Yesterday during the US session I was watching the support/resistance line on the Nasdaq shown:

It marks the March/April 2012 highs, and the battle below and above that level in August and September is clear to see. Having broken out above it in September, the market is now retesting the breakout and yesterday, marked by the arrow, saw the index briefly break down beneath it only to rally strongly into the close and hold above it. I believe that may be significant, and today’s out of hours action (Europe morning) is so far bullish. But, there remains the possibility that we are making a bear flag in a protracted correction, and the SP500 (below) and Dow are higher above the March/April peaks with more room to consolidate downwards.

We have a 2 week period of low forecast geomagnetism and upward pressure into the new moon now, and given last week was the seasonally worst week of the year together with a full moon, damage to pro-risk was contained. Supportive of pro-risk pressing upwards here is a particularly bullish correction formation in gold and a bear flag on the US dollar:

Source: TSP Talk

However, there are some warning flags for equities. This chart shows that when the Fear and Skew indices spiked together with a low Vix, equities were approaching a top.

Source: Sentimentrader

And this composite of Put/Call, Market Vane and Sentiment Surveys also suggests equities should be approaching a top.

Note that with both charts, there is the scope for equities to top out now, or to keep rallying for another couple of months and then top out. So with that in mind, we can return to the top two charts of the SP500 and Nasdaq and watch to see whether they break back down below the March/April highs – which would make the breakout a fakeout and give more weight to a market top – or whether they can push on now this week and next and make the breakout backtest successful, which should mean a period of longer gains ahead as they move into clear air. My leaning is towards the latter because we don’t yet see the usual cyclical bear market topping signals or process.

We can look wider for more to gauge the environment for pro-risk. The key question is whether we are reflating or tumbling into recession. I previously noted the improvement in Conference Board global leading indicators but we have to wait until mid-month for new updates both in these and in OECD leading indicators. We have other data to keep an eye on though, starting with ECRI US leading indicators which rose again last week. It should be clear from the chart below that the action in the indicator does not resemble that in previous recessions:

Source: Dshort

RecesssionAlert caculate the probability that the US is in recession currently as 6.4%:

Source: RecessionAlert

Nowandfutures measure, which requires yield curve and CPI adjusted monetary base both to go negative, only has one in the territory:

Source: NowandFutures

Here are the latest global PMIs combined:

Source: World Bank

There is clearly some recent improvement, particularly in Europe. The key question is whether they are in a recovery trend, or just an oscillation in a continuing downtrend.

This is how I see it. There is some clear improvement in leading indicators globally. We have had 6 months of rate cuts and renewed stimulus. I expect the reflation. Solar and secular cycles support the reflation. But I’m not jumping the gun. I want to see more evidence of improvement. Clear upward trends. So it’s one day and one piece of data at a time. But I don’t see reasons to take profits on pro-risk longs at this point.

Dr.Copper is behaving bullishly of late, as is Dr.Kospi, and the Shanghai index was potentially breaking out of its wedging downtrend on a Demark buy signal and RSI positive divergence, prior to the Chinese holiday week – something to watch next week. Treasuries regained some ground as beneficiaries of last week’s correction in pro-risk, but by QE history should begin a more enduring downtrend – unless of course you believe this time is different.

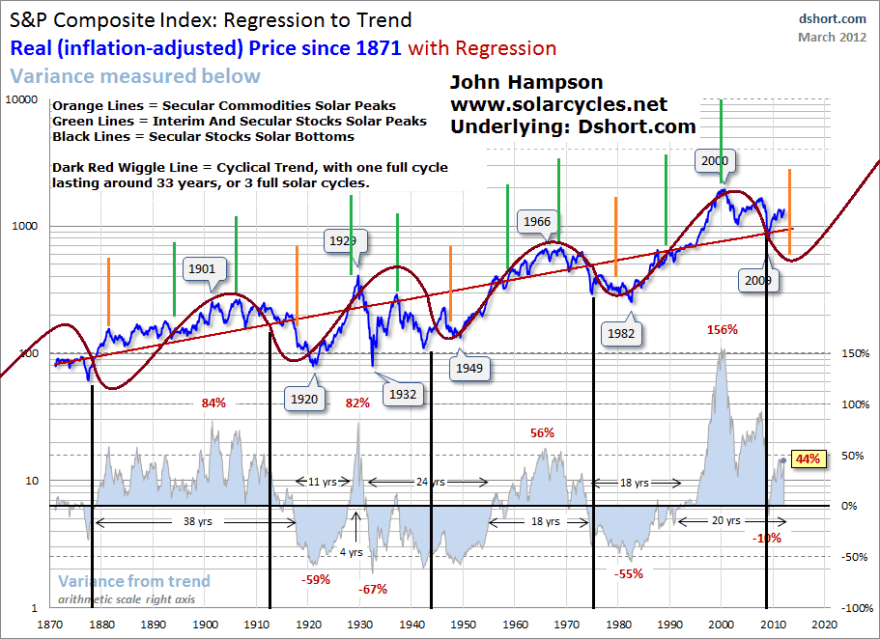

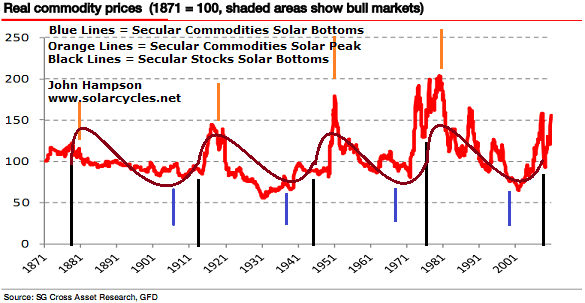

In summary, there is tentative evidence of a global reflation that should provide the backdrop to a secular commodities finale, but I want more evidence. I see stocks at a crucial point technically, either backtesting their breakout succesfully, or failing, and my leaning is the former. There are some technical indicators for stocks flashing a top in terms of complacency and overbullishness, but as yet a lack of other supportive topping indicators. Because those flashing indicators could remain at those levels for a while longer, and given Presidential seasonality, I think we can push higher yet into November. In terms of my solar and secular timings, a topping out of equities as we turn into 2013 would be reasonable, so I believe we are approaching that stocks peak, but are not there yet.