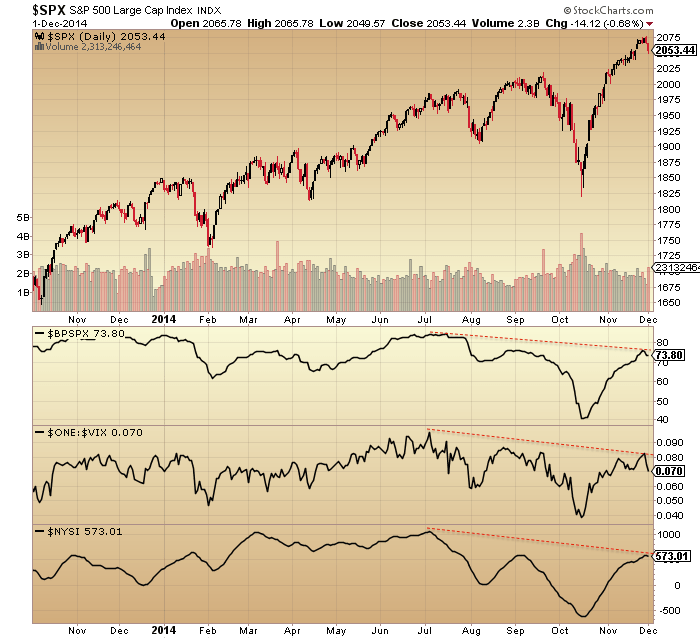

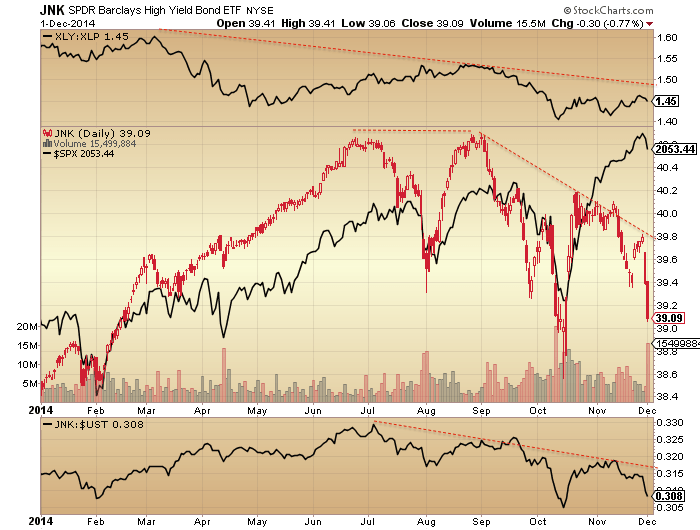

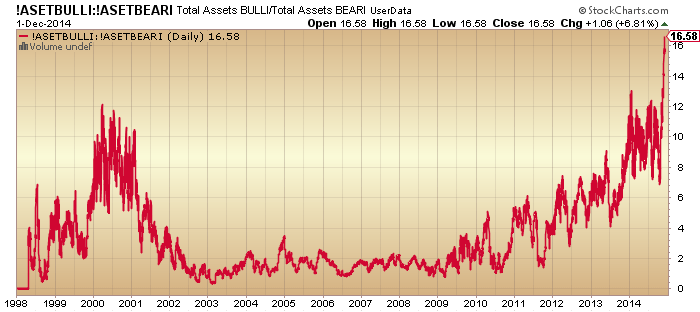

Oil plunging. High yield dropping. New all-time lows for bond yields in many European counties and Japan. Gold and silver major reversal. Apple large down day. Crazy spike in Rydex allocations.

ECRI leading indicators for the US negative. A combination of oil price drops and US dollar gains adding to sharp earnings projections revisions. On Sept 30th, earnings growth for Q4 was projected to be 8.3% and revenue growth 3.8%, but now these are more than halved to 3.8% and 1.5% respectively.

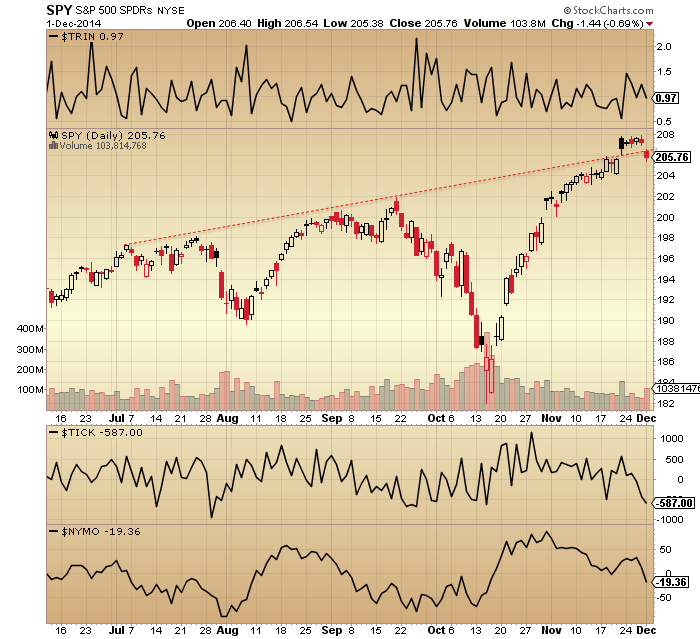

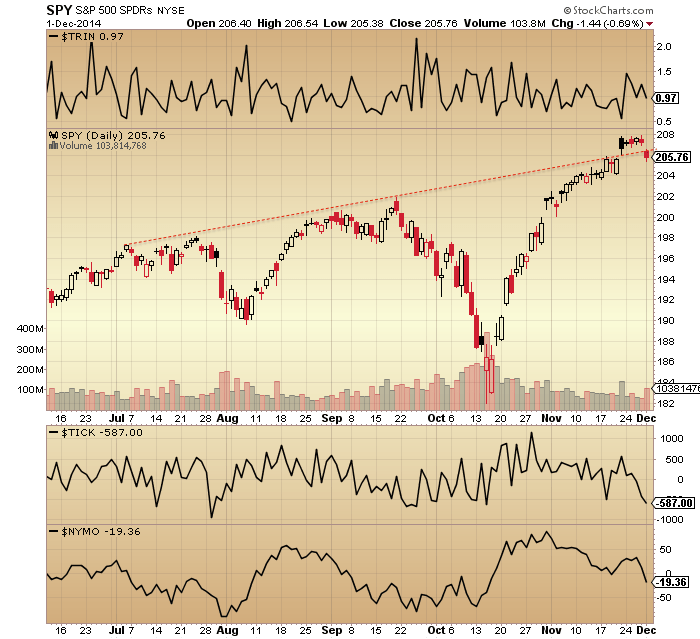

SPY looks like this:

Currently an island/overthrow top. But now we need follow through.

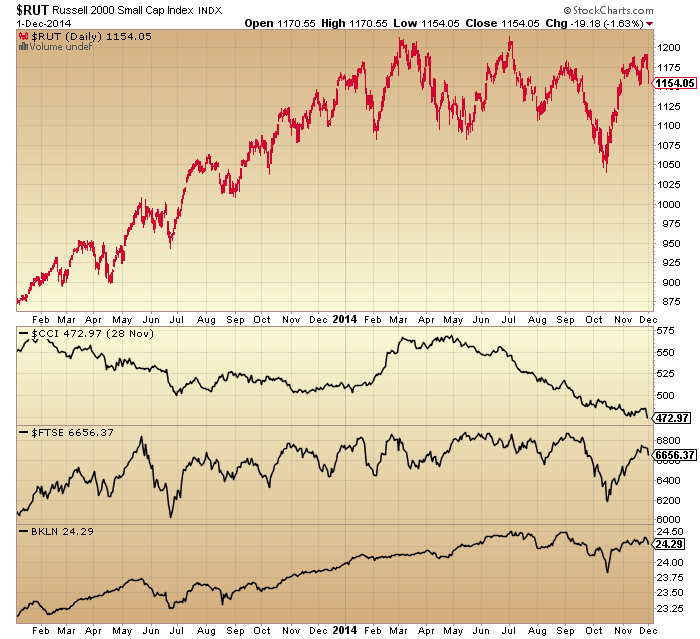

The Russell 2000 looks like this:

Repelled at a critical point. Same for the FTSE shown underneath. If these indices were to maintain their 2014 topping processes then they couldn’t stretch much further upwards.

Indicators largely rolling over again, also suggesting equities turn here.

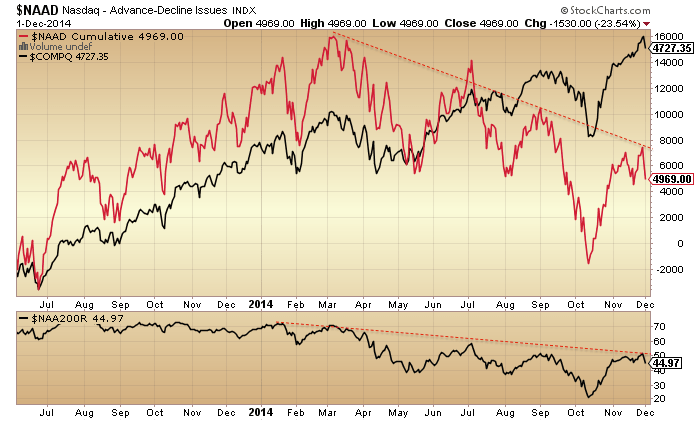

So it seems like indicators and cross-asset developments are turning the tide on equities just at the critical point.

I believe it comes down to how the price process now plays out. As previously noted, we might see a price range play out from here on divergent momentum which could hold equities up into late December, or we might see a more straight forward reversal from that island top / megaphone overthrow and print a significant down month for December.

We don’t yet see a significant reversal in the US Dollar, and the Indian, Japanese, Chinese and German stock markets are still motoring. Plus, Apple and the Nasdaq 100 reversal candles yesterday need follow through. So these are the threats, but it may be the point at which US equities start to lead to the downside.

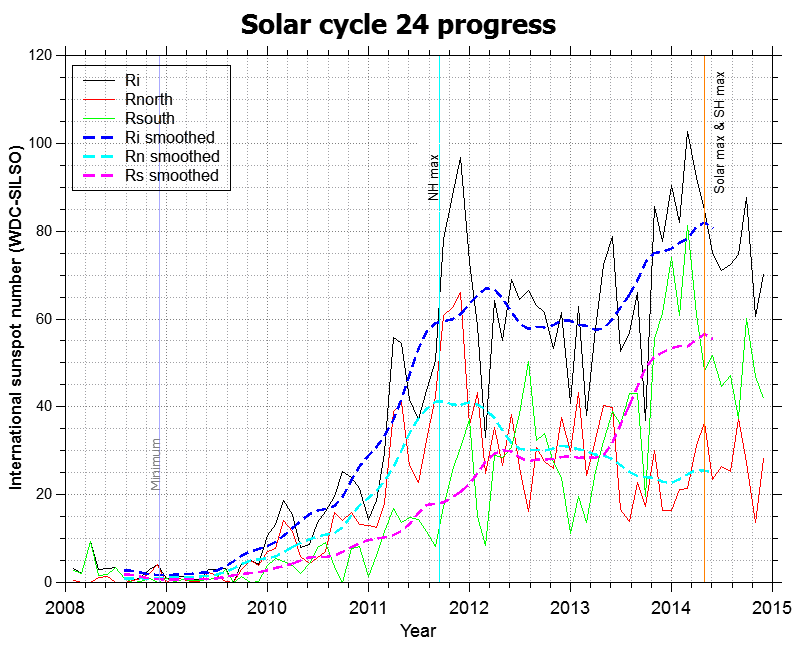

Commodities started plunging in May 1929 and forewarned of the stock market woes (hat tip Edward Dowd). They began to tumble in May of this year too. Some are quoting oil’s fall as a stimulus, but it should be clear from associated developments in government bonds and the USD that this is a deflationary wave more in tune with 1929. But this doesn’t pin down when equities might tumble, only that they should be on borrowed time. The latest sunspot update suggests the same:

With the story of the topping process in stocks (which I have laid out in detail on the site) revealing a kick off Jan 1st 2014 and an intensification from the start of July, I maintain the probability that stocks are completing their topping out now, and keep a lesser likelihood as the end of December. Given the recent cross-asset developments in gold, high yield, government bonds and oil, I don’t see a stocks bull market extending into 2015. The Rydex allocations spike looks fairly terminal too.

The situation is fairly delicate at the moment, as a little more craziness can’t be ruled out. So we need to see a follow-though day to the downside. But I believe we are into the final price manoeuvrings before the heavy falls finally come to pass.

Thank you John. The markets made a new Hindenburg Omen observation on Monday, indicating their instability. It is just a matter of time, either soon or rolling over in early 2015.

Also on Friday in Russel http://www.financialsense.com/contributors/chris-puplava/hindenburg-omen-black-friday#.VH1TAhHl7Hw.twitter

“Beat Market Bottom” points towards an American tulip phase in US Stocks. As one sector after another rotates into US Stocks the rally will continue and accelerate. This is the irrational phase wherein Small Specs get whipped out for being unable to stay financed against the irrational hyper parabolic rally caused by all sectors rotating exclusively into US Stocks. This rally won’t stop until the FED raises rates next Fall, 2015. P/E ratios no longer matter as “hope springs eternal” with no Fear and its Panic Selling in sight.

It may be difficult to understand but ever increasing Polarization in America is feeding the rally in US Stocks. “All” are attempting to become the “1%”. Until “All” come to grips with the fact that they can not become the “1%” the rally in US stocks will not end as there is no Fear in sight that would cause Panic Selling. For now, –Hope Springs Eternal– that “All” will join the ranks of the “1%” if they do not Panic Sell but continue to BTFDs.

You seem to know it ALL and have ALL the answers. You even seem able to predict the future!!!! You must be very wealthy by now.

How could I possible ‘know it ALL” given that I went short DOW futures two weeks ago and offset last Friday near the Monthly close at a lose? I am successful not because I trade perfectly but because I trade in a disciplined manner by cutting my loses short and letting my profits run. There are Traders who are successful even though they call the markets correctly only 20% of the time meaning that 80% of their trades are losers. Why? See above adage for the “why” of their success.

Note that if you have been following what I have been posting about stocks that I positioned based on a Weekly expectation leading to a Monthly expectation and that Neither occurred so I did not wait for my Stops to be hit but got ought AT A LOSE just minutes from the MONTHLY CLOSE last Friday. That I could have waited and got out better yesterday is of no consequence because I am successful BECAUSE I AM DISCLIPINED.

Note that I recently posted that Cattle could experience its Tulip Mania phase too. Last Friday I went long cattle futures (BTFD) and yesterday Feeder Cattle futures closed limit up and within minutes of this morning’s electronic trade it went almost limit up.

Yesterday I went long Oat futures (BTFD). Take a look at March, 2015, Oat futures for the past four trading days and note the three candle stick tails. Note that yesterday was the lowest close but also a Hangman candlestick. Note that Wheat futures are soaring and note what popular human breakfast meals are made of.

Another oops: “Bear Market Bottom”. Sorry about that.

What’s happening, John. I was getting worried about you, health wise. Summation index has given a sell signal from several megaphone formations. It should be a significant fall here. Even the a/d line is turning down from a megaphone and the OTC line has non-confirmed the OTC. It’s all there, now it just has to happen.

Thanks Kent

HOPE SPRINGS ETERNAL. In America, it is being forecasted that December will be warmer than average. That means that the Weather will not drop the velocity of money but allow it to rise especially given the expectations of dropping gasoline prices. HOPE SPRINGS ETERNAL at least in the minds of those stock buyers who envision themselves in becoming the “1%”and, therefore, they will not panic sell out of their highly leveraged positions but add to them by BTFDs.

The FED is unlikely to raise rates in 2015

as growth slows.

This is not some tulip mania, it is late

stage cycle price action.

The US markets will turn when the perception

beings to anticipate the turning of the earnings cycle.

IMV there remains too much momentum left in

domestic US (and earnings)for markets to trade

decisively lower right now.

A continuing sell of in crude could possibly rescue

the bears by beginning to quickly erode confidence,

however on my take we are still months away from that

point.

Richard, I’m probably the most mega-bull here, thinking the DJIA will reach 75K by 2032, but we are in for some volatile trading from now into 2017-2018. There will be some peaks and troughs along the way. I have us in the first wave up off the 2009 low. This wave will be retraced in a second wave probably kicking off in the fall of 2015. Then we will see the huge, multi-year, “tulip phase” move up after that period if my cycle and EW analysis is correct.

I just try to stay with the daily trend and capture as much of the gains as I can.

http://unbiasedswingtrades.blogspot.com/2014/12/swing-trend-indicator-timing-for-2014.html

That 2032 target ties in with the 17-18 year cycles that have been evident since at least 1929. Aldo ties in with Armstrong’s private wave, as money flees a government bond bear market into private assets.

I won’t be a broken record, but there’s only one way we get through 2015-17 and out the other side, kicking off a new growth cycle. That’ll be the same way we did in the 30s ant again in the 70s, devaluing everything against gold.

Nothing new under the sun my friends.

This fits nicely with Jeffrey Hirsch’s Almanac super boom trend beginning in 2017ish.

I only found out about this site when I stumbled on to it this summer as I was doing further research about the weather in order to trade commodities better. Many on this site know about the solar barycenter rotating inside the sun and before the top of a SC and that means a coming Little Ice Age. The depths of the coming Little Ice Age is expected in 2030 which wouldn’t fit well with you stock market mania top.

You might also want to find out about the complete Sun/Moon/Earth interaction of every 19 years 5 hours and what that means to stock crashes. The next 19 year crash will be in 2025.

You seem unable to grasp the political/democratic reaction to a mini ice age, or just the end of the confidence in government finance.

Money will flee into private assets, there will be nominal growth, although probably not real growth.

The era of big debt- funded government will end, but they will go down with all guns blazing and capital will seek safety in real assets, including stocks.

histiry repeats, including the risks of conflicts as empires die.

SPX top predicted Dec 30th at about 2105. The astrological basis explained : http://satsirikhalsa.com/articles/effective-use-of-the-varshaphal-and-lets-pick-the-market-top/

Still short here 🙂 But from what I gather we start the day up, another opportunity to add up there.

John, the sun still seems active here, both visually and with flux readings. 27 day forecast was boosted up.

http://www.wm7d.net/hamradio/solar/27d_forecast.shtml

Any thoughts on this?

If forecast month plays out, the mean flux would be 176 making a new solar cycle 24 monthly high.

Yes that’s the flux chart I had seen which made me doubt the relevance of flux versus sunspots as flux peaked late 2001

Maybe the flux peak lags ssn because sunspots appear at equator at the end of the cycle, and readable emissions are directed more at earth. Just brainstorming.

Mkt had another BIG high May of 2001…..As good as any other place to sell…..you can’t fight the mkt month after month…..seems to me you are talking and trying to support your short position……

Interesting…would that be a double top with 1/2014? Light therapy affects moods, so it could be why we are peaking late this cycle. Yes, 2001 was different, but with one data point, we don’t really know the mean and standard deviation.

Bond yields paint you the 2015 picture in advance,

or at least to a large degree.

Many of the points made here by both John and others

are valid, unfortunately it looks like the timing will be out.

As this is an exceptionally difficult area in which to be precise,

there is no shame in that.

The uber bulls see 2/3 years left in this cycle,

that just does not ring true to me.

We are likely to be in an early stage bear market by

this time 2015.

Phil, what about the oil train? Doesn’t that paint a picture…..now? No more funny money to prop up oil from speculators and since the world is broke those energy savings aint gonna be reinvested into the economy like the 1990’s. Hence, you are see true organic demand and the state of the economy.

Spiral update just tweeted https://twitter.com/mjmateer

Still has a ways to go… adding along the way. Nice opportunities in the yen crosses today.

Can’t really use technicals nowadays can we, look at the USDJPY USDRUB, especially the latter, huge shooting star and today new high again and ruble crashes and burns again. How do we trade these markets? I am rather jaded.

VXX rising putting pressure on SPY…

Crash in Stocks keeps becoming less likely:

http://finance.yahoo.com/news/u-construction-spending-posts-biggest-150248752.html

Yesterday the agencies loosened their lending rules for the US housing market. What that means is that the rally in housing could be over BUT it also means the Speculators in housing will be able to sell at profits. Those Specs will be looking elsewhere to invest in and that investment will be US Stocks. This is another “sector” that is starting to “rotate” into US Stocks besides the ongoing “sector rotation” out of bonds into stocks.

Most of the third world is based on commodities. With commodities falling (except for US cattle futures which are the exception to the rule) world wide investment money in world wide commodities will “rotate” to US Stocks along with some of it going back to Japanese banks in a reversal of the Yen carry trade.

As time advances more and more “sectors” will “rotate” to US Stocks that will feed a rally into late 2015 when the FED is expected to raise interest rates. That P/E ratios decline doesn’t matter as long as Profits exceed all other returns such as interest rate returns. That means that Profits can decline (2015) from greater Profits (2014) but stock prices keep on going up.

It is continuing reports like this that keeps the Hope Alive. With out Fear there will be Panic Selling regardless of the amount of leverage. The Riots didn’t produce the Fear for Panic Selling so what will?

It is becoming obvious that Stock Buyers are in a “climb the wall of worry” mood that just keeps stocks going up with no panic selling anywhere in sight. What that means is that any “worrisome” things/events/INDICATORS are just blocks in the Wall of Worry to climb over.

Anyone catch the great ftse long today? I managed 80 points 🙂 slowly recovering my silly bear losses of earlier this year. Ftse to 6900-6950 by end December me thinks. All indicators point to a fall but the market is unstoppable. Oil stocks recovering hugely today suggest the market expects oil has bottomed.

Congrats on your trade Krish.

Thanks. It was a rare one for me. Normally exit too quickly. Long way to go to recover my bear losses though!

Yes letting your winners run and cutting your losses short is a HARD trade!! Speaking from experience here although hopefully changing my habits one trade at a time.

Nigel, you can reference oil and a range of

commodities which underscore a similar outlook.

I have mentioned oil a couple of times recently.

All this is unlikely to be enough to save the bears

in 2014 imv, the key is the US earnings cycle and

lower expectations within a continuing rising trend

will not be enough, the perception needs to be that

earnings are about to turn lower to unlock the next

bear market, this is most likely 6 months away approximately.

Tomorrow is the last day for a turn. Then down into January 30th.

Andre,

Could you elaborate a bit on this? I had thought given the extreme roc in apo/perigee that late January was more likely to be a high of some degree? As you had been calling for previously.

And if January 30th is a low, then what do you think for the next extreme roc date in Late April? Low or High? There is a big fibo/geo date around 4.27.15 that seems to align for a market pivot.

Thanks.

you’re saying we go down from here and continue lower for the next two months?

I see a major low on January the 30th, with a first stop on December 19th. After that a significant high in the last week of August, with a minor high end of march and a minor low early June.

Gravity makes a multi year turn in December. Solar activity stays positive into 2015 as Neptune is heading for an opposition with Jupiter and Saturn towards a square. This is scheduled for September. After that solar activity will decrease. With gravity down august will bring the high and after that some years down.

If the august high will be a new ATH is uncertain due to gravity. But a severe decline will have to wait until solar activity turns in sync with gravity.

Need to clear up what u r saying. First top for ‘a’ low 12/19/2014 then 1/30/2015. After which a further minor high end f March 2015 to a important hi end of aug 2015. Do I read u right? Thanks, libadvsor

Do you have a sense of the minor high between 12.19 and 1.30? I have 1.12-14 and wondering how that fits with your work?

Thanks

What’s unclear?

Main structure : jan 30 low, august 22-ish high. The move down into january will be a 3 wave; down, up,down. First low december 19. The next date will come soon; probably early january.

The move up to august is also 3 waves; but they take longer. march 30 high, june 2 low, aug 22 high.

There will be minor subwaves everywhere, but I think this is the main structure. I combine solunar force (not the same as apogee/perigee), solar activity cycles and my own astro timing.

Andre,

For what its worth I do timing work with spiral analysis similar to Carolan. My dates, at times, are very precise. One spiral ….48-78-127…. (in trading days) is an example that you will find has been very accurate recently. And 127 projected from the 11.28.14 high out gets you to 6.2.15.

Looking out into 2015 my work suggests big pivots near Feb. 6th, March 24th, June 2nd, and August 14th. At least when looking at dates that resonate with your scenario.

Also, the 78 trading day period is generally near 112 calendar day which fits with the 108/9 day cycle that you have spoken about.

We’ll see. Thanks for your work.

Anyone who is short US stocks needs to wise up and fast. The last two day’s decline in treasuries exceeds the rise going back for many days –and– the US Dollar index is rallying all over again. This means more “sector rotations” into US Stocks. Yesterday’s one day decline is it. That is all she wrote. Rally time in US stocks has restarted.

If I am correct about this then my offsetting my shorts near last Friday’s November monthly close is going to look vey professional and wise on my part. Those of you who start Hoping beyond reason that the Top is in, as prices keep going up, will be undisciplined in your Stops (if you even have any) and will suffer devastating loses. Above all else, success in trading means success in keeping loses small.

Richard you seem to have gone from someone who had quite interesting macro economic ideas which were appreciated by most here to becoming a somewhat ‘forceful’ advocate of how we should all trade. Chill please. We all ‘know’ our own trading strategies. Thx.

I don’t want to see people on this blog get financially wiped out which is very easy to do especially given the heavy commitment that a major top is in (betting the farm) with a major decline to follow should it not happen. I think that John’s report a few days ago “Bear Market Bottom” needs to be reviewed and built upon for a clearer warning of what could go wrong and/or what is brewing to drive stocks much higher.

Should yesterday be a one day decline and stocks continue higher it will be a very big blow to many who are heavily committed to the short side.

With respect, no don’t need to try to save other people from losing their money. I bet the viewers/posters here are all big boys and they can deal with their own conviction and losses.

Share your market view here. It is good enough.

Please remember. No one has a crystal ball.

Richard Issacson is the new Cramer and Gartman.

Hahahahaha! Now that I know I know what to do. Thx

Sorry there needs to be a comma between the first ‘I know’ and the second one. I’m sure most of you got that but Mrs Cooper, my English Language teacher would have been horrified. Lol.

At least he is not the new Elaine Garzarelli.

IMO short term indicators leading to possible price acceleration upwards until Friday with outsized sell off next week. Opinion based upon Solunar chart on Time Cycles Research.com, declination to North on Friday, seasonals, and todays price action. Next week has weak seasonals first three days, full moon(weak until 4 day after) on Saturday, apogee(weak days prior) next Friday.

Today: Up, Wed: Up, Thur: Up, Fri: Up

Next Week: Down all week.

Betafish that’s quite a compelling list for next week. Thx for the info.

Yes, I have found that the first three trading days of the second full week of every month are negative. Also, the three trading days before and day after apogee are flat to slightly weak over many time cycles. The days after full moon are usually flat to slightly weak. Combining all three points to a weak second week of Dec.

Richard,

with respect you do not need to resort

to caps lock to make a point.

If you are long and happy with that position then great,

no one needs to be bludgeoned in to sharing that position.

You did the very same when short before a rapid about turn.

Some of us have had the same opinion for months,

long is usually the winning trade in a bull market.

Where did he caps lock? When you say caps lock, I expect to see something like this: YOU DO NOT NEED TO RESORT TO CAPS LOCK!!! I don’t see anything like that in any of his posts.

I do see an occasional word whose first letter is in caps. I presume that’s his way of adding emphasis, which is something virtually all of us do in conversation via tone of voice, etc. We don’t have access to underlining or italics in these comments, so caps are the only way we have to emphasize a word.

We could be entering a period similar to early Sept. which saw 4 whipsaws in a row. 2 days down were followed by 2 days up that then reversed, again and again. Eventually the trend became visible, as each whipsaw did not regain previous highs. The market finally succumbed after the 4th whipsaw.

The swing trend indicator is still on tentative sell, but it did whipsaw March-April 2014. Could do the same here.

So, I’m selling into this rally today. If the system flips back to tentative buy, I’ll close shorts and go long.

look to deceasing $NYAD cumulative for clue.

Newt. – Need to break the 13dma Chart idea courtesy of SoulJester

http://stockcharts.com/h-sc/ui?s=$NYAD&p=D&yr=0&mn=7&dy=0&id=p44883089207

Bounce of it today is not good for bears.

$NYAD cumulative, A drop below the center line of the Keltner Channel is a pretty reliable sell signal.

Keltner signal seems a little slower http://scharts.co/1ycAFRg

Ah! We see the same chart. No sell signal in my book. I also use 5 EM to draw my fans.

OPEC –can not– outlast low US crude prices:

http://www.marketwatch.com/story/opec-is-wrong-to-think-it-can-outlast-us-on-oil-prices-2014-12-02

Also, US shale oil producers won’t be crashing into bankruptcy like many suppose nor crashing bond and stock markets like many suppose.

Understanding current “market conditions” the meat of this article points to no stock market crash at this time but a rally in stocks to resume. For that purpose it is one of the best articles I have seen.

The first word of the article is “Opinion:…..”. one man’s opinion.

It will take time to reveal the cause and consequence of the oil crash. No rush. I’ve bought my first position of the strongest… could I be wrong and better bargain ahead? May be.

Today’s US auto reports point to this mania being like the 1920s and not the 1930s:

http://finance.yahoo.com/news/gm-s-smokin-sales–obama-aids-taser-and-biogen-idec-attacking-alzheimer-s-171527310.html

Euro/Yen lower high not confirming equity highs – 72% retrace from first move down with today’s action firmly bearish. Keeps bearish aspirations alive and well.

What is up with the USD/JPY? I thought we would get a reversal by now.

going long or short a yen carry trade, one needs to differentiate which currency you are trading relative to the yen, it is not like the old days where any of the yen carry trade will more or less move in the same direction. all relative to their strength or weakness against the us$ now, things are more complicated these days and if it wasn’t difficult enough before…so many cross currents, learned it the hard way.

$ index at critical juncture – fail or break through – reason for vol in commodities as players position according to what they think the outcome will be. Euro looks to have a little more down-side to 1.22. Yen not so sure.

if you look at the rsi for the weekly US$, major divergence, in normal times i would position to short but…i just try my best to follow the trend and hope i make a few pips even when technicals tell me otherwise.

strong $ index resistance going back 10 years

http://www.investing.com/quotes/us-dollar-index-advanced-chart

Pegasus, are you trading the yen (long or short) and if so which pair? I’ve gone in and out (mostly long) on the US/JPY

Thanks

James – have a long yen short $ position and short $ stocks – financials and tech. Not nimble enough to catch smaller moves but hope that on the way down can catch 1 or 2 counter trend moves. $/y has clear topping patterns here and is quite oversold. A reversal like in 1990 or 1998 or 2002 can move the pair down into strong support in the 92-94 area in 3-6 months. That is what I am looking for.

John, agree that Oil is crashing. So has gold. Is there a chance that Gold/Oil is the solar max crash, just like 1980. The stock market did not crash in 1980, but did have a correction. Why not the same this time around? SPX drops -20%, but in hindsight, the mania/crash is in Shale Oil and Gold.

Your own “trading-the-sun.pdf” says that 2013 should be a commodities peak, not equity peak. That was right on with Gold and Oil. Shorting those would have worked very well.

The closest analog I can find based on a variety of sentiment and technical indicators is March 2012 following a rally of over 200 pts in SPX from end of Dec 2011. Then we saw a triple top – early in month, opt exp, EOQ, where each top showed a higher high and low. I would expect similar outcomes here.

Bad news for bears. No sell signal on options indicator then or now (yet) so only a 7-8% decline followed. Correction would only be to SPX low to mid 1900s then a 300-400 pt rally.

18k dow very soon….santa rally might bang us up to 18,500

Krish, everything you say CAN happen. However it doesn’t hurt to keep things on a VERY TIGHT LEASH!! Good Luck to all here.

Everyone just loves taking a stab at predicting the future so they can have that I told you so” moment. Huh?

On the contrary Ronbo. Most people who take a stab don’t follow up with ‘I told you so’. That’s one of the many great things about this blog.

If the indicators are playing like the past few sell-offs, we should get a new low under 2049 then a new all-time high, followed by the larger sell-off.

This would also give the $NYAD bearish divergence on a new high.

AAPL should test 108, so I bought the Dec. AAPL 115 Puts

You observation is very good. I am looking at $NYHL(histogram). If it turns negative again in the next few days, it would a clue for me to send in my scout short again.

The Swing Trend Indicator stayed on tentative sell today, so I’m comfortable that I sold the rally today. The market will decide if it was the correct decision. 🙂

The “safe” short is $VIX TSI zero line cross over. I always short there to protect my SPX and RUT positions bought two years ago.

Too much air space below the price curve. A (partial) fill would be nice and health.

Good luck to you trade. It should work…

DJIA Should trade down to 17,630 this week

WOW!! That’s a BOLD call geno0010. Much as I would like to see that happen a 200 point drop in the DJIA sound a bit ‘incredulous’. Of course if it DOES turn out to be true then look out for my ‘CHEER’ to you.

Thx for posting.

Purvez – It’s only a 1.4% move down, very easily achievable. I have this move up starting yesterday as a B wave with a C down to come.

Mr. Hampson – Do you want to keep the comments guided toward solar/lunar/astronomy or are other methods welcome?

SPY Dec put option OI jumped 17%, about 120k contracts. VIX put option shrunk 15%, call option OI jump 16% to 20% for the 17 and 18 strike price.

About the Christmas Rally everyone is expecting, you shouldn’t expect one just because it’s Christmas. Market situations change. For one, the past six years have seen Christmas rally because of QE. This is the first Christmas without a QE.

A few more points. Russell2000 is a good yardstick and it broke 10ma and 20ma. Nasdaq 52 weeks low stocks has now outnumbered 52 weeks high stocks 2 to 1. And the number of stocks in Nasdaq above 200ma is less than 45%.

To Richard, the panic you’re referring to is called herd panic. It doesn’t come until late in the game when the herds realized too late they’re about to be slaughtered. I remember you said something along the line (and not just once) that if one doesn’t know such-and-such one should not be managing his or her money. If you don’t mind me saying, this is quite a put-off. And not trying to be rude, as a professional trader and from reading what you’ve been posting, I feel too there are a lot of things you don’t know about the market. But I wouldn’t be telling you things because, well, that’s just manner. It’s good you’re being disciplined. That’s a valuable trait in this business. Another trait you might consider is to “stay empty”. It’s an old Chinese fable, if your cup is always full, you won’t take anything in. I don’t write much here because most of time I’m listening to what the market is telling me. If I talk too much, I won’t be listening enough.

We get schooled by the market everyday. Stay humble.

As the most interesting man in the world says, “stay thirsty my friend”.

I love the “stay empty” mantra.

Again, Great work John! I’d like to add a fundamental perspective that earnings have not been supporting the advance over the past 3 years. The S&P 500 has risen 5 times faster than earnings since 2012 as depicted in the following chart.

P.S. John – How do I insert the chart directly into the post?

When John posts a new post, I’m sometimes guilty of kinda skimming through the text and charts, and looking forward to getting to the comments…

Still do it, but was looking through the charts at the top of the page a little closer tonight, and have a question for anyone that is “long and strong”….

How does the last chart, the “Total Assets Bull / Total Assets Bear” chart, ~not~ bother you??

Thanks!

The last chart looks at just Rydex Index Funds. I have no idea how representative this is especially with ETF being the dominant investment vehicle for traders. Note also that this chart did nothing in 2008/2009. Alone, I do not put much weight into this chart.

@John Li or whoever is familiar with shanghai composite

Something is brewing in shanghai index. The bottom looks complete in from a weekly chart. It still got lots of room to run till early next year. Anyone know how to play this?

HangSeng and Shenzhen is at higher valuation. I can foresee the divergence between Shanghai index versus Shenzhen will narrow in the next few month.

Divergence indeed. ETFs that trade A shares have seen large outflows in the past week, and the exchange link shows that foreign investors are just not interested in China. So why have Shanghai kept going up? I suspect the Chinese govt is buying so as not to “lose face”. I don’t trade Shanghai if there is an opportunity here, or if the random whim and fancy of the state adds so much noise that any signal is not really profitable.

While Hang Seng is at a higher valuation, the quality is also better. If you compare the same companies, Shanghai is actually more expensive, eg by 11% according to Hang Seng China AH Premium Index.

I suspect the most profitable place to go long is where there is free money thrown by the govt….perhaps to support IPOs to get retail interest up again. Not sure how non-Chinese can trade it though. I remain a China bear.

Thanks bro.

Spiral update – 12/4 cits at 3:00, 8:00 and 14:00 https://twitter.com/mjmateer

If you review VIX and UVXY then you can just lump Nov 28/Dec 1 as another “false bump up” just like what occurred Nov 12/13 and Nov 19/20. That is the market can only muster up at most just one follow through down day in USA equities after it hits a new high with a slight selloff reversal in the previous day. Or to put it in layman’s terms, what is happening are the dip buyers are rushing in on any slight weakness even if it is just 20 or 25 SPX points decline.

Expect new ATH soon either this week or next week latest.

In the comments of some past article some other poster pasted a chart of the 1920-1930 DJIA chart and annotated that we are presently equivalent to early 1927. The market is on the verge of breaking out in parabolic fashion and the final climax will likely end in some form of exaggerated blow off top. It would be in everyone’s interest to review that chart again and keep an open mind, especially if you are always leaning towards the short side or attempting to pick the top.

The big drop (i.e. 10%) already came and passed in Oct 2014. You will likely not get another perfect storm until spring 2015 at the earliest and worst case scenario (for bears) maybe even not until fall 2015.

Change your mindset, change your perspective, change your focus. Instead of trying to “catch tops” for 20-40 SPX points, you should avoid that (uncontrollable) urge and instead focus on waiting for those temporary spots of weakness to catch opportunities to go long instead. The bull trend will net you double or triple the 20-40 SPX points you might get (if you are both fortunate and lucky enough to time it exactly to get in and out before you get killed) and you also have time and nature working with you.

What exactly will initiate such a parabolic breakout? If I were to guess I would speculate it is when the Fed decides to raise interest rates. Initially the market might sell off on that news, but it likely creates a mass stampede out of the larger bond market and a mad rush into USA equities.

great post, Steve. Much appreciated!

Your posts one of the reasons I continue to pore over these comments.

What if the stock market becomes a replacement for the bond market. The “equitization” of debt could bring unprecedented stock market highs.

I think I was the first one to post the chart source using an analog of 2009-2017 compared to 1921-29 on Aug 28. Both 8 year periods where the Fed went bananas following a sharp 18 month economic contraction and a 50% stock decline. The mantra then was also “do whatever it takes”. Someone a couple weeks ago added the annotations – good work.

Source: http://stockcharts.com/freecharts/historical/djia19201940.html

There is also a high correlation with the bond market which peaked in year 6 (2015) and the blowoff was a result of rising interest rates and bond investors switching into already elevated stock prices.

Bonds: http://thehousingtimebomb.blogspot.com/2009/05/great-bond-crash-of-1930s.html

Requirements I see for meltup (2016-17):

1 – Republicans retake control of the Senate – check

2 – Euroland implements full QE (with or without Germany)

3 – Republicans retake Whitehouse – probably Bush III

4 – Massive corp tax cuts – see John Mauldins proposal for 15-20% rates

That does not mean everything will be the same – history may not repeat but it might rhyme.

Wow now Steve T has decided to stop providing useful information on fractal comparisons and decided to tell us how to trade too.

People like you with your sarcastic remarks are what drives folks away from good quality discussion. I do not need to listen to this or put up with any of it. I post only because I enjoy the “chat” and exchanging useful info with others. Besides that it is actually detrimental to my overall investing or trading.

Steve T a large part of your comment related to telling all of us HOW to trade. The rest as I said has been very welcome and would continue to be so.

The sun’s overall magnetic dipole is continuing to gather some strength, but very very tentatively (as befitting a weak solar cycle: http://wso.stanford.edu/Polar.html#latest

But the northern hemisphere strength is refusing to budge. When it eventually does so, it will most likely give rise to a temporary increase in sunspots – how long that increase will last is impossible to know, but it is possible that we could be seeing some of it right now (northern sunspot count has started to increase recently). Judging by previous solar cycles, the final surge in sunspots could complete any time between now and late 2017, with the statistically most likely time around Q3 2015.

Mark, while the dipole is shifting, can you explain why the tilt angle is back to highs?

I am a true newbie at this.

Thanks for posting that – its a very obvious illustration that SC24 is not done yet.

The heliospheric current sheet devides the sun’s northern and southern magnetic polar fields as they extend away from the sun; so the sheet is flattest when both fields are balanced and strong. At the moment, they are relatively imbalanced and becoming increasingly so, and also persistently weak – hence the steepness of the angle.

While this angle remains high, our planet is being exposed to the sun’s northern field then its southern field alternatively four times every 27 days. Whether this is one of the solar factors which influence human behaviour, I don’t know – but it isn’t going away anytime soon.

Mark,

I too am on board for mania in 2015. Here’s sc 16 vs 24, my fav sc comparison since i first visited this site. I trimmed off the first 18 months of sc24 in order to line up the similarities in behavior. This projects to November 2015 peak, market peaked 2 months before sc16 peak, that renders September 2015 as the peak (give or take a few months from that projection given several lead lags in each spike within the cycle compare).

Place your bets. (Accumulation mode gold/silver stocks and index calls)

To further that conjecture, one might be able to evaluate the next breach of 100 as the execution of the final cycle peak.

Joseph, your chart shows the very strong similarities between SC16 and 24; and the 18 month offset makes sense to me to account for the unexplained delay in SC24 getting started.

And now we have neutron counts at Oulu apparently dropping away from their 0% level. See the bottom chart here: http://cosmicrays.oulu.fi/

This is exactly what happened in the lead-in to the last five solar maximums (including the relatively weak SC20). These previous lead-in times ranged between 6 and 18 months. The current (as yet very tentative drop) coincides with the upturn in solar flux since September 2014, so that suggests SC24 solar max between March 2015 and mid 2016.

Neutron counts at Moscow have not (yet?) confirmed a drop-off (see the -8% level on the monthly chart at Moscow): http://cr0.izmiran.rssi.ru/mosc/main.htm

Moscow’s daily chart shows the effect of increased solar wind since September. An increased solar wind shields us from galactic cosmic rays (actually hydrogen nucleii) which cause neutron showers at the earth’s surface.

Mark and Joseph Teofilo,

Great posts. Thanks for writing. I also expect Oct 2015 to be peak for world equity based on historical Lunar model I follow.

I often feel like that guy in “True Grit” about to hang, who asks not to let his family have to go live among low people. I am the fool who bought silver on “advice”instead of sticking to what I understand. The stock market seems to me, to be what would happen if the Soviet Union had a stock market and their employees were given a list of what to buy or sell each day using state funds.

John, good movie reference. I watched this scene from True Grit, it is really rich. I also lost on SLV, which may have a crazy gain middle of next year based on astro indicators featuring Venus in the main role as the Retrograder.

Barry,

I think many long here are aware

this is a late stage phase bull market,

only uber bulls seeing another 2/3 years left

in this upswing may disagree.

I agree with many of the points raised here,

having seen multiple cycles it gets easier(a little)

to recognise the various signposts.

My outlook only really differs related to timing,

although it would surprise me if the next bear

is multi year.

The only real hope for those heavily short right now,

outside of an outlier event, is for a sudden loss

of confidence in the global growth outlook

altering perceptions of risk, and equity valuations.

That looks very much an outside bet to me,

however I reserve the right to be wrong.

Unfortunately I do not have any magic formula.

FWIW Phil i agree. I expected a pullback in October which we got. The market seasonality is doing what it normally does. This time is no different. Best hope for bears is to top out by end of this month. Next window is March next year which i think is likely. Like ive said before, one candle stick does not signal a market top. We need to see multiple signs. Also there will be plenty of time to get on board when it does turn as i very much doubt this bull will die without a fight!

Someone mentioned the Nasdaq. This has been the leader and continues to be. As soon as we see it top out there is a another warning shot. We are about 10% away from all time highs – double top? If so S&P could easily be 2250.

luigi, I like that Chinese proverb,

had not heard that particular one before.

And yes the market is known as the great humiliator

for a very good reason, it has the ability to make

any of us look very stupid, that certainly applies to me

many times over the years.

John I’ve read your great blog for a year. I also believed fundamental indicators but this time price didn’t confirm them. We have in Poland such phrase “to seek a hole in a whole” (sorry if it’s not correct English) what describes people who search problems in perfect scenarios. I started searching such holes when my shorts started bleeding (currently I’m without position).

First: Emerging/Developed market cycle supports developed markets since 2010: http://wojciechbialek.blox.pl/resource/MSCIEMMSCIWOrldod1988.png

This cycle is also visible on dollar, inflation etc. When developed markets are weak, commodities strong, emerging/third world countries appear to be strong and rising. But when situation turns back capital escapes to the strongest economies and emerging economies have big inflation, some bancrupt or even experience war (currently also in Europe). This is why dollar is a king and euro is still alive.

Since Fed prints money bonds are not safe haven. Turning this money back will cause implosion of the system so they need to supply economy with fresh money (about 3% a year). And there is a hole number one:

– What if this solar cycle ends mania on governments debts?

Stocks topped 2 cycles ago, equities 1 cycle, perhaps it’s time for bonds?

A hole number two:

– What if stocks rise until the strongest of them – NASDAQ makes all time high? It’s still about 10% below ATH from 2000.

More weakness in euro yen keeps the stock market rally in check. $/yen without a proper pull-back since 105 or 14 points. Normal 62pct pullback would be around 111. $ index into strong resistance zone between 88.80 and 89.80. It is bound to get interesting here.

Yen short covering rally not expected until USD/JPY hits 120:

http://www.marketwatch.com/story/dollar-flat-against-yen-after-setting-fresh-7-year-high-2014-12-03?siteid=yhoof2

and probably won’t happen until after this Friday’s NFP.

Good point

Euro yen continues to exhibit bearish patterns foreshadowing a potential larger move in stocks and yen.

Steve T has a valid point on the lack of follow through

selling since the October low, this trend has been

dominant with even the most minor of dips being bought back.

Breath indicators on the RUT and SPX were mentioned frequently

here a few weeks ago – can anyone provide any updates? – TIA.

The NAS was mentioned earlier today.

As far as what I follow for clues, the bottom-line for me is…..breadth has only gotten worse since I last chimed-in here on that…

Money-flow looks even weaker, and RSI on the various charts I look at has (overall) rolled over even further…

Chart after chart, to me, right now looks like a more drawn-out version of September… Which tells me that it’ll probably be a bigger break than we had in October, ~when~ it breaks….

Wish I could tell you when that’ll be, but really no clue as to exact timing…

Regardless, still holding 100% short, and even flirted with being back in profits on the overall position Monday.. That was quickly fixed on Tuesday, however..

Regardless, that’s what I see, and where I am…

Channeling my inner-BBE, and I think he’d agree, we’ve got Wile E. Coyote running over the edge of the cliff, his legs have stopped running, and he just looked down…

The only thing left is for him to look out at the viewer with that “Holy crap….” expression, right before he plummets…..

Obviously, I’m still waiting….

Thanks..

the comment by purvez at “wow a 200 point drop in the dow as incredible” sums up this market perfectly and why johns analysis is correct in a crash occuring

Hi Rob;

I thought the same thing when I read that…. My first thought was they meant a 2-THOUSAND point drop….

Then I realized no, they did mean 200 points, and called it “incredible”….

All I could think of was, “Wow……indeed…..”, but not for the reason the poster meant, I’m sure…

My bad… “Incredulous” was the word….

EUR/USD is about the enter the Fib Support Zone that resides from 1.21-1.22, I’m a buyer there.

http://unbiasedswingtrades.blogspot.com/2014/12/getting-ready-to-buy-eurusd.html

Barry,

Appreciate hearing your view, thank you.

Call up a chart of FXY (yen etf) and SPX. Yen began its rapid descent in mid-October, just as SPX shot higher. the correlation is near-perfect. So when the yen finally reverses, so will the SPX. Or, the correlation (i.e. the carry trade) breaks down.

Yup, a -.90 correlation, about as inverse as you can get.

Nasdaq cumulative breadth measures (2 hr):

http://stockcharts.com/h-sc/ui?s=$NAAD:$NATOT&p=120&b=4&g=1&id=t10521341486&r=1417618114665&cmd=print

30 min…

http://stockcharts.com/h-sc/ui?s=$NAAD:$NATOT&p=30&b=5&g=1&id=t18975380182&r=1417633958407&cmd=print

There appears to be a dichotomy brewing where if someone presents their viewpoint, especially when it pertains to the big picture, and the logical and rational action plan for such viewpoint that it gets reinterpreted as someone telling another how to trade or invest and that such benevolent teaching or advice is mostly unwelcome.

Richard Isaacson is probably bang on with his big picture view. I think it only comes across bluntly because he likely cares about what would happen if others choose to ignore it.

I presented a bigger picture view (2 – 3 years out) of what I think is going to happen. And if I am one to believe that it could happen (i.e. parabolic surge with final blow off top) then obviously I am going to shout from the rooftop to anyone who cares to listen to presently quit thinking about trying to get an ideal short entry and instead change your mindset! Now if you disagree with my perspective and instead are macro big picture bearish then that is a different issue. But for others who do not see what is occurring and only see new 52-week or ATH, and say “gee, time to short the overextended and long bull market now” then that would be my target audience.

In a bull market the surges from the overall trend dwarf the mini dips by at least a factor of two to three and it keeps repeating. It is a futile and tiresome journey to attempt to call or pick the market tops and short it, especially when it could not be any time close to ending and you have all of the forces of nature working against you. Not saying one cannot still profit from making counter trend moves to the market but that the bigger and easier money is made investing in the trend.

Steve T since I was the one who commented about you trying to advise us how to trade I believe I should respond to what you’ve said above.

Most people on this blog, including myself, have welcomed and looked forward to your views on where the market is going and have had respect and even admiration when your predictions have delivered. I will repeat I would welcome to continue receiving them.

My only objection was your INSISTENCE that we all change perspectives, views, etc to your way of thinking. I think that’s where I draw the line.

You are welcome to keep shouting about how you strongly believe what is going to happen in the market.

All I ask is that you leave it to the reader to take action on your comments or not.

That was also the same thing that Richard did which I, along with others, objected to.

Richard has since continued to post and his comments remain well worth reading without any accompanying advice on how to trade.

Please may I request that you do continue posting and allow us the intellectual independence to take action or not.

Thanks

Sorry, but I don’t get the whole “how to trade” thing. What am I missing? To me “how to trade” has to do with timing entries, indicators to use (or not use), stop placement and risk management in general. I don’t see any of that in Steve’s posts, only a warning that the dips are small and the surges after the dips are multiples (in terms of points) of what the dips are.

I personally welcome this kind of advice because, even though you might say it’s stating the obvious, I can use reminders of “the obvious” from time to time. Just that simple concept that the surges are several times the dips in terms of points is something that I hadn’t really thought about in those terms until Steve pointed it out. And because of that, the easy trade is to buy the dips. When the drops start being longer than the surges, well that will be the time to consider changing course, but until then buying the dips will likely be much more profitable than selling the rallies.

So I appreciate these posts and although I can’t speak for anyone else who reads these comments, I suspect there are a few others who appreciate them as well.

Thanks for the friendly reminder. Never have I given trading advice or command what others have to do. I only have stated logical thinking as to how one should rationally act given a specific scenario. If you disagree with the scenario then that is fine.

But if the market has the potential to DOUBLE in price from current levels (my thinking aloud here), why would anyone consider shorting here in the hopes of picking off a possible interim top?!!! Not only do you incur potential trading losses if you do not time the entries/exits to the T, but more importantly you miss out on profit from what could be possibly the biggest stock boom since the dot-com era. And back then there were many publicly traded companies that soared to ridiculous valuations with no profit or tangible business plans but just based on hype.

If you want to short then you better definitely have a high probability tool to pinpoint exactly when the markets are prone to have those 8%-12% significant declines to make it all worthwhile. Otherwise it is a fool’s game to play the other side.

That is all I was saying. Hopefully last thing on this issue.

pimaC this is the paragraph I was specifically objecting to:

===

Change your mindset, change your perspective, change your focus. Instead of trying to “catch tops” for 20-40 SPX points, you should avoid that (uncontrollable) urge and instead focus on waiting for those temporary spots of weakness to catch opportunities to go long instead. The bull trend will net you double or triple the 20-40 SPX points you might get (if you are both fortunate and lucky enough to time it exactly to get in and out before you get killed) and you also have time and nature working with you.

====

If you are fine with that then that’s ok with me. Just not fine with me.

+1

Gold approaching resistance of 1000 euros.

As I posted a few weeks ago when gold was near 900 euros and should bounce, all year gold has traded in a range of 900-1000 euros as both gold and euro fight rising dollar.

http://stockcharts.com/h-sc/ui?s=$GOLD:$EURUSD&p=D&yr=1&mn=0&dy=0&id=p22993123412

Well, I never realised that StockCharts had FX data, albeit EOD only.

Still… great to know – cheers to you, arthurk.

http://stockcharts.com/h-sc/ui?s=$GBPJPY&p=M&b=5&g=1&id=p81383313437&a=378993603&r=1417633310883&cmd=print

Hang on, it gets better…

http://stockcharts.com/h-sc/ui?s=$GBPJPY&p=M&b=5&g=1&id=p81383313437&a=378993603&r=1417633770247&cmd=print

http://www.peaktheories.com/self.php?id=1774

Thanks for sharing that rob.

THANK YOU

Weakness should start hitting the markets now at 2:00 EST and last through December 8/9

Should read 3:00 EST, it’s 2:00 where I am

Just curious to know based on what indicators do you say with confidence the exact time when markets should get weaker ?

Well, they’re based on daily indicators,so it’s tough to get the EXACT time, but should’ve been toward the EOD today.

Just some thoughts to the “big bullish wave that is projected to occur” posts…

I’m currently 100% short…based solely on a system….

I have no idea if I’ll be right or wrong with this trade, but it’s been a pretty decent system the past several years, with trades that last anywhere from 3 days to 3 months…

That said, actually, I hope you’re right….

I’m SURE I can make more money in bull market than I can in a bear market, if for no other reason than there are a couple of accounts I manage that are pretty much only offering a “long stocks or long bonds or long cash” choice….

And I’ll have some real estate to sell in a few years too, so I REALLY want the bull market to persist…..for years….

That said, again, I’m currently short because my system tells me to be short…

No other reason… Not trying to pick a top…..not trying to make a political statement….not trying to prove the economy wrong…..

Not anything…..but make a few bucks….

Hopefully, we’ll get another downdraft, my system will reverse, we’ll all get long, and we can all, along with CNBC, cheer-lead the market higher until it doubles or something….

But until then, all I currently see (through my indicators) is increasing erosion in everything that I “think” makes the market go up, so there we are…

I will of course let everyone know when I get the next buy signal (cover shorts and go long), but I can assure you, it won’t be right now…

GL to all….

Thx Barry for reminding me that we are all here to make some money. Greatly appreciated. GL to you and all here.

Unfortunately, I seemed to have forgotten that myself for the last 2 trading days…

Well, I see we at least we got another new high out of the way…. 🙂

Hahahahaha!! ‘another new high out of the way’. Now THAT’S a perspective I LIKE VERY MUCH!! Thx for the late night smile.

hi all ! So, have you finally bought IBB and QQQ and AAPL ? Good God, this market is very easy.

I’m not sure exactly ~what~ is going to happen in the markets going forward, but there are just times I’m convinced it’s going to be epic…. 😉

I read your comment and then saw ‘eclectics’ comment below!! Together they make a great read.

Stupid post, lol.

Size matters?

True, but distance matters just as much.

https://pbs.twimg.com/media/B384H4mCUAAUWOD.jpg:large

I read the following within the ‘subscribers section’ of the site but thought it was worth repeating here. Hope I’m not breaking any ‘intellectual property rights’ here. Any ways its a good ‘general observation’ which resonated with me.

=====

Remember, this is an auction market, no one has put a gun to anyone’s head to buy or sell a stock. In my experience, the source of the loss comes from the way some trade…their strategies or the lack of them, not from price volatility.

=====

Sorry should have mentioned that the site is hftalert.com

The million dollar question for next year’s rally is how big is the bazooka? Any less than impressive will certainly disappoint.

All eyes on ECB in the next three meetings.

Well, the Swing Trend Indicator went back on Tentative Buy, so I have to buy tomorrow.

I have a feeling it’s going to whipsaw me, but whipsaws only eat a little bit of yearly profits.

is this a system you developed? You trade it, so you must have confidence in it. How do the returns from the system compare to just buying and holding, using a simple exit mechanism like the 200 day MA? What did you use for back testing?

It is a system I developed. I posted the 2014 yearly results earlier on this thread, all the buys and sells and the dates of the buys and sells. The returns far exceed buy and hold, but a lot of the short trades get their profits eaten unless I use a different exit strategy. Finding bottoms is A LOT easier than finding tops.

thanks, geno. sound like a great system. I’ve been working on several systems over the past few months, some of which have backtested well. I’m using TradeStation for backtesting. The problem with the ones I’ve developed is that they don’t trade very often, so I’m trading them on a number of different instruments in order to have more trading opportunities. The one I’ve been working with lately does best on the FX etf’s like FXB, FXE, etc.

Wondering why every sell signal reverses in the nick of time? Bet your shorts don’t scare these buyers. http://www.zerohedge.com/news/2014-12-03/central-bank-buying-sp-500-futures-extended-until-end-2015

That’s old news. See the “newer” incentive program on metals from Sept 1 14 to Jun 30 15. Hence my weight on the metals 🙂

weight means long AND short, before anyone decide to… you know.

WT, sells. reversing in the nick of time is a sign of a bull. Many of us have been fighting it, to our chagrin. I still am,

pimaCanyon – Have you ever tried your system on FX pairs?

no, but I suspect it would there too. I haven’t traded forex. I’ve looked into it, but there are a couple of things that bother me about it: 1) the bid/ask spread seems wide (especially for a market as huge as forex is), and 2) my broker would be one that comes under the category of “dealing desk”. I’m not sure I understand completely all the implications of that, but what I do know, I don’t like. So, to trade forex comfortably, I’d need to open an account with a broker that does not have that “dealing desk” deal.

Sounds like you trade forex? If so, do you have a broker you like and trust? What’s your feeling about the spread?

first sentence should have been “no, but I suspect it would perform well there too (on currency pairs)”

word has it that there are large $/Y sellers @ 120 thus the nibbling around the area so far. read a number of reports that there are major resistance coming up for both $ (90) and $/Y (120 but this may just be due to it being a rounded number, the real battle lines are in the 123 to 124 area), if these resistance lines gets broken then who knows how crazy things can get.

120.15 61.8 fibonacci from 1998 top and 2011 low. Big test here. Fx tumbling not something which all Japanese welcome as Richard has pointed out.

No correction in pair for 1500bps which is pretty rare.

interesting, it just took a quick pop to 120.15 area.

Central Bankers are not limiting their buying to the SP500. They are buying every major market on cue.

Aside from the historic run in the US indices out of the October lows look at the price action of the European and Asian indices the last few weeks and you don’t have to be a looney conspiracist or a genius to see what is going on.

Central Bankers are scared s#%tless about the markets declining even a few percentage points.

The rhetoric from the ECB and Fed Reserve when markets were selling off in October was obvious. They were literally falling over themselves to offer the markets guarantees……….WHY?…..Why do Central Bankers now see it as their duty or responsibility to support stock prices at any cost?

Why have stock markets been allowed to become nothing more than an extension of Central Banks and why have CBer’s abused their positions to the degree that yield chasing has become extreme and risk insurance is no longer quantifiable much less attainable at a reasonable rate?

Italian 10yy’s at less than 2%………bloody insane!!

Do you have data that’s accessible that shows that CB’s are actually buying stocks or stock index futures?

I thought it was illegal for the US CB to buy stocks or futures. Obviously it’s not illegal for Japan to do the same, but I understood that the Japanese CB is buying ONLY the Japanese market and not buying other markets such as the US market.

Australian AllOrd up strongly for the third day running after Tuesday’s disastrous GDP results, in fact the worst results in years……maybe not such a surprise thet stock prces were driven higher given how the picture looked going in Tuesday.

The same can be said for the Hang Seng today.

Central Bankers paw prints are all over these markets.

http://stockcharts.com/h-sc/ui?s=$AORD&p=D&b=5&g=0&id=p44075910531

Allan, what’s ur view on gold miners and gold itself when the miners are lagging the progress of gold considerably?

Allan

Agreed, southern europe debt is just a basket case, 2% yield to hold that rubbish lol?

Lets see what the crooks in ECB can muster today. Perhaps they can indeed find justification to break some laws to give the banks what they need?

Should be a fun few days coming up.

imho

J

By the looks of the DAX it seems like the market has high hopes for ECB today? Rumour—->news or just bulldozer….?

J

Alan, Jegersmart….I too keep asking the question that Alan asked. Why are the CBs propping up the Stock Market? Given their mountains of debt I can understand their need to manipulate interest rates via the Bond Markets but how does it help them to have strong Stock Markets?

My own answer to this comes down to the systemic risk of the Too Big to Fail Banks. These guys have got derivatives exposure which could topple them in an instant and the only way to ease the risk is to fund them to allow them to keep the teetering mess upright.

Now giving money to Banksters openly is clearly not a politically acceptable option so one ‘stealth way’ of funnelling funds to them is via the banksters buying leveraged call option positions which are then bid up by the CBs through their stock purchases. To funnel $10 to the Banksters the CBs only have to bid up stock by $1.

The bit of my ‘answer’ that I can’t fathom is if the banksters are winning who is losing? It surely is not the MMs. Clearly I need to think further on this.

However if anyone here has an answer or an alternative suggestion then I’d love to hear it.

Thanks in advance.

Purvez. I think the more they intervene (manipulate) the more they are afraid their whole ponzi scheme will come crashing down. They also know another 2008 endangers their power and existence, so they desparately do not want anything to go wrong. They are presiding over a house of cards.

Purvez,

rHEY GET IT FROM FOOLING TRADERS, PENSIONS AND OTHER MONEY THEY MANAGE THEY MANAGE.

Please excuse the caps. Plus they cover shorts placed, having preknowledge o \f the coming support.

I think the main (or only?) reason to prop up the stockmarket if that is what is definitely happening is to allow banks to deleverage further because they are allowed to post their own stock as T1 collateral under current regulations (which seems nuts to me at least). That complimented by almost free financing for them (and not much lending going out) should mean they can deleverage over time so that they can survive a “normal” market in the future. Quite a few banks are insolvent technically speaking as stated beofre on here – contacts that I know well across the European banks at least are quite concerned to say the least.

Any other views welcome of course…

J

In terms of market timing, none of us have a crystal ball.

You can be utterly convinced in a certain trade and

still be wrong, conviction does not always equate to accuracy.

I appreciate posters alerting others to a different take which

they think may be overlooked, underestimated.

I have taken some flack over the past few months

for views that some considered too optismistic.

It’s ironic as I tend to be uber cautious rather than an uber bull

never using margin on any positions.

Where I differ from some here was/is on timing,

as 2015 seemed a more natural end to this bull market

with the likely turn in the US earning cycle.

There appeared to be a lack of a single decisive factor

that would tip equities over and that still appears the case, for now.

The best hope for the bears right now is a continuing rapid sell

off in crude which may begin to erode confidence in 2015 global

growth prospects, with investors beginning to question current multiples.

This erosion in confidence is more likely in the second half of 2015,

that’s how I currently see this developing.

Just FYI – I have gone short DAX at 10018, stop at 10098 – looking for a retest of the (steep) trendline at around the 9750 mark over the next few sessions.

I dont normally post live trades but there is no point making the hindsight comments as most do on here,

J

In fact I clearly cannot even spell optimistic, just noticed the typo

in the prior post )

3 billion of USDJPY 120’s roll off today – that will open up the topside and expect equities to be dragged along with it… more soon

Looks like another buy the dip opportunity today with the Dax. Maybe dow too if it drops a bit more. Have a feeling this will build and and then sell off in Jan/Feb like last year.

I don’t want to say I told you so, but I told you so,,,Mario, all talk no action.

No QE from ECB, and hearing live con link it’s unlikely to be early next year either,TBH he never will.

Next body blow is kamikaze Abe losing election next week.

Market starting to turn down. Dax just dropped nearly 3% from peak

these momo traders can’t figure out what they want to do with the euro…they so desperately wanted draghi to deliver.

CBs fear index just rang, buying what they can again to shore up market.

Just a matter of time now.

somebody decided to take a peek as to what it looks like on the other side of 120 ($/Y).

They are now full on looking at it……… relentless doing it too.

Abe, beware what you wish for. this thing may quickly get out of your control, would not celebrate too much if you get your ‘landslide’ victory.

James, I am a bear …… I am just really puzzled by everything that is going on in the world…….. USDJPY EURUSD USDRUB gold silver, oil, copper, miners .so many things seem to extreme and don’t seem to make sense to me to the point I will just accept how crazy volatile this market can be. Look at the ruble and the way it’s crashing – it’s scary.

Closed my USDJPY longs ahead of rollover, shorting more SPY here…

Aaron, the ECB will be unable to boost Euro

area growth unless they can significantly devalue

the Euro, that’s the key longer term.

In reality, the ECB is not trying to boost growth, just deliver price stability, its sole mandate. They say it all the time, do it all the time, still no one understands it.

Their sole mandate guarantees they will act next year to fight deflation.

The only asset able to cope with their bid is gold.

And they’re already alluding to it.

I don’t trade, but I see traders here trading markets they think the CBs are directly manipulating upwards. That is a sign of madness on two counts. Why trade such markets if you believe them to be manipulated.

No, this is just a topping process, a big bubble takes time to burst, and sentiment is still strong. Time will kill that, then you will see the CBs, as usual, are in control of very little.

You have crude selling off again atm with Brent below

$70, the ECB has not obliged with any immediate aggressive

QE, so in this context if you cannot generate some downward

momentum in equities it will look evermore like a rise to year end.

i don’t think the yen cares what the equities market is doing anymore, moving on its own now.

There’s no risk in equities, so buy all you can. Look, let’s say the S&P 500 drops to 1800, then the FED will do QE4, print trillions of $$, buy stocks, buy bonds, and in a few weeks the correction would be over.

Thank you Nicolas, your advice is always so simple and concise. Equities simply will not come down as far as we can see.

so buy here at today’s price and hold thru a drop to 1800? You’d be comfortable weathering a drawdown like that?

I should be transparent here and divulge that my trade was stopped at 10103 on the Dax, due to IG Markets (in this case) calculating their Cash price on the futures contract….

So a loss this time:)

J

Great day for us bears. Oh yeah.

Yay weakness, coming in right on cue.

At least medium term top may finally be in.

A summation sell signal 2 days ago, then new highs yesterday. Since they were nonconfirmed, it was actually good, but how did it make me feel. Uncle, I give, tap out, concede, no mas and now a primal scream. Man, this has been torture.

Add to that the NYAD -div and now testing that 13dma

Whipsaw action just like early Sept? Indicators say the market is vulnerable to a correction.

I can’t comment on whipsaw until it’s over, unfortunately. You never know.

Add to that +div in VIX:VXV, -div in BPSPX, -div on macd, rsi and +di on BPSPX, -div in SPX:VIX, etc. etc. a top is either at hand or very close. (Very close = within 40 pts on SPX)

We also have daily ADX rolls on all 4 indices now, DJIA, SP-500, Russell and Nasdaq

Geno, we use similar tools….as you’ve said and I agree…our tools are pretty good in picking the bottom. Not so good in id the top….

First week of December is seasonally strong. Moon reaches north declination Friday(some time deep sell offs after North is reached). Full moon on Saturday(price suppressor). First three trade days of second week of December are weak. I have short bias from Fridays close until next Wednes.

Although I now notice that my trade would not have been stopped on any of the other accounts I hold with FXCM, Saxo and GFT……I will raise it with them, although I am sure they will me to f**k off….

J

Worth a try Jegersmart. A few years back I had a glitch on their platform at a most unfortunate moment and a position got closed out because of it at quite a loss. I hadn’t done anything to initiate the transaction.

I spoke to them and to their credit they investigated it and re-instated the position.

Unfortunately I still closed it at a loss, albeit a slightly smaller one. Lol!!

NYAD -div http://stockcharts.com/h-sc/ui?s=$NYAD&p=D&yr=0&mn=7&dy=0&id=p44883089207

SPX:VIX -div http://stockcharts.com/h-sc/ui?s=$SPX:$VIX&p=D&yr=3&mn=0&dy=0&id=p30582041105

VIX:VXV +div http://stockcharts.com/h-sc/ui?s=$VIX:$VXV&p=D&yr=3&mn=0&dy=0&id=p89606448817

BPSPX -div all indicators and -div http://stockcharts.com/h-sc/ui?s=$BPSPX&p=D&b=5&g=0&id=p15511561883

Yeah thanks, they calculate the Germany 30 “cash” contract on a futures price and apply a “fair value” adjustment apparently….it doesn’t seem so fair at this point lol…I suggested they call it the Germany 30 futures instrument or alternatively a Germany 30 “we just make up our own price” going forward…..I am sure that will help:D

80 odd point loss instead of a 160 odd point gain doesn’t seem so fair right now:)

J

Yes I find IG pricing compared to FXCM quite skewed almost continuously. Only just now as we were reaching the lows their pricing which had been consistently ‘lower’ than FXCM’s all day suddenly caught up and is now slightly higher!!

I use it as a vague sentiment/front running gauge by comparing the two.

Buy the dip worked well today. I made good money on it. Hope others did too. The FED probably made a few bucks too buying S&P minis today.

Yeah but do you know WHAT CAUSED that sudden up swing at the half hour? Nothing on the news that I can see.

Huh!?! Does anyone know what just caused that spike upwards?

Sorry that was me closing my shorts. I give up. Good luck.

I commiserate on the pain underneath that comment. 🙂

Every point of weakness is being manipulated. Now that I realize it, it is too late to get in.

Basically, the ECB wasn’t happy with this morning’s market reaction, so they came out and talked again….

That’s pretty much what “investing” has come down to nowadays, it seems…

Wow more non-verifiable rumours but what a reaction to the rumour. Indeed we live in strange times.

By the way anyone seen this?

http://www.marketwatch.com/story/its-official-america-is-now-no-2-2014-12-04

Report released about ECB QE package which will be brought out at the next meeting in January. no doubt released to reverse the losses today.

ECB QE package: ECB will buy one bond per month for 3 months.

the “markets” are but a stage

the director (PTB) waved a wand and a rally was created

Can you buy these wands?

Before you buy it watch what happened to Mickey in Disney’s Fantasia.

at the begining of the year 100% of strategists were calling for higher rates

30 yr treasury bond rates are now 1% lower

is a similar situation developing in the dollar

over 95% of strategists are currently calling for a stronger dollar

while the dollar is right up against a 30 year downtrend line from 1985

http://jessescrossroadscafe.blogspot.com/2013/09/us-dollar-very-long-term-chart.html

Specie, it’s a point on bonds I mentioned earlier

this week, it has been a huge about turn from

inflationary expectations to lower growth with

possible deflation.

Ultimately it signals towards the beginnings of the

next recession, but that remains in the distance for now.

WT, I hope that has not been too painful,

unfortunately many others are likely to join

you over the next few weeks as this market rise

is unlikely to top at the end of December imv.

Q3 2015, then you may have more fortune on

the short side.

Well just woke up(5 am local) to see that the markets have done it yet again……BTFD is alive and well and this tidbit….

LOL an Italian telling the German’s it my way or the highway. Now that’s going to go down really well……….NOT!!

Sayonara to ECB QE.

http://finance.yahoo.com/news/ecb-weighs-further-action-economic-090041372.html

maybe not, but the market bought it (ahem…) anyway.

Market participants continue to believe in more upside and they continue to use every news event as an excuse to buy.

This comment is a little out there so please skip it if you want

There have been a lot of newletter writers and such calling for a collapse in the dollar for a long time

i figure the dollar has the most powerful people (PTB) behind it and will be very difficult to topple.

a lot is developing in the IMF/SDR/yuan area but it’s an uphill fight.

the universal bullishness on the dollar right now shows overconfidence and may lead to a large decline

but i heard a new one as far as reasons why the dollar will never fail

supposedly the u.s. has received alien military technology which will allow dollar supporters to never fail in their efforts to keep the dollar in power

that’s how far dollar propenents are willing to go, funny

Tch tch Specie…how can you even DOUBT that!!? It’s all verified and true. Not only are the markets a stage the whole world is. The Bard had it right.

Oh and the aliens want in on the theatre too.

Oh, and Amelia Bassano was the lead writer of the famous drama (the polyglot mistress of the Globe’s owner, not “Will Shake Spear” (who’s parents were illiterate country folk, who’s children were illiterate, and who knew neither French nor Italian). Read or research Joseph Atwill’s Shakespeare book, he makes a very thorough and convincing case that Amelia was Shakespeare’s “Dark Lady”, who he was constantly leaving the stage work to consult with.

I am sure they are well meme-ing.

seen on twitter: “Will all experts who predicted the demise of the dollar, hyperinflation, gold to $5000, sky-high interest rates, and peak oil please report to the Principal’s Office.”

mr pang, or may i call you doodoo? lol!

yes, i know what you mean about being confused or puzzled with all the cross currents re various currencies and commodities. i tried to make sense of it and trade according to my analysis and have lost money. presently, i try to trade with the trend and hope to make a few pips out of each and so far have been able to break even or make a slight profit. there are 2 trades thou that i want to be in when the time comes, short the equities market when it is ‘time’ (that is why i am here to read up on John’s analysis and what the rest of the folks here have to say) and short yen when/if boj loses control.

the volatile markets, i.e. ruble, turkish currency and even silver, i have learned (the hard way) to stay away as my account is not big enough to withstand the wild swings.

The markets will keep lofting higher if the yen continues falling. When the yen reverses, markets will decline. It’s not just a function of the carry trade, it’s a function of the algos keying on the carry trade for momo direction.