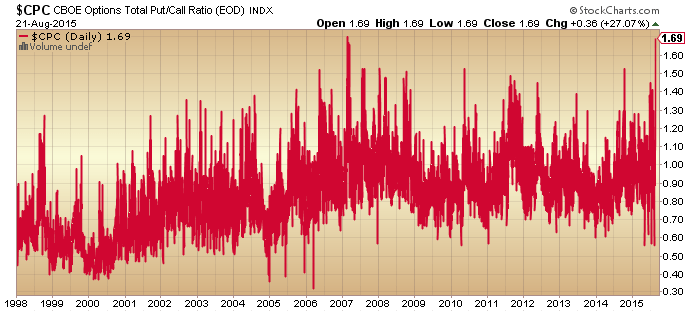

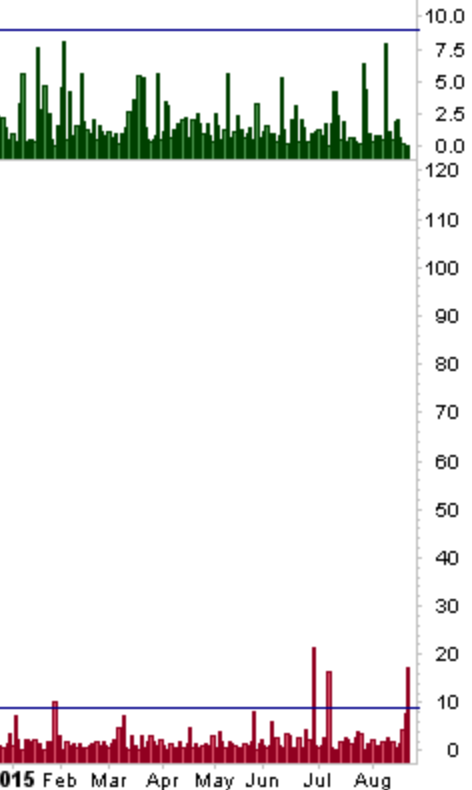

There are a bunch of indicators already at contrarian extremes and they would argue that stocks are close to a low. Here, ISEE put call, daily sentiment index and CBOE put call:

Sources: Contrahour, Chad Gassaway, Stockcharts

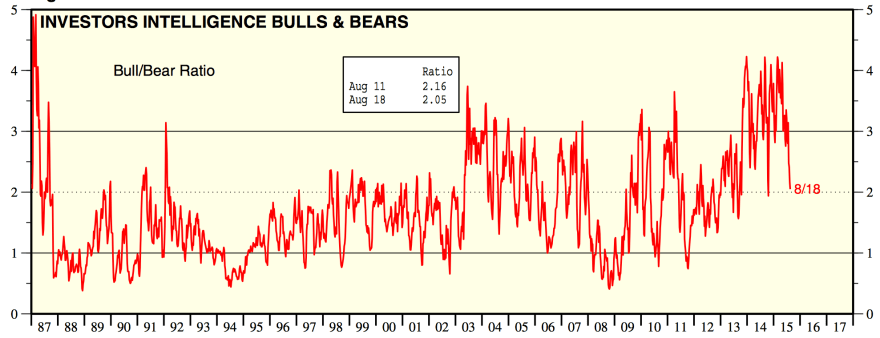

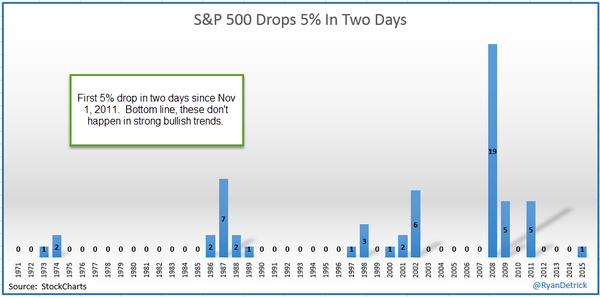

Then there are others which have either not washed out sufficiently yet or at levels whereby we might argue ‘done’ if just a bull market correction or ‘just getting started’ if we are now in a bear market. Here, Investors Intelligence sentiment, AAII sentiment, SP500 new highs new lows, NAAIM manager exposure, volatility, and the Arms index.

Sources: Yardeni, Stockcharts

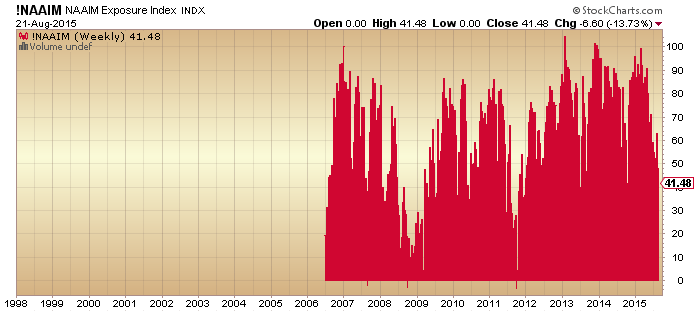

If we consider the 5% decline across the last two days of last week, it suggests we are in the territory of a nastier correction or bear market.

Source: Ryan Detrick

Additionally, Friday was a major distribution day and one of four recent such events. Major distribution days near the highs are a typical sign of a market peak. On the chart below, green above the line = major accumulation days (none in the last 6 months), red above the line = major distribution days.

Source: Cobra

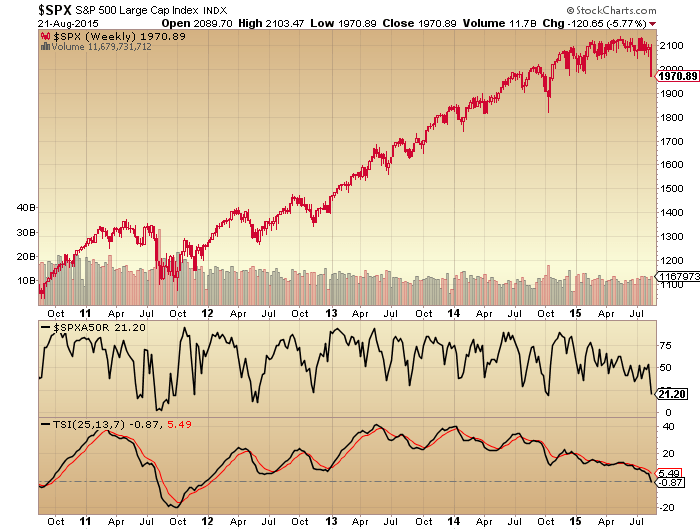

If we look at the SP500 chart we can see that the steepness of the declines of last week does not resemble the v-corrections of the last 2 years. It looks more like the crash of August 2011 (also preceded by both an arching over in price and divergence in breadth), but notably without the volume spike that may signal a bottom yet.

The heaviest falls in August 2011 took place on Monday 8th. Ditto Black Monday in 1987. The reasoning is that investors have time to stew over the weekend and rush for the exits on Monday morning. Typically stocks crash from oversold overbearish conditions, not from highs. So we have a similar set up here for tomorrow (CPC, daily sentiment, RSI all at oversold, overbearish), and a major down day is possible.

Source: Mark Minervi

Closing at the lows on Friday makes it more likely that we will open to further selling tomorrow. The question is whether buyers now step in and that can be turned into a reversal or consolidation day, which is also possible.

In short, certain indicators suggest a bounce should be near. But the steepness of the declines and the bigger picture of the (likely) bear market suggest that we could drop further and trigger the more neutral indicators to greater extremes before a bounce. I suggest the best all round fit here is that we fall hard at the start of this coming week and then get a bounce soon but from significantly lower levels. I suggest a bounce is more likely on a high volume intraday reversal hammer candle and a bottom more likely to hold if it shapes out as a lower low on positive divergences. Both are absent so far.

Here is 2011 for reference. Note we saw higher fear spikes than we currently have, two long tailed intraday voluminous reversals and two lower/twin lows on positive divergences.

Thanks John – good information!

Here is Friday update from Glenn Neely, he believes Bear Market has started:

“UPDATE

IMPORTANT NOTICE: Earlier today, I released a “subscriber warning” that there was a 65% chance the S&P had ended its bull market (the one that started at 2009’s low)! I went on to state that a break of 1980 cash would increase those odds to 80% (1980 was broken later in the day). Finally, I anticipated that a drop below 1972.00 cash would provide near-certainty that the 6+ year bull market was over. After updating my Wave charts this evening, I noticed the cash S&P broke 1972.00 (which is below last December’s low) right into today’s close. As a result, I’m “officially proclaiming” THE BULL MARKET IS OVER! On August 18, 2015, a 2-4 year bear market began in the S&P in which it will lose about 50% of its value!”

Reblogged this on Rajveer on Markets and commented:

Terrific Market Analysis

Thanks John,

I am sad. What is about to transpire will be terrible for many. There is a chance we crash into the fall. My buddy Tim Wood put this out today. http://www.safehaven.com/article/38681/the-reckoning

Yes, but it’s the start of the process to rid the world of the warmonger supreme (America), so let’s get it started. 20-30 years of hell, but a better world awaits (as long as Donald/Hilary/Jeb) don’t nuke us all whilst going down.

Keep your Anti-American Propaganda to yourself GM. Russia and China murdered

about 60 Million of their own People just remember that.

And widely recognized. But that in no way exonerates what the US has done.

The USA’s military industrial complex with the neocons at the helm (regardless of which party holds the WH) has been propagating perpetual war for decades now and has turned us into the most despised nation on earth. Those without blinders on see this country for what it has become. But our bought and paid for media refuse to let these observations slip into the mainstream consciousness. So I’m totally with GM, but I’m also not entirely confident that some despot won’t hijack the cleansing process and take matters from bad to worse.

It’s called an opinion my friend, so feel free to avert your sensitive eyes.

Yes, the Yanks did a good job on their natives first, then financed 2 world wars, whilst stirring things up. Good riddance to bad rubbish in due course.

It is not the America of a half century ago. The so-called “Greatest Generation” made America into a militant society. At its core America has always been militant. This is why the word “power” is replete in the American Constitution while the word “right” is totally absent. Only because of expected popular rejection was the Bill of Rights added to the Constitution in order to form the new federal government based on power, power, power and more powers and gain support of the Populace.

The Soviets at least had the decency to state in the beginning of the Soviet Constitution that there is no civil jurisdiction but only Martial Law jurisdiction unlike the American ruling Caste that uses deceit to rule as military conquerors with no morality. And by-the-way, I am an American.

And which nation hasn’t?

@luigi,

Most nations are similar, but none have declared themselves to be Ruler of the Planet and acted accordingly (entirely out of self interest) in our history. All on debt.

Do whatever you like within your own borders, but please, spare the rest of us your *realism* and *exceptionalism*, because literally everyone outside the US knows it is BS, and more importantly is ready to put it to a stop.

Ouch GM, you seem to have forgotten the British Empire here.

There have been other empires, including the British purvez, but they don’t come anywhere close to the US in terms of implementing war the world over.

None of those will be the next president

Damn Pedro if America is so bad why is every person from every piece of crap country in the world trying to cross our borders and live here. Don’t start with the self rightious garbage either – I can bring up the genocide of Christians in the Middle east by the idiots of Islam, what Europe did to the Jews during the second World War (by the way – If America has not stepped in with it’s war mongering you would be speaking German and eating Sour Kraut now), the Genocide of . Armenians by Turkey, the multiple genocides in Africa and the list goes on and on –

So in a very nice way I’m saying you and GM are Morons.

https://en.wikipedia.org/wiki/Cloward%E2%80%93Piven_strategy

Are you confusing morons with Mormons by the way?

America is exceptional GM – we don’t have a herd of goats and yaks walking down our mainstreets as you have in your flea bitten Country.

Just curious, does anyone believe that humans can exist without power? And Exactly who do you trust with the power? The Russians? Chinese? Wait, how about North Korea? no this one tops them all, let’s give it to ISIS? I see very poor students of history here IF you think America is the problem. Just an opinion, you can turn your eyes if you are offended, but just know we will continue to take care of your problems and are happy to do it. I hope that wasn’t too war mongerish for you. On my last note…. You are welcome for all the World Policing at our expense. ~Proud American

JaFree, a bit presumptuous to elect yourselves as the World’s Police?

Purvez, We do not elect ourselves the world police, we do what other countries cannot do and it is usually with their support. You can beleive that many Americans are tired of supporting the weak with their young men’s lives. As realist, you cannot expect Europe to protect themselves. They have been unable to do so since WWI. We would greatly welcome Power improvements from our allies. Only Question I have at this point, is are you going to put your young men in harms way to solve your security issues? Or will you keep waiting around for Amaerica? History never seems to work out when America decides to isolate itself from the world. We could easily isolate ourselves between Canada, Mexico and USA in a free trade agreement. I doubt Europe would last long in that situation.

P, those countries with goats and yaks don’t have $19,000,000,000,000 of debts.

Your days of reckoning lie ahead, I wish you luck.

For those who have just read JaFree’s comments on power and the world police (Is it Henry Kissinger I wonder), I am sure many of you will share the same feelings as I do.

Firstly, it’s not much of a surprise that he actually believes all that he has written, and is genuinely proud of their actions. He’s probably never had an independent thought on these issues in his life, fully conditioned by the state/media all of his life.

Secondly, little surprise at the pure ignorance to the facts of history. I could list dozens, but the most obvious: there were no WMDs in Iraq. It was just an excuse to keep the region destabilised and the oil price high.

http://www.foxnews.com/entertainment/2010/11/01/exclusive-naomi-watts-hopes-film-expose-americans-ex-cia-agent-valerie-plames/

We should all fear the US in the next 20 years, as they will spread terror anywhere and everywhere to try to maintain their Empire. Let’s hope their failure is swift and total. And then they will enjoy totalitarianism and a civil war, just rewards for their past efforts.

JaFree, you are a ‘chuckle’. Here’s another ‘bone’ for you:

Europe existed MANY MANY centuries before your lot were even ‘discovered’.

Let’s see what you come back for that.

P, where do you think GM comes from? Yaks in the UK? Your natural history is a bit awry, my friend.

News Flash, Europe exists today because of the USA. If you beleive otherwise, please, please by all means tell me who is the ignorant fool. I will tell you this, my thoughts about America can be summed up by the people I have worked with in this country. Russians, Cubans, Iranians, Vietnamese, Nigerians, Koreans, Indians (from India), Ukranians, Nicaraguans, Chinese, Mexicans, Haitians, Jamacians, Polish, UK’ians, French, Portuguese. And that is just a start. Too many to actually mention. So All these people from professional to average workers that I have had close work relations with, all say the same thing. They fled opressive governments, either by threat of death, tax opression, or just no work. They all have the same motive, to come live in a free society. So please, please, just tell me how small my world is compared to yours. I doubt you have a scintilla of perspective relative to mine. Why? because nobody is going to your country except people looking to take your countries over. And beleive me that will happen without America. If you honestly beleive otherwise, I wish you Good Luck!!!

Poor JaFree.

At least this is way up thread now, out of people’s way, considering this is a trader’s blog.

A few comments, JaFree’s precede mine:

‘Europe exists today because of the USA. If you beleive otherwise, please, please by all means tell me who is the ignorant fool.’

I’m guessing to his meaning, which gives a sense of the incoherence JaFree displays. Does he mean America has protected Europe in decades past? If he does, I’ll assume he is ignorant of the US funding (via banks & corporations) of Nazi Germany, to enable it to wage war. Is he also ignorant of the US funding the allies also? And then entering as late as possible to establish control over the continent? Gee, I bet the Europeans are really grateful for all of that. Since then the US has merely tried to keep its boot on Europe’s neck, but we now see some evidence its destabilising goals are failing, despite the lovely Ms Nuland’s concern for the EU.What a girl.

JaFree again:

‘I will tell you this, my thoughts about America can be summed up by the people I have worked with in this country. Russians, Cubans, Iranians, Vietnamese, Nigerians, Koreans, Indians (from India), Ukranians, Nicaraguans, Chinese, Mexicans, Haitians, Jamacians, Polish, UK’ians, French, Portuguese. And that is just a start. Too many to actually mention. So All these people from professional to average workers that I have had close work relations with, all say the same thing. They fled opressive governments, either by threat of death, tax opression, or just no work. They all have the same motive, to come live in a free society.’

The world is full of people moving from one country to another. Sorry to disappoint you, but some move to America, some move to the UK, some move to Australia. The one advantage the US has enjoyed for 90+ years is that its living standards are built entirely upon debt, which itself is built upon a system imposed by America after WW2. It will be fascinating to behold in the next 20 years how well the US copes with tough times, and I’ll bet that plenty of its citizens head for the exits before it all breaks down. I’d bet that JaFree has never travelled outside of America, and so has no knowledge of life elsewhere. He just thinks America is somehow special. Well, it has been, it’s had a great (but relatively short) run as the world’s superpower. And now it is dying, slowly but surely.

JaFree again:

‘So please, please, just tell me how small my world is compared to yours. I doubt you have a scintilla of perspective relative to mine. Why? because nobody is going to your country except people looking to take your countries over. And beleive me that will happen without America. If you honestly beleive otherwise, I wish you Good Luck!!!’

Poor chap, has he not realised that the socialists, the liberals, the atheists, they have all already taken over his country? Has he not read about Building 7 at the WTC? Has he not dug into Obama’s fake birth certificate? Has he not realised that every politician is bought and paid for by the military/industrial complex, who are squeezing every last drop of blood from the country before finally fleeing? Does he not see the videos of police brutality? The evidence, month after month, that this thing known as ‘the constitution’ has already been torn up and burned?

No, it seems these things, along with the $19 trillion in government debt and an ageing population, have passed him by. Well, no matter, the future will unfold whether JaFree sees it coming or not, and those of us who are able to see it will be prepared, safely in Southern Europe where a new free market economy is being developed, whilst America tears itself apart. I think it must be genetic, given the attitude of those who fled England and other countries hundreds of years ago, they are the malcontented aggressive kind, even after generations have come and gone.

I will not wish them good luck, they will reap what they have sown.

GM,

You are not worth my time. Let’s face it, I think you are a moron and you think I am a moron. No harm loss in leaving it at that. I would suggest that you just think twice before spewing your mind on a Site designed for trading. You started with the innappropriate converstation and I am graciously letting you finish it. Nothing changes and we all go back to trading. Just have a little more tact in bringing up topics on history and politics for which you display poor knowledge. I can still respect your opinion on trading. Although I do not really follow you much.

Good Day Sir!

I don’t actually think you’re a moron, just a typical Yank.

Agree we drop it though, and also agree the future will reveal all.

Interesting that you’ve never appeared here before, and yet here you are today, when I post my little comment. Fascinating.

Wonderfully considered analysis as ever. Sincere thanks

SPX: http://schrts.co/YSMqfG

For other weekly red candles of last week’s magnitude, we are looking back to 2010-11 – and as you discuss, they didn’t mark a low. A 15% correction would take out the October low.

A wave counting system known as “Delta” has a very rare double Long Term solution for Stocks. There is the more popular Six Point solution and the less popular Eighteen Point solution. Point Five of the less popular Eighteen Point solution is due in the first half of August. I am holding that its odd number points are lows and the even numbered points are highs for the four year duration of the Eighteen Point solution. Thus, I am looking for stocks to have bottomed, already, or soon to bottom and turn back up to a high Point Six.

I have been looking or expecting Point Six to bring in the Six Point solution’s point Two along with the Super Long Term solution’s point Six as the ATH for years to come –in mid October. But if that doesn’t happen then I am looking for the Eighteen Point solution’s Point Six to be a “second chance” top that will lead to an Elliotican’s famed “third wave” decline. The Super Long Term’s point Six is due in May, 2015, and that may be exactly what happened.

This is why I am sitting on cash and calmly bidding my time looking to go short stocks for a huge decline.

(In short: Delta’s Eighteen Point Long Term solution with Point Five as a low argues that Stocks will turn back up in a significant way which backs JH’s view of a potential significant bottom –soon).

Well done Richard… thanks for clarifying your position…

JH… brilliant as ever… but I know its too soon for you to be dancing the jig… you have more than your hard won funds at stake in support of your theory on solar cycles. It seems clear to me that the SC has unequivocal influence. What is unclear is how to harness that pattern more precisely. Perhaps precision is less important than good money management skill and caution/faith near the turns.

Hats off to the majority of posters here who keep these threads congenial and yet challenging to read and study. Much appreciated as I’ve learned a tremendous amount from you all.

Best,

HVA

Hudson Valley Astrologer,

Agree with you. Solar cycle does have strong impact on markets/economies worldwide but we still need to do lot of work to figure out exact relationship/timing of SC with say how a top is made in Dow, employment data or inflation etc

As bearish as I am longer term I actually agree with you Richard RE rebound. I think stocks will bounce decidedly, but from a lower level.

We may get to that lower level very quickly. I have said all along that there will be NO US interest rate rise and that in fact the Fed will be forced into panic reactinary mode at some point and another round of QE.

Richard I, I think John Li asked you for a link to the Delta system. I tried ‘Googling’ it but with no relevant results.

Please, we need some credible links to read up on. Thx

Here are my wave counts for the leading equity indexes. Sorry I do large charts. I called the top back in May for the SPX, but I don’t see it as THE TOP, rather primary wave [3] with still another push up to complete cycle 1 of the bull market that began march 2009.

The typical target for fourth waves is the fourth wave of lesser degree. I’ve marked these targets and as you can see, other than the Dow, the other indexes still have a fair amount of downside ahead. I’m looking for a triangle pattern to develop for the fourth wave, but it isn’t a must, it can take a number of forms other than a flat as that was the pattern of primary wave [2]. So, if I’m correct, then we should see an abc pattern down to the pullback low for the (A) leg of the triangle, then more chop for months before the equities break out to new highs. Then, next year everyone gets to “celebrate” the crash.

SPX:https://alphahorn.files.wordpress.com/2015/08/spx-daily7.png

DOW:https://alphahorn.files.wordpress.com/2015/08/dow-weekly-cycle.png

Nasdaq:https://alphahorn.files.wordpress.com/2015/08/nasdaq-daily1.png

RUT:https://alphahorn.files.wordpress.com/2015/08/rut-daily2.png

Alphahorn,

I agree that we WILL see ATH probably in 2016 and possible ALONE in the DJIA.

Nice charts Alphahorn. Thx for sharing. Please may I ask what does SC1/SC2 etc stand for in the DJIA chart?

Super Cycele 1 and Super Cycle 2

Thx for the explanation Alphahorn.

JH, excellent post. As a reader of many blogs yours are always the most useful as your data is relevant and conclusions make common sense. And you add demographics and SC which makes it unique.

Thanks everyone

I have only been posting for about a year on this Blog. Soon after I began to post I brought up the issues of a coming Mini-Ice Age –and– a major El Nino. I did this because both are issues involving celestial bodies.

Starting at the Equator the Sun “rises” and “sets” going as far South as it can and then crosses the Equator to go as far North as it can and returns to the Equator every 365 days/one year. Well guess what. The Moon does the very same pattern but goes five degrees further South than the Sun does and five degrees further North than the Sun does but takes 18.6 years to complete that pattern or cycle. This is what is known as Lunar Declinations. When the Moon is rising and setting close to the Equator, for several years, it helps to produce the most powerful El Ninos. And that is exactly what is happening right here and now!

That I predicted a powerful El Nino a year ago is no great mystery. I simply went off of those who have made this discovery and it is they who have been proved correct –not me.

I am bringing this up because the expected El Nino caused Drought of India and southern Asia just got powered up ….big time. Why? Because those two Typhons did exactly what Typhons do during powerful El Ninos.

Last week I went long World Sugar futures because I am expecting the mild Droughts in India, Thailand, and Australian sugar cane growing areas to start intensifying. I have no other positions on at this time which means I have no stock positions on. Due to celestial bodies etc. I have been looking to go long Sugar and Short American Stocks.

What? Despite ath in stocks in October as per many recent posts? Surely you should be buying dips?

Sunday prices on IG indicate a bounce at this time fwiw…

J

I bought a dip: World Sugar futures (Sugar #11). (I have stock, forex, and futures accounts).

Richard, I don’t see this as a sweet chart set-up, apart from the potential for some Fib support:

http://screencast.com/t/bO2bS1drKs

(A nifty interactive chart tool at Barchart, better than Investing.com).

Good luck with the sugar trade, but it would appear to be the latest in a long line of weird and wonderful ideas you have espoused over the past year or so, and I can’t recall any of them making sense or coming to fruition to date.

But I am interested in hearing from Peter_ as to how high he thinks the final wave up in US stocks might go, and over what timeframe? Thanks.

I took profit on my stock longs on the day of the February high and posted on this blog about that fact. Latter, I went long again and took profit the week before the May high and posted on this blog about that fact too. If you don’t believe me then go research if for yourself.

My going long World Sugar futures isn’t based solely on the weather even though that is a very powerful reason to do so. It is also based on my expectations that the multi-year decline in the Brazilian Real is over and will most likely start to rally. Why? In the past several weeks Brazilians to the tune of a third of a million at a time have been using social media to hit the streets demanding the removal of their (Communist) President.

Hmm, another wacky thesis, this one is possibly your best yet.

Excellent… the timing of the rain is crucial here. Also, coffee, rubber, palm oil, rice, tin and copper concentrates out of Indonesia could negatively affect supply when the floods come… Thanks R.I.

John, I use a different cycle count which is based on Iching. 2015 should be a volatility year but 2017-2018 is when the global financial market will experience a greater collapse that is bigger than 2008 and 1998. In the near future we will see China and US join hands. By 2017 I speculate even China will exhaust all ammunition. We’re in the cycle of exhaustion.

September we will see the bottom and will continue to make highs. If I say this two weeks ago it will probably get a lot of cheers. I say it now and as I type ESU15 running 1956, I think I will get a lot of laughs. But I just work with law of nature. If it doesn’t happen, it’s my fault, not the market.

As a trader, money management is the only rule. it really doesn’t matter if I’m right or I’m wrong. I just need to be on the right side. I believe all of us have witnessed some pretty good drama these past weeks. How easy it is to change the mind of the mass? One week they are ultra bullish of ATH, by weekend they say it’s bear market. Time is indeed relative and subjective. If there’s one thing I learned, it’s that we’re slaved to time, time dictates us. It’s the reason no one has accurately predicted the future. Except for the very few. And the secret lies in the very few.

Good luck to all. Stay Humble (…Richard)

Wasn’t it Gann who said Price and Time?

Rise and run. Law of nature 🙂

luigizerozero,

Can you please suggest path of SP500 once bottom is made in Sep 2015? You expect bottom around 1770? Also You expect rally all the way to Jan 2017 to 2500/3200 after Sep 2015?

Thanks.

From this week onward I am expecting that “weather premiums” will be put on the Ags. Strong rallies in the Ags will initially help third world commodity societies. That will help to stabilize and rally many third world currencies and their stock markets. In the long run this El Nino is going to cause a Biblical type of drought that will be very bad for many third world societies. But that is then and this is now.

If this week the Ags start getting weather premiums put on them then I think the odds are still good that the DOW will make a new ATH in October.

I will be watching the Brazilian Real to see if it starts to rally early this week and if it does then I expect US stocks to turn around and rally too. But that doesn’t mean I will be long stocks as I am expecting to short stocks in October.

I am long Sugar and I might go long other Ags such as Coffee, Soybeans, Wheat, Corn, and Rough Rice etc. (Commodities that will be effected by the Drought produced by the powerful El Nino.)

Even if the weather changes, it does not mean the ags will follow. Look at oil as an analogy. If someone had told you the current conditions in the middle east and Iran would be embargoed several years ago, most would expect oil to be $200. The dust bowl lasted from1930 to 1940. Most commodities bottomed in 1933 and no great shakes after that. Ironically, the good part of the bull mkt got started in 1940 (WWII) AS THE SEVERE DROUGHT ENDED. Markets do not play.

This American Sunday evening Asian stocks have opened lower and DOW and USD index futures are also lower….so why has Gold futures not move higher? Could it be that the lack of Gold futures moving higher in what is supposed to be a continued panic in stocks is actually indicating that the panic selling in stocks is over and a new rally is getting under way? (I am not positioned one way or the other in stocks but this is something, seriously, that stock traders should be considering). (This also raises the question that Delta’s 18 point Long Term low 5 is in and a rally up to point 6 is underway –that is due in October– while Gold reverses and continues on to its low Long Term point 1 –also due in October–).

Gold’s lack of continued buying and the prospect of the Grains getting a weather premium put into them points to no more stock panic selling for now.

Do you have a link to this Delta system?

I think I just had it confirmed that Nicolas has several aliases…..:

The certainty, the non-sensical non-answers, the avoidance of debate.

Yep more trolling. Unashamed, unaware and irrelevant. Just another liar, as if the world needs one?

J

“Gold’s lack of continued buying”……….

Sorry, but now I have to say something. Look at volume on up days compared to down days starting June. Not to mention that withdrawals from the SGE are soaring having reached another record last week.

Physical buying is through the roof in Aus and I can guarantee that as I have it first hand and suspect it is everywhere.

http://stockcharts.com/h-sc/ui?s=%24GOLD&p=D&b=5&g=0&id=p35551000307

Just as an aside on oil, I think EIA has production numbers of the US too high for Q4 2015 and also into 2016. I suspect that the market may lose up to 1m boe from peak to trough in terms of US production. Whilst I won’t be going long oil just yet I am just keeping an eye on this side of things, because I would like to start building a swing long position over the next few weeks or couple of months, especially if there is a “washout”. I think that quite likely as the curve has flattened considerably so there are some tough decisions for producers in terms of storage economics waning, storage capacities limited and turnaround season starting to come into effect.

This may have some opposite effect on things like RBOB price despite record refining quantities currently.

Looking pretty brutal at the moment, I have taken half my Nasdaq shorts off the table this morning, still have XLF and QQQ and IBB. This quarter could be the best of the year yet….we will see….

Be careful

J

I should add to the above that I am referring to WTI only here, I expect we could see some WTI/Brent spread widening in the next few months potentially. That could also be traded of course, but I prefer to wait until after refinery turnarounds.

J

I’m gonna trot out my dog eared chart for one last airing:

https://www.tradingview.com/x/aUvlzySO/

The data is up to last Friday and the dotted arrow shows the overnight lows. I’ve left the original count ‘as is’ (to show what my thoughts had been) but it is the ALT line that has clearly prevailed.

The break of the lower green trend line overnight shows that the ‘top’ is in. In the short term we might get a bounce back up to the green trend line but it will then rapidly fall to the start of the ‘Ending Diagonal’ (the horizontal purple line). So there is at least another 1000 points to lower go on the DJIA before we get our 2nd chance (wave 2). That wave at a 50% retracement will only get us to 16500 and at the 61.8% to 16960.

That is some serious technical damage and I can’t see any new highs for the DJIA any time soon.

Congrats to all who managed to get the bulk of this down wave.

There is however a ‘niggle’ regarding my above post. Unlike the DJIA where the bottom trend line is clearly broken, the equivalent trend line on the S&P is where the overnight lows stopped.

Right now this divergent behaviour is difficult to reconcile in my mind. I’m just putting this out there to outline possible conflict between S&P and DJIA.

I wrote the above ‘niggle’ bit too soon. The S&P has also broken below the lower trend line. So for the moment it would seem like my original thoughts stand.

If the carnage continues we’ll have QE4 before the end of the second week in September and gold will go moon shot.

And when I say that I am nit talking about the carnage in the stock market. I am referring to the carnage in corporate bonds.

http://www.forbes.com/sites/stevekeen/2015/08/24/china-crash-you-cant-keep-accelerating-forever/

From now and for decades to come the Ags/Grains are the place to be.

Fascinating, he’s started repeating himself within hours this time.

Congrats John! Its happening just like you said as I feel this is more than a correction now. Took a bit longer than you thought and its happened earlier than I thought but we all knew this was inevitable. I hope the pain continues and we get a proper 30% washout.

Are you short Krish?

10k just went past, didn’t take long did it?

No I missed the opportunity for most of the gains. I’m waiting to go long when its all over

Shame, be careful with the longs. Good luck.

A couple of charts, showing where I think the bounce will come.

I read some interesting stuff on the angle/speed of declines years ago, and so far this one is very steep, which fits with the initial decline from the high back in May.

Close up:

http://screencast.com/t/mGtTSUjGiBmX

Longer-term:

http://screencast.com/t/TKCoMnGJYcu

Owning a bad call now….I was calling for 10k on the Dax in short order, and it’s now under 9,700, support has given way. 🙂

I think today may see capitulation in the US markets, and that may be the time to buy.

8/24 9:15 1st wave down in 1929 from 9/3 to 10/4 = 17%. If this time is the same, target 1769 as early as 8/30. just saying

Basically 8.6 x 10 years from 1929. Is Armstrong mentioning this ?

1770 is the 23.6% Fib retracement level from 2009 bottom to recent top.

That would be interesting.

I think it makes sense to keep in mind the market was losing its underpinning one stock/sector at a time, and as I said on the blog a couple weeks ago, the indices themselves might be the last to go in the stealth bear. That’s exactly what’s happened so I think the operative approach is not to think this bear has come out of the blue but has been a process and some time has already passed.

Perhaps:

Now this is not the end. It is not even the beginning of the end. But it is, perhaps, the end of the beginning.

And I realize I’m speaking to the choir here 🙂

Waste of pixels, but no one noticed it.

What an absolute putz…

Wow the DJIA just lost 400 points in the FIRST 5 MINUTES of the opening. Now if that’s now a WATERFALL then you must be looking at something bigger and more spectacular than Iguazu.

……and in the next 10 it’s gained twice as much. Steve T please take a bow for your ‘volatility’ and ‘sell off on Monday’ calls.

Can’t say I took ANY advantage of these moves sadly. Been sidelined since about an hour ago (now = Mon 24 Aug 14:45)

Time above is BST.

I have a post in moderation that identified c.1848 as a bounce point on S&P.

It was posted around 1pm BST I think.

The charts are time-stamped 13.45 BST, when they appear.

GM great call!! Bigger question is did you take advantage of it?

Right now I’m looking at the ticker and each ‘tick’ move (on my quote system) for the DJIA is 20+ points either way. THAT is WAAY too rich for me.

No, I haven’t traded yet p.

I should have got my account sorted earlier and gone short, I hate going long risk when the trend has changed. I’ll admit I’m not a good short-term trader at all, asI don’t have time to watch it closely some days.

I will concentrate instead on nabbing some cheap junior gold miners in the weeks ahead, for the run up I think lies ahead over the next couple of years. 20x – 40x potential returns if the gold price goes to c. $3,000.

Wow, GM those return beat anything you can achieve on a shorter time frame.

I wish you ALL THE BEST with those trades.

Thanks p.

My XLF gapped down so far it hit my limit at 18.9. So I am out of that one. IBB also now closed. Nasdaq shorts still running (half of them closed earlier).

This is much better than the China short earlier this year.

J

Congrats to you and all other shorts over these past few days. Can’t have been an easy few months, but hopefully you’ve all banked some very nice coin.

I wonder will we EVER see Nic again?

Thinking of the poor guy today, he was fun, polite, but sadly always going to come unstuck.

Don’ t worry, he not worried one bit.

Maybe today he was just a little, who knows.

HSBC graph looks grim. Does make me wonder about them and any big cockroaches with theiir exposure to the Far East. Too big to bailout, any rumours?

Steve,

Congratulations spot on

Do you have an idee what’s next into September?

Thanks in advance.

Hi John,

Wonderful analysis as always.

One thing i expect to remember for some time.

Joe Weisenthal at Bloomberg nailed the bottom in gold per dollar perhaps for all time with his pet rock comment

It wasn’t Joe, it was Jason (versus me):

http://incakolanews.blogspot.co.uk/2015/08/screwtape-files-versus-jason-zweig.html

my mistake

thanks for clearing that up

nice work

Screwtape is just fun, fibonacci stuff is fascinating.

Be interesting to see if the SPY gets to 1770, a fib support level.

Hey there’s a bloke I follow who was long at S&P 2015 and has just added more longs at 1890ish.

He used to be a professional trader for a firm but now just does this for himself.

He is very rarely on the wrong side (apart from the 2015 long trade OBVIOUSLY!! lol!!) and despite the ‘setback’ I suspect he will still come out ‘smelling sweet’ at the other end.

Maybe he plays Poker as well to keep his ‘edge’ up.LOL.

AMAZING!…How much money was thrown at this market in the last half hour?….and what are the chances it all evapourates Chinese style before the close?

Allan, perhaps not all but certainly ‘half’ of what was thrown will disappear.

8/24 10:46 Sean at 7442 Lab expects Spiral radius price 2040 by 9/11. http://www.ustream.tv/channel/7442-analytics

Hi Peggy, previous target was a possible retest @ 2103 by 9/11…I assume that scenario is now out?

I posted here last week that it would be a lower high by 9/11. Those price targets currently are 2040 and 2090.

You can tell a lot about a person’s wit by the way they present themselves on the internet. In your case, GM, you talk a lot but you don’t have much wit. That post was directed at P, not you. Read. Think. Speak. Or better yet keep it shut.

So when P wrote:

‘Keep your Anti-American Propaganda to yourself GM. Russia and China murdered

about 60 Million of their own People just remember that.’

and you responded:

‘And which nation hasn’t?’

I’m supposed to work out that you’re responding to him? (That was his only comment to which you could have been responding).

I love posters like you that arrive on a down day (disgruntled bulls I suspect). You think many other nations have murdered ‘about 60 million of their own people’? OK, well, facts would tend to prove otherwise. As if that would excuse US policy.

As for your kind advice to me to ‘keep it shut’, as I’ve mentioned before here and elsewhere, if it pains you to read my words, skip over them, it’s not hard to do, or come back with some reasoned debate. That might be hard.

I will consider your advice carefully. Best wishes. (I love Americans, they really don’t like it up ’em).

Just shut the f•ck up GM… that is also an opinion… an opinion that people like you just regurgitate crap being spread around the net. Any nation in a position of power has an obligation to help maintain order…. to keep bullies at bay. Apparently, WW1 and WWW2 were lost on you. Yes, every nation has problems, corruption, abuses of power, etc… but idiots like you need to grasp the big picture in my opinion.

Another one tells me to shut up. Another who can’t read.

Perhaps the truth hurts the warmongers, lost in their glow of powerful protection to the drone targets in ….. Name your location.

America is a danger to the world, always has been, soon won’t be.

Hurrah for that, I’ll enjoy seeing it collapse.

if someone were raping and abusing your neighbor, almost all except fringe left think something should be done to stop it, at least call the police and get the perpertrator counseling. But as for the Yazidis, Christians, Jews, Baha’is,being slaughtered far away, best to just look the other way, lest GM call you imperialistic, etc.

Folks Give up on GM, He is too lost on his own belief system and everyone else is wrong. It has nothing to do with trading and he should keep those comments to himself if he had any sense of forum politeness. I too participated, but I think we have all been around long enough to see how this ends ie. it’s endless. Just move on. I guess we will all find out the future soon enough.

I think the comments by you Americans today has made my case far better than I could have done so myself. You have no idea how the rest of the world feels about you, and you have very few friends these days. And so it ends.

But yes, let’s leave it there out of respect to our fellow visitors and to JH, sorry John.

GM likes to believe that “Americans” are the ones opposing his narrow-minded view of reality. I posted my “opinion” and am NOT an American… but this fool assumes differently.

When this “genius”, GM, was lost in the woods scratching his head last May, I posted my analysis in no uncertain terms that the top in the broad market was in mid-May… that Gold would bottom in mid-July. His little group of thin-skinned know-it-all tyrants objected at the straight forwardness of the message delivered. They whined until I finally quit posting my analysis. lol

I can tell you’re both sad and bitter WW. I hope things improve for you, and you can avoid feeling the need to lose your temper on blogs. As for whining, well, lol indeed.

Makes you feel better GM to characterize others as you are… go whine to Pervert and J-smart@ss about that. You pompously extoll your opinion but when someone else expresses theirs, you don’t like it. My opinion is that you’re a loser without a clue… no idea what you’re doing… there are guys like me that could set you straight on the road to profits, but your ego would never allow that. You would be astonished and amazed if you only new what a fool you are, and what you could learn in a few hours with the right instruction… you, the hypocritical “wife beating” J-smart@ss, the Pervert and the other losers in your boy scout club may feel safe in your blanket of shared stupidity, but the ignorance among you is your downfall. I won’t waste my time trying to help.

‘You would be astonished and amazed if you only new what a fool you are, and what you could learn in a few hours with the right instruction’

You could teach me your tricks, and I could teach you how to spell ‘knew’.

Fair deal?

I do enjoy internet meltdowns, hope you’re better soon.

GM, I make typos all the time… because I don’t take the time to correct them does not mean I don’t know how to spell better than you. But anal ignoramuses like you always pick up on such insignificant details… People with little minds like you have nothing better to comment on… that is my opinion.

I am sure readers of this thread will make their own minds up.

PALS: Tuesday to Friday

Phase: +

Distance: +

Declination: +

Planets: +

Seasonals: –

Summary: “If” a rebound were to occur PALS system would be supportive. I avoided the down move by being in cash. Possible rebound Tuesday to Friday. This market may be so choppy that better to wait until October.

Good job being in cash.

I do think VIC did something. VIX spiked to higher than 9/11/2000 peak.

Venus has big effect, VIC is major, VSC (superior) has effect, and Vquad (90 degrees to earth) also. This VIC is at ATH, with declining SS, and deflationary world economy so apparently the upside will be muted. On short time basis, may try to buy the dip for a day or two move this week. Next week PALS is weak so probably try to short then.

You really have to stand in awe at a market that can go from over 6% down on the open to nearly even, less than halfway through the day.

Then you have to ask where in hell that kind of liquidity suddenly emerged from. We’re talking mega mega dollars here!

There is only ONE enitity that could possibly provide anywhere near that degree of liquidity.

Can’t wait to see the Feds updated balance sheet 😉

Allan, there is also the PPT (plunge protection team) I hear. They DON’T even have a Balance Sheet.

It’s not often the market can go down 1-2% in one day and you feel ripped off that you are not getting 4-5%. So will the PPT save the day? or Will they be overwhelmed? It appears the PPT failed in China and I suspect they will fail in Western Markets too.

Regretting not selling my shorts this morning, but I expect more opportunities. I don’t think we have seen this type of swing since 2008. Very impresive. It will be interesting to see the end of the day. This is a major sprain in the Market, recovery will not be easy and I doubt there is enough Central bank liquidity to solve this issue. If they even dare try, it will only bite them in the rear most likely. I am watching for SP500 and DOW short exit and lovin my cash reserves right now. It should be a very interesting 8 weeks coming up.

Come on now Allan, it’s just buyers nibbling at obvious support levels.

This market is going down over the next 2 years, gold is going up, manipulation or otherwise. (And I think otherwise).

Mate I got a bridge to sell you!……Liquidity evapourated and was all but non-existent with the Naz down 400 pts. A 400 pt run up in the Naz in 2 hrs is not a nibble, whether you choose to believe it or not.

There was a massive liquidity injection out of NOWHERE!

Allan, sorry to disagree, but we simply reached a level where buyers emerged.

I highlighted the likely spot before it happened (see much further upthread).

If it’s Fed manipulation, how come it’s on the way down again?

Come on my friend, it’s just market waves, up and down. No need for the conspiracy stuff to explain any of it.

(NB, China’s market just hit new lows, how did that happen if the PBOC are in control?).

Actually it is good for bears that the gap in Naz was closed. Great opportunity to enter shorts now at SPX 1950

WHERE THE HELL IS NICKOLAS???

8/24 1:54 Spiral update – the shorter cycle (octets) is up until midday 8/25 and then down to this weekend.

SPX not yet 1820. Something like John’s 2011 SPX chart could produce it for commence of primary wave 5. No better credentials for this than the heads up for today’s action – very astute.

Peter_ are you suggesting that Primary IV is already done? No 3 waver? Just one ‘WHOOSH’ down?

Not very EW in my opinion! Also time wise waaay too short.

Sorry Peter_, I misunderstood you (again). Yes the 2011 SPX chart would be a very good ‘prototype’ for the start of your Primary 5.

Although as I’ve already said, I think we are done for the ‘top’, at least on the DJIA.

Let’s wait to see what the market really throws at us.

Allegorical thoughts fill my head (LOL):

http://www.bbc.co.uk/sport/0/athletics/34041589

You’d have to have b%#^s of steel to hold long positions into this close!

seems to me if the fed stepped in to stop the futures at 1832 this morning to prevent the circuit breakers from triggering they won’t stop trying to support the market until they can’t

i’m still looking for the september window lunar solar eclipse time frame for the big one

Greedometer looks like he’s right on:

https://www.greedometer.com/blood-streets-not-long-greedometers-nailed/

Liquidity injection is nit about saving the markets. It is about stopping the fallout from a full blown liquidity crisis that would have implications for the major financials.

There is no doubt in my mind whatsoever that what we saw today was an intervention to halt a major liquidity crisis unfolding.

Eyes on 1820? Think I will hold on the remaining Naz shorts for now:D

J

WOW! Last Trading hour was wild. Gotta love USA Nat Gas here on the long side. It only went down 1% compared to WTI down 6.7%. Symbol UNG – Nat Gas has a nice trading channel between $13 – $14 and holding some for a long attack into a hot September, then cold Winter and then followed by a hot summer 2016, Nat Gas sould have some nice spikes. Still looking for a bottom to sell DOW and SP500 shorts. If we get another panic sell I’m out. If it rises, I will wait for next big drop within the next 2-6 weeks.

Futures collapsing AH. Tomorrow may test the lows and present the opportunity to reverse position?

Those ugly Americans –

https://www.yahoo.com/movies/french-actor-caught-in-train-attack-accuses-127481831202.html

Raise you a thousand:

http://www.washingtonsblog.com/2015/05/newly-declassified-u-s-government-documents-the-west-supported-the-creation-of-isis.html

Yeah, I might have to go long tomorrow or overnight for a bounce play at least. Will stay up a while to see what happens in Asia if I can keep my eyes open….

Be careful all.

J

The onlynway I woould play the long side here is if we went directly lower. Ie from a lower washout.

The last thing bulls need here is a bounce. It will be short lived.

Did anyone read my link to greedometer?

I think he is on to something. Sp futures froze from 9:14 to 9:29 this morning.

This happened for the first time ever according to him. They were probably going to open much lower but the PTB knew that if they fell below 1832 the NYSE circuit breakers would kick in and the stock market would be halted. Nobody on earth is ready for the stock market to be halted so the PTB intervened and futures began trading again magically at 1832. There was no way that the PTB would let them print anything lower.

Keep that in mind. The PTB will say and do anything to prevent the markets from falling. It will likely fall eventually. Just be prepared for a helluva fight. Just my .002 grams for what it’s worth.

Specie, I read it last week and he was calling for a dip.

Re your other points, the PTB may prefer markets not to fall, but they will be unable to stop it happening.

I hate to crap on everyone’s bear party, but if my cycle chart and wave count continue to track as they’ve been doing for a couple of decades now, then this correction is rapidly reaching its low point. I’ve been waiting for an extremely rapid sell off as we had a cycle bottom (green) coming just after the red cycle top. It had seemed that it just wasn’t going stay true this time, but 3 trading later it’s all lining up.

i don’t know if primary wave [4] will form a triangle or some other patter. i’m guessing triangle as large fourth degree waves seem to love them. But, the DOW might be the first equity index to turn as it is the only one thus far to have already reach its wave (4) of lesser degree. Time will tell of course, but I’m looking to switch back to the long side, having been short since May.https://alphahorn.files.wordpress.com/2015/08/dow-weekly-cycle1.png

Alphahorn, are your red and green cycles proprietary?

No

Where can I get more info on them please? Thx in advance

they are a standard stock chart indicator, if you have stockcharts, then you have them

you do customize them within stock charts though, but it’s a simple process

Aah Alphhorn, I’m not a Stockcharts subscriber. However thanks very much for your clarification.

Had a thot today with my two brain cells (I am not bragging Purvez). What if this is a transition time between US and Dollar bull and new commodity bull. The sell off in everything (deflation) will set up perfect non liquid environment for rapid increase in the price of commodities and commodity countries (Brazil). Fewer participants and more profit for the largest players. If this sell off continues and GDXJ goes along for the down move, risk to reward becomes irresistable.

🙂 🙂 Valley, good to have you as company, I’m honoured. Us 2 cellers have a much easier life than all the others. Not too many conflicting thoughts all at once!!

Also your comment fits in with Richard I’s about droughts and Brazil etc.

Raw sugar seems to have gone down alot?

Raw sugar – oversold??

And I have a name for these two cells: tweedle dum and tweedle dee.

Mine are more like ‘cell 1’ and ‘cell 2’, monickers of ‘thing 1’ and ‘thing 2’ from Dr Seuss of Cat in the Hat fame.

Constantly on the rampage!!

Alphahorn

A lot of technical damage has been done but markets are massively oversold in the short term. Do let us know as you place your trades won’t you?

GLA

J

Every trade i make is recorded on my blog

Nice –

38.2 hit….imho…and rejected for now……

1970 next stop on SPX perhaps. Just entered a small long at 1942, will keep a close eye….

J

Looking into the bullish case here, I managed to find a chart with intact support.

And curiously enough it is the weekly Dow, which already smashed its October low, unlike SPX: http://schrts.co/bwaiGW

The bull vs. bear war has started. Looking to see how much of the losses will be recovered until the next leg down starts. Hope most bears took some profits yesterday as short term markets are very oversold.

Interesting thread. I noticed that GM talks a big game but doesn’t make any money.

From my post yesterday (pre-open):

‘A couple of charts, showing where I think the bounce will come.

I read some interesting stuff on the angle/speed of declines years ago, and so far this one is very steep, which fits with the initial decline from the high back in May.

Close up:

http://screencast.com/t/mGtTSUjGiBmX

Longer-term:

http://screencast.com/t/TKCoMnGJYcu

Owning a bad call now….I was calling for 10k on the Dax in short order, and it’s now under 9,700, support has given way. 🙂

I think today may see capitulation in the US markets, and that may be the time to buy.’

Thanks for your contribution Siggy, and welcome.

Siggy

I doubt that anyone here could judge whether someone makes money or not. Perhaps you made that observation purely for the purposes of insult/derogation? That seems much more likely to me.

Having said that, most people will feel personally attacked or insulted when someone refers to the geographic location defined by lines on a map someone drew in the past in a negative way. Perhaps you felt hurt by GM’s comments aimed at “America”? At some point, everyone has to ask themselves why, and also why “countries” were created…..

imho

J

May: Stocks eighteen point rotation point 4 was as high that brought in a six point rotation inbetween point and did not bring in super long term point 6.

Yesterday: Eighteen point rotation point 5 was a low that brought in six point inversion window point 2.

Conclusion: Six point rotation point 3 will be a high that brings in super long term point 6 and that means a new ATH.

Richard I, both John Li and I asked a very simple question.

Please where can we get more information about the Delta system?

Hopefully you’ll be able to provide an answer. Thx

https://www.deltasociety.com/

so thats in all markets or any specific one?

Registration (free) is required to read this link:

http://ftalphaville.ft.com/2015/08/25/2138192/offshore-repo-capital-charges-and-petrodollars/

But the key issue it highlights is this:

‘With a fall in oil prices, fewer Petrodollars will be available for investing in USD assets in 2015. If petroleum prices continue in to year end at their current YtD average ($52), this would represent a 60% decline in Petrodollar generated in 2015 vs between 2011 and 2014. Assuming that 30% of gross Petrodollars generated per year are invested in financial markets, this would imply $288bn ready for investments in 2015 vs a $726bn average between 2011 and 2014. Lower purchasing power from oil-exporting countries may in turn reduce demand for $-denominated fixed income assets, including $ IG and $ HY. US IG and HY firms have issued $918bn and $220bn YtD, which in total marks a record-high vs past years.’

This squeeze also guarantees a higher dollar, it’s a self-reinforcing loop.

Good stuff. It also makes for a shortage of dollars to service the zillions of dollar denominated debt, causing a short aqueeze on the $ as well.

Im now short looking for todays rise to be sold into over the coming days. As a minimum I’m expecting all of todays gains to be lost by the end of the week. It may then be the moment to buy for september before selling again come october.

Where are you short?

10090 dax and 16350 Dow. It was meant to an intra day trade but the bulls are far too powerful today and it doesn’t look like this trade will work out.

In fact closed out shorts. No point fighting the trend today.

Krish, for your own good, please learn to join some dots. In the case of the Dow it broke the Feb’14 low to Oct’14 low trend line. So at a minimum it’s going to want to go back and test that line. Today that line is around the 16480 mark.

Now if you can stand that amount of draw down then you are A-OK otherwise a small hedge may be a good option.

Wish you ATB for your trade.

Good trading Krish!! Even better than my suggestion.

Not in hindsight. My thinking was right but the signals werent really there so Im not dissappointed i closed out.

Here’s my micro count for the SPX I posted last night on my blog. looking for a wave (iv) triangle before the final push down to 1860ish, then I’ll look to take the long trade

Hello, Alphahorn. I remember your charts from a few years back on Slope of Hope…

yeah, it’s been 5 or 6 years probably since I posted over there. I know Springhill Jack did a story on me over there back in 2012

Helpful – thanks, AH

End of this week I will be looking to go short. 1929 repeat awaits, much bigger washout lies ahead IMO, another 20% to come off stocks.

Watch the candles.

Your new account all set up and ready? 🙂

Yep. I need to send a form off today so I can trade US/Canadian stocks.

Ready to buy some junior gold miners.

So far looking like a weak short covering rally to me. End of the day price and volume should tell us a story. Any retest of DOW 15800 or below in the next few days and I am out on the shorts and holding cash to evaluate further action. I am still holding long trading and hold positions in Nat Gas (UNG). Will sell between $13.50 or $14 for a trade.

Jegersmart,

I’m glad I stimulated a conversation. I actually agree with most all of GM’s comments. I think that to put one race, or a government over another, no matter how well meaning a system or a person in power may be, is pointless. All governments have failed and will fail. It can not be overstated, humans simply cannot rule themselves.

And so we busy ourselves to find some purpose – or in the case of this pursuit of a dollar, to achieve esteem and a bit of bragging rights through mathematical formals. My point – is chill out people! it’s not that serious – at the end of the road I don’t think any of us we will be lamenting that fact that we missed the bounce on the SPX low of 8/24/15?

S’funny, but very little of that *message* came across in your original post. Well, none of it to be more precise. Let’s just drop it eh?

Wow, what’s up with GDX. I am so focused on the stock market that I didn’t realize that GDX is near lows again.

Yes, with all the stock market goings-on yesterday somehow HUI was down over 8%. And another 3.5% today.

It’ll take a while before the market realises it needs gold, and that its miners are doing well, and then they will start their run.

Meanwhile, more bottoming to come, no doubt 100 on HUI will be tested.

John, the inability of this market as a whole, to interpret or understand what is going on has never been stronger.

These markets are completey broken. I have been saying it for the last two years. Intervention has guaranteed that stock markets can no longer price risk or determine value.

That is why there are divergences growing,particularly in high yield. It is also why markets no longer accept gold as a safe haven.

It will change but it will take something horrendous to change it.

The UKX came within 3% approx of a bear market,

Have made gains trading helped by volatility,

very tired as it requires a lot of screen watching,

will try to catch up with the comments over the weekend.

John Hampson – really hope you have profited in quantity

from this market action.

Admire your resilience in sticking with your convictions

which must have taken a toll, enjoy your gains.

Still unclear whether this is a late bull market correction,

best to stay openminded and alert for changing direction.

The RUT provided a clear indication last October,

forming a base 3 days before the SPX from memory.

Perhaps worth watching in particular.

Best Regards to everyone.

Take a look at interest rates. Little noticed yesterday was that 90 day Tbill rates were up as well as today. 10 yr treasuries had what could be a capitulative Elliott 2 bottom and are up strongly today – a 3? $dollar also had a stop out the longs type turnaround last 2 days.

Also $SSEC. It looks very 1929ish. The 1929 market fell about 50%, the $SSEC will need 2600, it is now at 3200. Plus it appears to be in a very clear 3 of 3 Elliott down. These are money making times!!

https://www.deltasociety.com/

In case it was missed above

It doesn’t seem very mainstream. You have to pay to get any information.

I bought the Delta book by wells Wilder. Do not like Delta. It is like after the fact Elliott wave counting, one can force a market into its points, but frequently not be before hand. Ron Rosen Gold Report is somehow affiliated with Delta. He did call the 2009 stock market bottom. His gold was a disaster missed the run up to the top, and has been bullish for most of the decline. Alastir Gilbert runs a similar service out of England. Don’t know his track record.

Thanks for the review. Very helpful.

I followed Elliott Wave back in 2000 and found it too subjective too.

Thanks very much for the link richard M.

Wow, looking at today’s almost catatonic trading, who would have said we had the last 3 trading days? This market is more than schizophrenic. It’s down right barmy!!

no it’s behaving precisely as expected

I predicted this pattern yesterday morning

and the beat goes on

Alphahorn, a question please. How far down does it have to go before you say your count wasn’t right?

I’m not criticizing your count. Just want to know what your ‘failure’ point is please, and ideally also WHY that would be your failure point.

Thx.

how far does what have to go, on what scale are you talking about this 30 min chart or the big picture

alphahorn I just woke up, not as in, a light went on, but as in literally woke up(live in Oz), checked my intra-day charts and the first thing that hit me was the consolidation triangle.

I agree, another leg down appears imminent to at least 1770.

Sorry for not being clear. How far down does the DJIA have to go, (whatever time frame suits you) for you to say that this is NOT a correction?

EW rules permit wave [4] going down all the way to the top of primary wave [1]’s high, so you’re talking sub 13000. I don’t think that will happen, I will rethink things below INDU 14750

Thanks very much for your response Alphahorn. My reason for asking these awkward questions is because I am following the EWI wave count where the current wave was a ‘b’. I am trying to ascertain when I am going to be ‘wrong’ vs someone like yourself with an alternate count.

I very much appreciate the alternative count that you present and am trying to be objective.

Hope you don’t mind being questioned like this and I hope I’ve explained why I’m questioning your count.

Just over half an hour to go this could get ugly.

Sorry I revise that SPX target to 1800 and 14900 on the DOW. Time target?

Remember what spooked the markets last week was the Yuan devaluation. Well the Chinese did it again after their markets closed.

This afyer trying to calm global markets after the first deval saying they wouldn’t do it again……then, they did it again and then again….and now again!

No Really, I mean it this time, this is the very last time. BTW – I don’t think I was on this site when the Swiss decoupled from the Euro, but that was a major red flag for me that the currency markets are getting wonky. Was that ever discussed on this website? It seems to me that with the interest rate increase on the 10 yr bond today, that this correction may finally be the currency collpase so many have been concerned about. Time will tell, but more signs of lack of confidence in the Central Banks seems to be creeping in. When that confidence completely breaks, look out below.

I was ready to sell below 15800 today, but the end of this day tells me to try for another panic sell tomorrow. I like the DOW 15000 target, but depending on the action I will decide tomorrow. Nat Gas still looking healthy.

I just added another SPX long at 1876, same size as 1942 – if we close below yesterday’s low I will be out:D

J

Just for finality, if there is such a word – I closed the last of my Nasdaq shorts 10 mins ago as well.

J

J, I repeat what I said last week. Why stand in front of a freight train!

PALS:

Phase: + into FM

Declination: + into weekend

Distance: + into weekend

Planets: ++ post VIC pre MIC

Seasonals: –

Summary: if PALS is to work it has to buy when price is weak (or super weak) and when PALS is super positive. So, I am L (long) into Thursday at least. Bought hour before the close and took a 2% loss, however, eyeing 2050 by Friday.

Valley,

agreed, and prices will begin to move up about 1:00 am on Thursday, but I believe you will need to hold your position until Monday to get max level short term. Good luck.

Hi Steve,

So after thursday 1.00 am you expect prices to go up till monday august 31.

Is it a goodtime to enter shorts again after September 1 or better wait till mid September?

Thanks in advance

Cheers

valley,

doesn’t 2050 look like a huge task now, we could have if we crossed 1950 today.

Thanks… using you as a contra-indicator!

Come on, man, that’s just unnecessary and frankly not very bright. Valley has made some excellent calls.

Jeez louise…

the triangle for (iv) is dead. the final leg down is either underway or it bottomed yesterday. Still favor the move to 1820.66

Thanks Allan, I remember – and luckily I was on the freight train the last few sessions and made this quarter the best of the year so far. Freight trains don’t only go in one direction though…..in my experience:D

Risky trades these, but let’s see what happens.

J

For the untrained: Those flash crashes of the 24th with a 1000 point drop on open of the dow would mean game over for alot of traders.

Yes, good point – guaranteed stops are your friend(s)…..

J

Well you certainly were on the tracks back in May when those two freight trains ran over you… back in mid-May when I called the top in equities and the low coming for fold in late July… apparently you were drunk again and beating your wife… lmao.

Can you please just go away –

WW

If you are referring to me, yes I either tend to be on the train or in front of it. If you are neither of those things, I assume you are not here to contribute? (unless you have compiled a list of deposit accounts with the best rates of interest):D

I am not religious so do not have a “wife”, I also do not really feel that physical violence produces positive results very often. I am occasionally inebriated though.

What was your point again?

J

Yes… reality is a ha

rd pill to swallow for you.. zigged when you should have zagged. lol

Fibs give 1826/7 SPX for commence of Primary wave 5, assuming this is the C (goodish probability) of Primary IV and not the A. Correlated from JSE index, which does an excellent job of de-fuzzing the SPX chart.

Peter_ please can you tell me (in easy to understand sentences, preferably) what is the JSE index.

Thx

Because you know about Google I will assume you are too busy interacting at the political and interpersonal level to remember how to use it or what a stock market is. I see a game played hereabouts by wiley posters (present company being assessed) which takes the form of a distract and conquer strategy, don’t you?

🙂 The rebuke is well deserved Peter_. How could I have even thought of asking such an imbecile question.

Actually, now that I reread your post, it seems that one of your points was to remind us that apparently you called a top somewhere and more importantly according to you, that you were right? Why do so many people here feel the need to do this? Are there that many aliases?

A secondary point you seem to have made is to make a derisory remark about me. I don’t think it will help you feel better about yourself, but hopefully it will remind others that I am frequently wrong (also in real-time on here). This is very important because when you have to trawl through the wild predictions, the incessant need to be right, the need for approval from strangers and the repetitive jabs at others without any specifics being contributed by many, it is healthy to be reminded to be selective in what one reads. One guy this week basically admitted being a massive fraud here. I suspect he is not the only one…:D

I calculate that I have about a 50/50 chance of being stopped out on waking tomorrow. I hope “Nicolas” is filling his boots overnight…:)

J

J, to use some ones very wise words. ‘Don’t feed the troll’.

We’re in a downtrend J, it’s no surprise that the bulls (the majority) are feeling disgruntled and so pop into a pragmatically bearish blog to fire off a few taunts and jibes. They just demonstrate their inadequacy and low intellects. Like a monkey showing its ass at the zoo. Amusing, but not very clever.

We all see through them I hope, I know you do. Let’s hope they’ll vanish as their trading accounts are wiped out in what lies ahead.

Meanwhile, good luck to all the regulars. I’m keen to see if valley’s PALS system holds up during a downturn, it’s served him well in a sideways market.

Night all.

Jsmart-a**… the “derisory remark” you whine about was the same language you used towards me… that makes you a hypocrite as well as a fool that was wrong.

Unfortunately for you, I was right when it counted, and being right at turning points is all important in making profits in trading/investing.

You and your ilk, purvey, GM, Gary and the other trolls that are clueless beyond reproach, don’t have a clue and will continue to get run over by freight trains… if only you knew what’s coming. I won’t waste my time on fools… good luck with your coin toss! lol

WW

I am sorry that I hurt you, but you don’t really make so much sense sometimes…..”unfortunately for you I was right when it counted”…..what does this mean? I am happy that you made a right decision, always happy to see someone make a bit of money, but I don’t understand that it could be unfortunate for me that you were right….? How does the fact that you were right impact me in any way?

You seem very angry for someone who has been so right? I am wrong quite often and I have rarely been half as angry as you….?

Why do you insist on labelling me and putting me in a group with “others of my ilk” – such as GM, purvez and Gary etc? I don’t know these guys and we frequently disagree….what is the common denominator for you to create a group out of us? Is it purely as a focus for your anger?

I hope you get back to a state where you are not so agitated, and that my apology helps.

I have to take exception with one thing you said though: no one knows what is coming. “Knows” implies certainty and everyone can probably agree that there is no such thing relating to future events. If you have a different opinion, please share that with the board.

Please also bear in mind that I do expect the SPX to take out the 666 low in the future. I am pretty sure that if it does happen, the path there won’t be a straight line there.

Just out of interest, you say you called the top perfectly (I don’t remember so will have to take your word for it) – how have you traded or “invested” that from then until now? Obviously this is tempting hindsight trading commentary but just interested. What I am more interested in is how you are playing it now? So you have a plan? If you don’t mind do let us know when you “know” when the next turn is – and before it happens please. If you also want to share your ideas on how you are going to play it then all the better.

Or…you could say something like “forget it, I am not going to waste my time on fools” which would be a lot easier I guess?

As to the cointoss, well as we do not have or even know what all the variables are in order to judge the probability of any trade or decision we make – I don’t have enough data to say whether your description is correct or not. What I did was to make a poor attempt at humour by basing the probability on the number of possible outcomes. I see now that you did not find it amusing. I encourage you to have another look though when you are less upset – I think you might like it. Not saying you will definitely guffaw with laughter however….

Well I hope to hear more from you in the future unless it is all insults of course. Hopefully there are many correct decisions in your future, I don’t need so many but some would be nice occasionally.

J

The insult, WW, was you lumping me in with GM. That one hurt…

Anyone remember my ‘3 peaks and a domed house’ musings a couple of months ago re the FTSE? Have a look yourself, it’s played out exactly as the pattern dictates.

The FTSE has a sharp angle of descent from its highs, as this close up doesn’t really show:

http://www.screencast.com/users/Gary_UK/folders/Jing/media/f66d80fd-c393-4a19-a4a1-d097ba9dd325

The big picture shows a target for this initial decline:

There’s a good chunk of lateral support at 5,200, and no surprise that a 50% fib level is nearby, and that its bounce today was within 50 points of a fib level too.

So, if we bounce into the end of the week, I’ll short it. If it collapses from here, c’est la vie.

Just what China needs. More debt!……..a debt to GDP ratio approaching 300% isn’t enough. In fact it may be far more than that but we’ll say it’s around 280%.

And Martin A keeps telling us that the economists within the PBoC are smart, whilst out of the otherside of his mouth says that the Chinese economy is doomed to collapse?……..once again he minces his words. The man baffles me!

How can they be smart whilst creating the conditions for a collapse which he admits that they had a hamd in???……utterley bizarre!!

I have been doing research to recall who posted a link to Ron Rosen early this year and it was (you) Allan on April 15. The reason I have done this is because I now think that a six point rotation Inbetween Point as a high did come in but not in February but in May. I was of the opinion that Ron Rosen’s reason for such a rotation call was that he was holding to super long term point 5 as a high that was becoming very late so that a six point long term Inbetween point had to be coming it with and the 2 point would be a low thereby. I was strongly of the opinion that super long term point 5 was a low and that point 6 would be a high which I think is now more obvious to be the correct solution; however, I was “big head”ed that six point long term 2 was going to be the point that would bring in super long term point 6 that I completed closed my mind to the possibility of there being a six point long term Inbetween point with point 2 as a low. What a mistake that has proved to be.

I think that eighteen point long term point 5 is a low that is “averaging” in with six point long term point 2 as LOWS. This means that I am now expecting six point long term point 3 to be a HIGH that brings in super long term point 6 as a new ATH.

I think that a six point long term Inversion Window Crash to a low 2 point is the best Delta “reason” for the recent stock market action AND why Gold is reacting the way it is because stocks super long term point 6 is going to be a high and Gold’s long term 1 is going to be a low that has not come in –yet.

Good luck with Delta Richard .I got heavily into it when the book was first released maybe 20 years ago.I finally and expensively reached the conclusion that you could come up with any combination of rotations within reason and make them fit the rules.

If it works for you then go for it.

There is no system that works all the time. Human nature seems to have evolved to the point where we take such short cuts in our understanding that anyone who makes more than 2 correct calls in 6 months gets to set up a website and fleece poor suckers of their money by selling subscriptions to a “Greedometer”, or other “trading system”.

Having said that I do respect Phinney, purely because he uses price levels, action and his experience to make some calls that are not emotionally led whatsoever, but he is by no means right every time.