Namely, the Biotech sector within the wider stock market.

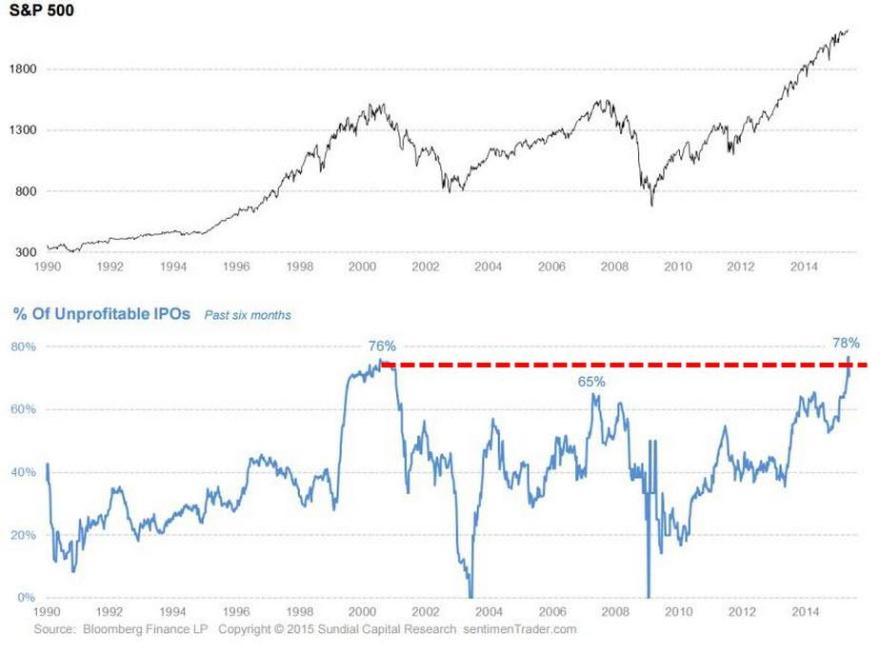

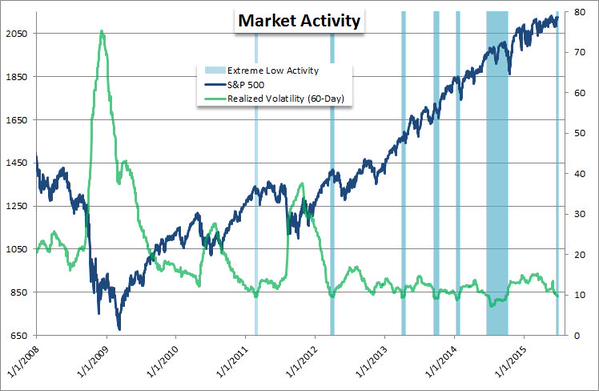

Is the wider stock market in a bubble? Valuations in the 97th percentile, record extreme leverage, allocations second only to the dot.com bubble, all time record cluster of readings in sentiment, and more. Bubble deniers point to the context of ZIRP and QE as this time it’s different. Or they argue the froth we are seeing is of a new secular bull, with the stock market leading the economy. But ‘this time is different’ has rarely worked out historically and there have been many indicators acting like they did at the peak in 2000 or 2007, which I have published on the site in recent months. Here’s one:

Source: Sentimentrader

That surge in unprofitable IPOs looks a lot like 2000, and whilst then it was particularly concentrated in dot.com companies, this time round there is a lot of Biotech.

Source: Biospace

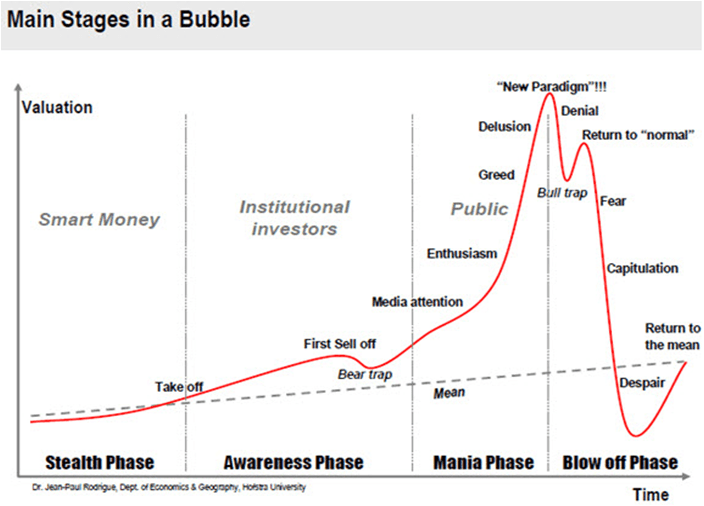

As we all know, into the dot.com peak of 2000, the mantra was that traditional valuations didn’t apply any more, and that stocks were ‘revalued’ on potential and expectations, justifying the crazy prices. Ultimately, traditonal valuation methods did still apply, and the pop was fairly unforgiving.

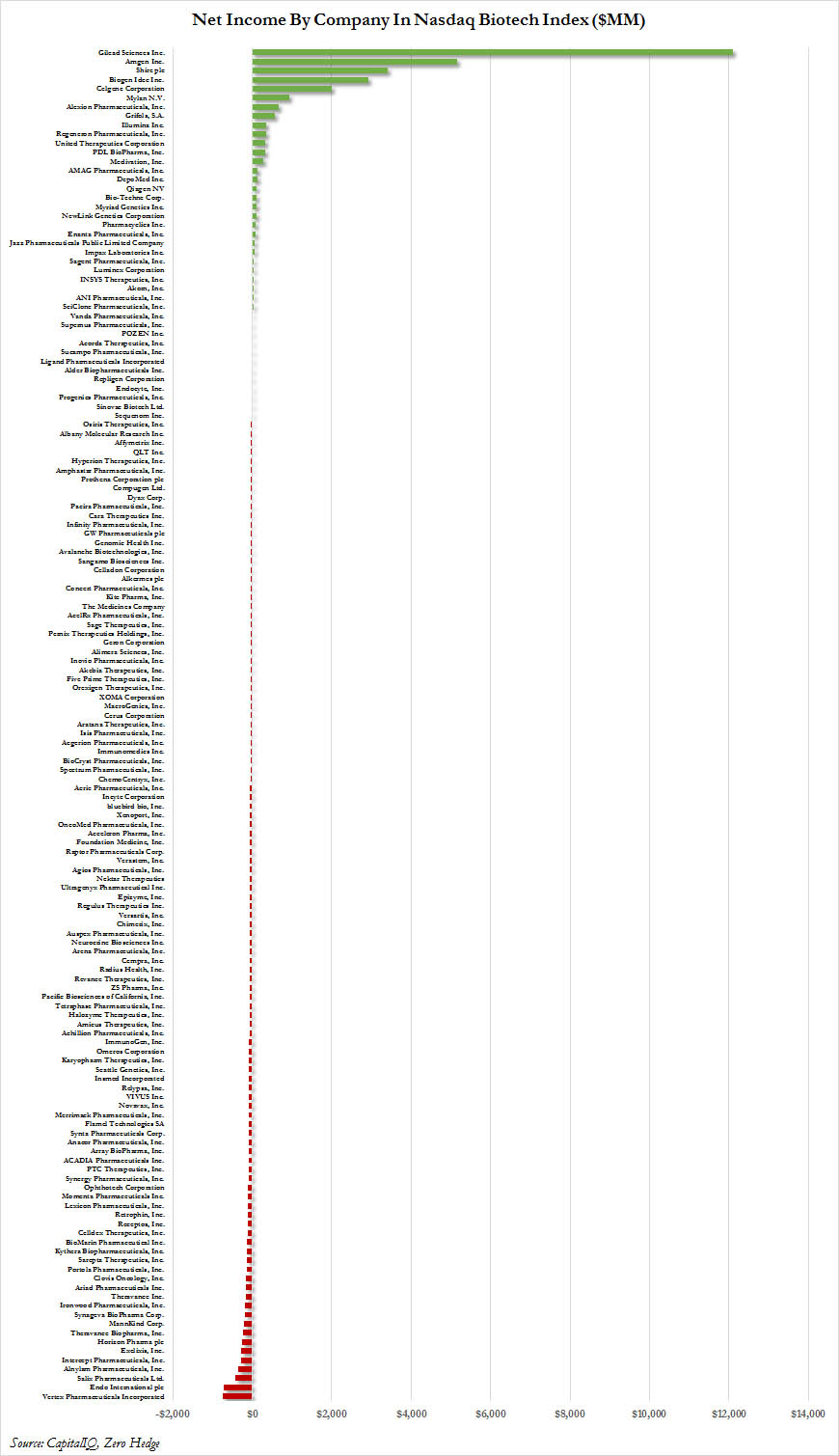

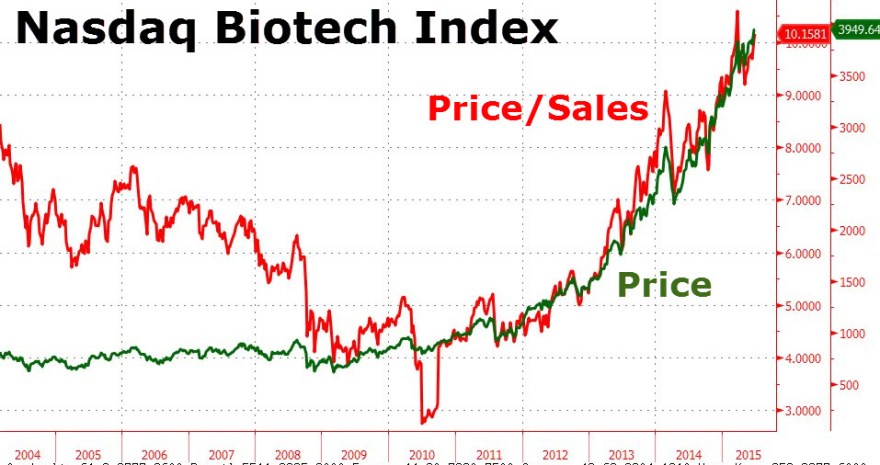

Today’s Biotech bubble is the same. Take a look at the constituents of the Nasdaq biotech index:

Source: ZeroHedge

Just a handful of companies are making any money and the vast majority none or a loss.

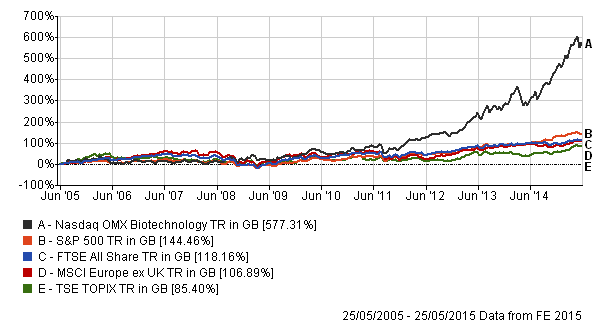

Now look at how Biotech has outperformed the wider markets:

And see how that run up in price has been solely multiple expansion, i.e. valuation rising hand in hand with price:

Source: ZeroHedge

The price to sales ratio in Biotech is now over 10. Compare that to the SP500 which is around 1.8, which in itself is at the very top end of its historic range and close to the 2000 peak.

We can all see the parabolic, and we all know how parabolics end.

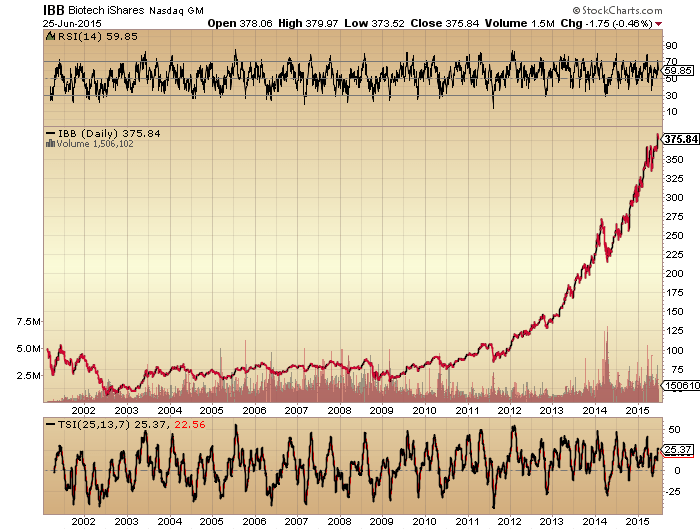

IBB is the vehicle that mirrors the Nasdaq Biotech index.

I want to short Biotech. But we have to be careful with a parabolic because they can steepen further before collapsing. So do we know when the game is up? One is a technical breakdown. Here’s how the Shanghai Composite looks today:

It broke mid-June. There was a divergence in strength leading into the peak, and there is such a divergence on the current Biotech chart.

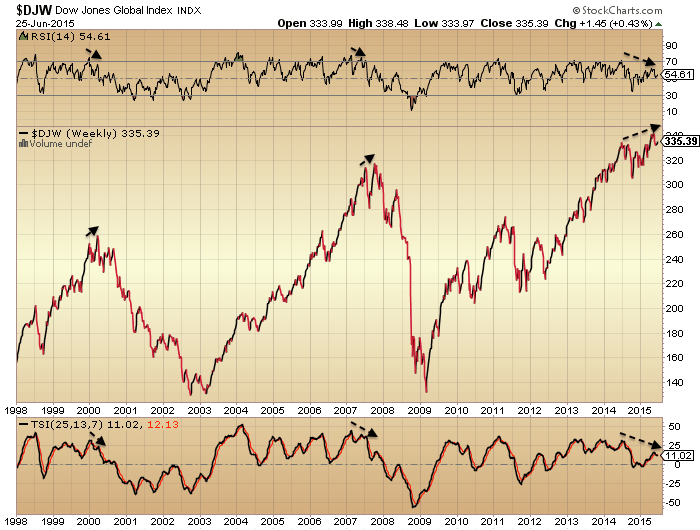

The other clue is the wider market.

Source: Stockcharts

Source: John Kicklighter

The last couple of days delivered another telling bearish reversal. Those negative divergences are all still in tact. We await the news on Greece and whether some kind of deal announcement would pump the markets back up again in the short term. So whilst I’m looking for short entries on Biotech and Russell 2000, the timing has to be careful. Plus, it will be a little at first, then building up. That building up may happen swiftly, as when Biotech breaks there are reasonable odds it will be quickly ugly.

If you have been long Biotech then sincere congratulations. It’s been the trade of the decade so far. But I would equally expect that short Biotech will be the trade of the next couple of years. It’s going to be about nimble and accurate timing and attacking. Will let you know when I enter.

Great analysis; thanks.

André

Hi Andre, What’s your view of SP500 in the short term? Do you see a low around July 1? Any capitulation of the current downward trend? Thx.

KL,

July 1st will be an important day. My view is that the market will be testing this date in a retrace. Then the bulls will capitulate. And then down into early (march?) 2016.

No trading advice 😉

André

John, why not target the UKX rather than the RUT.

With significant commodity exposure the FTSE100

pukes on any risk off sentiment, as per today.

RUT’s more overvalued than at any point in history, plus relative to the SP500 too. Multiple biotechs, and 20% of its companies have negative earnings. Then cross ref to the sentiment, allocations and leverage readings all at extremes. And under a bear small caps will be hit the hardest. If you have a similar picture for the FTSE100 (valuation, sentiment, allocations etc) please share. I don’t have that data.

I shared this before, but here it is again.

http://www.aaii.com/journal/article/valuing-growth-stocks-revisiting-the-nifty-fifty

I think quite instructive to see what IBB:SPY will look like in 1970s. The top was before the dow top, and the bottom was way after the dow bottom. Moreover, some of those stocks actually proved their worth after the solar minimum. So perhaps one of these biotech names will become the next pharma indeed, out of many that will fail.

karni/jeger, re your discussion on the previous post. If you look back at previous cycles, it’ll be inflation that pushes money into the markets, same as in the 70s.

Whilst you may double your money in nominal terms with the SPY, you will almost certainly be going backwards in real terms. Remember, when inflation gets going, it will be the corporates raising their prices to survive.

However, I too wonder how the can will be kicked far enough to see a cycle out into the early 30s, and the ONLY answer I keep coming up with is a much higher gold price, which increases activity and wealth in the East significantly, covers much of the debt problem in Europe (via settlement through the Eurosystem) and off to the races we go. Again, this rhymes with previous cycles. Gold is the great saviour for debt-ridden sovereigns.

John,

Have you ever tried to compare the current market and economic situation to the 1920s? I’m curious how your solar analysis would stand up. 1921-1928 seems to have many similarities to today:

Virtually the exact same % move in the market following the 1920-21 recession

Deflation over the broad economy, while the 1% became wealthy

Technology replaced manpower

Aside from a few regionally bubbles, real estate declined

Margin debt accelerated as the 1929 end drew near

Similar monetary policies moves & strategies employed, though in their infancy

Strong feelings late in 1927-28 that the market would correct, but didn’t

These are just a few, there are many more. I’m interested in your thoughts.

This? https://solarcycles.net/2015/06/17/comparison-to-1929/

Thanks – My thought was that we still have a year or two to run up to a blow off top like 1928 -1929, and that we are not there yet. Is there a solar scenario that would put us in the late 1927s early 1928s timeframe?

I don’t know of one, and I couldn’t square it with all the topping indicators that have been in place for 12 months.

posted last night:

6/25 10:30 pm Spiral update. Expecting a lower low at 2062 July 1-2. Forecast a low of 2091 for 6/25. Target hit tonight. Expecting a bounce now but tomorrow is forecast to be another down day.

now: 6/26 8:33 am ET next high 9:20 then down to midday

Thanks Peggy for your frequent updates. What are you trading tomorrow when all stock-echanges are closed ? Waiting for Monday ?

6/26 9:38 that was written last night – said “tomorrow” meaning today.

6/26 10:52 Spiral update – expecting a low @ 11:30 ET – price targets 2091, 2085-86

Hi Peggy – very interested in your accuracy. Elliottwave indicates hi prob of ending diagonal done. Wave 1 down from 2126.25 to 2061 huge retracement to 2122 fed talk as well as based on Greece hopes. FRom 2122 to 2086 pumping action.

2062 your call for Jul 1-2. Cash spx break thru 2072.14 is needed to confirm we may have made THE TOP of this 6 year rise. Does your spiral work tell us more

as regards a MAJOR TOPPING here.

Cash SPX EW count is impulsive from 2134.72 to 2072.14 and again from 2129.87 to 2095.38 from which we had a small rally. I would expect from rally 2104 point, another leg down to hit your futures objective 7/1-2.

Thanks

I doubt that the long term top is in. 7442 Analytics price objectives are looking for a bull market top at higher prices – most likely 2325-2400. In the shorter term, the Spiral looks for lower lows in either August or Sept/Oct. Those price objectives are not confirmed yet but could be as low as @1879.

For those pondering whether the 35 year bond bull market has ended, please have a look at these two charts, which to my eye confirm the trend in yields is intact:

http://data.okfn.org/data/core/bond-yields-uk-10y

http://data.okfn.org/data/core/bond-yields-us-10y

(Side note to JH, some great data-sets and charts at the site linked above).

Thanks

Temperatures v the market?

http://data.okfn.org/data/core/global-temp

http://www.advisorperspectives.com/dshort/updates/Regression-to-Trend.php

I don’t find gold very “funny” anymore.

I let some of my gold calls get exercised…we will see…

Hi- pray tell me what your chart spreads are telling us?

look here

solarcycles.net/2015/06/12/the-conundrum-of-our-times-part-1/#comment-56824

The rise in US longer term rates gathering pace.

Deflationary fears beginning to diminish, for now.

US macro is clearly indicating a Q2 bounce back.

This does not bode well for the end of the bull.

Lets see what the summer brings.

Have a good weekend folks.

Bit of sunshine, some ice creams, maybe a day at the beach?

Thanks, Phil. Have a good weekend, and successful trading next week.

j-your thoughts in previous duly noted

the reason I posted PUG’S was that before I was that tossed from his site I found his elliot the most rigorous I had ever seen and it is in agreement with the medianline work posted a few weeks ago.

Slater to your credit a few are following your Medianline…….and have become dam good at it……………….tyvm

Referendum called folks,

just as I was winding down for the weekend!.

Anyone short going at the close

may have a large grin right now.

Next week watching some of the high beta

UKX stocks for trading opportunities.

short at the close – that should have read.

Anti-crash:

http://finance.yahoo.com/news/biggest-threat-economy-vanished-104800919.html

Greek talks fallen apart. didnt expect this to happen but I’d like to see the faces on European leaders when their stock markets plunge Monday morning. The ECB will be forced to buy huge quantities of bonds and equities to prevent a meltdown. This is also the perfect opportunity for Putin to jump in and bail Greece out in return for permission to position his warships in Greek waters. It should provide a great opportunity to get back long European shares once the panic is over and investors realise the loss of Greece won’t affect Europe. No trading for me next week…just observing the carnage 😀

Krish, both Greece and the ECB want to see default, so a very good chance that’ll be the end result. The ECB will not be buying huge quantities of bonds or equities, they are only interested in price stability, and navigating their system through what lies ahead.

I will raise a glass to the ECB as all the foolish lenders to Greece get wiped out, and the currency’s integrity is preserved for the benefit of all Eurozone citizens.

A brave new (old) world awaits.

Krish, not sure there will be carnage, depending on your definition.

I agree on opportunities.

Would expect maybe 2-4% off, but that is a guess

and China have already eased today.

If you are margined long it may be painful!.

Greece should not be part of the Euro and hopefully this

is a first decisive step to an exit.

Lunar Chord:

Phase: – all week, especially on Wednesday to Friday

Distance: + all week

Declination: – until Wednesday, + Thursday to Friday

Planets: mixed but post Saturn opposition, Mars conjunction, more bearish

Seasonals: + all week

Summary: Greek news, distance, declination, and seasonals may indicate the following pattern;

Monday: down especially in morning

Tuesday: more down all day

Wednesday: doji

Thursday and Friday: snap back rally into US Fourth of July Holiday.

US markets are closed on Friday for the Independence Day Holiday. So US markets have a 4 day week, end of week is Thursday.

Thanks, pimaCanyon.

July 3rd, US stock markets close early (1 PM). US Bond markets open.

From media market closed all day on Friday. Futures may be open to 1PM.

Looks like very approx – 3% near the open Monday,

subject to change clearly.

China will be interesting overnight.

Staying up are you Phil?

Interesting times may only last a few days. Tempest in a tea pot?

To all those that said that Greece didn’t really matter…..let’s see what hapoens when you blow bubbles in bond and stock markets and create corporate earnings out of thin air.

LET THE GAMES BEGIN!!

Oh and remember some time last year I first mentioned concerns over Australia’s largest bank the CBA and economy?

It appears I am not the only one. What worrys me nearly as much is the degree of naysayers within Australia that there is any problem with most still believing that there is no RE bubble.

Many sight that Australian mortgages are recourse and thus Australian banks will be insulated.

To wit I reply with one simple word……LIQUIDITY.

A house reposessed or not is not very liquid and when your exposure to that market is in excess of 65% you had better lookout if it crashes.

My GOD, people are ignorant or niave!!

http://wolfstreet.com/2015/06/13/how-australias-big-4-banks-can-sink-the-entire-economy/

My spelling is terrible sometimes, for which I apologise……..worrys hmmm

Standard comment by the Bears on some news that a tiny country is going bankrupt and thus destroying the world. Greece will vote yes on the referendum and a new bailout deal will be struck. It’s quite obvious the Greeks will feel the fear of closed banks and no access to their money next week and I expect a them to vote in favour of the ECB conditions simply so they can continue living. The drachma can’t be reinstated overnight let alone in one month. anyway rant over. I will look to initiate long ETF positions on the Dax and maybe other indices if they continue to plunge this week on anticipation of a rebound on the YES vote. No place for leverage with the expected volatility.

Read my comment below Krish, Greece is just something, the markets are over-ready to welcome the bear.

Sorry but I disagree on the bear. I still expect new all time highs on the dax later this year. I think there is another leg up before a bigger correction arrives. A weakening euro will help boost Europe too if the Greek crisis continues. I do agree that summer may not be strong for markets but they will catch up towards the end of the year. One of us is right. We will be able to see at the end of the year I guess.

Irish, fascinating that you are relying only on fundamentals. I fear you have some tough lessons ahead of you, but wish you luck.

BTW, the ECB QE is designed purely to wreck the govt bond market, in much the same way that negative interest rates started the dollars rise last summer. The ECB knows exactly what it is doing: bringing matters to a head. Hurrah.

Krish, indeed, we shall see in due course.

I’m curious, apart from the possibility of a weaker euro, what precisely leads you to expect higher highs later this year?

Some detail would be most informative, thanks.

I just expect European fundamentals to improve rather than deteriorate. Partly due to a weaker euro and secondly due to the ECB QE feeding through initially. I am sure the QE will fail in the end but short term I’m expecting an improvement.

JH needs to take a look at these charts:

http://www.businessinsider.com/the-state-of-the-official-4-recession-indicators-2015-6

Sorry…I just don’t understand….why?

The article is attempting to show what is believed to be the indicators used by the Officials who declare Recessions. Most of those indicators are no where near recession levels.

It could be argued that the upward trend in most of those indicators is pointing towards a “reset” of the type of indicators that John uses. Note that John has warned that a “reset” is possible even though he belies the possibility.

Thanks for the explanation. It looks to me like a “Rorschach” test.

From Hussman this week:

‘This is not a Goldilocks market. No, this is a Roseanne Roseannadanna market (Gilda Radner’s character from Saturday Night Live). Though investors seem to believe that catalysts for a market plunge should be known ahead of time, they’re likely to learn in hindsight that the specific catalyst didn’t matter. History teaches that once obscene valuation is coupled with overvalued, overbought, overbullish extremes, and is then joined by deterioration in market internals, the outcome is already baked in the cake. Afterward, investors discover “Well Jane, it just goes to show you… It’s always something. If it’s not one thing, it’s another.”

There will be a few who actually truly believe that the markets falling will be because of the Greek situation. Such people in my opinion are fools, who must visit this site each week, but ignore all of the evidence that JH posts showing the topping process.

The market is exhausted, over-extended, and ripe for a bear market. Greece just happens to coincide with that exhaustion, and bear in mind Greece has been rumbling for months, and quas-defaulted a few years ago (when a new bear market did not appear).

John, your work here will be proven to be spot on, and I hope you make a shed full of cash on your trades. Others who just report from the BBC or Bloomberg, day by day, over and over, deserve only pity at their ignorance.

Greeks might not be that bad off and the Greek contagion thing is way overblown:

http://www.vox.com/2015/6/28/8858727/greece-gdp-chart

Richard everyone is TOTALLY missing the point on Greece. It is about the greater issues in regard to markets that have been distorted.

For instance you have Italian and Spanish 10 yy’s at absurd levels as a result of interventionist policies. Policies that are destroying liquidity not creating liquidity.

Greece will show the whole house of cards for what it is. Wait and see what happens when Spainish,Portuguese and Italian yields jump and make the recent Bunds saga look mild in comparison.

I jnow you are also bearish gold. Wait and also see what happens when bond markets collapse and capital begins looking for a safe haven.

In 1980 precious metals accounted for nearly 25% of global capital after averaging just over 10% for most of the decade. Today that figure stands at less than 1%.

There is no way known to man when the panic begins that gold won’t easily double in a few weeks.

Capital will be looking for ANY safe haven!

Krish and Richard, I believe the Greek o nomics situation may be the beginning of a summer bear market or a non event that will be a bear trap leading to higher prices in the short term and then a summer bear market. Either way, shorts have advantage until a few weeks before Venus conjunction on 8/15. Venus conjunction has been a reliable shorting opportunity over last 16 years. Would be interested in what Nicolas has to say about this situation and if he is beginning to see the writing on the wall?

LOL.

Yeah, just LOL, at the interest in Nic’s comments.

Here we go – banks AND stock market in Greece will not open tomorrow !

“Greece will keep its banks closed Monday and place restrictions on transactions, as the country’s financial crisis continues.

The banks will remain shut for an unspecificed amount of time, following a recommendation Sunday by the Bank of Greece, Prime Minister Tsipras announced.

The Athens stock exchange will also be closed as the government tries to manage the financial fallout of the disagreement with the European Union and the IMF.”

Thanks Phil.

Oh, hang on, sorry.

DOW futures down over 300 points, time to buy….(Gold hardly moves).

Lol Richard, had to throw that last bit in!………..given that Asian markets aren’t even open yet and the bulk of trading in gold futures begins in NY I think you’re way out on a limb in regards to that comment

Now is the “market” to unload Gold. (Buy on rumor; Sell, Sell, Sell on fact).

This is the chart that I am most interested in atm as it may be about to unleash!

http://stockcharts.com/h-sc/ui?s=USERX&p=D&b=5&g=0&id=p84471611546

Everyone knows there is going to be another equity

bear market.

If you are going to be validated by predicting this then

everyone is a winner.

Some posters appear to view this as some incredible

original foresight in seeing this occur ultimately.

‘The rise in US longer term rates gathering pace.

Deflationary fears beginning to diminish, for now.’

Hmmm. Hope you weren’t trading your comment from Friday Phil.

A huge credit crunch is both deflationary and higher interest rates. That happened from 1930 to 1932. Actually short term rates spiked as the deflation was dramatically reducing income so the weaker companies scramble to borrow to try to meet payroll, etc. Long term rates had a very small blip as rates continued down for over 15 years.

There is such a penchant for “predictions” here……what is the point? Just keep massaging it…..for whatever reason…..

J

Some predictions on here – such as that of dismal returns on US equities over the coming years based on historically verifiable valuation techniques – are very useful. Other predictions – such as attempts to pinpoint major turning-points using faith-based esoterica – are not.

Summer time in Greece, the worlds vacation playground, banks CAN NOT remain closed for long without reeking havoc on millions of international visitors. Tempest in tea pot most likely, banks reopen on Monday afternoon…or…this could be the beginning of GM’s cascade of doom where save haven assets catch a bid.

Greece itself is not the big issue here.

it’s the precedent that is likely to be set: defaults are the way forward in the EZ.

Suddenly EZ sovereign bonds are a big sell.

Portugal, Italy, Spain, France, they’ll all default within this bear IMO.

All deliberate ordo-liberal ECB policy BTW. They say it all the time.

6/28 8:00 pm 2058-2062 target reached. Will update tomorrow with price targets.

Krish, I suggest you take a close look at the DAX. Unable to reclaim its 50dma despite QE onslaught and what appears to be moving to progression to a bear market.

http://stockcharts.com/h-sc/ui?s=%24DAX&p=D&b=5&g=0&id=p28071096054

ASX looking even worse. Down over 2% again today.

http://stockcharts.com/h-sc/ui?s=%24AORD&p=D&b=5&g=0&id=p18736895238

Wrong, the European indexes are close to a bottom.

2% is hardly end of world stuff Allan.

I am tempted to tuck some RIO away

this week, depending on price.

China off nearly 4%, so last weeks steep

sell off continues.

A very mild reaction in US futures atm,

scope for more downside as the open nears.

Need some breakfast before the fun begins

in Europe.

Shanghai took a big dump in the last few minutes.

First short on RUT this morning, and later will enter first short on IBB. Not an easy call after such a sharp drop, and a some point there is likely to be better news out of Greece, as chances of a Grexit or default still remain less likely. However, at some point we get the dip which isn’t bought, and then all the record leverage is in trouble. I’ve covered all the weakening internals which would argue this could be that dip. Downward pressure into the full moon of later this week, plus two geomagnetic storms last week. China cut rates at the weekend but stocks still plummeted today. I take my chances here.

Thanks, John.

Good luck John, demonstrating guts as per usual,

you must have more mental resilience than me

as no way could I run that position in this volatility.

It looks like E-wave of the triangle that has been forming in ES contract since end of April. News driven shakeout. So the expectation is for SPX to rally now and test 2140-2160 zone in July.

Gold reacting very moot to Greece news and confirming it is in perfect setup for major decline.

U.S. markets will probably go through volatile distribution phase until final October or January 2016 top.

All this may change if SPX starts to decline below 2050-2070 support zone. That would signal imminent crash in Aug-Oct timeframe. But it is lesser probability in my opinion.

Burnell noticed that, Gold just not reacting.

Euro markets bought back quickly from lows.

Wish I had been a little braver this morning and bought

more, see how it develops.

I was expecting a mid morning revisit of lows which atm

does not look to be happening.

6/29 9:29 short term Spiral update – low expected 10:20 ET, then up to midday. 2088-90 first target

Hi all ! I still maintain that Greece is a non-issue. There’s still a high probability that it will remain in the euro. As I said, at the end of the day, the ECB just has to print a bunch of money and help them. The market seems to agree with once again. Dow Jones is only down 0.6%, gold is barely up which is pathetic.

So, continue to accumulate your IBB, AAPL and QQQ.

Regards

Any stops?

Dow down 2% at the close Nic, maybe you are the only bull buying the dip?

Keep at it, you’re like Hercules, you can do it.

6/29 10:11 Spiral update (longer term)058 achieved -next targets 2048, 2002 possible. Singularity low 7/2. Next upside target (long term) is 2198.

Peggy, please, if you don’t have anything valuable to contribute, we would kindly ask you to leave this board. We don’t want to be rude but your ‘spiral update’ doesn’t belong to a serious discussion.

Best regards.

Your “we” should be “I”. Many have commented on their appreciation for Peggy’s contributions.

Nicolas, it happens to everyone. it does not mean, that, if you get caught on the wrong foot.. you need to start venting. breathe…

Please define your concept of valuable & serious & discussion & concept.

PS – Peggy going like a traders dream.

O….M….G….

I am quite literally, speechless….

Really bad form throwing shade on Peggy, Nic. Apology in order…

Nicolas,

Who asked you for an opinion on any other poster. The fact is, Peggy is substantially above your pay grade. If you don’t think a post is valuable to you, don’t read and move to the next post. I, and it appears every one else, value Peggy’s posts with direct view of price and time and what it is based on. Few can match that. Certainly not you.

SC

Nicolas, I guess you are getting cranky. There is nothing valuable in terms of your contributions. If anyone should leave, I think 98% of everyone on here would maintain it should be you.

All the best

J

DAX didnt close the gap in this session…hmmmmmm

J

Dead cat bounce! The falls are not done yet but they will be soon and then the gap will be closed mostly likely within 2 weeks once Greece decides to give in and stay in the euro.

i dont have a crystal ball like you, but the DAX as been in a downtrend for weeks now, so it needs to break out if I am to commit full positions.

J

for DIV

even with all the evidence

there has to be a trade signal

using tools publicly available and shown here before

here was mine

http://stockcharts.com/h-sc/ui?s=%24SPX&p=60&yr=0&mn=1&dy=21&id=t01370597926&a=247870051&r=1435591575435&cmd=print

Slater9 – you have taught us well on the art of pitchfork trading.

Agree –

in the end, slater matters little…. all that matters is the tools

if even only a couple of traders have taken the time to understand the tools in depth… then my posting has been worth my time..

That was a terrible attempt at a bounce and a really ugly candle

A trip around the blogosphere produces suggestions like buy the dip, get ready for the rip, buy grek for a bounce, and our ever present genius telling us to buy CRapple and Biowrecks.

i appears to me that a lot more pain needs to be inflicted – maybe quickly

But, but, but…Phil said *everyone* knows a bear is coming.

It’s so confusing.

Puerto Rico……is toast?

6/29 14:31 ET Spiral update – 7/1-7/2 low – new target 2024-2031 http://www.ustream.tv/channel/7442-analytics

what? we dont get the V-turn today? is today the day the market does not get bought as John predicted?

yup

One month before quarterly earnings companies are prohibited from share buy backs with ZIRP loans from CBs. This may account for the headwind the market is experiencing in addition to being overvalued by historical metrics and Greece and Puerto Rico not paying loan obligations.

May be something to do with the rising risk aversion JH has been highlighting so well for months.

6/29 16:41 ET The Spiral – as simple as possible. https://twitter.com/mjmateer

Complacency. Everyone I heard on CNBC said buy the dip. Jim Rogers said the Greek default would be CB’S gone wild, part II, a la Nicholas. I have been saying that while everyone is looking at Greece, China sould be the real dilemma (their real estate mkt topped out Aug, 2014). Looks like we got Greece, China, and Puerto Rico thrown in for good measure.

At normal tops, pe’s are low. It is commonly said this is because the mkt discounts the future, I think it is because the real economy’s demands for funds is so great it pressures financial assets like the stock market. Hence news and earnings are great but few realize why the mkt is flat to down with such “good valuations and good news and earnings.” Now earning are high but flat, lots of good economic news, low unemployment, but only slight signs of shortage of funds. The pt is that high valuations like now and a strong econimy are a major top like 2000.

The really unusual thing is that major tops only occur every 50 years not 15.

Now on the cusp of a market decline that may last a few days or longer and in the context of a topping and rolling over SM over almost half a year and valuations that are either overvalued or really overvalued, it is time for Nicolas to up his game and give a convincing argument why investors should remain in QQQ IBB SPY. CB printing, ZIRP, corporate buy backs have been discussed. Will this be enough to start the ball rolling further up hill? Nicolas, the podium is yours…

Boy, there’s a lot of back and forth discussion here about fundamentals. I’m strictly technical, a combination of Elliott Wave and cycles. My take is that we continue down through the first week of August. We topped on May 20, which I called with a long term cycles chart.

Here is tonight’s technical analysis for the US indices. http://worldcyclesinstitute.com/wave-three-down-us-indices/

I wish you profitable trades …

Hi Peter,

I read your article and agree that a July to August sell off may be in the cards due to global macro and US chart topping into summer (with the reliable Venus inf. conjunction sell signal that points to bottom on or about 8/15). By the way, on your site you have a planetary index that matches up nicely with price movement. It this similar in any way to Alphee Lavoie’s planetary index on TimePriceResearch?

Hi, Valley,

Sorry for getting back late. The planetary index comes from work at the Foundation for the Study of Cycles using Edward Dewey’s original data. I didn’t know about Alphee Lavoie, so thanks for that link. I see he’s showing a similar forecast to mine … http://worldcyclesinstitute.com/discovering-the-market-tell/

(my latest as of tonight).

Slater to your credit a few on Pug are following your Medianline…….and have become dam good at it……………….tyvm

New post is out