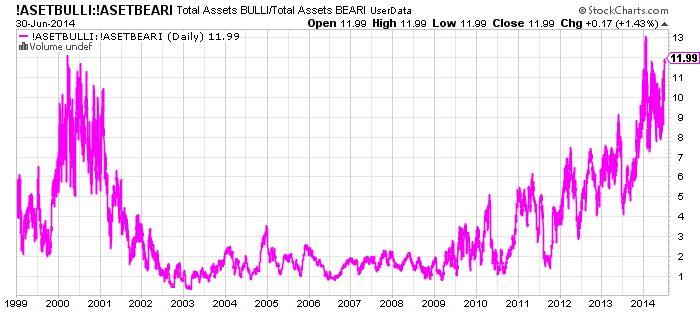

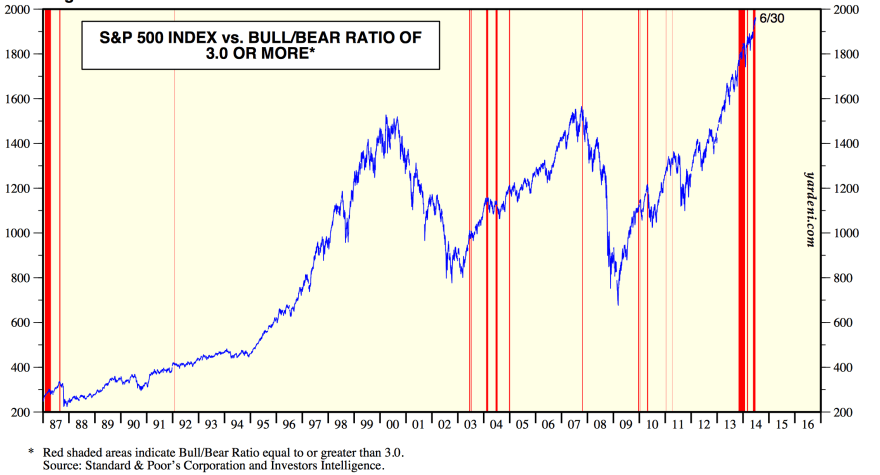

And this echoes what happened in 2000, where there was a first peak around the turn of the year (real Dow, Nikkei and FTSE all peaked 31 Dec), a second central peak around March (hot sectors, margin debt and smoothed solar maximum), and a third and final peak around August: So could stocks then run higher yet and postpone the final peak until late summer or even further out? I can’t rule it out, and it is the main threat to my positions: greater drawdown before it swings definitively my way. However, the trend in leverage suggests further price gains from here are unlikely. The COMPQ is at a suitable double top, whilst the RUT and IBB should make lower highs here to honour the Feb/Mar central peak. Various indicators are stretched to levels that are suggestive of ‘all-in’ or imminent reversal. We have mature divergences seeking satisfaction and fundamental doubts through Q1 GDP, negative economic surprises and Q2 earnings warnings.

So could stocks then run higher yet and postpone the final peak until late summer or even further out? I can’t rule it out, and it is the main threat to my positions: greater drawdown before it swings definitively my way. However, the trend in leverage suggests further price gains from here are unlikely. The COMPQ is at a suitable double top, whilst the RUT and IBB should make lower highs here to honour the Feb/Mar central peak. Various indicators are stretched to levels that are suggestive of ‘all-in’ or imminent reversal. We have mature divergences seeking satisfaction and fundamental doubts through Q1 GDP, negative economic surprises and Q2 earnings warnings.

The bull case: low rates, benign leading indicators, cumulative-advance declines. But the rhyme with 1937 is still very applicable here in my view. Low rates and a/d breadth accompanied stocks to a high overvaluation peak, like today, front-running a return to normal growth and earnings that didn’t happen, and peaking out with the solar maximum. Q1 GDP has gone some way to puncturing that normalisation assumption again, adding to the other factors being in place. Earnings season could now add to that. Once stocks fall, the wealth effect from a rising equity market will evaporate, helping tip the fragile economy over, as it did in 1937.

I am long steel… mostly because you sir must surely have a horde of it lining your spine… so impressive. Courageous! And you just may be right…

Excellent analysis again John.

Taking on board several different analyses my take is that we may grind up to another high on the Dow, 17k is not that far away & when you’re within 1% of it, can’t but help think it’ll get tagged before a drop.

I expect Q2 earnings to disappoint, various geopolitical events waiting to explode ( Ukraine, Iraq) & there could be a surprise which will make this market drop.

Like you, my issue is managing my short position in the event we keep grinding higher so have a partial long to hedge short position.

Will be interesting to see if we stay positive in the run up to 4 July.

Looks spot on. 17k is coming. Shame i added a small short yesterday. Was biding my time and looked like rolling down but seems to always pop when I short. At least I’m confident we are near a short term top.

Thanks John for all your hard work which we are privileged to read for free!!! Just wanted to post a technical chart on the Nasdaq Futures which is currently testing a crucial level on the daily. http://www.screencast.com/t/yqtmo0e1M

shame on us who are short. I guess we are clueless what central bank can do or are dong. trying to justify my bad decision is definitely a widow maker trade. Man realizing this in real time.

I am very surprised by how adamant John is in not acknowledging central bank role. There is not point in being right after sp500 hits 2100 and you get 10 percent decline.

The Russell within a few points of another new

high – bulls look in full control currently.

This top is impressive and for now it looks like all bears are squeezed. I think we are witnessing final crescendo of this bull market. My bet is correction now and then one more top in S&P 1980-1990 range in 2nd half of July. Change of the trend can be quite dramatic afterwards

I went long today in the morning (Europe) as I had a magic buy signal, well, it’s not that magic, plenty of long signals if you look at any trend following system, even retracement to daily 20ema worked. This is why the market goes up fast, all bulls see buy signals;) Is the Dow going to close above 17k today? I will buy myself a new sofa to see even more clearly:)

If anybody is late and affraid to buy : the DAX may play the catch up tomorrow

Yes quite surprised by the dax lagging so much. Or maybe the Dow is overdone… I don’t believe today’s rise is warranted though. It’s more the bulls wanting to hit that 17k which they have done now. I think we are looking at 5% potential upside versus 15% potential downside so being long is definitely the most risky option at this point.

Yellen the Bubble loves inflate everythings with no limits

market cap/GNP at 125% and growing (fast).

Earnings compression is needed before any

dramatic % declines(20% plus).

The FED is running a near $4 Trillion balance sheet,

what, what was their 1937 position?

We look to have near ideal correction conditions,

however bears have continually been unable to

gain traction over recent months.

Don’t be upset, bears. The bull market still has a long way to go. It’s never late to change your position and go long.

Maybe, but US FED-Market is the most expensive on the planet.

The markets are soaring today, and that is not a surprise at all. The FED always keeps the markets up as a feeling good gesture before the Independence day weekend. In this highly manipulated environment, I will not be surprised to see the Dow hit 17000 or higher before the corrections.

Based on John’s analysis, the correction is imminent and unavoidable. I don’t think John is completely ignoring the FED factor. We all know that the FED plays a crucial role manipulating the markets, but they still could never prevent the crashes/corrections in 1937, 1972, 2001, 2008…etc. to name a few.

SoS. This week is a perfect opportunity to go short. IMHO

Erick,

was the FED unified as they are today across globe. Dont you think it dramatically changed after 2008. anything older than 2008 that is just nonsense to believe in.

Bill: I agree with you that the FED has changed dramatically after the fall in 2008. However, while they are capable of stretching or delaying the cycles, there is no way that they can completely remove the cycle highs/lows. I think it is just a matter of time that the correction will happen, and the fall may be quite deep since the cycle low has been stretched out beyond any measurement.

I am mostly in the bull camp the past 5 years, but I am turning bear since April. Very much appreciated John’s work and his tenacity. I have no doubt that the bears will be rewarded handsomely sooner than later despite the pain they are going through right now.

On another note, John’s analyses over the past month spell out very clearly that the correction is imminent. I think after this week, there is not much/ nothing else for the FED to keep these markets up and the markets shall start, at a minimum, a healthy summer decline between 10%-20%, or better yet, a spectacular fall between 20%-40% from the current highs. IMHO the correction could start as soon as the full moon 07/12.

Erik, would agree completely.

The FED can alter the business cycle,

they can not abolish it.

They are not omnipotent.

When earnings come under pressure

with the onset of the next recession,

then we have major declines.

Significant corrections can occur

before the business cycle turns.

Ditto. Agreed with you Phil. Q2 earnings would be the key. These markets are on the verge of declining but dumb money keeps pouring in. I’ve found this amusing and sad at the same time. Stock market with high level of manipulation is no longer a real market. It is just simple a market of stocks, a big casino won by those who set the rules.

Forget July 4th, load up new shorts if USA gets knocked out tonight by Belgium.

All logic has now gone, total shameless greed has taken over, bankers are now picking up penny’s in front of a fast moving steam rollers.

When the music stops they will say the same as they did at the last crash/crunch to get off , but this time I doubt the 98% of the worlds population who suffered for the 2% will let them off as lightly as they did before.

This is a rogue game. The banksters know who is short and how much : the brokers rat the bears out. As much as playing poker at BetandWin where strangely no player bluffs, your opponent is dealt two aces two times in a row, and even with straight flush you win nothing, BEACUSE the others know your cards. If only one player is a BetandWin player, nobdy has a chance. If only one player has two nicks at the table, nobody else has a chance. They own media. They infect your mind. All those cycles, models, fundamentals, where did you get that from? who gave it to you? I’ve got something what’s mine : ignorance.

Bradley turn date mid of July, I would think you are a fool to be short until then the way this is going now. But even then I wouldn’t bet much.

Disagree Don,

This market will drop like a proverbial if a surprise event occurs. Problem the bears have is the grind to new highs in the absence of this / these events.

Once a drop starts it’s very difficult to buy into it psychologically or it is for me. Stops become very wide if you’re wrong.

Money & risk management is the key to make sure we’re still in the game when it starts to go our way, if you’re a bear that is.

At this point, I think the Feb capital plus the dumb money from innocent retailers are poured into this highly and beyond belief manipulated markets. The smart money already left. Big boys already took the profits and are sitting nicely on the sidelines.

The big boys know how to suck in more pennies for the last time before dropping this thing down. If so, the window of escape is quite small imho.

Markets are long overdue for a healthy summer corrections or a potential market crash to correct the over valuation.

Erick,

Who is this big boys you are refering. FED holds more than 4.1 trln dollar of assets. why would they sell

HI Bill. I am referring into the big banks. Major manipulation by the big banks the past 2 years. Take gold / silver as an example. The reason why gold/silver are in this deep of the bear market is because of the big banks’ manipulation. The manipulation normally takes place when big banks sell gold/silver overnight before the US market opening.

I’ve seen major liquidity leaking from equities back to precious metals since the end of May, which may signal that the equity market is very close to top out, very similar to 2000/2001. On the other hand, gold is finally breaking out of the 3 year bear. IMHO gold will rise from here and will not look back. It is the new secular bull market for precious metals in the making.

Nobody can predict when the crash will take place. It could be imminent, or Sep/Oct 2014, or Jan 2015. I think it will be an epic crash, as the rubber band US equity market has been stretched beyond any imagination. Just my two cents.

Erick,

good points but I still don’t fully understand.appreciate your detailed answers –

1. Liquidity leaking into metal – how do you know that ???

2. if you crash the system what happens to pension funds and other liablity funds. everybody wants return and cant get it anywhere else. If you get a 20 percent decline..will the FED be sitting quite. Do you really believe FED will let it go there. Didn’t FED say stock market is indicator of how good they are doing. It might run up to 2250 and then correct to 1900. that doesn’t count. John has been wrong from 1850 sp500.

Bill. IMHO the liquidity leaking from equity to PMs is evidenced by the fact that The Dow and SPX keep hitting new highs after new highs on historical low volume, while GLD/SIL creeping out of the 3 year low on historical high volume. Besides, a sell on strength and Buy on Weakness ratio also suggests the institution reallocation from equities to PMs.

I think the bull trend is still very strong and buy on dips mentality is still on going as evidenced in historical low VIX around 10-11. Once the sell off takes place and the markets dip low enough where fear and panic selling finally set in, I don’t think there is anything else the FED could do to keep this thing up forever. I would really doubt that they would risk reversing the QE strategy just to keep this artificial market up.

There is impossible to predict if they could run SPX up to 2250, but 2000 is within reach, maybe when the employment report released on Thursday. If so, it would be the fastest 100 point rise ever in history I believe, as SPX takes only 5 weeks to get from 1900 to 2000.

Personally I don’t believe in parabolic rise. The snap back to the 50 DMA is inevitable IMHO.

I concur with the above posts I.e.

A good week to add to shorts

Something as innocuous as the US getting knocked out of the World Cup will cause the markets to drop.

Whatever the fed is or isn’t doing, they’re bright enough to give the market & media what it wants, a correction, though will they be able to contain it.

My question is, if the Dow starts a correction next week say, is there a likelihood of a dead cat / second chance bounce? As other indices appear to be doing?

I’d appreciate views of John & others more technically & historically astute than myself

Thanks

Here’s a scary thought, expect the unexpected, USA wins the World Cup!

Where would the indices go then?

Great play by US so far.

Keep dreaming; US was sent home yesterday. The cup will go to Europe!

Disclosure : I’m Dutch

I strongly believe that John’s predictions were right along since many months.

An article from Tyler Durden from ZeroHedge explains why the stocks keep going higher.

“VIX-Manipulating HFT Algo Is Booted From Dark Pool, Exposed For Whole World To See”

http://www.zerohedge.com/news/2014-07-01/vix-manipulating-hft-algo-booted-dark-pool-exposed-whole-world-see

Yes, I think the Fed and or their agents have been using the VIX – VXX – TVIX HFT algo to sell volatility in the dark. This enables the other bots to run their buy programs and holds the mysterious bid under the market. Now that some of the dark pool is being shut down and the HFT algo is out in the open for all to see, I think the fed and their agents will have to eventually stop that plank of their levitation magic plan. The VIX recently skipped a very established cycle. It will be paid back eventually.

Today we hit the measured move/fib resistance and printed a gravestone doji on the 4 hour chart.

FWIW.

I admire the determination and resolve of the bears out here.

I am a ‘Nimo’ in a pacific ocean, I can barely make the wave splash so I tend to swim under the ‘sharks’ and ‘whales’ of the ocean. This way I will not get easily swept away. I see fellow small fishes like myself on this website, but like to swim against the current.

I wonder why?

Small fishes want to feel like sharks, they are happy to pay the price for that feeling. Isn’t it the same when it comes to women? To pay for beauty? This is men’s genetic flaw and as I wrote some time ago, women should in theory be better at trading : no ego trips, respect for the stronger (women know how to subordinate themselves) less abstract thinking = more pattern recognition and so on. On the other hand trading means non-conformism and courage, confidence – this is not women at all, that’s why there is so little female traders out there.

Is this why male trader like zerohedge.com, gold, and shorting. And women likes Warren Buffett and reads risk management 101?

Probably yes, men think this is an intellectual game and try to outsmart the market, this is why they want to be the first to catch the top, bottom, a move : if they don’t, they think it’s too late or too easy to profit from a move which has started without them calling the start before the start. They think so because they are intelectuals by nature and want to predict the future. While predicting doesn’t work, as Linda Raschke said, trading is about consistency, not brilliance. j. Livermore said ‘sitting made my millions, not thinking’. So men apply those models, cycles, Elliots, well it doesn’t work, so they try to fit their abstract theories by force. They believe in them so much that they don’t see that their models don’t predict anything. In the end they look for excuses : what is distorting their cycle, their forecast, their theories and timing. They believe religiously in their timing, it must be so, as they spent whole two days to arrive at a conclusion. While women, if somehow they manage to get into the world of trading, the nature is on their side : patience, respect, caution, reliance on practical tools that work. Is this why men like zerohedge? I don’t know for sure, I don’t read that. On the other hand, 97% of what you can read out there about the markets (including Gann) is pure BS, written by ignorants and losers, or purposely distributed by sharks, who love the keep the small fishes in the dark.

despe906, please show some respects to other people’s hard work. this is a precious window to watch the real world. don’t be an annoying boy and destroy it.

Similar view

http://www.forbes.com/sites/jessecolombo/2014/07/01/these-23-charts-prove-that-stocks-are-heading-for-a-devastating-crash/

Great article. Thanks! Confirming the points that John has been making during the past few months.

Scenario #1: After several more years of the bubble-driven economic recovery, the Federal Reserve has a “Mission Accomplished” moment and eventually increases the Fed Funds rate (after it ends its QE3 program this year), which pops the post-2009 bubbles that were created by stimulative monetary conditions in the first place. Rising interest rates are what ended the 2003-2007 bubble, which led to the Global Financial Crisis.

Scenario #2: The Fed loses control of longer-term interest rates after investors sell their Treasury bond holdings en masse in fear of a sharp decline in the U.S. dollar’s value after years of money printing.

despe,

good post..really very good post..so what works is the question. Buy XIV with a ATR stop when market is non mean reverting.

“Economists” and Fed still insist p/e ratios are justified. This rally will not stop until Nasdaq breaks 2000 peak. For some disturbing reason, the consensus seems to be that a bubble isn’t a bubble until it’s bigger than all previous bubbles. I am reluctantly considering buying the next dip, since the bubble inflators keep winning over the skeptics. Perhaps the unusual solar activity (mini max) is a poor predictor this cycle, causing psychology to zig when historically it zags.

Nobody in this world really understands the Sun. It’s likely that a few smart solar scientists are watching stock markets closely in order to forecast the solar activity maximum.

The sun has been worshipped for thousands of years. But then so has the male phallic. In fact i’ve probably made more decisions following my phallic than i have based on the weather. Particularly as i live in QLD where its sunny 95% of the year.

In a world of misinformation we all become expert Apophenians in astrology, numerology, cycle analysis, sentiment……….just saying, the human mind and soul strives for meaning, purpose and truth.

I’m suggesting a swing lower into the 7th July. Well actually my Phallic is just pointing downwards.

As of tonight (currently 10PM EST) almost all the currencies (against the dollar) have done what appears to be one complete Elliottwave down (wave 1). So, they’ve resumed their downtrends (GBP still has to top).

They all need to retrace 62% and then we’re into wave 3, which hopefully will drag down the US market.

The final trigger, of course, the solar max. Amazing.

Imagine that, if asked ‘how did you make money in the markets’, Gann replies ‘well, I was struggling for 10 years in trading, looking for something logical that could predict the market’s behaviour, so that we make money easily by applying a science. I found nothing. I made money by trading double tops and bottoms, nothing special, I resorted to some technical patterns that worked for me’. So Gann goes down the history drain as an opportunistic trader who was eventually forced by the market to give up science.

But if Gann replies like this ‘For the past ten years I have devoted my entire time and attention to the speculative markets. Like many others, I lost thousands of dollars. Finally, I discovered that the law of vibration enabled me to accurately determine the exact points at which stocks or commodities should rise and fall within a given time. My forecasting methods are based on geometry, astronomy and astrology, and ancient mathematics.” In result, Gann is elevated to the status of master market scientist – as millions of suckers strive for a science that could curb the market’s behaviour.

Like between teenagers : ‘show me how did you do that’, – ‘well you know, it’s not that easy, first you need to know this, then that…and finally you may be able to do what I do”.

Gann says : you must be intelligent enough to understand what I do, and even if you do understand, I am still ahead, because I am the creator of a science.

I don’t know if I am right or not, my bet is that in Gann’s work there is 80% of ego, 20% of applicable knowledge.

I don’t know either if I am right saying that men are intellectuals, therefore they want to outsmart the market by predicting the future. I don’t know, because I started by jumping into deep water without reading about the market and I never wanted to predict the future price levels. I found the mania of calling tops and bottoms later, when I started to look at what others write. So the big possibility is that top/bottom picking mania is something that has been inspired into the market participants, that it doesn’t necessarily come form their nature.

Nobody should listen to anybody, pick a simple tool, pick one market, rely on your senses. The rule is this : more I know, less I see and perceive. So that if losers are perpetually looking for food for thought, smart individuals should appreciate to look for emetics to clear up their minds.

Is the cup going to Europe? Is Shakira can beat J Lo&Pitbull, Colombia can beat Brasil. And let’s not forget about amazing Rich Coast 🙂

+1 🙂

Apparently NASA have developed a super elastic rubber for some of the weather balloons they are testing at high altitudes. However turned out they didn’t require it as new technology made it redundant. Anyway they sold the new rubber to Ben Bernanke a few years ago and that explains everything….

I can see the broader point despe is making.

There are so many professional commentators who

have called “the top” over the past year, only then

to make subsequent adjustments to their models.

In many cases there are so many adjustments made

as each new target is taken out that is borders on

the ridiculous.

John is kind enough to share his views and work

without charge, however when the waterfall declines

failed to happen and then new DJI high was made,

there were clear warning signs that this may develop

differently.

I can see the logic and reasoning for an imminent

market correction, however it’s price action and timing

that determines how good a call is IMV.

If anybody likes conspiracies : why all have heard about Gann, but only some about Wyckoff? Gann could polish Wyckoff shoes. Everybody knows Einstein, some know Tesla. Einstain could polish Tesla’s shoes.

The point being that the big players can stretch the market as far as they need to wipe out the small guys. Hell they know where your stops are.

Around the time of his deportation to Italy, mobster Lucky Luciano granted an interview in which he described a visit to the floor of the New York Stock Exchange. After he visited the floor of the NYSE someone explained to him the role of the floor specialist, he commented, “A terrible thing happened. I realized I’d joined the wrong mob.”

Like i keep saying the market isnt some mystical sentiment and cycle following entity its a method of distributing wealth back to the rich.

There is ofcourse a known code which the insiders follow.

Like the magic number ‘3’. Three impulses, then correction. Three retests then continuation. Three fake-outs, then the break out.

Dow 17k blown away by the futures.

Yep today is make or break for me. I can’t hold my positions much longer as nearly out of funds. Shame if I have to shut out but will re-enter when I can. Good luck to all those still holding.

GBP/JPY breaks out to the upside after 6 months consolidation. There is good upside potential. Trend followers should look for signals and profit.

As per Nadeem Walayat’s last comment, there should be a good number of stops between 17000 and 17040 in the Dow, so the market may propel higher than that.

DAX over 10k atm.

Forget hurricane Arthur, how about hurricanes Greenspan, Bernanke, and Yellen. I believe this explains the reason this market just keeps going up in spite of all the extremely bearish indicators John has so elegantly elucidated. It is as if we know all the points of the tide. Regular to extreme neap and spring tides all marked out on the beach. We have it all correlated with with the phases of the moon, maybe even the sun. The waves had hit the old highs and just keep going. The excessive money creation is the hurricane that is pushing the waves onto the roads beyond the dunes. Hamilton Bolton of the fantastic Bank Credit Analyst (1949) was the first to use flows of credit in the banking system to predict the market. It still works but anticipation has changed the timing a lot. Everybody seems to know about it. G0 to http://www.mcoscillator.com to see the incredible correlation between the FED’s balance sheet and the stock market. Basically the stock market does best when the FED is flooding money into a weak economy. The money mainly goes into stocks and bonds as now. Then the market tops out as the FED restricts credit into a strong economy, coming soon. The profligate creation would indicate a tsunami is possible, the tide is sucked out far beyond any low tides.

PS What comes after 3 peaks? A domed house! 3 peaks and a domed house comes from George Lindsay, a great stock market prognosticator of the past. His stuff seems to have been overwhelmed by the hurricanes as well. There were several earlier indications that we were topping. Even hurricanes have eyes and opposite wind directions as they pass over which would seem likely here. In fact, one view is that a lot of Lindsay’s indicators arecalling for a top now.

Bearish indicators are for newsletter writers to make money, not for traders. When the market is topping, it’s highly probable, but not for sure, that some bearish indicators have already showed up. However, when bearish indicators are showing up, does that mean the market will top very soon? Yes, at a 50% chance. This is something like the relationship between cloudy weather and rainy weather.

I had a dream last night. A deejay waving a flag with two horns at a peak of 17100 feet.

I had the same dream too… but deejay was waving ‘his’ flag

This is panning out just as I thought. As per above. Macro news still surprises to the upside. Steady to the end of the quarter then a rally up to the reporting season start on the 5th July.

To take the market move of the 2010 high …..2004 equivalent on SPX …..then there is possibly more to go, but I have sold 1960, 1971 and I will sell again above 1984.

Good luck to all.

Will,

You might be right we might get some correction. But what if its a blow off top. till end of the year. I think biggest flaw in Johns theory is it based on historical extremes which can still register more extreme reading. and there is no understanding of central bank roles.

Bill

I feel like a huge idiot for believing the bear theory. What worries me is that I still believe it.

bill, I am not sure the FED wants that.

It may suit them to introduce a little more risk premium

to equities as this will helps cap any significant

rise in longer term US rates.

You could see higher levels from here,

however a 6 month parabolic phase is less likely.

Just my take.

I am hoping or praying for a dip back 1800 and then it might go up again. So mad to believe this bullshit theory proposed by John. I am more annoyed that a intellectual person like him has totally sidelined CB’s money injection.

It’s better to learn and grow than dwell on the past. I believe this site has a disclaimer at the front page “Never Investment Advice”

I am not eschewing John’s theory ….but I am not trading for it.

I was short at 1890 for a while based on a year 2 press cycle rhyme but as I have said all along the second term should be stronger. The drop in jan synced with 2010 and by time it tried to top , the same in week 14 like in 2010 but the price was too low. So I bought it back.

just to match 2010 the market should have peaked at approx 2000. so prob more this time.

Then a retracement. I have not questioned Johns view on here because I have too much respect for him but I think he will be correct in the end in 2015. Year 7.

Like 1987, 2000 and 2007. ……all year 7.

i do think though that if we run up too far…….say to 2050 in the next week or two then a crash is possible.

For now I’m going for a normal move at this stage in cycle.

7 eh? 2015 eh? Here’s something I mentioned a couple of years ago-

When the US markets reopened after the 9/11 attacks on 17 September (Rosh Hashanah) the Dow lost 700 points (7%). 7 years later on 29 September 2008 (also Rosh Hashanah) it lost 777 points (7%). 7 years after that will be 13 September 2015 (Rosh Hashanah again). The nearest trading day will be 11 September 2015…

Bill, it’s unfair to blame John’s thoughts for your loss. John did his homework very well. I think he has a good chance to be right in the long run, maybe slightly more than 50%. But if someone just want to copy John’s homework and make fast money, the winning chance would be falling greatly below 50%. So, blame yourself for the bad luck.

I believe John’s analysis

It’s short time, After July or Fall

^.^

The whole issue is that there are more natural influences on mood than just solar activity. The most important one being gravitation. The big advantage of gravitation is that it is totally predictable, up to a specific day (even intraday).

So I think John is correct in his theory that electricity – caused by the sun – affects human mood. So does magnetism. But John’s timing would improve – in my humble opinion – when he includes graviation in his analysis.

This week gravitation was going down, so the markets went up. Tomorrow will see an inversion, so European markets will top out. Then it will be down next week into 13/14 july.

After that I expect one more run up into august 4th, based on the apogee/perigee movement. The moon will have it greatest distance from earth on july 28th. After that a short tidal cycle shifts the top to august 4th.

Glad you asked; yes, 2007 was a year with an extreme apogee, just as 2014.

The apogee/perigee table is on the net, so you can check for your self. Whithin this table you will find long multi year cycles, and multi month cycles. Beneath that I have my tidal cycles from multi week to multi day.

Probably nobody wants to be preached like this, but bears don’t worry. I was wiped out in 2003 : I overtraded in options while I was caught by a range contraction. This is why I am so ‘smart’ today, and cannot imagine trading without the concept of range contraction/range extension which is still widely ignored. Nial Fuller, a pro technical trader (14 years trading), wanted to short gold testing above 1280 in mid June. I thought ‘ouch’, range is extending, no way this could be a winner. So being wiped out or having a big loss is THE BEST lesson the market can teach you. As in ‘Big Shar’ movie : a highly motivated newbie wants to become a poker master and keeps annoying Big Shar so that he gives him all his knowledge. In the end Big Shar gives him a lesson : the newbie loses twice as much as he owns in a big game he dreams about (he has borrowed money to get into the game).

Despe906, thanks for the example.

“Give a man a fish he will live for a day”, “Teach him how to fish properly, he will live for a lifetime”.

i hold 55% “TPINX”

http://stockcharts.com/h-sc/ui?s=TPINX&p=D&st=1989-01-01&en=1949-01-01&id=p63397464788

45% cash, will buy follow MSCI Fund ,after stock fall

so I believe John’s analysis.

This is one of the best discussion boards for sure…. There are doubters of John’s theory, which I think is very healthy for discussion sake. But let’s please give John and ourselves a little more time, say until Sep/Oct 2014 before we jump into the conclusion that his work is invalid. Don’t forget the fact that Dow at 17000 and SPX at 2000 is long anticipated. These peaks are not surprise at all, so when we are finally here at the peak, why panic and doubt ourselves? The fall will be epic just like 2001 or 2008. Just like everything else in life, what goes up must come down. And in this case, the markets will come down hard. The US hiring is gaining steam because more part-timers get hired. Cost of living is up the roof. Corporations are buying back shares instead of reinvestment….etc. More than enough evidence that the economy is recovering, but not at the same level of the stock market.

In my opinion, all the technical indicators and solar cycles presented by John are all valid. It is just a matter of time that his great work will be validated.

John,

Thanks again for sharing your thoughts and providing a forum for free for other people to discuss and debate. There are so many free riders in this world. They are too lazy to think, or they just don’t know how to think. What they want is to take a free ride and make some easy money. But If they fail, they would say harsh words to the generous driver. This is mean and ignoble, but this is also called human nature. So, John, please just forgive all the unfair/wrong comments and keep this forum open. Those comments have their unique value: we would know more about thoughts of real losers. Those comments are workable indicators.

agree +1

OK, I am out of the Dow at 17067. I am not going to pay rollover fees over the long weekend.

“Except in unusual circumstances, get in the habit of taking your profit too soon. Don’t torment yourself if a trade continues winning without you. Chances are it won’t continue long. If it does, console yourself by thinking of all the times when liquidating early reserved gains that you would have otherwise lost.”

http://www.tischendorf.com/2009/12/20/linda-bradford-raschke-50-time-tested-classic-stock-trading-rules/

I continue to follow USD YEN. Bearish triangle seems complete today with a E position in place. The rest should fall in place from here. Biotech is hitting a 2013 trend line which should repel further advance. Earnings season should support downside as it has done twice this year. Anecdotal evidence of a top is people start talking targets in 2000s same as they did with Gold in 2011. Same speculative forces at work. Different underlying. Similar downside force expected. A little more patience needed but almost there 🙂

It’s probably too early to speculate about the direction, but it feels like USD/JPY may follow GBP/JPY and break to the upside.

Wise, Pegasus. On the USD/Yen monthly chart, the trend-following indicators (e.g. MACD, TSI, etc) already crossed down, but the price action tends to lag on these long-term indicators.

Moreover: “What Does the Collapse of JPY/USD Volatility Mean for the VIX?”

http://gavekal.blogspot.ca/2014/07/what-does-collapse-of-jpyusd-volatility.html

For those who are not comfortable with the general stock market, metal miners now have a better risk/reward ratio. Base metals (DBB) and nonferrous metals ($DJUSNF) are breaking out, gold/silver miners also appear to be following within this group.

Last but not least, many thanks for John’s sharing.

Despe makes some good points in a rather condescending way. The way I see this is that there are different types of people on here discussing the market from different perspectives. Despe is “out at 17067” – he is looking at this from a trading perspective, others are looking for long term clues for long term activities and I get the feeling that some are academics where research and patterns and history are more important than making money per se.

I separate trading and investing. One of them is shorter term, the other much longer term. I would never use solar activity, full moons and history to trade, but I am interested in this site from a longer point perspective, demographics and overviews of margin debt and so on are things I like to look at.

What I do have a problem with is people like Despe who actually spend their time on here for some reason displaying derision for the content here. In my 23 years of experience in markets, this type of person is usually someone who couldn’t make money selling water to a greenhouse owner in the desert. My advice to him is that if he is not interested in the content here then he should disappear ASAP. Even if he doesn’t agree he is not interested in debating but rather just pours scorn on the site he spends considerable time on…..doesn’t make sense to me?

J

Jegesmart, I didn’t mean to offend anybody. I do believe in solar cycles, lunar cycles and even demografics, but I don’t agree with some trading/investing techniques. I have a different opinion and I will not pretend I don’t have it. As to my time: trading is a lonely business and often boring, I try to find an activity other than looking at the trees out the window and charts. As to personality, you may not understand it. People used to go to work, school, are members of society and for their whole lives are bullied to the point that they don’t have an opinion and even if they have, they are affraid to speak their mind. I don’t have this problem. If police come to my house, I will shoot them. If I meet a lying politician in a dark alley without bodygurads, I will tear his head off. 23 years in the market and you never met someone like me, shame 😉

I tried to watch movies, but the risk is that if the movie is good, I switch off the platforms and miss things. At least posting about the markets keeps me sharp. I think you’re right about the water in the desert. I don’t have a ‘seller’s mentality’, I rather used to be a buyer. So if I go to the desert, it would be to buy the greenhouse or the land up around the greenhouse. You have to be nice to sell or pretend to be nice.

Jegersmart, I agree with most of your points. But I don’t believe you are not interested in solar cycles at all. To be frank, anyone who posts comment here must have read some or all of John’s articles. What caused them to find John’s website and spend much time to get into John’s thoughts? The most probable answer is solar-cycles. I would bet even Despe is eager to know how is the Sun doing in its current cycle. Admit it or not, we are all cycle believers.

Its sad that I have started believing in cycles/sun/lunar and astrology to justify my wrong investment. This is a good lesson and I hope it stays withe me. I believe this is manipulated rally and it should show in next few month with earnings surprise, But thats not enough for calling bear market. There is absolutely no stress in the system which can cause a systemic risk at this point. There is no credit risk and plenty of liquidity provided by CB’s. Despe thanks for posting your thoughts. It always good to get other peoples thought. John is blidsided with his indicator madness and he has managed to get 50 of them. Its very convincing, but there is something major he is missing. despe how would you trade you cant go long here.

Thanks all. New post coming.

I closed all shorts yesterday, so it bound to drop now, lol

I do think it will drop in the near future, but I think now it will be controlled drops of 2 or 3%, any larger decline would be a result of the fighting spilling out of the Middle East prompting Turkey or Saudi Arabia getting involved.

Even then I don’t think it will go down as much as some people would hope for, the 2000 SPX mark is too close now, they want that figure and more to kill off any remaining bears.

I do like John charts and updates and I think he has put a good case for the bears, but sadly I now feel CB and co will do anything to keep this going at least for the rest of this year.

Bill,

If you want my opinion on the market : we are a bit overdone, especially Nasdaq100. There have been 3 impulses up on S&P, so an ABC correction is in the cards. Even if the market goes higher, the risk is getting bigger, so even if I am still long some selective stocks, I am out of leveraged Index long trades. We still wait for that correction since March 2013, it’s more likely to occur in summer 2014 than it was in the first half of 2014. I will try to remain flexible and opportunistic.

What do I do now? Nothing, I don’t expect anything to happen in the next few days.

As to trades and tips, I don’t believe in offering signals. Trading is everybody’s individual business : following others you don’t learn, you get lazy and dependant. Only trading on your own you will acquire confidence and system developping skills, both of them are a must to succeed.

Now you want to get the money back quickly so already you’re not in the right mindset to trade. You don’t decide when to make money, you need to wait for the market to offer opportunities. The price is the ultimate leader, it leads sentiment and fundamentals. It can throw economies into the abyss of depression or be the only real power the defeat the global communism which is today suffocating the world. Trading the price is my specialty, but would it be yours? You pick the tools.

Pick one successful guy out there (Tudor Jones, J. Livermore, R. Wyckoff, N.Walayat, W. Buffet, L. Raschke, S. Druckenmiller) and try to understand. You don’t need to know everything and everybody. Beware of newsletters, investment advisors and the whole trading community talk out there, including mine. You ignore me. Last but not least : respect the market. More than your own opinion.

People need at leats 3 years to start winning consistently. It’s hard work especially on psychological front. So patience, respect, resilience.

❤

xoxo

André,

My response was not meant as critisism. Like I said, I really believe moon & tides make a difference, and under the right conditions can affect te markets more than most people imagine. I do hope your efforts will pay off.

Peter.