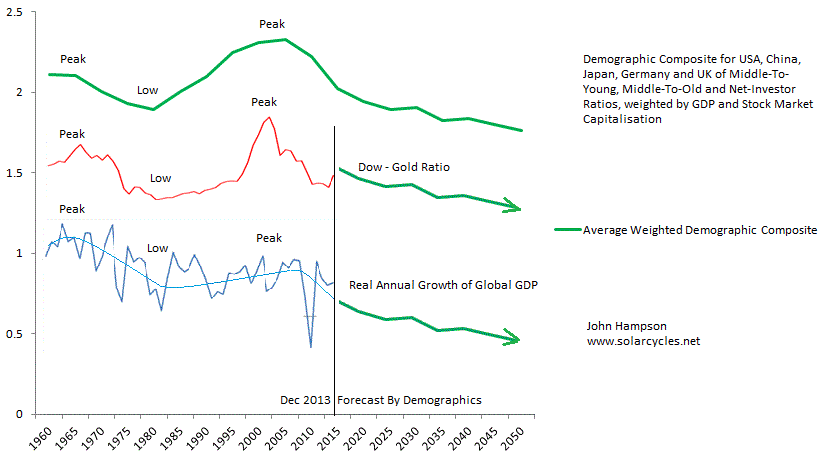

Gold as an investment: not straight forward. It was the original money, valued for its rare, precious and indestructible qualities. Fiat money then took over, but convertible to gold. Now, fiat money is purely a game of confidence, and gold floats freely. Gold is a non-yielding, non-productive asset so comes into favour (jewellery demand aside) only under specific conditions, namely when real interest rates are negative (which can be under inflation or deflation), when fiat money is being diluted (such as by policies of inflation or money-printing), when debt is growing significantly (as this is money borrowed from the future) or when other assets are in decline (which chiefly occurs due to demographic trends).

Right now, real interest rates are borderline negative, public debt is at record levels, QE has been rolled out across the developed world and demographics are united negative (i.e. pro gold) in the major nations. So why isn’t gold going up?

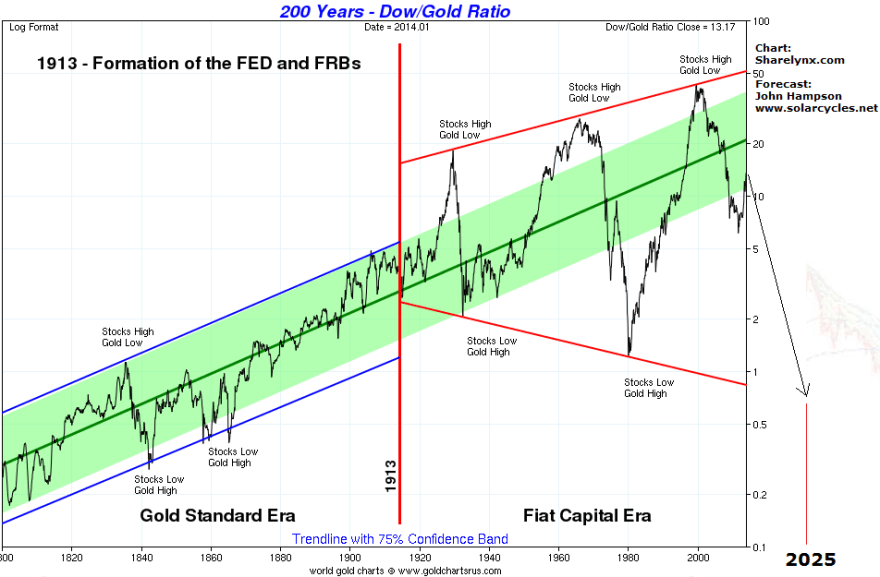

By demographics and solar cycles, gold should be in a secular bull from 2000 through to circa 2025, the next solar max.

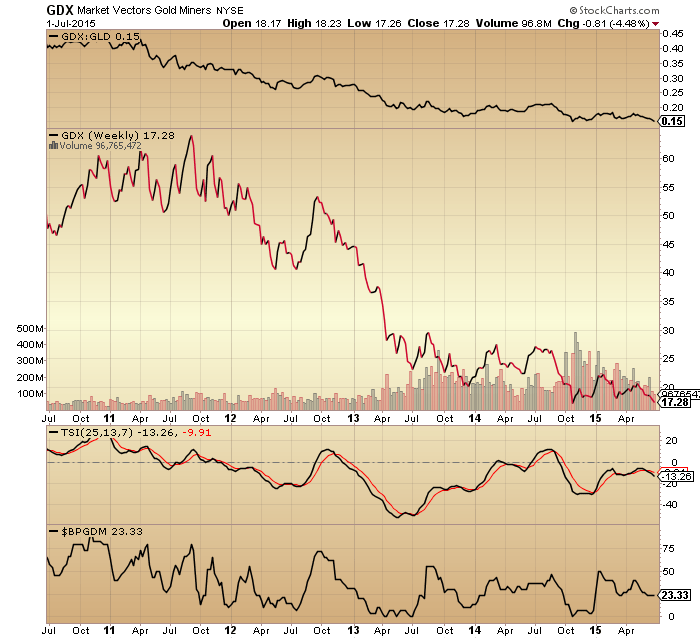

Therefore, gold’s bear market from 2011 to 2015 would be a cyclical bear within an ongoing secular bull, similar to as occurred in the mid-70s. Gold has been making a long basing, as evidenced in the TSI below, over the same period that stocks have been making a topping mania. When stocks start to fall in earnest, then I expect gold to take off, in a new cyclical bull within an ongoing secular bull.

Therefore, gold’s bear market from 2011 to 2015 would be a cyclical bear within an ongoing secular bull, similar to as occurred in the mid-70s. Gold has been making a long basing, as evidenced in the TSI below, over the same period that stocks have been making a topping mania. When stocks start to fall in earnest, then I expect gold to take off, in a new cyclical bull within an ongoing secular bull.

Source: Stockcharts

A bear market in equities would, through the wealth effect, tip the fragile economy into a deflationary recession, which should then result in negative real rates, additional fiat dilution by central banks, rising nominal debt levels and cash-flow looking for a safe haven. All favourable for gold.

However, contrast that with the common perception currently, which is that we are in a young secular bull in equities, with the economy early in the cycle and about to start growing strongly, and a trend of increasingly positive real rates ahead. Once this perception is revealed to be a misunderstanding, then the narrow interest in gold will become much broader.

A near term look at gold technicals suggests one more washout to the downside may be needed, as evidenced here in the gold put/call. The short interest is already at contrarian levels.

Source: The Daily Gold / CFTC

I would see this as fitting with a last rally back up in equities into the mid-July new moon (to a lower high), which was predicted by CPCE and Vix/Vxv as highlighted two posts back. I therefore lightened up my equities shorts and gold longs after this week’s full moon. Earnings season starts next week and properly gets going the week after. With a predicted 4.5% yoy drop in both earnings and sales for Q2, this provides a backdrop for stocks to topple over from that second week in July, and in turn gold to finally wake up. I believe that point will mark the definitive trend change in both and currently see that as the point of max attack.

Gold miners sit between the two asset classes: as both equities and tied to gold. In the last 4 years they have very much sided with the latter, declining in the face of a rising stock market. But notably they have performed much worse than gold, as shown in GDX:GLD below.

In fact, on the long term view, the miners to gold ratio is the lowest its ever been.

In fact, on the long term view, the miners to gold ratio is the lowest its ever been.

However, the major miners have been diluting their shares, making them not the bargain they initially seem.

Additionally, there is a question mark over how they might perform under sharp stock market falls. With few historic reference points, we can at best draw on the 1929 experience whereby the gold miners didn’t escape the initial falls but broke away later once the stocks bear was more clearly cemented. For these reasons, I stick with gold itself as the pure play and will pass on the miners.

Thank You John for the great analysis.

I think when people figure out that GLD and SLV are not really backed by all the gold and silver – the miners will be much more popular.

It is good to support the miners because they need to bring more gold up to the surface. It is said that we are going into a “Golden Age”, literally meaning that there will be more gold on earth and that the spiritual and enlightening qualities of gold will be appreciated as gold becomes more abundant.

I don’t have much faith in a bottom here either, based on my own long term gold chart:

http://stockcharts.com/h-sc/ui?s=%24GOLD&p=M&st=1981-01-01&en=today&id=p09758980239&a=297193633&r=1435907922294&cmd=print

I do own some silver – on shorter-term charts we look close to a break-out, but if the USD catches a bid again, I will forget that.

FWIW, I just read the morning note from Julius Bär – they just opened short on gold with a target of 1000.

Great chart!

Gold is going to $50-$60,000 within 20 years maximum.

Long term chart at my post here:

http://screwtapefiles.blogspot.co.uk/2015/04/martin-armstrongs-tense.html

The miners & gold go up sharply in relatively short periods, and we’re just about to start one of those.

That 32 16 32 8 etc looks awefully arbitrary. We can data snoop for other seemingly interesting patterns if we wanted to but i leave that detail to the aspiring data dredgers.

Thanks John, brilliant!

In regard to miners it is about finding the gems amongst the mountain of garbage. There is heaps of garbage but definitely some gems that will be paying dividends alone in a few years, at multiples of their current share prices.

Allan, for newbie gold mining investor, would you include GDXJ as being in the garbage category? And if so, are there any stocks within GDX or GDXJ that you would consider the pick of the litter?

The job report yesterday was not good. The official unemployment number is 5,3 but there are now a record number of 93.6 mln Americans – in the right age- that have given up on finding a job. On a population of 309 mln that’s 30%. Together with the official unemployed total unemployement is close to 36%- and rising.

On top of that the number of permanent jobs goes down. Every month the number of temporary jobs goes up. And wages are flat.

And then the fantastic jobcreation of 280.000 last month was just a wish (or lie); the real number was 230.000. So this months number will certainly be revised downwards next month.

Is this about definitions? No. People without a job – either registered of not – don’t buy houses, don’t buy cars and so on. In an economy that depends on consumer spending that is very bad news.

The business results that will be published next week simply can’t be good. Only the ‘rent-a-tent’ companies ares going great as more Americans than ever live in one.

The GDP number last quarter was supported by a huge increase in inventory. Any thoughts what that will do to the q2 GDP?

Not the story the FED will tell you; bur this is reality.

July 8th the Gann panic window opens. Mars still OOB and still within a severe moonwobble period.

I rest my case.

André

Andre, I saw a really bright star last night, it would have been in the South West I reckon, looked huge. Any idea what that is?

Spot on re the data you mention, there is reality, and it does not correlate with mainstream media fiction (as relayed here by some).

Probably Venus conjunct Jupiter

Yes, there was another smaller light just to the right.

Thanks, wish I had a telescope.

GM and A’, Venus and Jupiter together in the sky is awesome. Each night until 8/15 the bright star Venus will fall in the sky until it and sun will rise and set together. That is why it is called the morning and evening star; half time it rises before sun in morning, and half the time sets after the sun in evening.

John, I hope you don’t mind me mentioning something for the potential benefit of all here, regarding your comment:

‘For these reasons, I stick with gold itself as the pure play and will pass on the miners.’

At some point, I know not exactly when, the current XAU driven gold market will implode, as Exter’s pyramid reaches its natural conclusion. Could be in 2 years, could be in 6 years, or at the latest in 2034.

When that happens, ‘gold itself’ will be the only thing that retains real increased value, but that means the real physical gold, in your own possession, or in a non-bank vault. Trading vehicles will just go bust, your counter-party will not pay you, or will pay you in dollars/pounds worth 10% of their previous buying power.

Trading gold will be fine for a while, maybe a long while, until this dollar-based debt bubble collapses.

If you’re making nice profits with your trading, the investment of a lifetime will be physical gold.

7/3 12:07 Spiral update. Approaching Singularity. The contracting Spiral has created a flat market. Expecting 7/15 high. Targets 2086, 2094-96.

GM,

you have referenced gold as only been available to buy at

these levels “for weeks”, previously.

What do you define as weeks, is that 5/6/7/8…

Once Greece is “resolved”, either through another bailout

or exit, gold looks exposed to me.

Have a good weekend folks.

Phil, Greece will neither be bailed out, nor will it exit.

Why does it matter precisely how many weeks until gold bottoms, especially to the 3 month window man?

Good article, John. Very interested in the gold sector and appreciate your analysis. Having lost big time in the 2013 decline, I would like to win big time in the 2015 to 2016 rebound.

Andre

Can you explain more about “July 8th the Gann panic window opens”

Joe,

Gann found that 49 to 55 calender days after a major high a panic window may open. When this high was May 20th/21st, we get a window between July 8th and 15th. No guarantees; but a possibility.

Al

What do you think of GOR. Big find in WA

IMO i think the bottom in miners was November 2014. The entire gdx and gdxj float moved in three consecutive trading days combined in early November.

Right now bulls and bears are all calling for 1090, 1050, 1033, 1000 and dozens of other targets for gold supposedly b/c they all think we havent bottomed. I think we stay in the 11XXs for a couple more weeks and then we resume upward. OTC gold volume in any currency have been through the roof since September 2014.

Place your bets.

Yes November 2014 was a bottom, but not of the bear market just important bottom… the rally now will be just wave C of a-b-c , B will bottom in the next few weeks.

The bear market will bottom next year.

I wrote about this http://practicaltechnicalanalysis.blogspot.co.at/2015/06/goldsilver.html

And the only one who get it right until now is this guy http://www.safehaven.com/article/38076/gold-the-big-picture

I think both bears and bulls we be wrong and there will be a few left to buy the bottom next year.

EW can produce so many different options for markets, so why bother?

Here’s why I think gold is about to bottom (plus all of the fundamental changes in market sentiment that are happening as I type):

http://screwtapefiles.blogspot.co.uk/2015/06/the-beginning-of-end.html

I do not think that will see the bottom next year because of EW. You are right I can find you a count to justify a bottom.

It is because of cycles. It is too early for a bottom.

When the stocks plunge lower in 2016 the drying liquidity will take down everything including gold an miners like in 2008.

See the new post am talking more about cycles – http://practicaltechnicalanalysis.blogspot.co.at/2015/06/long-term-update.html

I will entertain your scenario, if it in fact plays out, then to fool the most mkt participants we’d require a breakout to 1400+ in order to convince shorts the “downtrend” is finished and to convince longs that the correction is finished. Then that flushout you outline should take place, but when that run begins it must be parabolic b/c it needs to maximize doubt of a bottom again for longs and it should convince shorts it’s just a quick upside correction before the downtrend resumes. The price must blastoff quick to the 2011 highs in order to leave the most behind and once it’s near 2k no one will have balls to go long.

Regardless, i assign a higher probability to carving out a secondary (nov2014 primary) bottom here in the next several weeks. To extend the correction into the summer of next yr would end up being an extraordinary cyclical bear within a secular bull. But Jim Rogers always reminds us that the run of 12 positive years for gold was extraordinary and your scenario would be a nice extraordinary scenario to match the former so its occurence entails a meaningful probability.

Yes I know it will be really a long bear market compared with others, but from cyclical point it will be really extraordinary if the bottom was in November 2014. See the new link above for a newer post where I pay more attention to gold and cycles.

Short said rounding bottom and only 6 year cycle with 8 years average length this will be really strange and extraordinary.

With everybody on the sell side the price will blast higher and squeeze the bears like lemon and bulls burned many times for years will just watch from the sideline scared not believing that it could happen.

Your new link suggests stocks to keep running to 2020?

Yes stocks will continue higher after a deep correction into 2016

So what kind of Dow:Gold ratio are you anticipating? The two asset classes are orthogonal in secular long term.

Only in the sense anything is possible is that guy right. The 1980 peak in gold was spectacular! To call it a one is wishful thinking.The 2 is most probably a 4 and the move from 1998 to 2011 was a extended 5 of an extended 5 of a 55555 since 1932-3 and possiblly 1893. 2011 was a very significant top.

Even better with finished 5 waves 2011 a huge correction is running…. which mean I am right:) there will be more to the downside and the bear market is not finished.

I am not following him and I do not know what he wrote, just for the first time I see some one writing a descent cyclical analysis and not rushing for the bottom.

EW there is always room for interpretation. This five waves could be A and B running now than C and gold going much higher… I will not be surprised. I expect huge run in all assets.

Karni David Chapman has not got it right In Dec 2011 he was still bullish on gold. He said there were few signs the bull being over, and shrugged off the obvious bubble top in gold.

Into the new month, dare I say, monthly short setups do not get much tastier-looking than this. Note small caps have started to lag Dow stocks as in 2007-8:

http://schrts.co/U1KPci

http://stockcharts.com/h-sc/ui?s=%24RUT&p=M&b=4&g=1&id=p69345758272&a=371672811&r=1436011994885&cmd=print

Beautiful chart.

Wow China just launched the most obvious market pumping exercise yet! $19 billion to be pumped in the market and they won’t be selling until the index goes above 4500. Lets see how this works out…

http://www.cnbc.com/id/102809584

Krish (and Phil),

The worst mistake investors can make is to read a CNBC article and treat it as fact. Same applies to Bloomberg, and many other mainstream media outlets. These sources are stupid and biased, and they want you to believe that everyone is *pumping stocks*, because they are cosied up to the US govt.

Here’s the truth (this took me 5 minutes to find):

http://news.xinhuanet.com/english/2015-07/04/c_134381984.htm

A bunch of very worried brokers are trying to keep the bubble afloat. Would it be fair to imagine their businesses are threatened if the bubble bursts?

The amount of (only large cap) shares they will buy totals around $20billion, including shares in their own companies.

Various figures exist on the total value of the Chinese stock market, but It seems to have reached around $10trillion (Shanghai & Shenzhen combined) at the end of May.

So, $20b/$10tr, you do the maths, it’s a drop in the ocean at 0.2%. You think that will turn the tide for long, if at all?

The original xinhuanet article does not mention ‘China’ or the government at all in regard to this buying of shares.

The Chinese government/central bank are no doubt worried about this, and have been tweaking things, but I did smile when I read the closing comment from the head of their central bank, generally a switched on fellow:

“China will hold fast to the bottom line that no systemic or regional financial risks should occur.”

Please continue buying shares if that sentence gives you confidence that everything everywhere is under the control of wise and powerful governments and their minions. I’ll rely on Mother Nature to sort things out.

GM I didn’t say this would pump markets up as I did the same calculation in my head and realised how small it was. I’m just interested to see the effect it actually has. I have the same views as you regarding the Chinese bubble. I am looking to see when investors lose faith!

Krish, you wrote:

‘Wow China just launched the most obvious market pumping exercise yet!’

I could almost smell your excitement. But it was factually wrong in that ‘China’ has launched nothing.

Then you wrote:

‘I didn’t say this would pump markets up’.

Well, ‘market pumping exercise’ does give that impression you know.

GM it is a market pumping exercise in THEIR eyes not MINE. Apart from China I predict we will print new highs on most indices by the end of the year and no bear market will emerge. You have the opposite opinion so let’s see who is right at the end of the year. Dax will be the best performer by far. the only thing we have in common is we know it’s a bubble. It’s just when it bursts where the difference in opinion lies.

It’s only a market-pumping exercise in the eyes of CNBC. You shared that link with excited comments about *China*, which was BS (many exclamation marks).

But, you know, whatever, I don’t really care, I just call BS when I see it.

First serious low will be August 10th, 55 days into the Galactic Year and an important lunar inversion. But acceleration down will get serious after July 27th, driven by moon cycles, the superior mercury sun conjunction and mercury/venus conjunction early august. We are still within orb of the uranus/pluto square and the sun and mars are also within orb of a conjunction. And the sun and mars will be translating (square) the UP square this month. On top of that the new moon on July 16th falls within this period and it follows logically that this new moon will be conjunct mars. That should stir up things a bit.

Another date to pay attention to is when Mars leaves its OOB position the 17th, that should also speed up the decline.

First Monday low and Wednesday high (one day after 21 days in Galactic Year).

André

Galactic year begins when earth directly passes the Galactic Center in Sagittarius?

Is the Galactic New Year the same date every year?

Valley,

The Galactic Year starts when the sun crosses the galactic equator. This equator connects the gate of god with the gate of man. You can see this only in sidereal astrology. Yes, every year June 16th.

This year the new moon was exactly the same date which leads me to believe – unlike other people – that the 19 year cycle ended June 2015.

Solar declination – the basis for a Gann year – doesn’t make sense in a heliocentric approach. The primary orbit of the sun in the galaxy does.

Thank you, Andre’. Obliged.

Hello Andre,

So we have to watch for a high near July 16 -23 after that a serieus decline will start to take form..

Or is a first low between 8-14 July still in the cards?

Thanks in advance

John.

GM:

Easy to control the sheeple when only 3 corporations own:

1500 newspapers, 1100 magazines, 9000 radio stations, 1500 TV stations,

and 2400 publishers.

Joseph; one of the most psychologically astute insights Iv’e read in some time.

Re EWT; there is a scenario which also agrees w/your observations; but it’s

hanging on by a gnat’s eyelash.

Im always playing mental chess on how the maximum number of mkt participants can be fooled. I personally loathe these “gurus” , “newsletter whores”, or whatever you want to call them who only present their case as the only case in their subjective probability space. If one doesn’t have a handful of scenarios in their probability space then they aren’t making a meaningful cognitive effort. And for these pricks to go around acting like gurus and charging money and not being sufficiently thought provoking pisses me off. Everyone and their mother for months now has been expecting various valuations for gold below $1,100 and that’s why we will not see those values in the near future b/c everyone expects them. That’s why I like K’s scenario, but it’s not the only one.

The other tendency I can’t stand , regarding the discussion in one of K’s links, is this annointing of the 6.5 year cycle, the 7 year cycle, the 8 year cycle, 18 year, and so forth. If such cycles existed then we’d all invest accordingly and be filthy rich. I have a commodities book from several decades ago. I dont have it handy right now but gold’s mean cycle was calculated at about 6.5-6.8 (cannot recall exact value and silver was slightly higher at 7.0-7.2) Anyway i cannot stand this rubbish of very exact discrete repetitive cycles. If they were exact we’d all be rich and we all know that’s not possible.

Lunar Chord next week:

Seasonal and moon phase +

Distance and Declination –

Planets: – (confirmed by Alphee Lavoie’s prediction on Timepriceresearch)

My plan: day trade or swing trade on short side, especially if Monday gaps up.

Made a bit on shorting Monday near the open. Reluctant to go short until price reveals something. End of this week, and next week long opportunity.

John, I simply do not understand your logic on bad demographics is good for gold? It seems to me bad demographics would be bad for stocks and gold.

Kent, gold rises when the system becomes unstable.

A system loaded with debt (notably sovereign debt) when demographics means that taxes won’t keep up with liabilities guarantees that the system will collapse at some point, either via defaults, or (in most countries) via currency collapses.

Add in bank failures and depressions…

Hence gold takes the bulk of money seeking a way through and out the other side.

Bad demographics bad for profits hence lower stock prices. Lower stock prices decreased wealth effect middle class. Perfect time to create a bubble in gold and miners when fewest non insiders have capital to participate.

I am not a massive fan of ZH but every now and then they uncoversomething that is indeed intruiging.

How in hell is this even remotely legal?!……A’la Hunt brothers 1979.

Thanks USA for turning the whole global financial market into a total joke!

“And also: how is it legal that JPM is solely accountable for 96% of all commodity derivatives while Citigroup is singlehandedly responsible for over 70% of all “precious metals” derivatives? Surely even by the most lax standards this is illegal, but what makes the farce even greater is that all of this taking place out of FDIC-insured entities!

The final question, which we are absolutely certain will remain unanswered, is whether any of these dramatic surges have anything to do with the recent move in precious metals prices, or rather the complete lack thereof, even as Europe is on the verge of its first member officially exiting the Eurozone, and China’s stock market is suffering its worst market crash since 2008. Oh, and we almost forgot: with both JPM and Citi now well over 50% of the derivatives market in two critical categories, who is the counterparty!?”

http://www.zerohedge.com/news/2015-07-04/why-did-citigroups-precious-metals-derivative-exposure-just-soar-1260

Hello Allan,

Typical ZH drivel, utter nonsense all of it.

They are the classic pumpers that simply don’t understand some of the things they read, and spin it as manipulation.

http://research.perthmint.com.au/2015/07/02/mea-culpa-on-occ-derivatives/

A very large majority of gold derivatives are traded via the LBMA anyway, US figures are a sideshow.

GM, mate I wouldn’t be too quick to discount the ZH assumptions. I’m still sifting through things to workout what is what but there are a few things that don’t add up.

Like I said I don’t give ZH much cred with most things but they aren’t wrong 100% of the time.

Cheers

OTC derivatives were designed

to be above any law or even any morality

for this very purpose

welcome to the not so brave new world order

One answer is that hedgers (both producers and users) as well as speculators/hedgefunds use JPM and Citicorp as brokers. They bundle these and report it under their name. They have legal exemptions issued by the CFTC to do this. So they actually are not really exceeding position limits except to the degree they are cheating. They cheat in other ways such as withholding supply, etc. It is basically just another goldbug argument trying to explain away how wrong they have been for the last 4 years.

The world is not ending according to Chris Puplava. Credit markets are not showing the same stress that they did back in 2000 or 2007.

http://m.financialsense.com/contributors/chris-puplava/bull-market-top-pause-credit-markets

No offence but he has his head squarely planted up his …..!

Just about every bond trader I know is backing out fast!!

How do you make comparisons between 2000/07 and 2014/15 when the later has been distorted via global QE??

On the subject of Bonds. You’d expect the PIIGS yeilds to have increased substantially into this weekend? Wrong. Check out the video below. Ofcourse bears could aruge thats it different this time … http://www.seeitmarket.com/video-blog-understanding-the-risks-tied-to-greece-14534/

Allan, he has a good track record. He called the 2007 a few months before the top.

If we take out 7.28%, the trend would be confirmed IMO:

https://research.stlouisfed.org/fred2/series/BAMLH0A0HYM2EY

Good chart –

Greek NO vote likely. This will create the best swing trade long opportunity for the dax this year. Will start loading up long first thing Monday if the futures remain this low. Target will be 11,500 initially.

On the fundamentals, a no vote equals the start of the end for EZ sovereigns and banks, so run for the hills.

Technically, the Dax looks ready to fall to 10k.

But good luck to you.

Wrong this is a bottom, technically the DAX looks ready for 12k and above.

Too much bearish bias and emotions…. watch the charts.

What a beautiful recovery this morning. Taken some profits at +200 but leaving the rest open for 11,500

Krish/karni,

I’m no expert trader, but this looks like a clear downtrend to me, support around 10k.

Love to hear either of you explain why you see otherwise.

http://screencast.com/t/B7kKjyP3XXh

Overlapping structure – corrective

Week 38 – 40 week cycle low expected

Market breadth – divergences

Greece – not a surprise, well known news… it can not change the trend

The Greek drama is just max fear before correction end. The big boys pushing lower to shake out weak hands.

Yes the Greek drama is max fear which is what we are at now. Expect a big rebound as usual following these events. The Dow should hit or surpass 18000. The DAX I think will reach 11500-12000 and start the next bull leg to new highs. US markets will probably trend sideways until the respectively cheaply valued Europe catches up.

I guess neither of you two perma-bulls have looked at yields and commodities today?

It’s fairly clear what’s unfolding, and it has nothing to do with Greece.

SP500 futures open -30

hhttp://4.bp.blogspot.com/-C42J73eKdyo/VZluLXQXjdI/AAAAAAAAAtM/OBopgWPJmOk/s1600/DJIA%2Bvs%2BOption-Adjusted%2BSpread%2528Daily%2529.gif

To all the sad traders who entered the office tonight I wish the best of luck. This is an ” Oh dear” 50/50 moment .

GM. i just spent the last day going over details of both aricles, the ZH one that I posted and the PM article youposted and I believe tjat ZH have indeed uncovered some very significant points.

It would go a lng way to explain WHY in early 2015 god and silver were on the verge on breaking higher only to suddenly drop dramatically just as the USD were to also decline.

It also explains WHY precious metals have failed to react even slightly to the events in Europe.

They really want evryone to think that PM’s are NOT any kind of safe haven and t is working judging by some comments from here and eksewhere.

gold and silver always catch a bid during ASian hours and get sold down towards Europe and US sessions opening hours……….. they are determined to stop gold from moving in any direction but down

Sorry Allan, I’ve read enough about this issue over the years to know ZH don’t grasp much about the gold market.

We’ll see gold go through $3,000 soon enough, when market confidence dwindles, all talk of manipulation will vanish then. Same as last time.

if this is true then the game is up

In an extraordinary move, the People’s Bank of China has begun lending money to investors to buy shares in the flailing market. The Wall Street Journal reports this “liquidity assistance” will be provided to the regulator-owned China Securities Finance Corp, which will lend the money to brokerages, which will in turn lend to investors.

Red Dog, quite bizarre isn’t? Chinese central planners allow a stock market bubble to unfold and do nothing to arrest the inevitable at any point and then panic when it all goes bad.

What in the hell is going on in this world???!

I never had much faith in central planners ability to manage global markets but I have to say the events of the last few years has left me with ZERO confidence in their abilities.

There is not ONE central bank/government ANYWHERE that has even a modicum of talent or leadership to offer global markets.

Nobody ever wants to make the hard decisions required to solve the real issues.

This is not true. The Wall Street media want you to believe it though.

Here is the People’s Daily article:

http://en.people.cn/business/n/2015/0706/c90778-8916154.html

Here are the websites for the CSRC, and the People’s Bank of China:

http://www.pbc.gov.cn:8080/publish/english/963/index.html

http://www.csrc.gov.cn/pub/csrc_en/

The central bank is just carrying out normal prudential liquidity operations. It is not supporting or pumping the stock market.

*China* has been trying to pop the bubble for months by the way, but bubbles….what can you do?

Do not believe media reports (full stop, Western or Chinese).

The wheels are coming off, find your own truth, or (potentially) pay a heavy price.

There will be tonnes of misinformed comment on Greece and the EZ in the years ahead also. C’est la via.

GM,

“Do not believe media reports (full stop, Western or Chinese).

The wheels are coming off, find your own truth, or (potentially) pay a heavy price”

Mate the TRUTH!

PBOC policy rate cuts earlier this year is all the PROOF I need that they helped fuel the bubble.

They repeated their action twice after they saw the results in stocks first hand after the first time they lowered rates and then repeated it!

They were complicit in the bubble FULL STOP!

PBOC is no different to any other CB. They allowed a shadow banking industry to explode, malinvestments in property to explode and then overflows into the stock market, only to compound the situtation by lowering rates to alleviate the former two, thus driving the stock market buble further.

Then when it all goes pear shaped, they panic by injecting further liquidity. No different than the rest.

After years of watching this repeating cycle I was amiss to understand how in hell these people could be so stupid ad repeat this time and again.

Enter John Hampson………. 😉

Allan, the central banks are on our side (in that they see the bubble in debt, and are trying to manage their way through it). It’s not their fault the world went the wrong way in 1922. It’s governments and their voters, wanting an easy life. Read this:

https://twitter.com/Trident_one/status/613056913438339073

Specifically regarding China, head over to Jeff Snyder’s blog at Alhambra, search for ‘China’ posts, have a good read, you may develop a more nuanced view.

Cheers.

7/6 10:02 Spiral update – looking for a high @ 7/15 – price target 2139. short term low this am @ 11 ET.

Peggy, this prediction can change depending on the market’s behavior, correct?

7/6 16:32 Yes, although the chances for that are small as Singularity was 7/3. The Expansion high is July 18 but the high is expected either 7/15 or 7/22. I’ll update as the uptrend evolves. The new low today changed the outlook to forecasting a higher price than last week’s low.

krish/karni, you guys must be sweating tonight if you’re still long the Dax. Good luck.

Allan, I’m sure you’ve noticed the past 2 days for HUI.

Will 145 be the low again?

Or a quick plunge to the 120s?

Haha no sweat. investing is not for you if you sweat over positions. No emotions should be involved.

4th time the Dax is testing 10,800. Looks heavy to me.

Time for a short?

GM as I have said previously, the chart below is the one that I pay most homage to in regards to NA stocks.

Also as I noted several weeks ago based on the 30 year seasonal chart of gold we should be entering a period of strength. Last year that situation was completely reversed,(again oddly as gold was breaking out), but I’ll leave that one alone as you suggest.

Let’s see what happens this year?

http://stockcharts.com/h-sc/ui?s=USERX&p=D&b=5&g=0&id=p17136868777

Thanks Allan.

Gary, I fully agree with you on the gold scenario. I have been a gold bug for many years, but yet I have not been in any gold stocks or bullion for a few years. I have been waiting for the gold stocks to take another pounding. Yes the hui will plunge towards the 120 or lower. I am looking for a 18 – 22 % correction in the markets over the next several weeks. I am waiting for one more bounce in our North American markets before layering in the shorts.

Good luck to all.

I don’t really enjoy being the alarmist but this gels with what I posted the other day in response to Duncan.

Many of the bond traders I know are backing out fast. Liquidity is drying up and they are REALLY worried. There is nothing that spooks bond traders more than a lack of liquidity:…….

“NO ONE is standing up to market prices and to liquidate even a small portfolio can take weeks”

http://www.silverdoctors.com/insider-warns-credit-market-is-shutting-down-75-trillion-implosion-looms/

This is a fellow who keeps a track on actual goings ons in credit markets for tells on equity markets. I find his cross market analysis quite helpful:

http://www.seeitmarket.com/credit-markets-update-is-something-scary-headed-this-way-stocks-14446/

German DAX and China, the best performing ones with US markets, are severily correcting….IBB remains the BUBBLE. Who is giving so much confidence to this incredibly overvalued sector?

“Who is giving so much confidence to this incredibly overvalued sector?”

Trolls…on internet sites……we know who ours is…?:D

imho

J

I can smell a waterfall/crash arriving. Just the look of everything: gold, silver, oil, equities, bonds. Looks to me like a big risk-off move.

But I could be wrong!

Where’s my mate Allan, with his ‘no deflation and bond yields melt up’ tales today I wonder?

Oops, edit, I meant Phil of course.

16 pips til Dr Copper declares a global pandemic: margin calls.

2.384 on the futures,that’s where it bounced in early 2007, nothing below this level but gravity and doom.

Copper bounced 3 pips above 2.384, after 8 years, fascinating. To me anyway. (I feel like I am talking to myself!).

Dax might catch a bounce at 10,600, lateral support there.

Where are all of the bulls?

Nic mate, how are you doing today?

Time to sell, the exits are getting crowded. 😉

And this: https://www.tradingfloor.com/posts/stress-indicators-a-game-of-musical-chairs-5463167

Not making a market statement here or anything, but just an update as to where I am…

Trading system still at 100% short…

For my own trading, a few minutes ago, reduced from 189% net short to 155% net short… More a risk-management statement (as positions grow) than a particular market statement…

Did that by liquidating a few short positions, as well as going long EDC…

We’ll see how that works out, but money flow has been looking best in the Emerging Market ETF, versus all other sectors…

Energy is looking interesting as well, but really difficult to pull a trigger there until oil itself at least ~tries~ to set a bottom…

Barry, smart little update on crude:

http://www.futuresmag.com/2015/07/07/dollarloonie-may-have-date-six-year-high-crude%E2%80%99s-collapse-continues?mc_cid=45f60df42e&mc_eid=25abf79058

SPX chart starts to look really ugly. Surely decline today is frightening. Looks like great top MAY finally be in. But it would have been unusual for it to happen before September/October. ES contract chart suggests that today’s decline might be C wave of small abc correction that started yesterday. If we do not take that 2035 level in decisive way then frantic reversal may be in the cards even before close today. For now it looks like retest of bottom at 2035 so let’s see if it is taken or not.

Good call on 2035. Now we might fill the gap from late June.

Poor bulls.

Peggy … came across this website >> http://www.oss.cc , peggy is the same author – Steve? it is Spiral based too.

no. It’s not the 7442 Spiral.

7/7 12:29 Spiral update: Short term forecast: 7/8 and 7/9 midmorning highs. First target 2081. Expansion high mid July – new target 2100

The White House has confirmed that President Obama spoke with Angela Merkel today, and pushed her to avoid Greece leaving the eurozone.

Russian fleet prepares to sail?

THEN SO WILL THE US 6TH FLEET!!!!!!

People buying the dip…..business as usual then:D

I was explaining and posting charts the last two weeks….

Now the FED will be blamed, rigged markets…. bla bla

And all you need is to look at the charts…

So, what do you see karni, between here and the end of 2015?

one more high and than a correction will begin which should last for months lower at least to the October 2014 low

7/7 15:53 Short term Spiral forecast – next 18 hours expecting 11-12 pm high, 2:30 low and 10-11 high

Peggy: so the Spiral system would just have one sitting through these huge swings? Does it ever place a stop loss in case it’s wrong?

Trading it is up to the individual – fwiw, I use a stop for my swing trades.

a good example is the May 10 Singularity to the May 25 Expansion – a couple of good swings in between.

PEGGY, APPRECIATE YOUR INFO…….DO YOU HAVE A LONGER TERM FORECAST ON THE SPX…….2-3 MONTHS DOWN THE ROAD????

yes Team Winning. The Spiral expects lower lows ahead in the Aug-Oct time frame. The mid July high will shed some light on price targets for the low.

But longer term the Spiral expects 2139 and higher, correct?

yes.

China. wow.

Key US session ahead, if markets continue

to build on yesterday’s gains then Tuesday

may have marked a major reversal.

I mention “may” as those who expose certainty here

have been made to look utterly ridiculous over

the past few months.

Gold – the bulls have been humbled yet again.

Ah, hello again Phil.

You still appear to be dismissive of JH’s fine work over the past 6 months, all of which is proving accurate since Mid-May. How ignorant of you to choose to pretend your own narrative is correct, when the signs were pointed out for readers here by our host.

What say you on deflation and bond yields today? Still shorting USTs and long commodities I wonder? Your certainty just last week on those two asset classes would have cost you dear I imagine (if you were trading your views).

I assume you never bother to compare gold to all the other commodities?

Yesterday was a great day for gold, if you but understood one iota about its value, or how market participants are behaving during a forced liquidation.

Starting to think you got this one correct GM. Even US indices are turning down now. You don’t need technicals or fundamentals to lead us down when you have a bunch of incompetent leaders in Europe! I really am surprised how long these guys are taking to sort Greece out but investor confidence is taking a hit.

Krish, as I mentioned in a comment to Phil, the evidence of what is happening now has been presented by JH for many months. It started months ago, so one can’t blame Greece or China.

I wish you good luck.

The only certainty I know is that you and GM will forever disagree, lol.

We both agree a bear market lies ahead!

The death of the Middle Class in America could be a major reason why Gold is no longer rallying.

China’s stock sell-off is pointing towards Delta’s S+P 500 Super Long Term point six as a high, not a low, and it is due May, 2015. The next Solar Cycle may not have enough “power” to rally stocks up to point 14 due early 2025 unlike what happened in 1929.

I an now neutral looking to short stocks. I don’t really want to see a stock/economic crash as I suspect that all hell will break loose on the streets if it does.

The US middle class (and all other US & Western classes) haven’t been into physical gold since the 70s, and they won’t get back into it either. It’s a hated asset.

Well according to one of our more ‘insightful’ financial newspapers aka The Daily Mail, our dear Chancellor apparently gave the UK Middle Classes a huge tax cut. Perhaps we can help with this gold thingy!! LOL!

A soft socialist budget purvez, no real attempt at austerity. A quote from a Guardian reader: ‘Oddly enough I think it looks quite like a first labour budget would have looked judging from the manifesto , he’s stolen a number of the better ideas minus the mansion tax.’

They know mire lies ahead, but the gravy train rolls on.

Yeah, gold thingy, let’s do that.

Some very interesting and informative charts recently posted by this chap on Twitter:

https://twitter.com/andrewunknown

It would appear warning signs are appearing in more sectors.

“Technical issues trigger systemwide halt at NYSE” 11:32am EST

What the WHAT?!?!?!

ES contract must be supported at 2035. If violated then it means big bear is taking over and November lows will be quickly revisited.

“NYSE: All Open Orders will be canceled” 11:57am

Might want to double-check your open stop orders once this is over….

But seriously, “system software upgrades”?? Mid trading day??

I’m looking at YOU, Bob Pisani…. Jeez…what a tool….

A major gap? Time will tell.

http://peterlbrandt.com/sps-a-breakaway-down-gap-is-very-possible/

I am betting on it. Than slide in to the short side into Aug sept time frame.

Unlike Bird Flu the Chinese Flu contagion has never been stopped chemically but has always run its course. Lots of vitamin wave C typically brings relief. It is not previously recorded as being extensively fatal. A hammer shaped candle is known to highlight the probable point of recovery.

After effects include general loss of confidence in most everything and frantic dreams of digging for gold.

Peter_ I don’t always get every nuance of what you say…..but I do love your posts. Thx

CHINA IN FREEFALL……IT DROPPED ANOTHER 5.9% INSPITE OF THIS!!!!

Over 700 Chinese companies have halted trading to “self preserve”. That means about 25% of the companies listed on China’s two big exchanges — the Shanghai and Shenzhen — are no longer trading.

COMING TO A MARKET NEAR YOU!!!!!

China Bans Stock Sales by Major Shareholders for 6 Months

China’s securities regulator has banned major shareholders, corporate executives and directors from selling stakes in listed companies for 6 months, its latest effort to stop the nation’s $3.5 trillion stock-market rout.

China WOW to repeat Reb. A 40% drop is a major bear market. But their’s is even worse. Over 2500 companies have not even traded. That should be an interesting opening. Oh no, China no longer omnipotent. The key was Chinese real estate peaked in the middle of last year, now the market has crashed, and coming soon the collapse of the economy should become evident. So why have commodities been so weak? China represented over 50% of world growth.

Now, we have bearish Greece, Puerto Rico, and China. QE ended last year. In Japan over the last 25 years, their QE helped the economy, mkt, employment and inflation. But even though momentum continued for several months, they all turned down within a year after QE ended. We are there.

Finally, I have noticed a lot of bullishness about Europe and esp the DAX. It sounded logical due to all the bad news. I looked at the long term chart of the DAX and they have had a 6 year bull mkt just like us. Plus, it has a fairly clear 5 wave count up, is rolling over and in position to break below the 200 day moving average.

That is a very bearish scenario – Rosey Scenario’s brother Beary Scenario.

thought a few of you might enjoy the “trollette’s” last post

Nicolas

June 30, 2015

Hi all ! Hi Valley ! I maintain this is still a bull market. The ECB said yesterday they are ready to increase QE if needed, the chinese central banks cut rates and is willing to support the stock market. In addition, this morning we have a big deal between Celgene and Juno which should drive IBB higher.

So, I’m not worried at all. I’m looking forward to new all time highs shortly.

regards.

Reply

Turned in to a nice day for those short, congrats folks

to those who benefited

Another nice day for those long USTs too Phil.

Message for jeger….never got round to congratulating you on nailing the China top, I wonder if you’ve been short through the crash? Hope so.

Message for Nic….. 😉 Chin up, keep smiling, and press that sell button to ease your pain (before everyone else does).

Lunar Chord:

Seasonals: +

Moon Plase: + (new moon next week)

Distance: neutral (sell off fitted perfectly with post perigee weak zone)

Declination: flips positive Friday

Planets: super bearish Venus inferior conjunction 8/15; bullish V/M helio conj 7/18; bullish M superior opposition 7/23.

Summary: went long today near the close. Hoping for bounce up tomorrow and into favorable new moon next week. Convergence of negatives appear end of next week, moon phase goes negative, apogee weak zone, seasonals change to negative. Will probably get stopped out tomorrow and sit on hands until after new moon.

Message for Nicolas: please refute those who don’t understand the CB equity perma bull thesis; if you are correct, now would be the time to be fully invested as prices have been taken down to yearly lows.

I understand the CB equity bull thesis valley, but consider it nonsense.

Valley, I’m pretty sure Nicolas has his hands full right now, trying to wrap his head around this:

(as was posted earlier)

“Over 700 Chinese companies have halted trading to “self preserve”.

That means about 25% of the companies listed on China’s two big exchanges — the Shanghai and Shenzhen — are no longer trading.”

Everybody has a thesis….

The trick is to find a new thesis ~before~ a bad one blows up in your face….

*rant over…….carry on….* .

Time will tell. Nicolas has been on the right side of market movements since he has been posting and only the last few months does it look like his buy and hold strategy may be in for a corrective phase. Kudos on your success with market timing Barry.

Whatever a person’s thesis is, as long as it keeps you long, while the market goes up, may seem like it’s a good or correct system/thesis (rationale for being long, in this example).

I mean, I could say my reason for staying long is…..the sun comes up in the morning…..

The sun’s up this morning??

Check off the box, and stay long the market another day….

My trading “analysis” is done…. 😉

I could even call it my “Sun-Up, Market-Up” system…. 🙂

AND……the best part is….. I could even tell people, “you’re welcome for my analysis”…. hahahaha 🙂

And dang if that ole’ “Sun Up, Market Up” system hasn’t been paying off…in spades….for several years now….

However, as is obvious to anyone still reading this, that doesn’t make it a “good” system…..or thesis either……

And not meaning to belabor this, but my point is:

If The Fed, or any other CB in the world could just keep markets always going up, wouldn’t 1973-74, 1987, 2001-02, and 2008 ~not~ have happened??

And yet……the Fed was around then, and…..they did….

How could that be? Never seem to get a good answer to that one…..

Regardless, thanks for the kudos…. Fair to say, I’ve had a pretty terrific last couple of weeks here, but until a few weeks ago, this whole year has been nothing but wasted time and trading money back and forth…. Whole lotta “nuthin”…..

And don’t even get me started on the PMs….. *shaking head here*

Whaaaaa?

“Time will tell. Nicolas has been on the right side of market movements since he has been posting”

Nicolas recommended buying BHP @ $49 now $37. RIO @ $46 now $38 just for starters.

Yep always on the right side??????!

Given all the outages yesterday (NYSE, United Airlines, WSJ) would anyone know if we had one of those CME things hit us and cause this? Just interested whether there was any extra terrestrial reason.

Hey GM

I closed A45 short positions last week. Very happy with that but probably would have been happier still this week;) I may lay off that market for a while, those 4-9% daily ranges are a bit……unnecessary in terms of my risk management…^^

J

Chinese plitburo have completely lost the plot?

I am gobsmacked by their decisions of the last 12 months….GOBSMACKED!!

China is headed for meltdown unless they can begin making solid proactive decisions. Banning large shareholders from selling is NOT a wise move.

Allan

Agree. Despite numerous historical examples of what to do and not do, this sort of action just smells of panic and incompetence. But then, I have asked many politicians in different counties over the years questions on many topics, and to be honest they don’t know anything. Not about how to get clean water to people who don’t have it, how to speak honestly and take responsibility for their decisions or actions, not about how to create a better future without debt and money, not even about why cities like London have a transport system that is so packed with people that even veal calves are better off. Politicians’ education these days is in how to avoid scandals, how to lie without lying and how to gain and keep popularity through various dishonest means. They unfortunately have no experience, knowledge or expertise in handling the problems that face us these days. They can’t answer my questions because they just don’t know. The people in Chinese government as are as clueless as our governments in the western world. They will also find that out eventually of course, when the people that elected them didn’t elect them to protect corporate profits at all costs at the expense of themselves. It just has to get bad enough, and people have to be conscious of where things are going to go….that unfortunately will take a long time I suspect…..:)

imho

J

I agree government is clueless, give me an anarcho-free market system and I’d be happy.

The bigger problem is that government is composed of humans, and humans are erratic and emotional and driven by evolutionary desires to survive at the expense of fellow humans.

I think we close the gaps now, or try to, I’d be loading up on shorts after a day or two.

GM

The single most powerful driver in this system is money. Sure, humans are emotional and erratic without money – however these people do not need to survive in its most simple definition, however if you mean financially then we agree:)

J

It looks like ES contract may retest 2075-2080 resistance today. We will probably break out of this 2035-2080 range on Monday with “final” decision” on Greece.

Kick Can 1 Break Toe 1 – both own goals

New post out

Excellent commentary John. Enjoy reading your blog.

there will be incredible gains in some mining stocks, as we have seen in the past, in this Sector and in all the other sectors

astro analysis are bullish signals for gold …

If the resistance is broken occurs rise in 1105 to the 1122 level in 1130 li …

on August 13 to be seen if the level is broken this rise continues until 20 August a …

level rise if it is not broken down again on August 20 will start a trend-way