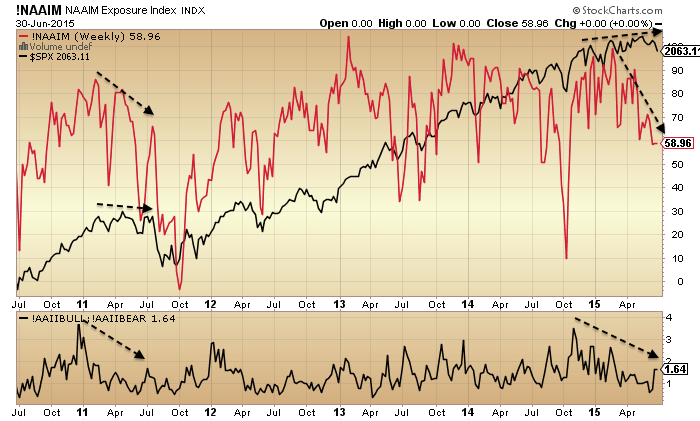

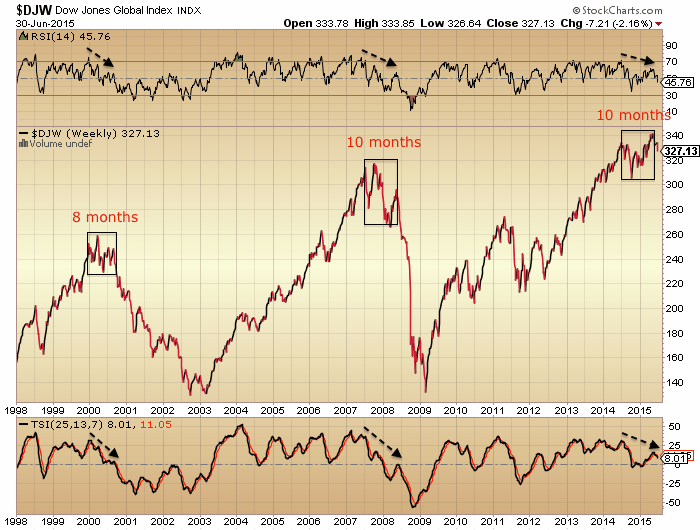

It’s a picture of a major market top. The ‘real’ peak was mid-2014 at the solar max, as it was at the last solar max of Spring 2000. The supports for price since mid-2014 have been dismantled and evidence suggests the nominal price peak in equities occurred May 2015. Annotated, so no further comments.

Greece defaulted and the world has not ended.

The UKX finished the month over – 6% down, so those short

had a very nice few weeks.

Gold has not reacted to the current volatility, US longer term

yields edging higher.

Lets see how July develops.

US 10 year yields:

http://data.okfn.org/data/core/bond-yields-us-10y

Edging…….?

You decide.

Question is with the 19 year cycle high late followed by a late SC high is Delta’s Super Long Term wave count such that 5 is a late high followed quickly by an early low 6 thus implying that the Trend in stocks is up in a very big way.

A practical question to ask is the first half of 2015 a topping process or a sideways process that resumes the Bull Trend. Most sideways trends end up being only a pause of the major trend and that points towards the Bull Market resuming after the sideways process soon ends.

Note that Sideways Trends often have a “head fake” (or what Ellioticians call a Throw over/under) before resuming the major trend.

I think that question has been asked and answered Richard.

Time will show us.

Misleading statistics. Most days where I count more blue birds than black birds, there are no earthquakes in CA too. This is because they are rare. Most of the time, the market does go up and most of the time there are no earthquakes. That is the argument for buy-and-hold, which is respectable if one is willing to do that and forego any other opinion for life.

Poetry.

Great post, JH.

NYSE Margin was updated yesterday, and so the graph shows a decline in the next data point.

Some more positive US data this morning.

10 year yielding over 2.40% again and gold weak,

“then “fakeout” call is incorrect.

Hopefully too many have not been hammered being short.

Time of lunch then Tennis )

Hammered being short?? It was John himself who provided a number of charts indicating short-term selling exhaustion a couple days ago! Phil, not a particularly insightful thought, I’m sorry.

I believe that the ‘next move’ by the stock market will depend on the CBs ability to paper over the cracks left by the Greek Banks if (when) they fail.

Has anybody had a chance to identify the size/breadth of contagion that the Greek Banks can offer?

Unfortunately I have not had much time to devote to this but I believe it is crucial to what comes next. Please post if there is any info. Thx in advance.

Aaah well, Deutsche Bank believes everything is OK. So then it must be!!

http://www.google.co.uk/url?sa=t&rct=j&q=&esrc=s&source=web&cd=6&cad=rja&uact=8&ved=0CDYQFjAF&url=http%3A%2F%2Fwww.businessinsider.com%2Fdeutsche-bank-greece-contagion-and-limited-eu-impact-2015-6&ei=1fOTVeXYL8b9-AHP7ZmAAg&usg=AFQjCNGSH3N3RPR6gRlPoRlnFymQThnRBQ&bvm=bv.96952980,d.cWw

purvez, I can give you an indication of Greek exposure across major banks if that’s any help:

http://www.screencast.com/users/Gary_UK/folders/Jing/media/6a4190fc-b824-4881-b1cc-26d1b5b0ffaa

Thx for the info GM. So who are the major creditors of Greece. The Troika?

If that’s the case then there will be no major market repercussions cause those guys make up their own rules for pricing their ‘assets’.

When the market sees that Greece was allowed to default everything changes.

The EFSF becomes untenable instantly, as it’s just a house of cards. Greece, Portugal, Italy, Spain are all backstopping the guarantees to one another. Suddenly, default is an option for all EZ sovereigns: NO MORE BAILOUTS.

It’s easy to say how Armstrong’s 2015.75 date for the start of the sovereign bond crisis will be pretty accurate, maybe that will be the date the EFSF has its credit rating slashed.

Yep I think the last figures I saw were that the ESF has about 6x% of the exposure….which is really just taxpayer money over many decades so that won’t affect the stock market….just the future of your children:)

J

J, I can’t make up my mind whether its the tax payer’s money or the children’s future which is valued the least. Any thoughts?

purvez, re your question on future generations, here’s an answer for you:

https://www.ecb.europa.eu/press/key/date/2013/html/sp131108.en.html

A quote:

‘A first question is how the burden of high public debt levels in Western societies will be shared between generations. This question is particularly pertinent in the euro area because all countries are bound by law to start reducing their debts to below 60% of GDP – and average public debt levels in the euro area are currently in excess of 95% of GDP.

If fiscal consolidation starts today, then the generation which has benefited most from this debt will play the largest role in reducing it. But if consolidation is delayed, then future generations will have to bear the burden of debt reduction – this would constitute a direct transfer from our children and grandchildren to ourselves.’

The ECB do not feel that big govt and devaluation are fair.

It’s all part of the plan to unravel socialism and the debt bubble.

Going to be a big job though.

If fiscal consolidation started today, it would be a recipe for disaster, GM. In a contracting economy, one doesn’t want to decrease fiscal spending – one wants to increase it until private sector balance sheets are repaired and able to take up the slack, if you will. Paul McCulley, formerly of PIMCO, is the man to read on this very topic.

Gary, that’s the mantra of the socialist. But that will not happen in Europe, thankfully. Reality will arrive, and it will be tough. But it will shrink governments and give people and businesses a chance to thrive at last.

That which is unsustainable cannot be sustained, as we will see in the next 10-15 years, when socialism, deficits, all of it, collapses in a heap.

The world will learn in due course a harsh lesson, that these past years since 1922 were simply a bubble.

Prepare now, buy gold, or repent at your leisure.

I think this will continue until one of two things happen.

(1) We get inflation that consumers actually see and protest about.

or

(2) Someone can tweet in a small number of words, explaining why printing free money in the absence of inflation is harmful.

That is just the sad truth in today’s world.

For the second one I nominate JH. He is a master of the ‘precis’!!

I don’t want to rehash this topic but thoughtful observers have suggested that (at least in the Fed’s case) the CB is not printing free money but essentially engaging an asset swap (distressed assets swapped from banks’ books to the Fed in exchange for money in order to reliquify the banks so they can lend again to get the economy moving).

That’s an important distinction and one many (most?) people miss.

In a perfect world as those assets repair themselves, the Fed reverses course and sells them back to the banks in exchange for “cash”, pulling liquidity out of the system once the economy is back on it’s feet. (That’s how it’s supposed to work, right?).

Yes, you are correct Gary (to the best of my understanding).

We’ve yet to see the ultimate result of QE.

I believe it will be negligible in terms of inflation, that will be caused by other factors.

CB credibility is what is on the line as we go through the cycle.

Most will lose ALL credibility.

One day the US Congress will strip the Fed of its charter, within 15 years I reckon.

I don’t get the asset swap explanation. If I buy a bond, I give the bond holder cash and I get the bond. That’s an asset swap. The same amount of cash is in circulation as before. But if a CB is doing QE, when it buys a bond, it gives the bond holder cash that didn’t exist before by pressing a button. It credits the bond holder’s bank account, and the bond magically appears as an asset on the CB’s books. After this transaction, there is MORE MONEY in circulation than there was before.

How is this an “asset swap” when the CB gets to add the bond to its assets, but “pays for” that asset with the touch of a button? And how is it an “asset swap” when the amount of money in circulation is greater than it was prior to the transaction?

pimaC,

The ‘money’ in circulation hasn’t changed at all.

The bank now holds ‘cash’, rather than a bond, both at the same value.

All that has changed is the size of the Fed’s balance sheet. That doesn’t circulate of course.

The ESF is a house of cards J.

https://en.wikipedia.org/wiki/European_Financial_Stability_Facility

It will unravel, and it will cause market mayhem, as many of the sovereigns go bust.

That’s the ECB way, allow the market to clear now, rather than burden future generations via currency devaluation.

Hurrah for that.

GM, your line of thinking gets more and more intriguing. Are you saying that sovereigns will go bust but the Euro will survive?

You need to complete that ‘paper’ of yours please. I’m very much looking forward to reading it.

Evening p (can I call you p?).

Yes, that’s what will happen. QE may have fooled some into thinking the ECB is the same as the other CBs, but look closely, most of the risk is with the national central banks. Eventually, when the bonds default, payment to the ECB will be required. In a real asset that represents settlement.

I’m 70% there on the post on this subject, but it’s long already, a meaty subject.

I’ll post a link here, hopefully within a week. Maybe two, it’s golfing season.

Hi GM of course you can call me ‘p’. I’ve been calling Jegersmart, ‘j’ without his permission for some time now. Who am I to complain what people call me? Lol.

7/1 10:48 Spiral update: last forecast was 2036-2039. Time window for low is close and price missed by 7 points. 13:30 ET next low

7/1 12:25 Spiral update – 3 possible places for lows. Expecting an Expansion high 7/21. https://twitter.com/mjmateer/status/616281186839629824/photo/1

No, it missed by 17-18 points.

Clearly this is an important correction underway, but is it the 4th wave or a new bear cycle. For a 4th wave the form needs to show alternation and confirm itself against its impulsive 2nd wave partner, or show the trend to be complete. The 5th should show scale in price and time within accepted range of comparison with the 1st. So far, this is not the observable case. With the 4th being the favored count then a 3-3-5 flat or 5-3-5 form is next sought.

Peter_ please may I ask, do you consider the 2011 correction as the 2nd wave?

Yo Perez – FWIW The significant correction of 2008 is my preferred option for wave 2. Since that was sharp then my preferred wave 4 should be flat with a reduced range, where I expect a 0.62 ratio.

OhhhKay!! So you are looking at a much ‘larger’ wave count than just from the bottom of Mar 2009. Please would you post a chart so I can get some perspective? Thx.

Even before you get round to posting a chart….what’s the top of Wave 1 for you here?

Peggy

The low today I have seen was around 2057.xx so I make it around 17 points or more….:)

J

you missed 2046 yesterday

Peggy, all my charts only show 2057ish yesterday too. Where are you getting your data from, please?

2046-48 was hit on Monday 15:30 and Tuesday 12:30 – esu5 – September emini

Aaah yes, I forgot you are quoting emini prices. My fault.

The bears have the DJT on their side,

this is the most compelling current bearish

indicator.

US macro continues to appear supportive,

yet the Transports is in correction.

Assuming the US business cycle is not yet rolling over

(appreciate some will disagree) it would indicate the

possibility of a wider market correction, rather than a

new bear market, for now.

Plenty of opportunities to make money with this volatility.

Phil, the Dow Theory, or at least its most scientific version, has yet to give a formal sell-signal. Divergences such as the present one have happened often without lasting ill effect. And, in recent years, even full-blown Dow-theory sell-signals have mainly been quickly reversed. So, the bears shouldn’t rely on the DJT performance as part of their case for now. (I myself am a bear on a multi-year view, just not quite yet.)

Is July2nd a half day? I saw it mentioned here, but not the official nyse website. July 3rd is a holiday.

markets open all day tomorrow

thanks

pimaCanyon, see: http://www.federalreserve.gov/faqs/money_12853.htm

7/1 2:50 Spiral update. Acceleration causes price highs and deceleration causes lows. Here’s a graph. https://twitter.com/mjmateer

7/1 16:11 Lab 7442 forecasting 2094-2097 price target. http://www.ustream.tv/channel/7442-analytics

“distressed assets swapped from banks’ books to the Fed in exchange for money in order to reliquify the banks so they can lend again to get the economy moving”

It isn’t working. VoM is horrendous and is just one indicator that has been flashing for years, so what is wrong?…… In very basic terms

1) We are at the peak and final stages of a massive debt bubble, thus the princiole that you can not nflate something beyond what is its capacity

2) ZIRP has destoyed liquidity not provided liquidity. Bond markets will be the first to go and are already well into the process. The majority just haven’t woken up yet.

Now you know why there is no inflation.

OK we are getting there…say the market crashes. CNN HEADLINES.

MARKET CRASHES DUE TO XXXX

WHAT IS XXXX?

John

Some data from investor village

robry825

From the gas draws it looks like we may be entering recession. ….

Hard to hid hard numbers….

ECONOMICS: Economy peaked June 25th (according to gas-flows) in the near-term, as both the Industrial-production

……and the Consumption models put in a top. Now we have a tandem down-move pushing 5 days. Down-move started

……Friday. Greece-related?

……………………………………………………..–28.week.avg—………—Daily.(Raw)—……..Daily

……………………………….Dailies…………..Prod’n…..Cons’n………Prod’n…..Cons’n…….Food

……………………………..06/19/15………….138.2…….220.8……….2.121…….51.11…….49873

……………………………..06/20/15………….138.2…….221.1……….2.132…….19.81…….48520

……………………………..06/21/15………….138.2r……221.6……….2.116…….49.81…….49237

……………………………..06/22/15………….138.2…….222.1……….2.098…….48.46…….48660

……………………………..06/23/15………….138.2…….222.9……….2.110…….49.71…….47443

……………………………..06/24/15………….138.3…….223.1……….2.135…….49.51…….43867

……………………………..06/25/15………….138.3…….223.1……….2.098i……48.14i……44526i

……………………………..06/26/15………….138.2…….222.8……….2.099i……47.34i……47190i

……………………………..06/27/15………….138.1…….222.5……….2.097i……47.14i……45712i

……………………………..06/28/15………….137.9…….222.5……….2.082i……48.14i……47999i

……………………………..06/29/15………….137.9…….222.1……….2.104i……47.04i……48450i

……………………………..06/30/15………….137.7i……221.5i………2.076i……47.73i……47351i

……Industrial-production model (137.7) is up from its 132.5 low (03/11/05) though it remains below its August 26th 2014

……all-time high (141.5).

……Consumption model (221.5) has climbed from its 200.5 low (02/04/15) but remains well below its August 28th 2014

……peak (234.0).

……Steel-scheduling continues to suggest parts of the economy (durable-goods) remain mired in deep recession.

……Question now turns to the Commerce Department’s GDP report… will they show 2nd-quarter GDP retracting (as it

……did in the 1st quarter) and call the recession? Gas-flows say consumption grew about 7% quarter-to-quarter and

……industrial-production grew about half-a-percent. But the steel-group (which is a good indicator of durable-goods)

……fell 22%, and the Building Materials group dropped about 2%, which leans me in the direction of Recession being

……called by the Commerce Department.

……NATGAS: EIA-weighted model expects 75 BCF to be reported by the EIA Thursday. Baseline (69 BCF injected) scores

……the injection as 6 BCF to the bearish.

Today’s refining numbers…

……………………………..Scheduling………………………..Scheduling………………………..Scheduling………………………..Scheduling………………………..Scheduling

……………Weeklies……(MMCF/D)……….Weeklies…….(MMCF/D)……….Weeklies…….(MMCF/D)……….Weeklies…….(MMCF/D)……….Weeklies…….(MMCF/D)

……………06/28/13…………416……………12/27/13…………451……………06/27/14…………397……………12/26/14…………444……………06/26/15…………376i

……………07/05/13…………426……………01/03/14…………447……………07/04/14…………394……………01/02/15…………448……………07/03/15…………376i

……………07/12/13…………398……………01/10/14…………429……………07/11/14…………403……………01/09/15…………431

……………07/19/13…………391……………01/17/14…………441……………07/18/14…………382……………01/16/15…………428

……………07/26/13…………397……………01/24/14…………420……………07/25/14…………379……………01/23/15…………419

……………08/02/13…………416……………01/31/14…………392……………08/01/14…………438……………01/30/15…………415

……………08/09/13…………406……………02/07/14…………411……………08/08/14…………419……………02/06/15…………425

……………08/16/13…………418……………02/14/14…………419……………08/15/14…………412……………02/13/15…………435

……………08/23/13…………424……………02/21/14…………442……………08/22/14…………381……………02/20/15…………420

……………08/30/13…………386……………02/28/14…………410……………08/29/14…………384……………02/27/15…………428

……………09/06/13…………426……………03/07/14…………438……………09/05/14…………395……………03/06/15…………446

……………09/13/13…………412……………03/14/14…………431……………09/12/14…………387……………03/13/15…………447

……………09/20/13…………394……………03/21/14…………452……………09/19/14…………390……………03/20/15…………445

……………09/27/13…………411……………03/28/14…………452……………09/26/14…………380……………03/27/15…………435

……………10/04/13…………406……………04/04/14…………431……………10/03/14…………382……………04/03/15…………453

……………10/11/13…………431……………04/11/14…………426……………10/10/14…………385……………04/10/15…………467

……………10/18/13…………393……………04/18/14…………458……………10/17/14…………387……………04/17/15…………448

……………10/25/13…………436……………04/25/14…………420……………10/24/14…………380……………04/24/15…………442

……………11/01/13…………423……………05/02/14…………383……………10/31/14…………426……………05/01/15…………428

……………11/08/13…………435……………05/09/14…………397……………11/07/14…………354……………05/08/15…………404

……………11/15/13…………458……………05/16/14…………404……………11/14/14…………416……………05/15/15…………411

……………11/22/13…………439……………05/23/14…………415……………11/21/14…………456……………05/22/15…………426

……………11/29/13…………454……………05/30/14…………405……………11/28/14…………463……………05/29/15…………406

……………12/06/13…………446……………06/06/14…………400……………12/05/14…………446……………06/05/15…………402

……………12/13/13…………467……………06/13/14…………399……………12/12/14…………426……………06/12/15…………409

……………12/20/13…………467……………06/20/14…………401……………12/19/14…………439……………06/19/15…………379

……………………………..Scheduling….Weeks

……………..Dalies……… (MMCF)………Avg

……………05/30/15.(w)……402

……………05/31/15.(w)……406

……………06/01/15…………404

……………06/02/15…………404

……………06/03/15…………402

……………06/04/15…………405

……………06/05/15…………393………..402

……………06/06/15.(w)……411

……………06/07/15.(w)……413

……………06/08/15…………408

……………06/09/15…………413

……………06/10/15…………418

……………06/11/15…………407

……………06/12/15…………394………..409i

……………06/13/15.(w)……374

……………06/14/15.(w)……368

……………06/15/15…………365

……………06/16/15…………400

……………06/17/15…………386

……………06/18/15…………384

……………06/19/15…………374………..379

……………06/20/15.(w)……375

……………06/21/15.(w)……385

……………06/22/15…………397

……………06/23/15…………370

……………06/24/15…………373

……………06/25/15…………373i

……………06/26/15…………357i……….376i

……………06/27/15.(w)……373i

……………06/28/15.(w)……375i

……………06/29/15…………369i

……………06/30/15…………385i……….376i

……………(w) = weekend (Saturday/Sunday)

Today’s economic numbers…

……………Weeklies………Production…….Consumption

……………03/28/15………….132.9……………..205.9

……………04/04/15………….135.3……………..207.4

……………04/11/15………….137.2……………..208.8

……………04/18/15………….137.9……………..211.5

……………04/25/15………….138.8……………..216.7

……………05/02/15………….138.0……………..218.1

……………05/09/15………….136.9……………..220.5

……………05/16/15………….137.0……………..224.0

……………05/23/15………….137.1……………..222.1

……………05/30/15………….136.2……………..220.7

……………06/06/15………….136.8……………..219.4

……………06/13/15………….138.1……………..219.9

……………06/20/15………….138.2……………..222.1

……………06/27/15………….138.1……………..222.5

……………………………………–28.week.avg—………—Daily.(Raw)—……..Daily

……………..Dailies…………..Prod’n…..Cons’n………Prod’n…..Cons’n…….Food

……………05/31/15………….136.3…….220.5……….2.153…….48.81…….54459

……………06/01/15………….136.2…….220.6……….2.117…….48.88…….55843

……………06/02/15………….136.3…….220.4……….2.171…….48.88…….56931

……………06/03/15………….136.4…….219.9……….2.175…….48.88…….56008

……………06/04/15………….136.6…….219.8……….2.203…….48.88…….55690

……………06/05/15………….136.7…….219.6……….2.193…….48.85…….57205

……………06/06/15………….136.8…….219.4……….2.178…….49.58…….55866

……………06/07/15………….136.9…….219.3……….2.161…….49.16…….57139

……………06/08/15………….137.1…….219.0……….2.175…….47.70…….45850

……………06/09/15………….137.3…….219.1……….2.201…….48.84…….49905

……………06/10/15………….137.6…….219.3……….2.212…….51.35…….52233

……………06/11/15………….137.9…….219.5……….2.223…….51.45…….49095

……………06/12/15………….138.0…….219.6……….2.184…….50.47…….55269

……………06/13/15………….138.1…….219.9……….2.166…….51.96…….54064

……………06/14/15………….138.1…….220.1……….2.150…….51.56…….53243

……………06/15/15………….138.1…….220.1……….2.132…….50.31…….51855

……………06/16/15………….138.1…….220.2……….2.111…….51.36…….51650

……………06/17/15………….138.2…….220.4……….2.105…….50.33…….50011

……………06/18/15………….138.2…….220.5……….2.113…….50.77…….49877

……………06/19/15………….138.2…….220.8……….2.121…….51.11…….49873

……………06/20/15………….138.2…….221.1……….2.132…….19.81…….48520

……………06/21/15………….138.2r……221.6……….2.116…….49.81…….49237

……………06/22/15………….138.2…….222.1……….2.098…….48.46…….48660

……………06/23/15………….138.2…….222.9……….2.110…….49.71…….47443

……………06/24/15………….138.3…….223.1……….2.135…….49.51…….43867

……………06/25/15………….138.3…….223.1……….2.098i……48.14i……44526i

……………06/26/15………….138.2…….222.8……….2.099i……47.34i……47190i

……………06/27/15………….138.1…….222.5……….2.097i……47.14i……45712i

……………06/28/15………….137.9…….222.5……….2.082i……48.14i……47999i

……………06/29/15………….137.9…….222.1……….2.104i……47.04i……48450i

……………06/30/15………….137.7i……221.5i………2.076i……47.73i……47351i

Purvez – I’m watching something like thus. Hope all is well.

Disclosure: Long SPY July 206 calls

Break 2000 likely in white wave 4 from the chart and should target prior 4th wave around 1800

Hi Geno, thanks for the chart and yeah I’m doing good. Hope you are too.

On the DJIA I’m still sticking with my view as per below.

https://www.tradingview.com/x/JgjvqqzD/

Reference my chart above, of course it could be argued that what I’ve marked as wave A is wave 1 in which case we have completed all 5 waves and are on the way down.

My current projected wave 4 point will tell us which it is. If we slice through that without faltering then all 5 are done. Otherwise there is still a 5th wave out there.

Purvez

I think it more likely that the price will backtest the channel it fell outof, however your red line looks a bit dodgy in terms of how it is drawn, I would have drawn it a few degrees less steep…

So I think it likely that we may see closer to 18k on DJI.

Tbh I am not really doing much index trading right now. I don’t like to trade when there are issues like Greece etc hanging in the balance.

J

Yes J, I agree that red line was a bit of a fudge in either direction. I do think the current up wave will want to kiss that red line from the underside before peeling away.

Regarding trading indices in the current ‘news’ climate. I only stick with intra day trades and very tight stops.

“The ‘money’ in circulation hasn’t changed at all.

The bank now holds ‘cash’, rather than a bond, both at the same value.

All that has changed is the size of the Fed’s balance sheet. That doesn’t circulate of course.”

Well, its not quite that simple. In a normal scenario, there would be a *reduction* in something like cash in order to buy the bond in the first place. There has been no such reduction in this case as the CB created the money out of thin air (oversimplified, but effectively this).Generally, when a CB wants to print money they usually do so against the government in question issuing debt that they buy and the once the cash is deposited the banks do what they are mandated to do. This is because there are accounting rules that even apply (currently) to CB’s, even they cannot create an asset without a liability on their books. In the case where CB’s are buying equities directly, perhaps the rules have changed so that they do not need to buy government issued debt and convert it to cash and then buy equities, perhaps they can literally do that straight now which means that even the very weak case for our elected government having control over these rogue institutions – even that fata morgana is gone.

I am very interested in what GM is writing, depending on what the basis is. I do however believe that the only way we can move forward in the long term is to get rid of all forms of “money” or medium of exchange – in my view the only thing that makes sense so far is to go to a resource-based economy. With money and any monetary system you will always have corruption, always division, always inequality. It is in fact built in to the system. Having said that if GM is writing a thesis on how to make any kind of monetary system work better, then I will only read it out of respect for him.

imho

J

J, you’ve mentioned ‘resource-based’ economy in the past, but I’m not understanding what you mean by that. Are you referring to Natural Resources only or some wider definition of ‘resource’?

Hi Purvez

Yes, the closest thing to what I imagine is something called the Venus Project, headed by Jacques Fresco. Take a look and let it sink in, think some more about it and let me know what you think. A monetary system is not the best we can do, it was useful at a time when our society was very simple but now it is the cause of the majority of waste of resources and even crime on the planet. This is why I am not interested in reading about a different way to make a monetary system work, however out of respect for GM I will read it if that is what he is working on.

Enjoy

J

j, I will read about Venus later, no time now.

Consider this though:

http://screwtapefiles.blogspot.co.uk/2015/04/its-not-easy-being-animal.html

J, have you ever read this?

http://marshallbrain.com/manna1.htm

J, ever since I read the marshallbrain link I posted above, (Chapter 5 onwards is a utopian description of The Venus Project) I’ve been convinced that such a system is what’s needed.

Sadly I doubt that it’ll happen in my lifetime.

I read a little on the Venus Project. Lines like this one:

‘It is not money that people require, but rather free access to most of their needs without worrying about financial security or having to appeal to a government bureaucracy.’

Sorry j, it’s pie in the sky in my opnion, never going to happen. Global nuclear war and human extinction is more likely, we’re just animals, fighting for survival.

I’ll try to finish my post on monetary developments this weekend.

J,

‘In a normal scenario, there would be a *reduction* in something like cash in order to buy the bond in the first place.’

That’s wrong. The total assets in the marketplace in a *normal* transaction don’t reduce at all. Both sides swap, cash for a bond. Total sum of cash and bonds in the market place remains unchanged, just in different hands.

QE is only different in that the bond goes ‘off-market’, to be replaced by cash, but there is net no new cash out there, just cash instead of a bond, hence it’s an asset swap.

Re money and all that stuff, the Star Trek system was imagined by a socialist, Gene Roddenberry. We’ll always need money in some form, to trade and account for debts. Doesn’t matter what you call it. Equality: a socialist pipe dream, we’re not all equal.

“We’ll always need money in some form, to trade and account for debts. Doesn’t matter what you call it. Equality: a socialist pipe dream, we’re not all equal.”

This is a preposterous statement, but understandable in the sense that all we know is a monetary system. An open mind and the strength to face uncomfortable ideas is paramount to moving on as a culture/society.

J

you mentioned that the bank now holds cash instead of the bond as if it’s the same thing. It’s not. The bank can buy things with the cash. Can’t do that with a bond. That’s the reason a bond purchased by QE is different from a bond purchased by an investor. The QE purchased bond INCREASES the amount of cash in circulation. The investor purchased bond does not. That’s why QE is thought to be inflationary and generally has the effect of pushing up asset prices because the bank spends that cash on assets, like stocks.

pimaC,

Bank reserves increases (cash). Yes. But banks don’t spend reserves.

They just park them at the Fed (go check the excess reserves figures).

QE just has a psychological effect on market participants (as many believe what you believe). Hence the bubble.

I was trying to get my head around how the Greeks may vote on Sunday and that lead me to wondering what exactly they were being asked to vote on.

Turns out that they have to understand 2 large proposal documents from the Troika to make a decision. So that’s a non-starter.

The impression I get from reading various bits is that the Greeks believe this is a question of whether they want to stay in the Euro or not. But the Government are putting out a message to say that it’s not ONLY about that and more to do with on what terms to stay in the Euro. They seem to be suggesting that the Greeks can say NO and still stay in the Euro.

Confused? You will be…..

This all calls for large doses of ouzo to clear the mind.

SPX correction probable target – 1871, ultimate limit 1371, but I like 1577.

http://barestbodkins.blogspot.com/

But beware of geeks bearing grifts

Peter_, thanks for the chart with the longer term perspective. My only concern with it is the very short time frame for the Red 2 compared to the Red 1 which took over 2.5 decades but other than that it does have the right ‘look’ to it.

“That’s wrong. The total assets in the marketplace in a *normal* transaction don’t reduce at all”

You are right but in most circumstances cash is more readily useable for fractal banking purposes. Of course bonds are counted as assets and can be used as collateral for money expansion, but it does depend on the situation. Cash is more readily leveraged in some senses of the word. In addition, when a CB purchases toxic assets, swapping cash for junk and worse I would consider expansionary even though on an accounting ledger somewhere it looks neutral.

In any case, the system is heinous from a taxpayer point of view. Whichever way you look at it…:0

imho

J

http://www.forbes.com/sites/francescoppola/2014/01/21/banks-dont-lend-out-reserves/

Not quite.

The only thought I would add is the Forbes piece was written in January 2014. See what C&I loans have done since:

https://research.stlouisfed.org/fred2/series/EVANQ

Spiral update 7/2 8:34 short term price target 2086

wow, hit already! 😀

no – the high for today on the sept emini is 2078

ah ok, i don’t trade those. Thanks for the clarification.

I’m no expert on the intricacies of wage growth measurement but I found this interesting:

The trend was even worse in the Bureau of Labor Statistics’ report on median wages of full-time workers, which have grown just 1.5% in the past year. That’s not so good.

It looks like average wages might be going up for the same reason average incomes went up in Buffett’s bar: A few outliers pulled up the average.

That conclusion may be deceiving, however, according to researchers at the Atlanta Fed. Their wage growth tracker is probably the most sophisticated measurement of wage growth we have, because it looks at wage growth for individual workers over a period of a year, so it measures actual raises received by actual workers, not aggregated data that compare the wages of Person A with the wages of Person Z a year later.

And what does the wage growth tracker say? That the median raise over the past year was 3.3% through May, up from 2.3% a year ago. The median raise for college-educated workers and for prime working-age workers was even higher at 3.5%.

“Labor” participation is lowest since 1977……..whether its demographics or something else, that ain’t good…..

J

J, I think you raise a very good point, i.e., has this particular stat (which is quoted so often by the media) been normalized for the age of the country’s workers. I haven’t read anything that speaks to this so if anyone has something to link to, it would be appreciated.

For all those who are looking at the Non-Farm payroll data, I would urge you to go over to the Alhambra website and read Jefferey Snider’s analysis of the data.

To summarise: The ‘adjusted’ data appears to be a derivative of ‘other’ data from the Bureau of Statistics and therefore has almost ZERO link to reality.

His version is more accurate but verbose.

http://www.alhambrapartners.com/2015/07/02/pretty-ugly-for-employment-showing-slump/

SpanishArcher, appreciate the context, thank you

Just for the record, I believe that the Greeks have misunderstood the ‘referendum question’. They believe it is about being IN or OUT of Euro. On that basis I believe they will say ‘YES’ as most of them want the ‘higher perceived value’ of the Euro to the Drachma.

To play this I’m going in with a hedged ‘long’ and ‘short’ position. I’m hoping that the ‘long’ position will pay off when the Greeks say ‘YES’ and then at some point reality will settle in and my ‘short’ position will pay off at the other end.

Of course as Peter_ says ‘beware of geeks bearing grifts’…..the opposite could happen too, hence the hedge as well.

I think you’re right. Even though the vote is NOT about whether Greece should leave the EU, the EU spinmeisters have done everything they can to make the Greek voting public believe that a No vote is a vote to leave the EU. It’s not. A No vote says No to the “more of the same” austerity-kick-the-can-down-the-road-a-few-months. Greece has endured 5 years of Depression era austerity. I can’t imagine they would choose more of that. But TPTB in the EU are trying to make the Greek people think that a No vote would be very bad and would result in them leaving the EU.

The real problem is that the people in charge of the EU apparently know very little about how economies really work. They also have little respect for democracy.

Here’s an explanation of why austerity in Greece has had the exact opposite effect of what Brussels told them it would:

Question for JH, are you going to be ‘flat’ in the market ahead of the Greek referendum?

Anyone else want to state their positions?

Cash, want to go long next week into earning season.

Short, very short, the stock market…

No change to my system, still 100% short, and going with it…

Nothing new to add, so been pretty quiet…

Appreciate everyone’s comments though…

Thanks,

Barry

Thanks Valley and Barry for posting your thoughts.

Barry you are one ‘BRAVE SOUL’!! Wish you ALL SUCCESS with your trades. Only comment I’d make is that ‘systems’ can’t/don’t see geopolitical events. Be careful out there.

Purvez,

I am very short. I covered my puts earlier in the week. My prices on cash shorts are near the top. I have been holding for months. These are swing trades where I don’t get too cute. My short term trades are options both long and short.I think the four year cycle top is likely in. I don’t give a rats ass about Greece. The market is not going down because of Greece. I think we likely waterfall soon. My expectation is a swift decline then a second chance rally then a crash.

Hi Purvez;

Sometimes more brave than brains, but regardless, HY has firmed up a bit in the past few days, so if we take off higher I expect to be on a buy signal pretty quickly…

It was a pretty successful week – Monday in particular – BOOM-shaka-laka 🙂 – so I’ve got a decent cushion here…

But not trying to lose it, obviously, but that said, I appreciate that my SM trend-following system has had a LOT of whipsaws so far this year, so it’s been a grind (negatively) all of 2015…

But I’ve also been able to out-trade it, so I’m fine where we are here…

That said, if 1871 happened (as mentioned in Peter’s earlier post) soon, that would about make about my next two years……AND pay for that sailboat I’ve got my eye on…. hahaha

And holy crap, @ 1577…. You’d never hear from me again….. 🙂

Thanks all, new post

Reblogged this on rajveeronmarkets and commented:

Terrific Analysis