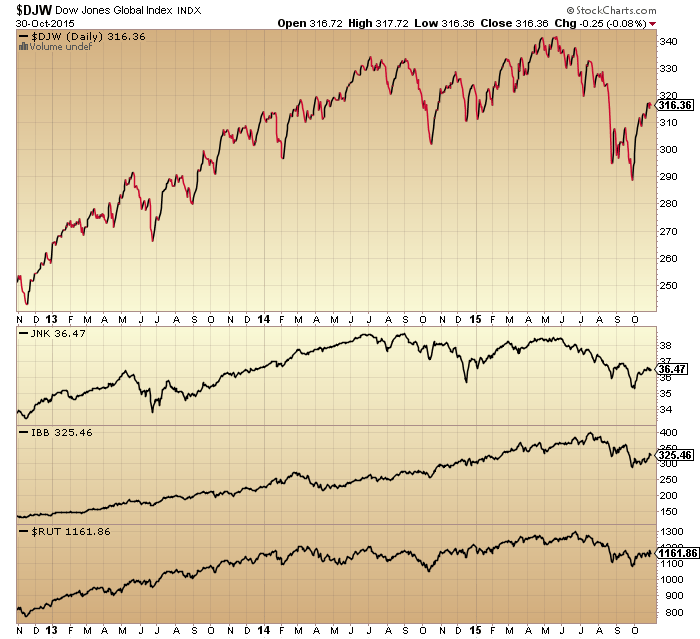

It has been a strong, unforgiving, bullish rally – but – only in select US large caps.

For the Dow Jones World index, junk bonds, Biotech and US small caps index the action better resembles a dead cat bounce.

Source: Stockcharts

The FTSE, HSI and crude oil similarly show weak bounces.

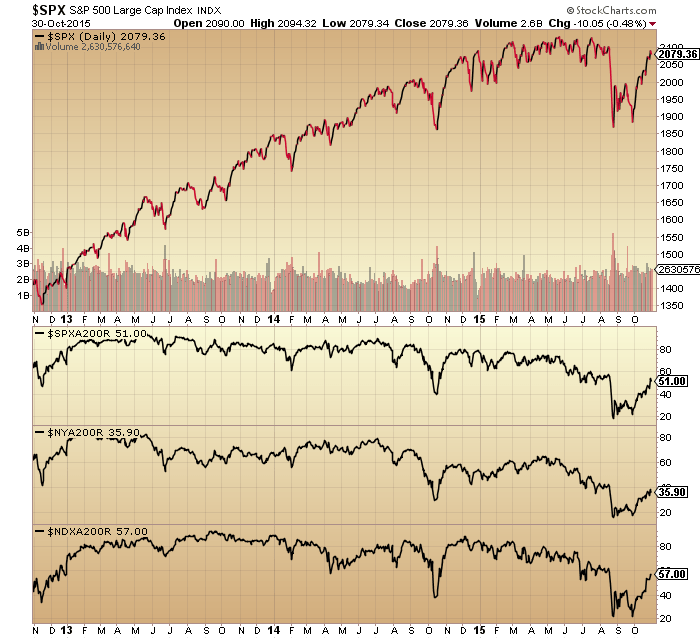

Here we see it looks much stronger on US large caps, but even there under the hood breadth has remained in weak longer term downtrends.

The NDX has double topped but on just half breadth. Therefore, even in the stronger US large caps, longs are doing well only in select stocks.

Another angle on the same is the equally weighted value line index which shows a particularly meagre rally.

In short, the ‘strong’ rally in October has seen the thinnest participation yet in both the US and globally.

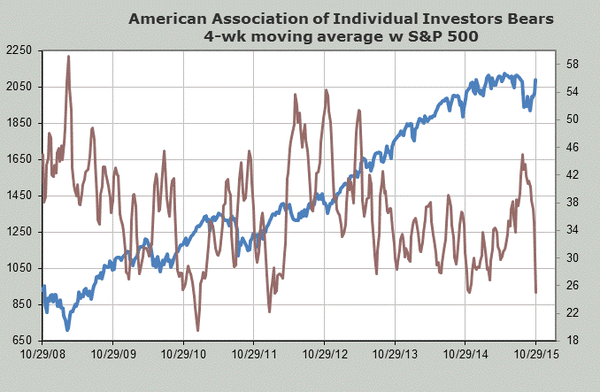

The model of similar solar lunar years from the past predicted a rally throughout October to the start of November. Now we are at that point, various indicators which had become particularly bearish (contrarian bullish) have now reversed back.

Source: Callum Thomas

Therefore, we may be in a position to rollover again imminently and maintain the bear market in equities.

However, there is little wiggle room. The SP500 is back at the major topping arc.

Source: Northman Trader

If strength persists from here, even in just select large caps, then this would break upwards beyond the arc, the NDX would make a new high, and the danger then would be that the other weaker indices start to attract a bid again.

For now though, the opposite holds. The persistent weakness in all areas beyond select US large caps suggests they are the last pillar to fall. Continued weakness in economic surprises, ECRI leading indicators, narrow money leading indicators and earnings (less negative than expected for Q3 but still negative, and still predicted negative for Q4) provides no thrust for a renewed move higher. Meanwhile, negative feedback looping around the world persists and until we see a break in that pattern then the likelihood remains of both bear market and recession, globally.

Source: Callum Thomas

Thanks John, Good visuals, I like the nice major topping arc!

I like the arc too but is it just fitted to the current price? I assume the arc curvature can be changed to suit a further price rise but the touchpoints would decrease. Anyway we should start declining over the next few days to keep that arc in play.

interesting article in The Guardian arguing that recessions are the result of governments cutting defecits and going into surplus. If you accept their logic it looks like we’re still about 5 years away from a crash.

http://www.theguardian.com/commentisfree/2015/oct/28/2008-crash-government-economic-growth-budgetary-surplus

“What this means is that if the government declares “we must act responsibly and pay back the national debt” and runs a budget surplus, then it (the public sector) is taking more money in taxes out of the private sector than it’s paying back in. That money has to come from somewhere. So if the government runs a surplus, the private sector goes into deficit. If the government reduces its debt, everyone else has to go into debt in exactly that proportion in order to balance their own budgets.”

This is leftist statist simplistic nonsense george.

If one takes the argument above to its natural conclusion, eventually the state would have zero debt, and could slash taxation.

But the state never does that, it grows ever larger, consuming and wasting more resources as it goes.

State, like central banks, are powerless in the face of natural cycles anyway, I can guarantee you will see recessions even as the *wise and powerful* flail around trying to prevent them. But they have to do *something* to justify their salaries and to appease the masses now dependent on them.

Hence, we are doomed to at least 40 years of hell on earth, or most of it.

Why are you expecting 40 years of hell on earth? Why hell on earth and why 40 years? Why not 25 years or 50 years? Come on, GM, please try to elucidate why you feel there will be 40 years of hell on earth.

You’ll note I wrote ‘at least 40 years’, so that does not preclude 50 years or longer.

The debt bubble of the past c.100 years is bursting and will do so over the next c.20 years, due to demographics, the laws of mathematics, and the cooling of the planet. Sovereigns will lose control and will default, one way or another.

These cycles come around every few hundred years, they are nothing new.

Wars, revolutions, famine, maybe an apocalypse or two.

I have read about this before, and the 2000 top was concomitant with Clinton surpluses.

Another succinct post John, many thanks.

The majority out there appear to be bullish still, and even the bears (like me) are only expecting a re-test of the lows.

So, perhaps the most likely outcome is new lows?

I suspect I will hold on to my shorts to give new lows a chance at least, optimist that I am.

Why are you expecting a retest of the lows? Come on, GM, please try to elucidate why you feel there will be a retest of the lows.

I think we’ll take out the lows.

I think underlying this rally is nothing but weakness.

I suspect it’s been driven by short-covering, and I smell distribution to late-comers.

Like John, I see numerous divergences within markets, and I see bullish sentiment is widespread, including the year-end rally narrative.

Certain fib levels have been hit, and I suspect that we’ve peaked for this rally, but I would not rule out an SPX double top to fool the majority.

(Also, the commodity complex is screaming a warning to the markets, falling prices are not just a symptom of supply/demand, but of the global financing based upon raw materials, i.e. a margin call of sorts).

Global central bank interference persists. Perhaps some consolidation in Nov and then on to new highs. Unless an exogenous extreme event occurring major indexes will continue to painfully grind higher. The truth is that CBs have not quite run out of ammo/ options yet.

Thanks John for your excellent updates.

Zoe, please explain to me how the CBS ‘run out of ammo’?

You say ‘not quite yet’.

What defines the dividing line then?

I hope you respond, as I find it bemusing when comments like these appear.

Either they can keep doing whatever it is you believe they are doing forever, and markets will rise forever, or they cannot.

Please explain your comment, if you can.

I echo purvez’s sentiment from a while back.

Part of the attraction of the comments section (for me anyway) is some back and forth debate on issues raised.

Zoe hopefully will respond to my question, maybe not.

I’d like to request anyone that comments to be prepared to discuss their views (debate with others), for the benefit of everyone here.

Am I deluded in this desire?

Possibly.

Well in to November now and although the rally did not

make further progress last week, we avoided major falls.

Interesting week ahead.

Why interesting Phil?

Come on Phil, try to elucidate why you feel it will be interesting please?

Thanks John. I see the long term bearish bias outlook of solarcycles is still the favoured oulook. Whilst im short term bearish I still think the medium term prospects are positive. Let me explain …

Its no secret that investor sentiment has been supportive of central bank actions. The FED seems to have most influence with their actions. Now as I mentioned im ahort term bearish. The FED have effectivly said they may raise rates in decmeber and there lies the trigger for a selloff. However, I dont belive rates will go up. Instead a new bout of QE may be around the corner. Until sentiment turns against sitmuls its onwards and upwards.

In my humble opinion, the “Second Chance Top” is in.

Last Friday I posted that I thought that the Second Chance Top is in. Why? I saw Ten year US Government Treasury futures break to new lows while Thirty year US Government Treasury futures did not but reversed and rallied. For me this was “the straw that broke the camel’s back”.

What this means for street lingo is that “the yield curve is flattening”. And for the first hour of Sunday’s trade that trend has accelerated. This mean’s the “smart money” is not only selling stocks to buy long dated US Government Treasuries but they are in such a mad rush that they are also selling short dated treasuries in order to raise all the money they possible can to buy those very-much-hated long dated US Government Treasuries.

I recommend comparing the recent hourlies of ZBZ15 to ZNZ15 (Dec, 2015, T-Bond futures to Dec, 2015, T-Note futures)(and see it for yourself).

What happened on the close Friday? It looks like the bottom was falling out. Not much follow through tonight, but no bounce either.

In only an hour of Sunday trade 30 year T-Bond futures are soaring and DOW futures are down over 40 points.

It seems obvious to me that the “smart money” is seeing a world wide decline that will crush long term inflation which is why they are pilling into US government 30 year treasuries as the best buy available at this time. Of course this means a serious decline in equities is imminent.

I like the ref to the thinnest market. That was a more common term in the bear market era of the 70’s. Also the time of the nifty 50. Stocks like Eastman Kodak. Polaroid, Xerox, IBM, several drug stocks, etc. Only the generals were left, as the troops had long since deserted.

Anyone got views on the DAX? I like trading it as it’s quite volatile but there seems to be significant buying pressure on it. I wish to mainly trade it short but there are big SnapBack rallies at the moment like this morning. I favour a move down to just below 10k if markets do roll over this month.

Krish, based on a cursory glance at the 5 min DAX chart I would say that we are completing a tiny triangle and therefore there will be one final ‘thrust’ upwards.

I don’t really follow the European markets but I have read that the rally had as much to do with the Euro falling vs the USD than the markets rising of their own accord. So I guess you have to throw the currency angle into the mix.

Yes the currency does have an effect. I bet the ECB were also buying german stocks to help inflate the market bubble. The DAX move this morning is far greater than any of the other indices. Oh well it just means even more money to be made from well timed shorts! Almost put on 200 points since the lows overnight!!!

John,

You appear to have lost some focus on the very essence of your website – the solar cycle. And many who used to comment here on their own associated work have been chased away by the “he who shouts the loudest” attitude that has developed here.

In the meantime, the short term solar effects (eg. flares, CMEs, sunspots) that fuel speculation have declined only very slowly, as we knew they would. With no sudden decline, there is less chance of crash-type events in the markets.

Even more importantly, the longer term effects (eg. coronal holes) that create increased geomagnetic disturbance (and which fuel nervousness and risk aversion) have already peaked. The peak months for SC24 geomagnetism were March and October 2015 – no surprise there. But the Ap figures for those two peak months were only 16nT. The corresponding peaks for previous cycles since 1933 (when the Ap series began) are 35, 44, 36, 30, 49, 40 and 36, so geomagnetic disturbance for SC24 has barely been half of what we have been used to.

In an even numbered solar cycle, Ap makes a double peak on 27 Spetember and 10 October each year so it is unlikely to increase again over the next few months. But it is also very unlikely to increase over the next few years either because:

– for Ap index since 1933, geomagnetism trough-to-peak has always taken six years, and the trough for SC24 was October 2009 – making October 2015 the geomagnetism peak;

– for aa index since 1868, the timing was also mostly 6 years but with a few of them varying between 5 and 7 years.

Also we are now just passing the Minor Lunar Standstill, a time which almost always sees the start of a new major economic boom, against all expectations. This is caused by the clearing away of banking and debt debris in the years after a banking crisis. Previous banking crises coincided closely with Major Lunar Standstills (2007, 1930, 1893, 1874, 1856, 1837 and 1819). So from 2015 to 2024 there is a formidable natural buoyancy for economic activity (technology, rapidly expanding populations in emerging markets etc).

We should now see a bubble phase in stock markets (all of them) up to Q1 2017 as solar pressure dies away slower than expected, and geomagnetism dies away quicker than expected. At the moment the vast majority are queuing up to forecast deflation and collapse – “blood on the streets”.

Hello Mark. Interesting post, which fits with your views from earlier in the year.

A couple of points I would make: there is no need at all to forecast either deflation or economic collapse, one just has to look at the figures over the past 18 months or so, they have both already happened. I suspect you ignore them because it doesn’t fit your narrative?

Also, this: ‘This is caused by the clearing away of banking and debt debris in the years after a banking crisis.’ It hasn’t happened yet has it? Once we see that happen, and we will do, I will share your optimism for the *system*, but all we have seen so far has been papering over the cracks and hiding the problems.

As for the chasing away of posters, please don’t think I have forgotten your outburst directed at Allan and bears generally a while back, just before you disappeared. I have no idea what caused it.

Whilst I welcome your posts on solar activity, there’s no need for snide comments, given it’s much like the pot calling the kettle black.

Mark, the last I recall you thought markets would peak right around now. (Correct me if I’m wrong, it’s been quite awhile since I read your last forecast.) Now your time frame for a market top has extended to 2017.

What caused the shift?

I’ve been talking about early 2017 for around a year, possibly longer: https://solarcycles.net/2014/12/18/break/#comments

And I’ve been saying for many years that around September 2015 would be the most likely time for the solar max to effectively end.

I’ve pointed out several times, over several years, that the end of SC24 induced speculation in stocks will be either September 2015, Q2 2016 or Q1 2017.

Surely you should include Q4 2015, Q1 2016, Q2 2016 and Q3 2016, and maybe Q2 2017, just so you’ve covered all of the possibilities?

None of us know of course, and our views do change with time as new evidence emerges, but you present a very wide window of options Mark. Why not just say ‘I don’t know’.

At least every piece of JH’s analysis is honest about his firm view based on what he sees. He doesn’t vacillate like you.

GM, I find it interesting as the rebound stalled last

week, however we are getting very close to a new

all time high on the SPX.

So either that will be repelled or we break through.

If we do print a new SPX high it becomes very

difficult to see this price action as an early stage bear

market.

I would accept my assumption of a Summer top to

be incorrect if that happens.

I make it approx. 2% to taking out the SPX all time high

at the time of this post.

Yep, 2% away Phil, and so far, early days, but an interesting move in US markets, and a few others.

Nor welcome for those of us short, although I’m at break even on FTSE positions, as it’s the dog of the pack at the moment.

Will there be any bears left when (if) this thing collapses?

Or something else?

Tick tock.

It’s gold that has really surprised me over the last couple of

weeks, as I think the chances of a December FED move are

remote.

I don’t short as previously mentioned, but have held a very

high cash level thinking the final bull market top was in.

So a little frustrating to say the least, but I suppose that is

what keeps markets so fascinating – that is what is called

a positive spin )

Phil surprised you why?….do you really thinktjey were oing to let gold and silver rise above their 200 dma’s despite the bullish fundamentals??

ECB making statements that coincied with a bearish imminent breakdown of the USD and breakouts of PM’s was all that was needed for the bankers to pile on near record amounts of PM contracts to cap the rise.

No need to deliver, no acountability and deep deep pockets.

Late night raids timed during the hours of thinest trading volumes where multiple paper contracts are dumped to overwhelm the long side snd so as to trigger multiple sell stops is nothing short of manipulation.

It has been statistically proven beyond doubt that Au and Ag are the ONLY commodity markets to suffer a convincing lopsided bias toward this kind of dumping.

Yes it occurs in all markets, however in other markets it is evenly weighted, but in PM’s it is deidedly in one direction.

Evening Allan.

We may recognise the bullish fundamentals, but tis fair to say the market currently disagrees with us, although slowly the tide is turning.

Regarding manipulation:

http://kiddynamitesworld.com/gold-manipulation-continues-unabated/

The only thing Draghi had to do last month was open up his mouth and hint at further QE to cause a dollar rally at a crucial level and Euro drop.

They know the banks will take care of the rest and if not then they take more direct action.

Look back through past event and it is obvious that statements amd deisions are made at crucial inflection points in regard to price levels of FX and metals in particular. That and strategically timed dumping of contracts on the COMEX to overwhelm the long side.

Allan, you do know that ECB meetings and press conferences are scheduled over a year in advance? It’s a coincidence if the markets happen to be at a certain level on those days.

IMHO: The time has come to short the DOW.

Yeah you said it yesterday too.

The intra-day rally (15 min bars) in Dec DOW futures from Sunday/Monday lows to Friday’s heights is a fiver with resistance at the Fibos.

Superb effort by the bulls today, but so far, still short of last week’s highs.

I am looking across the chart to August, there was a period of chop (remember the triangle) before the drop, so perhaps we will have a week or two of sideways action now?

LMAO like the following revelations should be a surprise!……the whole show is rigged in favour of a few select bankers and prominent fund managers.

Just look at what has happened since the US Fed intervened via REPO from September. Who do ya think were the main beneficiaries of that little exercise??

It is why I gave up this whole stinking thing ages ago. TPTB literally crap themselves if the markets now decline more than 10% and see it as no conflict of interest nor unquestionable to hand major players a free ride for the greater good!

It sickens me beyond belief.

http://www.zerohedge.com/news/2015-11-02/secret-diaries-show-ecb-board-members-met-banks-hedge-funds-days-policy-meetings

Global banks ciaught rigging FX, LIBOR and just about evrrything else, but of course there is no rigging going on in this market is there!?

This is so so contrived as to be an insult…. I keep saying it……how is a paper market that can leverage to infinitly with ZERO accountability against the physical commodity be allowed to continue unabated when it is clearly a vehicle for abuse by the very players that have been fined again and again and again for fraud in just about every market in which ney participate?

http://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&yr=1&mn=0&dy=0&id=p20559626203

This is not topping behaviour unfortunately. Looks like the S&P arc is well and truly broken. Melt up is more like the current market status.

Krish

Well you have to trade what you see, so if you are seeing a reason to go long there is nothing wrong with that and why don’t you? Stops are there to be used long or short after all.

Good luck

J

Hi all ! Congratulations to all longs. Nasdaq almost made a new high today. I would still recommend to exposure to QQQ, AAPL, IBB etc… The melt-up will begin now, through november and december. It’s easy money.

Good analysis by John this week-end although it will probably turn out he’s wrong again.

Best regards

Is this a sign that the economy/markets are rolling over:

https://www.yahoo.com/autos/ford-launches-huge-sale-despite-hot-market-172016653.html

Nice to see gold down today. Beautiful drop. It should be below 1100$ soon. So, I still recommend no position in gold and gold stocks, although I woudn’t recommend a short position either. Stay focused on the winning sectors.

Allan, how are your gold stocks doing ? Phil, how’s your summer market top call doing these days ?

Ok, I’m just teasing you.

LOL

I think US market may have topped today, with ES contract HoD at 2100 and NQ at 4699.50. This would mark end of A-B-C correction from August lows where C wave was sharp, extended and quite painful for the bears. But next stage of this bear market should begin now and the drop should be even faster then in August.

We are ripe for reversal here. Only in case when ES moves past 2103 and higher I will close my shorts.

Here’s a short video that echo’s John’s thoughts about this rally. She’s calls it a low quality rally. If you take out the mega-corporations, prices of indexes are well below the August highs. Have a look, 3 min, 43 seconds long.

Thanks PC

A large herd has gathered here now, the most bewildered of whom have taken to bellowing a dozen times a day at those who approach with a different view. And all convinced that they are contrarians.

While small fry have been bailing out of US stocks during the last six months at the highest rate in 30 years – same as 1988, 2003, 2009…

http://kingworldnews.com/alert-stock-market-mutual-funds-see-largest-outflows-in-30-years/

‘A large herd has gathered here now, the most bewildered of whom have taken to bellowing a dozen times a day at those who approach with a different view. And all convinced that they are contrarians’

Oh dear.

Whilst I have no idea of John’s site traffic numbers, judging purely by the very small number of people that comment (as Mark must be), I’d say the use of the adjective ‘large’ is unjustified.

The noun ‘herd’ indicates everyone following along in the same direction, with no free will. That’s an ad-hominem, A sad and pathetic one (they all are), but there is plenty enough disagreement and debate on this board, and it appears to me that 95%+ of visitors have their own views, their own methodologies, and quite often clearly have no fixed bias at all.

Is there a law that dictates the number of comments allowed each day? Does the number of comments correlate to the level of bewilderment? Or is Mark just a tad pissy about something, as evidence in the past suggests he is prone to outbursts and emotional meltdowns?

But of course, anyone (like Mark) who reads and quotes King World News is so much more enlightened than the herd that visit this blog. Thanks for the link Mark, and your thoughts, very enlightening indeed.

I’m guilty of bellowing at Nic, I confess 🙂

A good occasional bellow never did nobody no harm hey! You can’t hold what’s not in your hand.

On the other hand, hovering over a keyboard all day, every day, and bellowing at everything that moves is an illness. I’ve been trialing a brand new cure over the last three months – called “scrolling through the bellow”. It works, but I need a catchier name…

Mark, I think demographics of retirees being forced to retire early and young people not able to get quality high paying jobs are at work here. The pure population numbers also do not play well for continued investment support even if the young did have better jobs.

Mark, I read here for different views,

as probably many do without ever posting.

You can be cautious on markets while being

bullish on individual stocks, and the reverse applies.

It does not need to be divisive.

This seems important “so many rallies in 2015 coincided with options expiry”

And…I’m trying to understand but not quite getting it, what is the relevance of very high MACDs?

Something like this may help. Or else just google ‘explain MACD

http://www.investopedia.com/terms/m/macd.asp

From Nicolas:

”

Hi Jafree ! I think central banks can control pretty much all markets. They can keep rates at 0 and continue to buy bonds and stocks for a long time to come. Don ‘t forget that when rates are at 0, the value of stocks and bonds increase. So, they are doing a good job by driving the markets higher.

You’re right that at some point there might be a crash, especially if they try to reverse their policies. At that point, i will re evaluate my positions and philosophy.

regards and don’t hesitate to ask questions. I am here to help new investors.

”

Thanks, Nic, I definitely don’t need advice from you, I have been investing for nearly 25 years. What I was curious about was how you expected 0% interest rates and QE infinity to end. As expected, your clueless with no real logic. What you are missing is that throughout history, when a currency is abused by artificial value, it will eventually lose it’s value. This can only happen to initially strong currency that then becomes abused. Enter the USD. No one can say how long it will last, but you cannot pour 4.5 Trillion of QE into the market and expect for there to not be consequences when those funds need to be returned. You can keep replacing it with more and more, but this only leads to default. If you think that the USD is beyond default, you are living in a dreamland. The bill will come due and in history, the bills are usually paid in war. With Today’s nuclear aresenal that option is nearly off the table, or at least a very dangerous option.

So how does it end? You gave me nothing.

Hi Jafree ! The FED can keep rates at 0% for a very long time, the Bank of Japan has been setting the rate at 0% for decades now.

The FED can also keep its QE program pretty much for ever. The FED creates money, then buys a bond or a fixed income instrument and lets it expire.

You’re right that if the FED increases exponentially its money creation, it will to inflation. But we don’t know when and there’s no point of wating 10 years, 20 years for that to happen.

Regards

I know lots of folks here don’t believe the governments stats regarding inflation, but if they are close to the truth, then inflation is not a problem and not likely to be a problem for the foreseeable future. Deflation is more of a concern and that was at least partly the driver for QE.

I think you’re right, Nic, that there’s no point in waiting years for inflation to rear its ugly head. We could go into serious deflation between now and then, gold could go below 1000, maybe well below 1000. Very long term investors with a time horizon of decades might decide to weather a storm like that. But most of us do not have that kind of investment horizon. And even if we did, what if the very long term prognosis turns out to be wrong, and world economies battle deflation for many decades (like Japan)?

PimaCanyon,

The government is funny when it comes to inflation. They use core inflation and take out volitile food an energy. Like that doesn’t matter to low earners, right? The articles and perception is where the confusion lies (PUN intended). So when food and energy were skyrocketing, the press focused on core inflation, ex food and energy. Now when they talk about deflation, they mention food and energy as a reason for deflation. I am not talking about inflation calculations, which is a subject all and of itself, but the mere reporting to the lesser aware. When the press claims there is no inflation in the core during rising infation and then claim there is deflation worries becasue of food and energy, Do we not have a problem with these mis-representations?

I definitely do have a problem with the constant changes in calculations methods and more importantly the way the press reports.

JaFree, I’m not Nic, but I wonder about your comment “you cannot pour 4.5 Trillion of QE into the market and expect for there to not be consequences when those funds need to be returned.” It brings up two questions:

1) Do we know that it will be returned? If so, when? Next year, 2020, 2050? The Fed did a QE back in the early 1950’s and bailed out of it successfully then, so is it not possible that they could do the same today or next year or in a few years?

2) 4.5 trillion is a lot of money, but doesn’t it pale in comparison to the dollars that have been created out of thin air by the banking system itself? How many dollars have been created since the early 1900’s by fractional banking where a bank lends money it does not have? The point is that it’s the banking system that has destroyed the value of the dollar. QE is just a small blip on the downward trajectory that’s caused by the banking system itself. Lots of folks have said that QE is going to destroy the dollar. I say if you’re worried about the destruction of the dollar, you’ve come way late to the party. This should have been pointed out decades ago while the banking system was continually creating dollars out of thin air.

That $4.5 trillion will never be removed because most of it has ended up in the hands of the super rich via their hedge fund investments and the US hates taxing the rich or anything that can damage the stock market.

Regarding whether the QE money will be withdrawn from circulation at some point: It doesn’t matter who got the money. The Fed created it by buying bonds with money they did not have. If at some point in the future they decide it’s time to withdraw that money from circulation, they won’t be going back to whoever sold them those bonds asking them for their money back! Doesn’t work that way. That money is gone, it’s in circulation somewhere. When/if the Fed pulls money out of circulation, they will do so by selling bonds and “disappearing” the money they get for the bond sale. At that bond sale, anyone can buy.

PimaCanyon,

You just described the Perpetual Motion Machine. Everything has a cost and the money does have to be paid back. It is in the CB charter and the reason why the CB claims no money is being printed. It is temporary liquidity and it has to be paid back. You can inflate it away and make it appear like less, but that has a cost to.

As my college Professor of Thermodynamics used to say,

“There ain’t no free lunch” ~ Dr. Gater – RIP

PimaCanyon,

Your wrong. The 4.5 Trillion is a step jump in percentage and volume relative to any other CB actions ever taken in history. The original idea is that you create a temporary faucet of liquidity to solve a bad time of money flow. Then the money is returned over time with interest. This time around it has been GREATLY abused and the worst part is that the money just went to fix insolvency of the current banking problems. Meaning it did not do it’s intended job of stimulating growth. The growth stimulation is supposed to create the money out of thin air by creating economic activity. Again, which didn’t occur. So, back to the question, how will this be repaid?

So your example of this working before is correct. It worked as intended. This time it has not. Other times we were able to get the needed growth and we have shrunk the FED balance sheet with bond buy back programs. This is called responsible fiscal policy. However, this time we have almost ZERO growth, which is why we are stuck and I continue to ask, How this will end. NOBODY and I mean NOBODY knows. If you are inclined to believe the nonsense fed by the so called expert economists, good luck. They are Academics with titles and have zero accountability and their histories are not followed or reported correctly. They haven’t a clue.

The currency markets remain in a quandry and the way out is very unclear. The economists and CB’s are fighting the rising high tide with sand bags, ie temporary fixes.

You’re missing my point. Yes, QE is a jump compared to other CB actions, but it pales in comparison to the amount of fiat that the banking system itself creates day after day, year after year. Fractional Reserve Banking is what has destroyed the value of the dollar over the past 100 years. QE was very late to the party, started in 2009 or 2010, right? But in 2009, the dollar had already lost 95 percent of its value compared to where it was in 1912. Fractional Reserve Banking did that, not QE.

Ja Free,

Because you didn’t address this in your replies, I’ll ask again: The trillions created by QE are a drop in the bucket compared to the money created over the last 100 years by the fractional banking system itself. Why do you place so much emphasis on the QE dollars instead of addressing the real perpetrators of money counterfeiting: the banks and the banking system?

And second, if QE is going to destroy the dollar and send us into hyperinflation, where’s the evidence? And when is this hyperinflation likely to start?

http://blogs.reuters.com/breakingviews/2015/08/28/review-ben-bernanke-and-a-global-monetary-plague/ I listened to Brown on Bloomberg. He gave a pretty convincing testimony to his treatise. Of course the real difficulty is in the timing of it all as you say PC. Inflation is much nearer than people think and in some ways went stealthy already into asset prices. We will need to see supplies shrink, liquidity dry, and demand stimulated… inflation will arrive but not hyper inflation… that will take another 9 years or so…

thanks!

More from one of my favorites Louise Yamada.

http://finance.yahoo.com/news/big-problem-rally-louise-yamada-130000697.html

I am not a technical junkie and all technical analysis has to line up with fundementals, I think she is on the mark here because we are in the beginning stages of value destruction. It starts with companies buying each other in droves to hide problems with earnings and revenue. Accounting of joined companies leaves huge discretion for obfuscation. The M&A trend will work it’s way out and true accounting will eventually show through. I’ve lived through two of these cycles and it seems to me to be occuring again.

Who knows, maybe this time REALLY is different. Hmmmmmm!!!! If you’ve heard that before clinch those cheeks tight and don’t drop the soap.

Quite dramatic situation in gold as bears are close to break three month old support line..

Yes, I think it’s fair to say sentiment has been totally reset as regards gold and the stock market within the past month.

What will that mean for November we shall see in due course, but I think the crowd is in for a nasty surprise, whilst gold will be on the up (despite the evil manipulators). 🙂

Your 2103 level is having a sever probing as I type, fingers crossed for you it holds.

I covered at ES 2104 as it is clear now that SPX is going to new marginal ATH above 2135.

But it still looks as A-B-C from August lows and as big a-b from July top. Therefore I suppose that this will probably prove to be a bull trap and we’ll crash in c wave afterwards.

You live to fight another day, I agree, a re-test of the highs looks probable now.

Large caps leading the way in another BTFD. The reversal to the downside will come hard and fast and when its least expected but for now I see absolutely no evidence to enter a short position although the bearish scenario remains in play in small caps and Biotechs. I would like to see large caps dropping along with small caps to enter shorts via a negative weekly close >2%.

Agreed Krish, The drop will seem like it came from left field to many.

“Get ready for a bigger Santa Claus rally: Strategist”

Headlines like this are what I like to see. We may be in a time where this is actually true, but if it is true an volume remains high, watch out below when the biggy’s finish selling.

What has struck me more than anything the last few weeks is how pretty much everyone has glossed over US third qtr earnings. Whilst not a total disaster, sales by and large were bad.

Once again market particpants have shown that they can only focus on one thing and one thing only. The majority have largely lost the ability to think outside of Fed and other central bank policy statements, but this is of course what TPTB have wanted all along.

They don’t want markets that react to the real underlying story. They want markets that only respond to their orchestrated plans and string pulling.

Nicolas:

“The FED can keep rates at 0% for a very long time, the Bank of Japan has been setting the rate at 0% for decades now.”

Barry:

Yes they have, Nic…

Looks awesome…. You ~sure~ this is your bullish stock market argument?

Nicolas:

“The FED can also keep its QE program pretty much for ever. The FED creates money, then buys a bond or a fixed income instrument and lets it expire.”

Yes, they can let the bonds expire….

But one more thing happens too…..that I think you just ignored…

The bonds expire, and the Fed gets it’s money back!!

But as JaFree pointed out, that money’s already been spent… Hmmmm..

So, either the money comes back OUT of the economy – by higher taxes – which we could argue would be highly recessionary…..or the Fed prints more – to buy more T-notes/bonds – so it can be paid back…

Sort of an infinite do-loop…..of lending your borrower money, to pay you back on your earlier loan to them….

Only it IS actually finite…. And I can’t help but think we’re about there…

Just a quick point on QE. The vast majority of the money created via QE has ended up here. It has done nothing, it just sits there, idle. Banks do not lend reserves, they never have done, never will do. They are literally excess to requirements. Hence, QE is merely an exercise in *the illusion of control* and nothing more.

https://research.stlouisfed.org/fred2/series/WRESBAL

so that would explain why the inflation (or even hyperinflation) that some say QE will create never comes.

but surely the Fed knows this. They are not stupid. So if this is all that’s happening with the QE dollars, then why are they doing it? Why do they believe it’s a tool to fight deflation? I suspect we’re missing something with regard to the reserves.

http://www.forbes.com/sites/norbertmichel/2015/04/06/risks-from-feds-interest-on-reserves-threaten-more-than-monetary-policy/

Sorry, on,y just seen your reply.

Re the Fed, yes, they are quite clueless. They believe their models, not their lying eyes. Also, they are the puppet of the U.S. govt, so if the pols want printing, the Fed will deliver. It will end in tears, and the Fed will be dissolved.

Inflation will take off when the sovereign bond bubble bursts, and faith is lost in gift and CBs.

Does Dec “paper” Gold pushing down thru a major uptrend line point towards not only a further collapse in Gold but a new ATH for the DOW?

What happen to the top being in yesterday?

Its definitely a great day for the bulls yet again.I look forward to John H’s next post and his continued defence of the waterfall scenario which I believe is completely invalid for 2015 now. 2016 is a different story.

A Delta late high I-6 did not bring in L-6 and L-3. It now looks like that I-8 will be a new ATH as will L-6 and L-3.

Even though I did not expect a rare back-to-back Intermediate points I did recognize that possibility which is why I had very tight stops and got stopped out with a minor loss.

I am still short. I think the next 2 days will be down big, and you will be ready to call a super crash again soon.

What’s your reasoning for two big down days? The FTSE is only just joining the party today.

This gets more insane by the day. It’s ALL bullish!

US factory orders decline yet again, as the stronger dollar continues to bite hard and that is before the latest pop in the dollar. BTFD back with avengeance!

No way the Fed raises in December.

What’s bearish for markets pushes indices higher, whilst what’s bullish for gold pushes it lower……LOL

I feel your pain. It looks like that Delta’s Gold l-1 is high and that means the odds of its L-2 being a low is 70% (because there was a low Long Term Inbetween point).

LOL Richard….PAIN.?!…..I suggest you checkout the ASX gold stocks that I bought back in November last year which BTW I signalled on here.. Here are some:

NST

SBM

RMS

NCM

EVN

Certainly taken a hit in recent days but hardly painful, remember nothing goes up in a straight line

Mate you really need to get your facts straight before making assumptions about other posters situation!

Exactly Allan, when the market get’s insane like we are seeing. And the opposite occurs than what’s rational. Look Out!!!! Be on Guard. BTW, the drop in Gold is looking like an opportunity to me. I’ve never really been good at trading gold, but I am consindering some smaller longs.

anyone else find the vxx and uvxy barely selling off today unusual ?

http://finviz.com/quote.ashx?t=vxx&ty=c&ta=1&p=d

Certainly did “scott” amongst others:

http://stockcharts.com/h-sc/ui?s=GDX&p=D&b=5&g=0&id=p99785867684

Some of you might be interested in this article. It discusses a HALO crash. almost everyone would tell you that you can’t have a crash from all time highs.

In this case, it’s a requirement.

Charts are not up to date but it’s an interesting read – for some.

http://www.riskmanagementblog.info/article/8079117084/mega-risk-halo-crash-to-minsky-moment/

another poster to visit might be

http://ponziworld.blogspot.com

And now it becomes clear as to why the PM whack down and market pop.

Draghi once again felt the desire to open his big fat mouth. Last month wasn’t enough of a reaction for him.

The show goes on.

Oil – Remains one of the most difficult to call due to geopolitical actions on production. One thing that can be stated, is the US producers have gotten obliterated and the churn is still occuring. Rig closures to continue. It still really bothers me that oil never retested the Aug. lows. Oil could break either up or down based on news, but my best call is continued trading range. I am not trading oil due to the news sensitivity from unknown decisions from many producers. I am sticking to my prediction of $60-70 by end of 2017.

Nat Gas – I have had a rough time here, but this remains my main trading instrument. I expect 3 weeks of warm weather and 4 weeks of continued injections. After that, Winter starts and it is possible before that the traders realize the poor predictions from the NOAA CPC. We are in for a wild winter in USA with major population centers getting cold and snowy weather. This should create spikes in Nat Gas. I have one more purchase left and I am waiting to see in the next week or two if we get another drop. Or I may decide to put it in Gold. Still deciding.

Correction: $60-70 by end of 2016, although a push out to early 2017 is looking reasonable.

From my side I am pretty bearish on oil over the next 3-6 months, I think we may test the lows of 2009. I haven’t yet opened a position but will try to post here when I do.

J

US trucking is slowing when it should be increasing:

http://wolfstreet.com/2015/10/28/why-the-heck-is-trucking-slowing-down-swift-cummins-load-to-truck-ratio/

What Hershey said about the American Consumer:

http://wolfstreet.com/2015/10/29/chilling-thing-hershey-just-said-about-american-consumers/

California’s (and other area’s) manufacturing slump:

http://www.businessinsider.com/california-has-joined-the-manufacturing-slump-2015-11

not a good sign for economic conditions down the road (ahem…). Or for stocks either. Remember this tongue twisting stock market truism: Stocks track truck tonnage. (Say 10 times real fast)

This is disturbing: America is full of high earning POOR people:

http://qz.com/520414/the-high-earning-poor/?utm_source=YPL

On the assumption that some of the many solarcycles.net visitors still maintain an interest in what the sun is doing: http://wdc.kugi.kyoto-u.ac.jp/dst_realtime/201511/index.html

That brief move into positive trerritory is the typical precursor to a major geomagnetic storm – a bit like to tide going out before a tsunami. So the next few days will give a major clue whether the sun’s geo-effective influence is fading, as I asserted above.

So far, the evidence is that risk-averse geomagnetism has already peaked for this solar cycle.

Thanks Mark

Mark, are you suggesting that people are ready to take on more risk again? Just want to be sure of my understanding. Thx in advance.

That’s how I read it.Considering the rally since late September, one could make the argument that the horse has already bolted, risk has been taken on again?

I read Armstrong with interest lately re the Dow, don’t know what others may think.

He reckons two options: phase transition (i.e. shares double or treble from here), or new lows followed by new highs, but no phase transition (yet).

GM I read Armstrong as well although, I find him quite indecipherable, when it comes to any of the indices. Not sure what he means by until ‘Gold Benchmarks’.

To be honest I find his ‘index calls’ vague enough to be played either way. The main reason I stick with him is because he does have some ‘out of the box’ thoughts on the economy in general from time to time which are worth considering.

As long as you stay on top of his blog it only takes less than 5 minutes per day. I will confess that if he starts on ‘Gold Promoters’ then my eyes glaze over and I skip the rest of the repetitious rant!!

Hello purvez.

One gold benchmark has passed, back in the summer, and the next one (roughly) is in January. He showed a graphic of the benchmark a while back with indications where they occurred, so call it an informed guesstimate on my part.

For me, the key to equities is where will the crowd run as the economy turns down?

If it once again runs into govt bonds, then equities can/will have a full 2-3 year bear into c.2018-20. That’s what I expect and hope to see happen.

If the crowd starts to fear ALL sovereign debt within the next 2-3 years, then equities will go way up (in nominal terms), as the bond bubble bursts via defaults and currency collapses.

Mark echos the fear that many of us now have. That the market is like the early 1960s post-solar max. PE ratio was in the 20s too, and the market did not crash but has 20% corrections in an uptrend. Some of us would take a 20% correction at this point too, but then the question is whether to hold for a deeper crash, or take profits at 20%.

You’re aware of similar solar influences in the past John, as you discovered some of them yourself. If the markets choose to rhyme with those same influences now, as they did then, like 1885 and 1896, then 20% moves will look fairly ordinary over the coming years: http://www.chartsrus.com/charts.php?image=http://www.sharelynx.com/chartsfixed/USDJIND1800-1900.gif

I think the FTSE is now at, or very near to point 27, what do you reckon?

http://screencast.com/t/UPGQc3PACp0

http://www.tradersdaytrading.com/3-peaks-and-a-domed-house.html

From memory, the RUT has a similar look to it.

GM, I’d agree for the FTSE and for the DJIA I’d plonk for 25 and if today’s down holds/accelerates then we should soon be at 27there too.

Nice little drop there but not doubt the crowd will power in buy orders leading to another reversal win for the Bulls.

My personal thougths (re DJIA) is that from the late Sept lows we’ve got 5 waves up. W1 & W3 were normal waves but W5 was the naughty one which extended and THEN to make matters worse w-v of W5 also extended. That was that drop last Friday to complete a ‘head fake’ W4 and then the ramp on Monday and yesterday.

This morning in pre-open the DJIA on the 5 minute had a ‘triangle’ from which it popped higher to complete the w-v with a tiny wave and has since reversed.

I know, I know here I go with triangles again….but this time it is AFTER THE FACT. I’m getting wiser in my dotage.

The ‘bug bear’ with my above comment is that I still haven’t seen a clean 5 down from today’s pre-open high.

Reading Jegersmart’s comment about a rising wedge I had another look at the charts and today’s pre-open high may yet turn out to be w-(iii) of w-v which I said had extended. Well….it may STILL be extending. If today’s drop remains a 3 waver then I would expect to see another 3 waver UP on the DJIA.

As usual we’ll wait to see what the market really throws at us. GLTA.

On the grounds that a picture is worth a thousand words, here are 2:

http://postimg.org/image/kr7bgjrmh/

The above is my count from the late September low.

The next one is a detailed counts of the w-v of W5 on the assumption it is tracing out an Ending Diagonal.

http://postimg.org/image/6at7bgo0n/

Annotating charts is tiresome business….and a thirsty one!! LOL.

I’m no wave counter, but looks like wave 4 up now for today’s move?

John H, I’ve just added to my comments above with a couple of charts but that ‘comment’ is awaiting moderation. It needs to be read in conjunction with the above comments so please would you expedite.

Many thanks.

I’m going to ‘cheat the system’ here and hope it works. I’m breaking up my comment ‘awaiting moderation’ into 2 parts and see if it will get through. One chart at a time has been allowed in the past so here goes:

==================

On the grounds that a picture is worth a thousand words, here are 2:

http://postimg.org/image/kr7bgjrmh/

The above is my count from the late September low.

Ha!! that worked. Sorry for messing up your blog John H.

===================

The next one is a detailed counts of the w-v of W5 on the assumption it is tracing out an Ending Diagonal.

http://postimg.org/image/6at7bgo0n/

Annotating charts is tiresome business….and a thirsty one!! LOL.

The market has gone the other way p, time for a re-count. 😉

GM sorry but don’t have ‘another’ count for the w-[v] of w-v of W5. It either is OR I’ve got the thing wrong. (Wouldn’t have been the first OR the LAST time. lol)

A REALLY REALLY PAINFUL count would be a Leading Diagonal Wedge down which is the only one that currently makes ANY sense.

Although I’m responding here, I’m really uncomfortable doing so….not because of anything you guys have done but simply because I change my mind 10 time a minute sometimes.

I’m struggling NOT to become like Richard I here where every twist of the market gives me a new direction that I MUST post.

Richard I, please do not take this as a negative comment against yourself. I understand now that you have continuously changing views due to the EVIDENCE that the market provides AND I’m also looking forward to being challenged in my own interpretations. So (at least from my perspective) your posts continue to be very welcome.

However to go back to my own posts, I’m going to have to find a way of moderating what I’m thinking vs what I’m posting.

Please bear with me. Thx in advance.

Rising wedges generally are quite reliable, let’s see what happens….:)

J

Where do you see a rising wedge?

SPY hourly, SPX daily, just gone short 2108 SPX, stop 2116.5

doing some spy puts spreads, stop just above today’s high. scouts and GN calls them 11/13 spy 211s against 208.50 11/6s. peggy has the spiral high today and low next thursday

Today, the most important market is Ten year note futures. Why? Because Yellen is speaking to the Republicans (congress) and when she said that rates could rise Ten year note futures fell down through its 100 day ma and found support at its 200 day ma. This action has sent the USD higher, the PMs and Energies lower, and Stocks lower. “If” it has found major support at its 200 day ma –then– a rally up will effect the USD and many other markets such as the PMs etc.

Personally, I think that she will not raise rates but is speaking before the Republicans (congress) in order to political please them and get them to turn their eyes away from the FED that they so want to take control of. Thus, she is telling them what they want to hear but is being two faced about it (lying).

Oh, and in case some of you are not aware of it, when 10 year note futures broke to new lows, down through its 100 day ma and to its 200 day ma, 30 year bond futures DID NOT BREAK TO NEW LOWS. Of course, this means several things. One is that the yield curve is flattening once again. Another is that the odds are high that the low in 10 year note futures is in. Thus, the rally in the Dollar may be over; the fall in the PMs may be over, and the DOW may rally onward and upward some more (possible to a new ATH).

Be nice to see 2088 on ES futures taken out right now, at least that would break the higher highs/lows pattern on an hourly time-frame.

Until that happens, nothing has changed.

Any EW views at this point please?

Two people with ZERO credibility!

Martin Armstrong’s date has come and gone without so much as a hiccup and now he appears to be desperately looking for anything and I mean ANYTHING, to tie to his 2015.75 date. Everything from Russian moves in Syria to two flies crawling up the same wall and taking flight at the same time!

Janet Yellen’s latest….”December will be a live possibility for a rate hike if the upcoming data are supportive”

How much fricken data do you need!!??….you have been saying the same old “s%#%” for month afer month after month after year after year!

TRANSLATION…….WE WON’T BE RAISING RATES IN DECEMBER!

The Fed lost virtually all credibilty 3 years ago. They lost their opportunity to begin crawling back rates in late 2012 but instead opted to save the stock markets.

If this wasn’t so pitiful it would be hilarious!

There’s been some great chokers throughout history. Greg Norman springs to mind initially…….but the US Federal Reserve takes the cake!

Morning Allan, good to see your passion as always. I hope your heart rate is steady though!!

Greg Norman though, the man won two Opens and was world No.1 for ages, harsh to call him a choker, in an era when there were plenty of really classy golfers, he took a very respectable share of the prizes. We all remember that Masters, but overall, fair to do say he did the biz on the course more often than not.

Monty, now there was a choker.

Allan I echo GM’s thoughts. Hope your ‘ticker’ is not affected. 🙂 🙂

Calm down friend, it’s only a ‘game’….even though I’ve got some real money at stake here.

I’m fine. Nothing wrong with a bit of passion and fire in the belly. I really have nothing to be worried about in the sense that I am not invested in stocks other than select Aussie Ag/Au and continue to accumulate physical. Coundn’t be more unworried actually from a personal perspective.

From a broader perspective CB’s have destroyed all semblance of rationality or functionality in financial markets.

Markets are nothing nor behave anything like they once used to. There is NO going back to the norm. We have entered the new norm.

ZIRP/NIRP forever unless they want to crash everything. Continuous bailing out of major overleveraged non-performing institutions and companies that under a real capitalist system would be left to go under.

We now need to expand credit to infinity, which BTW has expanded exponentially since 2009 with ever diminishing returns for GDP growth but that won’t stop them.

And Au and Ag get trashed because it serves no purpose in this new norm. LMAO!

Those holding all the physical WILL be the new mega rich in a few years, mark my words!

Cheers fellas 😉

Very GOOD to know that you are fine. This investing ‘game’ has got to be seen as a ‘lark’ otherwise you can’t sleep at nights. Been there for a while and didn’t like it one bit. Took my ‘pill’ and go out.

I agree re Martin Armstrong.

Yellen is a different story and I’m giving her the benefit of the doubt. Why? Because she’s said all along that they are data driven. They will not raise rates based on a calendar date. They have a mandate to try to effect two components of the US economy: 1) unemployment, and 2) inflation. Their unemployment target was met months ago, but the inflation target has not been met. Ergo, no rate raise.

So why would they raise rates now if the inflation rate still has not been met? I think the answer is that with inflation that want to look ahead and use the data that they have to forecast when their inflation target might be realized. If it’s imminent, like in the next few months, then they will probably go ahead and raise. They don’t want to wait to raise until inflation is running at 2 percent because there is a lag from the time they raise rates until those higher rates start to put the brakes on inflation. If they wait till it hits 2 percent, they’ve waited too long and what would likely happen is several months down the road inflation will have jacked up to 3 or 4 percent, and then they’d have to take more aggressive action. I believe it’s their hope to start applying the brakes a little early so when inflation hits their target, it won’t continue higher.

Today, a USD rally may have begun that has months to run. Why? Because almost the entire world is lowering interest rates and starting QEs. Even if Yellen does not raise rates (and I think that she won’t) the market place now sees it as “safe” to rally the long delayed USD. This will pressure USD based commodities like Gold and Crude lower and pressure US stocks lower as foreign profits will decline.

A rally of Ten year note futures from their 200 day ma may not stop or reverse the rally in the USD but only slow it down…. Gold Bugs (and stock/commodity Bulls) beware.

In fact, a strong USD rally may help Ten year note futures to rally up from its 200 day ma. (Its time to think outside of the box).

I’m also expecting a dollar rally, although for different reasons, more because of a ‘risk-off’ flight to the dollar, and the ongoing global squeeze in eurodollars.

At some point, gold will rise in dollar terms, even as the dollar is seen as the safest currency, but maybe not until early in 2016 for that.

fund managers are afraid to by bonds, can’t buy stocks, hedge funds can’t hold cash or they get fired, won’t buy gold because it is out of favor, what do you buy? AMZN, GOOGL, FB, BIDU, BABA, LNKD, TSLA… that’s your choices. belly up to the bar!

Aaaaah scott you forgot poor NETFLIX!! They may stop streaming to you…so be aware if your TV appears to be ‘on the blink’ ….technical UK term for ‘not working’.

In any case the FIRST one put me off the remainder of the list so I didn’t bother to go down the list.

Good old Bezoz thinks he has stuff under control. Let’s see when he decides to turn on the ‘profit spigot’ or some such.

Will probably find dry dust coming out of the ‘spigot’ when he eventually tries.

What if, because Yellen is talking out of both sides of her mouth, Yellen wants both the Dollar and the DOW to rally higher? What if she has no intention of raising rates but is sending a signal that the Dollar is approved to go higher so that the world will benefit from Americans buying their junk especially with the coming holidays –and– she wants the DOW to go higher so that Americans “feel” wealthier to start expanding credit in order to buy more cheaper foreign made junk?

This may be her “hidden agenda” or “secret narrative” that explains her words.

When the time comes to raise rates she won’t because the Dollar will have rallied so much that a rate increase would be seen as negative. Recall that the last two American winters saw economic declines and she doesn’t want that to happen with this winter. She could also be banking on the weather to help get the human herd optimistic enough to “expand credit” through the winter.

In other words, Yellen is using “slight of hand” to spike the punch bowl it keep the “party” going.

I now think that Delta-wise yesterday’s DOW close was a very late high I-6 and that, now, the DOW is going to decline, for several days, to its low I-7 but turn back up so that its high I-8 becomes a new ATH.

Yellen is using the “threat” of an interest rate rise to “bully” the Dollar and DOW higher. However, with the Dollar taking off, the DOW is due for a “correction” before rallying on to a new ATH.

The DOW’s “correction” price target: 20 day ma. Then it rallies up to a new ATH.

Oh Richard, where do I begin?………

Do you really think that the Fed wants a higher dollar or for that matter that US conglomerates can withstand a higher dollar?

The likes of AAPL ,CL amongst others have made it quite clear that the strong dollar is damaging their prospects.

Secondly to say that the Fed are using the bullying the dollar higher is to imply that the Fed have some kind of control or handle on what is going on and how they can fix things.

Mate they don’t have a bloody clue what is going NOR how to fix it!

Last, to suggest that the US consumer can carry the weight of the world is so 1970 as to be absurd. That was an era gone by and yet still I see it brought up again and again. Ain’t gonna happen.

Re the Fed not having a clue, this is a cracking read. (Eurodollars, eh, what?).

http://www.alhambrapartners.com/2015/11/02/how-we-got-here-the-fed-confuses-itself-part-3/

speaking of wedges…. this is worth a look http://www.zerohedge.com/news/2015-11-04/equities-and-yields-are-approaching-critical-targets-what-charts-say-will-happens-ne

American stocks are going to start a “correction process” that goes around the world for several days.

DXY projection implies hold and accumulate shorts on gold & silver.

That weekly count on SPX not on. This is wave IV in alternation with wave II.

c.50 point rallies all day on the DJIA, currently pausing after another, collapse here would be very welcome indeed. Suddenly the complacency might vanish.

I think the DOW will “correct” at least 500 pts to its 20 day ma because it will start a corrective process that feeds on itself as it goes around the world –and– because the more it goes down the more it will look like an Elliot 3rd wave to the downside.

GN, geno, any EW thoughts on today’s action please? Would be very much appreciated now. Thx in advance.

I guess the SPX will bottom on Thursday mid morning and then climb until Monday at noon. From next Monday at noon until Friday will be when a mild sell off will occur. Maximum low tide is Thursday and it often marks short term bottoms of month. Also seasonally 5th to 8th trading day of November are weak and that would be this Friday to next Wednesday.

bradley turn date 11/10/15. peggy’s spiral has a low 11/12/15. esf futures target 2072. then progressive lows going out the next 60 days.

i’m looking for a retest to 2080 by this coming tuesday which is why i threw on put spreads 211/208.50s with the 211s expiring 11/13 and the 208.50s 11/6

I notice peggy has been absent for a couple of weeks or so, and if I recall correctly her dates for lows came and went during the rally. I suspect the spiral is unravelling.

regarding peggy and spiral, no system is perfect as demonstrated by many of us. the spiral has been significantly more right than wrong in the several months i have been following her reports. i utilize it with the other cues I utilize hear and on other sites.

Meanwhile, where is the real strength building, slowly but surely:

http://screencast.com/t/XIqHjoo4ZlbJ

http://screencast.com/t/mGCgTw8R

Mark will appreciate this:

http://www.telegraph.co.uk/finance/economics/11973507/Ill-eat-my-hat-if-we-are-any-where-near-a-global-recession.html

My prime mantra, easy to guess, monetarism doesn’t work, it’s voodoo nonsense.

The statists and economists love it, but it’s a huge waste of time, in a eurodollar world driven (forwards and backwards) by bank balance sheets.

The BIS, via its FSB offshoot, is deliberately bursting the bank bubble, and we see evidence that the big banks are shutting themselves down already.

Plans are in place for the denouement, it doesn’t revolve around a period of growth however. AEP is wrong on this one, as he is quite often I have found over the years.

I just have a very quick scroll down the comments here now, stopping at a few names – yours is one of them. I haven’t read through that all of that Telegraph article, just the last paragraph and it is very similar to what I’ve been saying recently.

We have a very positive combination of natural forces – positive solar influence is fading very gently – negative solar influence has recently peaked – positive lunar influence is picking up. We haven’t seen this combination since 1884/5 – nothing new under the sun, but all new to anyone who still has a heartbeat.

Gann knew as far back as 1909 that 2006/7 would see the start of a banking crisis and stock market declines, and that that would be followed by economic rebuilding led by the stock markets. But this time the banking crisis is still being tackled with QE and NIRP, and there is nothing more UNnatural that printing free money and charging negative interest. It is so unnatural, that people have been instinctively hoarding money while they wait to find out how all this plays out. The more they hoard, the more it is met with QE and NIRP.

When the natural background positivity reasserts itself, it will be fueled by all that additional money. It doesn’t matter that the vast majority are very gloomy at the moment – they always are, and at the wrong time (look at the comments under that Telegraph article).

If I’m right, then we will soon see a stock market bubble. Most think that has already happened, but for SP500 to match the increases and timing of the 1929 bubble (for example) it will have to reach 4000 by April 2017.

‘It doesn’t matter that the vast majority are very gloomy at the moment’

LOL at that comment. Telegraph readers tend to be a tad more switched on than most, but as for the markets and the majority of the global population, they are oblivious to the doom-mongers, and sentiment is very perky. One would have to be living in a cave NOT to see the similarities between NOW and the peak in 1929. Just have a night out in any major city anywhere.

I believe Mark & Gann will be proven right about the stock market bubble, and velocity picking up, but not until we’ve been another downturn into the solar minimum. I also note his snide opening comment (yet again). Poor bitter soul.

Mark,

In terms of money fuel, do you pay attention to money velocity? Will it be a key to your thesis and a signpost for the rest of us?

No doubt that velocity is very important, but paying attention to it in the short term is dubious I think, for several reasons: https://research.stlouisfed.org/fred2/series/M2V/

These measures are evidence of past “fact” and backwards-looking, so they are already priced-in by the time we see them. And official figures (from unemployment to global temperatures etc) nowadays are so heavily massaged and adjusted that there’s no way of knowing how realistic they are.

By the time we see the signpost, the markets will already have left us behind.

For at least a year now Mahendra has been calling for 2800, maybe 3000. It will be funny if his numbers end up being too low! 🙂

Gary, what GM is saying is correct. What Mr Pritchard is hanging his hat on is just counting the money created by the CBs. That is where he is wrong.

My reading of J Snider of Alhambra blog has finally got me understanding that ‘depression/recession’ (whatever you want to call it) will occur because the amount of money that had been created by the TBTF banks during the 70s through to the 20s was ENORMOUS (think all the leveraged loans to EM countries and their corporates as well as all the C grade debt created in the West) and MORE IMPORTANTLY they were making huge amounts of profits from being in that ‘dodgy’ market.

Now that profitability has disappeared because of various defaults and they are all trying to get out of that market. Since the CBs have not accounted for that ‘other Dollar’ market properly they cannot understand why their stimulus is not working.

As J Snider explains the amount of money being taken OUT far far exceeds what the CBs have created and that is what’s going to cause the depression/recession.

exactly what I’ve been saying regarding QE versus the banking the system. The banking system allows banks to create money out of thin air by loaning money they do not have. Money creation by the banks dwarfs anything that’s come out of QE. So maybe a deflationary depression is unavoidable. The big question then is will we have a blow-off stock market before the depression occurs or have we seen the top already? Sentiment would suggest the former as we have not had a real mania phase in this stock market yet.

China’s economy will break down:

http://www.thestreet.com/story/13350457/1/emerging-market-prophet-predicts-china-s-economy-will-break-down.html

John, a well delivered and thought out brief. Question: Where do you see gold prices in 5-10 years noting a recession is pretty much inevitable from the reading I have picked up over the many months. Is not gold due for a normalisation like most prices over the coming years which may be back to $250?

Thoughts appreciated please

Thanks

Sorry to butt in re your gold question, but gold goes up in recessions, so add a zero to your $250 and you won’t be far off.

This may seem crazy but has the ECB run out of things to buy so now it will start buying US treasuries:

http://finance.yahoo.com/news/europes-economy-bad-ecb-run-094306415.html

Why is the ECB thinking of buying US treasuries when the FED is saying it wants to raise rates (falling or selling US treasuries). Meanwhile, on the overnight trade, “Dr.” Copper is dropping like a rock. Triple bottoms don’t hold and if that is so then Copper is going to break to new lows and that is only going to happen “if” the world economy is imploding. Strange isn’t.

I read the article. The ECB isn’t thinking of buying USTs, that was merely speculation on the part of the writer of the article.

“Buy the rumor, sell the fact”. US treasuries are rallying with the ECB’s newest words and that is opposite of the FED’s words, yesterday, on the price action of US treasuries. It would seem obvious that those two CBs aren’t in policy agreement. Meanwhile Copper keeps on dropping….

How can they ever run out? Change the rules, buy Greek bonds, and ask the Greek government to issue $1T more in debt.

They will buy gold, at the worst of it. They will not buy every govt bond, just enough to assuage the politicians and markets. The plug will be pulled eventually. Effluent will flow south.

The ECB may run out of bonds to buy before its QE program ends:

http://www.bloomberg.com/news/articles/2015-11-05/ecb-firepower-waning-as-out-of-reach-bonds-approach-1-trillion?cmpid=yhoo.headline

Draghi replaces Yellen as driver of EUR/USD:

http://www.bloomberg.com/news/articles/2015-11-04/draghi-steals-yellen-limelight-as-ecb-propels-top-currency-trade

I really think house prices and stock markets should have some weighting (albeit small) in inflation measurements. Why is inflation measured with only select items?

Oh and once again any drop in markets at the open is repelled with a godly force. Since 99% of the bears have been stopped out or wiped out I assume everyone currently invested in the market is making huge profits.

That doesn’t make sense. If 99% of bears capitulated, surely it is ripe to sell short.

Thats my point. It must be ripe to short right now. I have taken a dow short at 17909 as I think we are rolling over after the recent rise. Stop at 17925.

Today, the British Pound and Copper are showing the truth about the world economy outside the USA.

Good Points about Copper and I liked the trucking article too. For me, both are showing that the negative feedback cycles are continuing. While the real economy melts down, the Market appears to be melting up. This is not an environment I want to play in. I am ultra interested in the Christmas shopping season spending.

Nothinghas really changed from yesterday? Bearish rising wedge still playing out…..not too much talk about…?

I have entered an initial short on Crude today, half weight USO with a stop above today’s high. Inventories at all time highs, another considerable build at Cushing today (Tuesday data….)

Jeger, I will say this, a break up or down is coming in the next week or two. I see oil consolidating and this usually points to a move one way or the other. The question is how big of a move. I favor a trading range, which most definitely can be traded. I just don’t like the news cycle environment on Oil.

Jafree, I understand – this is really a longer term swing position based on supply/demand balance. Iranian barrels will (officially lol) start to enter the market quite soon amongst other factors I am looking at – but we will see.

J

Good to see Martin A has all his bases covered.

Stocks will either “sling shot” lower, shoot higher in a “phase transition” OR trade sideways.

The man is a genius!….he can’t possibly be wrong.

Now why didn’t I think of that!? 😦

Headline – First-time homebuyers fall, ‘desire to own’ jumps

So as the article points out, New Home buyers are out worst levels ever, but their “Desire” to own a home have jumped up. REALLY??? Well desire is all it takes right? I mean a good paying job has nothing to do with it. I know people with Masters degrees that are working in restaurants and this is not that uncommon. Granted the type of degree matters, but this is still an unusual day where College grads work in Service industries as servers and not management. This is a BIG difference than prior recoveries. Most of the jobs created are poor paying jobs, minus the oil industry jobs that have now been eliminated. Sure you have some technology jobs, but not enough. Now many many high paid jobs are being cut and the young are unable to get real jobs.

Just more on the negative feedbacks we are seeing and I predict to accelerlate into next year. Another bad winter for jobs ahead as well.

Yellen has made a big mistake: she is “market” dependent instead of “economy” dependent:

http://finance.yahoo.com/news/citi-janet-yellen-violated-one-120253056.html

Here’s another one by Michael Pettis, which although long as usual, is particularly informative about where ‘money comes from’ and the consequences of its origin .

Haha you are supposed to guess the URL!!

http://blog.mpettis.com/2015/10/how-to-spend-thin-airs-endogenous-money/

Sorry.

small short entered on Nasdaq now as well, stops just above recent highs.

J

I have changed my S+P 500 Delta Intermediate rotation such that the 1 point was the September low and there was a “replacement” Inbetween point so that the 2 point was also a low. This means that, right now, the Intermediate 7 point is a high that is trying to bring in L-6 and L-3.

What I thought was a low I-3 that started the linear rally was an early low I-4. Point 6 was an early low and then it made a “recognition point” and the market took off the day after.

An on-time high I-7 is trying to bring in a late L-6 and early L-3. If so, then it is down in an Elliot major 3rd wave from here and a new ATH won’t happen.

From time to time I like to read things I don’t understand at all. Hope all these calculations are making money for you. For me, with no calculations, ATH is a matter of time.

ATH surely a matter of time, I agree. Maybe the year 2024?

2015 wise.

Maybe, see the patterns in the book. If I am correct then stocks will be going down from now into 2017 and, yes, that means trending lower for all of 2016. That means to “buy the dips of treasuries and sell the rips of stocks”.

I thought you will see things my way two days go, after two big down days. Welcome to the club.

John Li if ‘that’ was your response to Richard I’s Delta discourse….and you understood what he was saying then I have to give you a HUGE SALUTE!!

I’ve tried ‘really really REALLY’ hard to get to understand what Richard I says in his ‘Delta’ posts but I have to admit defeat.

In fair disclosure I’ve never bothered to read anything about Delta so it’s nothing against Delta or Richard I.

However when I spew on about Elliott 3rd of 5th of ‘something’ waves I probably (most definitely) sound the same.

So ‘double kudos’ to you if you understand Richard I.

Am I waffling here? Had a few glasses of Chablis which may explain things. Lol.

I am disappointed on my short position. I expected more fireworks, but instead I got IBB -43 and IBB -192 basis points in two days.

As for Richard I, I agree with his crash call from now and all year 2016, but I haven’t changed my view all that much. I do hope he sticks to this call now, and be proven correct with the rest of us.

I gloss over the delta stuff because I don’t understand it. Richard, perhaps you can explain. I believe it is something as simple as full moons to new moons being bullish or bearish — and when a pattern is formed, it sticks around for a long time. However, there are inversions, which changes the meaning of the moon sub-period. Only Richard can tell you when/why these inversions happen. That is what I picked up anyway.

Good to see ES 2088 taken out intraday, hope to see the close below that level.

Good to see Carney adding £7 an ounce to my stash of gold today, in a battle between some pet rocks and the BoE there will only be one winner. Woof.