We can now see that the arching over in price in 2015 set against negative divergences in breadth and strength were indeed a prelude to a collapse in stocks like in 2011:

Source: Stockcharts

After such a steep collapse and catapult readings in fear indicators, the market historically needs some time to consolidate and recover. The pattern should be that the rally of the last 3 days gives way imminently and we retest the lows.

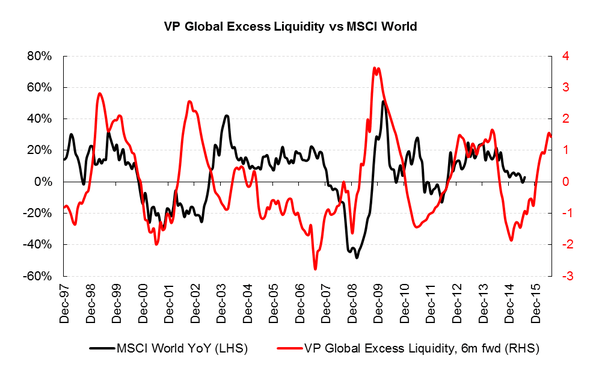

Source: ShortSideOfLong

That point would then be the next key test.

Bulls should be looking to see a double bottom or lower low on positive divergences from which price then resumes a bull trend to new highs. The best fit timeline by geomagnetism/seasonals would be a bottoming out in October and Xmas new highs. Supporting this scenario is liquidity trends.

Source: Variant Perception

However, I rather see the overall evidence as supportive of stocks now being in a bear market. Drawing together all the indicators and disciplines that I trust, the data suggests stocks entered a topping process Jan 2014, made a first major peak in June/July 2014 with the solar max, made a first major low in October 2014 and a final second peak in May 2015. Several indicators reflect this progression, so here is one: stocks to bonds.

Source: Stockcharts

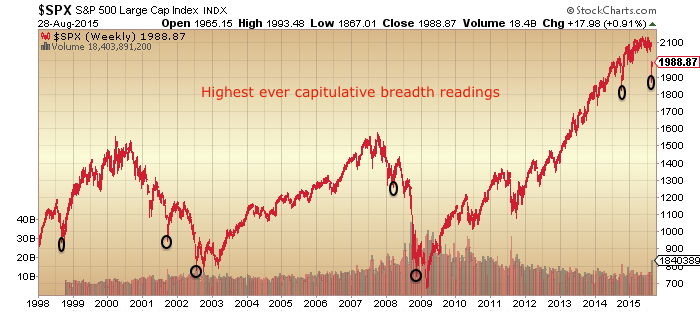

Multiple indictors have registered bear-market-bottoms readings over recent months. Here’s another one from Dana Lyons:

Source: Dana Lyons

Capilulative breadth too, which hit its highest ever reading last week.

CBI data from Rob Hannah

If we take the bull angle again, then we could argue that such readings are a springboard to much higher prices, but we need to explain why they have anomalously occurred at <10% from the highs. If buybacks were to blame for the shallower washout in nominal prices then we should have seen small caps and non-buyback large caps collapse whilst buyback large caps held up, but this has not been the case.

If, on the other hand, they are signals that we are in a bear market then prices should now fall again Sept-Oct and make significantly lower lows. The shaping in Biotech is supportive of this:

All in all, I think the extreme bearish readings we are printing this year in various indicators are a fair match for the all time record bullish readings we saw last year, namely that the markets have become excessively unbalanced.

But, what can we can say for sure is that multiple indicators that were screaming for a reset in equity prices have now been satisfied (such as breadth, sentiment divergences), which makes the next move particularly telling. Again, bulls see this as a refuel for eventual higher prices, but certain big picture indicators make any such notion that we have now reset rather foundation-less.

Valuations ought to end up negative, and leverage ought to be wound down from their extreme high readings:

Source: DShort

Which brings us to our particular environment not seen in over 50 years: ultra low rates, low inflation and overall deflationary trends. Are such valuations and leverage fair in the context of ZIRP? It’s a really useful test. If stocks are in a bear now and break down, then it will be without high rates or oil prices ‘choking the economy’ and despite QE ongoing in several major nations. It will be clearer that valuations do not need recalculating in the context of low rates and low inflation. In short, it will be much more supportive of my dumb model of the markets: demographics and solar cycles.

On that note, what I see as most important here is what has been offsetting demographic trends, namely increasing leverage. Buybacks through borrowing continue, but did so at record levels in 2007 despite stocks breaking down into a bear. Buybacks didn’t stop the collapse occurring last week. Margin debt dropped in July, and likely dropped harder in August. If stocks are to rally to new highs then leverage has to recover and make new highs too. However, what I see as likely is that a section of high leverage participants were wiped out last week and all-round appetite for high borrowing levels has been dealt a decisive blow. I very much doubt from here that leverage will make new highs.

Using Rydex as a proxy for retail, I would argue the craziness has been broken and we will now see a gradual reversion to mean.

Looking cross-asset, I believe gold will now make a higher low than the July low and in so doing cement its new bull trend, completing the gold and equities flip at the cyclical level.

To finish, here is the SP500 big picture again. If we are in a bear then we should make lower highs and lower lows. But note that in a bear we still get some ripping rallies that test the overall downtrend.

For now then, what’s important is that the rally of the last 3 days topples over in due course and eventually prints a lower low than October 2014 in all indices.

We have had significant geomagnetism in progress the last couple of days. It adds to the recent cluster which acts as a negative pressure on market participants.

I am short Biotech, Russell 2000, Dow and long gold.

John,

Excellent post. We collapse as early as Sunday night futures or later next week. I am short SPY, Single stocks, XBI puts and IWM puts.

Thanks

You mean long puts?

yes

Gann GFT says 2015 is a panic year. We have had it. Nothing to see here, let’s all move along and enjoy the long term rally. Sure we will be in for a bout of sideways price action. After 6 years you need a correction…and the worst of it is now over. This social media inspired selloff got what it deserved. ie those with the money (fund managers) bought value and smashed the shorts (social media). Nothing new here, US economy is getting stronger and China is still up 40% over the past year or so (best performing market?). Remember that the China stockmarket only accounts for 30% of the economy (not 100% like US) and only 10% have exposure. Property in China is still strong (up last 3 mths) and far more important than stocks. Property everywhere is moving higher. Sydney going strong (sorry to the clown here who sold 2 years ago). London flying along, US picking up fast…what’s not to love about the world!

Catch the tone in this poster’s comments?

Another busted (nearly) bull?

No need to be snarky daveg, juts because JH has been proven correct, and you’ve lost some cash. Get out now, before you lose the rest.

As for your comment: ‘US economy is getting stronger’. Yes, and pigs fly.

Wake up.

Ha ha…do you think the FED wants to raise rates because the economy is weak

The Fed doesn’t control rates at all, the markets do.

oh I see, so the markets think the economy is strong…but you, you sly thing, know better right?

Oh and I have VERY strong Chinese connections and you ain’t seen anything yet with what is going to occur in China and what has occurred.

Thier shadow banking industry is set to implode and will wipe out millions of Chinese investors overnight. Many will sell their overeseas investment into that implosion…..goodbye to the Sydney RE bubble and investors who have overlevergaed at 3-4% yields.

A masacre is afoot!

Oh and Just because I constantly say that THE Fed will not raies rates does not mean that I think rates will not rise.

Rates are definitely going to rise and QE is going to be powerless to stop them this time.

Buy RE when interest rates are popping and sell when rates are bottoming. It aint’t rocket science but boy do people stuff up!

they do stuff up, I am watching one now..”oh I have very strong connections”..of course you do…off to bed now, there’s a good boy

daveg, you possibly haven’t looked at the commodity markets, the corporate credit markets, or even the yields on US treasuries. There are at least a dozen other data points that show that the US economy is already in a recession, and we’ll see that announced retrospectively next year.

But good luck to you with your *beliefs*.

London housing booming eh daveg? Right.

http://www.standard.co.uk/news/london/stamp-duty-rise-hits-london-home-prices-with-fastest-fall-since-the-crash-10413171.html

THE FED DOES NOT CONTROL RATES, THE FREE MARKETS DO!!!

The Fed controls the rates until the market loses faith in the Fed. To me the market is showing signs of losing faith in central banks around the world. We shall see soon if rates keep rising. I’m watching the 10 yr. The problem the Fed has found themselves in, is if the market does fall, they have very little actions to stop it.

Daveg, interesting perspective. Question why real estate prices in select hot markets equates to the direction of stock market going forward? Also given the fast and deep correction and strong seasonal period still 1.5 months away and lack of clarity as to Fed rates plans isn’t it likely that a continuation sell off will occur.

Most people have the majority of wealth in RE. RE weakness led the 2007 recession. RE is growing, not falling. RE doesn’t fall with rates at 0%

Don’t confuse New York or Sydney with most of the world. RE is not increasing unless in cosmo areas such as these. For example, RE is not increasing in Texas, most of California, or non urban Australian cities.

it is going up in little towns like London and little countries like China, but if RE is not going up in an Oil State, with oil at 6 years lows, or in a shockingly run state like Cal, then that’s it is it..surely that’s not the best you can do…

You could be right about RE prices rising a lot in trophy cities and modestly in rest of world, I don’t follow the RE market. Will note you think we are going to have a bull market.

“Sydney going strong (sorry to the clown here who sold 2 years ago)”

daveg, yes that was me to whom you refer and it was not two years ago it was 12 months ago after having bought in heavily during to 90/91 Oz recession when HL rates in Australia hit 18.5% and buyers were non-existent!

I bought one property in the Sutherland Shire south of Sydney for $147.5k and sold it for $1.35m.

YEP I AM AN IDIOT!

Sydney property is the BIGGEST bubble in Australian history and prices will decline 60%.

My timing is not perfect but who’s is!??

Ah yes, you are the guy, how could I forget, you went into Gold, which then went to 6 year lows. 30 years in markets and still haven’t learnt about them. if you had, you would have learnt that property never falls with interest rates this low. You would have learnt that there has never been a recession following the the first rate rise in a new up cycle in rates. But I suspect there is little point telling you, you seem to know everything…..only kidding.

daveg, shiws just how much you know. Which is about ZILCH. But ignorance is bliss hey?

Gold is AUD is up…..that is right you know all……..UP!!!

daveg , you’re aflling over yourself to drag people down and you sir can’t even understand basic markets dynamics…….once again a self prclaimed genius that can’t look at anything except from a US centric perspective.

You are a wste of time.

Cheers

Thanks for reminding me that I bought gold at the low. Argue with this:

http://stockcharts.com/h-sc/ui?s=%24GOLD%3A%24XAD&p=W&b=5&g=0&id=p31827069468

It posters like you that stink up this place.

Hello Allan.

We need to prepare for an increase in posters like daveg as the markets begin their bear. They’ll all be pissy and (likely) ill-informed, and will feel anger towards pragmatic (but currently) bearish sites like John’s.

Like water off a duck’s back though, to an experienced investor like you.

GM, you’re right mate but it gets my goat when posters throw insults and rant like they know it all andyet they’re are fundamentally wrong.

I reslly don’t mind people taking an opposing view and stating as much, in fact I welcome it because it makes you think, but I won’t put up with bullies like him calling me a clown.

I am far from the smartest person on this forum. That is evident to myself all the time as I read through posts. I have however over the course of my life been able to do very well for myself.

That came from investing from an early age and not letting myself get carried away with the herd and standing by the old rule of buy low sell high.

When everyone else wants to buy, to sell, or the opposite when prices are low, is one of the hardest things for humans to do. Most findit impossible to do and will find all the excuses in the world to justify why not to do it and then chastise others that have done so, so as to make themselves feel more self assured.

Real estate prices the world over are in a major bubble thanks to ZIRP and the Chinese phenomenon which began in the late 80’s.

China is in far more desperate trouble than most realise. As the Chinese economy continues to implode defaults will begin to rise exponentially.

This will result in a massive selling of Chinese overseas investments, which when coupled with rising interest rates globally will pop every last remaining RE bubble worldwide.

The rebound off the 2008 RE bubble burst is in many cases making lower highs.In areas like Australia and Canada etc, which have made new highs, the bursting bubble is going to so bad that it will takes decades to recover.

Cheers

You’re plenty smart enough Allan, I wouldn’t let trolls wind you up, I suspect that’s their sole aim.

Allan you are the ultimate FIGJAM.

I don’t drop-in much, just to check I am doing the opposite of what you say, its an amazing, basically foolproof strategy.

I also use John Hampson’s notes, they help very much. I don’t think he gets the market moves very well, but his charts will help me get back to 100% invested within the next 6-12 months.

Mate good on ya. And whilst you’re at it trot on over to Martin A’s website I am sure he will give you the impetus required to get you all psyched up for the explosion to >23K DOW! 😉

daveg = troll.

“Gann GFT says 2015 is a panic year”, and we are just getting started.

Those big drops were wave 3. The rally the last couple of days is wave 4.

Look out for wave 5 to come likely next week. Then a partial retrace of the whole 5 wave decline in September and then a larger degree whopper of all declines to take place going into October, when they will be forced to bring out another type of QE to restore confidence (crutches) back in the markets. That’s my guess 🙂

Yes, many of us are tired of the craziness of the markets and look forward to reversion to the mean.

feels like a prelude to a crash to me. The markets dodged a bullet last week. Other markets globally were not so lucky. The action in the Vix clearly suggests lower levels are coming

JH, any thoughts on the surprisingly strong U.S. GDP print this past week?

The latest from the Atlanta Fed’s GDP forecasting model:

https://www.frbatlanta.org/cqer/research/gdpnow.aspx

Dug out the stats for what quarterly GDP read at previous major peaks:

Q4 2007 4.4%

Q1 2000 6.18%

Q3 1987 6.08%

Q1 1973 11.91%

Q4 1968 9.84%

Adds weight to the stock market leads the economy rather than the other way round.

There isn’t a single statistic coming from the U.S. government that has even a shred of credibility. That GDP number, like all other numbers out of the U.S. government, is nonsense.

“There are lies, damned lies, and statistics.” –Mark Twain

First GDP print essentially a guess, and they always guess high.

JH, I agree re leverage, but it’s leverage everywhere, not just market-related.

There’s a chart in this post that shows the size of the bubble:

http://www.businessinsider.com.au/global-financial-assets-2015-2

NB the biggest increase in percentage terms is in sovereign debt, that’s what has kept this party going these past 10 years, having grown far in excess of economic activity. When the ability of government to borrow at ultra-low rates vanishes, it’ll be game over, and we will enter a whole new world, reset at much lower levels of economic activity, and secular lows for equity valuations. Tough times ahead, and watch as some of those financial assets try to escape into gold, $50k and more an ounce lies ahead.

Hello, where has Andre gone?

I don’t know why he isn’t posting here, but his posts are missed.

Excellent post, John. Great charts, looks like your going to be rewarded, soon as market looks ready to get more volatile.

Demark 4 hour sell setup should finish at EOD Monday.

I plan on selling on strength at open on Monday. EOD will be 1 percent lower than open.

Thanks

Death throws of Primary 4. The 5th cometh.

When there is Drought in India Gold tends to sell off because of all the farmer/public selling of their gold hoards to stave off starvation.

September is the month with the greatest monthly rainfall in India and Thailand. Powerful El Nino’s can produce Drought in India. Drought is already occurring in India, Thailand, Cambodia, Laos, Vietnam, and northeast Australia (and central Europe). Should the month of September increase Drought conditions, in India, then Gold will continue to be pressured lower and into its Delta long term point 1 as a low due in mid-October.

Note that the ATH in Gold, five years ago, was a Delta long term point 1 (same numbered point) high. This pattern is common with the five Delta rotations and very common with Intermediate rotations. And btw, Silver is all ready on its way to its Delta long term point 1 as a low and there is a Delta “metals” group rotation solution, too, that implies (very high odds) that Gold will break to –new lows– to its Delta long term point 1 as a low just like Silver is doing and will continue to do.

‘When there is Drought in India Gold tends to sell off because of all the farmer/public selling of their gold hoards to stave off starvation.’

Richard’s comment above moves to No. 1 in my top 10 of his wacky ideas. Classic, love it.

As usual Richard, your analysis is useful and fascinating.

I know a floor trader on Pacific Stock Exchange who is a student of Welles Wilder. I tried to buy his books online but are way overpriced.

Most of the posters on this blog are Deltoids who don’t like to talk about it because they have lost too much money blindly using Delta. Delta is only a filter and a wave counting system much like Elliot is. Neither are true cycles but waves within some other greater cycle(s). Wave counting systems “invert” all the time but true cycles seldom ever invert.

Will those who are Deltoids please raise their hands? Because I have been trading for twenty years and I have never heard of it…not to say it is not a good system. I just don’t know.

Delta system of Welles Wilder developed in the 70’s studies “secret of the order behind the markets.” Their website is deltasociety.org.

The only reason that Welles Wilder went public with what he/they knew about Delta was because a secret member made the information for sale in Asia.

I bought it for $150 from Mr., Wilder. Yes it is extremely overvalued. I do not recommend it.

To better understand the Drought potential in India and SE Asia reverse the exception to the normal. In other words, treat India and SE Asia as though their “normal” is to be deserts like North Africa and Arabia and to treat their being tropical as the exception instead of the rule.

nice charts!

Dear John,

YK Hui of Hong Kong said that BDI has reached bottm and is going to rise. Also the oil price will reach bottom shortly. So the world stock markets will rise soon. What do u think?

Then shouldn’t markets have fallen with bdi and oil?

Where American stocks are likely making another “V” bottom Crude is going to make a “U” bottom that will drag the lows for most of, if not all of, next year. American technology has made new American oil fields profitable at very low prices and when Iran cranks up production the battle for market share between Iran and the other OPEC members will be on in a big way.

Agreed, US has a great big faucet ready to be turned on anytime the the price gets high. That’s why I am focusing on US Nat Gas, which is starting to join the world Nat Gas Prices and has potential decent upside over the next 2 years. Right now it is a nice trading instrument as well.

Once again, I believe the charts are pointing to a final push up before we roll over in equities.

Here’s my count for the SPX on the daily chart (I do believe there is a chance we could see another push down to complete (A) or [4], but it needs to begin Monday):

Here’s my weekly chart for the SPX with my topping and bottoming cycle waves, which as you can see have been spot on. I was looking for a pretty rapid paced primary wave [4] (at least in its bottoming efforts, it can still chop horizontally forming a triangle over the coming months).

And finally here’s a screen shot of my System chart for the DOW. It is on a buy/long Alert, the signal will be confirmed should the DOW close above Thursday’s high (for information about how the system works visit the tutorial tab on my blog).

Nice graphs, Alphahorn. My expectation is that price is moving down within the context of lunar seasonals. Would expect this week good to short, next week rebound.

i hope you’re right I’m still predominantly short

Nice Charts Alphahorn

Great charts, my count is pretty similar but I am counting 2009-2015 bull as A-B-C rather then 1-2-3. So I think we have already started major bear that will end up much lower then 2009 low. And it will be extremely difficult to trade. I am not going to assume long positions at any time, even if all indicators scream major bottom. This wave is going to be special and not to be messed with.

What’s the effect of this “supermoon”?

Doom in the markets imminently. To be followed by joy following week. And greater doom at the end of September/early October.

During the height of the Euro debt crisis, which is far from finished, the talking heads of CNBC were constantly denouncing Europe for dragging down the rest of the world.

That used to really anger me not least of which was because, the GFC had it’s roots firmly planted on US soil beginning with sub-prime, which they rarely mentioned.

Aside from that, certainly the PIIGS need to stand up, it was however US IB’s that were largely responsible for many of Europes woes.

For which Mr Blankfein and Mr Dimon have been rewarded with billionare status:

http://www.spiegel.de/international/europe/greek-debt-crisis-how-goldman-sachs-helped-greece-to-mask-its-true-debt-a-676634.html

i used to office 20 feet or so from Dimon when he was merely a millionare

With last night’s Full Moon shouldn’t a rally occur for the next fourteen days?

Maybe Tuesday will be another “turn around Tuesday” (as it is called in Chicago) because it will be near four days since the nearest Full Moon.

And hasn’t falls to Full Moons –reversing and rallying– to New Moons been a reliable trade for over a year? If so, then why the continued bearishness and talk of immediate sell offs in the coming days?

It seems to me that last night’s Full Moon is going to support another “V” market bottom and RALLY to new ATHs for American stocks.

True, Wednesday is four calendar days after Full moon (Saturday plus four), but given recent volatility market may not find bottom till Thursday afternoon.

Natural Gas and other energy prices dragging the bottom of a large “U” as Egypt develops a “Super Giant” (research Peak Oil arguments for what a “Super Giant” energy find means) natural gas field. European money and technology will be made available as it will greatly help to alleviate Europe’s dependency on Russian supplies:

http://news.yahoo.com/eni-says-found-supergiant-natural-gas-field-off-133441315–finance.html

…any wild guesses what this news will do to markets on the way to another New Moon? …highs? as has been the pattern for well over a year now???

Negative focus on China now “yesterday’s news” with new focus on positives of India:

http://finance.yahoo.com/news/indian-economy-offers-hope-china-210000182.html

Could be, I just think this week will be lower, and rally will start second week of September. Still a super giant gas field 300 miles south of Italy is major news.

Valley,

I think we rally till 2040 roughly and then might go down…Does your PALS support that theory. I cant see lower before CBI is lowered. Too oversold still.

Bill

Bill, Valley, as per EW and since the late afternoon reversal last Wed Aug 27th I’ve been tracking a contracting Triangle on the DJIA. We are currently in Wave ‘d’ up which would go above 16,600 but stay below 16,680.

Thereafter we’ve got a Wave ‘e’ down which shouldn’t go below 16440.

If those parameters remain in place then we’ll have a ‘thrusting’ up wave out of the triangle which would go above 17000, although how high would ultimately be determined by the wave count that unfolds.

Once that ‘thrusting’ up wave completes then it will completely reverse and end below the recent lows.

So on that basis it would seem sensible to expect a 2040 touch before turning lower on the S&P.

Just my 2 cells worth of EW.

PALS negative this week. Yet, if we are oversold short term could move to 2040. I am still going to play cash or short this week and miss out on the up move.

WOW!!! That is huge. As in huge impacts on Nat Gas markets and a decoupling from the Russian markets for Europe. To me it is just more proof that as we search for Energy we find it. Eventually all this low cost energy will create a good economy. The economic activity relative to energy prices is a pretty solid correlation. I suspect if we can keep Geo-Political tension within reason, the next big economic boom is just a few years away. If the market corrects and flounders in the next yr and we reset all the commodities. Get ready for a great boom cycle, and this one could be built upon real economic activity rather than Central Banks. I suspect it could be strong enough to overcome all the debt created and reasonable inflation will shrink that debt. If you haven’t heard about all the recent developments in Fusion, you ought to look it up. Electricity has the potential of dropping significantly as well. Further, Fusion will be used to operate planes and ships if Lockheed Martin succeeds. Helion is pushing to beat Lockheed Martin’s time frame. France is trying to get a humongous Fusion project going, but I am not as enthused about that project, because it is not necessarily a low cost venture, but All-in-All, a very interesting time for Energy.

JaFree, that is indeed very good analysis. Low cost Energy has in the past been the catalyst for huge economic activity and gains.

I’ll need to read up on Fusion. Is that the one that is the ‘good atomic energy’ vs Fision? I can never remember.

Oil was 25 cents a barrel (not per gallon) in the early 30’s. You are right, by 1950’s the economy was getting better.

Fusion is the good kind, it is like the sun , hydrogen atoms are fused together to make helium and a lot of energy. Fission is the bad kind that breaks atoms apart, and a lot of radiation is around.

Thx people for sorting that out for me. The good kind is fUsion. got it!! coz no radiation right? Any problems with disposal of waste materials?

question seems answered, Fusion good, Fission bad.

Purvez, sorry for not answering all your questions. The waste of fusion is non-toxic as well as very small amounts. On top of that you fuel every 5 years or so. The fuel is super common Helium or tritium and requires very little fuel because the energy release in fusion is so high. The joke on fusion is that we are always 20 years away. So there is risk that they fail. However, there has been some very big breakthroughs on fusion in the area of magnetic controls which are needed to contain the reaction. As well as a new technique to pulse the reaction to get more energy out in the form of heat than it takes to maintain the fusion wirh magnetics. It is like a mini sun. I guess this is explained on this appropriate site. Especially since I found this site because I was looking at sun spot cycles for weather when I found this site and immediately loved the concept, It was quite a surprise to be able to connect my interest in the market with my interest in weather/climate.

I think it is to the huge detriment of this site that people shout each other down when they disagree. No one has a monopoly on knowledge, and no system knows what is going to happen next. One poster was even prompted to divulge personal economic information through bragging in one of these exchanges……

Good luck but I am out.

J

Mate sorry to see you go and I assume you were referencing me in part and I apologise. My intent was not to brag but to show by example that when a house rises in value by nearly 1000% in less than 25 years it is a massive bubble in the making.

Take care.

J, I agree with your sentiment but leaving only makes it easier for the trolls. We all value your input here and would rather that you stayed, please.

Same –

Joining the Plea for Jegersmart to stay for more interesting input.

Ditto.

Ditto

Added to US Nat Gas (UNG) emotional response to Egypt news and weak inventory response last thurs. While Egypt news does affect longer term US NG prices, while trying to tap into the World Prices, I suspect the Supply/Demand on the World pricing is still higher than US prices. The action today is for a short term trade based on speculation that Sept. will lead to higher than expected seasonal demand and reduced production from Frackers. Another factor is that Nat Gas is at the bottom of the trade range. Pure speculation based on watching weather, weekly numbers, as well as news. ie not very analytical.

The board has largely been respectful since its inception, please keep it that way. Too many egos in trading and too many boards where bitchiness is the norm. Encourage others to post, don’t deter. Don’t get personal, thanks.

aye, aye, cap’n!

WOW!!! WTI Oil has been screaming. Something has scared the heck out of the shorts. My personal belief on WTI pricing is in the $50-70 level by mid 2016. I am not putting my money where my mouth is on this one becasue oil has too many factors that make it harder to predict, but any increase in oil plays well for Nat Gas even though the two commodities are loosely coupled due to lack of international trade of Nat Gas, which is changing, but slowly.

8/31 13:15 Spiral update – sideways to 9/5 then up to 9/12

Peggy – is there a range that Spiral expects for this week?

ES has broken down to 1931 AH and does Spiral expect a retest of 1831?

9/1 20:25 I should have said sideways to down – this is wave B of an ABC W4. Price targets 1897, 1880.

Peggy, I take it that a 3% drop is not considered sideways movement. I’ve been trying to understand and believe in 7442, but it seems to have gotten a lot of calls wrong lately. Do you think it would be beneficial to include the % probability when you provide price targets?

9/1 20:27 My bad. The Spiral pulse topped at 8/29. Here’s the chart.https://twitter.com/mjmateer

Sean of 7442 Analytics had been predicting the 1855 low since July and now expects 2050 by Sept. 12. What calls have been wrong?

Geno, good call on BBG up 10%.

Where r the likes of Jonathan and Mark? Havent heard from them in some time. I would like to gather their observations instead of the same folks posting daily about their interday trading coin flips.

I second that. Mark was right on regarding the late solar max, and I like to put our attention back to indicators that might predict the market. Coin flips even if randomly prove right are useless.

Hi J Teofilo, who are Jonathan and Mark? We used to have a Jonathan who was ‘ultra bullish’ but he left the board a loooong while ago, long before the ‘down draft’ that we’ve felt. I haven’t had the pleasure of ‘meeting’ Mark on this board yet.

Mark was extremely knowledgeable about solar cycles and provided additional insight on such to the great analytical work John does. But his insight on markets was broader than just SC – hope he returns.

Interestingly, Mark was another who seemed to take umbrage at those of us investing for the long term in gold. I remember he had a large hissy fit, then vanished for months, tail between his legs, came back, and had another one.

Hard to believe we’re all adults here, there is literally nothing anyone could type that would cause me to lose my temper or walk away from the blog.

But if folk write BS, they can expect debate and challenge, and trolls especially. Anyone can challenge me too, that’s fine. Facts tend to win out in the end.

I have absolutely zero objection to being questioned or opposed in my view. What I do object to is being called a “clown” because I uave a different point of view.

I guess my, what many would consider, an overreaction goes back to my childhood. Unfortunately I was bullied as a child and in my early adulthood vowed to never let anyone do it to me again.

J, I find many of the comments made here useful and interesting. I rarely follow any of it as advice, but it opens my mind to different thoughts that I can feed into my thought process. As with any market decision, a coin flip is inherent. I have yet to find the guy with a two headed coin in this game `,~)

Well that wasn’t a pretty close; my gut says that Asia is going to be ugly tonight. Buckle up the chinstraps for tomorrow

IF tonight’s closing action is the wave ‘e’ of my contracting triangle call, then I’m looking for a BIG move up tomorrow. Sadly I don’t have the ‘guts’ to play that move overnight. I’ll probably regret it but I will certainly take the ‘down draft’ that follows.

Will keep all here informed when I do take the ‘short’ position.

Ref the move in oil. Oil had a massive top from 2011 to 2013 – an Elliott 1-2. Since then it has an amazingly clear 5 wave 3 drop. Right to the minute, the last 3 day rally looks like a 4 of 5 of that 3. That means we should get a lower low before a rally back to the 55 to 60 area. Then another major leg down. The commercials had been selling oil in record amoints before this collapse. They have slacked off a bit, but this is the numbers. The old record was short 100000 contracts. Before the collapse, 500000. They are still at 2X+ now at 268000. One would guess they would do their normal thing and sell into higher prices thereby blunting this rally.

Kent, I will not disagree with your analysis. I defintely believe we could have more downside. But after a 60-70% downside from the top, I would also accept a stabilization in the low 40s after a retest of recent lows. What I don’t like about oil is the drivers are difficult to predict. OPEC, Geo-political tension, price wars to damage enemies. among others, then supply demand falls in some place too. However, I feel long positions on the retest or lower would be a good strategy. If I see oil hit the 20s I may change my mind and buy in. Until then I am of the mind set that the destruction is mostly done and I am hoping it rises to support my Nat Gas positions by BTU proxy. No matter what happens the past three days were just darn impressive. Something you would expect as you near a bottom. It looked like short scare (ie worse than a short squeeze)

A new low should be followed by a rally to 60 or 65. That is a worth while long but is going long in a bear mkt, which is especially dangerous. For instance, wave 5 in commodities frequently extend, and it just started a 5, apparently.

I have cash in hand waiting for panic and another spike in the VIX. If I see value on a panic day, I am in for companies that have value. My time frame is between now and Nov to see if we get TRUE panic. We are not there yet. I am with you on the 5th wave if it occurs. I am still long US Nat Gas, as it seems fairly stable and should be a good trading vehicle as well as long position. I still believe oil is near a bottom. I doubt it will reach my buy point in the 20’s. My entire history of beating the market relies on buying value in bear markets. I welcome the bear if it occurs. Time will tell.

I think we are at the beginning of major leg up in gold that should accelerate after last high of 1170 is taken. That trendline connecting January and May highs will be broken to the upside and mad rally should begin then. Someone mentioned target of 1590 which is at 61.8% retracement of last gold bear market

Gold will see 950 first. That is 50% retracement from the ATH high

I am more or less with this guy:

http://www.safehaven.com/article/38769/golds-7-point-broadening-top

Agree !!

Bunell, this guy is already wrong with his prediction from 22nd June.

http://www.thevoodooanalyst.com/commodities/gold/239-gold-update-june-2015-d

A non-starter.

Either way we could be pretty close to the bottom. If buying physical, now is about the time.

RD you’re Aussie right?

If you are you should have been buying physical months ago. It is going much higher in AUD in the months ahead.

Oi Oi Oi

This market looks to be heading for a free fall judging by the futures at the moment.

Its pretty much over if govts think this will solve the problem.

http://www.news.com.au/finance/markets/chinese-journalist-paraded-on-state-tv-to-confess-to-causing-market-chaos/story-fnvyr345-1227507316529

Wave 5 has begun. Expect a quick drop to take out previous lows on indices. Missed my short entry but looking to enter short.

I hate it when big moves happen overnight. It makes taking a position really difficult the morning after.

I’m very glad I stayed away from my incorrect ‘long’ call though last night. Clouds and Silver Linings!!

I hate it when I don’t realise Monday was a Bank Holiday and our markets are closed for trading. Meh.

Yes I know what you mean. Us ‘at home workers’ don’t remember which are the Bank Holidays. If it wasn’t for my wife having the day off I would have forgotten too.

Still for a swing trader / long term gold trader like yourself the odd day off doesn’t affect as much, hopefully.

Yesterday was the day to get short, Friday too early, today (probably) too late.

Hey ho, We’ll get a bounce before the big one hits I reckon.

Meanwhile, this is interesting:

http://t.co/iRbKZAEL0b

Jeffrey Snider of Alhambra Investments takes a critical look at the disparity between the Q2 GDP vs GDI. As he explains, since GDP measures spending and GDI Income they should be within spitting distance. However the former is 4% and the latter 0.6%. He then goes on to explain the mathematics (statistics) behind the numbers and informs us that they both have over 30% of ‘guesswork/indirect sources’ (officially known as Trend Cycle bias I think).

Anyway the whole article is here:

http://www.alhambrapartners.com/2015/08/27/gdp-might-have-been-almost-4-in-q2-but-gdi-of-just-0-6-has-the-quite-damning-weight-of-revisions/

Be warned it’s a hard read as per normal.

Thanks, purvez

Jegersmart, (if you are still around) how often have you had IG reject a deal when the price was going AGAINST them? Yet when it goes towards them they give you a couple of points in your favour and then pocket the rest.

Today I had 3 attempts when IG rejected my deal saying the ‘price was no longer valid’ (or words to that effect) because the price went against them.

I have written to them complaining about the actions. Particularly as they have computers that can execute in milliseconds.

Just wanted to know what your experience was please. Thx in advance.

Red Dog, I’ve been trying to tell people for years that attempting to time gold is a recipe for failure. The only guy I have ever known to get anywhere near close is Jeff Kern and even he has had his failings in the past and his approach is based toward US gold stocks rather than physical or more particularly physical in other currencies.

The best you can do consistently is to get somewhere near the ball park by buying when sentiment hits extremes such as in 2000/01, 08, 11 and now or by basing your approach from a domestic point of view.

http://stockcharts.com/h-sc/ui?s=%24GOLD%3A%24XAD&p=W&yr=5&mn=0&dy=0&id=p39956929702

looks like a puetz crash window is closing now

he said that the six days before and three days after a full moon within six weeks of a solar eclipse is a potential crash window

the next solar eclipse is 9/27/15.

that would put the 8/29 full moon within 6 weeks so 8/23-9/1 was the window

not bad for a mini crash but i am anticipating the real action to be during the next window.

that would be 9/21-9/28. everybody ready?

Haha Specie….are we ready? Well I am and I suspect so is our host and a ‘few’ others around here. Is the THE FULL BLOWN VERSION CRASH or just a ‘taster’? That’s what I want to know?

wow, i can’t write

what i meant to says was

the next solar eclipse is 9/13/15

therefore the 8/29 and 9/27 full moons are within 6 weeks

so 8/23-9/1 is one window

and 9/22-10/1 is the next window

very simple information that i managed to mangle while trying to do two things at once

i will never be able to multitask

Hmmmm? Lines up with the Shemitah and Greek elections.

Surely it can’t be so obvious??

The 9/27 full moon is a total eclipse. The 1929 crash ended on a lunar eclipse. Usually the second chance top is on a lunar eclipse.

Kent, based on a sample set of how many?

Hi Specie.

From what I understand of the Puetz crash window, the more common occurrence is that the crash begins around a lunar eclipse that is also a full moon and is within 6 weeks of a Solar Eclipse. However, the crash can begin around regular full moons within 6 weeks of a solar eclipse as well.

09/28/2015 is a lunar eclipse full moon, obviously within the 6 week time period following the solar eclipse on 09/13/2015.

As far as the 6 days before to 3 days after stipulation, I’m fairly certain it is concerned with trading days and not calendar days.

So, we could be looking at a likely Puetz crash window between September 18 – October 1.

Another important fact to keep in mind is that the 6 trading days before to 3 trading days after window is concerned with the top that is made until the crash reaches its low point.

Hope this helps.

ugh me and my typing skills …..*Is THIS the FULL etc’.

hi john – thanks for the continued posts. what’s your preferred mechanism for shorting biotech here? thanks in advance

Spreadbetting – but depends on your country

ah, not legal for the US folks. what would you recommend for a US based retail client?

Get ready for global QE including US QE4 which will crash the USD and send gold soaring in all currencies. The difference this time is that it will have no little to no effect upon markets and rates will make their own arrangements.

I did not see panic today, but rather a steady downward bias, with stiff volume. Much of the volume was in the last 30 min. on an slight upward trend. Still a rather dismal (for longs) day overall. It was basically unimportant to me, I want to see REAL panic. Cash staying put for now. Nat Gas longs still looking stable, waiting for a break up, but will add more if it breaks down again like yesterday.

Anyone got any idea if Feeder Cattle have topped out yet. They are one commodity bucking the trend. The spread on Grains to Cattle is pretty big now.

FYI…

Bought half my bull back just now at 1926 that I sold at 2120 odd.

My gut feeling is that we will be warned of the bigger move by how markets behave in the run into Oct. If they rebound quickly and become overbought/overbullish then something more akin to 2007 might be in place. More weakness would suggest a set up more like 2011 is likely.

Good luck all.

Now short 3x FTSE 100, at 6066. 6100 looks like lateral resistance. Let’s see.

Dissappointing not to see further selling today. Wave 5 should be as or more severe then Wave 3. Maybe we could see a big bounce if wave 5 fails but for now im short the FTSE at 6136 which is a risky trade.

Bring your stop to BE and your risk goes away. Also although 5 will go lower than 3 it is unlikely to be the severe ‘waterfall’ type event. In fact it will be much more halting in it’s progress.

Krish, we’re on the same page it seems.

Plenty of time for some selling in the next couple of days in my opinion, certainly don’t see any major strength from the bulls.

Good luck.

PS Jeger, I’m sure we regulars recognise that this little blog is a nice place to hang out and share trading and other thoughts, with the vast majority of posters decent folk in my opinion. None of us are perfect however, so I hope you’ll reflect on matters that might have peeved you in the days ahead. I am hopeful you will reconsider your departure. But best wishes to you either way.

I think market wants to head higher. Closed FTSE short at 6075. Strong buying in US at close so keeping out for now. Still think it’s too early to say it’s a bear market as opposed to a bull market correction.

Further correction up to 200 DMA at SPX 2060 may be first in the cards

Maybe, but bulls struggling to break 2040.

Triangle and Fibs (from May peak to recent low).

http://screencast.com/t/oN1jGbL0euv

Right here would seem to present many hurdles for bulls.

It may reach 78.6% retracement at SPX 2065 and that would be great “second chance”. So it is important not to short too aggressively before Fed

But if it breaks back under 1900 then it means crash is underway. ES contract retraced 61.8% of last move down, reaching 1957 after hours

http://www.bloomberg.com/news/articles/2015-08-31/s-p-500-rout-has-room-to-go-if-bond-spreads-have-anything-to-say

9/2 1:12 Spiral short term – 9/12 H, 9/23 L, 10/27 L, 11/20 L Sean discussing the macro – price target 515. http://www.ustream.tv/channel/7442-analytics

9/2 1:20 (pm) next price target for an important low = 1463

what is the time on that Peggy? thanks

I wonder if Slater (or others) have any comments on these efforts at pitchfork channel:

http://screencast.com/t/NuejrRlN

http://screencast.com/t/YYVGCglhljsp

Both show a broken channel. 1600ish support perhaps.

don’t know yet. I think the next low will be 1777.

Has the BOVESPA bottomed and turned higher? Could this be the first of the BRICs to revive? Does the BOVESPA turn higher six months before the Brazilian economy typically revives like in the USA? What about the Brazilian Real?

Here is an after thought: I just looked up the Real and in July 2011 the Real made a multi-year high. That was four years and slightly over one month ago. Looks to me like the Real made a Delta long term 1 has a high in 2011 and is making a long term 1 as a low right now. Honestly, it doesn’t matter if it is a 1 or not because it is a long term point of some sort. And if the BOVESPA is turning up in a big way then it is turning up from a Delta Super Long Term low point and so could the Real too.

Gone for a small long Dow. Think we will head back over 17k before the next leg down. Markets are stabilising and the Bears have lost momentum.

Added some more FTSE 100 shorts 13.35pm. Bull trap is set.

I think the central banks will propel us higher again. Most on this site know central banks cannot solve the problem but if the majority of investors do believe it then the markets will charge on higher until the next let down. This is why I think shorting is a dangerous trade unless you are great at picking the tops…or you can afford massive stop losses. The bears will struggle short term to get back into this given the apparent failure of wave 5 down. My stop loss is at break even on dow longs and will just ride the rally up. John I assume you have taken profits on some of your shorts or are you still holding them fully?

I see bear flags on the daily charts for S&P and the FTSE.

I see the S&P on a weekly basis lower than last week’s close.

It all just looks very weak to me.

Central banks have one final bullet, QE4 from the Fed, which will produce the last chance rally into year-end.

Let’s see, I’m going to keep adding shorts though, prepared to sit and wait til new lows arrive later this month.

stopped out of Dow long. Looks like it was a one day rally so want to see fresh selling to take us below 16000 within a few days.

I’m still holding. Going with my conviction that a bear market began in May.

9/3 8:14 Spiral pulses for September https://twitter.com/mjmateer

12 point SPY bump from Draghi’s increase of ECB QE limits.

That’s it, 12 points.

If you needed a sign that the game has changed, there it is. Their powers are waning, nearly totally evaporated.

Draghi sounds less confident than usual, more stuttering. He even looks impotent. Shame, it’s his birthday today too. Happy birthday Mario.

Agreed, pretty weak response.

Nat. Gas Inventory report every thurs at 10:30am eastern US time. There is a higher chance it will be a strong inventory injection. This sometimes causes spikes downward and I am a buyer if this occurs with any significant move. Yesterday did not drop much below my last purchase, so I passed on adding to position, plus I thought it best to wait for the weekly report. Oddly enough, even if you get a big injection, sometimes it is less than expected and we get a break upwards. In this case I doubt it will meet my selling goal of $13.50 or above for UNG. The following two weeks have a higher chance of inventory surprises to the down side and should create a rally in Sept.

Strong injection but only slightly above expected. Sitting tight with no actions.

Strong rise on a strong Nat Gas injection report bodes well for further up price movement. in coming weeks. Oil seems to be stablizing as well, but tough to call. Watching for now.

Hmmm, not certain but SPX appears to be forming a symmetrical triangle. If that is the case would expect tomorrow to likely be an inside day perhaps, before breaking down OR up next week and setting the next move underway. It could of course break out tomorrow.

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&b=5&g=0&id=p63664046170

Just clarify that. If it is indeed forming a triangle then tomorrows high and low should be inside todays high and yesterdays low. As I say, unless it decides to move tomorrow.

My guess is it will take a few days to move toward the apex meaning it breaks next week..

Given the declining volume on this rise and the nature of a symmetrical triangle pattern, ie. consolidation, then this suggests it is a consolidation ahead of a break lower???

According to Bloomberg, August non-farm payrolls have been overestimated each of the last four years by an average of around 50,000. They’re calling it the “August Curse.”

Obviously if NFP comes in around 170K against a forecast of 220K we’ll see a decent move to the upside as it would seriously weaken the case for a September rate hike.

They won’t be hiking, that’s guaranteed. Too many calls both internationally and domestically for the Fed to move and I suggest that the markets will force the Feds hand in the weeks ahead anyway, ie. a bit of arm twisting.

Brazil is the place to be. Brazil is the largest sugar producer on earth and today say the largest one day up move in over a year in World Sugar futures. If not long World Sugar futures then how about the Brazilian Real and/or the BOVESPA?

I think that Brazil will be the first of the BRICs to recover and that their recovery has begun. (I am long World Sugar futures).

Russian Ruble and Russian stocks next to recover:

http://www.bloomberg.com/news/articles/2015-09-03/ruble-holds-firm-as-minister-moots-return-of-dollar-purchases?cmpid=yhoo

Gee guys, isn’t the Russian MICEX making a rounded bottom or bowl of the past four years and doesn’t that mean a bull market will soon break out in Russian stocks? If the Russian Ruble stabilizes then wouldn’t that add “fuel to the fire” of a Russian bull market in stocks?

If the Russians start dumping Gold to buy their stocks and the Brazilians start dumping Gold to buy their stocks and the Indians start dumping enormous holdings of Gold to stave off starvation caused by the El Nino’s famine then who will be buying all that worthless Gold to keep the price up? Gold is going down and possible far longer in time and price than is currently expected…

….and besides it is deflation don’t you know (and no QE4 by the FED).

http://www.wsj.com/articles/south-africas-gold-mines-face-uncertain-future-1441113689 That is an interesting perspective Richard…

Are Dip Buyers rulling in the MICEX and BOVESPA?

Even though I do expect the DOW to trade up to a new ATH that doesn’t mean I would buy American stocks at these levels when there are other stocks (Russian and Brazilian) that have sold off to rock bottom “sale” prices with much better upside potentials than American stocks.

In cash still?

i’m thinking too many here are watching too much teevee.

the stuff on television is called “programming” for a very good reason.

expecting countries like russia and brazil to “dump” gold is like blaming iraq for 911

Some fictitious and irrelevant employment numbers announced.

Markets confused.

Ahead of a US long weekend what’s the likely action?

Buy?

Sell?

🙂

there is a really interesting article from one of the most brilliant thinkers i have found.

The Danger Of Eliminating Cash

http://lessthunk.com/2015/09/04/the-danger-of-eliminating-cash-2/

He talks about ‘government money’ but fails to mention (ignorant of) the evolution in monetary matters driven by money disconnected from the state. (The euro).

The solution to the problems he highlights have already been put in place in the Euro zone.

GM, time for Nexus 2? I’m still struggling to understand what it is that you see in the Euro that will make the ‘difference’. Money disconnected from the State is merely a replacement for a money connected to a ‘Super State’…as if that is going to improve things.

sorry should read : ‘….is merely a replacement BY money connected to a Super State’.

The ECB isn’t a State though purvez.

It’s merely an issuer of money, with some very clear mandates set at its inception: not allowed to finance govts, and must keep currency stable. It’s not controlled by the EU, nor by any govt, nor by the people of Europe.

I’m struggling to motivate myself to write Nexus 2 to be honest, but maybe a link-fest post will enable readers to do their own research and thinking.

I could live with that kind of post, GM.

If it’s not controlled by the EU or the people of Europe then who governs it?

i’m not sure why people get hung up with the name or background of the writer of a piece of opinion. The bias of the author should be meaningless. the facts or logic of the argument should stand on their own. the reader then needs to read other sources of information from other points of view and compare those to their own experience. Only then can you accept it pending further review.

I fail to see the euro being a solution to the problem described. to think that it is disconnected from the state is ludicrous. it is the pinnacle of state sponsored money and is likely the first to fail in the next round of monetary panic.

Your biases are clearly expressed. They are shared by virtually everyone on the planet, so please don’t think I’m attacking you.

How much time have you spent studying the ECB’s words and actions, the set up of the system, the history, the plans for the future?

I’d wager not an awful lot, again, most just read the research that is easy to find.

The fact that you ‘fail to see’ something means little.

I see it, and others too.

The future will unfold and will show you why the Euro is so different.

Meanwhile, have a great weekend.

GM, i really think he may be so far ahead you may need some catching up.

maybe a reread over the long weekend

I’ll bet you didn’t stop to give a moments thought to what I just wrote?

Try comparing the UK/US bank bailouts with the Cyprus bank resolutions.

Did you even know there is a difference?

If he thinks all currencies and central banks are the same, he’s just one of many that have no clue about the evolutionary monetary changes that are already happening.

He works for a gold selling site by the way, they all sing the same song. I feel sorry for anyone that buys their half-informed biases.

Pattern unfolding perfectly keeping both sides guessing. Looks like next week we’ll get the break. Price could get squeezed for a few more days into the apex

http://stockcharts.com/h-sc/ui?s=%24SPX&p=D&b=5&g=0&id=p73228771463

You’re up late (or early) Allan?

Commodities, bonds, the dollar, gold/silver ratio: all pointing to ‘risk off’ at the moment, so the trend downwards continues IMO.

Allan, yes it is unfolding as a triangle but I’m troubled by the look of it (looking at the S&P hourly chart). Wave 2 down which ended on Sept 1st is too short compared to Wave 1 up from the lows. It should have retraced more of Wave 1.

HOWEVER there is the ‘OTHER’ possibility that from the recent capitulation lows to the Aug 27 high is Wave A and the current triangle that we are looking at being formed is Wave B. In that case we would have a thrust UPwards for Wave C. Of course once Wave C is complete then we’ll go lower than the recent capitulation lows to complete wave 5 of a larger Wave 1.

In many respects, if this is a larger triangle which will eventually break to the downside as wave 5 then I would prefer the current wave to go below Sept 2nd’s low to complete wave 2.

Let’s wait to see what the market actually does.

purvez, mate check out the Trannies. Descending triangle says it breaks down thus that gives a hint.

Also the ASX has been a great leading indicator. I suspect due to the China syndrome. It is breaking as well.

GM I’m one of those wierdos that survives on 4-5 hrs sleep per day 🙂

Sure Allan, I think the odds are with you but I would favour them more, provided this down wave goes below Sept 2nds low.

However, I’m just looking for alternatives so that I’m not caught on the wrong side of a trade. Unlike your multi-year trades I deal daily so we have very different time frames.

I very much appreciate all your thoughts here, particularly from an Aussie perspective, because of your country’s close commercial links with China.

For John Hampson – John, per your comment above that you believe we’re in a bear market, can you point me to one of your pieces where you describe how you think the bear will evolve over time and where we end up (duration, intensity, etc.) I’m looking for your “travel map” so to speak if you care to share.

Needless to say, I appreciate all the great work you do and the generosity shown in sharing it. And now great to see you’re profiting by it!

I’ll cover that in tomorrow’s post. And thanks back to you Gary.

GM if you have a linkfest on why the ECB is different i would be very interested

thanks

A link-fest would be great, but I would prefer an executive summary supported by links. I believe the world is on the border of currency crisis and I would like to hear how the Euro fits in this picture. I tend to believe that the economy that can back their currency with real productivity and commodity riches wins. I am sure at this point we could argue greatly on how that plays out, but I am pleading ignorance to the importance of the Euro and I would like to hear the plan.

JaFree: “I tend to believe that the economy that can back their currency with real productivity and commodity riches wins.”

So so true. However I’m struggling to think of even ONE country that can do that, on the world stage.

Anyone got any candidates here?

purvez, Like I said, we could argue many outcomes. I honestly feel that it is up for grabs right now, which makes me curious to hear the Euro plans that GM is talking about. I am personally not a fan of central banks and even like the idea of a currency not in control by governments. Gold used to be just that, and in some smaller sense it still is. I do not see Bit Coin filling that gap, but I am intrigued by it’s success. In general, I do not believe you can get the majority of the world to go to bit coin though. I will wait patiently to hear the Euro plan.

re gold

kinda neat picture

Or not.

http://research.perthmint.com.au/2015/08/07/a-very-silly-thing-to-think-about-comex/

Wow, one hour trading left for the week and this could go either way. We either rally into the close from here creating indecision into Monday OR the bottom could could drop out setting up another Monday collapse scenario??

I predict the US market will be exactly flat on Monday with zero volume.

Very good prediction John Li!! 🙂

However can your repeat your feat for Tuesday too, please. 🙂

Nicolas is not the only one with a perfect record of predicting the markets when on vacation.

🙂

🙂 🙂 Thanks for the late night chuckle.

John, I gotta be honest I can’t decide but this looks decidedly bearish to me.

http://stockcharts.com/h-sc/ui?s=%24FTSE&p=D&b=5&g=0&id=p73576001815

As does this:

http://stockcharts.com/h-sc/ui?s=%24TRAN&p=D&b=5&g=0&id=p23194568256

Whatever happens, whether it is from lower lows or from here, I think there is a great bounce coming that is likely John’s second chance sell before the big one.

That looks like it is going to rally significantly over the next week as does our markets. The Bears are going to get their asses kicked. Mr Market wants to clear out the bears before resuming downwards to new lows later this month. Good luck to you.

Haha, that went way over my head. I concur with that prediction 😉

New post out