The solar maximum peaked out mid-2014:

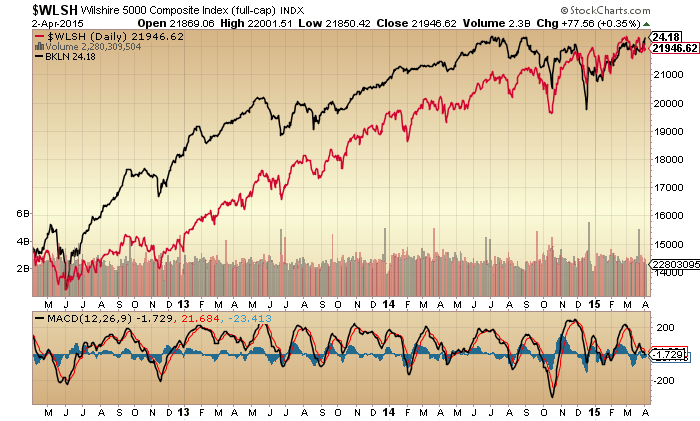

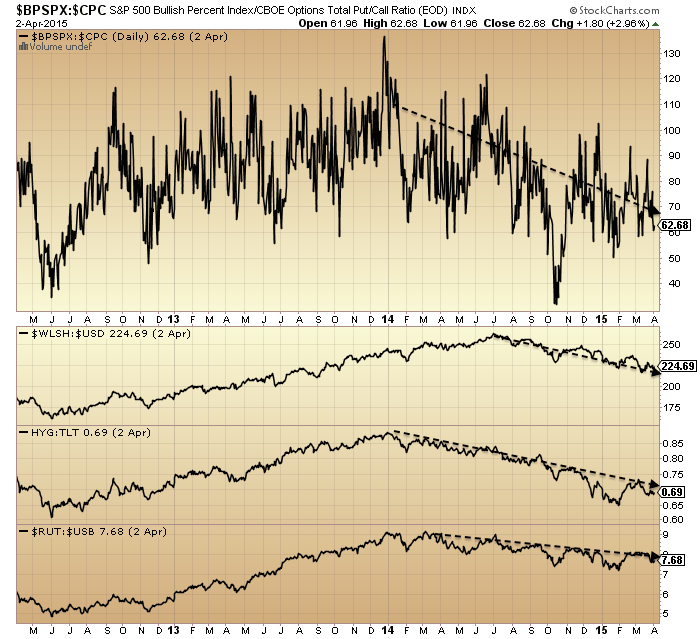

Speculation should peak out with it, and that appears to have been the case with trend changes in stocks, commodities, dollar and treasury bonds:

The speculative target into the solar maximum was primarily equities, as evidenced in allocations, sentiment and (here) valuations:

Source: DShort

Stocks are now at risk of a sharp reversal, due to the twin supports for lofty valuations of earnings and (here) economic data having turned negative:

Source: Not_Jim_Cramer

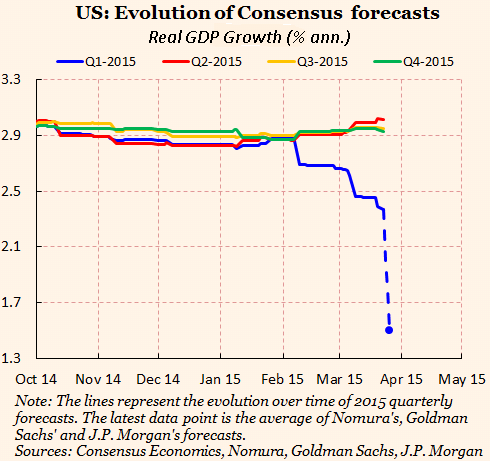

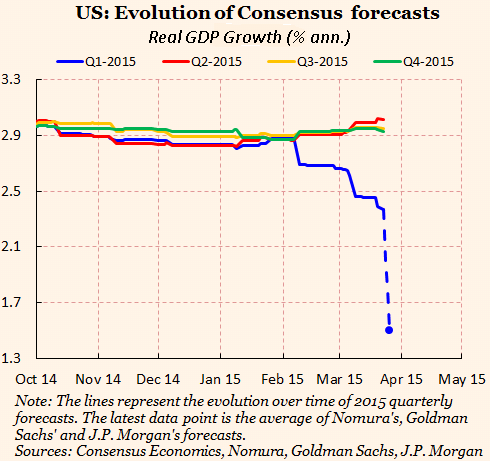

However, analysts are predicting both will improve as 2015 progresses. The first chart shows they have been downgrading Q1 GDP forecasts whilst slightly upgrading the next 3 quarters. The second chart shows they expect a significant recovery in earnings in H2 2015:

Source: FT Source: Charlie Bilello

Source: Charlie Bilello

Narrow money trends are also predicting an economic recovery by H2 2015, in part due to the benefits of lower commodity prices.

Source: Moneymovesmarkets

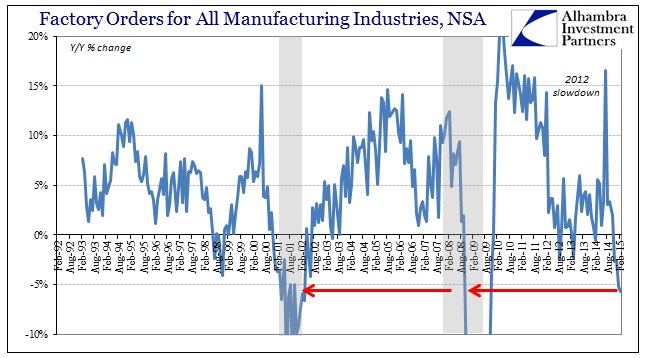

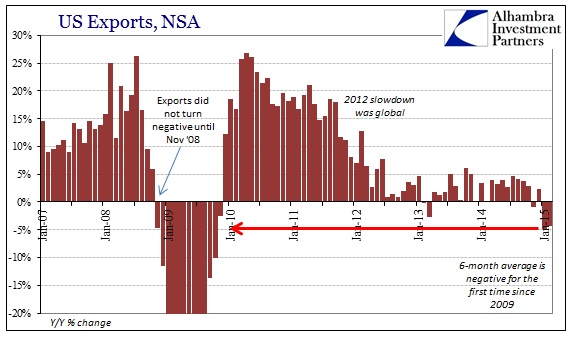

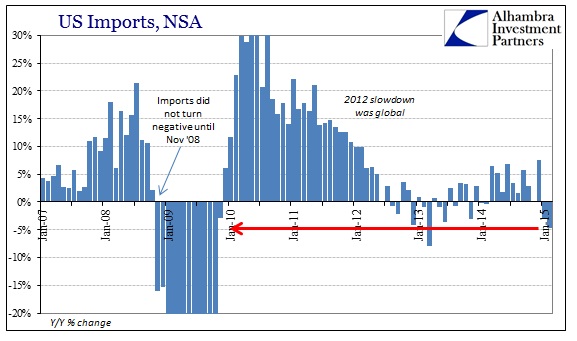

Counter to that, a range of economic data has already dropped into recessionary levels:

The latter two charts play into the global picture, which is one of dwindling world trade:

Source: ATimes Source: Stockcharts

Source: Stockcharts

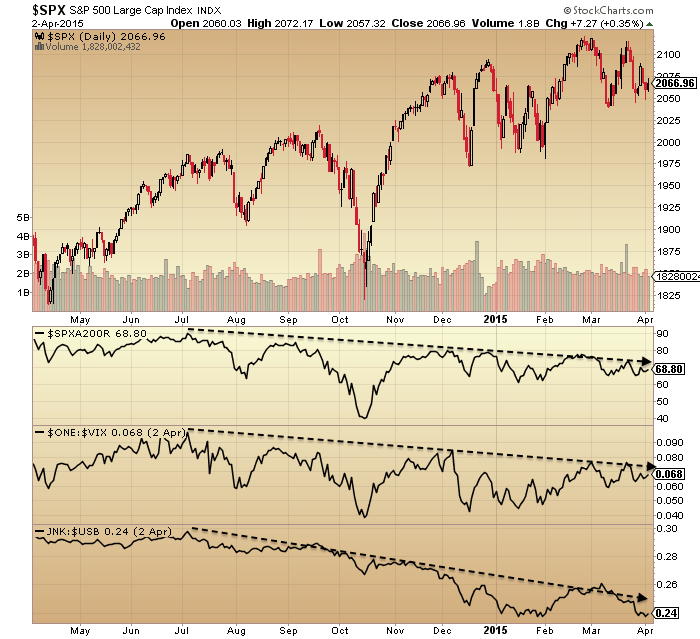

Financial stress in the US is not yet apparent but has crept up in a way similar to 2011 pre stock market falls:

Supportive to the bull case still are cumulative advance-declines, outperformance of certain cyclical sectors and small caps in 2015, and a current rechallenging of 2014 highs in both leverage measures of margin debt and (here) leveraged loans:

However, most other indicators show continuing degradation and divergence.

So, piecing it together, I believe the key is whether earnings and the economy do recover again or whether we are in the early part of a negative spiral. Solar theory would argue the latter, whilst analyst opinion favours the former. Either the sharp falls in commodity prices are deflationary and recessionary, or they are to become a new form of easing as 2015 progresses, with positive benefits for the economy and most sector earnings.

I suggest it is unlikely stocks will advance whilst the reporting of Q1 earnings and economic data plays out. Rather, at such lofty valuations, we will need to see evidence of the anticipated improvement first. That sets the scene for either a meaningful correction here, or a sideways range trade in the weeks ahead.

My opinion remains the same: we are in the last gasps of a topping process in equities. We see ample evidence in both indicators and economic data of the shift in behaviour post-solar-max. The negative feedback looping is underway but needs a significant drop in equities to complete it. That should now come to pass, post Equinox and post-second-chance (last post). April is clearly a window for a meaningful drop, set against earnings reports beginning on Wed and anticipated further bad economic data.

If somehow stocks can hold up and range trade over the next several weeks whilst early evidence of a pick up in the US does start to trickle through then maybe this mania can continue for even longer. But I still find it extremely difficult to make a case for that.

The SP500 now needs to break down beneath the March lows. The divergences suggest this should occur.

Meanwhile, the commercial positioning on gold suggests a rally, which would fit with a drop in equities:

John, thanks for your consistent view and great analysis.

You know I subscribe to this view. The apo/peri cycle simply peaked dec 2014 and bottoms early 2018.

My harmonic timing set the date on feb 27th as the end of the inverted period. S&P made the high march 2nd, 1 trading day later.

So the question that needs to be answered is why we haven’t seen a meaningful decline so far.

I think I can answer that.

1) Jupiter and Saturn together form the Great Chronocrator (Richard Nolle); the mother of all timers. As of early March, both planets were stationary retrograde. In other words : they were at a standstill. When time stops, everything stops. This week Jupiter turns direct again.

2) The Uranus-Pluto square has been with us for some time, but hasn’t lived up to it’s promise yet. The full moon on April 4th formed a T-square with Pluto. In other words, the bloodmoon activated the Uranus-Pluto square. This is surely the most significant activation in the square yet.

3) april 3rd we saw the first major Bradley date this year.

So after the December-March inversion period, some random events kept the market from falling so far. This will lead some people to believe the trend is up and has consolidated in time. They are wrong.

Last week I told you about the hidden divergence between VIX and S&P. This is very bullish, so volatility is set to spike up next week. All this built-up energy will be released next week.

Usually there is no trade on good Friday. This good Friday was different; some big boys managed to open the exchange for a brief moment when the rest of the world didn’t expect it. Apparently, they needed to unload and they couldn’t wait until Monday.

I expect a w3 low around April 20, a pull back into April25th and the W5 low May 4th. This first wave down will run into the end of September/early October.

Cheers,

André

Thanks Andre

Andre,

Thank you. Maybe I am reading this wrong but are you expecting a bullish up week this week?

Bluestar,

I expect a strong decline to start Tuesday or Wednesday and run into April 20th.

maybe this was a typo, but Jupiter was not “stationary retro” in early March. It was just retro. “Stationary retro” is the term astrologers use to define the point in time when a planet is changing from direct to retro motion. “Stationary direct” is the opposite, it defines the point in time when a planet changes from retro to direct motion. Note that the slow moving planets (Jupiter and Saturn) are essentially stationary for about a week prior to the station date until about a week after that date.

Jupiter’s retro cycle lasts 4 1/2 months. The last time it was stationary retro was December 8. 2014.

Jupiter goes direct on April 8, so it was stationary from about April 1 until April 15.

Saturn went retrograde on March 14, 2015, so it was effectively stationary from about March 7 to March 21.

Thanks; appreciate your response.

Thanks John and Andre, this is how I see it also. And thanks John for the shocking charts of imports and exports and factory orders. The markets will have to catch up with this nastiness.

Thorough and insightful analysis as always John. I also always love and appreciate Andre’s unique angle of view. Thank you both! Quick question for JH: Are you fully short or plan to be fully short next week?

Thanks erick.

Out of curiosity, are you shorting the SPX? Do you have a stop and where? What triggered your short order?

I am short (SPX) but price has to roll-over for me to add more short.

Right now I’m a little short US stocks and a little long gold. I want to see more technical price breaking and more momentum to add more.

Thanks Andre., John , very good as always …n

Interesting charts and analysis John, many thanks.

Bob Hoye has noted several times in the past 6 months that he expects the economy to turn down in earnest when the credit/stock markets themselves turn down in earnest, so he sees the markets as the horse and the economy as the cart.

With all of the leverage employed in markets, I tend to agree with Hoye, when markets turn, confidence will evaporate, and credit will tighten, that’ll be game over.

Enjoyed your latest “Big Picture,” and although receiving your newsletter for 2 years, this is my first comment.

1. Although I initially subscribed due to an interest in full moon, etc., because over 10+ years, I’ve analyzed my trading around those periods, but continued because of your excellent reporting/analysis of a huge breath of fundamental and technical data.

2. I’m a perma-bear; actively trade SP e-mini futures, about 99% from the short side, although am quite profitable both this year and last. My bearish viewpoint is mostly due to monetary analysis, which of course has been distorted/delayed with all the Central Bankers drinking from the same QE Cool-Aid.

3. Monetary policy/actions, seems to be the only significant aspect missing from your analysis, although it is reflected in a batch of your indicators.

4. Minor point, but in the April 5 report, where you again think a negative breakdown is likely in stocks, and per recent letters, I assume you are still short, I think it would have been useful to point out that not only was the Friday unemployment report disappointing to The Street, but that in the 45 minutes after the release, SP futures dropped about 20 handles / 2000 points. That may change when mkts open Sunday evening, but so far, DOW would be down 150 or so points, and the SP would be just slightly above the March lows.

Regards,

Appreciate your input, thanks

Hi John

How do you explain the 2007 top in equities vs sunspot numbers?

Thanks

Daniel

Just because the wind is out of the north at 20 MPH, and the ocean currents are out of the north at 10MPH doesn’t mean the ship will move south at 30 MPH. The ship has an engine that allows it to move in any direction, just that if it goes north its max speed will be 30 MPH less and if it goes south its max speed will be 30 MPH more. A lack of sunspots may just mean that the market has to expend more energy to rally which may be why the 2007 rally was followed by the 2008 non rally.

There had been an “inversion” in the 19 year 5 hour wave count (not cycle counting as cycles seldom ever invert whereas wave counts invert all the time). The top of the Tulip Bubble and Mississippi Scheme (1720s) was the end of a 19 year 5 hour wave count just as it was in 1929 and 1987. The end of that 19 year 5 hour wave count was in 2006 –but– an Inversion occurred and the start of the wave count became a high in 2007 instead of a low.

The truer “total” interaction of the Sun, Earth, and Moon would be the 19 year 5 hour two dimensional interaction cycle multiplied by the 18.6 year Lunar Declination cycle multiplied further by the mini-Ice Age cycle of at least 178 years if not 200+ years. This is a major “reason” why probably more Traders have lost their (family) fortunes trading the wave counts of the 19 year 5 hour supposed “total” interaction of the Sun, Earth, and Moon than have made money using it.

There is a tendency for bubbles when Saturn is in Sagitarrius. The SS Bubble peak was S in S, as was the 1986 to 87 rally, the 1957 to 58 rally, the 1928 to 29 rally. So, even tho’ I am a bidirectional short term trader, I will not be suprised if the next two years are in rally mode, even tho’ prices are high and solar waning has commenced.

The tulip mania also really got ramping up with S in S in 1634.

This is all verifiable in 2 minutes by going to “theplanetstoday.com* and scrolling back to dates mentioned. Why S in S is somewhat mania causing imo is unclear but does seem to be the fact.

Solar maxima make for speculation frenzies but not all speculation frenzies are caused by the sun

As always a balanced and well-reasoned presentation of the state of markets. Thanks, John.

The On Balance Volume* indicator has peaked in late December and trending down since Feb. it is currently dangerously close to breaking down below its lateral support. If it does, I will attack it with an increasing short position. Otherwise, continue to observe.

The winner in my portfolio based on this indicator is RSX which just broke out on the news of the Iran accord. Check it out.

Thanks John. Been a while since I last posted. In my opinion, Phil is the one to watch – his top call of Q2/Q3 is still on the table and most probably has the highest chance of success.

On certainty – it does not exist in precise stock market

timing.

It’s akin to children believing in Father Christmas.

You can with ‘certainty” make longer term calls –

another bear market will follow this bull market.

Reading JH’s views it’s about probability,

John uses multiple data sources that indicate

a particular outcome.

There were numerous posters last year who appeared

certain the bull market would end in 2014,

some no longer post on solarcycles.

When I read some posts which appear to proclaim

certainty on a given short term outcome,

it amazes me.

I either think this is disingenuous, or more likely foolish.

We can all share strong convictions on a given outcome,

but claiming more than this is ridiculous and enters Nicholas

territory.

John Hampson- many thanks for continuing to share your views

freely and facilitating a really great forum.

The lunar chord which uses moon phase, distance, and declination, tidal action and seasonal patterns is an attempt to achieve a probable short term direction for the market. In my opinion, this is more useful because there are more profit opportunities than making a unidirectional monthly or annual trade.

El Nino predictions increasing:

http://economictimes.indiatimes.com/news/politics-and-nation/now-imd-predicts-50-chance-of-el-nino-this-year/articleshow/46802885.cms

This has nothing to do with the Sun but it has much to do with the Moon as in Lunar Declinations. Do your research. For those of you into the 19 year 5 hour supposed “total” interaction of the Earth, Sun, and Moon finding out about the 18.6 year lunar declinations to the Earth will open your eyes to the fact that the much hyped 19 year 5 hour “total” interaction is based on a two dimensional plane of those three bodies and is not the real “total” interaction of those three bodies.

A “Canyon of Fire” has erupted on April 4 on the Sun and ejected a massive CME that will deliver a glancing blow to Earth’s Magnetic Field on April 7th. Combined with the very recent Full Moon and Lunar Eclipse could this glancing blow to Earth’s Magnetic Field help to unsettle the minds of the human herd such that an unsually deep sell off occurs this week for US stocks and the Dollar?

Or if I have porridge for breakfast, perhaps the China A50 will sell off some?

J

I hadn’t thought of that “the porridge indicator”. You may want to create a data feed linked to your pantry so we can all benefit. I could try to correlate my dinner choices with the Nikkei as it opens about the same time.

Thanks all

Of course the other explanation is that markets have nothing to do with sunspots.

So why do you come here? Plenty of other sites for you to frequent that would take the same line.

And as if by magic Mr Benn disappears

Go away –

I witness a spectacular red/blood moon rising yesterday 9pm GMT.

JohnH, thanks again for an amazing post and forum. This time the chart that ‘stands out’ for me is the ‘Evolution of Consensus Forecasts’ one.

It highlights the complete ‘nonsense’ that Wall St. analysts are trying to hype up.

It’s fantastic to read a forum with views that are

not readily available on many mainstream sites.

You can go on to just about any stock discussion site

and find 1000 posters who subscribe to FED/CB

omnipotence.

To the vast majority of stock analysts the cycle peak

is perpetually about two years away, it’s never today.

How many recessions have the FED anticipated.

Just fyi, the DOW long stop is moved to profit. Will see what happens later.

J

Took profits on DOW shorts. An Ascending Diagonal Triangle has an upward trend with ABCs in both the down legs and the up legs. It is more of a sideways trade with an upward trend. I am not expecting the ATH until this Fall nor am I expecting a parabolic tend higher in US stocks. Good luck trading Guys….

Note that June DOW futures are collecting a lot of daily Candle Stick “tails” under the 100 day sma. This is not bearish but bullish for new ATHs.

Hi all ! How are you ? Great employment report last week with less job creation than expected. This should encourage the FED to print more and drive the markets higher. I recommend to increase exposure to IBB and QQQ today.

Good post by John this week-end but I still don’t see any analysis on central banks actions.

You call that a “great” employment report? Are you nuts?

Ah the hindsight guy is back. Having said that, my DOW long worked out great:)

J

Good for you as the king dollar fell off his chair just at the right time-:)) This is a catalyst for the near future.

My oil stocks rocking.

Rotation to the weak sector such as oil can keep the market afloat. Internals are enjoying significant improvement.

Anyone who went long that futures dip deserves

their profits as it was a gutsy position to take.

The futures move looked exaggerated, enjoy your

gains.

Phil W: You have been quite accurate with your calls and always balance view. I recall a few perma-bears jumped on you when you made that gutsy call. Good job!

I think the current rally is short-lived though. Markets will quickly reverse tomorrow and sell-off will potentially soon resume. Great time to book profits imho.

50% closed on DOW, stop moved up (non-guaranteed btw). Just gone short China A50, stop at 12475. If not stopped, this I may be willing to keep for a while.

(In true JS fashion, this will probably be stopped within 10 mins).

J

too much pessimism…today the market structure has been fully reversed by Big Boys. Some money are going on commodities sector.

What a coincident! US dollar falling and Saudi raising oil price at the same time. They are game changers.

Looks like last Friday’s Full Moon has done all that it could to help an ABC lower in the DOW and now it is rally time to the New Moon on the 18 that will probably be a new ATH given the cluster of daily Candle Stick “tails” beneath the 100 day sma. A cluster of daily Candle Stick “tails” implies an Intermediate to Medium swing turn is occurring. In this case, swinging higher to a new ATH.

Until this Fall; Pivot, Swing, and Day Traders may “rule the roast” as the markets trade sideways with many ABCs with an upward trend.

The optimistic news that refineries are going to produce the most gasoline in history, over the next several months, may “trump” the pessimism from a credit downgrade of the energy sector this month.

And we still have 92% odds of a new ATH before taking out 2039

There have been a few cases when the market has spiked around the full moon, then trend continued down

I’m itching to go short here at DJIA 17939…..Newt, tell me why that’s not a good idea please.

I won’t tell you. We wear different lenses-:))

Hahaha!! Yes but it’s very useful to look at the world through different lenses from time to time.

I guess what I’m asking is whether you see the ‘internals’ of the market as being strong or weak despite the 300+ point rally on the DJIA?

P.S. Whatever you say, I won’t hold it against you, promise.

We are still in a trading range on a day when bad news is good news. No need to sweat on either side. Just watch lateral price support/resistance.

Please can someone help me here:

When the market is at a high of a range and the RSI is trending downwards whilst the market makes new highs then that is a ‘negative’ divergence….and vice versa.

However what is the significance if the market is near the top of the range but below it’s previous peak whilst the RSI is above the equivalent peak. Is that a ‘negative’ divergence or will the market catch up with the RSI? This is first time I’m seeing something like this ever in my (shortish) trading life.

Thx in advance.

Traditionally called hidden divergence

happens all the time on lower time frames

slater9 I’m sorry I just saw your response and am very grateful. Please can you tell me whether this set up means that the price will catch up with the RSI or vice versa.

Thx.

Excellent day for longs. I’m pretty sure there’s been strong central bank buying earlier today to prevent a gap down. Good job central bankers. We should be at nwe highs soon.

From a more experienced viewpoint, it appears that the topping patterns are complete in both the biowrecks and the transports.

Where’s the edit button? U.S. Dollar too

I boldly went short at the close today. Resistance is 2-3% higher, so this three day trade should only cost me that amount.

I have to hold this trade till Thursday AM so hoping some weakness appears by then. If not, I will blame it on today’s Uranus conjuction and the red moon eclipse not being sufficiently bearish.

I also went short today with a tight stop loss. It is so late in the current cycle that I don’t see a new ATHs in the next few weeks. Need to see a reversal first, preferably tomorrow, before adding more short positions.

It is kind of risky chance of 2 – 3% loss if market keeps higher, but sometimes this time of year (esp. with moon phase near full and falling tides) market falls by several times that. My ideal would be red candle tomorrow same size as today and continue lower. Won’t stay short past Friday tho’ as that is when tides reverse and new moon/perigee are on the horizon.

I went long in Aftermarket.

Key factors:

–fear subsided as shown by $CPC:$RHSPX;

–a buy signal flashed by $NYSI;

–SPX higher lows;

–$NYAD (cumulative) ended ATH and fractals suggest high prices may be in work.

–strongest $NYHLR since Feb. 17.

Longs need a price close above resistance at SPX 2,088.

stopped out for a small gain.This is getting silly.

Ditto Valley. I too view this week as an ideal time period for a solid reversal geocosmically. I am willing to hold my short through the rallies, as I see very limited upside for the SM from here, 2%-3% at most.

As you already know, there are better opportunities to make some dimes in the commodity sector now. Both miners and oil might still have at least 2-3 weeks to keep rising, unless the cycle is somehow aborted early.

I am excited about gold as I am seeing a tremendous opportunity of a lifetime. 🙂

Could be true. Sometime within a relatively few months or years the miners will probably 2 to 3 times the current price (albeit maybe only for a brief window). So buying now with a plan to sell at a predetermined level seems like a good bet. They are real companies with real profits and an important international business so eventually they will probably have their days in the sun.

Their last big bull cycle was +2400% over 17 years, 1965-82.

So, yeah, I agree with you, some days in the sun lie ahead in the stagflationary 20s.

Crash now or around the corner?

In my tool kit, Cumulative $NYAD and $NYUD most often showed a negative divergence to price before a correction took place. Currently, there is no negative divergence. In fact, we have a positive divergence since $NYAD (cumulative) reached ATH yesterday.

Why does it matter?

In the Carl Swenlin article linked below. The 1987 crash was foretold by badly listed internals. The indicators cited in the article are most equivalent to Cumulative $NYAD and $NYUD..

http://stockcharts.com/articles/chartwatchers/2012/10/lessons-from-the-1987-crash.html

so my answer to Crash now or around the corner?

A crash is probably not going to happen anytime soon but hopefully I can sniff it out with my tools when it does come….

Newt, thanks for answering my question from last night 🙂

I was looking at the NYAD and NYUD yesterday and that’s what prompted my question in the first place.

NYAD seemed very strong but NYUD seemed quite muted and I thought that price was being driven by low volume rather than conviction.

I’m still MILES (and miles) away from reading any of this well but one has to start somewhere eh?

A comment regarding e-waves. You know. Bob P. gave his dire P3 count and many of my friends are still waiting for it. My point is. People have been burned by outcome bias tool like e-waves. ..but I am not the expert.

Yes you are right. And yet the same tool ALSO told them when they were wrong (a long time ago) and should take action to at least mitigate losses if not actually trade the other way.

That’s why I believe EW is used incorrectly….sadly most by Bob P. whose done so much to promote it.

Any way just to let you know I can see a 5 wave count completed on the ‘up’ side on the 5 minute chart on the DJIA at 17984. I’ve taken a short position with a stop at 17990 (being generous here…lol).

The bottom line is we shouldn’t blame the tool if the user can’t use it properly.

Hi all ! Ok, looks like to correction is over for IBB. I’ve just increased my position again. DAX is also doing very well, nicely supported by ECB buying. The central bank of Japan is also doing a good with the nikkei. So, all in all, everything is going as planned. I’m tempted to sing ‘everything is awesome’ from Lego Movie.

People my earlier call for a short will be validated if we break below 17940 on the DJIA BEFORE we break above 17990.

IF this one holds then the downside target for me is below the Friday ‘out of hours low’ for starters although I would like to think that it goes WAAAAYYY below that..

This may sound a bit preposterous ….and it may well turn out to be so.

Provided the DJIA doesn’t go back above 17990 I reckon we are heading to at least the early Feb lows and probably lower than that too.

Please do your own homework here. thx.

Wonderful! World-wide, the central banks are buying the broad markets propping them up and that is your reason to celebrate. Have you ever given thought as to why governments would resort to propping up their stock markets? Obviously not – you and mad crowd of people that panic into and out of markets. People with no understanding of markets are left holding the bag at tops and bottoms – they are fools. Study some market history or you too will be left holding the bag at the top after being played a fool by experienced traders.

if you have long positions, you need a plan that you’ll follow when/if the market tops. Nicolas, what’s your plan? SPX could go to 3000, or it could top tomorrow. How do you decide when to cash in your chips?

The problem with the crowd at tops is that they think they are safe in numbers… that there is an all powerful government that has their back.. that if the “experts” on CN’BS’, Bloomberg, etc. say it is so, then it must be so… I saw it several times before, smug, inexperienced, greedy lemmings appearing at tops with no exit plan thinking they the chicken can outsmart the fox…

Ugh the above comment was meant to be on ‘its own’ and not as a response to our friend Nicolas. However the message remains the same Lol.

impeccable timing

like clockwork

peak biowreck

You won’t get any details from Nicolastroll on anything like that. This is his repertoire:

1. Stay away when markets go down.

2. Come back when the drop is over and apologise for your absence like anyone gives a sh1t.

3. Pump QQQ, IBB, AAPL.

4. When asked for any details brag about the size of your position and profits.

Tell me, which of the above are NOT trolling?

LOL

J

Moon is Scorpion today, and tomorrow. Building a lego bridge to much lower prices next 5 trading days. “Negative Beta is Awesome”.

You can located ephemeris on numerous websites, and moon in Scorpio for some reason has SM non rally most months.

Anyone wish to pay Spain to park your money for six months?…….INCOMPREHENSIBLE!

I know I sound like a broken clock but these markets are broken and astoundingly non-functional and it will end in disaster for all but the few holding tangible assets like gold.

And I am NOT and have never been a gold bug btw……however sometimes you have to recognise things as just what they are amd in the coming realisation, tangibility will count for everything.

I had hoped that the Chinese were a little more astute but unfortunately they are just as dumb as the rest of us

http://stockcharts.com/h-sc/ui?s=$SSEC&p=W&yr=5&mn=0&dy=0&id=p08372245106

Allan

I think that exchange is open to global money flows.

J

J, it is a product of domestic decision making. PBOC policy is largely to blame.

I am amazed of the geocosmic factors that valley and andre are presenting. It looks like your call is starting to play out, which would be in line with a strong correction case that JH has been calling…

I am a beginner of financial astrology. My observation based on my limited knowledge of geo is that we are entering a very critical reversal zone today and tomorrow. The Sun trined Jupiter on 04/02, then Jupiter will turn stationary direct tomorrow. Between 04/06 and 04/09, Sun and Mercury conjunct Uranus and square Pluto, which imv is a major reversal signal. imho It looks like the reversal signal has been observed before the close today.

As of now, it is amazing that the geocosmic factors and Ewave are resulting in the same result: an imminent downturn. A believer of EW, I however have never used it as a trading tool. I rely more on cycle count, which currently points to the primary cycle peak due anytime. or could have happened already on 03/02. If that is the case, the imminent correction could be nasty, choppy then heavy sell-off into May.

I am remaining 100% short SM, long oil and miners.

Sorry for the obvious, but what is SM?

SM: stock market 🙂

Silly me. I keep forgetting.

A few successful calls like this per year could really boost your annual returns. I am short SM, 100% long miners (small amount trying to market time). I won’t be short past 4/15 cause invariably there is a post tax day rally in US.

So the start of another US earnings Q.

Alcoa has sold off sharply since the last update,

so it will be interesting to see how the market views

the outlook.

More than usual the focus is now firmly

on the outlook and any guidance changes,

rather than the Q earnings.

http://www.bloomberg.com/news/articles/2015-04-07/the-great-american-invasion-into-europe-s-debt-market-has-begun

Ref, the commercials gold chart. It is in a position where rallies occur, However, when gold hit $1300 late last year, early this year, the miners sold almost as heavily as in 2012 when gold was at $1800. In fact, the pattern of commercial buying and selling is somewhat similar to the 2012 distribution – the miners have been selling heavily overall for months. Plus the pattern is lower lows and lower highs. Do the large specs have the firepower to over come commercial selling and take prices higher?

I’m taking another short here at DJIA 17970 with a stop at 17990.

Yesterday’s drop was a complete 5 including overnight session. So W2 can’t go beyond start of W1.

Let’s see how this turns out.

Uh oh! Just checked on NYAD and NYUD. The former looks very strong although the latter looks somewhat muted. I really should get in the habit of looking at those 2 at least before making a trade.

Just went long. SPX 2075. I love the whipsaw.

still playing $NYAD (cum) continuous ATH will lead price higher.

$NYHLR at 18 is very very healthy.

Hi Allan ! I think the chinese are very smart. They saw all the QE in the US and Europe and how it created a huge bull market in stocks. They want the same thing and it’s nice to see the central bank of China driving their stock market higher.

Do we buy Hong Kong or China?

Hi John ! I would recommend China over Hong-Kong.

Regards.

One of the strategies to hedge against a US top may be to diversify to oversea markets as the US FED is becoming hostile (at least in rhetoric).

China may go down but it will bankrupt a lot of shorts with it.

So Nicolas may have a point. No teasing, his lenses are pretty good in seeing through the easing game.

I agree that earnings season will be pretty crappy but it doesn’t really matter. The important thing is that companies continue to borrow at 0% to buy back their stock + central bank buying. So once again I’m not worried at all.

By the way, don’t forget to short gold and gold stocks.

Target Purvez?

jegersmart, I’ve lowered my stop loss to come out with a small profit. However if this is the wave that I think it is then I would like to see at least the low of April 3rd. but potentially much lower based on my larger counts. I’ll definitely take profits at around the April 3rd low and then re-assess wave counts.

Looking at the whip saw since the FOMC announcement I can’t tell what this wave is. However suffice to say that it doesn’t look anything like the down wave that I was expecting so I’m going to take profits at 17885ish and call it a day.

Gone long dax at 12050 for the next power rally to 12500. Small position at the moment but will add on any bigger drops to build up a full position. Easiest trade of the lot in my opinion. Bailed on my dow short with a loss as I don’t think that will work out just yet.

Hi Krish ! Good decision, although you should have listened to me earlier. I agree that DAX 12500 is a walk in the park.

Fully short, market going to drop like a gold plated lego until next Wednesday.

Short again.

The DOW is losing its upside momentum. Its momentum could rapidly go south.

taking nicolas’ advice here… Thank you!!! Short stocks and long miners.

“Everything is awesome”. Legoland Movie

(If you have negative beta).

Someone didn’t like what the Fed had to say.

The FED minutes look great, nasdaq up almost 1% and gold is down. Indeed, ‘everything is awesome’ for my portfolio.

Of course the Fed minutes is old news and does not reflect the disastrous jobs report. However, fools will continued to be fools!

Exactly. The data is at least 3 week old, before the horrible job report, and before the expected horrible earning season.

Nicolas, when the analysis of this FED minutes is complete it could be interpreted as a short term indicator of indecision which may result in a few days of market pause in its upward path. I would only be short this market until next Wednesday while the market digests the implications of the latest news.

Hi Valley ! Yes you can, but why take the risk of being short for a few days when you can make so much money by buying IBB, AAPL, QQQ and holding ?

That’s boring! Why not use your lego’s to build new structure every day. Today build a bridge to lower prices. Next Wednesday a sky scraper to much higher prices. Buying and holding is like building a lego structure and then letting it collect dust.

which side is going to get worn out?

Nicolas will soon realize that swing trading is superior to buy and hold in the sense that you profit more on the upside and the downside. Perma bulls and perma bears are right but just like a broken clock is not a sound strategy.

+1 Agreed.

This market (in the short term) has become very schizophrenic but the slightly longer term charts still say down…..to me. So I’m re-initiating one of Newt’s ‘scouts’ in that direction at 17886ish. Stop is 17930. Have no idea where it will go but if it does head down below 17820 then I’ll add more.

Watch the toupee!

I stand by my back-tested tool that says current’s $NYAD cumulative ATH will resolve in new higher price for the markets.

Newt., without a doubt there will be new higher prices for the markets. Just not until next Wednesday. I have backtested my indicator system to 1998 and by Martin Armstrong’s beard, I can promise you a one or two percent decline before next Wednesday.

I can dig it!:-))

valley. i am with you 100%. My confidence is enhanced when the geocosmic factors, EW, technical indicators, and cycle are all aligned. imv the question is not IF, but WHEN and by HOW MUCH the market will retrace. Worst in the worst case scenario to me is a retracement of 38% Fibo by early May. Best case scenario is a 10% drop like last Oct. 🙂

100% short.

Erick, I am only bearish very short term. I am bullish next week. I am trying to trade only on lunar seasonals and price action cause even in a bear market almost half of the trading days are up (it’s just that the days that are down are doozies).

You have a great strategy valley. I agree that the correction doesn’t look like a straight drop from this level. It might be choppy, fleecing both long and short before falling hard. I too view my trade as a short term short. Will adjust or swing trades where I see fit. Good luck to you!

Purvez – On the daily charts the markets are basically trendless right now, so you have that correct.

Earnings season is as rigged as the markets and I pay almost little attention to it in my apporoach to markets.

From my memory in the last 20 years, overall earnings have have not met expectations on only 2 occoasions and neither of those was during the GFC. Companies know well ahead of time whether they are going to meet expectations and begin prepping analysts and accounting accordingly.

It is just another way that WS hoodwinks retail investors.

On AA earinings, case in point…..adjusted earning crap, who gives a?… Bottom line sales disappointed and are actually disastrous and it sells at EPS of over 60 !!!

The mirage continues.

“One of the strategies to hedge against a US top may be to diversify to oversea markets as the US FED is becoming hostile (at least in rhetoric).”

I hear this said all the time and yet history is filled with the exact opposite evidence.

The fact is that when the US markets go down, everywhere else goes down.

Usually it is more like a relay race where US leads 3 years, then Europe 3, then EEM for 2 or 3. Look at comparison of annual returns by market and you will see this is more or less (except for 2008) they way capital moves from market to market. Based upon this expect EWG or EEM to lead in the next leg of the race.

No offence intened but advising people to BUY this??

http://stockcharts.com/h-sc/ui?s=$SSEC&p=W&yr=5&mn=0&dy=0&id=p65068182090

That is not investing, that is tantamount to throwing your chips onto black or red!

imv SPX is just simply crawling along its 50 DMA. When SPX breaks down, we’ll quickly see the 200 DMA. I am confident that the correction is around the corner that I continue holding my short positions, even if SPX manages to crawl to 2100 first before crumpling.

GLTA!

Curious to learn about your view of the VIX vehicles… It is dropping like a rock on large volume the past couple days. I know VIX is not an indicator. If the current VIX simply reflects the over and extreme bullish sentiment now, the markets might soon be in serious trouble.

I bought VIX at the close for the first time. Small position anticipating fireworks to the down side tomorrow AM.

Went long EUR/USD @ 1.07837

Setup chart

Added @ 1.07622

Added @ 1.07470

Nicolas here is something to to think about whilst you continue to bash gold.

Anyone that had the intestinal fortitude to buy good quality junior and mid-tier Australian gold stocks in late 2014 are now up at least 300% on that investment.

Some are up as much as 500%.

Buy when nobdy wants anything to do with a sector and sell when it is the only sector people want anything to do with.

The really exciting thing is that gold and gold stocks are still not even close to being on investor radars.

I was jumping up and dow late last year saying that gold producers, particularly those outside of the US, such as Australia, were entering possinpbly a perfect scenario of declining domestic currency and collapsing oil price. One company I bought increased their cash on hand from $68m to $108m in one qtr whilst establishing a new record production and lowering costs.

Nicolas, time to pull your head out of you know where and look around a bit!!

A few examples

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Stock&symb=au%3Asbm&x=47&y=23&time=8&startdate=1%2F4%2F1999&enddate=9%2F13%2F2012&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=32&lf2=4&lf3=131072&type=2&style=320&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=10

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=au%3Arms&x=0&y=0&time=8&startdate=1%2F4%2F1999&enddate=9%2F13%2F2012&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=32&lf2=4&lf3=131072&type=2&style=320&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=10

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=&symb=au%3Anst&x=39&y=15&time=8&startdate=1%2F4%2F1999&enddate=9%2F13%2F2012&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=0&maval=9&uf=0&lf=32&lf2=4&lf3=131072&type=2&style=320&size=2&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=10

They are some of the most bullsih charts you will ever see.

Well done Martin Armstrong for scaring the c#%p out of investors and contributing to the hysteria surrounding gold and gold stocks at a time when they should be buying…..SHAME ON YOU!

He certainly made it easy for me though!

Yeah, it is easier when no one else cares about the sector you are sure to go many times higher. I wish I had the expertise in this sector, have to settle for the GDXJ which will do o.k..

Previously posted thoughts on oil of a triangle – seems to be playing out still so I’ll stick with it.

Vertical line was the timing model I referenced previously and when I went long.

Thanks JH for posting – Would like the time cycle to play until July/August for better odds of a final thrust down to 34 level.

Tomorrow is Mercury SC. Average returns over last 17 years for 7 trade days after Mercury Superior Conjunction have been slightly negative, and at during the same time the SP500 has risen from 71 to today it is at 204. This is another reason apart from seasonals and lunar that I expect bearishness next 5 trading days.

Can you chart your lunar declinations? My lunar Cycle had april 6 bottom and strength into new moon.

Or do you have a site that lists the parameters? I’ve been cautiously bullish because of your posts, usually I’d be bullish bullish.

Agreed strength into new moon. However, seasonals until 4/15 weak and Richard Nolle declination table shows 4/11 as far South position. Market often doesn’t rise until far South is past.

I don’t have ability in using Stockcharts. But with a few minutes work you can print a chart, go to Nolle’s calendar and post the far N, far S, and equatorial crossing on a few months of data. What you will find (this is fractal so applies to any month you look at, subject to exceptions) is that when moon crosses equator you get high tides and high stock prices and when moon makes it far N to Canada, or far S to Australia you get low tides and low stock prices.

That Hong Kong though……:)

What about a gap play on the Hang Seng? In my experience these always close sooner or later. There are 2 now below, from approximately 25300 to 500 and the most recent from 26250 to around 750…..

I think if 28000 is seen I would be tempted to short, hell I may short if not seen once this pullback is more directed…..

J

should have some more room to rise as with this momentum (best with the indicator divergence – target at 28500 – reason behind is this year low is 22500 +6000(6000 is a Gann target).

Nikkei old high at 20800 level (or 21000) so if looking from a global perspective, a bigger correction say 10% need to wait Nikkei hit 20800 level and revert.

Expected high day should be around of beginning of May.

China is still at 25% or so premium to Hong Kong. The problem with arbitrage is that those doing it do not care about technicals and stops.

yes and agree. That’s AH share is part of the story (to eliminate the difference) and the other is the volume. Look at that volume these two days breakout, these breakout are with volume and with enormous china capital inflow.

What would be the trading vehicle to short Hang Seng? Thanks.

Hang Seng future (in IB you type HSI and pick future and option month)

Hang Seng put option

I suggested you double check clearly before shorting this as this craziness can run for awhile, though the pattern is a daily shooting star but I don’t see any bearishness as of now

Thank you so much for your answer and suggestions, apple.

My last night’s DJIA short got stopped out at 17930 after I was already in ‘la la land’. I was miffed!!……but then after making a nice low it shot back up again a little earlier today so I’m short again from around 17920ish.

I still don’t know where this thing is headed but I have a ‘screwy’ wave count which says this is a ‘Leading Daigonal Triangle’. I admit a very shallow one and therefore highly suspect but nothing else fits the bill….and the one thing about EW is that there is always a way of counting any wave. Ha!!

So I’ll wait to see what happens.

Aaah well that didn’t work out so well.

I can’t help myself, I’ve got another ‘scout’ short since DJIA 17920ish. At time of writing it’s very healthy!! Haha.

John Li’s comment on arbitrage has prompted a question to jegersmart. Do you have any other spread bet trading accounts other than IG?

If you do, do you monitor the quotes between them and arbitrage on the ‘not so rare’ occasions when they go out of synch?

I have an IG spreadbet account and a CFD account with another provider and quite often they go out of synch by as much as 3-4 points before catching up with each other or even better going in the other direction. I have often wanted to play those as they are ‘guaranteed’ money. Unfortunately my IG account is for short term stuff and my CFD account is part of my SIPP pension fund so moving money between those is really difficult. I’m tempted to open an ordinary CFD account with the other provider but my laziness prevents that from happening.

However over the last 6 months one could have made over 5K GBP from just doing this arbitrage with a 10GBP per point trade on each side. Each trade lasts no more than a day at the MOST….and often just a few hours.

I’m talking about GUARANTEED FREE MONEY here. If one could afford a bigger amount per point then this could ratchet up very nicely indeed.

I haven’t looked at it tbh, the last time I traded arbitrage it was between Bitcoin exchanges and pools of liquidity over a year ago….:)

J

Was that successful?

Shooting Star candlesticks are lighting up the biowrecks day after day

i’ve never seen such a collection of inexperienced, uninformed, ignorant and greedy sheeple in my life

I was in the cancer business when often my partners (MDs) had to deliver the bad news to their patients. Biotech is about hope… human’s strive for a cure. Biotech share price reflects the collective hope. Look around you. your family and friends.

Biotech may be bloated but this is the kind of bubble we need. A flame out will have dire consequence.

My 12050 Dax long looking great. Stop moved to breakeven and hopefully it can power up from here and smash through previous highs. Can’t help but think it will drag the dow up with it to around 18100. Lets see where it ends up over the next week! GLA

Excellent Krish, wish you all success.

Out again with small gain. This is really silly but I am happy.

Newt, please may I pick your brains here. The following is a link to the free Stockcharts chart for NYUD. The extreme right hand bar which I’m presuming is today’s data is showing a clear (as opposed to red) candle starting somewhere below -250 and just under Zero.

Should I read that as being Declining volume or something else? I couldn’t FIND any explanation for this on the site, although I’m sure one exists.

An explanation would be very gratefully accepted with Thx.

Oops missed out the link:

http://stockcharts.com/freecharts/gallery.html?$NYUD

For $NYUD. Best to set the “Chart Attributes./Type” to “Cumulative” and “Indicators/Price” to “$SPX”.

I use $NYUD” to identify bullish/bearish divergence and bullish/bearish fractals.

Add “Williams%R (14)” as an indicator……as it rises above -80 from below…that is your BUY signal.

I am stuffing money in your pocket-:)). Free no charge.

Ok did that and that actually shows that NYUD is still climbing but the SPX price is flat. Do I take that to mean that the SPX price will catch up to the upside again?

Sorry but this stuff is really new to me, although it may seem like novice questions.

Thx.

Thx Newt, if I ever get good at this, I’ll remember who put me on this track and send you a bottle of your favourite tipple….as long as it is under 100 bucks LOL.

I encourage you to continue to observe. Everything (all your tools) will tie together eventually.

Now replace $NYUD with $NYAD (also cumulative) As long as Williams%R stays in the green, you don’t sell.

This is my last post on this subject so I don’t clot up the blog.

Thx Newt, I’ve been looking at the NYAD chart from their gallery and the first thing that struck me about it was that I could count 5 waves up!! EW habits are hard to break.

Using my EW trading tactics I would go short right here with a stop above the ATH on that chart.

Anyway thanks very much for your tuition and I agree we shouldn’t clog up the forum.

Thx again.

It is not very ofyen that I can agree with Larry Summers but in his latest rant about liquidity in the bond markets I agree 100%.

i have said it all along, liquidity is the key, destroy liquidity and you destroy the markets ie bond amd stock.

Central Bankers are and have inadvertently distorted bond markets and thus in the process liquidity.

Forget SM’s, bond and currency markets dwarf the SM and this will lead to a crisis of unimaginable proportions throughout all three.

Cheers

Stopped out on EUR/USD long, terrible trade.

geno, I saw your trade set up chart and you had identified a triangle with an eventual thrust down. So I couldn’t understand your logic for the long position? The gain was always going to be quite small if the triangle was effective.

Not being critical but just trying to understand your logic for the trade.

Lovely pop on the DAX, I suspect the US exchanges will follow soon?

J

There is some serious divergence brewing between US and Euro, particularly Germany.

The DAX looks like it’s just completing the right shoulder of an Inverted H&S, so there is potential for further upside. Although on what basis is beyond understanding.

Their Factory Orders for Jan and Feb and March have been ….uhmmm lacking, and this is Germany we are talking about here! All hail Draghi.

Purvez

Re bitcoin arbitrage – only moderately. The main reason that I saw for the betas was the slow speed with which money could be moved. It worked fine for a while, but as things sped up I didn’t have an advantage any more.:)

It was good to learn something new, and also to actually move markets withone’s own trades – volume and numbers were quite low then:D

J

Yes bitcoin is a whole brave new world. However if you look at the chart it’s starting to look quite bullish. Don’t know if/when you would get above 1100 again though.

Strong accumulation day in the energy sector. If you set your Indicator to Daily CCI(272), you shall see a pounding buy signal.

newt. I think the same thing is true with miner. Accumulation day… Good call on RSX a few days ago. ESX and RUSL are flying high. Russia is a gold mine imv.

Sorry for the typos.. I meant RSX and RUSL.

The only problem is ON BALANCE VOLUME** which measures the difference between up and down volume. This is indicative of buyer/seller commitment. Until it turns up from its double bottom??, Lower low has a higher probability.

** XLE OBV is showing higher highs since Oct. 2014.

I will continue to observe. Thanks.

Thanks again newt for all the great tips.

Hey newt. – finally somebody else that uses OBV. The only indicator that has ever worked for me consistently daily, weekly, monthly up down and sideways.

Yes. Sir! This is a powerful tool and should be used in conjunction with all other tools.

The bulls have already won the battle and it was already predetermined by the chart action going back three months ago. If the primary trend was to even possibly reverse into something bearish then things would have broken down by the negativity during the end of Jan and definitely during mid-March at the latest.

But what is quite clearly happening is that the market made a temporary top at the end of Nov, then spent the next two months consolidating in a relatively “tight” range within 5% before breaking out to a higher level during a one month run from the bottom of the consolidation (end of Jan)

It is now merely repeating that process again where it temporarily topped out late-Feb/early-Mar and is once again consolidating within an even “tighter” range than previously (under 4%). There might be one more minor dip later this month, but the probability leans towards the lower support level holding and likely bottoming before the end of April. That implies a continuation of the uptrend pattern towards a breakout into another 3-4 week run into mid to late May to post a higher high again.

I can’t believe some people are still expecting a big crash, it’s like waiting for Godot. I’ve just read the Swiss Central bank quarterly report, and it says clearly they have been buying small cap stocks. The japanese central bank is buying stock ETFs outright. These are facts.

This is definitely a new era. This time it’s really different and John Hampson’s analysis is missing it.

Do you really believe this time is different? Or do you believe that we should ride the wave while it lasts, but have an stop order to get out at the peak? I would respect you more if you argued the latter.

Hi John ! Yes, I do believe this is a new era. It’s the first time in history that we have central banks buying stocks directly and driving rates below 0. The correct strategy is to buy stocks and hold until this era ends.

When central banks stop buying stocks, raise interest rates, contract their balance sheets etc…. then it will be time to sell stocks.

Regards.

Thanks for the honest response. I wasn’t sure if you were serious or not.

But if the Fed raises rates 9/2015, you would then sell?

“This is definitely a new era. This time it’s really different and John Hampson’s analysis is missing it.”

If this is indeed your thinking then why do you even bother wasting your time coming to this site to post your comments?

Even though I might not agree with everything that JH writes about or the views of some posters, I somehow keep coming back here because the majority of the folks here are respectful, intelligent, razor sharp, use multiple tools for analysis/investing/trading, and I always learn something new from someone or at the very least a new perspective that I might not have considered.

I think why the majority detest you, Nicolas, is not for your assumed success in going long and staying long in a bull market, but the manner in which you present yourself. You critically demean the creator and facilitator of this great website and you completely disappear when the market goes against you and reappear only when it resumes its bullish trend with egotistical remarks that most folks find completely condescending.

So I would suggest if you think JH’s work has absolutely no merit, then maybe you should go and create your own website and post your own theories about CB omnipotence and see how many regular followers you get. CentralBankMania.com domain is still available … you should register it now before it disappears.

Also … NicolasTheTroll.com is also available if you want to blog about your adventures into hijacking investment website comment threads.

🙂 🙂

Bravo Steve T. Well said!!!!

If this is true it means unlimited buying power chasing fewer shares as companies buy back their own shares. Sounds bullish.

Valley,

Thanks for your posts. What do you make of todays action? Are you still short?

Steve T

yes agree, and as I guessed the US indices are following suit so all good for now.

J

A good day for the long. No doubt.

I laughed hard when someone is saying that now is a new era. I remember the tech bubble vividly, that the term new era was thrown out all over the place to justify why the tech bubble was still worth a buy. We all know what happened after that bubble burst..

New era?????? lol.

Just ignore Nicolas, nothing to see here, move along.

imho

J

Price won but at the expense of internals today! In this case, I go along with price. No short signals.

purvez. I suggest you overlay Bollinger bands to your $NYUD (cumulative) chart. it is instructive.

Price 1, Lunar seasonals 0.

So far, Valley. I still have hope.

Since the all time high in the DJIA I can only see 3 wavers everywhere. There are only 3 wave types that have that signature. Triangle and Leading/Ending Diagonals.

Since the start of the wave at the ATH there has been a slight downward bias. 26 Mar low was lower than 11 Mar. 23 Mar high was lower than ATH. Given that scenario it rules out the Triangle. It also cannot be an Ending Diagonal because that would have to be trending UPWARDS at this juncture.

Therefore that only leaves the Leading Diagonal option currently. I recognise that it’s a bit shallow but it hasn’t broken any rules of the Leading Diagonal. I believe we are completing W-4 of that structure currently as a flat or a double flat.

So until it goes above 18160 (then it is no longer converging towards the lower trend line) I’m going to stick with that as the most probable course. If it is a Leading Diagonal then we should soon get a 5th wave down in 3 sub waves which ideally should touch the bottom trend line between 11 Mar and 26 Mar or even go a little bit below it. Currently that would be just below 17500ish.

Although Newt said there wasn’t a sell signal yet, he suggested that the internals were weakening. Also I’ve added the BBs to the chart as Newt suggested and we are close to the top of the upper BB.

Let’s see what happens today and Monday.

Having said all the above, I’m currently flat but will get aggressive once (if) it breaks below 17800 which is where support currently appears to be.

It can ride along the upper BB.

When a horseman climbed back on his saddle (which took tremendous energy and strength), he probably would not fall off his horse immediately. He will continue to feel sick from his internal injuries, and his body further deteriorate by the sun, the wind, the storms and dehydration. The next time he fall off his horse, you can mutilate him.

So I watch the health of the market. No short and happy that all my longs are doing fine.

Op/EX next week and April typically being the best ave. return month of the year are anchors for the longs.

Chairman Mao would say…”retreat when your enemy advances”.

You can tell I have watched a lot of western movies.

Hahaha Newt, yes definitely a ‘B-Western’ plot there!! 🙂

Good to know that your longs are doing fine. I’m side lined at the moment and feeling like my Leading Diagonal hypothesis is slipping away.

Hi All,sorry I did not update the back as I have said before, I am busy for the analysis Astro Time JKSE(Indonesia), for the S & P 500 I am looking for 15 / 16Low and rally into high.pullback 22/23 27/4 into 30/4 rally.Gbu

sorry I did not update the back as I have said before, I am busy for the analysis time JKSE, for the S & P 500 I am looking for 15 / 16Low and rally into 22/23 High.pullback 27/4 rally into 30/4 .Gbu

So the significant falls to an approx mid April low

have not materialised, despite the certainty of some

in this scenario.

$ index will increasingly hurt so things get interesting

as we head in to Summer.

Big dichotomy in current views on the US .. beginning of

the cycle roll over, or temporary weakness with growth

accelerating in the second half of ’15 – the answer to

that largely determines if we see the final bull market

top over the next few months.

Have a good weekend folks.

‘Not materialised ‘ yet Phil.

Too early to count those chickens.

Take a look at a seven month daily chart of the June US dollar index futures with a 35 day sma and 50 day sma.

As the June US dollar index soars to new highs is Gold going to break to new lows? Is US stocks also going to smash to new lows right along with Gold as the dollar soars to yet new highs?

Is the Euro going to follow the Pound lower?

In current “market conditions” is it all about the strength of the Dollar?

How much more Dollar strength can US stocks take?

As long as Nicolas is not disrespectful to John or others I see no reason why he is not free to express his opinion as others do freely.

We don’t have to agree with him, because I certainly don’t.

Longs on DAX – stops set, SPX in profit but lagging as we can see. Here’s to another potential 32.3% profit in Q2 with any luck!

J

Closed dax long with almost 300 points profit. So very easy to make money on the DAX as long as you remain bullish on it. As I mentioned it is dragging the dow up with it but not as much as I had thought. I am not another Nicolas though as I pick my long positions carefully unlike him who blindly goes long everything (much to his luck). I am not confident to go long US markets but only Europe for the moment until things change.

I have taken half at over 300 points profit, and stops moved up the remainder and on the SPX long.

It’s never easy in my book.

J

Does California weather follow the solar cycle?

Drought in

2014, 2000, 1990, etc…

http://www.bloomberg.com/news/articles/2015-04-10/california-s-new-era-of-heat-destroys-all-previous-records

The self-professed “Blue-Ribband” experts will laugh at you for suggesting that there is a cyclical connection between the solar cycles and Earth’s climate! There might well be drought conditions in a specific area (eg. California), but the only temperature “records” showing an increase are the falsified ones from the likes of the NOAA: http://www.forbes.com/sites/jamestaylor/2012/06/13/doctored-data-not-u-s-temperatures-set-a-record-this-year/

It will be fanscinating to see where all this official falsification leads us – temperatures, GDP, unemployment, inflation etc.

“According to the EPA, US heatwaves are much less common and severe than they used to be”;

“According to NCDC, droughts have become less frequent and less severe in the US”;

“According to Rutgers University, autumn and winter snow extent is increasing in the US”

Forget about the doctored temperature readings…doesn’t the drought image look like the solar cycle?

Thanks for sharing that chart John, do you have a link please to the original?

@John Li I discussed this almost two years ago on here. A refresher is due but larger climatic patterns are solar cycle influenced.

Is the Pound going to lead the Euro and Yen lower?

Neither emerging market stocks nor European stocks matter to US stocks. All that matters to US stocks is how much more Dollar strength can they withstand.

GE selling its financials because this is the best time. This leaves GE a pure industrial play go forward. This is instructive for the econ. cycles observers.

Watch XLF not excited about the deal.

$NYHL made a lower peak today. Recent history would suggest a price peak in 2-3 weeks. So sell in May??

Sy Harding’s sell in May signal is triggered upon a MACD bearish cross anytime after April 16th…

Check out RSX (Russia). Gaps to fill at much lower price and overbought on daily oscillator.

Yes. It is overbought. Buy low sell high. The same rule still applies.

I guess it would not hurt us wary of now, the flash crash came not tell in advance.Gbu

Still short after all these green candles.

$NYA broke out from the Feb. Mar. channel resistance today.

Given the weak internals, a back-test of the $NYAD bullish fractals early next week may turn your position green.

Good luck.

Wow Valley, that’s not your trading style. You must have a lot of conviction about a down wave. GL.

Thanks, exiting shorts now. Next week Lunar Chord sans seasonals is perfect.

Probably a good decision from a risk’s standpoint since $NYAD is riding the upper BB.

The next best short set-up requires a noticeable down day and a rebound to marginally higher price with negative divergences baked in….then the HFT algos can take over and wipe out the longs.

Valley do you mean perfect for rising or falling?

Perfect for rising. Sans seasonals which imo don’t turn until 4/15 at the close (Wednesday).

Hi all ! thank you Allan for your comments, highly appreciated. Yes, the DAX trade was very easy, as discussed on this board.

Look, I think John Hampson’s analysis is interesting but he’s still missing the importance of central banks in our new era.

As I said, the Swiss central banks is explicitly buying small cap stocks for example. This is something important to know and few people on this board seem to understand that.

Nicolas, I will agree with you on te point tjat CB’s are most definitely supporting this market

One needs only study the intraday 15/60 min charts to see the constant injections that are being undertaken to support these markets.

I disagree however about the longer term success of CB action. As I keep saying,

Iiquidity is the key and liquidity is evaporating rapidly. This will be a failed experiment by CB’s that will have ramifications for decades.

The proof is in the pudding: GE is leaving the banking industry and will be followed by others.

The days are counting down to CB impotence.

Nothing to see here other than another CB disaster in the making. I can guarantee that a few years from now Central Planners will become THE most despised, hated and castigated group in history…….and rightly so IMO.

http://stockcharts.com/h-sc/ui?s=$HSI&p=W&yr=5&mn=0&dy=0&id=p64884472015

“The proof is in the pudding” ! Who corrupted the original saying so that it becomes meaningless.

“The proof of the pudding is in the eating”, is the saying.

This implies that you can’t “Judge a book by its cover”.

ie., A superficial analysis reveals nothing. You need to dig deep and thoroughly research a subject to really understand what is going on.

Yea, and all those “perfect humans” are broke too:

http://finance.yahoo.com/news/gaps-tale-2-brands-shows-100608760.html

Hamilton Bolton of the Bank Credit Analyst “discovered” the importance of CB EZ or tight money policy in the 1950’s. So it is quite old hat. He was one of the great stock market predictors of all time. The new thing is the Japanese experience. The economies are so overly indebted that even though loose policy still helps the economy, reducing unemployment and increasing interest rates and inflation albeit only slightly. When they stopped QEing, the economy maintained some momentum for 9 months to a year. We are at six months. They went into recession and a bear market

He is not missing central banks and has stated their behavior as humans is influenced similarly. Checks your facts.

What’s missing everywhere is identifying when the new bull market started as opposed to just ABC correction of Great Recession of 2008.

I called earlier this year for stocks to go up. Not like 2013 but like 2014. Think need to pay attention to 17 year stock markets cycle for electromagnetic energy influence as opposed to pure or a single solar cycle. I believe now the 22 or 44 cycles are more important then a single 11 year one.

Yeah…..the Hang……I am going to love shorting that sucker…….soon….:)

Good weekend al!

J

You don’t tug on Superman’s cape

You don’t piss (spit) into the wind

You don’t pull the mask off the old Lone Ranger

And you don’t go short in April

Slim in the above referenced Jim Croce song imo is actually the planet Saturn which entering Sagitarrius may delay the end of the bull market until 2016.

This Jim Croce song “Operator” is dedicated to Nicolas:

Operator, well could you help me make this trade?

See, this bullish market is old and faded

Living in L.A., with the sun soon losing Ray

This bubble hubris has created

Isn’t that the way they say it goes?

Well, let’s forget fundamental analysis

And give us the numbers that best fit

So the market will turn to equity gold

Operator, let’s forget about this call

You see there’s no pin that going to pop this bubble

Thank you for your credit, it’s been really kind

Going to sell my silver dime

Isn’t that the way they say it goes?

Well, let’s not forget fundamental analysis

And give us the numbers that best fit

So the market will continue to brightly glow

The seasonal high sell mid April & early May and go away.

Voltaire,

Superman doesn’t actually exist as far as I know – but point taken:)

(not sure about Lone Ranger though?)

J

A detailed summary from Bob Hoye.

The bull’s days are numbered.

http://biiwii.com/wordpress/2015/04/11/pivotal-events-44/

GM,

you have been vociferous is calling for an imminent

equity correction – so how soon is now?.

We are aware that the bull market’s days are numbered,

we are in to the 7th year.

That’s akin to to me predicting that an 80 year old has already

enjoyed the majority of their life.

I have referenced the end of Q2-Q3 as the final bull market top,

so we are only 7 weeks approximately from the beginning of

that period.

If the bull market rolls on in to 2016, then that call will

be poor, no reasons or excuses, just a bad call.

Certainty in conviction and the actual outcome are

often different.

The first is subjective, the actual outcome is factual.

There is no certainty in short term stock market timing,

it’s never existed and it never will.

Me vociferous? Go find some evidence of that and report back Phil. I’ve merely continually agreed with JH’s analysis since discovering this fine blog late last year. Topping is a process of course.

I may have been vociferous about gold and its miners once or twice?

What exactly does the ‘end of Q2 – Q3’ mean then Phil? 30th September?

Me, I think it’ll be much sooner than the seemingly wide window you generously give yourself. I’ll be surprised if we make it to the end of April.

But I’m pretty sure no one here will trade anything based on my view (except hopefully picking up some shiny real stuff).

Gold Bug Hillbillies

This is a story ’bout the metal AU

Gold bugs say equities are thru

Say load up on GDXJ

Having hard assets is the only way

To Preserve Wealth

(Or with Texas Tea)

Next thing you know all the bugs are millionaires

Kin folk say what savoir faire

Moving to California to see and be seen

Pack up the Lambo and move to Beverly

Hills that is, swimming pools and movie stars.

Followed by gratuitous banjo playing.

This attempt at humor is just to say that just as Jed Clampet in Beverly Hillbillies TV show became wealthy by being at the right place at the right time (beginning of the oil economy with oil on his land), the new wealth is digital and is tied to digital commerce. AU is historically wealth, times are a changing, no guarantee that it will continue to be so in future.

Nothing is guaranteed, tis true. But credit bubbles come and go, and this one’s a doozy, its bursting will be very painful for many.

I am invested in GDXJ so I am a bit of a gold bud myself 🙂

Here is an idea for you.

EEM:$SPX scores a confirmed double bottom this week. Could it be about time for the EEM to out-perform the US?

I will be buying EEM on any pull back if this young trend continues..

Or try VEU:SPY…VEU which excludes the US performs since US.

I am tired of Chair Yellen and her colleagues threaten me with a rate increase almost on a daily so I will go to friendly places where valuation is relatively low and their CBs are friendly.

First Post.

Here’s what I see:

1. Moon crosses 0 degrees into the northern hemisphere on April 16/17

2. Moon at perigee on April 17

3. New Moon April 18

4. Puetz Crash window still unofficially hanging around out there??

I feel that the longs are probably still in control next week. But after the above factors come into play I believe a strong possibility of a steep reversal exists. This reversal might have some extra bite to it due to the fact that we just passed through a Puetz crash window.

While we did not meet the exact criteria of a Puetz crash window, I’ve noticed there have been a number of instances where the solar/lunar eclipse + full moon combination has produced significant reversals even though the exact window of time and exact criteria was missed.

TechNoir,

Maybe a fractal analysis can bring some clarification.

Adding 5500 days to the very important March 2000 high gives April 15th 2015. The midpoint of this cycle – adding 2750 days- gives October 4th 2007; just a week before the biggest crash this century. This is fractal.

Adding 182 days (=180 degree Gann technique) to the October 15th low gives April 15th.

This will happen in week 15; 15 being the 110 degree angle on a 52 week cycle.

This coincides with a lunar declination extreme on April 10th.

Crashes typically occur after a sun-moon square and typically run for 3 lunar phases.Today is last square so this pattern predicts a may 4th low on the full moon.

I think the crash cycles are still open.

Cheers,

André

Andre’, this possibility fits nicely within the metal stem months which began April 4th and extends to June 4th. Metal chops wood (paper) and since stocks certificates are paper metal reduces value of stock certificates. Since 1998, stocks have averaged down .5% during metal stem months considering this includes about 38 months of data this indicates that these months are weak. Also, if at beginning of metal stem months, if you were to go short (this would be April 4) and remain short until 4% gain obtained, about 65% of time you would have made the 4% on the short trade; the other 35% of the time would have been about even. The only factor which works in favor of the bulls is the preelection news cycle which has so much tradable value that it may be more important that all of the other factors. Preelection years in year 5 of decade, 1995, 1975, 1955, 1935, 1915 have all had gains, especially Jan 1 to July 4.

thanks

So if I’m following you correctly, you’re saying the top might be in around April 15th?

That’s right.

Andre,

I take it you are still expecting a crash. Your analysis, while appreciated seems to be continually truncated by CB jawboning interventions. What are you current thoughts?

Thanks

Bluestar,

I am constantly updating my timing tools. Next weekend I will show what I’ve found. I remain bearish, but want to understand what kept the market floating. I doubt it is CB’s. But that’s just me.

Fractals explain electromagnetic properties at quantum mechanics levels. Spoke about angular momentum of light. You are just seeing the indirect data Andre. Look at light.

Welcome TechNoir, your post is dialed into how I look at the market with the moon as the fulcrum of most short term directional changes.

You real reason you don’t short April is because :-

http://www.seasonalcharts.com/saisonalitaet.html#pos03

In a “5” year which is also a pre-election year, you would expect a high around Aug/Sep, allowing for a May/Jun interim correction.

I do my Armstrong cycles from actual lows not fixed dates. That suggests Aug 18 as ideal for an important top.

The Central Bank experiment may well ultimately prove disastrous both for the economy and for the CBs themselves as the final result would probably require reconstructing the global banking system. But even if that should come to pass it may take 20 years or even more. As the ongoing rallies have shown, trying to time that has been futile and the path of least resistance has continued to be up.

Practically speaking, we have a tough choice in front of us when the buyer of stock pays in currency freely created. The stocks may be wildly overpriced relative to history but the currency used to pay for them may be even more overpriced relative to its potentially infinite supply. The theme that the CBs are pounding on is “Whatever you do, don’t hold cash” because as a group, we can truly turn it into trash. Of course, that is where Central Banks finally discover that they overplayed their hand.

From ZeroHedge:

Six days prior to Japan’s devastating 2011 undersea earthquake that killed over 18,000 people, around 50 melon-headed whales – a species that is a member of the dolphin family – beached themselves on Japan’s beaches. Now, 4 years later, and despite a lack of scientific evidence linking the two events, many Japanese took to social media in fear as the mass beaching of over 150 melon-headed whales on Japan’s shores has fueled fears of a repeat of the monster quake, which unleashed a towering tsunami and triggered a nuclear disaster.

Is something brewing in the sky?

Please note that the HC Jupiter/Saturn cycle made an opposition on February 23rd 2011, some 2 weeks before the March 11 tsunami.

And we are headed for a square on September 21st. Things will definitely get wild; not just in Japan.