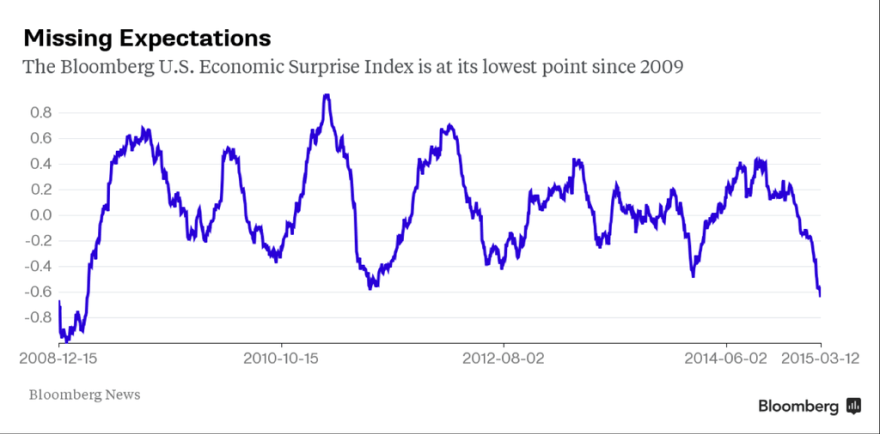

US economic surprises are now at their worst level since 2009:

Source: Bloomberg / Jessie Felder

Source: Bloomberg / Jessie Felder

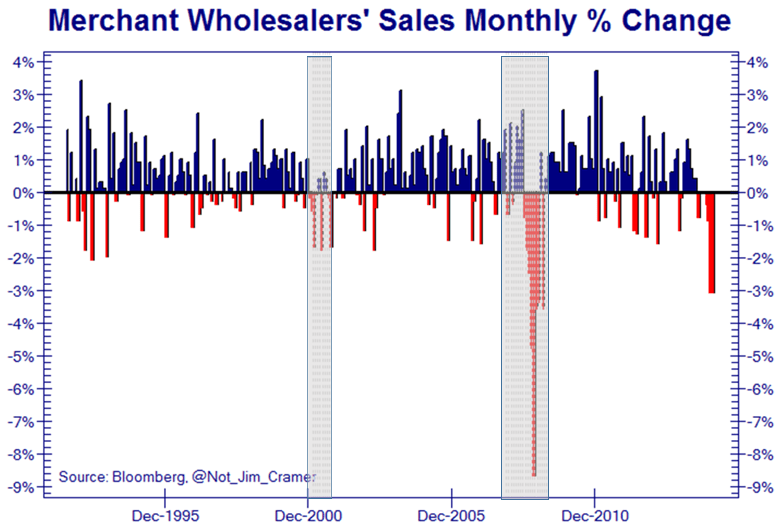

A trio of such bad data releases are charted here: retail sales, wholesale sales and rail traffic:

Source: Callum Roche

They are all recessionary. But Charlie Bilello hypothesises that the pattern in economic surprises over recent years could be inspiring stock market participants to hold through:

Source: Charlie Bilello

That pattern is a bit of a mystery and could suggest problems with the Citigroup calculation. Regardless, our positioning post-solar maximum should spell recession, no recovery this time:

(my chart)

The picture is similar for earnings. Forecasts for the near future are negative, yet further out participants expect earnings to recover dramatically again:

Source: Charlie Bilello

As things stand, the estimated earnings decline for Q1 is -4.9% which is the largest drop since 2009, and the bigger picture for declining EPS is shown here:

Again this would be consistent with a bear market and recession, unless that dramatic recovery later in the year is to take place.

Again this would be consistent with a bear market and recession, unless that dramatic recovery later in the year is to take place.

Solar theory argues that we see a speculative bubble into the sunspot maximum, which then pops post solar peak. People unwittingly buy and speculate both in the economy and financial markets into the smoothed solar maximum, and then do the opposite once the sun’s activity starts to wane.

There is some argument that government bonds are in a bubble, given their long bull market and ultra low yields. However, a look at household and fund manager allocations reveals the bubble to be in equities not bonds:

And the bubble in stocks becomes clear when we consider valuations, sentiment, dumb money flows, leverage, and more.

Commodities may have undergone recent falls but they were not in a bubble leading into the solar peak. Real estate has recovered some in the last several years, but does not show bubble characteristics. Sentiment and allocation to bonds has remain depressed throughout. Cash allocations are at low levels.

A common argument is that ZIRP encourages money into equities. Bonds and cash are returning nothing. At least some yield can be found in stocks.

Perhaps this explains why sentiment, allocations, valuations and leverage have remained at ‘saturation’ levels. Money has flowed in to maximum levels, producing common bubble characteristics, but money hasn’t flowed out the other way whilst ZIRP persists. The shallow corrections in equities have swiftly seen those measures topped back up to full.

Which brings us to this week’s FOMC. As things stand, analysts expect rate rises to start in several months time. Yet economic data of late has been fairly dire, which means the Fed may play safe and delay. If the Fed now resets expectations for rate rises (to start later) then will the correction of the last 2 weeks in equities be swiftly brought to an end and stocks rally to new highs on all-in measures again? I consider it a key test of whether ZIRP is the main driver.

It’s a test I expect to fail as I don’t believe it. I maintain the driver is the solar maximum, and that we see a range of evidence that speculation and the economy did indeed peak around the mid-year 2014 smoothed solar max. Even central bank balance sheet expansions topped out around then, as they too are subjects of the sun:

Stocks:dollar continues to show a clear peak at that time:

Source: Stockcharts

The negative divergences in volatility, junk bonds and breadth remain in place since then:

Source: Stockcharts

All this should mean we are at the end of a topping process.

But how do we square this with action in the Dax and Eurozone indices? I suggest as a function of the sharply declining Euro:

Remember the Euro was traditionally seen as risk-on? Hence the Dax and Euro largely moving in the same direction pre-mid-2014. But then, post solar max, things changed and remain changed.

Flipping back to the US, insider selling has leapt to a major warning level:

Source: Bloomberg / Nautilus

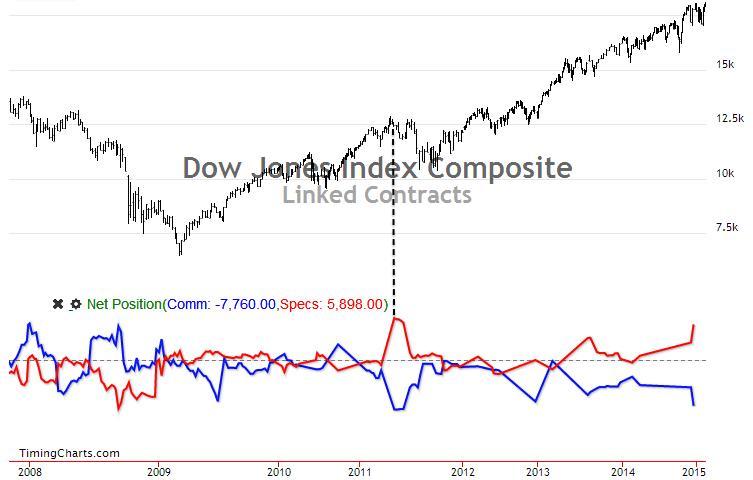

If we combine that with the commercial positioning, maybe the market can finally roll over here.

Source: Timing Charts

The Euro-dollar remains set for a significant reversal (positioning, sentiment, oversold/bought). Maybe then we can see a sell-off in US stocks and out of the US dollar occurring together: a contra-US move reflective of the current relative economic and valuation divergences. Just a guess.

By geomagnetic seasonality I still have my eyes on a March/April bottom, but this would be a significant low. This would imply a sharp sell-off erupts out of the initial falls of the last two weeks. Should that not occur then the case would build for the markets not properly rolling over until mid-year, and that would still not be inconsistent with the insider/commercials charts above (markets peaked but then took some time to roll over).

Select indicators hit washout levels by the end of last week, but the majority not. However, that keeps options open into the FOMC.

In the bigger picture, this is what I see: valuations, sentiment, leverage and allocations have been flagging a top for some time. Insider selling and commercial positions now join them. Various measures and indicators show peaks mid-year 2014 at the solar max and remain in divergences since. Earnings and economic data (concurrent and leading) have turned negative and Fed balance sheet expansion drawn to a close. If the solar theory is correct then earnings and economic data won’t come back here, and the realisation of this will finally see the scramble for the exits. Based on history a crash is already written in the leverage and highly skewed exposure and sentiment. Set against all this, central banks largely still continue to ease and keep conditions favourable for speculation. The outcome will be extremely telling.

John, thanks again for your – as always – great analysis. Maybe I can add a thing or two.

Last week I said markets would be up. And most European markets – and the Nikkei – made the high on Friday 13th, as per my forecast. I also said we are in an inversion period. US markets showed the inversion; basically moving sideways with increased volatility.

This reflects the alignment process I said would happen this week. Basically, the US markets wait for the European markets to roll over. They need to align before they can make big moves.

Next week should be down; no need to change my forecast.

My analysis supports John’s expectation. So the only remaining question for me is : when will this inversion end?

I like to believe this weekend is the most significant this year. I have multiple indications to confirm this. European markets just follow the gravity cycles. And this will be down (markets) with gravity up into the Supermoon on Friday. Next Tuesday we’ll enter the moon wobble period and are already in the Supermoon shock window. Tuesday will witness the famous Uranus/Pluto square. As of yesterday both Jupiter and Saturn are retrograde. This only happens once in so many years (slow movers!). And will stay this way until April 8.

Last weekend I gave the lines in the sand and my expectation for a retrace into the important march 26/27 timezone. This week I learned this coincides with a Puetz window. I can assure you my analysis for this date is completely different. Weird.

I hate changing my forecast, so I won’t. Now 3 legs down to start with. Last week I said an ABC down but that was foolish. We are in a primary cycle down for the next few years, we expect five down waves- at least.

For those not paying attention last week :

March 20 low

March 26/27 high (start of mini crash and the latest possibility for markets to align.

April 4 low.

I think.

Cheers,

André

For completeness:

This cycle will have 7 legs down due to an extension; probably in w3.

Other dates:

April 10/13 high

April 20 low

April 27 high

May 4 low

May 10 – first major low.

I’ll change my posting frequency to once every 2 weeks; will be enough to update and reflect.

p.s.

meant : between may 4 and 10 the low; will make this more precise when we get closer.

Thanks Andre

Thanks Andre

Andre’, thanks for your analysis on this excellent website. My system (new moon, perigee, seasonals, rising declination) all say we end week 4% higher. And give back 6% week after. Our systems are exactly opposite in their projections. So I will be sure to maintain a tight stop on my long position.

valley,

I am certain that the inversion period has closed. So there won’t be different trends in Europe/US. This should make forecasting easy again ;-). Monday may see a high, but after that I believe the long term trend has finally and definitely turned. So a tight stop seems wise.

André

John H thx again for a great post. The insider sales graph is particularly telling.

There is a blog by Alhambra Partners

http://www.alhambrapartners.com/commentaryanalysis/

One of their writers approaches analysis from an entirely banking reserves perspective. Although I don’t profess to understand the details it is becoming very clear that this bloke is worried about dollar liquidity. In fact both the Oct’14 and Jan’15 drops he attributes to illiquid dollar conditions.

The reason I mention this is to suggest an additional avenue of research for yourself if you would like.

The big benefit that I see with that avenue is it is near real time once one understands the data points to monitor. I haven’t quite grasped that yet. Perhaps you may be able to better.

A quality blog. Need to read more, thanks purvez.

Yes heavy going but I’m hoping one day to understand the detail of what is being discussed.

Mention of yield curves makes my eyes fog up or is that the brain? Lol.

purvez great site. I have said it many times.It’s all about liquidity. Therein lies the problem, paydown debt whilst maintaining liquidity and increase consumption.

Velocity of money just has not increased fast enough post GFC to maintain global growth and service debt at all levels, thus that leaves only one option.

And it is why we are now mired in the early stages of deflationary collapse.

With DXY and macro and precious little sign of any

inflationary pressure, it makes it increasingly difficult

for the FED to begin raising rates late this year.

If the patient phrase remains we have a catalyst

for a final mild parabolic phase.

It would appear the FED would prefer to begin

the very long process of rate normalisation,

however with the $ index their hands appear to

be increasing tied imv.

No rate rises this year is now beginning to

look likely.

Thanks John, Andre, and all..

Back in the day, long before I was trading, I had a cursory interest in financial astrology. I had wanted to share some information from my notes on a consultation I did with Bill Meridian back in the 80’s.

http://www.billmeridian.com/

At the time he shared with me some research he had done with natal charts of traders; along with what determined big wins and losses. Now, to be completely honest, I don’t really believe in the intimate connection between the two factors

nor that success is determined by such causality.

So, as a disclaimer; I am posting this information here because the vast majority of folks who post here are traders. And if nothing more just for entertainment interest; or perhaps for the superstitious among us. (:-)

We are all aware of the coming eclipse; this Friday, March 20, According to

Bill, one of the times where his sampling of traders made the most money in the market were during a solar or lunar eclipse. The findings are as follows.

Is the eclipse taking place in your natal 5th house?

Is the eclipse taking place conjunct your natal Venus or Jupiter?

Is the eclipse taking place conjunct the ruler of your natal 5th house?

I normally wouldn’t put much stock in this sort of this except that I made a trade

in August, 1970; near the bottom of the bear market; during an eclipse that was conjunct my natal Jupiter.

Probably a coincidence, no? Maybe this will help the astro minded traders with

their positions; or with initiating new positions on Friday, March 20.

Thanks for the post John, I’m still in agreement that stocks are overdue a bear market, and I expect it to start imminently.

I’m going to share some insights later today into why America is boxed into a corner now, and they have no way out, something will give (either the currency, the gold market, or the bond market).

I saw this tweet however:

It highlights why the bubble in govt bonds exists, as banks are hoarding them, and of course central banks too. The market is essentially broken, collateral shortages abound, a point often made by Jeff Snyder at Alhambra.

One has to ponder why banks are hoarding them, and also why big corporations are pumping up their shares via bond-funded buybacks, and then offloading them at record speed? At the same time Greenspan identifies the problem America has faced for decades: companies not investing in replacement capital goods for the future. http://www.investingforprosperity.com/stock-market-is-great.html

It’s obvious isn’t it? Companies and banks know the game is nearly over, and are squeezing the last drops of debt-fueled blood from the corpse of America before the collapse sets in. Who can blame them, it’s rational self-interested behaviour.

One just has to connect the dots to see we’re entering an end-game (that will take still a few years to play out). At the conclusion of that end-game, paper trading profits in the dollar may need wheelbarrows to transport them to the local shop for necessities.

GM, one of your points can be easily answered,

buy backs reducing share counts boost EPS

which many stock options are at least partially based on.

In terms of the insider selling, directors are benefiting

from signifiant amounts of yearly options so the case

for holding stock becomes weaker imv.

It was a rhetorical question Phil.

A great pianist said of the hardest pieces” They are either impossible or they are easy.Practice is the road to easy.Even then, most will not make it because they give up.”

My young student ”When I got frustrated with a game I would read blogs on the internet about how other people play the game and then get angry when I could not do or see what they did… I would think they must just be bad teachers.But I just kept playing and one day I could see what they saw.It was by playing I saw.”

I think my friend the trader Joed is one of the great trading minds of our time.He tried mightily to show how to see in his specific way IN REAL TIME.I could not.

Yet EVERY single trade I take is driven by his way of thinking about trading though driven by a different set of tools.

I am a painfully slow learner. To master what I do took countless thousands of hours.. I was driven by something Joed said”Before you add a setup to your trading, know that setup so well that you would be willing to risk your family’s well being on that setup alone.Short of that , don’t trade it”

I have described in detail more than once the traders dream, the 886 algo, the red line green set, the 382/447 abcd..my path was to study for countless hours and to archive thousands of example of each one.

It was suggested that my charts were too complicated that they looked like the crayon work of a 5 year old… when you are in the midst of trading that is what your charts look like you are constantly notating your charts looking for your trade setups. HERE is a cleaned up chart of recent trades entries. Because for the 886 algo and the red line green set the medianline sets are part of the trade I left the lines f or those on.

good trading

http://stockcharts.com/h-sc/ui?s=UVXY&p=5&yr=0&mn=0&dy=10&id=p64306618604&a=338712604&r=1426424868765&cmd=print

slater9: I am sorry.. I know you have explained your trading system before, your 886 and trader dream indicators. If you don’t mind, may you please give me your quick interpretation of the UVXY chart/strategy? I want to learn your trading system.

I am fascinating with volatility trading, where I think the serious money can be made.

Does traders dream on recent day mean imminent large down movement?

UVXY is 3 X volatilty… so the sell traders dream buy simultaneous 886 algo

in DIA,,,,,

is it possible that we are already in a recession/depression but the financial instruments we would normally use to judge this now have no more meaning than something else we could bet on such as the results of a horse race or who would win a game of monopoly?

good way of stating it

I’m unsure if insider sales function as

such a reliable indicator any longer,

as renumeration packages are so stuffed

full of stock options.

They are worth some consideration, at best.

One of you best John. Love your chart!

Thanks Allan

If you are looking for an imminent severe sell off

the FOMC has to remove the patient phase.

I think on that most of us can agree.

You think that’s the deal breaker eh Phil?

We will see.

(Far too simplistic a view in my opinion).

Since the Great Depression, the US economy has spent 15% of the time in recession. Two-thirds of those depressions started within two years of solar maximum. During this period, solar cycles were strong (high sunspot/ short duration).

From 1850 until the Great Depression, the US economy spent 46% of the time in recession. There is no apparent link between the onset of recessions and solar max timing during that period. During that period, solar cycles were weak (low sunspot/ long duration).

Given that the sun is now almost certainly entering a lengthy period of weak solar cycles, we might expect:

1- to spend much more time in recession,

2- to see a breakdown in the timing relationship between solar max and recession.

CB Leading Economic Index for the US was still steaming upwards during January (February figures out later this week): http://www.conference-board.org/pdf_free/press/PressPDF_5393_1424340004.pdf

The average of US CLI during solar cycles 19-23 shows a distinct peak exactly one year before each solar maximum. That would indicate that we have still not seen the effective solar max yet – no doubt because SC24 is different this time.

Looking at the history of the US CB LEI (in the above link) since 1998, a recession would not be due for a year or two after it turns down – ie 2016 or 2017 (if it turns down very soon).

2017 chimes closely with the likely speculation peak under previous weak solar cycles (excluding SC16), with a volatile shake-out occuring soon. Alternatively, following SC16 would indicate a more major sell-off during 2015 (depending on ISN figures over the coming weeks).

Your analysis displays just how overly valued the markets are at this point. If the strength of the cycle is a factor then at this point we should be at a peak, but at a much lower level, at least closer to, but logically lower than the mean. The S&P needs to catch down to the Nikkei.

John, the odd manipulated strength of dollar impacting everything. Not really discussed other then quick quip about Euro comparison… ZIRP vs Solar is a bit a misnomer in my opinion because as you said central banks are human managed and ergo impacted such. We need an update on demographic headwinds along with unemployment by demographic age around the world where available. Dropping population for producing population in terms in monetary velocity versus population living off the government and thus harming monetary velocity is key. We know unemployment in US is still fabricated as is inflation data. More accurate data explains the deflation on big items whilst inflation on smaller ticket items.

Euro even with QE not going to bounce Euro higher. I still maintain we will see DOW 19,000 soon with maybe a crash later in the year. The one last year was supposed to be worse, but there was an intervention of some kind.

There are a bunch of folks who stand to make money and have positioned themselves clumsily on rate increase in FOMC policy this year but the data doesn’t support an increase this year. If we assume ZIRP is here to stay through the next 10 years, is the way people need to be talking, but ignorant of demographics, they look to explain it differently.

10 years?, possible but highly unlikely.

No demographic decline in the UK, we are in the

early stages of a population boom.

A-hem. This is the final V sell off, and recovery, before the parabolic blow off top. I expect –The Top– to be in October, 2015. I also expect the bottom of the V sell off to be in April. I posted this before when I took profit on the day of what is the all time high in the DOW. (I got stopped out of my short USD trade but so what after taking nice profits. I am not a perfect trader.)

Good trading Richard. Nice location for the V sell off would be 4/2 to 4/15? A period of seasonal weakness, especially if prices meander higher until 4/2. A-hem. I have been accurate last few weeks and look for higher prices until next Friday. Though I am starting to doubt this based upon Slater9’s traders dream imminent sell off indicator.

John,

I posted here on March 2 at the most recent top with some charts using tech analysis from Elliott Wave Theory. We keeled over the next day.

I’m at it again because the waves are getting really clear and when you marry them with your work, cycle theory (Steve Puetz), and I see comments from André and Alphahorn, who are pretty much on the same page, I had to put together a few charts and I’ll perhaps follow up with a video in the next couple of days.

I’m looking at March 20 for a possible top and I’ve posted the reasons why online: http://www.worldcyclesinstitute.com/spendingdiagonal/

Would appreciate your thoughts. I think we’re very close.

Good article, Peter. Will look for 3/20 top to be epic.

Well, it’s never a “for sure!” But probabilities are starting the rise, I think!

To GM regarding imminent decline and boxed into corner. Same was being said in 1982 at end of oil crunch and Charlie Daniels sang the country and western song: “America is going to do it again”. I think that is an appropriate anthem for the new economy that will be brought forward during the next 30 years. Except this time is will be a global message. Cheaper, faster, smaller, lighter. In 30 years when all packages are delivered by drones, energy is much lower in cost, AI optimizes much medical care, and trees grow ever higher until they touch the clouds (well maybe not that) todays box will seem quaint. The SM will probably have another bear market or two during the 30 years but milder and of less duration than previously. And to the gold bugs: watch the Kitco youtube video with Daniella Cambona about the Canadian company getting PMs from melting glass in microwaves. The PM exudes in tiny amounts but still a lot cheaper than mining for it.

valley, in the early 80s the world had nothing to move to if the dollar collapsed.

Now it does, so the dollar has been cut adrift.

I don’t share any of your optimism for the next 30 years I’m afraid, the world is going to go through hell first, thanks to the bursting of a 93 year old debt bubble.

Imagine there is no debt, only equity in companies. Imagine a debt jubilee in which national debts are forgiven. Imagine slow hyperinflation in which govt. pays for expenses by currency creation, offset by dramatic improvements in energy, transportation, electronics; eat less, consume same amount or more of energy with better electronics, faster lighter cars, more convenient shopping (1 hour drone delivered shoes). You may be correct just seems to me like this is 1982 redux, and not 1929.

You’re dreaming valley.

If there was debt jubilee, you do realise that every debt is held as an asset by some entity? Bang goes everyone’s pension for a start.

There will be hell to pay over the next 10 years, then the US civil war.

I will try very hard to keep this brief. It may not help with day to day trading, it’s very big picture stuff.

I firmly believe to be ahead of the crowd, one has to be prepared to look at the big picture, and connect some dots.

We’ll start with a question: what caused the dollar to start to rise last summer?

I believe it was this:

http://www.ecb.europa.eu/press/pr/date/2014/html/pr140605_3.en.html

The ECB introduced negative rates. They are not stupid at the ECB, they knew this would cause capital to flow across the Atlantic. One of the main reasons (confirmed to me by several bankers) is that the banking systems cannot cope with negative rates on a practical level, the infrastructure isn’t there..yet.

That kicked of the rise of the dollar, which is slowly but surely causing a myriad of problems the world over.

Why do the ECB want to cause a dollar problem? Why do the Saudis want a much lower oil price? Why are major nations moving away from supporting the US Treasury markets? Why is the Euro already tracking the oil price? Why is the Euro able to withstand the bankruptcy of ANY of its member states? (An entirely new style of currency, separate from any nation, that’s why. The gulf states are looking at currency union, so too in Africa, eventually in the far east too).

http://www.bloomberg.com/news/articles/2015-03-13/central-banks-sell-treasuries-as-everyone-else-buys-u-s-debt

The very simple answer is that the current global monetary (non) system doesn’t work, and everyone else is fed up with US global hegemony. So, as quietly as possible, trying not to cause any major upsets, actions are being taken to replace the current non-system with a better system (yet to be agreed in its finality).

When looking at markets in the US (and actions the Fed or the US Treasury may take), there are only 3 items that need to be considered: the dollar, gold, and the US deficit/UST market.

In simple terms, the US authorities, like the UK, the Europeans, the Chinese, the BIS, they all know we’re heading into deep trouble, a bursting of a massive bubble, and deep recessions.

The US is in a league of its own though. It cannot allow the coming panic out of stocks to take T-bills or USTs into negative territory, whereas other countries can. The reason for this is that it would be game over for the dollar, as its mortal enemy (gold) would become the victor in a game that has been running since the 1930s.

How so you may ask? Well, Allan has mentioned many times how liquidity is a big issue, and because of QE, and Basel rules, liquidity is very tight these days. But the asset that keeps providing billions of liquidity every day is the London gold market (you may know it as XAU, or unallocated electronic gold trades). Over 2,500 tonnes of gold are traded every day via XAU, on the understanding that there is some real gold behind it in the LBMA system.

Trouble is that (physical) gold is being depleted, by entities taking allocated gold out of the system, heading East mostly. See these 2 links, and note the changes in vault inventory, a sharp decline in just a year (ignore the BoE holdings):

http://www.lbma.org.uk/vaulting

http://web.archive.org/web/20140727155710/http://www.lbma.org.uk/vaulting

The intricacies of gold trading versus dollar liquidity preference are very complex, but here are some links that go into some detail if you are curious:

(The links are within the tweets, and you’ll need to allow the blog to load, and it will arrive at the relevant comments from Victor).

Simply put, once gold liquidity disappears, the XAU market disappears too. Given the volume of liquidity this supplies (2,500 tonnes = tens of billions per day), and it becomes clear that without XAU, the gold price would shoot to the moon, and instantly kill the dollar en route. As physical gold levels deplete, year after year, we are likely to see a ‘crunch’ hit that market, at just the wrong time. What is one of the ECB’s largest assets, even at current prices? See here, and note where it is sits, on line one:

https://www.ecb.europa.eu/press/pr/wfs/2015/html/fs150310.en.html

So, despite the Fed not being blind (and seeing the US economy is in no state for a rate increase), I would expect to see some very odd moves in the next couple of years that will confuse many. They need to avoid negative rates, buy up a load of bad debts (again, but this time possibly to include foreign dollar debts), and keep the US govt in funds (when official support is waning). They also will need to cope with a rapidly rising trade deficit. It could add up to lots more QE at the same time as rates are increased, and they introduce unlimited ‘positive rate’ reverse repos.

That’s about it, as brief as I can make it, hope this provides some useful into the impossible position the US are now in. One thing that won’t be top of their agenda, but rather at the bottom, is the S&P or the economy, this is all about preserving their hegemony. (A final thought, if you were a country that owed $18 trillion, what’s the easiest way to wipe the slate clean for good? When will the speculative pool of capital sniff that out? When they do, it’s all over for the dollar, and hello to the Euro).

Get yourself some physical gold, hopefully from your trading profits!

Good luck.

Good post GM. Read many books with similar conclusions, but I just think this is a few years away still.

Also basket of currencies versus Euro will precipitate a global currency, I never see a Euro overtaking hegemony.

“There is no point in using the word ‘impossible’ to describe something that has clearly happened.”

― Douglas Adams, Dirk Gently’s Holistic Detective Agency

Random Observations

Haven’t posted in a few weeks since mid-Feb when I predicted the Naz would hit 5100 in Apr-May (did make 5k). Still looks possible after Euro crash subsides. Armstrongs cycles point to a panic low in Euro next week which looks negative for stocks. Maybe Andre’s crash was in the Euro..

Possible downside for SPX by end of month is 2020 (equals Dow at 17450 for EW diagonal and 125 dma) or if that breaks then 1950 from megaphone with Dec highs and Jan lows and 1960 H&S (from McHugh). Could bottom this week Megaphone top is 2150 by May.

Oddly enough this is consistent with my big picture 1921-1929 analog to 2009-2017 where we are in 1927. Dec ’26 and Jan ’27 DJIA fell 5% then rallied back to new high in Feb. Next, March was down then up Apr-May.

Bottom indicators

CBOE skew approaching 1-yr bottom level, excl Oct

http://www.barchart.com/chart.php?sym=$SKEW&t=LINE&size=M&v=0&g=1&p=D&d=X&qb=1&style=technical

Spike in equity p/c (CPCE) >=.80 usually precedes bottom by 1-3 days

COT for gold approaching buy levels of last Nov-Dec (large spec vs commercials)

w/ possible dbl bottom artound 1120

Interesting:

What about the 1000 corrections before that? 😉

J

Crude looks to be continuing to sell off atm.

US futures not look that perky either,

may all change over the next few hrs.

Completed a study showing the power of lunar effects on price. If you had exited the market during the last 18 years during the following days:

Apogee, trading day before at close, buy back on close 3 trade days after.

Perigee, trading day before at close, buy back on close 4 trade days after.

Your return since 1998 would have averaged 12% higher per year as these two had average annual losses of 7.5% and 4.5% respectively.

This implies that the days outside of these two should be much more likely to be bullish most buy not all of the time.

GM

A very interesting theory, one which seems plausible somehow because of the fairly evident desperate thinking that has gone onto this, and which in reality changes nothing longer term – which of course is the point. The old competition, labour, scarcity, debt systems cannot be allowed to die because they are so lucrative for the few.

If accurate, this scenario just proves how limited humankind has become. In the alleged words of Thomas Gore:

“If there was any other race than the human race, I would join it.”

One can hope not to be quite so disappointed in the future perhaps, but I am not holding my breath…:)

J

I’d certainly be with Mr Gore jegersmart, we’re a hopeless species in so many regards. (Although, upon reflection, we’re not, we’re just manipulated by the 5% of the species that are sociopaths).

Time is very big though. The past c.100 years since the Genoa mis-step in 1922 will be rectified, and then the world will be a more settled place, in terms of monetary imbalances, and in terms of no US bully causing wars everywhere. Still, far from perfect, there is no perfect of course. But back to reality again. Smaller governments too, hurrah.

But the masses will need to adjust to being very poor again, once the debts are gone, and possibly the world lurches to communism at the end of this phase, blaming the evil capitalists for all of the trouble.

Gold looking perky atm.

Where is Putin?.

I think money may flow out of the U.S. into Europe. Best add scenario I think will be DAX hitting 14,000 by July/August. We may get a drop I the US stocks but Europe is now in a raging bull market until end of 2016 at least. The following crash will potentially erase all post 2009 gains though unless central banks find a way to perpetually manipulate stocks higher. If we learn from the effect of US QE on US stocks there is lots of money to be made going long Europe this year and next.

This is likely to be a volatile week,

if in profit on an open position,

it may be worth locking that in, unless

you remain convinced of further upside.

Valley, best of luck for this week

on a very gutsy call and positioning.

I’ve just increased my dax long exposure on the break of 12,000. I think it’s going to fly this week. Maybe a 12,500 finish is on the cards by Friday. I hope others on this site have followed me with the DAX and have been rewarded with fantastic gains. All markets up today so there must be tons of money flowing into stocks! I believe the FED will push back expectations for a rate hike this week which will send the markets rocketing even further. Moved stops to 11750 on dax in the unlikely event we see that again this year.

They say Putin is attending the birth of his love child in Switzerland with girlfriend who was a past gymnast. So much for all the stories of him being sick or taken out.

Something Big is Coming to Markets http://safehaven.com/article/36982/something-big-is-coming-to-markets

Mae, there are some significant pre arranged meetings

today apparently, so if he does not make an

appearance some degree of panic may begin

to set in.

I find it very difficult to see anything dramatic having

taken place, perhaps minor surgery, soon see.

Looking for a break of 17830ish on the Dow at the close in which case I will keep my current long…probably….

Just entered a short on the Nikkei at 19381 but have a stop around 19500 on that one.

Ya gotta love em

I thought if I posted this traders would get a firmer grasp

Remember you can not do what I do unless you scan the index etf’s for the BEST

SIGNAL.On the close on Thursday, the traders dream was in place in SPY….

BUT THERE WAS NO SIGNAL YET IN UVXY…it came the next day in the first hour as the 886 algo triggered

LATER IN THE DAY

as previously shown, at the exact 240 pm bar, the inverse setup triggered

the traders dream triggered SHORT UVXY and long DIA basis the 886 algo…

With this approach to the market I am not trying to forecast price moves.Instead I

am trying to trade WITH the most powerful traders , the volatilty traders

by using a few simple triggers understandable to a ten year old… THE BIGGEST MYTH in the current market is that what the volatillty computers are doing is highly complex and beyond the reach of the average trader.The emperor has no clothes

What they are doing to capture the short term swings in volatility is simple.. but only if you have the tools to see… I hope you have gained some insight into the simplicity from my posts.

http://stockcharts.com/h-sc/ui?s=SPY&p=15&yr=0&mn=0&dy=6&id=p87386751040&a=338702695&r=1426507323170&cmd=print

This might help too.

I have archived and study thousands of examples of each trade trigger

It is from that archive I get my probabilities of how often each setup

reaches its MINIMUM target.. THE RISK set on each trade by using a stop

is never more than 1/5th the distance to that target. This is technically AND

psychologically important. I know IN ADVANCE that by risking the same amount on

each trade I could be wrong 4 out of 5 times and still break even.

The number one way a trade setup fails is if the very first thing that happens is an abcd sets up against it…

The second way is if another trade signal sets up against it.

so once in a trade it is simple a matter of working the charts to see if that happens

chart

http://stockcharts.com/h-sc/ui?s=UVXY&p=5&yr=0&mn=0&dy=11&id=p24001317945&a=337841009&r=1426514520695&cmd=print

Im going to put this as politely as i can. If you cant forecast price or time accurately then you are a gambler and no amount of pitchforks will ever change that.

Fantastic days for the bulls yet again especially on the dax. I believe the parabolic phase has now truly got underway in europe.

A small part of Europe, is that what you mean?

I think the parabolic phase is nearly over, so you be careful out there.

Hi all ! DAX at new record highs. I told you so. This is perfectly rational with the strong ECB buying since last week. Everything is going as planned. IBB at new highs also. Congrats to those who followed my recommendation a while back on biotechs.

So, stay focused on the big picture and you will make money. It’s very easy to make money in this market.

Shame I didn’t listen to your earlier as I would have been in an even better position. I do agree now that the bull market is fully intact and further rises are ahead. The crash scenario in the short term is complete rubbish. For those who are bearish it’s fine to have those views but looking at the market action of late it would be completely disastrous to hold short positions. It is just so easy making money being long I struggle to understand why someone would want to be short.

Hehehe does Nicolas have the ability to subsume other peoples personalities? Perhaps we should re-christen you Krisholas. 🙂

A student asked the Zen Master why he was having a relationship problem with people in general and the Master answered…” it is because you expect too much; demand too much; and criticize too much “.

For example, if you are critical of your wife, she will never stand naked in front of you. Lol.

This wisdom applies to the market participants. If you bash Mrs. Market and have a contempt for her, she will make sure you lose money. Why? is it your emotion that cause you to become self-destructive in the game of speculation but you don’t know it.

Ok in honour of Newt’s Zen Master’s wisdom I hereby apologise to Nicolas and Krisholas.

Got to love the squeeze in to OPEX if long.

Crude being killed but risk on for now.

Phil is ‘if long’ a typo and you actually mean ‘if short’. If not a typo then please elaborate. Thx.

Krish, I am very cautious on a medium term view,

but don’t go short this market, too dangerous.

It’s been my best day for awhile, nice bottle of malbec

this evening.

valley, looks like a great call by you, many congrats,

enjoy your gains – I do not have the nerve to go 100% long

even on a short term basis.

Digital bow, and virtual thank you. Gap up today portends Mother of All intraweek up trend in place. Watch out above!

Nicholas is correct again!!! Long stocks; short gold is a wonderful winning combination to employ and go to the beach. It’s so easy.

If the Dax is not careful it could bend over ‘backwards’ and do itself some serious damage!! 😉

The DAX should be renamed the widow maker,

the rise must have blown up multiple trader accounts.

Only the reckless ones Phil. I speak from ‘near death’ experience here.

German translation: Witwenmacher. Will this Farfegnugen up move lead to an air cooled engine light? My guess is no. QE = Price Appreciation. The more they print the higher their markets will go.

good stuff as always. Looks like the 200 dma near 2000 on the s and p would come into play soon. people are quick to write off deflation these days but dollar strength and commodity weakness seem to indicate otherwise.

Yes, it’s really easy to make money in this new era. You just have to understand what’s driving the stock market and forget all the old fundamentals like PE ratios, earnings, margin and so on. I’m glad to be living in this era, it’s a lot easier to analyse and you don’t need to waste time analyzing companies and earnings reports.

It’s not a ‘new era’ Nicholas, surely this perpetual increase in stocks will be everlasting? Everyone on earth can become so wealthy, thanks to the central banks.

Gosh, I also am so glad to be around as we enter the ‘Star Trek’ years.

Money for nothing….?

If Spock could weigh in he might say: “Invest in IBB and prosper”.

Its the ‘chicks for free’ bit that I want.

Only Nicolas, the rock star of the New Economy, has that benefit.

purvez, Albert Edwards remarked recently that this is

the stage in the cycle where he begins to doubt his own sanity.

I think that nicely sums up the DAX.

Classic troll comment by Nicolas, or of course he started trading post 2009 🙂

J

DOW target at 17970 reached, closed some of my positions here. I have a target of 18070 next, but don’t want to push it right now. Stop moved to 770.

J

Purvez, I meant prices being squeezed higher,

rather than a short squeeze.

I’m really not sure why Nicholas’s views

appear to be regarded as somehow unusual or exotic

in someway, this is the current consensus

view on the majority stock sites.

His views are now mentioned more than JH’s,

on John’s blog, it’s utterly ridiculous folks.

His negative way of saying things pushes buttons which elicits responces. He seems to be a bull in a bull mkt which is a good thing. So let’s just ignore the abrasive defensive way he says things.

Trader like Valley having a fine day because of his prowess. He gets a long with Mrs. Market and she gives him love and some money.

Gap and flap in play. Gap and crap no where to be found.

Thank you John for another excellent post. You touched breifly at the end on the U.S. Dollar. 2014 was the year for universal bearishness on long term U.S. Treasuries. It turned out to be a great year for treasuries. 2015 looks like the year for universal bullishness on the U.S. Dollar. I’m betting that it will turn out to be a terrible year for the dollar.

the hedgers position on the dollar looks like manufacturing process going out of control. the equipment operators would be forced to emergency stop such a process before the factory explodes.

The IMF implementing a change to reduce the dollar component of the SDR while adding the Remnimbi and a few other currencies might take a few myopic traders off guard.

It is frustrating with all the detailed work I have shown some of the comments that follow….

ONCE AGAIN!!!! UVXY IS A 3X LONG VOLATILITY ETF!

IF A TRADERS DREAM TRIGGERS SHORT IN UVXY

THEN THE EXPECTATION IS THAT THE STOCK INDEX INDEXES WILL EXPLODE UPWARD!

I appreciate your tutorials…….ignore the bad posts

Hi slater9

Which comments are these?

I had and still have a bit of a problem understanding what you write. The stories about 10 year olds and so on just makes it hard for me to understand. Also, posting historical charts and making annotations just make for confusion because anyone can do that. I can just call it “jegersmart algo” for example.

MY advice is to give the calls when you see them and why with a graph in realtime – then we can better understand why a 10 year old can understand this…:)

Thanks for sharing

J

And what if his 10 year old protege happens to be some phenom who turns out to be a future Bill Gates?!! I mean it is one thing to keep mentioning some elementary school kid is apparently smarter than 95% of us which makes us all feel like we are downright crap stupid. And then it could be something else if this kid is merely some young brainiac …

JH, I just noticed you changed your stance a little. Are you looking to buy an April bottom? Would that be after a waterfall decline, or are you looking at buying before a second chance rally?

As mentioned yesterday this is a week for locking

in gains when available imv.

WTI closed at a 6 year low yesterday and crude continues to

sell off today.

It does appear that global deflationary forces are growing.

The Eurozone macro outlook has not been transformed

by ECB QE, a weaker Euro will help what still appears to be

near recession conditions.

This does not mean equities need to sell off hard just now

and the FOMC may provide a platform for further immediate upside.

However fundamentals will ultimately come back in to focus

and the renewed sell off in crude may be an early indicator

of this.

If US macro data begins to trend back upwards

it would significantly weaken a more more cautious stance.

With the current $ strength that looks unlikely to me.

A minor geomagnetic storm this morning is stepping up to moderate: http://www.tesis.lebedev.ru/en/magnetic_storms.html

Will be interesting to see if this causes any nervousness today and over the next three days or so… and in which markets…

Can it ever go above 9?

I don’t know how high it can go, but I think there’s no theoretical limit. The strength of a geomagnetic storm is directly proportional to the speed of the CME, and this one looks like it left the sun in the early hours of 15 March. The Carrington Event CME in 1859 took only 17.5 hours to reach us, so it was around 3-4 times as powerful as what we are seeing today.

https://bookofresearch.wordpress.com/2014/12/15/the-largest-magnetic-storm-on-record-the-carrington-event-of-august-27-to-september-7-1859/

Just trying to put today’s Kp8/G4 “severe” storm into perspective, I see that Wikipedia quotes a Dst estimate for the Carrington Event (the most severe recorded storm) at -1750 nano Tesla. Dst (disturbance – storm time) is a purer measurement of geomagnetic disturbance than the Kp/G/Ap indices, because the latter are heavily influenced by latitude which has to be averaged out.

Today’s storm currently reads -170nT. The more negative the Dst, the larger the geomagnetic disturbance. That’s barely one-tenth of the largest recorded. Dst below -300nT is rare. Dst below -450nT is extremely rare. Between 1957 and 2008 there were only 40 storms stronger than -250nT (“superstorms”). Of these, 95% occured in the solar max year or the three following years, so we will witness more large storms over the next 3/4 years.

As for the time of year: 75% of superstorms occured in Mar/Apr/Sept/Oct/Nov. Interestingly, 10% occured in July (outside the usual geomagnetism season) but none in June or August.

Interesting Mark. Is the scale a log scale like earthquakes?

Why is there a seasonal distribution? The sun should be shooting CME without concern of the seasons on earth or any other planet.

Dst is a physical measurement with no log scale, wheras Kp is quasi-logarithmic. You can check the current Dst here: http://wdc.kugi.kyoto-u.ac.jp/dst_realtime/201503/index.html

By the way, it is now -224nT and threatening to become a biggie…

Geomagnetic seasonal distribution – I’ve seen several reasons put forward for this, but none are totally convincing. Obviously the geomagnetic disturbance peaks coincide with the equinoxes, so it seems that the southerly component of the Interplanetary Magnetic Field (Bz component) finds it easier to direct the solar wind onto earth while our magnetic axis is neither inclined towards nor away from the sun.

Some studies have found that simultaneous high speed solar wind and strong Bz are both required to induce strong geomagnetic disturbances (ie. when they act together their effects are multiplied).

NASA on geomagnetic seasonality: http://www.nasa.gov/mission_pages/themis/auroras/aurora_live.html#.VQiwteGbSM8

Thanks again.

RE Nicolas, his comments are way too obvious, ie “new era”, forget fundamentals”. He is trying to press buttons and seems to be achieving his aim.

His posts are humorous 🙂

Weakness at open. Reduced longs to 100 percent from 200 percent. DAX off 1.5 percent today. Still expect 2 percent more upside from US SM by Friday.

Good job. It is hard to sit tight during a period of indecision with such a concentration.

The defensive staples have made a nice move yourself. In fact, WMT has been quietly outperforming the SPX since August last year. A 2011 style correction could be coming.

It is statistical based trade. All of the indicators that I watch: moon phase, declination, distance, seasonals are + this week or very +. This happens only once every couple of months. That is why I am long til friday. Next week I will be entirely bearish cause all of the indicators move into – all week.

Statistical in the sense that each indicator has 60% or more correlation to price move and when combined much higher than 60%.

If FOMC is supportive that is likely imv.

It will be interesting to watch guidance now as

DXY is not fully factored in to guidance at this

level.

You were 200% long! – oh my, it

makes my trading look exceptionally tame.

I sure wish there was a way to parse messages by poster so that if I just wanted to read one poster’s comments at a time, I could do so. Slogging through everyone’s messages (as incisive and clever as they may be :), is a real chore. John, if there’s a way to do this, it would be very welcomed.

Hit enter to scroll to next occurence.

ctrl f will find it Ctrl f… Gary.

Thanks but I would like to see posts from prior periods as well. That’s the issue.

I took profit on my 200% long too as the bulls are lacking conviction. If $NYHL goes negative again, that the signal I need to sell short.

decent drop in Dax today so worth being cautious for the rest of the week. If it recovers this drop in the next couple days it’s a bullish sign otherwise short term there may be a bit more to fall. Medium term still looking quite bullish. Opportunity to add long for those who missed the initial rise.

Everyone has been 200% long? Is this just coincidence?

I am still 35% long, but stops set.

J

The only thing i’m ever 200% at is being confused

I was just over 40% long yesterday and that gave me

a headache, would not sleep at night running those

type of %’s.

I am 100% right now, in SPXL (3x SPY) with 1/3 of portfolio. Fed meeting pause, expect up move after statement released. If market sells off after statement is released I will exit.

All this talk about X% long has my 2 brain cells a bit curdled. Please can anyone/everyone explain what they mean by X% long and ideally quote the instrument that they trade.

My reason for asking is I want to know whether your positions, once taken, define the MAXIMUM loss (assuming you allow them to go to zero) or they fluctuate with price.

I trade ‘spread bets’ which are not dissimilar to CFDs i.e. every price movement means that your loss/profits increase. That I know is a very hard game to play and that is why I would like to know if that is the kind of play that you guys have.

The leverage can produce AMAZING LOSSES…..or gains!! LOL.

When did you get your second brain cell? If your cells double every month, within 64 months you will be the most intelligent person in the universe.

From my own experience purvez, I would suggest ditching spread betting, as the leverage can be a killer.

Play it safe using ETFs with a broker (in an ISA maybe), they cover every asset class these days, and you can keep things under control much easier.

http://www.zerohedge.com/news/2015-03-17/options-market-signals-2007-crash-risk-goldman-warns

John, these options markets metrics available from the Fed to overlay on top of other fundamental data.

“Long-dated crash put protection costs on the SPX have more than doubled over the past 9 months.”

How far back does 9 months go? July 2014? Haha.

For my account being 200% long is taking the total value of portfolio and investing all of it in a 2x leverage SPY instrument or today it is taking 2/3 of portfolio and investing in a 3x leverage (SPXL). 2/3 times 300% = 200%.

To get 100% long, I typically invest in SPXL with 1/3 of portfolio. 1/3 times 300% = 100%.

Valley I very much appreciate your position explanation. Thank you.

Any thoughts on oil? It looks like the bottom is forming, or at least temporarily in. Gold is totally unsettled before the FOMC.

I am banking profits on BIB and IBB, I might be early as always, but decided to sit on cash before the dangerous FOMC. Things could go either way from here.

Erick – I’m starting to see signs of the capitulation move I referred to last week. Numerous downgrades on oil and oil service companies, larger daily moves down, etc.

I’ll probably wade into my first positions on Friday, after the USD drops oil a little further.

Thanks geno.

My observations today from the EW perspective:

I think the drop in oil today signified a move down to a lower low in oil. So wave 4 is pretty much over, and wave 5 has begun. I am anticipating a bounce from here.

Gold is also ready for a bounce imminently, probably when the USD moves down to its cycle low.

QQQ, SPX is still quite bullish, but it all depends on the FOMC and if the Fed allows the SM move down to its natural daily cycle, or if they want to bring the Nasdaq up to the 5100 level before allowing it to retrace.

But gold has been within a $20 dollar range for a week now?

That’s about as settled as it ever gets.

Weird how we see the same thing so differently.

GM – If your post about Gold was in reply to my post about oil, there are periods when oil and gold are positively correlated and periods when they are negatively correlated. Just because pairs trade correlated doesn’t make it necessarily true 100% of the time.

http://stockcharts.com/h-sc/ui?s=$WTIC&p=D&b=5&g=0&id=p76194365859

Please elaborate more on your post, I’m interested in what you’re seeing so differently.

Thanks.

Ah no, sorry gen, I was replying to erick, who thought gold was ‘unsettled’, whereas I thought it had been very settled.

I personally think oil is due to reconnect to gold in due course, but not a firm conviction.

Hi GM: What I meant by “unsettled” is that there is no clear direction whether gold/miners would go up or down from here. Today short squeeze was epic, but FOMC day could potentially be a fake out day. Both oil and gold need a follow through tomorrow to confirm a reversal. I myself started accumulated miners and oil yesterday.

I am confident in my counts in oil, gold, and USD which I posted yesterday. At this point, I am still unsure about Nasdaq and whether it would hit 5132 first before the real 5%-7% correction, or the SM would completely reverse and head south from here. Judging from the VIX angle, my bet is slightly leaning towards Nasdaq racing towards 5100.

My post yesterday 03/17/15: I think the drop in oil today signified a move down to a lower low in oil. So wave 4 is pretty much over, and wave 5 has begun. I am anticipating a bounce from here.

Gold is also ready for a bounce imminently, probably when the USD moves down to its cycle low.

QQQ, SPX is still quite bullish, but it all depends on the FOMC and if the Fed allows the SM move down to its natural daily cycle, or if they want to bring the Nasdaq up to the 5100 level before allowing it to retrace.

Hi all ! So, IBB is green and making new highs, as expected. Biotechs are the leaders and are starting the next leg of the bull market.

And yes we are in a new era where central banks are driving the markets. It’s not my fault. I’m just trying to analyse rationally the reality and act accordingly.

I’d take some profit on that soon.

I was kinda bored today so I decided to invent a new cycle:

100 year cycle – 10 x 10 year solar cycle

1720s – John Law, a Brit expat in France, invented the fiat paper currency system to sell shares in the Mississippi Company creating the South Seas bubble where share value soon exceeded 80 times all gold and silver in France

1820s – the Panic of 1819 was the first major peacetime financial crisis in the United States followed by a general collapse of the American economy persisting through 1821. The primary cause was a land boom/bust following excess demand from Europe for agricultural goods.

1920s – excess speculation in the stock market due to surplus stimulus from supply-side tax cuts after the 1921 depression and financial stimulus from the newly created Fed lead to market crash in 1929 and depression of 1930s

2020s – ???, s&p 500 target 666 x 6 = 3996

I like the cycle.

The 1920s was kicked off by the Genoa monetary conference though.

Kipper und Wipper financial mania 1618-1623, debasement of currency thru out europe which was the precursor to the Tulip Mania of 1637.

Sometimes, it’s really great to be wrong. I had thought we might have one more wave up in this ending diagonal, but it appears not.

I updated my Elliottwave count showing the three waves up as at tonight. If nothing major changes, we should head down tomorrow.

http://www.worldcyclesinstitute.com/spendingdiagonal/

If so, it appears to me that the top is in. We wait to see …

Peter, I want you to be right, but your ed count seems different than the book example in that the live chart has 2 touches of the upper trend line in a row in late 2014 instead of alternating high to low, suggesting 1 more leg up.

That’s what I originally thought, too. So far this morning, we have one motive wave down in SP futures, so I have to go with the count I see … and the way the market it acting (to a lesser extent).

Let me also add that we’re in the final stages of software that has mirrored movements of the planets and gives us the turns. It told us the turn was last night and it shows the waves and turns going forward. If it keeps up over the next few weeks to this degree of accuracy, I’ll talk more about it.

The ES (eminis) has actually come down but not far enough for a 5 and the NQ … not sure it’s five waves, either, so in fact, we could head up. You certainly could be right, stormchaser … I’m now on the fence.

I did not want to be right, here. Dang.

So FOMC day has arrived.

Will “patient” be replaced with a similar phase

that signifies.. patience )

Be careful out there today folks.

Once today’s fun and games are out of

the way I would look for renewed focus

on DXY in the context of earnings guidance.

Given the significant $ strength over the last couple

of weeks, I do not see this being fully factored

in to current guidance – unless the $ index begins

to weaken from here.

Now THAT is a surge (geomagnetic disturbance as measured by Potsdam Ap): http://www.solen.info/solar/

Almost a “superstorm”. A sign that the sun is in (or entering) the year of solar max.

No apparent effect on the markets yet. There were comparable storms around September 1998, October 1999 and then April, May, July, August and October 2000 – so on that basis, stock markets could keep going higher for another 18-24 months before the risk aversion it induces really takes effect.

I looked at the chart Mark. I could see one line spike up, but the others all see to be in a declining trend?

Is the one-off spike that significant?

It is very significant GM. The central thesis behind solar-induced speculation is that increasing sunspot numbers (ie during the rise into the solar max) cause increased risk-taking, aggression, excitement, speculation etc. Then, during the sunspot decline after solar max, increasing geomagnetic disturbance takes over – causing the opposite (risk aversion etc).

And very recently we’ve seen sunspot numbers struggling (although I think they’ll keep tentatively recovering for longer than expected), and geomagnetism now starting to significantly increase.

The practical problem so far has been in determining just when the solar max was. During all of our lifetimes we have only experienced strong and short solar maximums. This time its different – a weak and long maximum. The level of sunspot numbers doesn’t affect the level of speculation directly – its the length of the max that seems to increase speculation exponentially.

So we have decreasing sunspots (but not suddenly disappearing); we have increasing geomagnetism (but it could take two years to take its toll, like 1998-2000); we have the moon repeatedly modulating all of this to the extreme (as witnessed by the tetrad etc) – all for many months to come. Yet just about everyone has abandoned all this, because the SSN (smoothed sunspot number) timing model didn’t work for SC24, just when it is starting to get interesting…

Fascinating, thanks Mark.

It’ll be interesting to see if so many items come together, monetary and solar.

I can definitely envisage a US stock market bubble into 2016/17, even as the economy goes to ruin, due to money flowing their way (and tying in with the length of the maximum maybe).

I wonder when the bottom of this solar cycle is due?Around 2019/20 maybe?

All very helpful for medium-term planning!

Is there a place where we can view the daily Ap indices from 2000?

http://www.solen.info/solar/history/

Thanks. On the other hand, from ftp://ftp.ngdc.noaa.gov/STP/GEOMAGNETIC_DATA/INDICES/KP_AP

It shows that the 1st big geostorm in 1937 was the market peak.

For 2000, it was the 6th big storm or so.

The first of 1937 John, or the first of SC17 maximum?

I admit I don’t quite know what I am doing. But this is what I did.

From ftp://ftp.ngdc.noaa.gov/STP/GEOMAGNETIC_DATA/INDICES/KP_AP, I clicked on each year.

For example,

ftp://ftp.ngdc.noaa.gov/STP/GEOMAGNETIC_DATA/INDICES/KP_AP/1937

I note that the format of the file is based on “fixed width” in Excel. Therefore, you cannot separate by a delimiter such as ” “. The column I am interested in is the 2nd or 3rd one from the last. For example,

For the first line,

37 1 11420 110 3 3 3 7 3 3 0 33 4 2 2 2 3 2 2 0 20.00144 0.03

The columns I am most interested in are the first 4 characters:

“37 1” which tells me Jan 1937.

And close to the end “20.00”, which I believe is some measure of Ap.

I then plotted a graph. From 1932, all the numbers were smaller than say 850. I noticed that the first time we got a big storm was

37 4281424107080807367675053540132207207154111111 48 561281.98149 0.03

which would be the end of April 1937. The Dow peaked in March 1937, which means the peak was before the first big storm.

This is unusual. (Zero storms before market peak) If you look at other years, we frequently have storms from before the market peak.

For example, [589]/1998, 2/1999 and 10/1999 are storm months. (5 storms before 3/2000 peak)

As are 5/1985, 2/1986, 5/1988, 3/1989, 10/1989 and 11/1989 (6 storms BEFORE the 1/1990 Nikkei peak).

After observing all morning, I don’t really have a conclusion, except this SC24, the storms are either milder on average OR that the major ones have yet to occur.

[IMG]http://i58.tinypic.com/zkoco1.jpg[/IMG]

First Peak Value of 1281.98 is on 1937-04-28.

Sorry…try this?

My message on how I plotted this is “awaiting moderation”.

Doing the same for 1964-1974…

We had couple of notable storms in 1966, 1967, 1968 before the 1969 SOY Market Peak.

If 3/2012 was a significant storm, then we had a long lull…3/2015 will likely be the second significant storm in this cycle. (Or perhaps our expectation of what is significant in units needs to be changed for SC24.)

Excellent John. Your first wo graphs show the classic scenario of first geomagnetism peak basically coinciding with solar peak, but then continuing into another (often bigger) peak a few years later.

Your third graph illustrates just how different SC24 is to what we had been used to. That March 2012 storm is close to the initial large sunspot peak of late 2011 (commodities benefitted up to then). So that classic timing scenario does not seem to hold for this weak cycle – do you have a graph for the late 1920s? That might help us to determine a likely path for solar/ geomagnetic timing over the next few years…

Unforrtunately, my source ftp://ftp.ngdc.noaa.gov/STP/GEOMAGNETIC_DATA/INDICES/KP_AP

Starts from 1932.

The message on how I did the graphs is still awaiting moderation, so I won’t spam again until JH approves.

But there is another source called AA* which goes from 1868.

1873 Crash using AA*

1929 crash using AA*

10/1926 — Florida Real Estate Bubble? (2nd highest)

7/1928 — highest peak

3/1929 was the higest in 1929, but quite disappointing.

Feel free to ask for other dates, but after reviewing, I am unable to find a pattern incremental to just using solar maximum.

For me personally, I felt nothing during this storm. The X-flare on 3/11/15 hit me on 3/13/15. Perhaps it is not geomagnetism. Or perhaps it is a Poisson process that cannot be easily predicted.

John – thanks for your graphs. There is something which immediately strikes me in them; something which I hadn’t noticed before. In the strong solar cycles, the general rule about first geomagnetic peak coinciding with sunspot peak (with second geo peak following a few years later) is obvious. But now I notice that in the weaker cycles, the two geomagnetic peaks are moved forward so that the first occurs well before sunspot peak – typically around two years before. Then geomagnetism persists, but without increasing, until around the sunspot peak. Sure enough, this has happened in SC24 (April 2012).

There will be exceptions of course, like the two storms during April 1869 which are a bit early for a strongish cycle, but exceptions are to be expected in any natural process. Looking at the late 1920s, there was a geomagnetic surge during 1926 – ie two years before the SSN peak. Then the main geomagnetic surge coincided with SSN peak. After that, geomagnetic disturbance remained but at lower levels – quite unlike strong solar cycles where there is the subsequent (and often higher) geomagnetic peak.

This raises the possibility that geomagnetic disturbance precedes sunspot activity in weak solar cycles, rather than the other way around in strong cycles. This would help to explain why speculation typically continued (albeit in a volatile way) after most previous weak solar cycles (SC16/ 1929 being the exception). My comments above about 95% of superstorms occuring within three years of solar max are based on studies looking only at the relatively strong recent cycles. http://ilwsonline.org/presentations/08-10/eecher.pdf We ought to check for evidence that weak cycles might be different.

So I would like to see one of your graphs covering SC13 (1890 to 1900) – it would help to show whether this relationship is a tendancy or a coincidence. Perhaps the big storm we’ve just seen is just an isolated event, and not a sign of things to come.

Mark, From Oct of 1999 through Oct 2000, even May of 2001 was a major topping process – sideways with a downward bias.

Good point Kent. Timing is one thing, but looking at the right market at the right time is quite another. As you mention, many major markets went sideways during late 1999 into 2000, but the Nasdaq nearly doubled. But then again, for 1999 as a whole “On the Nasdaq, 50% of stocks retreated an average of 32%”: http://money.cnn.com/1999/12/31/markets/markets_newyork/

How pathetic have global markets become when participants are fixated on the inclusion or exclusion of a single word?…… Unfortunately PATHETIC is the best way it can be described.

The sooner this whole charade they call global financial markets falls apart and we begin again the better.

At the moment it’s like watching a train wreck in slow motion.

Agreed we need a huge reset and then non QE fuelled growth to make it sustainable. But the central banks will do everything in their power to prevent this reset hence short term I’m still bullish. Gone long on dax at 11860 today expecting fresh highs on dax soon.

More comments from Dr. Steenbarger:

http://traderfeed.blogspot.com/2015/03/tracking-breadth-of-market-strength-and.html

Patience! my earlier post should have read (not patient)

posting before a morning coffee not a good idea

in my case.

Re the DAX, now it has broken through minor support at 11850 odd I will probably look to buy around the 11755-760 mark – if seen.

J

I doubt many trade the Chinese market, but I just noticed the SHCOMP is up 10% in a few weeks, and (perhaps) more importantly has broken above the high point from mid-2009.

Also, it’s up by 74% since June 2014. Just a bubble, or are the markets sniffing an impending Chinese devaluation?

Crazy times, in this new world.

The Chinese are dumping ton of yuans into a weak economy which is very bullish, esp with RE dying.

@stormchaser80

Another look the SP500 sequence this morning: Drilling down, the sequence is in an overlapping 3, so the trend is down by EW standards. We may play around in here a bit this morning, but by the end of the Fed, I would expect us to head down.

Unless the waves are in 5, it’s not a final 5th wave and can’t reach the top.

I learned what I do by collecting and studying thousands examples.so I show examples of a few things happening over and over thinking even one trader might copy and save and study.

On Monday’s close, the QQQ set up the traders dream..

In stead of selliing sharply to the downside with the other indexes

the QQQ completed an abcd retrace by 1130am yesterday pointing to a new high in the QQQ.. That is what happened.. As stated before the number one way a trade signal fails is if an abcd sets up against it.

At the high at the 335pm bar yesterday, the QQQ completed the red line green set sell signal, simultaneous with the 886 algo triggering long in UVXY..

I n addition Joed’s previously referenced volatility chart based on his work on time

was posted yesterday showing the time window for a turn up in volatilty is present.

Per Joed’s previously referenced thoughts about the tools working better and better on small time frames… the tools have had an extraordinary run these past

weeks…I suspect a bigger move is coming… will just have to see.

CLOSEUP of UVXY

with thoughts

http://stockcharts.com/h-sc/ui?s=UVXY&p=5&yr=0&mn=0&dy=2&id=p64878343521&a=399041327&r=1426684277821&cmd=print

Thanks very much, slater9.

Thank you, Slater9.

FWIW here’s my ED count, but I don’t have too much faith in the pattern.

Swing Trend Indicator still on Full Sell since 3/6

Buying 25% of intended position in OIL here @ 9.25

Chinese Depression of 2016. Fred Foldvary wrote a monograph in 1997 called the Depression of 2008. You can read the article, but basically per the 18 year cycle in real estate, an economic depression hits 2 years after the peak in real estate prices. He wrote a 2007 update noting RE had peak in the spring of 2006. Well, real estate prices peaked in Aug 2014 in China. In the US, stocks kept going up for almost 2 years. However, the the Depression of 2008 hit right on schedule. US real estate prices fell for six years. 2016, Chinese date with destiny The news about China, indicating they are slowly letting the air out of the bubble, reminds me of Bernanke and subprime contained and housing prices will not fall – I think they had already been falling when he said that.

Another Chinese developer in trouble. Nothing like throwing good money at a bad investment.

http://www.nytimes.com/2015/03/18/business/international/china-developer-gets-lifeline-amid-slump.html?ref=dealbook&_r=0

They don’t have a choice. It is all about filling up the rice bowl and keep the citizens happy. Unemployment would bring on instability most feared.

China may go down but it will bring the short sellers with it.

And the Chinese will kill their currency too, whilst dumping USTs to do it, no free money!

So much in play in the next few years.

Ref trying to catch the oil falling knife. The large speculators are caught extremely long. They have liquidated half but they are still 2.5 times normal peak. They are usually right during trends, but when the trend turns on them, watch out!

Kent – My timing model has Friday as a buy point, so I’m going to trust it. I wrote last week to wait for the capitulation move, which I believe is playing out now. Last weeks build was 9.6 Million barrels. Price, downgrades, builds….all capitulation moves playing out. Now I expect them to pay out.

Good eyes. I bought CVX last Friday sub-$101 may also marked a bottom. I hope.

I also bought BBG, think i has better return potential than CXV, XOM, COP, etc.

In BBG @ 8.47 for full disclosure.

This would be an interest scenario…”For Lindsay fans, a new high in the US indices would look like pt 23 in a 3PDM. Target April. Explained here:

http://carlfutia.blogspot.com/2015/02/lindsay-update.html …

–Urban Carmel

I just covered my little short ahead of Mrs. Yellen’s statement. I have been riding the waves and correct every time lately so I fear my luck may run out.

Lets wait for the reaction accordingly. I am flexible as the trading range continues.

Newt GREAT CALL on covering. Should have sent out one of your disposable scouts for a long too. Lol.

Geno0010, I love your insights and your contribution to this website. I see that your timing model has Friday as a buy point for oil. I was wondering if you have a timing model for SPX? I know you are bearish, do you still have any shorts left for SPX? Thx

Zenyatta – Buy stops are still set at 2083.49. If we continue down, the timing cycle on SPX is for mid-April low.

I probably should take some profit in the next 8 mins……..but it’s against the system. Should I……

“Patience” geno

Mark, I admit I don’t quite know what I am doing. But this is what I did.

From ftp://ftp.ngdc.noaa.gov/STP/GEOMAGNETIC_DATA/INDICES/KP_AP, I clicked on each year.

For example,

ftp://ftp.ngdc.noaa.gov/STP/GEOMAGNETIC_DATA/INDICES/KP_AP/1937

I note that the format of the file is based on “fixed width” in Excel. Therefore, you cannot separate by a delimiter such as ” “. The column I am interested in is the 2nd or 3rd one from the last. For example,

For the first line,

37 1 11420 110 3 3 3 7 3 3 0 33 4 2 2 2 3 2 2 0 20.00144 0.03

The columns I am most interested in are the first 4 characters:

“37 1″ which tells me Jan 1937.

And close to the end “20.00”, which I believe is some measure of Ap.

I then plotted a graph. From 1932, all the numbers were smaller than say 850. I noticed that the first time we got a big storm was

37 4281424107080807367675053540132207207154111111 48 561281.98149 0.03

which would be the end of April 1937. The Dow peaked in March 1937, which means the peak was before the first big storm.

This is unusual. (Zero storms before market peak) If you look at other years, we frequently have storms from before the market peak.

For example, [589]/1998, 2/1999 and 10/1999 are storm months. (5 storms before 3/2000 peak)

As are 5/1985, 2/1986, 5/1988, 3/1989, 10/1989 and 11/1989 (6 storms BEFORE the 1/1990 Nikkei peak).

After observing all morning, I don’t really have a conclusion, except this SC24, the storms are either milder on average OR that the major ones have yet to occur.

John, I’ve just been looking through your explanation and the new chart above of annual days with aa above 60. There is a lot of valuable information in these, because up until now the only geomagnetic-financial studies I’ve seen cover very recent geomagnetic data (ie. Ap and Kp) – so they therefore only cover the more recent, relatively strong solar cycles which show the first geomagnetic peak coinciding with SSN peak and a second geomagnetic peak a few years after that.

But your charts reveal a definate tendancy in the earlier weaker cycles for the first geomagnetic peak to occur around two years before SSN peak, and the second to roughly coincide with SSN peak. This, I would submit, is not because geomagnetic disturbances are pushed forward by a couple of years, but rather because sunspot peaks are pushed back in time during weak solar cycles. This means that after solar sunspot max in a weak cycle, there is no subsequent significant peak in geomagnetic disturbances (see the SC12 and 13 maximums of 1884 and 1894 in that annual days with aa above 60 chart above).