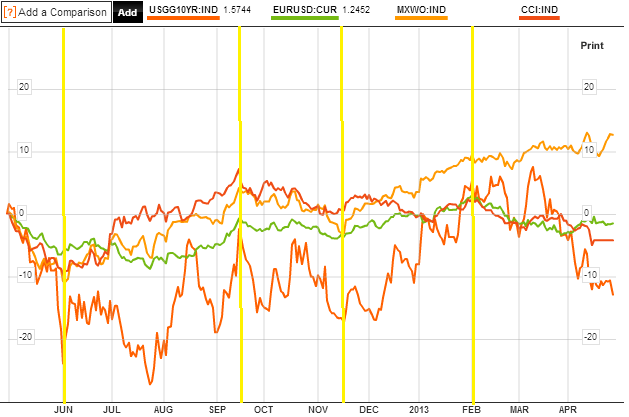

The lunar positive period begins here for the next two weeks. Is there a buying opportunity in pro-risk? The geomagnetic trend is still up. Sentiment is at pessimistic levels in a variety of commodities which would be fuel for a mean reversion rally. Sentiment remains a little frothy in equities. Economic surprises for the G10 are in a downtrend and negative. US earnings and revenue beat rates are so far unimpressive. PMIs and leading indicators for key nations have overall weakened a little in the latest readings. Here is the combined picture for pro-risk:

It still looks like a correction has been in place since the turn of February, but global equities as a whole have managed to carve out a sideways range rather than down. By 5-models-in-alignment the next move would be up from here into mid-year to make a cyclical top. PFS forecast that recent soft commodity prices will provide economic improvement ahead again, as cheaper input costs make for growth. If solar/secular history is to reoccur here, then commodities and treasury yields should start to make their move. I would like to see some evidence of change in trend in economic surprises and a renewed pick up in leading indicators to bolster this likelihood.

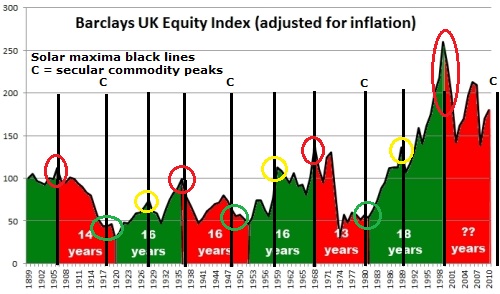

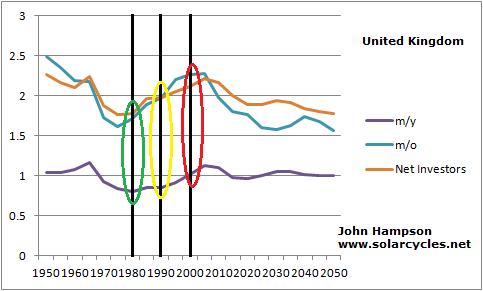

Back to demographics. Here is a reminder of real UK equities:

The biggest real gains came in the two solar cycles from 1980 to 2000. I have used the population pyramids to draw out the three demographic trends that have been shown to have a correlation with stock market performance, namely the middle/young ratio (m/r), middle/old ratio (m/o) and the proportion of net investors. We can see that the period of bumper gains in UK stocks was one in which all three measures were trending upwards – a kind of demographics ‘holy trinity’:

The biggest real gains came in the two solar cycles from 1980 to 2000. I have used the population pyramids to draw out the three demographic trends that have been shown to have a correlation with stock market performance, namely the middle/young ratio (m/r), middle/old ratio (m/o) and the proportion of net investors. We can see that the period of bumper gains in UK stocks was one in which all three measures were trending upwards – a kind of demographics ‘holy trinity’:

Looking forward there is no such golden period ahead for the UK. The caveats, as some of you pointed out, are that immigration policies can change (changing the demographic projection) and investor behaviour may change (disturbing the correlation with the local stock market). But barring any major changes, the UK stock market may struggle going forward.

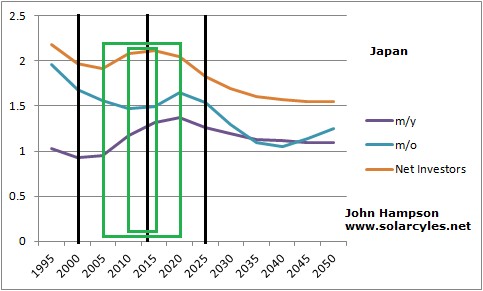

So here are three countries that do have such a demographic positive unity ahead, i.e. all three measures trending up for a period.

The first is Japan. The black lines are the solar maxima. The outer green box is the overall positive period, and the inner green box when all three are trending upwards together. The window of opportunity is now.

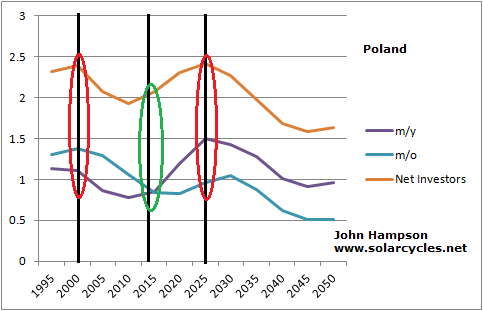

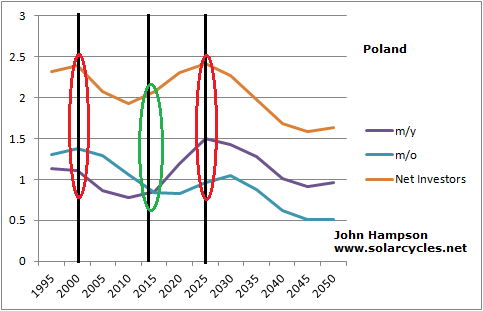

The second is Poland. This next solar cycle, from circa 2013 to circa 2025, is one where all three measures are rising. That makes Poland a likely secular bull market in that period.

The second is Poland. This next solar cycle, from circa 2013 to circa 2025, is one where all three measures are rising. That makes Poland a likely secular bull market in that period.

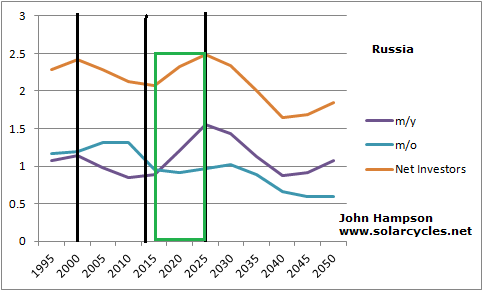

And the last for today is Russia. The positive alignment runs from around 2015 to 2025 for a decade.

And the last for today is Russia. The positive alignment runs from around 2015 to 2025 for a decade.

Russian stocks are still very cheap, at p/e 5.6 and paying a 4% dividend. If commodities can accelerate once more, as per my prediction, then I believe Russian stocks can mean revert to some degree. The positive demographics just ahead also suggest that if the trade does not come good quickly that it should with time.

Russian stocks are still very cheap, at p/e 5.6 and paying a 4% dividend. If commodities can accelerate once more, as per my prediction, then I believe Russian stocks can mean revert to some degree. The positive demographics just ahead also suggest that if the trade does not come good quickly that it should with time.

So my trade for today has been to add to (and average down a little) JPM Russia. The lunar positive period, the expectation that commodities will outperform, plus the picture just outlined.

Great use of data here. Using this very well-done demographic idea, Spain seems to be consigned to at least a decade or two of painfully slow economic development. Due to a sharp fall in births from the 1980s onwards, combined with high net migration in the 2000s, the baby boomer cohort in Spain is twice as large as the baby bust cohort. Spain’s population shrank in 2012, and the mini-baby boom Spain has enjoyed since the mid Nineties has fizzled out in recent years.

The latest GDP growth forecasts point to an enormous output gap over the next few years, which brings me onto the subject of deflation. Spain risks falling into a deflationary spiral from here. With falling house prices, falling domestic demand due to an ageing population and an ever-widening output gap, what would the best scenario look like for Spain in the next 20-30yrs?

I need to model Spain. There may be a glimmer of hope in the demographics from what I have seen,

Hi Pete. The best scenario for Spain is deflation. If property prices and cost of living go down, then more retirees from colder Northern Europe will come to spend some (or all) of their time in Spain, and this can make up for the lost population due to young people immigrating. Foreign retirees offer the best of both worlds: they don’t take anybody’s job, and their pensions do not need to be coughed up by the Spanish government. Countries like Greece and Spain made a big mistake by joining the euro, as it priced them out of the market vs other tourist destination like Turkey.

When I visited Greece in the 80s, a beer cost 0.5 euro. Now it is more like 4 euro in many places. People used to go for two months, now they can only afford a visit of one or two weeks. No wonder there are fewer jobs.

Many governments are fighting deflation, but it would be much better to let the deflation happen. The computer industry has been living with deflation for decades. Every time I buy a new laptop it is cheaper. But that hasn’t stopped the computer industry from being very profitable. Which proves that deflation is not a disaster. In fact, falling prices makes stuff cheaper and people happy. What’s not to like?

Heard that they are going to tax foreigners in Spain i.e. a wealth tax. Swedes really angry about that. Otherwise if climate stuff turns out true. People here in Sweden will leave. I would not be so negative towards Spain and Greece. When things look the darkest… ;). Heard Prem Watsa is looking at taking a stake in National Bank of Greece.

As for Poland, I often go there. Every time there is some progress. A new building/shopping mall etc as compared to the bad days, so maybe there will be progress. People are not as much in debt, (I have heard and seen stats) as they got their homes after communism or bought them cheap. Some people and young people have taken on debt for homes and consumption. Often in Swiss franc. If you look at the Mc Donald’s index the currency is cheap. Mall prices are the same as in Sweden. Salaries still low on average. I think real estate is expensive as compared to for example Florida in the US right now.

Some people dread the currency – they remembers the days of Hyperinflation and do not trust it (maybe the government has debt – do not know). I have an older relative that told me – I am buying a flat as I can exchange it for USD if things get bad. Right or wrong – I really do not know myself. Any ideas? Still a lot of catching up to do in terms of efficiency any many things but progress. A lot of people go abroad to work and then save the money and go back to build a home or start a business. I am a long term bull since the 90s.

Would be interesting to hear about negative points/risks?

The strength of all older Eastern Europeans is that when you talk about crisis here in western Europe and in the US – you really do not know what you are talking about. Crisis was bread cues during communism. The financial crisis is nothing compared to that.

In the end if Europe gets really bad – they will introduce Eurobonds and print. When US and EU are all in debt – they will introduce an new common currency between US and EU and in the end the world. 😉 http://www.futureworldcurrency.com/

Also, if you really wanna hedge against collapse stop buying gold. Buy cigarettes, vodka and chocolate. This is hard currency.

The best performing stock long term since the 50s has been: Philip Morris 25% per year.

Something to consider going forward is that some indexes are no longer tied to their domestic economies and demographic trends. The FTSE, for example, doesn’t reflect the UK economy as much as it used to:

“Critics say that the FTSE, launched in January 1984 with a base level of 1000, has lost its connection to its home market. It is now dominated by giant mining companies and others that are based largely overseas, rather than by stalwarts of British industry”

http://www.independent.co.uk/news/business/news/new-ftse-index-would-better-reflect-uk-economy-7720778.html

I don’t think this invalidates the argument, but it may reduce the impact of the trends perhaps.

It crossed my mind too Rob, for the FTSE which has now a fairly international flavour. However, I’m not sure that matters. The demographic idea is fairly simple: an increasing amount of people in the middle aged bracket who are investing for retirement and for their family increases demand for the stocks in the index, versus a shrinking amount of people borrowing or disinvesting instead, So if most regular UK people continue to invest in FTSE-based pensions, or FTSE ISAs or FTSE endowments, it shouldn’t matter whether the constituent stocks are international. What would matter is if people increasingly choose investments overseas instead. So the best countries for demographics to work on would be those where there is a big tradition of investing in the home nation financial markets. Japan springs to mind in that regard..

The FTSE 250 has been identified as a more true reflection of the UK economy. Comprising of Mid cap companies, the FTSE 250 gives greater weighting to domestic companies like restaurant chains and retailers, as opposed to mining and banking stocks. It has started hitting all-time highs since December 2012, and has enjoyed a strong rally since the start of the year.

I’ve started paying more attention to the FTSE 250, given that the bursting of the dot com bubble had less of an effect on the FTSE 250. This reflects the fact that, whilst the US and Europe had a mild recession in the early 2000s, the UK economy managed to maintain economic growth (partially fuelled by debt of course). Although it crashed by 40% between 2000 and 2002, the FTSE 250 was already hitting all-time highs by early 2005.

THANK YOU John!!!!

Thank you for Poland demography.

You can’t imagine how much I needed that one.

I hope emigration of Polish, Spanish, Greek and other young people will not change trends.

Immigration to Great Britain is an underestimated factor in good run of FTSE after 2000 IMO.

If you wonder why 30’/40′ of XX century where Winter time, think about spanish flu which made suffering 1/3 of the world population, especially letal to mid-aged 20-40- golden group of investors. (1918- large gap in population of mid-aged after 20 years gives 1938 😉

Absolutely demographic reasons.

http://en.wikipedia.org/wiki/1918_flu_pandemic

Thanks Pyretta

That’s interesting. This could add another causal loop as it appears from this paper that solar cycles influence pandemics, as they are more likely at a solar maximum – the paper concludes that:

“The results of this study support the suggestion by Kilbourne (1976) that there is a 10-11 year periodicity superimposed upon the occurrence of influenza pandemics. Moreover, we find evidence that there is a tendency for pandemics to peak in occurrence at solar activity maxima. The data set is small, and there is a degree of uncertainty in the dates of the pandemics, but the probability of the criteria for our conclusion arising on a random basis is around 2%, so there is a reasonable chance that the association is real.”

Click to access Tapping,%20Mathias,%20Surkan%20-%20Pandemics%20&%20solar%20activity.pdf

I’ll dig up the info I have on viruses flourishing during cycle lows and minima.

…..interesting as always John. Thank you.

EPOL is better at around 23.

DJIA priced in gold is in long term down trend but correcting up. By historical analogy it has always bottom lower then it started. But we still could be for a wild ride during correction (pricedingold.com/dow-jones-industrials/).

Duration of down trends varies greatly on this chart. In ’30 it was less then 5 years in ’80 ~10 and now it is ~10 and probably still counting.

P.

Thank you all.

I have more demographic modelling to do, but busy this week with the move.

I have updated the usual models (short/medium/long/peakvpeak pages) this morning.

Here is a graph of the wig20 in Warsaw.

http://www.tradingeconomics.com/poland/stock-market

I can not say that I think it looks very tempting – it is doing lower lows. S&P500 looks more tempting as it may actually break out to new highs.

Although it looks a bit like the S&P 500 did in 2008-2009. Just bigger failure of an HS that might break out.

and 2010

Here are some currencies according to the mighty Mc Donald:

http://www.economist.com/content/big-mac-index

Long term there is some mean reversion from studies I have looked at. Very long term. Venezuela devalued its currency a lot recently. Help – I am in Sweden. A “safe haven” ;).

Some (sorry I don’t have numbers now) fraction of young (30-40) people in Poland is servicing underwater mortgages made in swiss-frank. Therefore it may influence their investment behavior.

Because levels of m/y and m/o are changing between what was 1980-2000 and what is coming in the near future – I was wondering if relation between m/y and m/o would influence investing behavior. Having kinds could change the state of mind to favor more long term investments (for generation). Like buying properties maybe. When having no kids the strategy is more about your own well being in old age and possibly you would be more prone to stay in liquid assets (bonds ?, gold ?, cash ?) as you don’t want to take it to the grave.

There is also aspect of inequality as it is measured by gini ratio. If inequality grows it results in older generation having more and young having less or non. This can be seen very well now in south European countries. Spain, Italy, Greece have extreme ratios of youth unemployment at the same time average household wealth is higher than in Germany. This leads to the situation that old people are allocating wealth and young are trapped in some kind of limbo – without income.

Unfortunately presently I do not have numbers to quantify those effects.

best,

Pawel

What scares me about all Eastern European countries but then again with all countries nowadays is how truthful all those numbers i.e. debt, gdp etc are. Therefore do not trade on stories but on price.

http://www.forbes.com/sites/markadomanis/2012/08/01/mitt-romneys-embrace-of-polands-imaginary-austerity/

Hi Robert,

Government debt = deferred taxation (citizens will somehow have to pay for it later)

People often ask me why I chose to move to Bulgaria. Well, Bulgaria is a standout in Europe when it comes to debt to GDP, at only 17%. That means future taxation is likely to remain low compared to others. It also means that Bulgaria is not likely to join any eurobonds ideas, because people would protest to getting a share in the debt that other EU nations have accumulated.

Here you can see the world public debt map (hold mouse over any country):

http://www.indexmundi.com/map/?v=143

High debt to GDP country means that high taxes in the future will be inevitable (or the country will have to default)

Hi Danny,

Sure, but the question is just if the numbers are real. Greece is a good example. So one has to be careful about the funnymentals ;). Not sure about the Eurobond protest. Things change and new arguments arise. There is a good saying that if you owe the bank 1 million – you have a problem – but if you owe the bank billion/trillions then the bank has a problem and suddenly you can climb up on that mountain of debt and enjoy the view. Remember that before 2007 nobody cared about debt – now it is in vogue to care about it again.

Cheers

I couldn’t like Eastern European economies, simply because EU is no good for them. In all those countries production in agriculture and raw materials peaked around 1990 and first thing the West did after it took those countries over is to buy industry and close them factories, so that this part of Europe become a market for German products and others. Poland was in the past top world beet root producer, do the Polish have now to buy German sugar at foreign shops? What is the quality of all those investments… banking, to make a market for debt. Or care homes for old and sick Germans. So we have an active population drain and dependent economy; also stock markets will depend on money flows from the West. Wig20 and BUX still haven’t recovered from ‘accession rally’ 2004-2007 and funds are likely now to move further east i.e. Ukraine, selling Polish land and properties. Spain may be the leading country in Europe in the future if they leave EU, Euro and establish some deep economic ties with South America. But let’s trade the markets as they are:) After 3 good short trades on gold I am off – the volume dynamics suggest that gold may test above 1500. Lets see what happens.

Interesting someone else sees this also for Gold…I said $5K back in 2010 in 2018.

http://www.cnbc.com/id/100701561

John, perhaps inflation or deflation could drive your observations.

If comex wareh. reg. in gold and silver are any indication of supply and demand then we should have a rally in gold but not so much in silver.

http://www.24hgold.com/english/interactive_chart.aspx?title=COMEX%20WAREHOUSES%20REGISTERED%20GOLD&etfcode=COMEX%20WAREHOUSES%20REGISTERED&etfcodecom=GOLD

Last time such levels were in Apr 2011 and Jan 2010. Have a look what happened then.

Just for curiosity one may ask what is happening. Is it supply problems or just temporary spike in demand? We can read about personal demand in asia. We can also read about mines problems in ghana (http://www.bdlive.co.za/africa/africanbusiness/2013/04/04/gold-fields-mines-in-ghana-idled-by-strike) and wage inflation in other mines (http://news.yahoo.com/africa-mine-unions-may-win-big-wage-hikes-083021827.html)

http://www.magnoliareporter.com/news_and_business/regional_news/article_826c709e-b48c-11e2-8626-0019bb2963f4.html