Bulls still have the ball at the moment, but we remain neither confirmed in bear nor bull market so need to keep teasing out the clues.

One that got some coverage this week: two all time record high prints in the Skew (protection against an outsized move). The 8DMA of the Skew shows reasonable odds that turns out to be a top in stocks on a longer term view.

Source: @sevensentinels

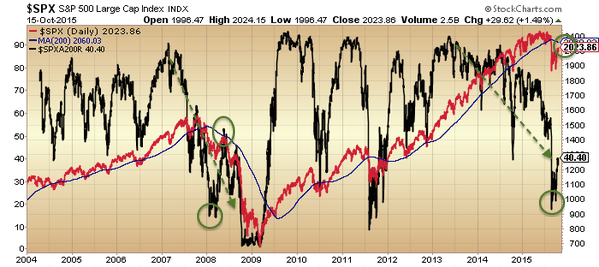

Next we see the long sagging breadth in the SP500 is similar to 2007-8. From the recent low in breadth a bear market rally is in keeping but ought to fail by the 200MA, shown circled in both instances, if this is indeed a bear.

Source: Stockcharts

Credit spreads are a negative divergence. Like breadth they have fallen some way and some time already.

Ditto oil. So take your pick: either all these things have washed out and yet stocks have held up bullishly, or, like in 2007-8, markets have rolled over gradually (back then: real estate, developed stocks, emerging stocks, and lastly commodities) with developed equities now the last this time to complete the bear.

Support for that latter option comes from various other stock market indicators which diverged pre peak in both cases and remain in downtrends:

The big picture shows similarities to the 2000 peak also, in terms of IPOs, leverage, risk and M&A. If this isn’t a third major market peak, then we need to explain away these:

Turning to the US economy, services are generally doing fine, whilst manufacturing is at recession levels. Various overall indicators, net of oil and dollar, are doing fine, but again the question is whether oil and dollar are flagging creeping disease or whether they are more isolated troubles.

Here we see how overall US economic indicators are weaker than at previous tightening cycle commencements, perhaps providing the justification for staying at ZIRP, but either way telling the story of a very delicate economy.

Source: Shane Obata

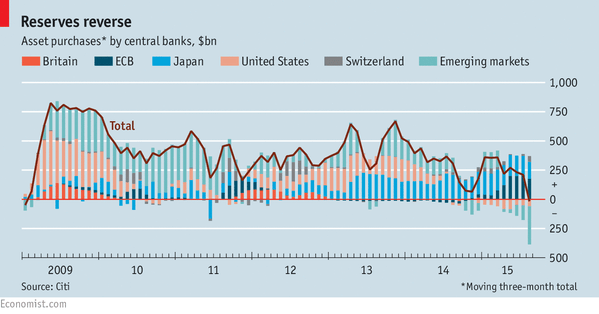

World trade is negative and central banks have notably recently been having to draw on reserves, something we haven’t seen since the last recession.

Source: Economist

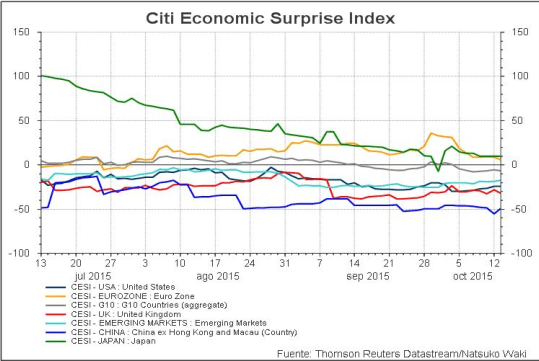

Economic surprises are overall increasingly negative around the world.

Source: Thomson Reuters

Has the world entered an unstoppable cycle of negative feedback looping? That’s what I see is happening and it befits the period post solar maximum. But it comes back to the stock market: equities typically lead the economy and for much of 2014 and 2015 the levitating market prevented the weak economy from tipping over the edge, due to the wealth effect. The 10% drop in stocks in August was therefore a major blow, but, having partially retraced, what’s happens next is key.

Here we can see that other major stock markets are in a more bearish position than US stocks.

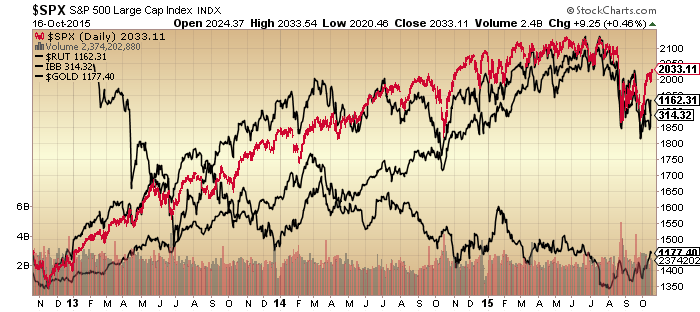

And here we see that US small caps and mania-leader Biotech are under-performing large caps, whilst gold has notably taken off (and rallied despite a pullback in oil this week).

This all adds weight to the likelihood of this being a bear market rally, with US large caps the last area of strength to break decisively.

My positions are the same. I am looking for stocks to arch over again this week or by 200MA / November at the highest / latest. However, even if this were to ultimately resume bullishly, this kind of technical price pattern historically has seen a pullback in prices from here to create a third but higher low. So if stocks do start to fall back again it still won’t be true bearish confirmation and both bullish and bearish alternatives will likely remain in play for a while longer yet. Thus, I will rather look to leading action from the likes of gold (ideally continued strength) and Biotech (ideally breaks downwards again to reveal recent stabilisation as a bear flag), plus some leading economic indicators and credit. And then there’s earnings. Earnings got properly underway last week but plenty more big ones to come over the next couple of weeks. Thus far the earnings growth is a blended -4.6% and the revenue growth a blended -3.2% from a year ago. Given US equities are still highly overvalued historically it’s going to take some big beats for this not to weigh negative on the market.

Reblogged this on Rajveer on Markets and commented:

A must read as always

Thanks

We read a lot about skew index. I think Its misleading indicator. If you check Oct 1998 daily chart of SKEW index (SP500 had decline in almost similar fashion then) with SP500 daily chart for same period you would notice SKEW gave false signal with reading of 146 on Oct 16, 1998.

But, I personally expect SP500 to re-test Aug 2015 low in near future.

Caldaro thinks this is the 5th Primary of Super Cycle 1. We could be weeks from the top. Even though I cannot agree short term, I do expect the 5th to fail. The bear of Super Cycle 2 is knocking. Caldaro thinks that will deliver about 45% or so correction and be around 2 years. Then a 30 or so year Super Cycle 3. Trouble is he’s been hard to believe in the past whist being about the one that was right.

https://caldaro.wordpress.com/2015/10/17/weekend-update-522/

My count is the same as Caldaro’s. I called the top of primary wave [3] over a month before he did. I use a number of charts to assist in my swing changes. I’ve posted my cycle chart here several times where I predicted in advance a rapid sell off for primary wave [4]. Here it is again. https://alphahorn.files.wordpress.com/2015/10/spx-weekly2.png

And here is my NYSI weekly chart, which is quite accurate predicting swing changes. It’s pretty definitive that a significant bottom formed. One needs to be objective when trading. Keep an open and don’t search for others that provide the enabler role to keep you in a bad trade. Cheers. https://alphahorn.files.wordpress.com/2015/10/nysi-weekly1.png

Yes SC3. The possibilities are extensive with something like 2000 – 2003 also there. The bigger the wave the longer until the confirmation. The assumptions get bigger too. e.g. that the form of the future will be a replication of history.

So your nysi chart confirms we are topping here…

I can confirm your count via std EW 12 (1) (2) (I) (ii) (iii) (iv) V) (3) 2019.26 (4) 1820.66 (5) 3 2093.55 4 1980.80 5 2134.72 5 waves done. Alternative count correlates with your count 3 3093.55 a irreg b c 1867.01 4 and we are in process of a new high.

If one uses a monthly MACD the sell signal is very clear and it is very unlikely that it will reverse and make new highs.

At 2038.84 a 5 wave count was completed which completes a 335 from 1867.01 wave 4 and a test of lows and lower should be impending. Or if a bull considers 1867.01 as completion of ABC wave 4 then the move to 2038.84 is w(I) of 5 for a new high.

The test is if SPX current strength breaks through 2052.09 that would confirm the bull count.

It is the 1993ish SPX high on 8/28 that tipped the markets hand. That was a 3 legger up. So we know it is part of a wave 4 or wave B. As long as the 5 wave leg down to 1892ish on 9/29 is a C wave, and not a 5th wave failure, we know this move up to this level ( and possibly a bit higher) is correctional. And it will most assuredly fail. The challenge here is not calculating what will happen next, but rather finding a good entry spot whereas risk can be controlled.

If God assured me the 5 legger down to 1872 spx was indeed a c wave of a bigger B, I would bet the farm this pattern would fail. It is a textbook death pattern. Over 90% of such patterns will fail. The fly in the ointment is the possibility that the wave 4 finished at the 2021 high and was followed by a 5th wave failure down. That would make this 5 legger up extremely bullish. Not just bullish, but extremely bullish because of the 5th wave failure.

When we look at everything John has brought to the table we see that is not a high percentage possibility however. If we use John’s work and astro work together we can pretty much eliminate the bullish scenario. Or at least reduce to very low odds.

We must keep an eye on that possibility, but trade the most obvious. And the most obvious is that this is a death pattern.

My greatest fear right now is that this continues to creep higher until it hits the F.M next Tues. and the FM slaps it down like a red headed step child. I am not accustomed to taking that kind of heat. One day of heat is about all my tummy can handle. I have been in this business too long to feel bullet proof.

If this last 5th wave is unfolding as a time crunching dia. tri. ( which is possible), it may test our gut for several more days to come. But test my gut as it will, the odds remain near 90% that this will end with lows well below 1867 spx. Based on all the info we have in front of us, there is a 90% chance this is a true death pattern.

My only question is, ” how many times will it take out my probes before it rewards me”? And, when will the establishment step in and steal our trading capitol? That is my bigger concern of the two. I know very few of you are concerned of gov. theft, but that is only because the banker’s network media does such a good job of concealing it.

“If the masses understood our monetary system and who was behind it, they would revolt by morning”. Henry Ford I may not have quoted him word for word but close enough.

2037.97 completed 5 waves from 1871.91 that has 2 connotations:

1. Bearish as it completes the ABC from 1867.01 for wave 4 and we are headed to new lows. OR

2. at 1867.01 that was an abc correction from hihs 2132.82 and a bull count of 1 a irregular b c to 1871.81 for 2. The move to 2037.97 would be wave (I) of 3

Thus we are seeing currently is a correction from the 5 wave move to 2037.97 and how deep the correction will tells us whether the bull or bear case has merit.

The monthly MACD of SPX tells me we are in a bear market and not likely to make a new high as bullish count implies.

All very compelling John, but there is one very bullish force in the background: there is hardly any alternative for stocks to make some money.

You will find that when investors become risk averse, they are not interested in making money, rather in holding on to what they have already.

So, you will find the UST market (and gilts and JGBs, maybe bunds) will go super bubble in the period down to the solar minimum, also gold will be well bid.

I’m still feeling a downdraft lies ahead here, overhead selling resistance must be huge about these levels, longs trapped for a few months. I am torn between whether we will see new lows, or just a mini-correction. Will have to play it by ear

I noticed the USD perking up on Friday, I know Allan has written it off, but I suspect it has more legs, and perhaps therefore one final low for gold lies ahead, and perhaps its miners too.

I am looking forward to playing a no limits poker tournament tonight on foreign soil. Plenty of French tourists around, playing fast and loose, me, tight as a rock, after a few obvious loose hands.

Good luck everyone.

American manufacturing starting to recover:

http://finance.yahoo.com/news/american-manufacturing-trouble-red-flag-110700169.html

Armaments & Munitions? Is oil so important still?

We can frack we can frack

And do it til u can’t stand still HA!

Exactly who are we manufacturing for??? Who will buy the products??? I think this is more hopeful wishing. I am watching to see how this Christmas sales season goes, I am of the feeling we are on a negative spending trend. Time will tell.

PALS and SPX this week:

Phase: very negative all week

Distance: very positive all week

Declination: very positive all week

Seasonals: weak Tues, Weds

Planets: very negative all week (except lingering VIC effect)

Summary: fully short into Monday’s open, will switch to cash if 1 to 2 percent realized. May look to buy weakness as late October rarely has sell offs due to wealth effect and holiday shopping.

Gold failing at it’s 200 day simple moving average points towards stocks going higher…..much higher.

Is the Australian and Canadian Dollars breaking above their 100 day sma’s an early sign that the Bear market in Commodities is over? If a Bull market in Commodities (except for Gold of course) is beginning will that be optimist or pessimist for Stocks?

Anybody know what Iron Ore and the Baltic Dry Index are doing?

Anybody know how many coffees Richard has had this morning?

No

I have had no coffee this morning. Instead, I have been doing my “due diligence”:

http://www.agrimoney.com/news/australia-ukraine-give-double-dent-to-world-grain-harvest-hopes–8911.html

Hold on to your Corn the basis (cash) is rising:

http://www.agweb.com/article/keep-that-corn-basis-is-rising-NAA-tanner-ehmke/

Now wouldn’t that be something to see both the Baltic Dry Index –and– American Corn start up in Elliot major 3rd waves. So much for Gold and Silver as they break down hard from their 200 day sma’s.

This is a nice top of the wedge position on the NASDAQ (1day chart):

Corrective form to there.

We can reference a 1000 different indicators,

those aside this is a key week being so earnings heavy,

the picture should be clearer by Friday.

JH, Thanks for the IPO and M&A indicators. My gut was both of them were running high, which is a red flag for me. My experience is that in the final stages of an up cycle M&A is used to combine balance sheets and obfuscate the real accounting numbers. Within legal limits of course. The result is that companies fight to hide the true decline in business activity and my feeling now is that when you see companies saying we made our earnings, but our revenue is shrinking, the gig is up. If it were aa few outside companies, it may not be a big deal, but every company is following this trend. If somehow we squeak through this earnings season without too much damage, the M&A accounting manipulation will start fading and companies will eventually be forced to show the reality in coming earnings that business is shrinking adding fuel to the Bear. I still find it hard to beleive that we will make it through this earnings season without damage to the indexes. I am a seller of more of my core holdings if this keeps rising.

Agree

Perter, interesting post re Caldaro’s views.

From a fundamental perspective some weaker

earnings are now the main headway in getting

back to those levels – can’t be ruled out.

If you tell me where my comment went amiss then I will know you got a grip there.

There’s a bloke that I follow (paid subscription…because he does this for a living) who has been following the VIX. Apparently the Oct’15 calls which expire Wed are worth $1.50 BUT the Oct’15 puts are worth $0.10.

Make your own conclusions.

BTW I’ve been reading up on the posts since I got back to Blightey and they are are ‘illuminating’. Starting with our host John H’s. Thanks very much John H.

Right this moment I don’t have the coherence or muster to make a call. But just wait for 24 hours for the effects of travel to wear off and then I’ll be able to make some ‘amazing’ (ly ridiculous) calls as usual.

Good to be back

Purvez

I conclude that followers should not try to be leaders unless they are recruiting for their master

Peter_, very politely….please go away. Thx

Peter_, hopefully nothing ‘cryptic’ in my message above?

It is my own conclusion as you asked non? No free speech what

Adieu, Bonne journée, À plus tard, Salut!, Ciao!

And the fountain of all knowledge accept you in its bosom

🙂 Very good …. but not good enough for me. Adieu.

I am “dip buying” the major grains.

Thanks for sharing your work. Well done.

From a pattern, or chart perspective we should expect another big top ( and reversal) this week ( c:4 or c:B), followed by a move down to the 1830ish SPX area ( provided this rally is a wave 4), or a move down of somewhere near 267 SPX points ( or more) if this rally is the c:B and the C wave down is equal to the A wave down.

What makes the pattern bearish is the corrective nature of the rally from the 8/24ish low. Some might see it as a bullish 1,2,3 up, but at this point it fits better as an abc up from the Aug. low. This long drawn out rally appears corrective in nature. A correction from a low such as we saw in Aug. would suggest a wave 4 at work or a “B” wave at work.

If Pastor Williams ( retired employee of the owners of the Federal Reserve Bank) is right, the US is about to get hit with news of devaluation of the dollar. Currency reset. He says the devaluation will come in increments starting this fall & winter ( possibly starting as early as Oct. 20). If that happens ( and we have to be a bit skeptical until it does), it would be extremely bearish for the US markets.

The USD is not backed by a commodity such as gold ( its considered fiat money). Since the USD has no real value, it would be easy for the USD to loose it’s standing as world reserve currency as well.

Let us pray?

I’ll have a pint of whatever Peter_ is on please.

And just a half of what Richard is on.

😉

The result would be a phsychedelic upper.

Awomen

Interesting comment. Devalued compared to what? If the USD is what everybody devalues to their currency to, how does the US devalue? If this were to happen, would it set off a wave of devalue across all other dollar based currency? In short, I see this statement as the creation of chaos. But I wouldn’t be surprised. The world is in a twisted state right now and this will have to be unwound eventually. The question is how? I tend to believe the markets will correct it over time, but a action to devalue by the US???? intriguing thought. It wouldn’t surprise me, but I still do not believe it.

It must sound crazy if you are hearing this for the first time. The first I heard of it was from John F. Kennedy in the 1960’s. In his speeches he talks of a secret society that wants to make all American’s their slaves. (John was the president of the US at the time.) In an effort to dismantle these people he made arrangements to abolish their ability to create the US dollar. He was killed soon afterwords ( as was everyone else involved with trying to abolish the Fed.).

This secret society Mr. Kennedy spoke of was the owners of the Federal Reserve bank. There were others in the secret society, but it was the bankers that seem to be the greatest threat. These people own our network media and censor all we see.

It is hard to believe any group could have this much power, but they do. Mr. Kennedy saw them as a major US threat in the 60’s and some know them to be an even greater threat today.

Now that you know who some of them are, I will tell you what they have planned. As hard as it is to believe, they plan to re-write the US Constitution and become the new leaders of the world. (Again, if you are hearing this for the first time, your immediate thought will be hogwash. Understandable.)

This fall they ( they ~ often called the elite bankers), plan to start with currency reset ( they estimate this one step will create 30% in inflation). Step #2, Sometime this winter they plan to offer an alternate world reserve currency backed by gold ( probably China but that info seems to remain their secret). This will send the US economy into a spiral that is unrecoverable. #3. Just when we need our retirement funds the most, they will go into our retirement funds and steal some portion. They will say it is necessary because they can no longer sell bonds and T bills. This is a deliberate and well planned attack on US citizens, but few will understand it or believe it as such. The media will convince the masses that it just happen by chance.

When the masses grow hungry they will protest, giving Obama the justification he seeks to declare martial law. He will use his unharnessed power to take our food, livestock, and even the food of our pets, saying it will be nationalized. When in reality, they need to take our food, the food from farmers, and livestock from ranchers so that it CAN”T be used to help the hungry. Hunger is going to be their key weapon. I was told this about 6 months ago. From there on the bankers expect blood in the streets… literally. They believe they will be able to dupe our military into violating our constitutional rights, at least in the beginning. In about two years, they plan to close down every bank ( derivatives will be the explanation for that step.). All deposits and the valuables in a safe deposit boxs will be lost. ( FDIC only has enough money to cover 1% of the US deposits). In order to convince US citizens to accept a new constitution ( one that makes the bankers our kings), they must drive us to starvation and bring us down to the level of a 3rd world country. This is their plan as I have been told. I have been told this by several of their employees, who also gave me a list of things to do to avoid the brunt of the future hardships. Should all of this take place.

I don’t know if they will be successful in their attack on US citizens, and I can’t be sure the first announcement will start on Oct. 20-21, 2015, ( actually their attack has already started), but I do believe they will go through with it in a timely manner and give it 100% of their attention.

There are a lot of people these elite bankers have shared their plans with. If you go to utube and look up Aaron Russo you will see one who tried to warn NY of the 911 attack months in advance. If you look up Pastor Lindsay Williams you will see another who is trying to warn the citizens now. There are others. They believe the elite because they tend to tell the truth. They live a secret life. They are seldom heard from. Some say they are the epitome of evil. But when they say something it is usually truthful.

If you wake up in the morning ( or in the next month or so) and see world wide currency reset plastered all over the news, you will know they told the truth. And if that part is true, maybe all their plans are true.

Well, what is the “endgame” in this scenario? A few people living boring lives with everyone else dead? Doesn’t seem to make sense to me…..

The end game for the elite is a one world government. If you can visualize what life was like when there were kings and servants. The kings owned ALL the land and the servants worked it for the kings. The kings held the power of life and death over the servants. That is what they are looking for. They are the kings, we are the servants.

About a 6 months ago they told a few people the Pope was coming to America ( Sept. 23 to Sept. 25) and encourage 1.2 billion Catholics to go along with Agenda 21 sustainable development, and the one world economy. Which is a one world government. I always find it difficult to believe them but on Sept. 23 the Pope was here and his speech was almost identical to what they said it would be. I continue to be shocked at their precision.

Their world will be very boring and even difficult for the servants, but, they plan on living like a King. Agenda 21 pretty much lays it out. We loose all our land, all meat is taken from our diet, we will no longer get electricity or gas for heating and cooling. Not in our home or our work place. We will be held captive the our assigned city. Perhaps 95% of America will be no man’s land. Meaning, we will not be allowed to live on it. Only those who are put in work brigades will be allowed to leave the assigned cities to work. Image a giant prison with no utilities…that is Agenda 21.

Well Golden, I have to say, this is not the first time I have heard it and I still find it hard to believe. There is a guy where I work that tries endlessly to get people to join some VERY expensive club that has all this inside information flow. He talks very much the same way you do. I will take my chances that this will not happen they way you describe.

Remember, The end of the world is always a few years away, until it is tomorrow. `,~>

JFK was talking about communism and is clear about that.

Any other interpretation is nonsense.

Communism is not secret. And communism didn’t kill him and all others who opposed the central bankers. When a group owns the printing press for a powerful country, they will not give it up without a fight. Kennedy and others who tried to abolish the Fed were shot or poisoned.

Lincoln tried to create the green back dollar in opposition to the bankers. The bankers threatened him, then he was shot. His green back dollar drifted away with him.

If you could literally print all the money you wanted and buy anything you wanted, including network media, and do it all without having to answer to anyone ( Nobody to even audit your money printing books), what lengths would you take to protect that situation? If everyone in the US handed you approx. 25% of their earnings every year and you did nothing to earn this 2 trillion dollars per year except print them a little money from your golden money printer, how far would you go to protect that situation? To what lengths would you go to keep those people ignorant of the fact that they are indeed your slaves for approx. 3 months every year. Benjamin Franklin said there were many reasons for the American revolution, but the primary reason was the bankers of Britain. America was forced into debt slavery because of the interest ( slavery tax or income tax) on the money they were being forced to use. The revolution eliminated that interest debt and freed the American people ( most of them that is). Then in 1910, this secret society went back to work creating a plan that would once again enslave the American people.

These people met on Jekyll Island under extremely secretive conditions. They had to. Everyone in those days knew who they were and recognized them for what they were. Within about two weeks they had come up with a plan that would allow them to steal money from every American citizen. This plan had a few flaws however. It was in direct conflict with the US constitution. So they knew they would need a president in their pocket to pull it off. And they would need to keep many future presidents in their pocket to continue the theft. What was their plan? To create an income tax that would be collected and stored as a payment to them for printing the county’s money. Their first corrupted politician would be Woodrow Wilson.

Us constitution says specifically that only Congress can print money and that no American would pay a tax on their labor. Many people lost their lives in the American Revolution to create those laws for us. According to Ben Franklin, those were the two biggest reasons for the American Revolution, and in 1913, the American people along with Woodrow Wilson ( employee of Rothschild, Rockefeller, Warburg, and JP Morgan) brought the slavery tax back to America, in complete violation of the constitution. All of those lives that were lost abolishing that slavery debt were instantly negated.

By the 1970’s these bankers didn’t even have to back the Federal Reserve note by any commodity. Thus fiat money printed from thin air. Look on the bills in your pocket andyou will see the money you have is Federal Reserve money. Not American money. It is made by the owners of the Federal Reserve bank, who are independent from our country. They are not part of our government, most aren’t even American. But, they use our government like its theirs ( and it is) to enforce their slavery tax upon us. For approx. 3 months out of every year you get up and go to work and give all of that money earned to your masters, the owners of the Federal Reserve bank. And you don’t even know their names because our government/their government has made it a crime to reveal their names.

When a government makes it a crime to reveal the names of a secret society, that makes that society pretty dam secret. These are the people Kennedy spoke of and these are the people he was about to abolish with his new “American” made money. Money with no interest of slavery tax attached. And these are the people who had the most to gain from his death. This is not theory. This is American history. But few know of this because this secret society ( with all the money in the world) own the network media and censor what the masses see and hear every day.

You don’t think they censor what you see and hear? They feed their info to you ( through their media) like a mother feeds baby food to a child. I was at an even 18 months ago ( and there are many other than this one), whereas maybe 1000 Americans took up arms and held maybe 350 federal agents at bay for the attempted theft of 80 square miles of private and state owned land. If a single passing car would have backfired, hundreds on both side would have laid dead in seconds. Headlines should have read ” thousands take up arms to prevent government theft of private and state owned land”. It should have been the biggest news since Pearl Harbor. It should have been plastered on the front page of every newspaper. But it was barely even mentioned by the bankers media ( and that 3 second mention was slanted) because it was the bankers who was behind the attempted theft. Still think you are not spoon fed the info they want you to hear?

We are all their little slaves for 3 months of the year and they spoon feed us what they what us to believe. The only thing that stands between us and them right now is a hand full of brave men called the militia. The militia is their main threat, and the establishment is doing all they can to disarm them. If the militia loose their arms or if they are abolished, the constitution will completely collapse and you and your descendants will become slaves to the Rothschild’s, Rockefeller’s, and Morgan’s for 12 months of the year.

Who revealed the ” event ” that lead to the deaths of thousands of Americans on Sept. 11, eleven months in advance? It wasn’t terrorist hiding in caves. According to Hollywood Producer Aaron Russo, it was Nick Rockefeller, one of our Federal Reserve Bankers. One of our masters.

If there is a glitch in the bankers timing, you can thank the militia.

Well golden nugget

I guess you come from Atlantic City.

i must have missed your point

What has all this conspiracy theory got to do with the present topping process?

Are we at the end of the line or is this just a weak period in a bull market.

Kind regards

bobc

Somebody said Kennedy’s secret society was communism. Just explaining that it wasn’t.

SP is still in a death pattern. It still needs a drifty correction ( getting it now) and one more impulse leg up to be complete. I probed short in the muddy complex 4 because it “could” have been morphing into a dia. tri. Can see now it was a muddy complex wave 4. From last night lows, we need one more completed 5 up. Already saw 1,2,3 up (of that 5) completed at 2048.75ES. Not much left now….but there is still another up leg needed.

If the market does anything other than a 4 down and a 5 up, then I may change my “plan” to probe short, but right now all is as it should be.

Thanks. I am familiar with the Illuminati and the Bilderbergers. They are still in control. The only question is how all of this have to do with a continued phony bull market or another bubble about to be burst?

Sorry, was just trying to answer their question. I wish more were like you.

I am now under water with my remaining puts. This is what happens when we probe to early. I hate it.

I just looked at the charts again. This pattern is rapidly maturing. Our wave 1 was Fib. 55 points. If this wave 5 is 55 points it would stop at 1946-47SPX. There is nothing that says w1 will be equal to w5, but in most cases they are similar in size. This measurement alone suggest the wave 5 ( and the complete upward pattern) is reaching maturity.

When we count the waves, we readily see the choppy sideways motion ( that could have been a die tri 5th wave or a complex wave 4) now appears more like a complex wave 4, abcxabcxabc. If that is the case, we still have the final little wave 5 ( v:5 ) ahead of us.

My puts are March, and I did sell a few more near the low last night. The sell off was a 3 legger which suggested another 5 legger up was possible and likely. It looks more and more like the FM has snared the S&P andwi ll not release it until it has also reached maturity next Monday/Tues.

Chap. Commodity analyst had a projection to 2065. He gave up on it yesterday but send me a note this morning saying it still may happen, and if it does, it will likely be a swift blow off affair that will end with a violent reversal.

My remaining March puts should be able to weather a storm of another few days, but I sure don’t like it.

I heard people will be turned into pillars of salt and she-bears will attack little children and rip them to pieces for call prophets “old baldy”.

Yeh, its in the Bible so it must be true.

as much as i am a bear at current levels, a google search reveals Pastor Williams has had the dollar devaluation position for several years….sky is falling. eventually will be right but so is a broken clock.

Actually he gave the date as Oct. 20, 2015. I was lead to believe it was coming fall and winter of 2015. Back in the 1980’s I was given Oct. 21, 2015 as their “target” date. Will history prove it to be accurate? Who knows. But we won’t have long to wait at this point. Fall/winter is upon us.

I understand we will be forced to eat jelly beans and ice-cream every meal and made to read Goldilocks every morning while standing on our heads.

If I was you I’d give trading a miss and find a simpler occupation like street sweeping.

Or perhaps you can re-write the constitution yourself. Surely if a handful of people can do so, why not just you.

the pattern continues to look correctional from the Aug. lows and it appears to be maturing. It still needs to finish the final v:5 of c:B ( “maybe” it will stretch another 15 points higher if there is no neg. news,) but it can end as a failure at any time. After that we should see this 3 legger up give way to a rather large down leg.

John’s work is in line with what the pattern suggest. The next “big” move should be down. Probing short when we see weakness or see the completion of this last 5 legger up ( that could be truncated) should be a good idea. The alternate count would be the SP is entering a wave 3 up right now, but the odds don’t favor that pattern at this time.

I see from your jelly beans you are confident in your security within the US. That is great, but as traders, we should always try to see both sides and have a protection plan for the alternate possibility. An overconfident approach either way could be costly. And, taking security for granted could be a lethal mistake. I was recently asked to help stop a theft in America. I stood my ground along side many others with rifle in hand while the local sheriff department fled. A dozen sniper rifles were trained on my head while mine was trained on theirs. Fortunately the thugs left their loot and moved on without a shot being exchanged. The same thugs continue to loot today and your home “could” be next on their list. If you think a 911 call will be answered against these thugs, think again.

As you pointed out, the bankers are few in number ( but so was Stalin and Adolf Hitler). The bankers are smart. They currently impose an illegal 20% to 25% tax on each of us every year of our life. That is 2 trillion a year we pay these mobsters and they give us nothing in return, except the privilege of using their worthless fiat currency. Congressman Ron Paul calls the elite bankers evil monsters that will eventually bring the US to its knees. The bankers themselves say it will happen sooner rather than later. Don’t be overconfident of anything if you want to survive as a trader or as a human. Study both sides of a trade and both sides of a conflict. Jelly beans & ice cream says you are only viewing one side. Study the other side and be prepared to oppose it should it be necessary in the near future. I have seen the evil first hand while defending the property rights of western US land owners. It is powerful, dangerous, extremely deceptive, well organized, well funded, competent, massive, and ugly. It should not be underestimated.

I am told many land owners along the Red River are learning this the hard way as we speak.

Golden Nugget

As I say, this sort of agenda doesn’t make sense to me, mainly because “they” already have this in place but with a huge bonus currently which is that most people have it good enough that they go along with it. If they wanted to expand it by alienating 7 billion people then they will find out that this is an impossible task in the longer term. As I say, in the current paradigm it is more logical to make incremental steps whilst enjoying almost all the “benefits” you mention without having to fight 7 billion people as well.

I am in favour of a “one world agenda” though, just not based on a monetary system. This has been debated here before in a very limited sense, but there is no appetite on an investing board for that sort of thing:)

By the way, who gave you the “target date” in the 1980’s? I think if you are going to allude to specifics then you are going to have do better than making vague statements.

imho

J

The elite no longer seem happy with money. They want power. And they want land.

The person who told me about the 911 attack months in advance was Aaron Russo. He claimed the 911 attack info was given to him by Nick Rockefeller.

The info regarding Oct. 21 was hinted in the 1980’s by a person I should not mention. He directed me to the place I would find hints regarding the attack on the twin towers and the date of their next attack which was reveled as Oct. 21 2015. The twin towers were replaced by a single tower just as implied in the 1980’s. It is still up in the air as to the next date of Oct. 21.

As you mentioned, this topic should probably not be discussed here. My apology.

Wow Jeger, This guy struck your fancy, most you have said in a month. I agree with you completely, how does this make sense to destroy the easy life that exists today for the elite. If they take it too far, it will tip over on them.

I am very interested in the topics u have laid out gold3n nugget. I do believe the #matrix exists and the elite plant clues everywhere , like in the matrix with me is drivers license 9,11,2001. And Lucy’s passport 8,24,2015. Back to the future 2 next? 10212015. Red Dragon Leo has some good stuff in his twitter feed. What forum do u post on ? Glp? @scott_Minnesota is my Twitter acct

Hi Scott, Talking about the Illuminati on this blog might be frowned upon, so I will share what I know in one concentrated piece. Anyone not interested in the laws of America, please do not read this. Please skip it and accept my apologies for using so much space.

The world is not what it appears to be. But, through censored media, it has been made to seem like what we all want..at least for now. Behind the scenes however, our liberties are evaporating. Our leaders, who are someone other than who we see in the white house, is gaining unharnessed totalitarian powers at an exponential rate.

They steal our property at gun point, they imprison innocent citizens without charging them with a crime or giving them a trial, they use the constitution as a door mat.

Recently, they have been murdering law abiding American citizens. Americans with no criminal record and not wanted for any crime. One or two were just school kids. One government official said the kids were killed because they were close to their parents. So now being close to your parent is a crime punishable by death.

Kings have been allowed to murder, but only recently has our president granted himself this “God like” power. Maybe you were not aware of this, now you are. So how many years has Obama served for murder? None. He just waved his mighty pen and made it legal for him to assassinate anyone on earth that he chooses to, including law abiding American citizens and innocent school kids.

Americans don’t act as if they understand the threat that faces them. This may be because their lives ( as they see it) is already too complex and stressful to research what the government has planned for them & their children. Or it may be because they believe the banker’s network media, that tells us everything is well and good in the land of OZ.

Major Page ( with top secret clearance) says they plan to take our children in 4 to 5 years and keep them in a prison like school for their own safety, allowing them to go home 1 weekend a month. What kind of country are they planning whereas our children will have to become wards of the government for their own protection? A government that murders and now plans to steal our children? Major Dan Page lost his job for sharing this and other info. American’s should be grateful for people like him.

The elite’s agenda right now, as I am told, is to mold our laws so they ( HML, FEMA, our military in the beginning, and UN soldiers) can treat us as enemy combatants, or POW’s, when the chaos begins. Future chaos of “their” doing. Basically, POW’s have no rights. They are hauled to the camps and indefinitely detained.

Let me point out some of the things that have already been done to mold our laws so we can be treated like POW’s in our own country.

#1, Bankers take over our monetary system and force us to pay them an illegal tax in 1913, by bribing Woodrow Wilson. Read “The Creature from Jekyll Island”.

#2, 911 attack was false flag according to Aaron Russo. Aaron warned us of the attack 11 months in advance when Nick Rockefeller, an owner of the Federal Reserve bank, informed him of their 911 plans.

#3, The purpose of 911 was to scare the American people into trading their freedoms for security. This attack allowed the establishment to take our liberties with laws such as Patriot Act 2002 & NDAA. Nothing patriotic about them. It gives the government the right to arrest and imprison any law abiding citizen without giving them access to an attorney or giving them a trial ( #1021 & #1022 of NDAA). It even allows the Feds. to torture & kill law abiding US citizens without a trial or due process. They can make you disappear.

Starting to sound like POW’s yet?

#4, Obama builds an inner country military ( HLS complete with armored war machines) that is loyal to him. Much like Hitler did with his gestapo.

#5, All rifles larger than 50 Cal. are outlawed for use by US citizens. ( Up to a 50 cal. will not penetrate the HLS armored mwraps).

#6, Obama takes all large weapons and gun ships from National Guard. How can they defend us without military grade weapons? 90% of the National Guard said they would NOT fire on US citizens if ordered to during gun confiscation.( Hmmm, maybe that is why they were disarmed.)

#7, Obama builds a US city for about 95 million so his Russians contractors, HLS, FEMA, and military can practice assaulting US cities.

#8, Obama moves his training to real live civilian population from July 15 to Sept. 15, 2015 {Jade Helm 15}. Thousands of UN soldiers observed training along side HLS and military.

#9, Obama signs TPP ( Trans Pacific Partnership).

#10, NSA illegally tapes our phone calls and Emails, and those who blow the whistle on this illegal activity go on the run to other countries ( Snowden went to Russia) for protection.

Big Brother is tapping your mobile phone: Obama admits NSA routinely spying on all Verizon phone customers in the USA

#11, Kerry signs small arms treaty with UN, obligating UN soldiers to enforce Obama’s illegal gun confiscation laws if the US military refuses to enforce them.

#12, Obama is deliberately following the Cloward & Francis Pivens strategy he studied at Columbia University, to destroy a country from within by running its debt to impossible levels and opening the borders to millions of aliens.

#13, Obama builds and or restores hundreds of FEMA camps and in his documents says these camps will be used as re-education centers.

#14, Obama spends our tax dollars to create false flag attacks (such as Sandy Hook), in hopes of taking our guns and any method we might have of protecting our freedoms and liberties. FBI and SS records confirm this to be true.

#15, Obama discovers ( through a litmus test) that 260 of our highest ranking military officers will refuse to fire on US citizens during gun confiscation, so he fires all 260 officers and replaces them with officers that will fire on citizens during gun confiscation.

#16, Obama creates Executive orders (and NDAA) that allows him to confiscate all food, vehicles, & property from citizens, and imprison, torture, and kill citizens without charging them with a crime or giving them a trial. Are we worthless POW’s yet?

#17, Obama signs an executive order that allows him to use ( unpaid ) citizens for work brigades under federal control. Executive Order 13603 – Obama legalizes slavery in America.

#18, Obama uses our tax dollars to hire and train tens of thousand Russian contractors who are loyal to him.

#19, Obama buys over 2 billion rounds of hollow point ammo that is illegal to use on any people except US citizens. This is enough ammo to fight 30 Iraq wars. Keep in mind, it is only legal to use this ammo on American citizens. Are we enemy combatants yet? Do you think he plans on giving 200 million Americans a fair trial?

Are we POW’s yet?

#20, Courts rule that any money we deposit into the bank, or safe deposit box, becomes property of the bank. They are under no obligation to return it. Also, FDIC has only enough money to cover 1% of all the deposits in America.

#21, Agenda 21 becomes their goal and objective for the 21st century. This document is signed by our last 4 presidents. I didn’t sign it. But our last 4 presidents did!

It says the population will be significantly reduced, all survivors will loose their property and be moved to a tiny apartment they will share with another family. Meat will no longer be allowed in our diet. No energy will be used for heating or cooling homes or work places. 98% of America’s land will be no mans land. Meaning, nobody will be allowed on the land unless they are a part of a government work brigade.

I didn’t write these laws and I didn’t sign them, and this is not speculation, so don’t shoot the messenger. I am reporting “SOME” of what I know to be true and accurate. I am not smart enough to make this crap up. You would have to be a banker to do that.

Have we achieved a POW status yet??

If anyone is in denial, please explain why a free nation has adopted these counter constitutional laws. Why has our bill of rights been wiped out? And explain why US citizens have to take up arms to protect their neighbors against Obama’s thieving mercenaries? If you haven’t had 30 Remington 700 scoped sniper rifles aimed at your head, all at the same time, then you haven’t lived yet. If you would like to experience it, call your local militia or give me your name and number and I will fix you a spot at the next stand off. You can take my place. Does this sound like jelly beans and ice cream?

What is next?

The elite bankers tell us their next move will be to devalue our currency and steal as much of our money as possible.

They will begin this step, according to them, with an announcement of currency reset. Because the US has the greatest debt, its currency will be set very low ( Within the 5% range). Soon after this announcement ( they have not shared this date yet), the USD will be taken from the world reserve currency status by offering the world an alternate currency backed by gold. ( The US dollar is backed by nothing. It is a fiat currency created from thin air. It only has the value we perceive it to have.) This will cause the value of the US dollar to topple at an even greater rate of speed. About this same time frame, our government will announce that China & Japan etc. will no longer buy our bonds and T bills. As a result, the government MUST go into our pensions and retirement accounts. They will say, “we have no choice, either we take your pensions or we allow the US economy to collapse immediately”. These were the exact words, or nearly the exact words they will say. Then bye-bye retirement account. They are not taking your money because they want it. They are taking it so you won’t have it. If you don’t have it, your family will grow hungry sooner rather than later. They will do the same with livestock. They don’t want the animals, but they don’t want you to have them as a source of food for your family or neighbors.

It is the collapse of our economy that will weaken us to the point that we will trade our remaining freedom for food. Their ultimate goal is to re-write the constitution making them kings of America, and the world. One world government.

As we starve, die off, get hauled to concentration camps, and struggle to find enough food to live on, they figure our spirit will be broken and we will surrender with only a few small unorganized battles against Obama’s military forces ( forces that are loyal to him and not loyal to the constitution.)

Anyone caught preparing for this crisis could be labeled a terrorist and thrown in a concentration camp under executive order ( NDAA) # 1021 & #1022. ~ Imprisoned without a trial.

There is actually some info the FBI has confirmed regarding execution devices in the FEMA camps, but I don’t mention it because I have not heard it from the elite or seen the killing devices with my own eyes. FBI reports there are 30,000 of these killing devices in the FEMA camps and in the box cars that carry citizens to the FEMA camps.

Have they made enough laws to treat us like POW’s yet? I think they have achieved their goal.

Why would the elite push for these laws and make Obama write up a martial law outline if they didn’t plan to go through with their economic collapse? It is just a matter of when. It will happen on “their” time schedule, not ours. But they have been hinting of dates such as Oct. 21 etc. One of their trusted employees shared with me what they expected to happen during this collapse. I was also given a list of things to do to soften the hardships caused by their attack.

Read Obama’s martial law below. If you don’t believe his martial law, then take it up with him.

Summary of Obama’s Jade Helm Working Paper Provisions for Martial Law

by Dave Hodges

From what I was allowed to read, which totaled 16 pages, I have summarized the provisions for martial law under Jade Helm in the following points:

1. Control of all travel. The use of checkpoints to control exit and entry from neighborhoods and cities will be employed. LEO will enforce neighborhood quarantines with the assistance of loaned military vehicles. Military and National Guard will maintain checkpoints leading in and out of cities. This is why we saw the Idaho/Washington military checkpoint checking for ID’s two weeks ago.

2. The command and control of all martial law activities will fall under the Department of Homeland Security. The President retains all executive control.

3. Refugee and civilian support centers will be established for the purposes of offering protection from anticipated widespread violence, looting and food/water shortages. The “guests” will be screened for the suitability to remain in the center. Those deemed to be a danger or in some way unsuitable, will be transported to more secure facilities. Each guest will be screened for health conditions and essential job skills which would be necessary to maintain the area. Based on the judgment of the Area Director, more vulnerable people (elderly, chronically ill, women and children) may be moved to move secure facilities for their protection.

4. Military assets will protect vital infrastructure with heavy armaments (e.g. banks, power plants, etc). No travel zones will permitted around critical infrastructure.

5. Air travel of any type will be suspended pending approval of the designated authority in both the area of departure and the area of arrival.

6. In volatile areas, dusk to dawn curfews will be established.In home curfews could be imposed until the crisis subsides. Violators will be arrested and taken to a secure facility. Lethal force can be used against anyone caught looting.

7. All business entities are subject to search and confiscation of supplies deemed vital to the survival of citizens in the present crisis. Every effort will be made to utilize private resources in an equitable manner.

8. Anyone engaging in behavior which is deemed detrimental to safety and welfare of any community will be arrested. (Note: This is the end of free speech).

9. Public or private possession of any weapon is expressly forbidden. The document spoke of voluntary gun confiscation where people come and turn in their guns. Compensation for the guns will be offered. The type of confiscation was not mentioned, but I would suspect food and water.

10. In volatile areas, the Area Commander can order door-to-door welfare checks. Further, if field officer feels that any weapon is a threat to the safety and security of a community, that weapon shall be confiscated and destroyed.

11. Food and water storage by individual citizens is encouraged. However, if shortages within a designated area occur, confiscation of these resources may occur. No citizen shall experience food and water confiscation that leaves them with less than three days of supplies per person living in any given residence.

12. There is no doubt that massive civil unrest will occur and in these instances, travel outside a designated distance from one’s home can be limited. Proper paperwork can be required based upon the judgment of the Area Commander.

13. Area Commanders will employ trusted members of the clergy to assist in restoring order.

14. Regional authorities will control the release of information under the guise of preventing panic. All elections will be suspended. Therefore, the belief that Obama will not leave office at the end of his term is correct if the martial law predates his last day in office.

15. Numerous references were made to Army Field Document FM 3-39.4 which is the means in which “detainees” will be utilized.

16. Unsanctioned community meetings and gatherings will be forbidden without written permission from the local authority. Also discussed was the disposition of dead bodies and under what conditions can funerals take place. Funerals will be replaced with memorial services and will be limited to immediate members of the family. This was a complete shock to me as I have never heard of such a thing. It is clear that the martial law authorities are anticipating mass casualties. Is this why we are seeing so many medical transport vehicles in these massive convoys around the United States?

17. Under “rare conditions” the military can secure private living space for their personnel. This is a clear violation of the Third Amendment, No Quartering Act.

18. Upon approval of the governing military authority, local law enforcement can recruit members of the community to form a posse (i.e. Brown Shirts?).

19. Violators of the martial law provisions can be tried as enemy combatants at the discretion of the local military authority (i.e. NDAA).

20. Energy conservation is called for in the event that there is power, or limited power, in any given area. Mention of home inspections for high energy users was part of this provision. I suspect that this is the guise under which gun confiscation will take place. It seems clear that the authorities want to gain access to our homes in a variety of ways. I am certain that this has to do with gun confiscation.

21. Farms, ranches and any food production center can be nationalized for the public good. This includes the transportation associated with potential food distribution.

22. With regard to the distribution of food, water and medicine (when possible), local community members will be conscripted to assist with the distribution. (EO 13603).

23. All private transportation can be commandeered for official use.

24. No private use of vehicles except with written permission from the local commander.

25. Schools, churches and other community centers will be closed during any period of chaos. These facilities will be allowed to reopen on a limited basis, and under specified conditions, when order is restored. This brings up the notion of the Clergy Response Team and the fact that the people will be told to follow Romans 13 and obey the governmental authority.

Conclusion

It was clear to me that the planning for mass casualties is a major concern. What to do with the bodies is of paramount importance to the authorities.

The document did not discuss any precipitating incident to martial law. The language is so vague in some places that it is easy to assume the worst with regard to the underlying intentions of martial law.

I want to stress that what I was allowed to view was a working document, not an official document. However, the list was very reflective of what I wrote about before. However, the notion of gun confiscations occurring under the premise of reducing energy use in a critical area, was something that had never occurred to me.

I suspect the language is vague for a couple of reasons. First, the powers that be do not want the troops to begin to form negative opinions which could lead to opposition from troops initially called upon to enforce these martial law regulations. Troops cannot be given much time to ponder their actions if compliance to an edict is offered which is fundamentally in opposition to many of the troops belief systems. . Secondly, by being vague, the authorities retain plausible deniability.

Finally, why was I permitted to see this list and encouraged to write about it? There is a strong move to encourage officers and enlisted me to followed their oath to protect and defend the Constitution. I know of others who have been given much of this information in various formats. I do not feel that this information is exclusive except for the different ways that the authorities want to gain access to your homes for the purpose of gun confiscation.

Hahaha, Thx JH, it’s like a theme park map showing us where we are so we can decide where we want to go.

I sure hope we get a repeat John otherwise I don’t know what is going to get the bear roaring in the face of such poor economic data.

Nice little chart John.

I will hold my short positions a bit longer.

Ftse weak today, oil not helping the likes of BP and Shell.

A bullish blogger at ibankcoin got snappy at my contrarian view today, be nice to re-visit in a little while.

On second glance at the chart, perhaps we are at the same spot as late in 2007, rather than spring 2008?

Doesn’t really matter either way if course.

Last month US Treasuries sold at ZERO interest yield for the first time.Then this month they sold at less than ZERO.. The Gold price immediately recovered.As useless as Gold is, its still not negative.

I agree with the market structure. It looks like Distribution.And earnings are falling.

BIG BUT……Interest rates will not rise this year. So there is no TOP.

And to all the brown bears, black bears and grizzly bears, you will lose your cash..

regards

Bobc

Bob, have a look at credit spreads and Libor/shibor rates.

See which way they are going?

Bugger all to do with a bunch of academics making proclamations.

Good luck, you will need it.

Hi,

Where can I get option-adjusted spread data?

https://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2

Thanks

The big misses are mounting up.. IBM, WMT, MS, AA.

just a few of the higher profile companies that missed.

There are some better number and beats, but it’s patchy

on my take.

Phil, I have yet to see a single large company with top line growth. Earnings meeting expectiations really means very little if they are not growing their revenue. The only way to keeping those earnings meeting expectations turns into cost cuts, like Layoffs, which we have seen quite a bit from large companies. ie the better paying jobs. I suspect we are on the negative feedback curve already. Let’s see how Christmas spending goes.

Latest NYSE Margin is out

http://www.nyxdata.com/nysedata/asp/factbook/viewer_edition.asp?mode=table&key=3153&category=8

added to spy puts this morning only to see to f’ing machines moving it higher. screwed again. ibm, wmt among others trading at 2-5 year lows, yet the s&p 5% off all time highs. truly exhausting

Roll the puts to next month?

That could be it since the first support of 2025ES just came out.

Looks like another day of stop running on the shorts as US stocks surge higher. (I am “dip buying” the Grains and I expect the American Ag sector (land and stocks etc.) to recover this Winter).

I am looking for the market to top today. We’ve just had another breakout from consolidation pattern in ES contract at the beginning of US session and that may soon prove as false and as ultimate bull trap.

ES may touch bottom range of long February-August consolidation zone before reversal, this is around 2035. Also 2044 may be in play as that would provide A=C in A-B-C correction that started in August. But I would not look that far.

The market has shown that it likes to revisit zones that were only thinly traded during August crash, namely SPX 2020-2040.

Thanks. I was expecting 2040’s for SPX but the SP has started overlapping on the shorter time frame. This may indicate a pattern change to a dia. triangle 5th wave, or it may indicate severe weakness in the 5th wave.

The more bullish alternate would be a running 4.

Another well reasoned call Bunell. Since the Friday 16th Oct low We’ve had 5 overlapping waves upwards on the DJIA. An Ending Diagonal of some sort. Today’s up wave may have a little more to run.

Good call.

Yes John H, we ‘hear’ you. Now let’s hope the market participants do too. Lol.

Clueless……

as to what is holding the market up.

IBM should more than offset aapl. IBB Down 2.5% AMZN, NFLX FB…among others all moving down. yet market off fractionally. pull the rug out already dammit

http://finviz.com/map.ashx?t=sec

just sayin’

http://www.zerohedge.com/news/2015-10-20/sp-earnings-expectations-tumble-15-days-row-longest-streak-financial-crisis

oh yeah….tsla and googl just shat the bed

Frustrating…but why bother with SPX. Just short those things that are going down.

all the rats leaving the ship (hedgefunds, pension, traders, hot $$) tsla, googl, nflx, fb, amzn, ibb, etc. mom and pop 401k and blue collar joe pension fund clueless until after a 30% drop then they get to sell. must be what is holding up the market

The market is as the market does. History doesn’t repeat, but it often rhymes. Stay tuned.

The market can present us with great humor in ugly times like this market period. Like IBM blaming a strong dollar for their poor performance. Because the last 17 quarters of poor performance were for other reasons right? Now today, TSLA…. what a grand scheme we have here. A truly talented innovator and a horrible business man. So we are to believe that Consumer reports is to blame for TSLA stock performance? As if an EPS of -$4 is not enough. Constant revisits to Capital markets and Gov. incentives to buy their cars and they still cannot turn a profit or even worse show no path to profit even with incentives. Imagine if the incentives dried up. SOOOOO back to the humor. Consumer reports is the reason for this stocks decline. Maybe it is just sour grapes, because I wasn’t part of this pump and dump stock. Maybe, just maybe. And then I laugh hardily!!!!

considering the after hours announcement by GM yesterday that it has cars to compete with TSLA, I would say some lobbying dollars were diverted to advertising/influence dollars to get consumer reports to announce their article today. no coincidence here.

on a side note, I see that Oprah has upped the ante., Instead of promoting little known authors into best sellers, she is now going to become a hedgefund herself. take a position in weight watchers, then leak your ownership.

I made no such announcement yesterday, it’s a lie.

needed a laugh…thx GM and enjoy your regular posts as well

As soon as TSLA anounced they were building cars for the masses, I predicted their failure, and I am sticking to it. They should have stuck to the sports car niche. For that I give great credit. I suspect they could have made money on that venture. Right now they are on the verge of complete collapse if the capital markets freeze up on them and the Gov. takes away incentives.

today’s sell off has some 5 legger characteristics to it. We might be witness to a wave 2 bounce here.

GN, on the DJIA I certainly counted a Leading Diag down as an ULTRA tiny wave 1…..but I’ve been here before and been disappointed. EW, as always, is in the ‘eye of the beholder’….John H has said so a number of times but in much ‘nicer’ terms.

I agree.

And some eyes are better than others. And, some people know the actual rules of RNE while most do not. If we don’t know the actual rules, how can we ever be right?

I would recommend everyone who uses EW learn the rules of RNE and ignore those of Bob Prechter.

EW has split into two systems. We have Prechter waves ( that almost never work) and Elliott Wave ( that works part of the time for the eye that uses it correctly.)

I use only EW . According to RNE, the wave 1, 3, & 5 are always 5 leggers. There are no exceptions. According to old Bob, as I know him, all waves but wave 3 can be 3 leggers. If we can attach any leg we want to a 3 legger, how can the system ever work? And old Bob made other changes as well. If we hope to be successful with it, we must follow RNE and ignore old Bob’s goofy stuff.

I will say that identifying a wave 2 while in it is exceptionally difficult. If i am right about this one, it is more luck than skill. But, I was able to identify the high today within 1 point ( and bought puts there) and identify the last low within 1 point ( sold my puts there) by doing nothing but counting the legs. I am now re-buying my putties near 2026 ES. But is this a wave 2? I can never be sure of a w ave 2 until after it has happened. Nobody can.

I am using the profits of my day trade to risk buying putties here. If we get a new high, then I exit my puts and figure the 5 down was a c:4.

So far however, this rally has more of a correctional look to it. We will know by tomorrow.

Astro study suggest Oct. 20 – Oct. 30 is a negative period. It also suggest some kind of high may occur tonight causing some selling pressure to start tomorrow.

When we combine EW and astro work, we see a potential for selling pressure into the Oct. 27-28 full moon time frame. All we can do is weight out the odds. But if you see this last low come out ( 2018.50 ES) in a gap type fashion, jump on the wave 3 down.

IBB consolidating nicely. We should have a break up or down soon. I am going to predict down and possibly hard. It may even be a trigger for a wider sell off. Let’s see. Tomorrow Biogen reports, it could be a cataylst.

Many people, perhaps even most people, think (1) we are in a new secular bull in stocks (2) there will be no bear market or recession until CBs have gone through rate tightening cycles (3) that we just experienced a 1998 or 2011 style correction. All making this a glorious opportunity to be buying. But, that’s all wrong. So, got to patiently wait for this to roll over again and then when we break down again there’s going to mass confusion… and forced redemptions.

I agree with (1) and (3) are silly, but I am hearing (2) from respectable finance professors and can’t so easily dismiss.

John Li, Did you know that Weathermen were created for the express purpose to make Economists predictions look good?

`,~>

If I had a nickel for every time an economists predicted correctly……… I would have a nickel.

No JaFree, you’d still be waiting for your first nickel.

To clarify, there are a those that say that the market cannot crash unless QE is off the table. We don’t need a full rate tightening, but just the Fed to run out of ammo for whatever reason — inflation/politics/etc. Until then, the market can flatline but not truly deleverage.

What if the IMF comes out with a currency reset tonight, would that kill the US markets? Will that increase unemployment to 50% plus?Will that cause people to be hungry and cause them to pull their money from the stock market to buy food? There are many things that can affect our markets besides interest rates. If our currency is reset to the value of our country will that be good or bad? Lets see, we are farther in debt than the entire world combined. Advertised 19 trillion debt but actual debt is closer to 240 trillion. That would devalue our currency by an estimated 30%. It could make it one of the least desirable currencies on the planet. It wouldn’t be felt right away, but it would just be a matter of time before necessities like gasoline and food climbed by 50%. And another 50% the following year. Those in debt would loose everything they have and beg for food at the FEMA camps.

Changing the subject. Lets see what tomorrow brings. Maybe we can all make money with some putties in this overbought market.

red swan, black swan, I would like to see some type of winged creature sending the markets crashing toward Peggy’s spiral targets posted on 10/14

SP took out its earlier low in the night session. That means a wave 3 down is possible tomorrow. Wave 3 often leads off with a gap lower at the open.

Now we just wait for tomorrow to see.

This is worth a read….options pricing as a guide to stages of bulls and bears:

http://www.zentrader.ca/blog/welcome-to-bear-market-stage-6/

Bob janjuah has turned bullish. Therefore we must be within days of a top or Bob might be right for the first time in 4 years!

Rally up to 2034ish SPX could be a wave 1 up OR a wave 2. Astro study leans toward a wave 2. And it stopped near Fib. 61.8% retracement. If she gaps down at the open, it’s likely a powerhouse wave 3 down. If she takes out today’s high, then I get stopped out of my putties.

Astro study suggest we may hear some bad news tonight. If that is the case, (currency reset???), then gap and gonner in wave 3 tomorrow. Everyone without a position may have to chase it should it unfold that way. But it should be worth the chase. EW suggest this rally from the Aug. low has a good chance at being a wave 4 or a B wave. If it is either of these the next leg down will be massive.

The alternate is that the 1867ish spx low was an entire wave 4 and this leg is a wave 5 up. There is always an alternate and we must always be aware of what it is.

The overall “look” of this rally fits better as an abc up ( “B” or 4) at this point however. THis may be one of those rare trades that allows us to magnify our accounts exponentially while trading in one direction.

Protect above 2040SPX.

Golden Nugget,

Thanks for excellent posts. Pl continue posting.

Agreed….great posts . both technical analysis and hidden agenda. Will the eu take down aapl, amzn, googl, and fb by going after their tax loopholes and do a claw back? Announcement e xpected tomorrow

thank you Gnug for your reply above. great read. was familiar with many of the points, but a very interesting consolidated outline. would be interested in your twitter account or blog sight for topics outside of the scope of john H.

I don’t have a blog but I will be happy to give you my email.

I sent you a rather long letter showing the new laws in America and Obama’s martial law outline. Did you get it? I ask because it may have been deleted since it was more about American law than trading opportunities. I hope John allowed it to get to you.

I’ve not blocked anything

Thank you John. Some people take advantage of a blog, and their posts have to be policed. I will be careful not to get off track too often. Thanks again.

Link? I only heard that he covered his short…not that he turned bullish.

John Li,

Re the Fed and markets. Worth your while reading some Hussman posts on the subject.

It’s a fallacy though, the Fed has zero influence, once the market becomes risk averse, nothing will stop stock valuations from mean reverting (and more besides).

It’s highly likely more QE will be announced, and when the markets still seek safety, then the CBs will be out of bullets….nearly. The ECB still has its golden bullet, which will be used I am sure. But even that won’t prevent markets from doing their thing, Mother Nature and human emotions always have their way.

I love Hussman and follow his weeklies. I am just relaying a discussion I had with a finance professor.

Cool.

Professorship of finance implies something different to me, you know what I mean.

The madness of crowds. Retail joes do not see any risks here at all.

Poor stupid dupes, as always, left carrying the can.

it all feels eerily similar to just before the August decline.

Today’s test of 2033 on the futures failed, will they try again?

No idea, but I see a wall of sellers just around the corner awaiting.

Whoever this bloke is, his advice is not bad.

https://twitter.com/reddragonleo

Been following red dragon Leo for a couple years. Excellent posts. Golden nugget, I think u would like it

RD great to see some Aussie junior Au/Ag miners coming out with some excellent announcements. This will be the hottest sector in town in 18-24 months.

AZS under Tony Rovira looks like they have stumbled onto something really big. Not sure if you know that he was head of the team that took Jubilee mines from obscurity and penny’s on the dollar to $23 ps and made multi’s out of ordinary mum and pops?

Al – GOR are worth keeping an eye on too. They have some pretty cool stuff that could happen in WA

http://www.asx.com.au/asx/research/company.do#!/GOR

That is a very ugly chart. No question where we are heading.

I had mentioned yesterday that I could see 5 overlapping waves on the DJIA since the 16th Oct low. However the overnight action has created a further higher high making the current count 7 waves. However IF this is an Ending Diagonal then we should either have 5/9/13 etc waves. On that basis I’m expecting another down up sequence on the DJIA. Here’s my chart and count:

http://postimg.org/image/glzjh2mch/

To fool MOST people this ‘down up’ wave will either fall short of the top line or overshoot it by a BIG amount.

G’Luck to all.

Purvez, after overnight rally ES contract touched 2034 this morning in Europe and reversed very quickly, currently at 2024. This could have been final exhaustion move, let’s see what happens after US opens. I do not want to see ES trading above 2034.

Will those investors trapped above 2034 all year begin to sell now?

Anywhere between 2034 and 2060 there should be plenty keen to escape I imagine.

The tape should provide some clues.

Will bulls be able to absorb that selling?

And just around the corner, another budget ceiling show to amuse us all.

Bunell, I can’t get an ES chart. Is there any way you can post one please? I’m comparing the S&P one with the DJIA and although superficially they are the same there are some important details that make the ‘overnight’ count the 5th wave there rather than yesterday’s.

Sure, here goes the chart. Around 2034 seems to be a border. Hopefully we reverse down here after some distribution at the top.

es_21oct

I’ve thrown in the towel this year. I incorrectly guessed that the majority of investors had lost faith in central banks. Turns out they have more confidence than ever before. In the face of such a bad earnings season I cannot see how stocks are still rising. I cant even rule out new ATH’s any more…One thing for sure is the FED can’t blame falling stock markets for a rate hike delay any more.

Patience.

Look at bond yields, commodities, the gold/silver ratio.

All of the indicators John shares here.

I’m 2% down on my shorts right now, it may go to 6% from here, but this is just a classic end of big bull rally, which takes out most shorts en route.

Fun ahead, most likely.

I am still bearish and will continue to short and take profits/losses but what I meant was that I’d thrown in the towel on waterfall declines. We could and are likely to see more falls and more recoveries but i think we will not drop to August lows and also not rise to ATH’s. Basically a big trading range we will stay in.

Krish, (I hope this is some consolation) the chart that I’ve posted above is one of THE MOST DIFFICULT to trade. Looks easy in hindsight but because of the HUGE gyrations it is almost always a looser. Sadly one only starts to find out after the 3rd wave is done.

We cannot rule *anything* out. This is rule number one. Sounds obvious, but one really has to be able to fully accept this statement. Seems to me that a lot of people are expecting a fall – these are good times to squeeze. I am short SPY/SPX but not underwater by much, will wait to see what the close looks like.

imho

J

Interesting thoughts here

http://www.goldsqueeze.com/analysis/the-worst-thing-that-could-have-happened-just-happened

The Grains have bottomed and started back up; and, it looks like the DOW is going to surge higher today. Stock markets can be “irrational” longer than most Small Specs can remain financed against it. If you don’t have “deep pockets” like JH then you might want to consider “cutting your losses short” before you give the market generations of your inherited wealth and end up working for a Temp Agency at a local factory on the graveyard shirt sweeping the floors and taking out the trash.

Richard I, was ANY of the last part really necessary commentary? Surely we all know the consequences of our actions.

I find Richards morality very relavant.. If everyone knows the consequences, why are they trying to SELL TOPS.