By various indicators, equities in 2014 align well with the last solar maximum year of 2000.

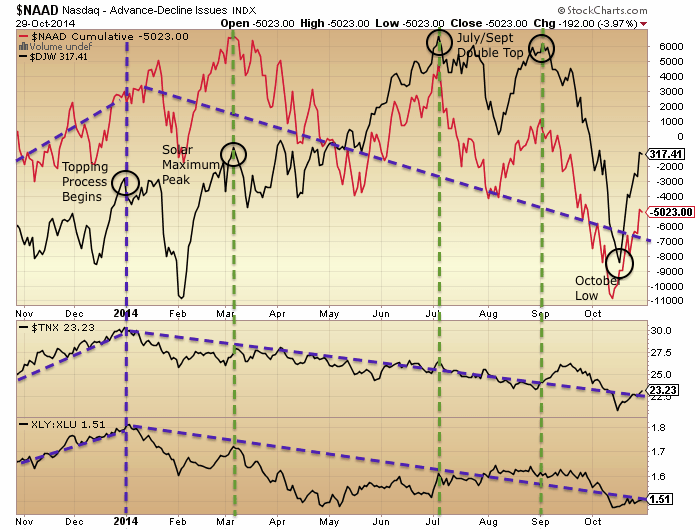

The topping process began in January. The solar maximum occurred in March with an associated speculation peak (margin debt peak, speculative target index peak with p/e>100 (Nasdaq in 2000, R2K in 2014)). A double top occurred in July and September, and an initial washout low in October (capitulative breadth spike >10). All this is captured in these two charts, using the Dow Jones World Index:

Source: Stockcharts

The July/Sept double top in price was higher in 2014 than the March peak (vs. lower in 2000), but the indicators reveal the topping process proceeding in the same way since the turn of the year.

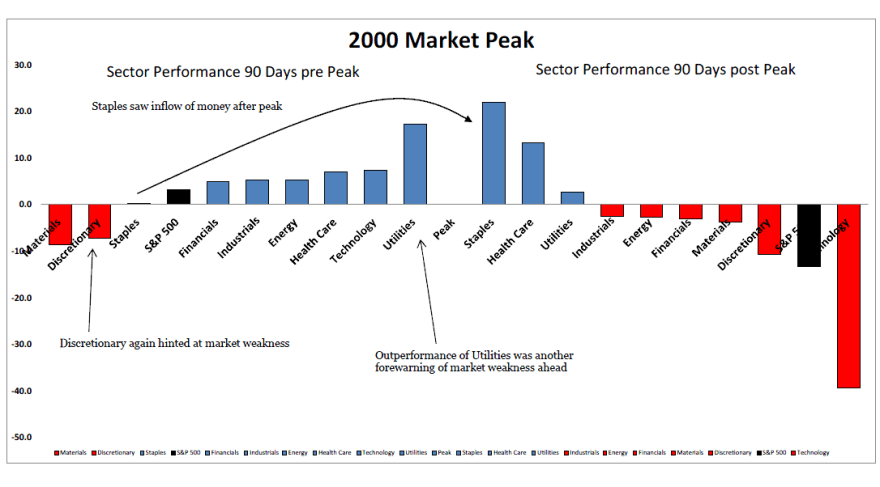

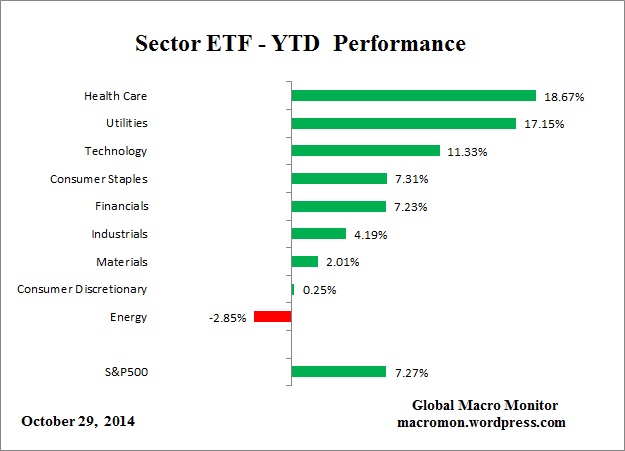

We can see the top performing sectors align (defensives signalling a market peak):

Source: All Star Charts

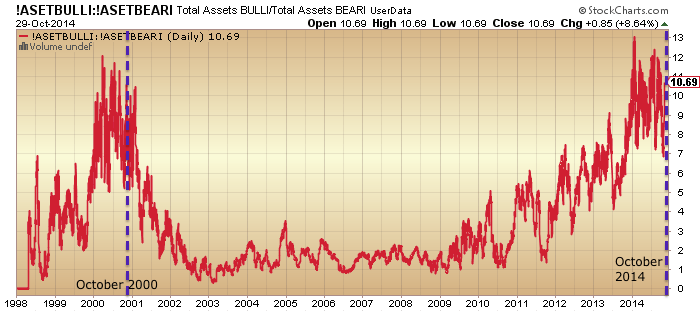

The extreme high banding in allocations aligns too. The October capitulative low failed to wash this out, just like in 2000.

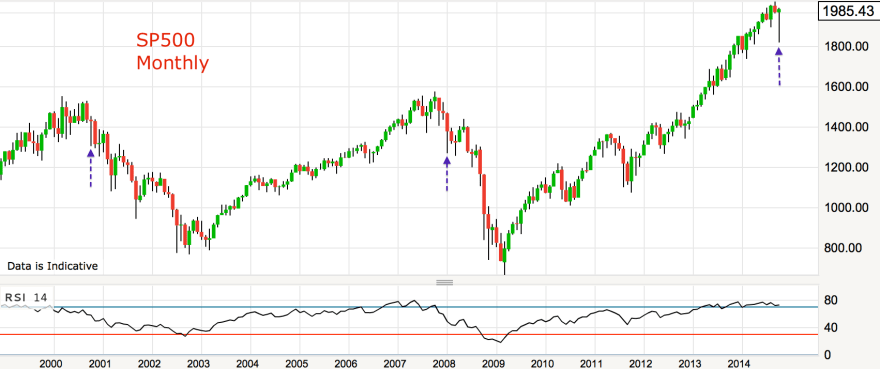

Indicators position us equivalent to October 2000 (and January 2008 if we tie in the 2007 peak). Subject to how October closes, the monthly candles look similar:

Indicators position us equivalent to October 2000 (and January 2008 if we tie in the 2007 peak). Subject to how October closes, the monthly candles look similar:

The long-tailed candle, rather than being a bullish development, instead appears as the first evidence of real selling befitting the end of a topping process. That makes the rally a rip to sell.

The candle comparison unites with the positioning by indicators (solar max, topping process, margin debt, breadth, treasuries, sector performance, allocations), so it seems right. A negative November looks to be on the cards.

John,

Thanks for you work. I love your insight.

Here is my two cents about some crazy stock market math.

If you believe in cycles and the way to count them, as I do, then check out this math.

The longest 4 year cycle advance in the history of the stock market prior to this one was 60 months (2007 and 1987). The current advance is 66 months if we peaked in September. We are about to enter month 68 of total 4 year cycle. The longest 4 year cycle from low to low was 77 months which occurred from 2002 to 2009. The last cycle was the longest by a wide margin. Unless we are going to stretch to a new record (doubtful) this 4 year cycle should bottom before August of next year.

Here is where it gets interesting. It implies the correction will be swift in time. If we are in a new secular bull market then the low will be above the 2009 low. If we are not in a secular bull but a bear then we will take out 2009 low. Either way this could be one of the most dangerous stock market set ups since the dawn of the stock market. Given this set up the chance we get an epic crash is high given we are running out of time to make a low. There is the chance we stretch but given where QE has taken price I don’t think this will be a long drawn out affair.

Buckle up this is about to get very interesting.

Thanks John and you too BlueStar.

I think both of you are going to be proven correct. I believe that we are close to a collapse of epic proportions.

The DAX could collapse at any moment IMO. Try as they did on Tuesday to hide the bearishness it only sIightly postponed the inevitable

http://stockcharts.com/h-sc/ui?s=$DAX&p=D&b=5&g=0&id=p39585218927

Interestingly the Rusty, which has been the leading indices along with the DAX since John’s SC top, is has back tested the underside of the upward sloping neckline from the head to right shoulder which also corresponds with the 50week.

It is also at a decision point. It either overcomes resistance or reverses here. If it reverses and takes out the October lows all hell will break loose.

US Thanksgiving may be packed full of surprises!

http://stockcharts.com/h-sc/ui?s=$RUT&p=W&b=5&g=0&id=p21042823067

Allan.

NO collapse here. Too close to Elections and Christmas. Besides FED still playing games in the background.

Why sing the song of collapse, collapse, collapse for the last couple of months – for forever already – you lose credibility – smell the roses instead and get real 🙂

Crash is NOT going to happen till sometime next year!

An 88.6 retracement too… similar to the SnP chop at the top in 2000 and July 2011. Yet another great post, thanks John!

yes.. the retrace in july 11 in the SPY WAS 886 to the penny

thus to be exact, the SPYhas another 35 cents to go

Roll over Beethoven.

Here we go yet again, will it be for the last time?

Aaron, sorry, but NO it will not be for the last time. You’ll be singing the same tune next week too 🙂

EXACTLY what the bears want to hear from complacent bulls.

In the great majority of cases, prognostications about the future – here on this board and elsewhere – rely on a belief that what’s occurred in the past will likely do so in the future, or at least a close approximation thereof.

So, simplistically but logically readers, why not take the same tack and review what has happened each time the Fed has ended a QE program? Has the market reacted and how? It seems as worthwhile an exercise in extrapolation as any other that has been put forth.

Unless, of course, you believe, the Fed continues to buy securities contrary to their statement yesterday. There I can’t help you. You’re on your own 🙂

Henry has apparently been reading my posts:

http://www.businessinsider.com/stock-market-fed-tightening-2014-10

Blue, I expected the bull to end in 2015,

My take was/is that earnings outlooks

Will begin to weaken providing traction to

The downside, however John’s outlook may

Still prove valid so remaining open-minded.

I am surprised that the longevity of this bull

Phase is rarely mentioned, even if you are an

uber bull, by about any historical metrics we are in

A late stage bull market.

this is a must read folks:

http://seekingalpha.com/article/2615715-a-once-in-a-generation-change-for-stocks

this is an attempt to read into Yellen’s philosphy regarding wealth effects of the market valuations. simply put, the author warns not to expect the Yellen put going forward. And even worse, expect her attack the stock valuations. I believe it, personally i remember vividly the performance of biotechs when she pounced on them. enjoy!

SS, thanks for this article. I think the author makes numerous leaps of faith in forecasting the Yellen future couching them in certainty rather than probability but laying that aside I myself have wondered how Dr. Yellen’s evident focus on the 95% might play itself out in Fed’s policies.

I do think she is interested in leveling the playing field which will evidence itself in policies that promote long-term wage growth, higher inflation and employment. (See Paul McCulley’s posts in this regard.) All other things being equal, that means, at the margin, a greater share of the economic pie to labor and less to capital.

I think the article is, as you say, a must read.

Great article!

JTTT, mate if you actually knew what amd others here were about you would know that most are not permabears, which judging by your previous posts I am certain is what you are implying.

Speaking for myself I actually called for a bottom two weeks ago and was looking for a very strong rebound, but of course let us ignore that shall we. Not only that, at that time I warned that the DAX weekly candle reversal should NOT be ignored. However, I call it as I see it and at present I see bearishness is still underlying most indices.

As for a collapse, a oollapse can last for years and a collapse is not a crash. Also in case you have not noticed, we have yet to make new all time highs in ANY major global index so as Gary just said, from a bears perspective I love to see cockiness of the bulls, who have once again become overjoyed with this latest rally as it augers well for those of us that are bearish and bearish because we see something that makes us bearish and not just beacuse it is easier to run with the herd.

I will let hindsight be my judge, thanks.

Gary, to paraphrase the great Mr Twain, history does not repeat

But it sure does rhyme.

We all know the bull will eventually die just as night

Follows day, any disagreement is really a matter of

Timing -and unlike night and day the timing cannot be

Set by a watch.

But that’s the point of this blog! To try through the efforts of this community to better judge the timing of the death of the bull (or bear as the case might be).

Gary FYI

The 10 largest crashes by magnitude:

October 15th 2008: -7.87%

December 1st 2008: -7.7%

October 9th 2008 – 7.33%

October 27th 1997: -7.18%

September 17th 2001: -7.13%

September 29th 2008: -6.98%

October 22nd 2008: -5.69%

April 14th 2000: -5.66%

August 8th 2011: – 5.55%

August 10th 2011: -4.62%

JTTT, huh? I lived through October 1987 –

Wow..do you mean the market is higher now than those days? Now, I understand why people believe in going long. Longs will be rewarded by sitting tight unless this time is different.

And Joe may I promptly turn your attention to the DAX whch has, in the last hour, gone from being nearly 50 points up to nearly 100 pts DOWN!

I say again. The DAX will lead global equity markets to hell in a hand basket before the year is out.

Make that 130 down!

Nope Alan, it will be the US Market that will lead the rest of the world down NEXT year.

Nothing much will happen for the rest of the year here except for violent swings up and down – and it will end the year on a positive note.

Joe.with due respect how do you draw that conclusion when quite clearly the DAX has been leading global indices including the US and did so into the early October lows and IF you look at the DAX rebound to date, it has been very lack lustre. In fact, as I posted two days ago.Is downright bearish?

You need to stop thinking that the major US indices are leading this move and understand that this is a global collapse that has been underway in Europe for several months.

The US WIlL NOT survive this on its own and nor will it hold up the rest of the world or are its major indices leading.

If you read John’s previous articles you will soon realise that he has nailed the speculative top in terms of the global speculative bubble, which is most obvious in the DAX and R2K indices.

Joe, just to add. The day of the lows in early Oct I was watching both Europe amd US indices very closely and I can tell you categorically that the DAX was the first index to bottom and to begin reversing. Not the US.

It is the DAX today that reversed and began pulling down US futures as I type. It will be the DAX and Europe that will be the fly in the US’s ointment.

Allan,

OK I stand corrected re the DAX

Resistance is at 1990 and next resistance on SPX is 2000.

I personally think the US market is good shape ATM thanks to 4 Trillion being pumped in by the Feds.

It’s Europe, war and Ebola which will drag the US down rather than the other way round.

Feds no longer have your back unless another round of QE comes about, please don’t think the US can isolate itself from the rest of the worlds troubles.

Denial- disbelief – fear.

Aaron, the US markets are in terrible shape.. Last I saw they were the 3rd most ovevalued markets in the world and by far the most overvalued in the industrialised developed world.

Interesting chart:

Breakout from bullish falling wedge, few bulls! $JJG $DBC $CORN $MACRO http://stks.co/h1EUS

I apologise for taking up so much of the forum but this is hugely critical today. The DAX is now just 27 pts away from taking out the critical 8900 level again.

To do so I believe sets off the most important phase yet of the collapse that began months ago and likely the initiates the waterfall declines that John writes about so regularly.

keep it up, Allan! your input is very much appreciated.

Allan,

DAX rebounded and closed – 74

BTW no need to apologise – I do enjoy reading your posts.. There will be no ‘waterfall declines’ till maybe next year.

Aaron, about half of the $4trillion splurged into the markets, another half is stuck at the Fed as per regulatory requirements banks reserves had to go up. i posted earlier my belief that the major reason for the fed to print was to replenish bank reserves and decrease their leverage. I believe we are far from being done on banks reserve reqs. Per Basel the reqs are to be inreased into 2018 gradually. i saw a stat recently that the current reserve ratio at the banks in the US is about 10%. As per Basel, its could go as high as 18%, depending on a bank! All this cash will have to come out of the market and be parked neatly with the big daddy. I also think that the current market valuations reflect the current amount of money printed already (there are numerous charts that confirm that) and that the yanked cash will continue putting pressure on the asset bubble.

Weaning bulls & corporate america off POMO will take some time. Once reality sits in, market should normalize to 1600ish level

As Bloomberg columnist Jeff Kearns recently quipped: “Quantitative easing may turn out to be a gift that keeps on giving for the U.S. economy.” The consequences of the Fed’s multi-trillion dollar bet will continue to influence markets long after QE3 is forgotten. As a result, fears of another sudden stock market selloff post-QE are likely overblown.

KISS: $SPY$QQQ $IWM $NYMO McClellan Oscillator @82 highest reading all year. Can it stay up here? http://stks.co/r0xQ7

euro/yen hit falling trend line from dec highs. 10 points to go down from here. Same as in January post the Fed taper decision setting in. Let’s see what this does to equity markets.

1929 and 1937 analog first stop 1890.

$/yen defended 109.30 trend line 2x past 24h which is bearish for stocks.

Trannies have gapped down on the open – can they stay down??

Well, they stayed down and still the market paid no mind! Crazy. To be fair, the overarching/underlying issue has always been earnings and those continue to be better than expected.

V

proof of the evolutionary brain damage –

Elvis, the chart that never lies has gone rather quiet

Phil,

LOL!

my dad went to the ER on friday and was admitted to the Hospital and passed away late Sunday night…

the chart that never lies has been bullish since Friday – but may whipsaw here soon.

with V for debt late fee usury saving the planet this morning breadth is bound to crumble quickly

LOL indeed – the video game is more real to all of you than life

too bad

Sorry to hear about your dad

he was struggling for a couple of months – just a reminder that THIS SHIT IS NOT LIFE

BBE

so sorry to hear about your loss

thanks guys

My sincere condolunces BBE.

BBE very sorry to hear about your loss. No matter how much warning/expectation its never easy. Our thoughts are with you.

wow, sorry to hear to hear of your Dad’s passing.

sorry for your loss BBE

So sorry to hear of your loss…………….

Condolences, BBE. Keep your chin up.

I’m sorry for your loss, BBE

Chop at the top… tops are very disturbing as hope is diffused in long and tedious process. Better to spend time other way then looking at the markets today.

On the other hand why is propping stock market until 4 Nov elections so important for them ?

good question. which party will benefit from the market staying high? And how would “they” keep the market elevated anyway?

Honestly can’t believe the U.S. markets this week. Corporate buyback a probably hit a record today. The government should cap buy backs to encourage better wages for the employees and more capital spending but they are so blinded by stock markets representing the state of the economy. Then they complain about wealth inequality. The government really hasn’t thought things through!

Or Krish it HAS!!

Can NOT believe that they turned the DAX around AGAIN after it broke down yet again from the wedge and what would have been yet another horrendously bearish bar on the daily chart.

Ya think these people don’t mean business to defend paeticular levels think again. At least the bears in Europe now know what DAX level has then S%#Y scared!

BBE sorry to hear about your dad mate. Kinda puts things in perspective. Chin up.

If this market is about to rollover – jury out for me at the moment – then I think we can expect more of the “Grand Old Duke” routine Allan.

I remember the wild swings pre-Lehman’s demise. Lots of money will be made/ lost intra-day as and when this thing finally gives up!

Let’s not forget that the 3.5% GDP number is actually .5 – 1% given that the way GDP is calculated was changed last July. Is it any coincidence that since then US GDP has been significantly improved………NO!

Also the hand of the Government had a massive influence on GDP last qr., so basically the US is doing just as poorly as Europe, which of course anyone living in the US would actually realise anyway.

BUT the numbers never lie right?

next week is week number 2 of the lunar edge negative period for stocks. If we don’t start down early next week, I’m thinking it’s not going to happen this year.

net line buy signals and some fairly clear buying pressure mounting in the small caps but iwm is still a lower high and it has rolled over on each similar rally attempt…

any long positions should be treated as pure speculation as the V crowd this morning indicates.

this is not a market of willing buyers and sellers individually and freely transacting…

http://stockcharts.com/h-sc/ui?s=$NYMO&p=D&yr=2&mn=6&dy=0&id=p18415994279&a=367906705&r=1414686861400&cmd=print

http://stockcharts.com/h-sc/ui?s=$NYDEC&p=D&st=2014-02-23&en=2014-10-30&id=p95368616073&a=368972370&r=1414687292229&cmd=print

I see the BEARS bears are now getting a lot of great support from Greenspan.; according to a piece in the WSJ to wit:

“Where should investors turn? “Greenspan said gold is a good place to put money these days given its value as a currency outside of the policies conducted by governments,” The Wall Street Journal reported.”

(News and sentiment are supposed to be bearish near market lows.)

How low can we go!

V madness

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=0&mn=6&dy=0&id=t52776484643&a=368645081&r=1414686524481&cmd=print

I am sorry of your loss..

BBE, it was time for your dad to go to a better place. We down here are still stuck on this prison planet waiting for more unusual things to happen. Regards.

bbe, sorry for your loss.

I am about to close my shorts and, folks, this is as a clear sign that the top is in as it gets:)

wait! whats up with those tranies?

IBB is awesome! Nic, you are a genius, i am long now!

Closed my ftse longs. Might be a terrible mistake but this rally stinks of manipulation. I’ve got a new motto for the FED…Long live wealth inequality.

manipulation or shorts like me puking out their positions.

SPX 2000 within touching distance.

Looking increasingly like this was a shallow

Correction in a continuing bull market.

Need an immediate reversal here or the

Bull marches on to 2015 imv.

jeff made money last week while I was flat – I did have my hands full with other things though

he is about to flip to the other side

as tedious and arrogant as he can come off he may be worth throwing into the mix…

http://www.bnn.ca/Video/player.aspx?vid=480315

I didn’t think he was arrogant at all. But the network that had him on is apparently staffed by bozos. They couldn’t get ONE of his greedometer charts up. Not one. They interrupted him to have him talk about the 2014 chart because they apparently found that chart and were going to show it, so he starts talking about 2014, but they couldn’t even get that chart up! Idiots!

It will be interesting to see if his call for a top within 1 percent of the 2019 high comes in. And did I hear him correctly, he’s expecting a drop of 65 to 70 percent?!

Wow what a recovery, mad swings

ok folks, pretty normal day so far. QQQ and IBB at record, GILD at record. GDX and GDXJ down their usual 4%-5%. To be really honest, this is by far the easiest market I’ve ever seen. I don’t understand why some people here refuse to play it and insist on being short the stock market. It’s really beyond me.

i closed my IBB short and went long! you are genius!

Heres the “bullshit reason” : http://www.zerohedge.com/news/2014-10-30/usdjpy-spikes-10-day-old-news-about-japans-pension-fund-allocation

this has been rumored for quite a while already, i can just see pensions getting wiped out…any reason to go long i guess.

nick buying more as he facilitates price discovery! ROFLMAO again and again

wave 2 retracement % in S&P 500 now in line with 1937 wave 2. # days at 58% or close to Fibonacci target 62%. Metals and Hui starting to look interesting. Reverse of 2011.

I see this as a 2 for now also –

ADX on GDX needs to settle down here – got hammered WAY out of shape

http://stockcharts.com/h-sc/ui?s=GDX&p=D&st=2013-05-27&en=2014-10-30&id=p81881432469&a=374053711&r=1414692358931&cmd=print

gold and silver probably a month away from a clear buy

be careful – this is a crazy ass china shop with old rotten shelves…

Hi BBE ! Don’t touch GDX and GDXJ with a 10 foot pole. This is a secular bear market. I don’t want to brag but my track record is very impressive. I might start an investing blog.

brag away – but at least my posts accurately before commenting

so maybe learn to read before bragging. lol

agree. sticking to long yen short stocks for now.

The GDX chart sure looks like it’s finishing a thrust down out of a triangle. i.e. final wave down. Also can count 5 within this final wave.

Short set at 2003 on SPX, 100 pt stop.

And short set below at 1989.

After seeing it earlier I really did think I missed any chance getting back in as I bottled it yesterday and made a small loss.

My other auto short is still waiting to hit below gathering dust at 1899., I’ll prob cancel that one out as it looks like it will may never get their.

time wise in 1937 wave 2 took 63% of wave 1 – we are currently at 58% of time it took to complete wave1. Getting close.

Price wise in 1937, US stocks had quintupled in value over the previous 4.5 years.

At the moment, they have “only” tripled over the past 5.5 years. A quintupling (if there is such a word) would see SP500 at 3330. I give it at least an 80% chance that we’ll witness a bubble to that sort of level.

Mark,

3330 by oct 2015?

I have us hitting the 62 percent threshold at the rollover between today and tomorrow. So today’s high or tomorrow’s high, assuming one of them turns out to be the top, would make the time expended by the recovery rally = 62 percent of the time the market took to drop from SPX 2019 to 1820.

Fecker!!!! It kissed 2000 on the buy end then drop, I’m waiting,

It’s bound to do one big pump up before close to kill off granny’s

Slightly down on my new IBB long but, Nic, counting on you and your impressive track record. this is total awesomeness, how could I have switched to the dark side? go Nic and his new blog!:))

Are you kidding or for real? I hope kidding.

no, he’s for real, buying HIGH and plans to sell even HIGHER!!

so far this market tracks 1937 by price and time as follows: 64% by price based on wave 1 down and 29-32% of time on both wave 1 and 2.

Assuming the market continues this shadow pattern on price and time wave 3 target comes out at 1469 to be achieved in 20 trading days.

Pegasus do you think we begin wave 3 soon. I have similar thoughts as you do.

what BBE says about this shit not being life

as they say “true dat”

a bunch of colored pixels on a computers screen backed by electrons used by most with little comprehension of what is really happening

the best cure is get outside! Leave the pixels behind for a few hours or a weekend or a week. Go climb a mountain or walk a beach, hang out with friends and family (and get them to turn off their damn smart phones!).

Hey, I’m talking to you Bud! Who me? Yeah you! Okay, I’m outta here, good evening to all!

This does not look healthy. I’m looking for mid Nov’ish for some sort of top.

http://stockcharts.com/h-sc/ui?s=$spx:$cpce&p=D&yr=3&mn=0&dy=0&id=p17028419660

Re: GDX

My last comment was posted to the previous article and likely missed by many.

https://solarcycles.net/2014/10/29/explosive-rally-again/#comment-37329

Do not think you are getting a “bargain” just because you are buying near the 52-week low. The potential for a swift and significant collapse is very real in the gold miners and gold!

nick takes profits?

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!?

BBE I never thought anyone could make ‘charts’ funny…. BUT YOU DO IT!! HEHEHEHE!

normal as a three headed snake

machines will eat themselves

digital feast of blood!

peak of wave 2?

yeah and then some

Sure looks like it. On the DJIA its dropped back below the top uptrend line that I was tracking. Dots connected were:

Oct 23rd 16775ish and Oct’29 17060 (my data includes out of hours)

Feeeeck! That’s all I can say,

Feck feck feck, ,

I’m still not moving it from 2003

digital feast of blood I SAY!

weakness into the close – that is how wave 1 started last month

if dow goes red it will be a record book data point of some sort

agree – also Biotech made its blow off top and reversing lower

if this isnt the WTF moment it is the penultimate WTF preview

but the machines have no flesh so they must drink BLOOOOOOOOD!

s&p back under wedge back test – if holds then bearish overthrow we have seen today

It works both ways and when it does they can try as many traing halts as they like( which will likely only exacerbate the situation anyways)

I would not be surprised to see the DAX crap itself again tomorrow.

Boy oh boy are the bulls cccky!

Allan,

Step back, market on its way to 2000.

same for $/yen – back under trend line – bearish overthrow

Might have been a fishing trip it coming back up

more like a shark attack!

198.80 on spy volume bar is what saved it for now

Proof enough of the PPT john? lol

“THEY” will not be able to stop it………….

Nic, buying that dip in IBB, counting on your track record, buddy!

Given the velocity of this advance, some minor pullback

Approx 2-4% would not surprise me.

By mid next month I would not be short unless

Something dramatically has changed.

retest of the recent lows and then we will see an attempt at a bounce for a holiday rally – pretty sure that fails hard

Followup on fibonacci projection to 2067, deja vu Oct 2007 from yesterday. Noticed the strong reaction to DJTA from trend top from Jul and Sep tops (approximates Calderos 3 year EW trend top from 2011 P2). Same projected top for Thanksgiving is DJIA 17570, SPX 2060, COMP 4730.

When i discovered this site i was so glad

i thought i had discovered a bunch of really smart people

only thing i’m thinking now is that i’m such an idiot

but perhaps i’m not alone

Specie depending on time of day I’m either with you or with the ‘smart’ people. I suspect they are feeling the same way too.

‘You can thank your lucky stars that we are not as smart as we like to think we are!’ …. a line from some song if I remember correctly.

thats right, Specie! Cant wait for you and Nic to start your own blogs and show them all how its done! thank you, you are awesome, lots of love!

i really didn’t mean to insult anybody here

just sayin’ i’m an idiot mostly

i understand where you are coming from, sometimes i find myself over analyzing things and maybe that’s why folks i know who have no clue why or how the markets continue to up is doing quite well by just buying a long fund…maybe it is no so bad to be like sheep? this must be the top, lol!

oh there you go thinking the universe is personal

lol

confidence is restored and you can go to the polls and vote

ROFLMAO

There is a great book called “The Idiot and the Moon” outlining the market implications of lunar phases. It is available as an ebook for $19.

Specie, I hear you and you are not alone.

there was major distribution today so somebody handed off what they thought was a hot potato

BBE how do you arrive at today being a major distribution day, please?

this day started with data anomalies on the dow with V opening 8% plus up.

the minute feed on the dow was all jacked up and then they resolved that only to go black on other feeds later…

lets all say it together

“its only a video game!”

bbe please keep telling me it’s a video game

it might allow me some sleep sometime

meanwhile, it’s time to go find some whipped cream gas if i can

Maybe my 2003 will hit tomorrow or overnight. Friday is alway an up day, I cannot remember any serious down Friday .

Good luck all.

Hubris……not a good trait to trade with…..

imho

J

It seems many of John’s fans are feeling discouraged, confused and lost. Wake up, guys! Everybody agrees there’s no free lunch in this world. How about free tips to make money then?

Bowed in and gone long dow albeit with a very small stake. To me this move makes no sense but it’s the only way to make money these days. Usually a top or bottom forms when I switch from bear to bull or vice versa so let’s see if it happens this time. Target is 17350 then exit and wait to see if it’s a double top.

Thanks, Michael. Great post!

I admire of John analysis also I said SP 500 will make all time high. Just short squeeze.Gold must be down under 1000$ before any correction of SP

Equity markets done good volatility recently.I think stock just doing sideway from now on. Meanwhile, forex and gold not doing much for 2 weeks. Now tide turns. Tomorrow Friday will be a firework for USD, gold and gas.

The following graph is by far not the only indication, that John and many others on this site just don’t want to consider, because it’s evidence is inconsistent with their bearishness or cycle bias.

Comparisons with 2007, 2008 are unjustified, if you look at the course/slope of the longer term moving averages of the main US-indices, (lacking) crossovers, (lacking) macd, rsi divergences and so on. Ciovacco is explaining everything you need to know in this regard.

Looking at the NAAIM graph the steepness of the upswing is only comparable with October 2011 and spring 2009. The first is the best outcome the bears can hope for and it may be supported by the bullishness recorded in the AAII-survey. But make no mistake, SPX 2150 by year’s end is by no means less realistic according to the stats and market models I have presented earlier.

Theo, frankly it’s just silly to say that John doesn’t want to consider the chart you present, et al. He may feel that other pieces of evidence overwhelm the facts you present and that’s why he leans bearish but to ascribe to him an outright unwillingness to consider contrary evidence to his thesis is plain incorrect.

I don’t mean „unwillingness“ in the sense of a conscious decision. But if someone is wishing to discover a cycle that is working as a tool for timing market tops and crashes, be it solar cycle or what ever,he is automatically inclined to give weight to indicators that support the suggestion. That is leading to a dangerous bias in judgement.

And solar activity cannot be an explanation for speculation peaks. People may get excited by solar activity, but it is up to them, how they deal with this excitement,just as John and his followers are deciding not to take part in bullish speculation peaks.

John’s short position is anchored on DEMOGRAPHIC so he plays a much much longer time frame than most people.

It fine for me. Jim Roger short gold around 400$ or 500$ sorry I don’t remember exactly the price short. When gold touched 800$ he felt sick. Eventually he so rich when gold down much. I already know sp may go up to 2150 but still enjoy John intellectual. However, I stay away from SP at the moment because it going down going up too much so it will be sideway for a while before any significant move. The problem John is a longer term trader whereas some reader here swing ones. Me as day trader so no problem for me. I just read his article and enjoy his vast synthesis.

Keep telling yourself that there is nothing wrong here and that the rally since 2013 has been “normal”

my naaim chart says otherwise – it also suggests a HUGE UNWIND is in the offing

http://stockcharts.com/h-sc/ui?s=!NAAIM&p=D&st=2006-12-29&en=today&id=p55210470393&a=374103854&r=1414710664538&cmd=print

BBE,

I am sorry for your loss. Best wishes, and my prayers are with you.

SC

CAN U PLEASE ELABORATE AS TO ‘NAAIM”

Alla Peters of http://alphawavetrader.com/ is bullish based on pure price for next few months. But the long term chart on previous posts correlating market performance with the solar cycle is very compelling. Also there is a regular downturn in the market every 68 months and we are due.

Steve,

Sorry we are NOT due just yet – watch the Market go UP gangbusters today ( Friday )

Hi Theo:

The chart does a good correlation. However, we need to add something at each one of those NAAIM bottoms, QE1, QE2, QE3. Take a moment and look at the first point that drops below the “Least Bullish” line. At that point and right up to the first QE, the S&P dropped 51%. It was at the fourth test that the rebound occurred. We also have to look at demographics, business cycle and credit cycle. With these and no QE, history will not repeat.

So, is this the first test, or the fourth?

The Sun has scientists puzzled:

http://www.newsmax.com/SciTech/sunspots-solar-flares-CME/2014/10/30/id/604043/

An interesting aspect was that the Dow Trans were down.

Nikkei up 1.7% at open on news pensions funds there are going to move more assets into equities from bonds. News to me is worthless, however, a friend told me today that US pension funds, etc., are reported to be doing something similar as bonds are not paying enough to meet their payout requirements. Could this be the next source of money to keep equities moving up?

in that case we may see another huge leg up, ‘dumb money’ is always last to go in, retail have given up on stocks does that mean pension funds are the new retail? if that is the case then i can see crashes to well below 09′ lows that some expect to see, after pensions are all in…taking down all the pensions, a nightmare scenario – trillion dollar question is when will it happen?

James,

Trillion dollar question? Sometime NEXT year – maybe the middle of the year. Meanwhile go LONG now…..and stop listening to any more doom and gloom.

thanks for the advice, i caught the boj news early and made adjustments immediately, we’ll see how things go when US opens later.

Looking at the SP from a pattern perspective, it appears we may see a crest tomorrow. This top my be a wave 3 or a wave 5. If it is a wave 5 then it will end as a 5th failure. Markets that end with a 5th failure of this magnitude are usually followed by a fierce sell off that last for an extended amount of time. It is safe to say they are crash type affairs.

If tomorrow completes a wave 3 however, we should see a wave 4 down that last several days and maybe drops up to 38% of this leg up.

If we look at the gap centered by 1910.50 level spx, we get a mid point gap flip that takes us to 2000.50 spx target. Sometimes the mid point gap targets a wave 3 and at other times it targets the wave 5. So it does give us a projected target, but not sure if the target is a wave 3 high or a wave 5 high. We should know by how it sells off which it is. A wave 4 is a 3 legged abc type affair while the start of a new bear market usually leads off with a 5 legger.

Thanks for all your hard work. I hope this info is helpful to some.

Kindest regards

TYVM

GN,

YES we are headed towards 2000

I think the peak might be 1/2015 after all. This will still be inline with the solar cycle, which peaked in 1928 and crash 1929. In addition, IBB and NDX are making new highs. The risk right now is that we go parabolic up +30% like in 1929 or 1987 with EVERYONE knowing it is a bubble and agreeing that it is overvalued. Still, that move will stop all the bears out.

The gold miners are collapsing. They have entered their annihilation phase where losses could be another 40-50% or more from here. Many juniors will go bankrupt. This is the ending phase of this cycle and no one knows how long it will last. But it’s about to get much much uglier. Beware.

Dow and S&P sideways since July. After reaching a high in July, both fell sharply to the 200 dma. They rallied back to a slight new highs to only sell off to a lower low signaling a DOW primary bear trend environment and flattening the 200 dma. Both potentially very bearish developments. Now, they have rallied back close to the Sep highs. After the lower low, even a higher high leaves the mkt in a precarious formation. That is the situation the Dow trannies are in, a 10 pt or more lower close will be a sell signal of the megaphone formation forming since July. The trannies have been down the last 2 days as the more popular indices have zoomed toward double tops? The r2k is down since July, never equaling the July high. The interesting aspect of this is that it feels like the mkt is zooming to all time highs and the bulls are chortling. Could it be a bull trap?

The Dow Theory gave a bull primary bull trend signal in 2009, and has now finally reversed. It is so fundamental, who cares. Everyone should have it at least near the forefront of strategy. One should be thinking bearish rules. I have already written how gold and especially oil had these tremendous counter trend rips that seem to exist to scare bears out and keeps bulls in all the way down. Time for a bear counter attack?

Kent,

Bears will be in hiding – so how can there be a counter attack?

If the bulls run out of firepower, as unlikely as that feels right now. Commodities, gold, oil, the $ and interest rates are fitting my scenario, but certainly not the stock market.

more easing from boj, yen dropping fast!

DJI looks about to break through to a new ATH.

GOLD looks on the prespice here.

Unless you are utterly convinced of an imminent reversal,

I would seriously consider closing shorts.

the last time boj surprised the world the yen went nuts for over 6 months. i wonder what kyle bass is thinking right now.

Quote from cnbc – http://www.cnbc.com/id/102139427

The central bank said it will expand annual bond purchases to 80 trillion yen ($726 billion) per year. Previously, the BOJ targeted an annual increase of 60-70 trillion yen.

Japan QE party again…

the awesome gift of free money keeps on giving, thank you Japan and Nic! i am happy to be out of the shorts and be loooooong! why overanalyze it when they just make money growing on trees! totally awesome!

PayPal freezes account accepting donations for “Ja” campaign in Swiss gold initiative:

http://kingworldnews.com/kingworldnews/KWN_DailyWeb/Entries/2014/10/30_Powers_That_Be_Have_Frozen_Money_For_Swiss_Gold_Initiative.html

US markets now at mercy of bank of japan…..is this a joke ?

Either a last gasp of this rally or it is going much higher. I say last gasp, the news is not worth a new bull leg from this point 5 years in.

r u kidding they will print almost a $1 trillion!!! after they are done, europe will start. then the Fed. I am seriously considering that I will quit my banking job and just rip these market benefits. who needs to work when central bankers work for you!! thank you, Nic, again, for making me see it through!

not only are they increasing their purchase of jgb’s, they are tripling the size of their etf purchases and don’t forget about their gpif, the size of that fund is over 1 trillion dollars, the stock allocation will be up to 25%…i am surprised that the nikkei is up only 5%!

Well my 2003 hit on SPX , lol, deep in red again.

Just closed it and will wait Sunday night, can’t sit here screen watching.

Good old BoJ 😦

watch the whole thing fizzle by next week.

Nikkei up 5 percent in a matter of moments, madness.

NIkkei up 4.8% however its exchange rate lower 2% only.

Either its stock market over shoot or its exchange rate need to further depreciated.

Gold support gone.

It is clear that “they” knew it before the news. So gold goes to triple digits, USDJPY to the moon but as for stocks… they should fizzle after the elections

I agree, My 2 hour 2.5 std deviation bands hit on es…always retraces within week or two and more.

http://tos.mx/dd8AGE

look how that upper band is hit…it might ride a bit higher but pretty much maxed out.

OMG, firework so soon even before US open. USD and gold and my Sp500 cash now stands at 2019, close to ATH. Oct usually the month for bottom

Excellent! Thank you BOJ. Moved stop on dow long to break even and revised target to 18,000. Feel much less nervous going long. Still find John’s analysis the most valid I can find but it’s getting close to the Christmas rally so a crash is almost 0% chance I would say. But that’s all my opinion which is far less researched than John’s so to be honest I’m probably just getting lucky with this move.

November can be a down month easily.

I just wonder how US can tolerate yen depreciated that much, with US dollar goes much much stronger and strong US do not help economy.

This is a sucker play to bring in longs and shake out shorts…they have every trick.

up 200 points in 2 weeks……whoever buys here is a fool.

yes you are right

WIth US no more QE, even sucker know double top (old top) is a chance for them to unload stock

today is the 30 days (trading days from 9/19 old high) cycle

need to see if the market likes sell the news

might have to wait until next week…so be it. I wont bail on a short here but it does suck.

Just going to say the same thing, I have never seen a SPX 200 point move down then anexact move up in such a short space of time

Volatility is back after no more new normal (QE) and this always happen before market starts to drop

You point out an important point, this fast up and down market action proves that only trader are in in these markets. There is no any accumulation phase or distribution phase.

Blame Putin. The west now in total war financially with Putin. Decreasing oil price, gold price , rubble rate….For example, to decrease oil price. Increasing supply by telling Saudi Arab. Could be keystone pipeline, SPR, cracking. Even increasing margin for whom want to long oil but decreasing margin for those who short oil. Lastly, all the west devaluating their own currencies except US. Conspiracy, I believe FED editted its FMOC announcement to make USD stronger in order to kill Putin. I see there is an orchestra to overthrow Putin globally

Kissinger: “He has succeeded beyond what could have been his expectation when this crisis started.”

http://www.businessweek.com/articles/2014-09-11/henry-kissinger-on-putin-ukraine-syria-and-islamic-state

You really should read Putin’s speech last week as well: http://www.zerohedge.com/news/2014-10-30/putin-western-elites-play-time-over

even a 38 percent retrace takes it back to 1950 or so…unless we are now in some new crazy paradigm where stock laws of motion no longer apply.

Here is McHugh’s Market commentary for Oct. 30. One analyst said that after a while people will get revulsed by these Markets. Here is one of the reasons:

“The parabolic rally from October 15th is likely to generate a new all-time high in the Industrials. This changes our wave labeling. This rally from October 15th has not been broad based, and has definitely had a huge push from the Plunge Protection Team, most likely motivated to support incumbents in the U.S. midterm elections next week. The PPT is pretty smart, waiting until the overdue and necessary decline from September 19th exhausted itself, not really reaching typical selling capitulation which we see after crashes, but enough selling exhaustion to remove much resistance for the overwhelming buying they kicked off. The rally has been parabolic, with no corrections to speak of, which is typical of deep pockets buying.

“The wave labeling change is shown on page 22, where wave d-down ended up being a 3-3-5 flat pattern, and the rally since October 15th is wave e-up. What is interesting about this development is that the coming wave i-down decline once wave e-up finishes will be more powerful than the sharp decline from September 19th through October 15th was. The timing for this decline should not be that far off, early 2015 at the latest, possibly as soon as next week at the earliest.”

“Thursday, October 30th’s rally in Blue Chips was not that strong based upon internals, weaker than the price gains suggests. Our Secondary Trend Indicator only rose 1 point out of a possible 9 on Thursday’s rise. There was a huge increase in New NYSE Lows on Thursday’s rise. Volume was very low on the rally. We came very close to seeing a new Hindenburg Omen observation. A small decline Friday could generate one. It will be very interesting to see how much higher the PPT pushes prices over the next three days, and even more interesting to see how hard prices fall after the U.S. election Tuesday. Most short-term indicators we follow are very overbought.”

Thanks. I would be interested on how next Tue stock market perform…

Click to access k141031a.pdf

” b) …The Bank will make ETFs that track the JPX-Nikkei Index

400 eligible for purchase.”

Well, there you have it. I don’t see how anyone can argue that markets are not manipulated by central banks; it’s there in print.

Likely the other CBs will follow suit.

With unlimited fiat currency at their disposal markets could be in the early stages of the greatest bubble in history.

http://tinypic.com/r/2yuc3gh/8

Near term, the FTSE will likely creep along upper trend resistance to the .618 fib.

But as previously stated, I’m not expecting much by way of a pull back until after the US elections on the 4th Nov.

#freemarketsnomore

Absolute power corrupts absolutely. Lets see if there is a real market left or it is just a ponzi from here forward.

CNBC will be calling a new bull market in a few hours…lol

May I interrupt. I see Americans always talk about end game. What end game would that be? we Asian need USA strong for ever because we kill each other very well otherwise. When US left Iraq the mess there but if US does so in Asia Pacific, I sure we killing each other far more than radical Islamist. IS brutality would be dwarfed by us Asia. With all respect, you as Americans should believe strong in your own nation, PLSEASE !

Le, I would start worrying about your OWN country.

My own country will down to the toilet soon.Nothing to lose nothing to worry

If spx opens up that will be the 5th gap in this rally. do they ever fill anymore ?

Runaway gaps are a sign of strength. They can wait years to be filled.

Exhaustion gaps, on the other hand… 😉

And Japan today ensured their demise. How stupid are politicians?

Gold cut through what many considered important support

Like a knife through butter.

The best anyone short can now hope for is a minor retrace

To work off overbought indicators.

Very luckily I do not go short markets or use any margin.

The case for 2014 waterfall declines is now dead.

And if anyone needed anymore evidence that Central Bankers were and are prepared to elevate stock markets then todays action by the BoJ should lay that doubt to rest.

There has been a concerted effort from the ECB,Fed and BoJ the last two weeks to inflate stock markets to avoid what was turning into a collapse.

As sure as night follows day Central Bankers understand cycles, technicals and they knew full well what was unfolding and what the potential consequences were.

I really don’t know now where this market goes. I do know at some point it will collapse and that it will be the most horrendous collapse in history due to excessive intervention.

I am thank God I am not short and I hope those that are really take great care to protect yourselves.

I will not be going long and refuse to participate in what I consider to be irresponsible, immoral action by global CB’s and trading banks.

May God help us all because I don’t think that anyone can comprehend how bad things are going to get when it finally does collapse. It will likely make the Great Depression look like a golden era.

Agree completely but I’ve realised I might as well stay long and become rich in the process of this stupidity. At least I’ll feel happier lol.

Exactly, these Market manipulations are Revulsive. . .

Did anyone read the small print released from BoJ?

Iv just taken a look, before I get shot down, did anyone noticed anything different?

Aaron I assume you are referring to the DIRECT purchase of ETF’s that track the Nikkei 400?

Here is a clue, look at the change of distribution, and time line, prob why Japan is up 5% and poor old ftse is trailing well behind that level.

EU CPI is out in 5 mins, could change or spike up.

Wtfdik

time to buy calls on the Nikkei

Allen

Just seen this scroll past the rubbish and look at the shift, below also noticed it was a tight call 5-4 vote

http://www.zerohedge.com/news/2014-10-31/markets-explodes-bank-japan-goes-all-er-increases-qqe-jpy-80-trillion

May I share my Biblical view of the end game ? It may bit of taboo for you so I apologize first. At the end, the Jews will conquer all the world. To save the world, all Christians needs to evangelize to the Jews about JC so they can admit JC into their heart. Then JC will destroy the whole world to make a new one on earth. But before that happening, Islamist trying to destroy Israel as well. They will be backed up by Russia and China. To counter attack, the West needs Japan, India and Vietnam to contain China in Pacific. So there will be a lot more things going before anything about your 41k, your retirement account, your hoarding gold, your pessimistic view about USA or whatever. I from the East, I know the weakness of China and Russia. They will lose to USA but US weakness about military industrial complex and banking controlled by the Jews. So in all, the West will win over Russia and China, then the Jews make American people like slaves, then Christians save the world with JC later on. Keep strong faith ! Keep your faith on your own USA please ! Why American so pessimistic about their own nation ? US won over Britain, Hitler, Islamists, USSR, Japan -The Rising Sun…..USA came over many crisis but always prevail from Great Depression, Bretton Wood, Oil crisis, dotcom bubble….You can have insane profits from SP500 down or up by long and short accordingly. US will go down last, actually last second after Israel, meaning all other countries must come down before happening to your USA. So don’t be panic, don’t sell out your America. Just for trading ,buy buy then short wisely even John right at the end but that not mean you can have profits by long in up swings

So does this mean you are long on US stocks?

LHL

I hope the above is an attempt at a joke…..

J

Jege.

Le is 100% correct. Suggest you read his post again and again. And try to get it.

where do you and Le get this stuff?

Have to start looking at new potential set-ups as the Head and Shoulders is out the window………..Potential megaphone perhaps?

http://stockcharts.com/h-sc/ui?s=$SPX&p=W&b=5&g=0&id=p53728775735

Le Hong you should be removed from this bb.

Aaron

WHY should Le Hong be removed from the bb? Does truth hurt you that badly or what?

And remember THIS is America not Israel.

Russia just raised interest rate by 9.5%

Aaron, fully agree ‘re LHL.

Phil,

WHY? cannot handle the Truth? If you cannot, you can easily SKIP past his posts surely? Nobody has a gun in your forehead FORCING you to read his post!

Grow up please. Reminder: This is AMERICA.

Ummmm in actual fact NO. It is John’s site and he is NOT from the US.

I think it is up to John what is posted and and what is not don’t you?

allan,

is your post addressed to me?

Thank Joecthetruthteller. Truth is always truth. Remove me or not, don’t bother me. But thank to John. His analysis very enlighten. John helps you prepare to end game, not CTA advisory services to offer trading position . I long Sp500 from the bottom but quit soon. John helps me not being so greedy. Im overseas so no way to access US futures market so I doing forex. Based on John analysis, I figure out USD will be the best. SP500 up or down USD always prevails especially ECB, BoJ and RBNZ all destroying their currencies now. Then I short gold early. Trading gold u need a broader perspective and John give you free here. Too much to get from here

To quote Rodney King: “Why can’t we all just get along”. Part of getting along is being respectful of others opinions without getting caustic. If someone has foolish ideas direct contradiction is ineffective.

many of us here are Americans, but John is British, so it’s totally up to him how he runs his site. Even if he were American, it would still be up to him! It’s his site, he pays the rent on it. He can close this comments board if he wants to, or if he wants, he can exclude certain members. Has nothing to do with free speech or truth telling or whatever you want to call it. If you don’t like how the site is run, you can always start one of your own and then run it how you wish.

prima,

I didn’t see ANYONE here saying they don’t like how the site is run. Where did you get that idea from?

I would say this, If you believe in bible, then you should remember 144000 is an important cycle, and in coming Dec 18-23 2014 would be (1) 1440 TD from 2009 Mar 6 low (2) 90 / 91 CD from Sep 19 top, in Gann term is a square and i think we likely to have the top around these date and drop til 2015 Aug.

My projection,

time is

Nov 4 big down day (if you believe in the PPT no need to support the market anymore lol)

Nov 7 TD (non farm payroll, mostly better than expected as hawkish statement from FOMC so buy on previous day Nov 5-6 and sell the news)

Nov 11 TD (low) and rally to Nov 20 Bradley day (possible top for 2014, if not this day then might be in Dec 18-23)

price is SPX 2050 around (if you draw a TL from 2007 first top Jul and connect it with 2007 final top in Oct and extend.

Good trade all.

Thanks mate. Thanksgiving full of surprises perhaps :).

I know of one analyst that says we top out just before Thanksgiving and begin the biggest decline in history right through ’til 2017 eventually taking out the 2009 lows by a mile.

Allan

A bit far fetched – WHO was this analyst?

I would like to supplement why i think Nov 20 Bradley is a high, if you have study George Lindsay and there is a famous pattern for 3 doom and a house or whatever and one of the pattern was a low +221 to 224 CD always was a final high. This corresponds to the low we have on 4/11 this year.

yes, The US government is very insidious.

However, Taiwan and China is now at peace.

Are you chinese ,Le Hong Linh ?

Just ask it ^.^

Vietnamese indeed

oh~ ^.^

Are u Chinese Chien Jen ?

Taiwanese

So let contain China , lol

yes, The US government is very insidious.

However, Taiwan and China is now at peace.

Britain–Lafayette, too

Hitler–Stalingrad

Islamist–Huh?

USSR– Bad Government

Bretton Woods–ongoing fiasco

On a GDP proportionate basis, the BoJ’s new QE program would be equivalent to the Fed printing $200B/month.

https://www.greedometer.com/boj-spikes-punch-bowl/

Thanks for your info

John, there was a graph on Your website with dependency of polish WIG index with solar cycles. But it was taken out. Can You tell me where can I find it again ?

I stopped updating that one, sorry

There is a significant amount of solar activity (flares, spots) that have happened in the last few days/week. Coinciding with the strong rallys. After watching this website for a few months it seems to me that prediction of the solar activity would be most beneficial for trading. From my observation the market trades very closely with the solar activity (maybe even to the minute). Those who could have predicted this october peak in solar activity woudl have been able to see this rally coming a mile a way, it seems.

Largest sunspot for 25 years, so they say…

http://www.newsmax.com/SciTech/sunspots-solar-flares-CME/2014/10/30/id/604043/

That’s what i’m saying. I don’t believe that we don’t know when those sunspots are coming. Look at Gann and Jensen and Bayer they all knew about this. This info has been known for YEARS. People know well in advance what the weather on the sun will be like not just when the solar maximums etc are going to happen.

I am going to have to spend less time reading this blog, as a few posters above are either trolls or just stupid.

Thanks John for your information over the years, I wish you all the very best.

J

thank you for giving us all a piece of your mind!

the chart that never lies, AS I SAID YESTERDAY, has been on a buy signal since last FRIDAY. Yet todays action hasnt forced a cross of the ma’s. that isnt so very important except that there are all kinds of weird candle sticks and patterns showing up like yesterday. I havent participated on that signal because as I also said yesterday my Dad went into the ER on Friday. So SUE ME jegersmart. (JEGERSMART! LOL no ego there! hohohoho That Jeger, he be a smarty! ROFLMAO!)

Check out that last two days candles on the $BPNYA – NEVER have I seen such odd spikes in that indicator.

And yesterday’s spy tape was one for the record books.

the NYAD is seemingly setting up divergence that is needed if a top is forming.

dangerous

I don’t want to make assumptions, but if I would bet that jegersmart was referring to a couple of other posts here and not yours when he said he’d be leaving.

Me personally, I like all your posts, both for the charts AND for the humor, so keep ’em coming!

I use google translate quickly.

I like to read John’s article,

Each I have a backup.

John is a very far-sighted and meaning person.

He is doing a very great job.

The following is taken from a very high accuracy explain righteous book (not China).

Provide users reference countries.

Historical events that have occurred, I will not explain (for example: the book naming names of Chinese leaders Xi Jing Ping.)

1. Prior to AD 2018,

a. Japan’s devastating earthquake is likely to occur.

b. Japan suffered bomb attacks.

c. Other

PS: Since then Japan has never recovered

2. between AD 2012 ~ 2018

Big events worldwide (or disaster)

3. AD 2033, China began to implement democracy.

4 …….

n. AD 2096, the Earth’s biological warfare occurred.

Derived from the Chinese Tang Dynasty accurate prophecy book:

Tui Bei Tu

Some believe that the future can be affected by the power of human intention.

That could have been the future for the people and intentions of prior times. The cumulative intention of all the people who have existed since that book may alter the events. Check out the work of Bruce Lipton if you are interested in this:http://en.wikipedia.org/wiki/Bruce_Lipton

I use google translate quickly

Since this is the present 1500 years ago in ancient books.

Most of the descendants of its interpretation is not correct.

This book should be used to explain the Chinese Book of Changes.

This book its circulation is only about 1,000. (2010 publication)

I nearly 20 years, I have read the contents of the clearest explanation.

So not many people know (the book explained after) the existence of this book

I found this book very similar to John speculation.

This book will direct sun pattern as illustrations.

Affect the time is AD 2012 ~ 2018

Correction:

Time of occurrence during the year AD 2012~2018

I consulted the I Ching in 1982 just before the beginning of the great bull market. Most people were bearish and pessimistic. So I asked was there going to be a depression and and huge bear market. THe I Ching said No, A great edifice was going to be built on a foundation of sand. As time has gone by, I have been more and more impressed with that answer.

I Ching’s more ancient than the Tui Bei Tu.

Tui Bei Tu want to read, you must first understand the definition of the I Ching.

Tui Bei Tu is the author of China in the Tang Dynasty astronomers: Li Chunfeng

He is now the prevailing lunar Modified.

This book is for the historical events that have occurred can correctly predict, and accuracy of prophecy has come to the point of “minute.”

If you’re looking to understand Chinese, this book is very interesting.

Entered a long on dow,,, yes ,,,I’m a big bear, but it Friday and I need to make back some losses.

Long dow 17325

wow not much play to the upside here but I thought the trendlines would be retested before a splat

this really is a classic set up for the divergence on the breadth indicators

Aaron,

Wise decison

I was atheist and do not indulge in superstition.

But I respect any religious person.

Everything I look at the evidence.

^. ^

The book includes not avoid alluding to the sun

Very interesting.

Chine-Jen,

Your comments are very interesting, but my background is minimal. What do you mean: “not avoid alluding to the sun”?

SC

My English is not good enough.

so I use google translate quickly. >.<

a. In a given year AD 2012 ~ 2018 period.

Global event (or disaster) will occur.

The sun is triggered culprit.

May be a serious global climate anomalies

John speculation or knock-on effects

Or other.

b. This book describes the situation in Japan is similar to severe volcanic eruption or a nuclear bomb attack.

Japan never recovered.

c. AD 2033, China implemented democratic politics after independence for the five countries.

Decades later combined into one country.

This book is a banned various dynasties in Chinese history.

Because it is extremely accurate, precise prediction history dynasties flourished.

So are afraid of each emperor.

Anyone has a new target for SPY for the bulls?

Baba wasn’t the top,Nikkei yelled Banzai and september was just a correction.

I like that – BANZAI! QE for a 1000 years – what could be more salubrious!

2150 technically. Just a measure move

Anyone else ?

2155

Commodity cycles is officially over. Anyone here has target for oil/gold/silver?

60$ for oil and 970 gold

Russia will barely

Anyone else mind chipping in?

Gold below 1000, probably hit 800, maybe 700. Oil 65

Gold will go to $800. Silver to $10. Oil to a minimum of $60 but unlikely in my view. The Saudis won’t allow it.

$ VIX and XIV has been several days without follow Index

Should be complete confusion from here on out. Commodities, pm, equities, bonds will trap huge money on wrong side. But vix will generally trend up through it all. Bet on chaos.

The Sun VS. The Markets & Governments. Guess who will win?

What? The big guy didn’t want to fight? He didn’t care? Both of the sides didn’t even know there’s a fight?!!

Come on! It’s for self-amusment only.

Is there anyone have a Nikkei USD denominated chart?

When I looked at Nikkei (Yen dominated) Today has broken the downtrend line from 2000 to 2007.

For USD/JPY, I have target first 112.67 (1200 pips) and 115 (1440 pips) from this year low.

I have the chart, but I don’t know how to upload it. You may do it yourself. It’s simple.

Draw the chart “Nikkei:JPYUSD”.

Thanks, will try at my side. Have a good weekend.

http://stockcharts.com/h-sc/ui?s=$NIKK:$USD&p=D&st=1980-01-01&en=1949-01-01&id=p94032547493

CAN ANYONE EXPLAIN THIS PRICE ACTION WITH A STRAIGHT FACE! LOLLOLLOL!

http://stockcharts.com/h-sc/ui?s=$INDU&p=D&yr=0&mn=6&dy=0&id=p04969861581&a=368645081&r=1414768535050&cmd=print

Bueller…Bueller…anyone?

jegersmart…jegersmart…anyone?

Breakaway gap exhaustion gap. It’s irrational exuberance based on US economic news and expectations of EZ money in Europe, Japan, and probably China.

The EZ money places are sending capital to the US for the strong $ and rising stock market due to US “strong” economy. I have been expecting deflation to overwhelm the EZ money Credit cycle, but obviously hasn”t happened yet. Oil and commodities going down, the strong $, and low interest rates have been correct, but not the stock market.

But did you wear a straight face while typing all that bs? lol

Yes, its a breakaway gap but in order to show it have weakness, must need a reversal bar (open higher than yesterday close but close below yesterday close).

Et tu apple? your narrative left brains wont let you look at the one hour gap in yesterday’s data feed and the agitation of the HFTMachines.

funny how the human brain simply confabulates a story to explain discursive data

Jigs – yes, that sounds very sensible. I personally want to keep an open mind about it though..!

Move along, nothing to see… http://scharts.co/108a0vg

Ditto… http://scharts.co/1nWqmlC

333 by oct 2015?

it will be a miracle if this holds up today

I said when I initially posted this chart that I respected his work

Today price hit his initial price target within a point

We shall see if price follows his script of 50% pullback..

http://pugsma.wordpress.com/

75% DOWNSIDE PROBABLE

thats a price target of 505 on the spx cash

i’d like to see it but i think you might hve started early on the WCG

Did you write that with a straight face? No argument (I’m a bear also), just can’t resist saying some of my snide, sardonic thoughts.

no straight faces around here AT ANY TIME! WCCG is never early but often in short supply!

I rate pugsma but I reckon price will likely go through by a few pips before pulling back slater9 – got to get the maximum number bullish.

And then there’s the matter of those elections! Bit higher than 2019 I reckon FWIW.

As an aside, Dow 13333 looks like a buy for a little intra-day trade IMVHO.

DYOR.

Oops 17333…

you were right the first time – your subconscious knows wat up

17333…I hope someone got that? 🙂

back at the old ML… http://scharts.co/1sVqC52

legitimate question”Did at least one index hit key upside target given by tools?”

yes

http://stockcharts.com/h-sc/ui?s=QQQ&p=60&yr=0&mn=5&dy=0&id=p44855264301&a=286359418&listNum=26

last question”Did sell algo that the computers have hit endlessly trigger?”

yes

each trader decides his own method and risk tolerance

risking 15 cents here is worth it to me…

http://stockcharts.com/h-sc/ui?s=SPY&p=60&yr=0&mn=1&dy=13&id=p94320468066&a=323847593&listNum=26

the erratic action yesterday and the desperation of using BOJ as a surrogate is proof of a back fire and unwind

hold on kids; this is no theme park

i’d heard somewhere that it’s just a video game

!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

accept this coupon for free…

a close below 2011.36 or the Sep high in the cash index would be nice. Similarity to Gold double and bubble peak in 2011 could be made then. Bubble tops are messy affairs. This one is no different.

Just one last thing, my comment was not directed at Banned by elvis…..as he seems to have got upset……maybe he gets that reaction a lot? But NOT aimed at you – honestly.

Good luck all.

I know who you were aiming at – honestly!

I just think calling yourself smart and others (any others) stupid is, well, stupid!

live and let live or move along?

avail yourself of your free coupon for

“I just think calling yourself smart and others (any others) stupid is, well, stupid! ”

ahem… 😉

Placing a short on the rebound rally after a greater than 6% correction from an all time high is a great way to short a major market. The risk reward is very high. Holding onto that short after new highs are made…..not so great. Still have 3 hours but not holding my breath.

Nice perspective scorpio

well, to me, it looks like “They Live” for at least another weekend anyway.

http://en.wikipedia.org/wiki/They_Live

take these “sun” glasses and then arm yourselves!

make sure to reload on the way down…

thank you BBE

i was hoping for a response like that

not suprised it was you

now that the boj has gone all in to devalue, other aisan countries will have no choice but to devalue, the problem is that a lot of their debt are in us dollars. i think what we have here is the beginning of asian financial crisis part deux…oh what a mess we’re gonna have.

free coupons available for!

I reviewed the last six significant corrections in SPY that had sharp declines exceeding -4% (each from a 52-week high at the time) which featured a subsequent V-type recovery that date back to May 20-2013. I used weekly charts for reference here so dates begin on the Monday of each new week:

SEP 15-2014: 201.9 to 181.92 (5wks) -9.9%

V-Recovery: to 201.82 (2.5wks)

JUL 21-2014: 199.06 to 190.55 (<3wks) -4.4%

V-Recovery: to 199.76 (3wks)

Exceed hi: to 201.58 (2wks) to 181.92 (6wks: Oct bottom)

MAR 31-2014: 189.7 to 181.31 (2 wks) -4.4%

V-Recovery: to 189.14 (<3wks)

Exceed hi: to 190.42 (<2wks) to 198.29 (next 7 wks) to 190.55 (5wks)

JAN 20-2014: 184.94 to 173.71 (<3wks) -6%

V-Recovery: to 184.95 (<3wks)

Exceed hi: to 188.96 (<2wks); to 181.31 (5wks)

SEP 16-2013: 173.6 to 164.53 (<4 wks) -5.2%

V-Recovery: to 174.5 (<2wks)

Exceed hi: to 181.75 (next 6 wks) to 177.32 (<4wks)

AUG 5-2013: 170.96 to 163.05 (<4 wks) -4.6%

V-Recovery/Exceed hi: to 173.6 (3wks) to 164.53 (<4 wks) to 173.6 (3wks)

MAY 20-2013: 169.07 to 155.73 (<6 wks) -7.9%

V-Recovery: to 169.27 (<4wks)

Exceed hi: to 170.97 (<2 wks) to 163.05 (4wks)

So the six past V-Top style corrections where the V-recovery reached back to its previous 52-week high from the bottom, all six of them pushed through to new ATH in the amount of (SPY points) +2.5, +1.7 (+8.6), +4, +8, +2.6 (fail), and +1.9 respectively (in date order from most recent to latest).

The only V-recovery that can be categorized as a "fail" was the week of Aug 5-2013 where it made the recovery and shot through to ATH in one leg before collapsing in price. The other ones typically took under three weeks on average to push through to new ATH after reaching the previous high on the recovery.

Considering NDX made a new ATH today and SPX only hit close to its previous 52-week high so far and based on past historical chart patterns, the probabilities weigh towards SPX also making a new ATH within the next three weeks of at least an additional 20 to 25 above its previous 52-week high of 2020. But be wary because in nearly every case (except for the Mar31-2013) after establishing a new ATH it also exhibited a subsequent decline that spanned 4 weeks on average.

the AD lines of the various indexes werent sporting this type of divergence with this type of price extreme…

http://stockcharts.com/h-sc/ui?s=$NAUD&p=D&st=2014-05-23&en=today&id=p22640337420&a=371810189&r=1414778979118&cmd=print

Thanks for your analysis and sharing.

Yes, I think there is a high chance we have a ATH for SPX as $TRAN and NDX has made a new ATH already.

For the target, 2051 is a likely target (that’s 1.5% from SPX high 2019) as this is an (1) uptrend line resistance (2007 Jul to 2007 Oct high TL) and (2) it is the 1.382 extension for wave one 2009 low to 2011 high (666 to 1370)

Thank you for the insight.

Steve,

New target 2060-70 on SPX

HUI hit the bottom of that 18-month trading channel today at 152 and it bounced along with gold. It took only a couple of days and did not even require Nov to reach that target. It probably stays in the channel recovering for a bit now before it can break out below 150. Maybe it does not happen or possibly takes a few more months of uphill grinding back up, but if HUI declines below 150 in the months ahead then you are realistically looking at 100 HUI and likely $1000 gold.

40

Steve, your call is spot on both shorting metal-related and longing stocks. Hats off to you. Interestingly, in the futures market we have the highest volume on down bar for two consecutive days this year, whereas all the other high volume days are on up bars. Professional money always buy on down bars (bag-holding the panic sell-offs) And in the background we have QE overdosed sentiments all over the stock market. Plus this news regarding Swiss Referendum in November. The end of a downtrend is usually marked by high volume large spread sell off.

http://www.forbes.com/sites/stephenpope/2014/10/25/switzerland-set-to-greedily-grab-gold/

Again I’m not a buyer in the precious metal market but this is what the volume and price action are telling me. I will not take on either side of the trade until a setup is triggered with a follow-through action, such as a pull back with a retest of previous low levels. And I do suggest others to do the same.

Elvis, do you think your bearish outllok

Comands any confidence with those reading?.

There are two posters here who have called this

Correctly, Steve T and Nicholas.

Phil do you think I care what you think as the minute charts look like a smiling baby puking after every bite!

What possesses guys like you and Jsmarty to personalize everything – if I am wrong then I suffer, not you.

By the way, IF YOU COULD READ, you’d have to admit that I said we’ve been on a buy since Friday – now I think it is stacking up now as a “sell”. I think there are many divergences lining up.

so again, if I am wrong I suffer. NOT YOU. Do what ever the fluck YOU WANT…

there are still coupons available for

seriously its just a video game! not even a movie for gods sake

shake off your cultural programming and reset your head!

phil

why would you even post that

everybody here can choose to read or ignore any post

the more ideas the better, and i don’t care who they come from

an idea isn’t right or wrong just because it comes from a certain individual

they all deserve consideration

maybe even mine – some day

Elvis, do you think your bearish outlook

commands any confidence with those reading?.

There are two posters here who have called this

correctly, Steve T and Nicholas.

Without typos.

your outlook is one big metaphysical TYPO son

the universe isnt personal – it has no self

nor do “I”

lol

I think Phil is really Nicholas.

of they are both NSA

or they are both NSA

typo corrected

roflmao

I’ve been cognizant of the bear arguments for a long time, whilst trying to let price dictate my next move.

But I really feel that today I was handed a gift by the BOJ; their move with regards to the purchase of Nikkei ETFs made it absolutely crystal clear why the “Prechter crowd” are so wrong.

Central Banks buying up the indices is a big deal. There was no subterfuge, no cloak and mirrors, no Presidents Working Group on Financial Markets (PPT) etc. There it was in black and white. A policy statement; a statement of intent. This time it really is different.

Gratitude to the BOJ.

BTFD

DYOR etc

what about the “pecker crowd”?

I repeat – long signal on Friday the 24th – now I think sell signal likely

peckers woods need to stop creating false dualities and straw men to stroke off to

baby took another bite; get the bib ready! ROFLMAO

that was a BIG BITE – will he swallow this time??????

and he swallows!

bulls go wild@!

http://stockcharts.com/h-sc/ui?s=$NAHL:$NATOT&p=D&st=2014-05-17&en=today&id=t53389518325&a=369189956&r=1414784062255&cmd=print

the chart that never lies is about as positive as it gets except for the NYAD divergence and the fractal setup on spx cash

Happy Halloween everyone. Going to take my kiddie out for a run and come back home for house party. Party safe for the bulls, full steam ahead

Elvis,

Highlighting your incorrect calls may be

Helpful to others as you often attempt to

Shout down those who disagree.

Perhaps time for you to reflect and reconsider.

Give it a rest Phyllis – nobody is forcing anyone to take BBE advice.

what FUCKING INCORRECT CALLS????

BUY SIGNAL SINCE FRIDAY AND I SAID I THINK THAT WE ARE GETTING AN ALIGNMENT of indicators THAT MEANS SELL RIGHT HERE!

CAN YOU FUCKING READ!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!????????????????????

now, my long term view IS bearish but I DO NOT TRADE MY LONG TERM VIEW you illiterate ass!

ahyeeeeeeeeeee communication not a possibility!

Take your uncivilized language and behavior elsewhere!

Elvis, please don’t use foul language or disgusting images anymore on this blog.

Happy Halloween. Enjoy.