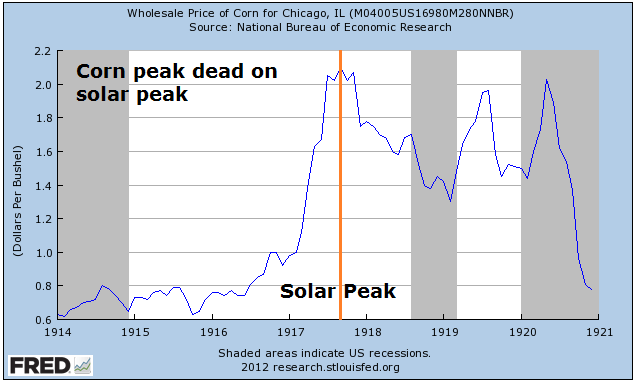

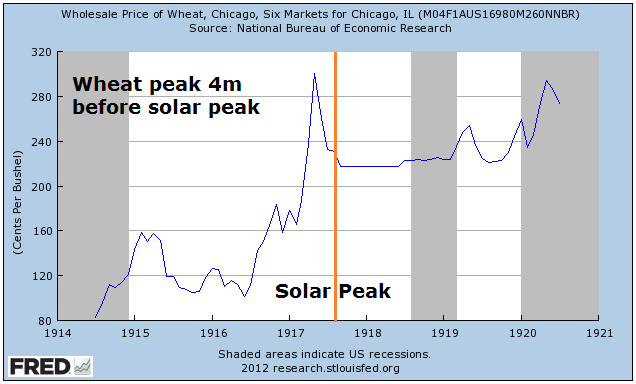

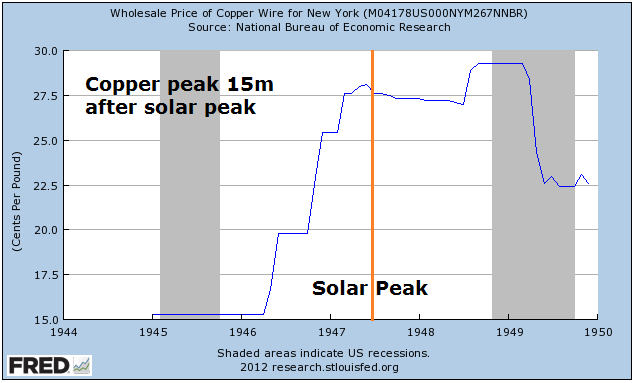

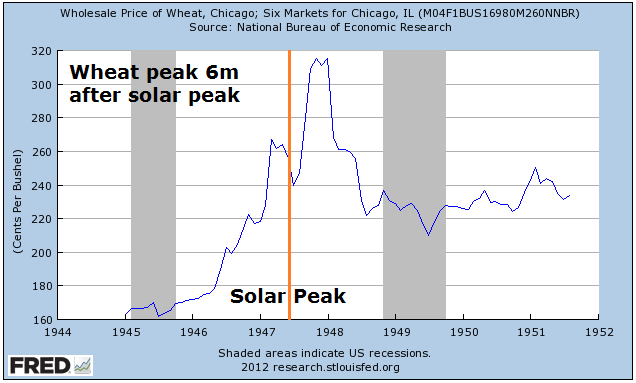

Today’s exercise is to look back in history at the previous secular commodity peaks of 1917, 1947 and 1980, that correlate with the solar peaks of August 1917, May 1947 and December 1979, and see how close to the solar peaks individual commodities peaked. This can then assist in expectations for commodities into and around 2013’s solar peak, which I suggest will again be the scene of a secular commodities peak. The data available is spotty, so I have to make do with a selection of four differing commodities for each of the 3 periods in history, but it is nonetheless a useful guide.

Firstly, 1917. Copper, corn and wheat all peaked between 5 months before and on the actual official solar peak. Whilst silver did not peak until 2 years later, its acceleration began around 12 months before the solar peak.

Source: St Louis Fed

Secondly, 1947. Oats, corn and wheat all peaked around 6 months after the solar peak. Whilst copper did not top out until 15 months after the solar peak, the bulk of its gains occurred in the run up into the solar peak.

Source: St Louis Fed

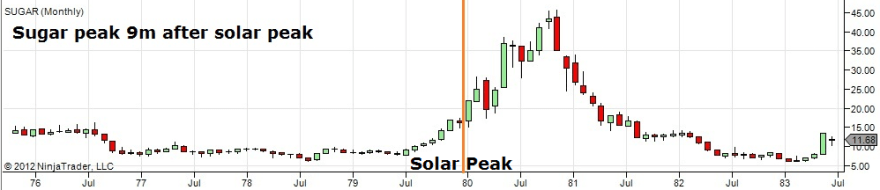

Thirdly, 1980. Copper and gold peaked with the sun, with oil and sugar peaking 4 months and 9 months after the solar peak respectively.

Source: St Louis Fed

On current forecasts, a solar peak should occur sometime between Q2 2013 and Q4 2013, with SIDC projecting nearer the former and NASA and Jan (of Sibet) closer to the latter. Based on the historical examples above, we might therefore look out for commodities making final parabolic tops as of the start of 2013, right through to 2014. The bias from history is more towards commodity price peaks later than the official solar peak, so we might rather look to the second half of 2013 or even early 2014, subject to solar progress. To add to this, another look at the charts above shows that most of the commodities made a big acceleration of around a year’s duration before reaching their tops (or the solar tops). Right now, the CCI commodities index (a broad measure of commodity momentum) is some way beneath its 2011 high and not yet in a major acceleration. By Gann, that acceleration should just have begun, in late November. I believe Gann methodology to some degree reflects solar methodology, in that it draws together mirrors from history to predict the future – only by my reckoning, it is the influence of the sun that makes for these repetitions in time. Nevertheless, it’s a cross reference.

One further conclusion from the above charts is that there was broad commodities participation in each period, so we might also expect the majority of, or even all, commodities to participate in a final ascent (though perhaps with a lag between individual peaks) this time round. If we consider our current period as a K-winter, similar to 1947, where gold is the lead asset, then nevertheless we can see back in 1947 a range of commodities also participated in parabolic ascents into and around the peak. Therefore, exposure to a range of commodities ought to serve well this time around, without the need to specifically cherry pick.

To repeat, 2013 is a major test for my solar theorising. I consider I have a true sample of 3 from history (three secular commodities / solar peak correlations), which by any statistician’s measure is a fairly meagre sample, and a 4th would add substantial weight. However, when we draw in my historical correlations between solar peaks and secular stocks peaks, and solar minimums with crashes, panics and bottoms, the relations through history between secular asset cycles and solar cycles are more compelling and the sample significantly larger. I also look on it another way, in that commodities secular peaks occur only every 30 years or so, and it has been amazing how close to solar maximums these secular commodities peaks have all fallen (including several exact hits shown above), given that huge window in time. The validity of this current cycle is already partially formed in that commodities again broke into a secular bull market in the decade leading up to the solar peak and the secular commodities peak occurred at the earliest 2011 (until that CCI high is taken out), which is again close to the solar maximum, in the context of a 30 year cycle. But I maintain 2011 was not the high, and that the secular peak will be closer to the solar peak, and that the final parabolic ascent is right ahead. If commodities rather continue to rise for some years following the solar peak, rather than topping out with the sun, then that would of course reduce the validity. As fossil fuel exhaustion and natural resource scarcity are real threats, that could be caused by a paradigm shift whereby commodities are permanently repriced higher. However, by my previous analysis, I do not expect that scenario in this secular cycle, but rather in the next secular commodities cycle of mid-century.

I maintain a broad long commodities exposure, with the largest exposure in precious metals, but significant positions in energy and agriculture too.

Great Article. I was just looking at charts early today and most charts seemed to tell me that a major top was due in Q1 2014 and your article confirmed my theory. Thank you so much.

My pleasure.

Great article. Any thoughts about Natural Gas.

Maybe due a breather after a good recovery rally, though it remains historically cheap and does not have excessively bullish sentiment. Here’s an update on the crazy cheapness ratio it reached with crude oil at over 50 at the start of this year – the parabolic collapsed:

Historically, storms have been very good for nat gas so Sandy is good news for this case, although I guess there is a big glut. I have focused on equity positions in this sector for my commodities investments as I like the concept of margin of saftey given that some companies there seem very very cheap regardless of where price goes. It feels like if the final commodities bull will happen you may get a big bang but if it does not for whatever reason then still these equities should reverse at some stage even at these gas prices.

Some ideas from the Bradly model:

Thanks

Shanghai Composite is not buying into recovery story you have posted here many times. That is probably because China is not actually recovering, but slowing even further. Personally, I would like to see a straight line crash down in this market and a final liquidation – before calling a bottom.

Both leading and coincident data show a tick up. Unless/until these tip over again, I don’t see the evidence for what you say. Yes, the Shanghai Composite is yet to bounce, but the associated plays of Copper, Baltic Dry, Kospi and Hang Seng have all risen.

We just need a spark to be thrown on the gasoline either direction is valid. The funnymentals I don’t believe in i.e. recovery or whatever. Price will drive whatever fundamental scenario i.e crash or boom and then crash. “Prediction is impossible.”, Nils Bohr

While $SPX retraced 50% of the down leg from Mid Oct., LQD:TLT couldn’t even retrace 38.2% of the drop…..similar to what its poor showing in April….the rest is history and down we went into June.

I say the Nov low of SPX 1,350 will be tested and broken.

I’ve seen you see renewed evidence further down the page for upside, Edwin, but to your point here about the Nov low to be broken, this is how I see it currently. The rally in stocks has been accompanied by good breadth and continued strong cyclicals performance. Global leading indicators have largely shown renewed improvement. I therefore don’t see a reason to sell out of my equity longs at this point. I commented in the early November falls that if this were a topping process in stocks then we should see a rally back up toward the top with negative divergences in internals and data indicators, but we don’t see that – at least not yet. I therefore think we can make more gains, and this is supported by positive year end / election year end seasonality plus having pulled back only mildly into Nov28’s full moon, with positive pressure now ahead. Both the Dax and FTSE are back challenging their breakout resistances.

Most commodities are very overvalued when adjusted for long term inflation or relative to long term real estate values. Or like cotton and have already topped and are heading down. One very clear exception is grains they are undervalued. How does one determine the tops of previous commodities? It is a few years process,,

Thus I prefer to say 1920, 1950, 1980, and 2010. A 30 year cycle. NASA has missed their predictions on this cycle several times starting with it’s beginning point and remember this really small one was supposed to be a really large one. From just eyeballing it chart wise it could have peaked a while back (or could roar up late). I would like for you to address this.

Overall it seems that the bulls think we are back in 2009, at the beginning of an up cycle even though it has been going on for over 3.5 years.

Hi Kent. I’ve argued before that post solar peak and secular commodities peak we typically see a shadow bounce, as the commodities demand/supply story does not reverse overnight. Circa 1920 and 1950 were such.

I concur the cycle is roughly 30 years, but it is more precisely 3 solar cycles. When it comes down to it, here in 2012, that makes a significant difference, as by your reckoning we already topped, and by mine it is ahead 2013/2014. If you are going to argue for a precise 30 year cycle, with no solar connections, then I would like to hear logical or scientific reasoning for why that exists.

As for the solar peak having already occurred or potentially occurring late, I can only point to the combined forecasts of NASA, SIDC and Norwegian Jan, which all predict 2013. If they change, I will change with them.

Precise! 30, we could only wish. If either of US is correct about the top past already or next year, I think it’s more credence to solar theory

Gann, and NASA, and the fortune teller lady near my office building are all predicting higher prices in gold. I am long PMs and also Agricultrue, but I do not see any lift off happening anywhere.

With Gold up 12 years in the row now, I think risks are to the downaide. Makes me nervous being a bull when something is up 12 years in the row, year after year. Where is the near trap before the final parabolic, just like in 1975?

Volatility is extremely low in almost all asset classes, so my view still remains that we will see deflation and a global crash first, followed by policy makers entering panic mode which pushes them away from common sense where they print above and beyond expectations to reverse a repeat of 2008.

My view remains that the only way Gold goes into a bubble and a mania is not because NASA said what the sun will do, but because fundamentally politicians push global capital into Gold and Silver as they print well beyond what we have seen in QE1/2/3! Not $40 billion per month, but $400 billion per month!!!

That would certainlly make Gold go parabolic. But think about it… what gets us there?

To get there, they will have to be pushed into a corner first and deflation will do that job quite well. I remain long commodities in the long run and would love to see this huge run up in the next few months as I would profit so much, but I personally think bulls will be wrong. The commodity bull market is not over, but it might not enter its climax until there is a catalyst for it to go parabolic…

Just my 2 cents.

You certainly talk like a Hugh Hendry. LoL. Central bankers cross the Rubicon and lead the money world to the promise land.

$VIX alone says we are closer to the top than the bottom. The time to seriously buy the market is when VIX hits the roof (north of 80?). Until then, all trades are for entertainment purposes..

I suggest the 11 month consolidation in gold was the pre-parabolic trap. Recall the extreme lows in sentiment in gold and miners mid-year:

https://solarcycles.net/2012/07/18/gold-2/

We agree Tiho. The bearish way to interpret the current situation is the incredibility deflationary forces of the gargantuan debt are inexorably eating up the liquidity starting another contraction. Think of the monstrous expansion of the Fed’s balance sheet it took to get back to 2007 levels, what next!? I see the bullishness in gold mostly as the 12 year positive reinforcement of the bull market.

Gann, NASA, and the fortune teller lady – very funny. I do find all the esoteric stuff add to where the markets are in the big picture, ie the 3 peaks and a domed worked.

You mentioned your study of commodities show they have 14 to 17 year bull markets. Being a bear on most commodities, I looked it up and saw you are correct. But one thing I did notice is they top after an approximately 10 year straight up blow-off which we have already had.

I agree on the 14-17 year time frame. I don’ understand what you mean by the “blow-off which we’ve already had”. IMHO, Gold has had no blow-off yet…if this is how a gold bull market ends with a run from 1500 to 1900

Nikeboy Commodities rose from 1750 to 1781, but almost the whole move was after 1770.

They rose from 1792 to 1815, over half the move in the last five years

Then 1843 to 1864, again most of the move in the last 3 years.

Then 1897 to 1920 with virtually the whole move from 1915-20.

Then 1933 to 1951 with the major move from 1939 to 1951.

1971 to 1980, just straight up with a pause in th middle.

Now, we had another straight up move from 1999 to 2008 or 2011 (CRB vs Goldman). So we have already had a major move that is bigger and longer lasting than some past episodes. In addition, most commodities reached extreme long term overvalued level -except grains.

Gann’s master time factor says commodities should have had a significant low Nov 21st. The rally should be until Apr 2014 My judgment is it will not be blow out but double tops, 50% pull backs and false breakout except maybe the grains.

One other aspect, the whole rise from 1933 looks like one gigantic move, a beautiful Elliott 5 wave count incidentally. Prior to that looks like a very long base. The new paradigm breakout was in the 1970-80 move. That was said at the 1980 top, now it’s also called peak commodities, and we really are running out this time in a Malthusian sense.

Historically it appears that when stocks are up then commodities are down. This relationship appears to occur in a repeating cycle that averages 18 years. For example, the approximate 18 years before the stock market top in 2000. This could be because commodities are the raw building blocks and when they are expensive corporations pay more therefore profits decrease. If 2000 was the commodities bottom, and, if the 18 year cycle holds, commodities may still be in an up cycle and there may still be a blow off top aided by QE3 to infinity which has yet to be felt.

If John is correct about commodities topping in 2013 – 2014 then it could be that, if the 18 year cycle relationship holds, stocks will go down as commodities rise. So we could be in for a couple of down years in the stock market.

The alternating secular cycles of stocks and commodities – I concur. But where I differ from the majority perception is that it is solar linked. It is the influence of the sun that spurs humans to speculation climaxes around the solar peak. If commodities peak in 2013 or 2014 then my theory will be validated. If they peak in 2017-2018 or so, then that would fit with those suggesting 17 or 18 year cycles, so let’s see. However, given there should be a shadow bounce in commodities, which could well occur 2018 or so, it is feasible both ideas could add weight. But to distinguish, I would argue that the first peak should be the higher peak, the second a ‘new high failure’, and that by the time of a shadow bounce equities will already be the place to be, that they will be the class of momentum.

John,

I agree with your logic and also think there is a solar cause that may influence people’s buying/selling decisions because our thinking may be electro magnetic in origin as some psychology theories speculate. But that’s another story.

“We are all light. The history of a nation is embedded in a ray of light”, Nikola Tesla

I think gold is dangerous and yes my barber is long gold and Apple. I think there will be a final leg up in gold and commodities as per the cycle and then something will happen to cause it to crash that none of us has been thinking about. Like for example China letting their currency float or something which will cause the unexpected. It is really pointless to think about it. Just follow the sun.

Gold is expensive, relatively and historically, which makes it a dangerous game. But also historically it should yet make a parabolic, with the largest gains yet to come. It should then be at extreme relative expensiveness and that will play a key role in puncturing it.

Just follow the sun – that’s essentially how I see it. I believe we will see a correlated commodities peak and solar peak again, that the sun will influence humans unconsciously to deliver it, and the rest will fall into place. Of course, it’s a theory of meagre sampling, which is why I carefully follow other technicals and fundamentals to continually assess its likelihood. I will play safe with my trades if it starts to look wrong.

The Economist released its latest look ahead to the next year, The World in 2013. I found a very interesting segment with an accompanying graph. It said it believed Copper prices would jump by 12% in 2013, due to tight supply, and then it said the Gold price would be quite stagnant in 2013, and then by 2014, it would have begun to fall sharply, due to “punters taking profits”.

Essentially, it’s suggesting Gold’s bull market has already ended. At the moment, I’m in two minds, as to whether this is true or not. The part of me which says the bull is still alive reasons that the decline we’ve seen so far was less than 20%.

However, the bit that says the bull is now dead points to the less than spectacular year that Gold has seen, in a year when it surely should have been rising sharply. There’s some kind of nonsensical logic to gold bulls I find. They go on about how QE will make the Gold price soar, and that Gold thrives in a situation of fear and downturns. The Euro Zone has fallen into recession, whilst Spain and now Cyprus have asked for financial aid, but the Gold price crashed into mid 2012 for some reason.

Since the debt ceiling debacle, we’ve had the EU initiating LTROs, the UK’s BoE has electronically created an extra £175bn since 2011, and now the US is planning on QE 3, at a rate of $40bn per month until unemployment falls below 6%.

This easing process has been going on for at least a year, but Gold has been stuck, and Silver has crashed. Sunspot activity late last year rose sharply around the September peak in Gold, then dropped sharply by early 2012, which is another thing that makes me think that the bull in precious metals may have expired in the blink of an eye.

Just because Gold soared by 2000% to its 1980 peak, it doesn’t mean Gold is destined for lofty height nowadays, even if it has been in a bull market. The past is never a good tool for predicting the future. This is a mostly deflationary environment afterall, interest rates are low and can only go up from here whilst debt is high.

When did the Economist ever say anything of trading value?

Can think of a lot of people who say nothing of trading value, such as those people who say we’re constantly on the verge of a new great depression, that Gold is money, that a new Gold standard will be adopted and all the other nutjob theories about economic collapses.

If someone keeps saying “markets will crash” for a long time, there’ll eventually come a time when they are proven right, but that’s only because they have a vested interest in driving the market down, not because they can actually see into the future.

Concerning the Economist, I just happened to come across the article the other day, and I knew someone would ask about whether the Economist is something to pay attention to. With a readership of 1.6m people worldwide (print and digital), it is worth mentioning it more than most things. Or would you rather I cited a trader with a vested interest, who lied to people all the time?

Shiller in bothers the stock market and real estate

Pete, sorry, my comment was not intended to be offensive (I think you might be right, I do not know, anything can happen in trading and often the most so called nuttiest people turn our right in this game as 95% lose their money trading in the long run).

I have a hard time with all financial newspapers that have theories that are not based on statistical significance (I like this blog as the author is trying to show something with the solar theory. As for the discussions about the economy or some indicator or funny-mental, I just find it completely useless in the long run. It may be right one time and so what. I might get right playing the roulette too.

For me all financial news is just entertainment created for people to gamble. It only serves to stir us up emotionally. I don’t think it matters if all people around the world read their news all day long. The market is gona do what it is gona do. There is no value.

I rather listen to a trader that has vested interest as he is putting his money where his mouth is, for example Soros (i.e if he is actually buying what he is saying he is buying). As for all newspapers I just do not see any trading value in them.

There is a place called Wall Street where there is a room with a black board with two columns. One with arguments of why a stock went up today and the other with arguments of why the stock went down today. Every day after the market closes, the Wallstreeters go in and pick one reason and write articles/analysis about it so that people think they know something and investors are addicted and constantly hungry and anxious to alleviate their own fear. Most of the experts never risk their own capital and take the subway to work so why would you listen to anything they have to say or think about the reasons? Can the reason be because people are actually gambling without a strategy that has a positive expectancy acting on hope with that stock, pension or flat or whatever aspect of their life? Crowds are hypnotized by prestige and I would theorize if this solar strategy works that prestige etc is partly driven by solar in one way or the other. History does not repeat but it rhymes.

Well actually, I do see trading value in newspapers. I am pretty sure that if you would backtest a strategy for buying every time they are saying that you should sell or sell when they are saying you should buy you would be profitable. Actually, I am gonna test this the significance for this when I get some more time ;).

No offense intended in my comments either Robert. Thanks for the insight 🙂

Chart showing how the price of gold has historically risen with federal reserve balance sheet. According to the article, Feds are spending over $85 billion per month through the end of 2013. This amount of spending may fit in with John’s blow off top scenario for PMs.

http://www.usfunds.com/investor-resources/frank-talk/chart-of-the-week-gold-and-an-ever-growing-balance-sheet/

Also a couple of interesting charts indicating that gold stocks historically are lower during a federal election year (e.g. 2012) but historically may bounce back the following year (e.g. 2013).

http://www.usfunds.com/investor-resources/frank-talk/a-tipping-point-for-gold-companies/

Gold has a good historical relation with food prices, real interest rates and – concur – fed reserve balance sheet. Currently, the three combined suggest gains for gold.

Long time lurker that would like to extend many thanks to John for his excellent commentary. Really great work being done here. Have a spectacular trip and cheers to a profitable 2013.

Thanks Rick

Reaction over…The market is poised to go higher. Next stop is SPX 1,468.

Bears have to sit out for another round.

A Friday update.

Leading indicators for Euro-area came in at -0.2 (versus -0.3 last month); for Canada at +0.2 (+0.2 last) and South Africa +0.5 (+0.4 last). Collectively same or better and adding to overall global pic of weak growth ahead, not collapse.

ECRI made a media appearance reiterating their recession call based on industrial production, sales and income having apparently topped in July, whilst the 4th measure, employment, has yet to turn down. I say apparently because both sales and income uptrends could still be in tact – I await the next data. Time is running out as they made the recession call in Sept 2011 and they advised it would be clear by the end of 2012. Let’s see how their own leading indicators come in this week later today.

Stocks and wider pro-risk made a consolidation-correction into the full moon of Nov 28 this week before reversing on that day. It was a particularly compelling lunar turn, as markets were selling off fairly hard on that day until 15:00h GMT at which point they reversed hard and ended up printing hammer candles across various key assets. The full moon occurrred at 14:46h GMT.

That clears the way for positive pressure to erupt as of next week, together with year end positive seasonality. No guarantees of course, but given the fairly mild consolidation-correction into the full moon, I believe pro-risk can move higher, and as noted above, the accompanying breadth and cyclicals outperformance in US stocks bodes well. The Dax and FTSE are back attacking breakout resistance. If they can push through this time, they will join the Hang Seng in having broken out upwards out of long term triangles. I believe they can, with global leading indicators showing improvement lies ahead. So for now, I stay put with my pro-risk portfolio.

Thanks John – it was great to read about the peaks from previous cycles. I feel your analysis is compelling, and ground breaking. If the theory holds for this cycle too, I hope you manage to write a book explaining the theory in depth.

As usual your tone is measured, probing and skeptical of your assumptions, yet displays an appropriate amount of conviction too, based on the evidence you have uncovered. Such balance is rare I feel among the investment community.

Technically, it seems to me, the charts still support your view, with the Hang Seng breakout occurring recently and the Dax and FTSE poised to launch out of their long term triangles as you mention. Similarly we have seen break outs from the long term descending triangles in Silver and Gold. And the US markets broke out of their triangles at the beginning of this year. Oil, agriculture indexes and the general commodity indexes are still ‘basing’ in their triangle patterns, but could launch a breakout in the next few months.

As these long term chart patterns tend to be reliable, I feel your analysis is still very much on track until the long term charts suggest otherwise.

As a side point, I found some comments on another site about the lunar inversion problem, where the author felt the inversions may have some relationship with solar activity. Here is what he has to say about it:

“When do these inversions happen? Why do they happen? Anybody who can find a good answer to these questions would become very rich very quickly.

One of the things that seems to trigger them is solar activity. Sudden spikes in solar activity (as evidenced by high sunspot count and/or high solar flux) can create a more nervous mood, regardless of where we are in the lunar cycles.

That’s what we saw two weeks ago, when the sunspot count suddenly jumped to near 200 (where in recent months the average sunspot count had been only around 60) and stayed elevated all week long while stocks declined. Last week the sunspot count came back down (now it is at 64), and the stocks recovered.

One thing to remember is that the solar activity has an approximate 27 day cycle (called the Barthel rotation), which means that the same side of the sun gets turned to us again after 27 days. A period of high sunspots count thus tends to get a repeat after 27 days. Watch next December 7 – 16 for a possible period of high solar activity again. Phase inversions that get triggered this way will typically last as long as that sector of the Sun remains very active.”

http://lunatictrader.wordpress.com/2012/11/26/phase-inversion/

Many thanks Rob!

Re Gold.

The history of the 20th Century suggests, as I have frequently pointed out, that the peak in PM’s is most likely to occur in year 3 of the Pres Cycle.

Note that 2012 saw extreme rel performance.

Further note that two term presidencies often create a bubble in year 7. I think it is less likely to take place in equities and more probable in PM’s.

Within the 4 year cycle the turning point is July of yr 1: pre that date,from the end of year 3, is a period of relative underperformance and post that date a period of much higher performance.

Using that as a guide it is most likely that as equity markets roll over into 2013 and for the first few months are joined by PM’s.

Providing the Gold price still holds above it’s critical levels around the 1500 level and continues to make a sideways rotation which started last year then it will be ready for a significant test higher with a top in 2015.

Regards to all.

Then we approach crunch time for your theories too Will. All very interesting.

Obviously when I said 2012 had extreme del performance I meant 2011.

“Gold has broken up through a declining trendline and is meeting some resistance near 1800. It has successfully moved above its 50- day and 200-day Moving Averages and the prior resistance at the $1700 level. A break above $1800 would suggest a test of the old high at 1923.70 and if that is breached, then the SKY is the limit!”, Arch Crowford. Any ideas about his methods validity?

A hit and miss record. Forecast crashes in Dec 2011 and Aug-Oct 2010 which did not occur, but other successes. Uses sunspots and geomagnetism, of which I of course approve. But uses all the planets – I have only found correlation with Earth, Venus and Jupiter.

Thanks John, it is all very fascinating.

In what sense do you see correlations with Venus? I have been backtracking the Jupiter cycle. I guess we are close and that should be another condition for next year. Noticed Arch uses the Mars/Uranus cycle and it normally happens at crash but also at bull from my testing. Any ideas for Mercury in retrograde?

See here: https://solarcycles.net/2012/02/23/solar-cycles-and-astro-trading/

Thursday was not only a full moon, but a penumbral eclipse. It is ever more unlikely, but we could still be in danger zone per Puetz’s stuff I”ve read. The stock has broken below it’s 200 ma and rallied back to it. Technical sell signal, and if it fails here, watch out.

28 Nov – 7 Dec by my calcs, so if we are to crash by Puetz it’s this week. I don’t see that as likely in the current evironment. Dow and Nas both just peeping above the 200MA and Dax just peeping over a breakout at the time of writing – I personally would see the most likely a couple of session’s consolidation before an upwards break. Let’s see.

I love this site John, and love the idea of solar cycles and how they affect commodities prices, but I also like to look at the relationship between stocks and gold in a simplistic manner. If you look at previous bull stock market cycles, gold was out of favor while stocks were in a bull period…then as the bear market in stocks began…gold began it’s journey up. It was only at the end of the stock’s bear market did gold start to sell off from it’s parabolic move…

1929 Gold begins parabolic move = 1929 Stock market crash

1940 30 year Gold bear market = 1942 20 year Stock bull market

1970 Gold begins parabolic move = 1969 Stock bear market begins

1980 20 year Gold bear market – 1982 20 year Stock bull market

2000 Gold begins parabolic move = 2000 Stock bear market begins

2016 Gold bear market??? = 2018 Stock bull market begins

Given that we should have two more bear markets between now and 2018…It’s possible we don’t see another parabolic move up in Gold until the end of this next upcoming bear market. QE has already been announced and yet it’s affect on PM’s is negligible…so it’s possible when the Dow reaches 8,000 in the coming years that another round of QE is announced which could then launch PM’s into that final parabolic move…possibly with John’s second scenario…in 2016/2017. The technicals just don’t make any sense for a parabolic move in 2013/2014….more likely it’s possible Gold goes down to fill some gaps say around 1450 or 1370 before a big move up…

If you look at the above dates, you can see that the parabolic move in Gold ended 2 years before the stock market bull begins, so that plays well with a top in Gold in 2016, 2 years before the stock bull market begins in 2018. My 2 cents…

I say the stock market will have its final secular low in 2016. Why? If I may (unscientifically) pick certain Fibonacci numbers to guess the final market bottom, I would have the following scenarios just for fun:

1982 + 34=2016

2003 + 13=2016

In fact, Bob Prechter, the super perma-bear said that he will have no more reasons to be bearish about the stock market by 2016 from a cyclical standpoint.

Does that make 2014 the top for Gold?

Edwin, my charts suggest two bear markets…and neither of them have a low in 2016…

Fibonacci and golden ratio – something I want to explore more when I make some time.

Btw, I think Gold continues to move sideways to up into 1Q 2013 before we see it start to pullback with the next stock bear market…

Thanks Karen

Hi Karen

Why is Gold pulling back with the next stock bear market?Your earlier post said Gold goes up when stocks retreat.

If you look at the chart of Gold you can see that it has been going up…it was at $337 in 2001…the question is have we seen the the highs already?

http://www.macrotrends.org/1333/gold-and-silver-prices-100-year-historical-chart

There are a couple of reasons I am speculating that we see lower prices in 2013/2014 for PM’s. First, I think that the government’s attempt to inflate may be defeated and instead we see a deflationary period somewhat similar to 2008/2009 where we see a “risk-off” environment. The rapid rise in PM’s in 2009 was because we were in the “beginning” of a recovery combined with many rounds of QE, which created an inflationary environment. Currently we are at the end of a bear market rally, not in early stages, and we will most likely be in a deflationary environment into 2014. That is why I believe the QE3 that was announced had minimal effect on PM’s. We have essentially been trading sideways in Gold since August 2011. Of course silver is more volatile, so chart wise I can’t see any reason why it can’t get back down to the $20 area in 2013/2014…? Of course I am speculating as everyone else.

There are similarities to the current chart pattern in Silver as in 2008. That is why it’s possible it could trade sideways for a couple of months before a final rally in March 2013. We will see how this plays out in the coming months…

I believe that if we are to get another sizeable rally in PM’s we may have to wait until we see this next bear market play itself out…

I like this graph but remember that CPI deflator is SCAM and CPI was changed hence the graph does not depict inflation. Use Shadowstats CPI. I think the following graph and scenario is more interesting:

http://en.wikipedia.org/wiki/Silver_Thursday

Found an article saying the average Gold trader is unsure if the Gold bull run is over or will continue, whilst Central banks have been buying Gold on the dips, to prevent it crashing below certain levels. If it wasn’t for central bank action, we’d probably have lower prices by now.

Gold’s rise has been increased investor demand plus central bank net purchases. Jewelry demand etc has been fairly flat. Without any dividend or usefulness, it’s all about capital appreciation for those two buyers, i.e. confidence in the price. It’s therefore easy to imagine a collapse in gold, IMO (post parabolic of course….)

if my Kitchin cycle works, time is running out for bears. Next top 2014?

But I see a semi-major top this winter and some weakness in 2013. A low around April-May or November. The top should be after New Year, maybe as late as March.

Hi Jan, a Q1 equities top would fit for me.

regarding solar cycle 24 I have summer 2013 as the most likely top

http://www.sibet.org/solar/index.html

I cannot rule out summer 2012 as the top, but the planetary cycles and the sunspot-number trend/pattern recognition favors a later max.

This should be a stretched flat top, and not easy to say where that flat top has its maximum.

The late alternative is ~Feb 2014 as the top, and next minimum summer 2020.

I am following your forecast, together with NASA and SIDC. This is the updated SIDC: http://www.sidc.be/html/wolfjmms.html

John

I have a ~5 year cycle in oil that makes low in years ending with 3 and 8, suggesting a low in late 2013. How does that fit with your work?

Btw doesnt have to be a deep low – can also be sideways…

It doesn’t Jan as a secular high in commodities in late 2013 is looking the most likely – unless the solar and secular commodities peak all happens earlier.

Martin Pring:

Interesting, thanks Niels

Hi Guys,

My 2c re if past is prologue.

The last 3 secular bear mkts lasted on average 191months ranging from 165 months to 237 months.

This would put the super cycle low at the earliest Dec 13 and the latest Dec.19 with the average being Feb. 2016. If as Karen says gold peaks 2 years prior to this the top would be Feb. 2014. It would also suggest even with the shortest bear cycle the gold high is still ahead of us.

PS. I enjoy your work immensly John. Thank you.

Many thanks.

Hi John, was wondering if you could weigh in on the solar polar field data coming in from the Wilcox Observatory. The data is here:

http://wso.stanford.edu/Polar.html#latest

Instead of relying on various predictions for the solar max, it may perhaps be a worthwhile exercise to look at the specifics of the polarity flips over past cycles.

I make no pretense of any sort of expertise in reading this data, but it would appear that when the 20nhz filtered avg reaches this level — 8 or -8 depending on the cycle — then the acceleration into the “flip” takes only a few months. And the movement does appear to be accelerating.

How does you read this data?

Hi X-class, I’ve been hunting around but I’m struggling to find others commenting on it, because I am not familiar with that data set. I am aware the polar flip tends to follow the solar peak – are you reading that the polar flip is to take place within a few months?

I was reading this dataset to see how the “flip” on the 20nhz filtered data correlates with the historical solar max dates that you and others have cataloged, with this data showing the polarity flips coming in 2/2000, 1/1990, and 1/1980. I find this pertinent to any discussion of potential solar max dates in 2013. It’s like watching the chart yourself versus just reading other people’s forecasts.

I noticed that the poles are accelerating towards the flip now that they are getting closer, which is a pattern that can be observed at previous solar maximums. Obviously there is not a large enough sample size for anything but rudimentary prediction but it does look entirely possible for the flip to come within 3 or 4 months from the current configuration.

I was really just looking for another set of eyes on this as I am eyeballing it myself, and have not seen any discussion of this data either.