Are we at a bear market bottom in equities? Take a look:

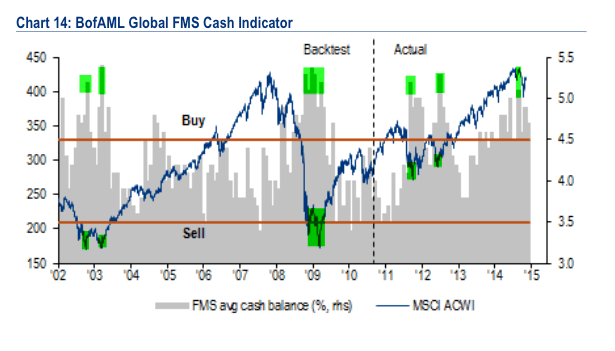

1. Cash holdings of fund managers like the major stocks lows.

2. Short Interest like the major stocks lows.

3. Capitulative Breadth in mid-October like major stocks lows.

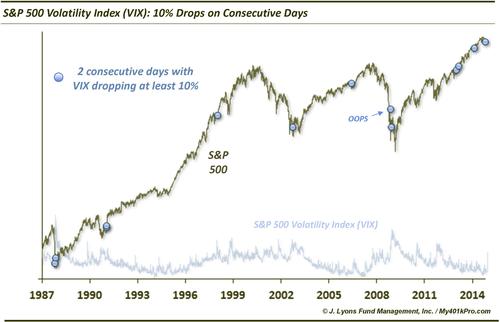

4. Volatility drops like the major stocks lows in 2008, 2002, 1990 and 1987.

Source: Dana Lyons

5. And yesterday the Vix put/call ratio reached the same level as the major lows in stocks in 2011 and 2010:

How could this occur as stocks reached all time highs yesterday? And how do we square all the above indicators with contrasting bull market topping readings in valuations, leverage, sentiment, allocations, dumb money flows, sector and asset rotation and others (all documented in detail on this site)?

One thing should be clear. We are not at a bear market bottom – we are at all-time highs, the very opposite. So in line with readings on some other indicators, we are in the realm of the unprecedented.

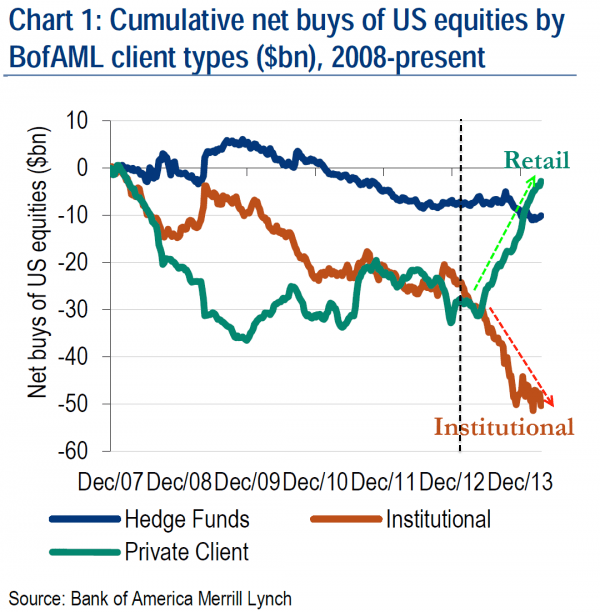

Look again at the first chart: fund manager cash. Note how it moved inversely to stocks until the start of 2013. After that, cash rose steadily as the stock market advanced. Same for the second chart of short interest: generally inverse to the market but not as of 2013. In that same period, institutions have been sellers whilst retail and buybacks have propelled prices higher, so maybe this accounts for what we are seeing.

Look, if you want to take a bullish view on the all the above, no-one can argue against you. In the realm of the unprecedented, the implications of these readings will only be clear with hindsight. But, drawing all market disciplines together, my take remains that the most likely outcome is that we are heading for a steep and swift crash. All the terrific imbalances in the market, both in levels and durations, I believe are most likely to be resolved with a major reset. It’s either that or we are now in a new normal in which many traditional indicators no longer have validity. I don’t buy that.

Yesterday was another painful day, but the clues that a reversal is close at hand remain. Small caps and junk bonds declined again, defensive sectors outperformed, negative divergences persist and gold miners advanced again. Recall gold miners popped out of the top of their topping megaphone formation in 2011, only to be swiftly reversed with a long tailed candle to the upside. So I am looking for something similar. Maybe we have to wait until the weekend’s new moon, we will see. But, the lop-sidedness in the markets is more extreme than ever, when we look at Vix, Rydex, II&AAII and ISEE p/c all combined.

Lastly, here is sentiment over allocations which reveals stock market mania, tying in with the sunspot maxima.

If this turn is really a significant one, this market behavior was to be expected.

Using Vuckevic’s formula for the Jupiter/Saturn cycle – what is really solar activity – it really seems that an 11 year cycle ended in 2013. This caused the 2007/2009 move to be short in terms of cycles, as the longer term was still up.

If we combine this with the apoperi cycle it really seems we are heading for a multi year decline.

As solar activity (electricity) is fundamentally an other force than gravity, both forces should confirm the turn.

This whole year the gravitational cycle was positive, while the solar cycles already had turned. I believe this causes all the divergences.

But time is running out. I now have January 30th 2015 – and a fwe weeks around this – as the most likely turn date.

We’ll see.

You posted what i was thinking, while i slept…

Thanks Andre

John, am I reading the ‘Cumulative Net Buys of US equities’ chart correctly? It is showing that since Dec’07 to Dec’13 adding up all 3 groups there were Net SALES in that period and yet the Stock Market went up by 200+%. Have I understood that correctly? If so then I’m checking myself into the nearest Looney Farm where I will be in ‘like company’.

BofA clients

Early AM dip in US futures,

if this follows the usual pattern it’s

a gradual improvement as the open nears.

I do not subscribe to the this time it’s different view,

as it never is.

What is unprecedented is the combination of ZIRP

with global rounds of QE which have elongated this cycle –

not abolished it as will become evident with the nest US

recession.

In altering the cycle it has thrown timing out

of the window, as a result a multitude of usually

reliable indicators are not working as they should.

The end result will be a bull market lasting well in to

2015, at least imv.

I totally agree that markets SHOULD reverse based on much compelling evidence, but let’s not underestimate the role of the the big three Central Banks (USA, Europe, Japan) and as long as the masses feel comfortable with their policies, markets will not reverse substantially any time soon.

agreed. Not only do we have CB’s actually BUYING the stock market, but we have the perception of traders/investors that CB’s have their back. That combination of actual buying and perception is going to be tough to beat.

Peter, you already have some countries entering the next

recession, global growth prospects are weakening.

The US business cycle will be about the last to tip over

and currently continues to churn out higher earnings and

dividends.

This is as textbook a sell setup as comes. Does that mean that you are guaranteed a multi-month down move? No. It means that the chance of a 1 or 2 R move down is very decent. Trade accordingly.

http://scharts.co/1xErxGr

Btw, of course, I should add that the trade is only triggered on a break of the low. I wait for the market to get me in and also to take me out….

” It’s either that or we are now in a new normal in which many traditional indicators no longer have validity. I don’t buy that”………

And I don’t buy it either. I heard very similar in 99/00. Remember Alan Greenspan’s famous quote at the time?

Hang Seng and All Ords had another down day. That makes three in a row for HSI and 4 for the ASX. The ASX has now broken back below its 50 and 200 dma only this time it has done it as the 50 recently crossed under the 200. Very bearish.

http://stockcharts.com/h-sc/ui?s=$HSI&p=D&b=5&g=0&id=p71428653615

http://stockcharts.com/h-sc/ui?s=$AORD&p=D&b=5&g=0&id=p32624840520

I suspect what is going on in Asia has more than a bit to do with Jaoan

Allan,

As an Aussie watching the ASX, I agree. We seem to be now driving our own destiny rather than following the big US of A stockmarket

“You can some of the people some of the time but not sll of the people all of the time”

Dr Copper beginning to look decidedly sick too

http://stockcharts.com/h-sc/ui?s=$COPPER&p=W&b=5&g=0&id=p31699677631

Lol that quote doesn’t quite make sense. I am sure you know what I meant.

“You can fool some of the people some of the time but not all of the people all of the time”

I think it goes like this: You can fool all of the people some of the time and some of the people all of the time. But you can’t fool all of the people all of the time.

Yes, the weekly MACD is pointing to a re-acceleration of Copper to the downside. But if you really want to see how “sick” Dr. Copper is then look at the monthly MACD and compare mid 2005 to now. Mid 2005 was when Copper did its famous and historical rally and now we could be seeing the exact opposite.

It’s not different this time in that the cycle

ultimately rolls over in to the next recession.

That never changes.

What FED action has done/is doing is elongating

that cycle.

You have to keep that in mind imv.

Today’s FED minutes may be more dovish than

some anticipate.

The FED will want to avoid a vertiginous rise in the $

index.

Not that the rise in the $ has prevented US equities

from powering ahead, however a more dovish tone

may propel a continuing move higher in to year end

providing another excuse to stay long.

Appreciate many see an imminent turn lower here,

so let’s see how this develops.

I am looking for three major key outside reversal bars: Monthly, Quarterly, and Yearly. Of course this points to the “top” being in early January. Should the monthly MACD not signal with the conclusion of November will raise the odds of a sell signal with the conclusion of December for the crash to start in January.

The Australian Dollar is considered a proxy for the Chinese economy so take a look at what happened today with the daily and monthly MACDs.

John–can you in any way highlight the excess in the SM compared to the 1920s–wasn’t Benron’s QE akin to The Fed’s coup de whisky the the late 1920s? Since the Fed has made this the Full Faith and Credit bubble, by buying up nearly EVERYTHING, wouldn’t cracks first appear in the bond market and even stoke the stock bubble more, before it ultimately collapses?

By demographics, economy, rates/yields, CB intervention and solar cycles I see us comparative to 1937 not mid-late 1920s.

The American Public’s craze in buying autos, phones, stocks, and putting Republicans in political offices mimics the roaring 1920s.

Yep–and they got booze this time, too-at least legally.

Gothic, this is a very nice analogue and very similar to how I am approaching the market presently. USA equities should be the last domino to fall after everything else collapses. So despite somewhat grim global macro conditions there will be an unprecedented and perverse manic euphoric buying of USA equities that continues to drive it skywards to levels no one ever imagined to be possible. And like all past bubbles the biggest gains will occur in the final six months as prices go parabolic.

John H will be proven correct and the market will eventually crash and probably lose like 60%-70%+ of its value. But IMHO this crash scenario does not occur until maybe two years or so later and from levels that could potentially be DOUBLE its price currently.

Hi Steve–no idea here–seems like sovereign bonds are the real bubble–any weakness there will just fuel stocks even more. And if the Fed buys ’em all– same deal. Too weird!

: Some thoughts from Jim Stack, a sober and reluctant bull who remains 83% invested:

“There are multiple scenarios or paths this current bull market might traverse, but there is only one outcome. Whether six months or a year or more from now, this bull market will end in a bear market. And judging from the fact that every bear market since 1933 except one has taken back approximately one-half or more of the previous bull market’s gain, the next bear is unlikely to be a mild one.”

Given that most bull markets last between 4 and 6 years (and we are well into year five), hopefully this will give some people the perspective necessary to deal with the current mania. There are no absolutes, but this would be the “benign” yet probable outcome that could give some of us (non-bulls) the perspective to stay strong in this mania phase…

An emergency vehicle in my township pulled out in front of me

yesterday… I had to chuckle… due to space considerations the

fire department’s logo had been abbreviated to a shorthand used

by modern traders…BTFD!

slater – That’s hillarious

You think that was unintended?

Remember…..”They Live”

What explains the high levels of shorts & puts is ‘timing’… Those traders that were ‘late’ placing hedges during the 2007-2009 collapse have been proactive this time around. So early to the party, sort-to-speak.

When the Japanese carry-trade collapses, so will the stock markets.

Ned Somers nedsomers@me.com mobile/text: 917-945-7667

>

We are not mid cycle, this is late cycle.

While there are never certainties in market

timing, I would find it jaw dropping if the

US business cycle can continue for another

couple of years.

This is the latest line from the uber bulls,

that we are merely mid cycle.

Plenty of LSE listed companies have cautioned

recently, warnings here over the last Q are at their

highest since 2008.

The ULVR and STAN updates in particular were

bearish stand outs for me.

The Far East is slowing and the foundations for the

next bear market are being built.

elvis,

you may think I am some flag waver for

the uber bulls, that is not the case.

My central view has been that a US bear market is

far more likely in the later half of 2015.

I think being short right now is fighting a number

of powerful factors pushing markets in the opposite

direction.

Would accept that we must be due at least a couple of

weaker days, but this market looks dangerous to me

on the short side.

Appreciate your comments, Phil…

I don’t agree with you at this moment, but reading your comments helps me to ~not~ get too excited in EITHER direction of the market…

Just following signals, and while right now they point down, your comments will help me (discipline-wise) get long when my signals flip….

And they will, I just have no idea from what level…

Higher? Lower? Just no clue…

Thanks again…

Something strange happened yesterday. Many bears began rationalizing why this could be the start of a long term bull market, whether or not they changed their minds. I read it on Yahoo Finance and then John Hampson tried the same here. I did the same — presidential cycle, year-end rally, rates only beginning to rise, 1959 solar cycle bull market. It is as if we are all in sync in thinking — are we all sheep or wolf?

Other than Hampson and Barry, is there anyone that is short? Raise your hands please!

I think I will join the shorts with Bradley tomorrow. I suspect there are many bears waiting with stop orders which is a great strategy too. Or bears in cash who will eventually turn short. Or bulls with trailing stops. That will add fuel to the downside.

If the market does not turn here and now, I am going back to my original plan of waiting until a more significant swing down before trying again short.

John Li, neither sheep nor wolf. Just conditioned through repetitive ‘therapy’!!

Could that be a vague definition of sheep?

I entered a very small scout short position last Thursday. The market will take the least number of traders along for a profitable ride. Short will be on the right side eventually and I am patient. Never easy since the market will not issue a “go short now for easy profits” signal.

Watching and waiting for price failure to add more shorts while taking profit on my remaining long positions to the extent I can.

To answer my question as to why we have to crash at all, I found myself thinking that the solar cycle failed in 1959. My answer was that there is something structurally wrong with the economy unlike 1959. The worst culprits would be Emerging Markets (Eg Brazil, China) from excess capacity and debt, and Europe from Euro experiment.

My model shows that EM (DFMGI/HSI/EWY/EWZ) are all post-second chance. And DAX is finishing up its THIRD chance right now at 200SMA. My discipline would say to short, even if SPY doesn’t yet pullback from peak.

I probe and test price.. No need to guess since my thinking (bias) kills profit…watch breadth and price failure.

I respect John’s work. A man is as good as his conviction. He is da’ man. We win some and lose some in life. it is OK. John is a winner. I can tell.

Dubai and Hong Kong are post-second chance, and that is where the bubble lives — look at real estate prices. If they waterfall, they might pull everything else down.

I said it the other day……We’re already in a bear market.

http://www.zentrader.ca/blog/?p=24494

I much agree, but how do we trade? EWZ high was on 5/2008, which was much later than the SPY high 7-10/2007.

BTW, are you the owner of zentrader? Interesting read.

Dominoes lining up. 1. Any kind of down day will give an $NYA McClelland Summation Index sell signal (NASDAQ already has). 2. That is usually good for at least a 4-6 wk correction. 3. That will turn the daily MACD down from a high level which will turn the weeky back down and continue its downtrend. 4. That will turn the monthly MACD down which indicates a crash in Dec or Jan (see Richard Isaacson’s comments today and previous post.) Joe Granville said all bear markets start with a short term sell signal. That first domino just needs a little flick and the rest will follow.

I am looking for the “top” in US major stock indexes to occur in the first half of January and for 2015 to be a key outside reversal bar of 2014. And, yes, there is such a thing as Quarterly and Yearly bar charts of stock indexes. Most Small Specs don’t have the view of Monthly bar charts let alone Quarterly and Yearly bar charts which is to their detriment.

I am both short and long as usual…..closed my Hang short way too early a couple of days ago though…..that’s life…

J

Elevated cash is likely due to ridiculously low interest rates. Perhaps being held in preparation of shorting market?

Barry, you have system and if that works

keep using it.

Is your system saying 100% short now

or still 50%?.

Apologies as you have probably already mentioned this.

No worries… 100% short signal as of 11/14…

And unless something huge happens, no change to signals any time soon…

The system is actually at -140% (minus 140%) right now, but for actual signals, it’s always on one of the following four: 50% long or short, or 100% long or short…

Thankfully, I’m a better trader today…

I got “schooled” yesterday…. 😉

What’s happening to gold? Suddenly beaten down AGAIN. Allan, any ideas?

I haven’t seen Trader Dan post on this blog in over a month but if you want a real eye opener about gold then go to his site as he has been posting heavily against Gold for weeks now and has been correct. His posts agree with the MONTHLY bar chart of Gold futures and the monthly MACD re-diverging to the downside in a very big way in both price and time.

Looks like markets trying to front-run a hawkish FOMC minutes. Major false-breakouts setting up in everything if prices hold here. someone knows something? no one knows except the Fed and the sharks. let’s see how we close the day.

Hi John,

I am ready to deploy all my saving in shorting stock index and buying gold. I am a plumber and I don’t know too much about stocks but I heard great things about shorting and buying gold.

Joe, if you are interested in gold and silver, I recommend watching youtube “Kitco” or “Cambridge House” where they have a lot of content from this industry. Some of the old timers are predicting another very lean years in the sector so timing can be a problem.

http://en.wikipedia.org/wiki/Joe_the_Plumber Hi Joe, I’m Doug and I’m a gay man and a gay journalist. https://www.youtube.com/watch?v=3mG-T9ocF_U You’re on the right track.

Trader Dan http://traderdannorcini.blogspot.co.uk/ just made another good post about Gold wherein he is comparing chart patterns of the Yen to chart patterns in Gold that indicate that Gold will drop hard again just like the Yen is doing. I recommend you go to his blog site and read all that he has posted for the past several weeks about Gold before you “bet the farm” on going long Gold or shorting US stocks.

Joe if you are a plumber then you SHOULD NOT get involved in the stock market other than through a financial consultant. Better still keep your CASH as that is the most undervalued asset at the moment but is rising fast.

Certainly DON’T deploy anything more than about 20% of your savings if you absolutely HAVE TO.

However I get the impression that this may just be a hoax comment. Sorry if my ‘impression’ turns out to be wrong….in which case just follow advice of paras 1 & 2.

Is that you Gordon?

Japan holding up nicely…presumably because of the strong economy…lol

J

1820 here we come

http://stockcharts.com/h-sc/ui?s=$MID&p=D&st=2014-04-30&en=today&id=t83349776642&a=374805050&r=1416410988358&cmd=print

stay long phil!

Be nice…

A bottom will be here before we know it, and hopefully, with Phil’s help, we’re ALL going to ride it higher…

why be nice? why be anything? why not just BEEEEEEEE?

Elvis, your prose reminds me of the poetry of E.E. Dummings.

BBE, I’m not getting excited here, until we can get through the 2030 area first….

But why 1820?? 1820 would pretty much make my year, though… 😉

GEM hourly forecast has last gasp high 13:00 hour today est. Then down until Friday. will update later

Hi Peggy, thank you for this update. Is the high an important one or will we have 3 days correction and then moving higher next week ? Please e-mail at giupepe28@gmail.com shoud you have further interesting study material.

GEM forecast looks for another high 11/25.

davinny, a more hawkish tone given the significant $

strength would surprise me, unless the FED deem the pace of asset price increases needs to be moderated.

Yellen has warned twice already on areas of excessive

risk in markets.

The market has chosen to focus on what appears to be her

central view that overall asset prices are not in bubble

territory.

The FED do not have a great recent record on excessive

risk taking, as Bernanke’s now infamous assessment on

the risks in sub prime pre 2008 show.

elvis,

thanks for the concern but I am 100% in cash,

as mentioned last week.

You appear to consider me some uber bull

which is not the case as my posts clearly show.

The shares I usually trade are at levels that I can not

justify buying, that does not mean markets

cannot continue higher.

1820 is a huge call to make,

see where we close today on US markets.

I dont consider you at all Phil except for comic relief

JSE ALSI, safex confirmed topping today into C-leg Primary IV, still in a SPX leading phase. No worry Primary V due in a few weeks, will bring new JSE highs not necessarily anywhere else.

Positive global economy recovery data will bring real fear from withdrawal of crazy QE & direct interventions (market manipulations). Fear of very real inflation after years of equity fantasy land. Reversion to norm gonna be real too, underthrow may be even more time consuming to rectify.

Stick this for next new norm, I buy what people want, I buy gold & silver. Now.

Its another BTFD? The 12M forward PE estimate for SPX is still at around 16X, if interest rate continue to go lower… I start to wonder where this market gonna stop… 2200 – 2300? 😰

Imagine a world where “real” investors are the majority. Where these figments of fiction look for proven and sustainable fundamentals.

OK go laugh, go roll on the carpet. But just imagine what it would be like.

Some old people say that they remember that is how it used be, a long time ago. Before financial weapons of mass destruction.

pretty funny

the ptb are trying hard to train the sheeple about gold

latest gold smash timed with headline about swiss gold referendum losing

they’ll have to come up with a new reason …. real fast

gold positive soon

Mirror image Symmetry ?

This month reminds me of January into opex and then a down move. On looking at the CAC take the high in June and a lot of time symmetry has occurred from the high to lows/highs after that date and going backwards from that date.

The Oct low was the end Jan low and the high now matches the high end of Dec. So we go down for approx 2 weeks though a bradley is 3 weeks time. Bearish candle today similar to January as well.

http://bigcharts.marketwatch.com/advchart/frames/frames.asp?show=&insttype=Index&symb=FR:PX1&time=9&startdate=1%2F4%2F1999&enddate=1%2F29%2F2014&freq=1&compidx=aaaaa%3A0&comptemptext=&comp=none&ma=4&maval=50%2C100%2C200&uf=8&lf=4&lf2=2&lf3=32&type=4&style=320&size=4&timeFrameToggle=false&compareToToggle=false&indicatorsToggle=false&chartStyleToggle=false&state=10&x=22&y=11

To answer John Li, I went short again at the market close yesterday. And 100% short I am. However, I do see the strong points made by Phil, Vinnie and others on this board and how much risk involved being short, going against the CBs.

I believe that we are almost finished with the market rounding top, and overdue for a reversal. Still don’t see a strong case for the crash in 2014. 2015 would be more likely by my count.

I was happy with IWM this morning, but not anymore. We need a -2% off highs to have a better certainty that the swing high is in. Otherwise, this could be 7/1929 instead of 9/1929.

You trap yourself by thinking too much. Simply trade the trend at hand. Dow was down 60 today, roared back, front month calls made a killing ATM. Now if you sold your shorts in this AM blip of selling, you did good.

It is hard to argue against you, vinnie. It is true that the BTFD mentality and this rally probably is beyond anything any of us have ever witnessed. But the fact hurts. I had gone short then got stopped out again today. While I agree that BTFD is a short term winning strategy, I simply don’t have the heart or the guts to buy this market. I would rather stay in cash and go all in short again when the reversal is clearly in place. I don’t think there is much money left to be made staying long this market. While the risk of shorting is quite high, the reward would be spectacular if the technical indicators pain the correct picture, that the correction is imminent.

barry – 1820 to be found here

http://stockcharts.com/h-sc/ui?s=$NYUD&p=D&st=2014-06-23&en=2014-11-19&id=p91327081220&a=367854604&r=1416421483432&cmd=print

and here (actually the pattern measures to somewhere off the page – near 1750

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&st=2014-03-01&en=today&id=p75690417263&a=372609499&r=1416421819833&cmd=print

by end of the year maybe

The jaws of death. This is the most insane rally I have ever witnessed.

BBE,

Thanks for your charts. How quickly do you think your 1820 target will be achieved?

depends how much “topping” we continue to see – the bleeding is internal right now so we need to get blood in the water. a day or two at the most before this starts to look shabby to the faithful

“before this starts to look shabby to the faithful”

EXCELLENT phrase!!

I concur. I bought some more IWM puts on Monday. I think we are about to teach people what fear is. It has been absent from this market for way to long. The santa rally will likely be cancelled.

Fair enough….

Lets just get through that little shelf they built last week – the lows around 2030-2032 – first… Then we’ll see…

Rest assured, I hope it goes per your target, but we gotta get through 2030 before we get to 1820…..or 1750….

the ptb training of the sheeple continues

when V-A-A-L speaks, sheeple must listen

Stocks good, gold bad

What would Sean Connery do?

wear a toupee

LOL

A: Elvis Parsley. Q: What’s green and sings?

10 points if you can name the Connery movie Specie was referring to.

Zardoz (1974)

Peggy, I’m not for a minute going to pretend I have one iota of understanding of your GEM model…

But if it called in advance the high within an HOUR of the actual high, I’m on-board!

Thanks!

thanks Barry. be careful – you might start rotating to the Spiral!

last anchor for bears really 117.93 was the October high in 2007 or the onset of the last big bear party. Talking $/Y.

Have to respect the power of the BTFD mentality. Who is buying? The FED? They have bought the Dow all the way back, a 60 point swing. Short signal imho can’t be confirmed unless a decisive and clear reversal is in place, say 3% drop from the current high.

Close. It’s more likely BOJ buying the Dow. All they need to do is rotate between a few issues each week that are heaviest dollar weighted, and bingo, no drop possible. They’re buying with worthless paper, so they have unlimited resources.

This whole month feels like a CNBC pump and dump before expiration this Friday. Everyone completely ignoring glaring technical sell signals.

OK, so…..what’s it gonna be now? Another day, more consolidation before heading off the days lows and ending barely scratched. OPEX should generate a huge bullish ramp, not saying it will last, just the usual OPEX ramp. Being short keeps getting you burnt daily. If you day traded the AM drop today, kudos.

<>>

Might want to check RUT, Vinnie….

TZA – up 3.1% today… Not so “burnt”….

Thanks for noticing, Phil…

Rule of thumb – Buy the strong, Sell the weak…

Nothing wrong with having a small position in the RUT via IWM, the index is filled with high beta and suspect to swings. Play both sides.

1820 on the SPX will have to wait

for another day then.

A glimmer of light in the RUT price action

for those short.

you funny Phil – like I was calling for 1820 today

what a putz

Talked to a smart quant. he thinks the correction will be fast and deep. the amount of people short vol products is alarming. It will cause vol to spike severely once we get going.

There are equally large plays on VIX calls, your statement is without merit.

Look at Friday’s OPEX open interest on both sides, pretty equal.

Vinnie you are wrong. People are now net short vol through etfs for the first time in history.

Aware of that, it’s called irony which appears

to have passed you by.

The English(that’s me) do it so much better.

Less than 230 SPX points to go, just.

LOVE the British version of “Top Gear”!

The US version is just sad, compared to the Brits…. *big sigh*

The irony and sarcasm IS much, much better…

Yes, the actors in the British Top Gear are paid much more to have the opinions they flout. It is staged to hell and insults the intelligence of the viewer…..

imho

J

John what you said here was all you needed to say:

“So in line with readings on some other indicators, we are in the realm of the unprecedented.”

All the TA you’ve done for weeks, all the calls for a pullback, none of it matters when we are in uncharted territory. So you point the flashlight forward, and go in the direction the market gives you to trade.

today, that was down. So did you short?

On a Fed day? Are you kidding. Better to enjoy the day and do chores than play with fire. Down? The indexes barely got scratched.Tomorrow may be interesting.

2 Questions for gold miner longs here:

1. If SPX rallies into 2100+ territory, what stops gold stocks from falling deeper? Who needs gold when stocks make money and bring dividends?

2. If SPX crashes, with all that exposure and margin calls, what stops traders from throwing away everything, gold stocks included, and pushing this market lower?

Tuna, both those scenarios are potentially valid.

However, whilst we may still see a capitulation sellout from gold miners, there’ll be plenty of buyers nibbling too, so a quick rebound should ensue.

I’m long miners over the medium term, HUI to 1,000+ is my expectation, within a few years. Timing the exact bottom not a priority therefore.

Good luck.

Vinniesj

If you could be more condescending that would be great. Also, if you could be less specific in your put-downs that would be good. If you could impart less information when putting people down that would be the icing on the cake. No? Not possible right?

You said something a few days back which was something like “I just trade the trend, and move my stops up periodically”…….is that about right?

To me, that sounds like a hindsight-investor (e.g. “I bought the SPX ETF at 666 – didn’t you”) or someone that doesn’t make a living from this……and there is nothing wrong with either of those. The problem is in your unspecific, naive and arrogant posts. Be specific, impart something worthwhile, contribute…….but don’t just sit there and deride others. There are many on here that do not trade but they like to analyse and discuss cycles and academic/scientific possibilities potentially affecting human behaviour. You have to take their views with a pinch of salt if you are trading for a living – especially prop. If everything you read here makes you angry and derisive towards others, why spend time here?

Let me know when the batteries run out in your flashlight lmao. Or something useful like price levels you are watching to closeout your longs from 666.8……^^

imho

J

“If everything you read here makes you angry and derisive towards others, why spend time here?”

My conclusion would be that he likes being angry and derisive towards others.

Amen.

2 Questions for gold miner longs here:

1. If SPX rallies into 2100+ territory, what stops gold stocks from falling deeper? Who needs gold when stocks make money and bring dividends?

2. If SPX crashes, with all that exposure and margin calls, what stops traders from throwing away everything, gold stocks included, and pushing this market lower?

————————————————————-

I will give it a shot:

1. I am not sure I understand the question. Gold stocks and gold itself is quite a different thing. Gold is an inert useless metal that has historically been used as a store of “value” and arguably still is. A stock is a proxy for the sentiment or perception of value in a company – that is to say a company that issues a profit warning is suddenly worth say 30% less than it was at 4pm yesterday. How can this be? Either the market has overvalued the stock up until this instant, or it now undervalues the same company at this point in time versus a future outcome (say if the eventual reality of the profit warning was different to what was expected), The reason for being so simple, is that I am somewhat long gold miners now and over the past 3-4 months have been buying because I often play or bet on this *perception* of value that always swings between doom and euphoria. The gold mining sector is one of the absolute dogs of the universe, and it doesn’t take much for a spark to ignite in that environment. A few % movement due to phys gold price, oil price, interest rates, war – whatever it is will probably be powerful when all other sectors are bloated, overvalued etc. and this constantly erroneous perception of value changes. Who needs gold? I don’t know is the answer. I have never purchased physical gold other than in jewellery. It doesn’t make me feel safe. On my modest farm somewhere on the continent with access to all I need to survive I guess I feel safe even though this is not a theme I dwell on. gold has no use in a world where survival is everything, and I cannot use it as a currency today either. I am not criticising people with kilos of the stuff in their homes, everyone is different and who knows whether they are right or wrong or if that is even relevant. Whilst I see gold as useless in many ways, I also see *money* as a scam. It has no value unless everyone believes it has some. It can be (and currently is) devalued ferociously by the people that we thought were there to protect us and make us a cohesive society. We all know the loaf of bread cost 1 million DM etc….it’s just a scam.

2. No one can know whether gold stocks will or will not go down with other stocks at the current time. In my mind, I have seen examples of many different types of behaviour of gold stocks over the decades, and I do not try to interpret the “why” – because human perception is flawed. I will most likely think I “know” something and make a wrong decision in the future. I try to keep it simple. It comes back to point 1 and this constantly wrong perception or valuation of a stock, sector, commodity. Do you remember when Obama decided to release 60 million barrels of crude from reserves a few years back? WTI futures were down 8+% for a period of time…..all because 18 HOURS worth of crude oil usage was released into the market. 18 hours…..and the global supply of this material is suddenly worth almost 10% less than 5 minutes ago?

At the end of it all, we all have our own ways to see things, to make decisions – whether investing, debating, trading or believing in a god or evolution etc. . You have to take chances in life and take responsibility for your actions. Remember, prices go up because there is more buying interest than selling – i.e. that whatever the object is – it is still worth the asking price. As the price of one thing goes up and up and the other stays the same or falls…..you get closer to the point were the perception changes…usually fairly suddenly. If I see an Aventador at £100k and a Ford Focus at £15K I still want the former. If the price of the Aventador goes to £10 million and the price of the Ford goes to £8k, I will buy a Ford and so will many others. The price of the Ford goes up and the rest is what happens in every part of the market and world every day.

Apologies for the ramble.

J

Gold has been used as money for 1000s of years. It is a currency just like sea shells, large polished rocks, woven beads, carved sticks, or any other symbol of wealth that have societal belief. As a metal it is useful for its conductive properties, lack of corrosion, reflectivity (satellite coating). It also has value as jewelry and adornment in many cultures. Also, it has the appeal to the city investor who never gets to travel into the wild north or the Andes and gets some satisfaction from investing and studying about the miners (eg, viewership of reality TV shows about gold mining and people who never leave their apartment without a Louis Lamore novel; it is kind of a vicarious camping adventure).

It is worth as much per ounce as people are willing and able to afford and given mining costs which include capex, management, taxes, land management, environment and local land owner issues it could be argued that the current market price is about the sustainable price for ongoing supply being provided by existing and prospective mines (this could be untrue if a game changing tech like what fracking did to natural gas). Given the rapid and seemingly unprecedented tech advances in materials in the last decade it could well be that most non monetary, non jewelry uses for gold could decline much the way silver usage in photography was with electronic images.

My only interest in this sector is that historically it moves up dramatically every 10 to 20 years with 5 to 10 fold equity appreciation. This requires that the investor is an excellent trader and has a thorough knowledge of the sector so as to acquire the better miners. It has proved a good place for me to start investing because it has a lot of volatility and many commentators who apply tech analysis to it. It cost me dearly last year when it declined dramatically. Have learned from the experience and will only invest there with a proven strategy that has a “no loss greater that x percent” built into it. Thanks for all of the valuable posts on this site, and with a prudent combination of technical analysis and solunar/astro/gravitional/electromagnetic approach I am confident that success is guaranteed.

To reconcile the Vinnie side which says trade the market price as it is both up and down, the Elvis whip cream gas inspired technical swing trading, and the more long term approach I would say that each has value. My tech. right now is to trade short term moves in the market both up and down with the instrument chosen based upon the condition of the seasonals, solunar, and other useful indicators.

The U.S. dollar, the Euro, and the Yen, to name just three unbacked pieces of paper we use today on this planet to transact business, are NOT money. They are counterfeit. They are a fraud. Gold became money not because people think it’s pretty, and it has nothing in common with the other things you mentioned, such as seashells and woven beads. It did NOT become money because of “societal belief”.

Aristotle first described the five characteristics a good money should have: It must be 1) convenient, 2) consistent, 3) durable, 4) divisible, and 5) have value in and of itself (intrinsic value). Gold simply fits this correct definition of what a good money should be better than any other element on Earth, with silver being a close second, which is why gold and silver came to be used as money.

What most people regard as money today, things like the aforementioned U.S. dollar, Euro, and Yen, have no intrinsic value at all. That is why their value is continually falling, giving us something we should never have when we use a stable monetary unit (such as gold): inflation.

Inflation is the primary symptom of the destruction of the value of paper money. Inflation is NOT necessary for economic growth. In fact, it is anathema to economic growth. If we were still using gold as money today, the prices of goods and services would NOT be going up. The prices of goods and services go up because central banks are printing trillions of new currency units every year, thus massively devaluing each unit in existence. That can only occur when the monetary unit in question is fraudulent paper (or plastic) money, which is not backed by anything tangible and can thus being created at the whim of central bankers, in any amount they so desire. (98.5% of the currency we use today does not exist as physical bills or coins, so the trillions of new currency units they create each year do not even have to be printed. They are merely computer entries.)

The current monetary system is a Ponzi scheme, and as such its collapse is inevitable. I believe by 2022 everyone will be well aware of that fact, since a new monetary system will have already been established.

P.S. — Gold and silver are currently very, very cheap.

thanks for your thorough reply.

just because something is oversold (relative to what?) or noone wants something does not mean it absolutely has to go up. crashes happen from oversold conditions after all, also bear markets are healthy and can last long time especially after such fantastic gains that we enjoyed since late 90’s.

i get your point about everyone not wanting this asset, and it could be a good contrary play perhaps, with very limited amount of risk. But in the current environment, with the prevailing trend pointing we know where, i am just trying to understand what would stop #1 or #2 from playing out.

There is some history of gold stocks being a contra-play to general stocks–but history doesn’t offer guarantees.

You’re right, of course, that bear markets are healthy and can last a long time. The cyclical bear market (within the secular bull market) in the precious metals that we’ve seen since 2011 has been deep and cleansing. Now we’ve reached the point where sentiment in the sector is rock bottom, which is always a good time to be taking a hard look at the specific asset in question.

Believe me, I’m not married to any single asset class. I don’t for a second believe that gold is some kind of mystical talisman and everything else is crap. Gold became money because of its utility, simple as that, not because of some dubious magical relationship with the universe. But gold and silver are actual, real money, with no associated counterparty risk. In that way, they are unique in the world. Everything else we use as money today comes standard with built-in counterparty risks that few people understand. Do YOU want to own the currency of a bankrupt and corrupt government that enforces the use of that currency, essentially, at the barrel of a gun? I sure don’t. History shows that unbacked paper money always reaches its intrinsic value — zero. (Voltaire was the first I’m aware of to accurately describe this phenomenon, in 1729.)

Since 2001, for mathematical reasons, we have been in a secular precious metals bull market. That doesn’t mean that cyclical bear markets within secular bull markets can’t be deep and difficult to navigate, as I mentioned before, but we have to understand that we’re still in a secular precious metals bull. I know it may sound far-fetched, but the reason for that is the current financial system is reaching its mathematical endpoint. That is what Jeff at Greedometer.com is actually seeing when he talks about the exponential decay in the time between stock market crashes he discovered is occurring. Stock market crashes are symptoms of a much larger, underlying problem. They can be altered, warped out of their natural, fractal rhythm, but only for so long. We are now reaching the point where those who manipulate the system (and believe me, they do it very well) are losing their ability to continue to do so.

Part of what they do, to instill continued confidence in the stock market, the bond market, and unbacked paper money, is to continually suppress the prices of the precious metals, which are the only real money extant. People argue that they’re doing a lousy job of suppressing precious metals prices, since the price of gold, for example, has gone from $255 an ounce in 2001 to $1,200 an ounce today. But you can only manipulate the price of an asset in the direction it wishes to go, based on the underlying math, and that is what they’re doing.

I understand the price suppression mechanism very well, and a price rise from $255 an ounce to $1,200 an ounce over 13+ years is nothing. Yes, it’s the correct direction the gold prices want to be going, but the magnitude of the price rise is being powerfully managed, capped by some extremely creative sleight of hand. The price rise we’re going to see over the next 6-7 years, from $1,200 an ounce going forward, will absolutely dwarf the price rise we’ve seen over the past 13 years. And it’s quite possible that it doesn’t take that long for the price to normalize (meaning to reach the level where its price effectively balances worldwide debt levels). I find it likely that we have an exogenous event that causes the spectacular stock market crash that John has been predicting (he’s absolutely right, but the timing of these things is always tricky) and, concomitantly, an explosion in gold and silver prices that will make the uninitiated shake their heads in disbelief.

My specialty is monetary theory, so I understand very well what I’m talking about, but being a specialist in monetary theory only aids and abets what I do in the financial markets. In and of itself, it isn’t sufficient to make real money. My specific path has been calling market tops (I did so accurately with the financial stocks in late 2007, for example) and judiciously shorting the overvalued asset, and by being a specialist in the junior mining sector, specifically the gold and silver juniors. The precious metals juniors are the toughest, wildest sector you can possibly speculate in, but I’ve learned a lot over the years. My ability to navigate the sector allowed me to retire young, and I haven’t had a normal job in many years. Played properly, the sector can do the same for anyone.

All I can tell you is that I’ve never seen quality gold and silver mining companies selling at more depressed valuations than they were earlier this month. Could they get cheaper still? You bet they can. Am I waiting for that to occur? No way. The technicals and sentiment are looking more and more bullish for the precious metals and their related stocks and more and more bearish for the stock market, WHEN you know where to look. John does, and so do I.

Again thanks for the thorough reply.

Gold silver options are expiring soon (2 days). This bounce is very convenient to let the puts below 1180 to expire worthless. We shall see soon if the bear has any legs left.

IF miners are leading the way then they are at the 2008 bottom levels. gold and silver are not at those levels still. this tells me phys prices are about to catch up downstairs.

Stock market explodes to the upside while PM’s tank. Thats when i buy very small amount of quality miners for a speculative long term play.

last active upside pattern in $/Y completes around 118.3 (inclining triangle with base at 117). Else have a 2-4 wave elliott wave long term channel from the 2011 low putting the end of the fifth wave at around 118.

ES in keeping with its megaphone pattern since July has a major correction approx. every 2 months. 1 month down 1 month up. Rolling into that time window again.

GEM hourly forecast update – not as sure on the velocity times but the general pattern of up to 9:00 est hour (consolidation on either side of it) to down to close is expected. https://twitter.com/mjmateer/media

Whilst I agree with some of what D.J. writes, his reply relating to gold specifically is something that mirrors what economists and to a certain extent mainstream media is telling us. It is this “narrative” that I do not like which I feel stands in the way of keeping an open mind and reinforces certain misconceptions. Perhaps a point of discussion for another time.

To Big Tuna, the way that you ask your question suggests that you have already made up your mind as to what you feel will happen. I would like to see if you could provide some context as to why you are asking in that case because I think that my answer is too obtuse.

Are you looking to invest in gold miner equities? Or physical gold?

J

In fairness to you, J, I don’t watch television or read newspapers, so what the mainstream media says about this subject is something I wouldn’t know anything about, but I can tell you that most economists know absolutely nothing about monetary theory, so their opinion on things like gold is one I wouldn’t put much stock in. As far as I know, most economists view gold as an anachronism and far too “risky” to invest in (since they don’t understand it).

I hope my reply to Big Tuna sheds further light on how I view things.

i like to hear what others have to say during critical market moves. especially such as these that happen only once or twice per generation.

As I write this the Euro has fallen back to 125. On Daily charts this is not important but on Weekly charts this is important especially given the time of the Week. Last Week the Euro rallied and so far this week it has also rallied. Should the Euro find support at 125 this Thursday points to the potential for a significant two day rally that will end the second week of an ongoing weekly rally. Thus the next two days could see a strong rally in the Euro –and– a fall in US Stocks given the current intermarket relationships.

Yes no doubt in my mind John that major US indices are topping and that we have predominantly already entered a bear market for the majority of stocks.. Reminds me of that quote:

“Nobody rings a bell at the top”

The bad news out of Europe this morning has resulted in the Euro falling back to the 125 handle. That price looks to have held and the Euro is rallying. If so, then an intense Short Covering Rally in the Euro may be underway that lasts into late next week. This negative European news, with support at 125, points to an over sold Euro in this time frame. Given the current intermarket relationships means that an intense Profit Taking Decline in US stocks could also be underway. I do think that an Intermediate Swing lower in US stocks has begun that could be larger than normal given that the short covering rally in the Euro could be intense, but, that is all that I think is happening. I am still looking for “the top” in major US stock indexes to occur in the first half of January. However, I could be wrong and “the top” might be in….

You’re all over this, John. Many thanks for all that you do. I view your work is an invaluable asset.

Weaker HSBC China data, and Eurozone output

figures lower than expected (what a surprise, not).

Miners selling off hard.

The only longer term hope for much of the Eurozone

is a significantly weaker Euro.

At least the UK avoided that complete and utter fiasco

by not joining the single currency.

They don’t need hope.

The ECB will QE into gold.

Problems solved.

Sovereigns may default.

Economic activity will be lower. That’s reality.

Ordo liberalism.

It’s mankind’s best hope.

Allan, For Whom The Bell Tolls, is more poetic.

Hello for the beginners out there like me …

This guy has some nice fibs on the Dow and nice explanation ….

http://tinyurl.com/kfhtpc4

This was done Australian time yesterday..

important reversal day today?

stat of the day: SPY have not closed near/at the lows since Oct 22. will today be different? reminds me of roulette betting on red after black 20 times in a row.

USDJPY potentially shooting star candle in the making. blow off top?

that will weigh on risk sentiment.

It depends on what you define as a reversal.

There is a huge difference between a 2-4% pullback

before a strong run to year end, and the waterfall type falls

towards 1800 SPX as referenced by some.

Jegersmart and Betafish. A well articulated and eloquent narrative from each of you on the jist of a complicated subject. In the final analysis currency is not money.

http://blog.milesfranklin.com/gold-is-money-everything-else-is-credit-jp-morgan

Good article, eclectic. While I do believe that eventually we will have to have a new financial system, I’m no longer convinced the transition to that system will necessarily be a catastrophic one. I believe either one of two things will happen: a) those who control the central banks will continue to create unbacked paper currency units until we have worldwide hyperinflation, which would of course be horrific, or b) someone, possibly a group of countries including China and Russia, will have to back their paper currencies with something tangible, most likely gold. In that case, the U.S. dollar and dollar-based assets would suffer a massive drop in relative value, but we might not have a worldwide financial conflagration. The latter scenario is my preferred scenario, for obvious reasons.

Any thoughts that bitcoin is gov’t testing for a future new currency?

posting activity coming to a low here – sign of a top? everyone has given up!!!

megaphone hit and test in $/Y overnight – lower megaphone support 107.75 currently. Aligns with Elvis targets on ES.

after 10 days consecutively grinding higher on the day, i think we learned to wait for markets to trade for few hours or the close before coming to conclusions. huge support looms at 2028, and after a bounce we will form a H&S before the collapse finally comes. i don’t think there will be hard feelings to miss the top tick or few ES points

Instead of focusing on American Stocks being overbought it might be better in this time period to be focusing on the US Dollar being overbought and the currencies being oversold. Should an intense short covering rally break out in the currencies along with a profit taking decline in American stocks then a rally in Gold that “takes on a life of its own” may be starting as well. But none-the-less I don’t think that the top in US Stock indexes is in nor the bottom in Gold.

FX looks to be the key – 88 looks like a hard stop for $ index (multi year resistance) – gold and silver strong reversal day last Friday and $/Y today seem to confirm intermediate change in trend here

rising wedge reentry at 117.80 for $/Y – completes bearish overthrow – 75.6 to 119 move looks complete – expect ES to accelerate down upon re-entry.

Two news events should have sent the Euro to new lows but haven’t. The one news event was European and the other American (new claims). Both times the Euro was tested at 125 but held. This is rare but extremely important as it shows that the Euro is greatly over sold and the US Dollar is greatly over bought. This is a rare time for Small Specs to make some good but easy money for several days and end up being larger Small Specs at the end. Warning: Any Small Specs who are trying to use the highly leveraged futures markets to make their fortune should realize the most Small Specs fail because they have both eyes on the physical instead of one eye on the physical and the other eye on the US Dollar index futures.

wedge reentry around 117.53 – dividing line between bearish and bullish

Looks like you are correct. The daily December US Dollar index futures only closed above 88 twice in the past eleven days. Otherwise it has been trading sideways just beneath 88. Someone who has the capacity should post a chart of the US Dollar index showing that resistance along with over bought readings such as COT. I think the “action” is currently in the Currencies and secondarily in American stocks.

Pegasus, the answer to your question is price

action will confirm.

Anything before this is probabilities, estimation

and essentially guesswork.

Some prefer to term their methods as a system,

usually TA based, but it’s a bit like the Wizard of Oz,

there is nothing all powerful behind the curtain.

If there was you would amass wealth beyond your

wildest dreams within weeks.

We are all just estimating/guessing.

The difference being that some of us are aware of this.

crystal ball….

God knows for 20 days, you’ve been clambering about a pullback and you’re getting a small one so enjoy it. Here’s a bone for you. At 1:30PM EST Fed Pres Mester speaks and his is very hawkish, this will help your case, so be aware and trade the sudden drop if it happens. Don’t get too happy unless you close below SPX 2030.

appreciated

head and shoulders in $/Y on s-t – base 118 – targets 117 – bearish patterns mounting

Betafish and BBE

Thanks for your references to Zardoz. I was totally unaware of this movie. I will check it out.

I was referring to VAAL from the original Star Trek series.

The uninformed natives kept feeding a machine that controlled everything.

i liken it to the sheeple continuing to use fiat and feeding the ptb.

http://en.memory-alpha.org/wiki/Vaal

thought of that later – no vaal in Zardoz

but Connery wears a really great wig!

Why are you so intent on throwing shade on a film icon. Connery is the man!

BTFD!!! Easy peasy. Free money.

http://stockcharts.com/h-sc/ui?s=$NYUD&p=D&st=2014-06-23&en=today&id=t06652107982&a=367854604&r=1416496934473&cmd=print

Powerful reversal is that holds.

SPX above 2050 again atm.

Any dips being bought back continues.

calm before the tempest

Thats right Phil. ANY dips. No central bank will allow it to fall. How many times until you all accept this.

Peak belief in central banks by retail

Well… your pullback lasted 23 minutes. Philly Fed report was historic, and there goes any chance of a pullback now. When will you all give up?…..

I agree: If you just look large caps and nothing else, the price action is strong. Under the hood, things are really weak: http://goo.gl/b56jof

Maybe at SPX 2150, you will get a 2-3% pullback.

last week gold silver reversal, this week Yen reversal, stocks next hahahaha

stocks next? An you laugh? You’re getting slaughtered, another new high on the Dow today. Money pouring in crushing any dips.

vinnie, it continues, with some volatility,

until the perception that the US business cycle

is about to roll over.

Once it does and earnings begin to compress

no amount of FED intervention will prevent a rapid

equity de-rating.

Backend of Q2 2015 is most likely near the

peak, that’s how it looks to me atm, but staying

openminded is often the safest option.

I love that term, “equity de-rating”, BTW… 🙂

You might be right, but just curious… Why Q2 of next year?

Why not now? Or why not 2 years from now?

I have no idea either way, but just following my trading signals either way….

And for all I know, I could be in a losing trade here…

So far in this trade, just watching money slosh into my account one day, and sloshing out the next…

That said, it’s still on (and again, unless something drastic happens to the upside, it will be here for a bit) a sell signal, so that’s where I am…

As you said, trying to be open-minded about all possibilities here…

Thanks for your thoughts, Phil….

And just a thought….

I’m not a “fundamentals” guy, but…..

Assuming the US stock market actually reflects the US business cycle (debatable at this point), if the US business cycle is about to roll over – call it Q2 of 2015 – and the US stock market usually anticipates that by 4-6-8 months – which I believe makes sense, wouldn’t that be about………~now~??

Just thinking out-loud, and would appreciate your thoughts….

Thanks…

OK, mid 2015, I’ll buy that thesis. BUT…. this board since Nov 4th, calls for daily pullbacks, that NEVER happen. They REFUSE to accept that endless amounts of money control the rally.

http://stockcharts.com/h-sc/ui?s=XRT&p=D&yr=0&mn=5&dy=0&id=p59817489177&a=370502282&r=1416502392693&cmd=print

wow – someone wants a Santa breakout

bonds and retail cant both be right

and the cycles here are powerful and finishing up

http://stockcharts.com/h-sc/ui?s=$NYUD&p=D&st=2014-06-23&en=today&id=t99582887766&a=367854604&r=1416498453967&cmd=print

VO T ends today and the Money Flow T ends Monday

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&yr=0&mn=4&dy=0&id=p78274573543&a=368144488&r=1416503132897&cmd=print

Wasn’t there a false retail break out in aug/sep as well? a day or two more just like you said Yesterday.

this is how I’ll answer BS (You might want to get new initials! LOL!!!):

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

BBE,

I actually agree with you. I meant that retail tried to breakout in September. It was a false breakout. I think we should be close. I am not Phil.

I was just using irony – I know you agree with me BS! thanks

My answer to everything on this blog now is:

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

DJ, I respect your ability to have made money in the markets and thank you for sharing your insight into the gold miner sector. The subject I would like to address is that “gold is a barbarous relic” and this time it is different. The reason sea shells, large polished rocks, carved sticks, woven beads had utility as currency in times past was that they were rare ( only certain sea shells, rocks, sticks or beads; prepared by skilled weavers or craftspeople ) and readily identifiable by all members of the society who respected them as money. In the age of tech when tech savvy youths around the world are enamored with virtual world as much or more as they are the other one, it seems like bitcoin or something similar will appeal to them a lot more than physical gold or silver. There are some youtube videos offering young people an ounce of gold or a bitcoin of equal value and most chose the virtual currency. Also, what if a game changing tech innov. such as fracking did to nat gas arises and makes the avail of AG and AU more than today. Combine under 40 people being mostly interested in all things tech and virtual (there is a reason the gold and silver dealers only advertise in media for people in their golden years-Smithsonian Magazine, Fox News, etc.), and the fact that with robotics, new energy applications, better methods of excavation, etc. the cost of mining may be drastically reduced. So this time it may be different.

Wanna bet when the truth is discovered about what really makes up those bond funds that average folks (whatever age) are heavily invested in, and then truth meets up with redemption requests in a mutual fund industry that embraces “liquidity”, there might be some more than passing interest in relics. Or maybe just cyber wheelbarrows?

Barry,

Why not now? – that’s easier the answer.

The latest US Q earnings were with some exceptions very solid,

mean earnings increased nicely.

Outlooks are too strong to suggest an immediate turn.

Why Q2/Q3 2015 may be the peak, or very close to it.

That view is based on growing global growth headwinds,

combined with a stronger $.

Much of the Euro area is near recession, Russia, Brazil,

much of the Far East slowing, this will ultimately begin to

impact, and that is my best estimation of when this begins

to hit mean earnings.

The uber bulls see the current US cycle lasting another

2/3 years, while that is possible it also looks unrealistic.

The miscalculation that many bears have made is not

paying more attention to earnings – even allowing for

reduced expectations and multiple expansion.

Multiple expansion has been hugely helped by ZIRP,

and although QE has ended, ZIRP has not.

You can still have significant sell offs while the cycle

remains supportive, John’s minimum target of an 18%

decline could still have happened within a bull market.

With seasonality and the year end looming large that

now looks increasingly unlikely in 2014.

But for a new bear market, the perception needs to be

that the earnings cycle is about to turn.

I gave KGF, the UK listed home improvement retailer

as an example of a bear market in microcosm

caused as earnings expectations turned decisively

lower, KGF has large Eurozone exposure.

If subsequent data suggests a different outcome

then my view changes, that’s how I see it atm.

As mentioned previously a rapid sell off here would

really benefit me with current cash holdings,

but you can’t always get what you want,

as the song goes.

earnings have been a complete fiction from start to finish since 2000

from how they have been reported and calculated to creating higher earnings through debt driven buybacks

Hussman has written well and extensively on this.

So I say again:

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

BBE, Phil has repeated said he’s ~not~ long, he’s in cash….

Nothing wrong with that, and I would say that if shorting is not someone’s style, then being in cash right now makes complete sense….

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

LOL!

Thank you for your response…

All good points, Phil, and I appreciate the time it took to write that….

FWIW (to anyone), I’m not looking for a crash, or bear market or anything like that… I’m short because the probabilities – to me – look like being short is the way to be in the immediate future…

No special insight or price targets, just short until my trading system says be long…

At some point it will – at either higher or lower prices – and then I will reverse and go long…

I’m ~not~ making a market call, I’m trading a system, that’s worked pretty well in the past, but it does NOT pick the exact top, or bottom, and it has losses along the way too…

For those expecting top tick calls, or bottom tick calls, good luck with that…

They won’t be coming from me, but I’m sure you’ll find plenty of people willing to tell you they can, for a price….

Just trying to be clear here….

elvis,

like the great man himself who’s name you use,

I imagine you a little like Elvis towards the end of his

career, in those final concerts.

I trade individual shares only and do not go long

an index.

There are currently all of 2 LSE listed UKX constituents

that I may consider buying following recent price falls,

RMG and CNA, that’s it.

Sentiment on those companies is dire, but longer term

I like the risk/reward ratio, currently I hold neither.

So then:

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

$/Y and E/Y nice reversal candles on daily

Elvis should invest in the US co. CAG which makes Reddi-Wip.

I’M Ready!

Try applying some reasoning, rational and logic to

your views.

My cat Gump, not know for his intellect,

could press a button to churn out a tirade

of charts, meaningless imv.

you funny and your views remain unsupported wind

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

China growth slowing, European growth similar but moreso. US growth in a mirage, best to just look around there. eg todays existing home sales be a downsizing cascade due to invisible mirage? Who knows and he not telling.

Antifreeze passed to fallout land under counter (not Geiger) Who knew and made a cookie. Because no one is ever corrupt then easy to believe all can fly from this highest building by flapping arms. All together now, Jump! Flap! Come back this way. See Strawberry Field Forever.

spx today might be 24th straight day above 8dma with %R>88%

only 4 times in history

short term top 100% of the time

so far…..

statisticians would say that a sample size of 4 is far too small to derive any conclusions.

how do you define “short term top”? How much of a correction needs to follow in order for the “top” definition to apply?

Sample size is history of stock market/24 day segments.

the sample size if 4. There were 4 instances of this configuration. yes, they all turned out to be short term tops, but a sample size of 4 is too small to be statistically significant. Doesn’t matter that you looked at 50 years of data, or 50 days of data, you’re still dealing with a sample size of 4. You’re drawing conclusions based on the 4 times you found this particular configuration.

typo: sample size “is” 4.

I get it now:

http://moneyweek.com/hugh-hendry-interview-part-1/

http://wolfstreet.com/2014/11/17/1-6-trillion-in-defaults-coming-legend-says/

Defaults and rising rates in bondland.

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&st=2007-02-21&en=2007-10-15&id=t62106636486&a=375321856&r=1416512724093&cmd=print

07

http://stockcharts.com/h-sc/ui?s=$SPX&p=D&st=2014-03-31&en=2014-11-20&id=t62106636486&a=375321856&r=1416512724093&cmd=print

today

looking familiar Phil?

virtually identical wave counts

Funny you bring this up – $/y also back at its October 2007 candle adding to the analog

XRT looking perky,

signalling impending doom a couple of days ago

apparently.

AAPL looking strong.

CAN YOU READ PHIL OR ARE YOU JUST STOOPING TO plagiarizing MY PREVIOUS POST! ROFLMAO

banned by elvis

November 20, 2014

http://stockcharts.com/h-sc/ui?s=XRT&p=D&yr=0&mn=5&dy=0&id=p59817489177&a=370502282&r=1416502392693&cmd=print

wow – someone wants a Santa breakout

Reply

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

some quote systems show AAPL taking out that spike high on monday

others don’t

seems nothing matters

BBE – breathe man

friends don’t let friends serial post

READY WHIP! me no care

ban me again ELVIS!

I’d rather be irrational than suffer 2D lifeless fools…

…anywhere

or should I say:

STAY LONG PHIL!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!!

I hope today just ends your misery in thinking a pullback is even possible, it’s not, and will never happen for quite a long time. Even the RUT ramped higher, all indexes getting bought with both hands, piles of cash pouring in.

THIS IS A MUST READ FOR EVERONE:

http://finance.yahoo.com/news/after-two-years—relentless-rally–needs-a-new-story-to-keep-it-going-195633145.html

DOW, SPX record closes, DJT less than 0.5%

from a new ATM.

RUT up over 1%.

On a day when futures were nicely lower.

It does not look bearish to me.

Any dips bought back.

SPX 1820 has to wait another day,

getting further away.

Are you finally giving in to the tape and not dreams of a pullback?

John, I dont know about others, but I find Elvis tedious and boring. Not only has he no idea, he has no manners either.

He does your site no favors and brings the down both the enjoyment and credibility of coming here.

I now tend only to visit at weekends when he/she/it is back wherever they belong and isn’t posting.

Richard, not sure that is saying anything

particularly ground breaking.

This looks late cycle price action and

ZIRP is a dominate factor in forcing people

to risk assets, and remain there.

Even on the most bullish assessments further

multiple growth is limited.

Very few would take issue with any of that.

What it does not address are reasons for

the eventual break down of the bull market,

that’s the interesting bit imv.

It doesn’t direct any reason for a decline but that there are no more sound reasons for a continued rally. Its like today’s action in the Euro. Four times the Euro was smacked down to 125 but each time it failed to break through. This doesn’t mean an immediate rally in the Euro but it does mean that no further negative news is going to result in the Euro selling off. So all that is needed is some positive news such as an important person flapping his lips in the wind and up will go the Euro in an intense and parabolic short covering rally. Its the same for the DOW. All that is needed, when there is no good reason to rally, is some negative reason/news that will set off profit taking. None-the-less, I am still looking for “the top” in the DOW in January just like in 2007 and for many of the same reasons. I am also looking for more than an 18% correction and more like what happened from 2007 to 2009.

The article is showing all the fundamental reasons why American stocks have rallied so much over the past several years. The article is not looking for reasons to crash but for new fundamental reasons to continue the rally. If new fundamental reasons to rally further do not arise then what? Permanent sideways trading? Obviously, the article brings out the fact that a continued strong rally is not likely unless new powerful fundamental reason(s) surface.

the fundamental reason is the one fundamental reason that always drives prices up: Cash coming into the market. Can anyone predict how much money will flow INTO the US stock market tomorrow, next week, next month, next year? If you can do that, you would know how much longer this market will continue going up.

Except the top in 2007 was near 3/2007 not January, and then we rallied for another half year in 2007. Am I missing your point?

FWIW, this is exactly what I would expect — the market should have topped 3 days ago about 1M from the October bottom. Because of Bradley, we now make a double top. The next few days will determine if this is a Bradley high or low. If it is Bradley market low — indeed possible like in 7/1929, we can rally through December where we will revisit at the next two Bradleys. If it is a Bradley market high, it would surprise most in the forums as no one is really long term bear anymore. This means those in cash will begin shorting as we cascade downwards. We probably start slow and build up downward momentum in 2015 in this case.

Not knowing or caring about Bradley anything, I can readily say, how would you call it a bottom in any sense of the market? It’s ridiculous. All indexes are at RSI’s of 70 even closing in on 80. There is no time in market history where RSI’s have been so high without a massive snapback down move. BUT… there has never been BofJ having 1T in paper to buy US stocks daily. So it’s a Mexican Standoff, leaning towards the bulls, as evidenced by DAILY new highs. Bradley Turn Dates seem like another dose of hopium for you all here.

Kinda wishing there was an “Ignore” feature here….

Regardless, Bradley ~ain’t~ part of MY system, dude….

Please don’t make ill-informed generalities….

But one last quick question… Based on your last few posts, you seem to think we’re never going down, because CB’s will never let it go down…

Yet, you are exactly ~zero~ percent long this market, for both yourself and for your brother… Is that my understanding??

And if that’s right, why all the bold talk of the market never going down, because that seems to indicate exactly ~zero~ percent faith in your own statements??

Hmmmm, as I eat dinner. You don’t read well. I ran a call position for my brother closed only days ago and psoted that here, for the simple reason of not being a pig, and it’s not my money to risk any further. Large gains are only that, if you close a position. Till then they are nothing but risk. Your crew belly ached for a pullback since nov 1st, jesus man, the Dow has risen about 360 points since then. My brother caught most of it, as 17,350 was iron clad support, easy to put him front month ATM. You try to sound like you know shit,but you don’t.

Never mind…. I won’t bother you any more…

I think the Dow and SPX can go up in paltry amounts that equal about 1% more. No reason to play with fire anymore for now, just enjoy a huge gain on an easy trade for him. I would be short when all the indexes are screaming 80, as they almost are, on the RSI, seems like a low risk money maker. Feel better now?

Let the market rally to crazy highs till year end, then the week of Jan 5th, 2015, Obama tells Yellen to stop the intervention to make the incoming republicans look bad with a huge market slide. Think that’s political fairytale? Then you’re naive.

This is an excellent forum… thanks to John and a number of other posters. However, please spare us the theatrics. Imagine if everyone acted that way.

yeah, and we all used CAPITAL LETTERS and LOTS of EXCLAMATION POINTS!!!!!!!

I agree, let’s stick to talking about the markets, the economy, the world, but leave the screaming and shouting out of it.