My targets are derived from what occurred under similar circumstances in history. Therefore they are an average and actuals can stray some way from averages, so caution is warranted. Nonetheless, there are compelling reasons for why they may represent the best ‘guide’ going forward.

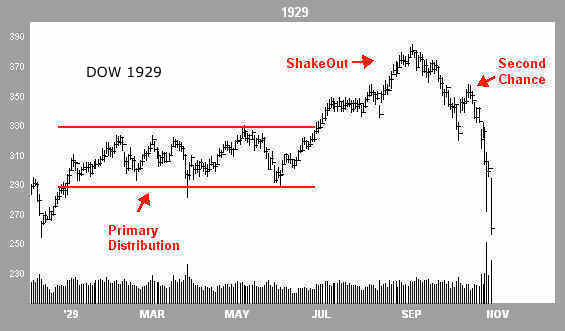

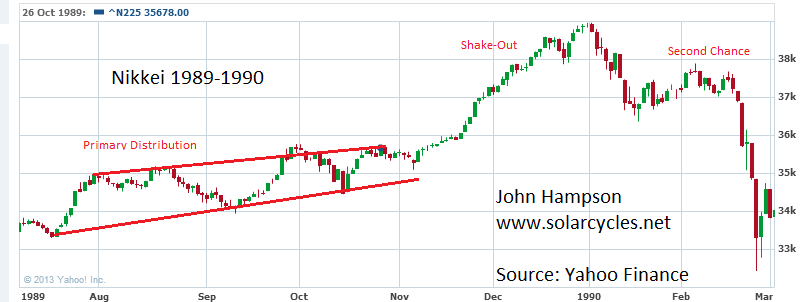

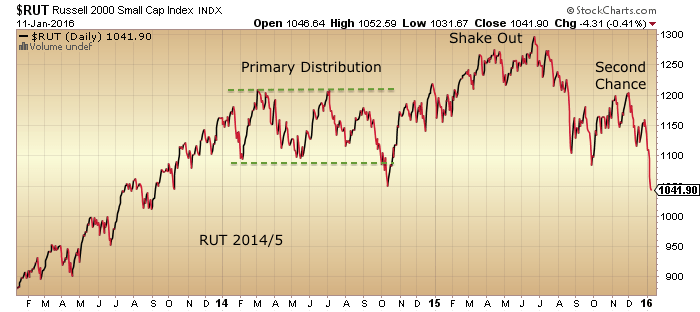

The equities mania into 2014/5 rivals the biggest manias of all time in terms of valuation, leverage, allocations and sentiment. Not only that but those biggest manias of all time share a similar topping pattern that may be playing out again.

Source: Financial-Spread-Betting

Think of similar waves of crowd psychology playing out each time. Post ‘second chance’, declines were swift and deep:

Dow 1929: 3 weeks 44% declines

Dow 1937: 8 weeks 38% declines

Dow 1968: 8 weeks 18% declines

Dow 1987: 2 weeks 34% declines

Nikkei 1989: 6 weeks 27% declines

Nasdaq 2000: 3 weeks 35% declines

SP500 2011: 2 weeks 18% declines

They average out at 30% declines over 4.5 weeks.

Continuing with history as our guide, we ought then to expect a subsequent slower partial retrace of those falls lasting around 4 months. So hard falls averaging 30% over several weeks followed by a 50%+ retrace of those falls averaging several months, before we tip conclusively into a fully fledged bear market, like this:

There is a seasonality to stock market peaks and troughs in a year, due to the seasonality of geomagnetism.

Based on this, we might look to around March/April 2016 as a bottom for the post second chance waterfall decline – if that is where we are in crowd psychology – followed by a slower retrace wave into mid-year. Remember, this is just a guide based on history and seasonality.

Biotech has been the mania within the mania, or poster boy. History suggests the full mania should be retraced.

Now the longer term. Cross referencing valuations with solar cycles and demographics we get this prediction:

Underlying source: DShort

Whilst gold should do this:

Making the 2011-2015 gold bear a cyclical bear within a secular gold bull 2000-2025 (or thereabouts).

The Dow-Gold ratio fits in like this:

And the Dow, something along these lines:

The waves and price points should not be taken too literally. The key point is that by demographics the developed world is set to follow Japan’s 1990s/2000s model: a long drawn out secular bear market. By solar cycles we should see a speculative mania peak in gold at the next solar maximum (circa 2025) together with a major stocks bottom.

However, this is all assuming the game remains ‘fair’ and central banks do not drastically distort market mechanisms, because it is a sure thing that they will respond with even more unorthodox and desperate tactics should an approximation of these forecasts play out.

Prior to the next solar max comes the next solar minimum, which historically has been the scene of bottoms, panics or crises. So circa 2020 we get a major low in equities before the deeper one of around 2025. In short, these may represent the ebbing and flowing of cyclical bears and bulls within an overall long term secular bear.

Underlying Source: Sergey Tarasov

By demographics, the future looks like this:

This suggests the global economy and stocks/housing markets will continue to struggle beyond 2025 and all the way out to mid-century. On such a long timescale, developments could feasibly make such predictions redundant.

Hope for a more positive outcome could be seeded in (1) major paradigm shifts from technological evolution (2) a shift to pro-active immigration policies in the major nations to alter demographics or (3) countries with positive demographics such as India and Brazil become much more dominant in the global economy to offset the others.

However, the kind of deflationary depression or long period of negligible growth predicted by demographics that may first come to pass historically gave rise to unrest and war. Additionally the world is forecast to be moving into another grand solar minimum, which also historically resulted in low/negative growth and war. Furthermore, the end game for debt is monetisation, which is where we now are. Recession, deflation and runaway debt is a poisonous mix.

Source: Michael Roscoe

In short, something much more devasting may be seeded in these themes and a long period of difficulty for the world could indeed be unfolding.

Photo source: National Geographic

Brilliant even-handed analysis as ever. Thanks John. If the game remains ‘fair’. Wonder what they’re going to be talking about in DAVOS next week.

Thanks Yogi

JH, can you please clarify the post-second chance for Nasdaq 2000?

“Nasdaq 2000: 3 weeks 35% declines”

My bad, I see that you did post a graph. Why was 4/2000 second chance when it is off the peak?

Hi John. I did post a chart previously showing a similar progression on the Nasdaq, but it doesn’t fit as well with the rest so I left it off this post.

The reason why I asked is because I suspect that China is now in the “long bear market” phase, given the drop of margin debt from 2.2T to 1.0T. That is not to say that the “long bear market” cannot be violent like in 2008, but the fuel will be corporate defaults rather than margin calls.

The biggest of your flash crashes (1929, 1990, 2000) were all in-line with demographic peaks, and since it is China’s demographic peak this time around, I suspect that China will set the pace.

Really insightful post, John. Thanks again. I agree with your logic, however given the rapid advance in tech of all kinds most of which have not yet been implemented (self driving this, ultra low energy that, etc) some of which involve novel materials that may replace current uses, could the next 10 years be less of a market down move and more of a sideways market in real terms all the while cost of energy and other input costs (labor, raw materials) staying tame? As far as AU being the lifeboat you may be right, however, tulips were a life boat once, as were goats in some places and times. One new development in mining technology (which is still very pick and shovel) could do to the AU price what modern ag has done to the cost of food.

Thanks Valley, and your ideas certainly possible.

Hi Valley,

What do you about the market tommorow and next week?

I think we will go down one more time and the turn will be next week mo/tuesday after that we will see a good rally..

Good luck..

oeps think again… haha

Very close to what I am thinking. Maybe bottom middle of next week. However, I will be considering staying long in case we retrace above 2000. So, PALS is negative Fri, Mon, Tues, Wed but price is way low. So for me it is a coin toss. Seasonally 10th, and 11th trading day of month is when 401K plans are buying mid month, so maybe sell off will be after Monday the 11th.

Thanks Valley,

Mahendra is bullish after the 20th:

We do strongly recommend taking aggressive positions during the last 63 hours of this cycle, or before the 20th of January, because on the 20th of January Mercury will rise in the east which is a positive astro move for the market.

Valley, check out the book, 4th Turning by Stauss and Howe. We are going to have a revolution over the next 10-15 years, hopefully peaceful. Even peaceful, it will be tough.

Just FYI, I am out of my SPX longs now – took the chance to close both in profit at 1910, so possibly not worth the risk at this point. We may go higher though, will have to wait and see….although I suspect we will go down take a look at 1850ish soon.

imho

J

Jeger, please may I ask, why are you expecting the market to decline to 1850 after such a strong move upwards today? Thx in advance.

Hi P

I should have defined “soon” I guess – I would expect within the next month:)

J

John H, wonderful wonderful analysis. This was the kind of thing I was hoping, nay EXPECTING, from your post. I need more time to go through it all but the different perspectives and their corresponding targets will help me to ‘follow’ the path of this bear.

Bravo!!

Thanks Purvez

BTW I don’t know if you did anything regarding the slow upload on the mobile platform, but I can confirm that things have improved significantly. I’ll keep monitoring for a while further and let you know if there is any residual problem. Thx for everything that you do for us.

Purvez – On previous comments section I wrote to ya.

There is always time to find opportunities to trade the market, but never enough opportunities to spend time with loved ones. You made the correct choice.

I’m still long from Monday and have been adding. Will stay long for awhile yet.

I didn’t do anything I don’t think, but good to hear

Geno thx for the thought. I’m glad to have had the opportunity to spend time with my mum.

At 90 she’s prone to repeating and for muddling things up but even that is quite delightful. Hope I’m half as good as her IF I ever get near that age.

Also very good to know your trade came off!! However with this schizophrenic market I would be inclined to grab my profits and run.

GL with your trades. I’ve just wound up as I have 2 days left here before returning home and have a round of H’byes to do still.

Sitting on hands, waiting to start layering on new short positions….

The day is off to a good start though… 😉

I like John’s analysis, but I believe this will prove to be the shake out phase when all is said and done. Perfect touch of the wave [4] triangle lower trend line, now the bounce for (D).

You’ve made a lot of good calls in the past, Alphahorn, so I shall keep it in mind.

It’s so very tempting to be short as hell right now, it’s taking all my willpower not to be long

oops that should have said, “it’s taking all my willpower, not to be short and to be long.”

Here are the daily swing bottoming charts I posted yesterday

Thanks geno

John, we think along very similar lines, using history as our guide. A pleasure to read your thoughts, many thanks.

For those fence-sitters (Alphahorn), this is a great read:

http://trader-moe.com/no-sitting-on-the-fence-here-youre-either-bullish-or-bearish/

There’s no reason a person can’t sit on the fence and play the daily swings. In fact, it’s prudent to do so. Why put all your eggs in one basket when there’s no need to?

Huh GM? I thought Alphahorn said he was bullish unless a particular level was taken out. Surely that’s just ‘good’ trading?

Fair point purvez, but it will be interesting to see who is right and who is wrong.

Oddly, I still am on the fence myself re new all time highs for US markets, it’s a possibility after a decline due to capital flows.

GM, I assume you are short the market? Otherwise, why call AH out? Please, do tell…

Appreciated GM

Welcome back John.

This is all very swish the new look site )

Thanks Phil!

I think we can get long Ferrari for 7-10% gain while risking only 3% with a 40.55 SL

John – Do you want us to keep comments geared toward indices or are individual stock postings okay with you?

Happy for the chat to be about whatever, within reason.

Gen

How do you come to that “buy zone” and the SL? Looks to me like it fell out of that “triangle”, didn’t backtest then did a bit of a bearflag thing and is now in limbo? Or are you guesstimating the end of the bear flag formation (if that is what it was) by the length of the “pole”? Or something else??:D

Thanks

J

Hey Jeger – sorry for the delay. The buz zone is calculated using Fib Support areas and time. I set the SL using the ATR.

Richard, regards Delta, may I ask what solution you are working off of?

First layer of shorts re-loaded toward the end of the day here…

Feel like I’ve f-up about all that I could have so far in 2016, and yet, it’s already been a really nice return so far this month…

Just reducing some exposure here, as well as looking for higher prices to build a larger short position… Just working my strategery to make a few bucks…..

Outstanding analysis, JH. I was one of those who thought (back in early October) that the Dow would break marginal new highs before turning down. You were right and I was wrong (although the SPX did get to within about 1% of the old high – an unusually steep retracement). You referenced a caveat that the game remain “fair” – no central bank intervention. I’ve suggested that the very reason for a bear market this time around would be a loss of faith in the Fed, as it has been the primary driver of the last four or five years. There is a psychic component to the coming events that needs to be appreciated. When there is extreme fear, traditional measures of technical analysis (momentum and sentiment) begin to fail – that is the only way a decline of the magnitude and speed predicted can happen. The markets may react violently in the short run to any Fed intervention, but in the end, I suspect the Fed will end up being the reason for the crash, not the deus ex machina savior. Any thoughts, JH?

Good comment…

That’s a reason I’m already starting my scale-up selling…

Ordinarily, I’d think I’m too early, starting at too low of a level…

My indicators are telling me we’re going higher shorter-term, but the truth is I’m thinking it’s just “safer” to err to the side of being short this market, and using a great deal of caution in having faith in any buy signal…

Just not convinced that signals will work out as they “should” in more normal times….

Another way of saying no cajones for this guy right here, I suppose…. hahaha

Makes sense to me. The mantra for the mania has been central bank policy trumps all, when they are in fact fairly impotent.

‘The mantra for the mania has been central bank policy trumps all, when they are in fact fairly impotent.’

Well put. They are in fact impotent. Investors should repeat that 10 times a minute until they grasp it. Even old Bluestar is writing about the Fed being ‘out of bullets’, when it always just a myth (he thinks they had talk powers and policy powers, both BS IMO).

Just human herding instinct caused yet another bubble.

Not sure of time zone here (8:28 pm pst)

Test 20:34 pst

Just FYI that I went long SPX again, I already have short exposure elsewhere so if anything it is a kind of hedge, which may morph into something else….

J

New blog top notch, tick tick…

15th Jan already, options expiring. Russell 2000 confirmed the bear 4 days ago and every day since. The chart fail patterns we have seen bring a need for new chapters in analysis. Is this very bad or less bad? Who knows? Its just bad, that’s all I can surmise so far.

Unless the Fed has interfered with the mass of the Higgs boson of course.

Now this makes very good straight forward sense to me…

http://www.investing.com/analysis/equity-market-musings-380046

One thing they are missing here comparing the 1940’s is we now we have massive debt loads in all sectors. That all needs to somehow wash out which could be nasty.

With the erudite and highly informative observations made now and for several years by our host, along with the highly unusual chart fail patterns that have recently come to pass, it is surely not clever to expect good things to happen from here as things stand. The basic premise of the financial system has been first corrupted (ref Clinton) then used for the personal gain (for the few). Then the core was broken (ref Lehman). The repair efforts have created a false wealth effect (we are only now told this was intentionally so) but more-so has enabled even more personal gain (for the few) with a pious belief that it serves the greater good to do so. No attempt to return to the basic premise of the system (e.g. undo Clinton) has been made. Therein lies the folly of it all. Now it loses the confidence of the major participants, which has been eroded by time. But the unworthy few will most certainly retain their status at a constantly elevating level. (All they need to do is read this blog, go short big time and buy gold big time)

Science fiction morphs into ugly facts in your face. So what you gonna do? Sit on the loo?

This behaviour has been wrong from the outset. The bastardised system will not fix itself.

Whilst I agree with much of what Peter_ says above, in fact the problem is much bigger.

This bubble has been expanded since the world went off ‘gold’ at Genoa in 1922 (enabling the Roaring 20s bubble).

It has enabled the great socialist expansion/experiment for nearly 100 years. The masses love it, so much free stuff!

But like JH, I have grave fears about what lies ahead as it bursts.

So hard to see the developed world avoiding wars, civil unrest and revolutionary impulses.

Hard to see that those impulses will be mis-directed by marxists-in-waiting toward the wealthy and the productive, rather than toward government itself, or the system.

In summary, FUBAR sums it up succinctly, and gold alone won’t save you: it’s physical location and your own will be crucial. This period could easily last for 40-60 years, before sense is restored.

I’m currently liking Iceland and Morocco for their values and culture.

Thanks Peter!

The last time the S&P 500 broke support like this was Thursday, September 6th of 2001.

911 happened the next Tuesday

Did the S&P breakdown cause 9/11 or did someone know it was going to happen? What a coincidence, especially if you look at airline stocks around that time lol….

J

“…did someone know it was going to happen?”

you’re pretty funny J

Here is one argument that it was a myth: http://www.911myths.com/html/put_options.html

Small longs on dax and US indices. Fall is overdone but I’m quite sure the top is in. Expecting a rebound of 4-5% before the falls continue into mid year.

I have no opinion either way, but it would be a helluva coincidence no?:)

J

Looks like Nicolas will never return again. Not a short term call, but it seems ATH is out of the picture.

jegersmart’s guy looks a litte spastic

barry’s guy looks mean

krish’s looks kinda like a pirate

john li’s looks uncertain

my guy looks kinda smart with his monocle

I ~am~ mean! LOL

Aaah you all need to beware my ‘guy’. Looks downright angry and hungry. That’s me: a pussycat in a tigers uniform. These artificial intelligence avatars are too damn clever!!

I told the little dude, a couple of months ago, that he was about to go on another “vacation”…

I’m sure he didn’t believe me… Oh well…

Sad to say, I could have traded this better as well…

Trying not to dwell on this, but if on Jan 1, I’d have closed my laptop, not looked at one single chart, and not made ~any~ changes to my portfolio, I’d be up over $100k from where I am today….

Just played golf every day and ignored this crap…. *big sigh*

As much as the market is down and near support, the VIX is really not responding. We are half of where volatility was on 8/2015! This shows the downside potential medium term even if we get a bounce now.

Well, it could be worse – for a couple of months last year if I had left my computers off WITHOUT any open positions I would have been better off……c’est la vie……

J

Well, the stock market is collapsing, but fortunately for me, I’ve hedged it by buying gold stocks….

Oh wait….

‘Wait’ will work Barry, patience may be required. Obviously as a short-term hedge I commiserate, and gold miners historically tend to get shaken about at these times, before hitting clear waters and a strong tail wind. (Low oil priced a real boon for the sector).

Hi GM;

It was kindof a joke, but as we all know, jokes are only funny if there’s some truth to them…

from what i can tell

the number of new lows are lagging the number from August

that would signal a likely short term bottom if they don’t expand a lot by the close

The big question is how will it open on Monday morning? Will there be a rescue over the weekend? Would you leave short positions open?

Hi Pulp,

you actually get an extra day, monday is a holiday

and the ptb are notorious for using long weekends to support the markets

publicly and not so much

I took 65% profits on short positions now as we approach the 1860 and 1820 support zones (on SPX), along with 50% of the rest of the puts. I have a scout long on Oil (CRU) after today’s crash – long Potash, Soybeans and Corn, Gold but slightly underwater after I took profit on the main tranches 2 days ago, and I have calls from 2020 to 2140 on SPX mostly Feb and a few March……at the moment these would seem more or less worthless….lol.

I would look at some of the refiners though, they look pretty weak and breaking down and I would have shorted them today but wanting to stay out whilst the market works out where from here. Once Crude gets going, many refiners shares will probably feel it.

I am more or less done so good weekend all!

J

Yeah, I’m not worried…. I’m sure that 1998 analogy is gonna kick in anyyyyyyy moment now, and we’re gonna roar off to new highs…..

Where are those guys anyway…. 😉

Regardless, would think we’ll see higher prices than where we are right now, at some point going forward, but jeez…. My TZA hedges were a lifesaver today, but I’m long crude, and at this rate, the gas stations will be ~paying us~ to fill our tanks by Spring….

The Dax still hasnt’ hit the August low.

I added some scout positions on QQQ and GDX as well, now I really am done for the week. All the best to you.

J

Covered about half my shorts, and am now back to net long…

Emotions aside, looks like a rally “from here” looks easier than a continued move lower…

To me, anyway… Clearly, not strong conviction here, but still, taking a stand..

[video src="https://pbs.twimg.com/tweet_video/CYx4TkeU0AAbeS1.mp4" /]

Chances of a bounce are elevated, thats not to say we wont go lower over the coming weeks. I am certainly not going short close to strong support….and haven’t as per earlier posts:)

J

John H, I was surprised that you expect stocks to bottom in 2025 which is likely to be a solar maximum, as I’d assumed stocks tended to rally into the maximums.

Are you expecting the manic rally to be in gold for the 202-2025 period?

My view: stocks hit a secular in 2020, but then gold and stocks rise together for many years, driven by the Western collapse (gold) and Eastern/Silk Belt advances.

I also expect the EZ to scrape through, with most of its sovereign debt gone, via default, or settled post-GOMO using official gold reserves. Small governments should remain, and reasonably open markets (ordo-liberal approach). The risk everywhere is totalitarian outcomes and war/civil war.

Thanks.

I second this view, with the caveat that if Nikkei 1990/2000 is the analog, Shanghai might be hitting bottoms in 2025. Global stocks would surely have recovered from their lows by 2025. Hussman suggests 0% returns, which if true, can be made by -50% and then +100% over the next 10 years, which means we are off our lows even if we go nowhere.

The q ratio chart in the post above shows there have been 3 solar maxima where stocks made bottoms and commodities/gold made a peak. Then by demographics I see us in a Japan style long secular bear, which fits with gold enjoying a long secular bull. Doesn’t mean we won’t get cyclical stocks bulls within that. So thats how I calculate it.

Thanks John.

It’s surprising that we have 3 maximums where stocks crash, and 5 where stocks are high.

But…16 and 17 could be compared to 23 and 24 in terms of the bubble bursting for stocks.

So maybe 18 and 25 will be similar too? As a gold owner, I hope so!

If it helps anyone, here’s a post I did with some charts on long-term gold miner cycles, and we appear to have a lengthy cycle up dead ahead:

http://screwtapefiles.blogspot.co.uk/2015/04/martin-armstrongs-tense.html

Also, fascinatingly, I found this chart last year, the writer has re-posted it only this week, and it seems to extrapolate the bottom in bond yields/shares (based on a cycle/mirror) to around-about….wait for it…2025.

http://www.marketanthropology.com/2016/01/equity-market-musings.html

It’s nice when a few different factors and views coincide, certainly gives one confidence one is on the right track. G.

The bounce from any support is quite normal. But normal is not often seen nowadays – correction – make that for some decades already. Now I am not sure that anything has ever been normal. But nonetheless things are appearing to be even less normal nowadays.

A few factors are slightly unfavorable toward any significant bounce here, viz: volumes still increasing, momentums still slowing, TRINs peaked a week ago, last new moon inversion, upcoming full moon bearish, DOW closed below 16000, plus failed ending diagonals not yet at their “normal” baselines for “normal” (i.e. not failing to give new high) behaviour.

But maybe a dismount into a hand stand will win a gold medal.

And now Caldaro comes to the party with target of 1100 for SPX “in a year or so”. Thats like getting the reels mixed up in the cinema and giving the kids a horror instead of a cartoon.

From crazy bull to crazy bear – poof!

yes, Caldaro’s approach sometimes misses the major turns. That’s because he goes with the most probable count based on his studies of using objective criteria to determine wave structure. I haven’t taken his course, but my guess is that he uses things like RSI, MACD, Stochs, etc. to objectify waves (based on statistical analysis of how waves have behaved in the past) and then creates the count from there. The problem is the outliers, the exceptions. His charts usually just has one count, sometimes recent price movement is market tentative. This works for smaller degree counting, but for large degree he posts the most probable count. There’s always the chance that one of the lesser probabilities will rear its ugly head, and the problem there is that it may take a while to confirm that lesser probability which is what happened in this case. Therein lies the problem with OEW.

posted this left translated cycle blog from 2011 about 2 weeks ago with SPX around 2060. today 1/15/2016 marks 22 weeks from the 8/24/2015 low. we now have a lower low. Spiral calling for an esf move to 2012-2040 in the next 2-4 weeks. SPIRAL has NAILED many of the short terms cycles of late.

http://smartmoneytracker.blogspot.com/2011/06/left-translated-cycles-are-bad-news.html

Long WE, all global indices approaching crucial support that needs to hold or all hell could break loose..

What are the chances that the bean counters launch a covert operation on Monday headed by the number one “baked bean” himself Mario Draghi, that sees follow through to the US Tuesday?

Why does my avatar looked befuddled???………….lol kinda fits that post.

I was hoping you’d leave Mr Draghi alone Allan!!

Here’s a view (to which I subscribe) about why the Euro-concept will destroy socialism and big banks too:

http://www.theguardian.com/commentisfree/2012/jun/26/robert-mundell-evil-genius-euro

When the time comes, you will be pleasantly surprised at the actions of the SRB and the ECB.

Meanwhile, leave Mario alone! 🙂

http://www.reuters.com/article/us-ecb-draghi-idUSKBN0O809P20150523

PALS SPX next week:

Tides: Low on Monday, rising Tuesday to Friday

Moon phase: Full Moon on 24th, Saturday; bullish Wednesday to Friday

Declination: Equator crossing 15th to North, bullish Tuesday to Friday

Distance: Perigee 15th, bearish all week as lunar distance is now increasing

Seasonals: Bearish all week post opex January

Planets: post Mercury conjunction 14th, was sell off due to this? Quickly rebounding is typical after deep sell off on or within days of this conjunction.

Summary: Was long and wrong last week. What will next week bring? Don’t know but hope (not a strategy) that SPX sell off will retrace back to the 50 day MA before falling further.

Hi Valley,

I was long and wrong also last week, not surprising as we use similar inputs. I was expecting a turn around 11th Jan. No real damage as FTSE was only 100 points below the low of 11th but it was a hairy ride. I am looking for a bounce this week.

One question:- I take increasing lunar distance to be positive and decreasing as negative. Less lunar effect at apogee, more at perigee. I was wondering why you have it the other way around.

Thanks,

Kerry

Hi Kerry, my research shows that if you buy 4 calendar days after apogee, and sell at the open of perigee or trading day before if on weekend, you gather much of the gains over the last 18 years. Greater lunar distance is cause of low energy, low tides. Closer lunar distance, higher energy, high tides. This energetic effect seems to have effect on equity market in US.

Thanks Valley, understood

Hi Kerry your cycle matches with danielcode second deviation (your 2.2 and 4.4) the bottom of 09 bottom of 2011 bottom now it took 3 attempts and it broke threw S&P 500 please watch

2016 the first 5 days

http://www.thedanielcode.com/display.php?nav=news

You can start at the 16 minute mark.

Cheers

Thanks Ricksbiz

The Hang Seng looks positively SCARY!… It’s pretty much sliced through ALL remaining significant support and let’s not forget where the 87 crash began.

Are you saying the 87 crash started from Hang Seng?

John, it obviously wasn’t the cause but it is where the big downward momentum began so it set the tone heading into European trading and then the US.

Hey Allan, Martin Armstrong has an offer for you in a recent post:

‘I can read a book on how to do brain surgery. Would you like to be my first patient?’

Lol, poor guy, must be under some serious stress.

Bankster injustice strikes again – http://tinyurl.com/j3m2zqr

No mention of the perps or their personal gains from illegal behaviour, instead the taxpayer is the perp yet again. Drug lords and terrorists got nothing on this hellhole of a oligarchic system.

John,

Just like to say that I love your new website, it looks clean, clear and concise. Great work

Mat

Thanks Mat!

One for purvez, John and anyone interested in a wide view, a site I discovered last year, but lost touch with, worthy of a regular read IMO:

http://www.marketanthropology.com/

PS My avatar is pretty much spot on for me and my mood, although my head is not triangular.

And its OK to be crooked, to dupe people & make money from it big time – its the American way, and you can now be brazen about it. Who of any importance actually cares anyway……….. http://tinyurl.com/z6c6l8e

The ongoing death of civilisation, evident in many Western countries.

Japan joins the bear brigade… http://barestbodkins.blogspot.co.za/

You’ve been a busy boy!

Its been a terribly lonely journey so far, but there are signs of overwhelming company with scant space.

GM – A few quotes from a very old book. Morocco or Iceland may not be far enough away. “Also, there will be signs in the sun and moon and stars, and on the earth anguish of nations not knowing the way out because of the roaring of the sea and its agitation. People will become faint out of fear and expectation of the things coming upon the inhabited earth, for the powers of the heavens will be shaken.” “They will throw their silver into the streets, and their gold will become abhorrent to them. Neither their gold or their silver will be able to save them…..”

Teach a man to fish and he will take all your rods and then all your silver and then all your gold so that you may eat well. Then he will take your house and charge fish for rent and hire out to you your own rods. And the circle of life will continue.

siggy, I’m thinking some farmland might be useful.

Time to focus on getting the most out of every day, as ‘normal times’ are soon to be consigned to history for a very long while I fear.

Some times Cycles make really really deep troughs….It’s hard to predict the end of the world isn’t it….because it only happens once. 🙂

GM, I’m looking forward to how Martin A is going to talk his way out of his 23k DOW or higher calls?………….AND not to mention his calls for gold to crash under $1k, just like he told everyone to avoid buying Au back in 1999 until it had ceashed under $200………DOH!

He’s sucked in soooooo many over the years. I too was one many years ago but eventually I saw through it 😉

He’s quite clever (sneaky) as he always hedges his bets, and then veers off onto the time aspect rather than price.

I’m guessing you won’t volunteer for his brain surgery training programme?

Lol, I don’t think so. As for sneaky, that’s one word. Cunning is another. He’s made a career out of it, not to mention millions of followers

JH is all over him as far cutting edge market analysis goes. MA just has one very very BIG trumpet thatt he likes to blow incessantly……..ABOUT FRICKEN EVERYTHING!

Valley – I got long last Monday too, and added on Wednesday and Friday. Positions aren’t too far underwater, but definitely didn’t time it very well. Should’ve stuck to my prediction of a bottom coming January 19-22

The arrows on the chart are my buys/sells since November 2015

My account is about 15% long right now. I like to keep my trades at 7-10%, so I’m a little overweight by getting in too early.

Question: Based on what technique have you forecast a turn by Jan 19-22 ? Thanks for an explanation. Best, Jaze

Thanks, Geno. There may be a big sell off Tuesday morning, or Wednesday morning according to my calculations. I am staying in until Friday for sure.

Hi Valley,

Did you short last week wednesday and do you stay short till friday before full moon?

I sold my AEX calls today ..

Good luck.

No, I was long last week and plan to remain long into this Friday.

Very nice calculation Valley I bought calls today on the AEX I hope I m not an early bird in this drop?

What do tou think of next week a rebound?

Until now the market repeats itsellf likeJan 2008 so if this is a guide this year will be a big rollercoaster.

PALS is bullish until Friday’s open, somewhat bullish until Friday’s close, and mixed next week. I don’t know if some news will happen this weekend that causes a big rally. Seems like early February may be the low of this sell off.

time 2 bounce. bulls at lowest level in years. left hand 22 week trough to trough 8/24 – 1/15 achieved lower lows. looking for 2040 spx before bradley turn date 2/5/16. http://www.zerohedge.com/news/2016-01-18/bulls-decade-low-oversold-bounce-imminent-jpm-repeats-sell-any-rips

Not trying to say you’re wrong, in fact you could very well be right and a good bounce could be coming right up. But taking a look at that link you posted previously regarding cycles it seems the 22 weeks from trough-to-trough is just the median estimate.

Quoting directly from

http://smartmoneytracker.blogspot.ca/2011/06/left-translated-cycles-are-bad-news.html?m=1

“Now in order to understand how a cycle is translated you first have to determine the average duration of the cycle. In our case we are going to focus on the intermediate degree cycle in the stock market. That cycle averages 20 to 25 weeks trough to trough. The median being 22 weeks.”

So this means the trough could potentially still be coming up anywhere in the next few weeks, according to Savage.

It all depends on where you decide the last daily cycle low (DCL) was. Most believe it was at the mid-November low, in which case we’re right in the timing band for a DCL to have hit on Friday. Savage believes it was the mid-December low which, if he’s correct, would have stocks headed lower for another 2 weeks, maybe longer. There are valid arguments for which date you choose to mark as the last DCL, so… flip a coin?

Savage had to delete his old blog, so wide of the mark so often.

He’s the antidote to CB printing.

Rather than trying to predict the future, these guys and certainly anyone trading should look at the risk-reward ratio and go with the flow. If you have a fairly deep correction with oversold levels and positive divergences which stops near long term support – the chances are quite good that there is some sort of bounce. How high the bounce no one knows, but there are targets to shoot for where price has found support, resistance and so on above.

These guys who try to predict the future through blogs and I assume through subscription services in some cases(?) are really just preying on people’s hopes – that someone will be found that can “see the future”. This will be a fruitless search as has been shown time and time again. Basically, everyone and every system is wrong quite often. To expect anything else is imbecilic imho. And just to be clear, I am not referring to anyone in particular here – I am talking in a general sense.

J

My problem is coding truisms like this. If it is indeed true, a computer would be able to handle this “going with the flow”. And yet for every example I see where stocks bounce at any oversold indicator, there is a counter example such as 1987 or 1929. The distribution might not be a coinflip — one can be right 4 times but be very wrong on the 5th time.

Every trade is a prediction of the future. When I see quotes that say not to predict, but to react, they usually really mean to follow some sort of a trend.

‘Every trade is a prediction of the future’ – I agree

John Li, whilst you may be right 4 times and VERY wrong the 5th time, provided you have ‘executed’ your trades with due diligence i.e. sensible stops to get out at and targets to take money off the table then surely your win ratio to lose ratio must improve. No?

In fact anyone who trades successfully MUST do that.

Charting is such sweet sorrow, but now it departs so that it may return maybe tomorrow.

Well, this is why I never speak with “certainty”. All I said was that that under the conditions specified above the “chances” of a bounce are elevated in my experience. I am wrong (at least in terms of getting stopped out) about 62.x% of the time over the last 12 months, but I never get it “very” wrong because I use stops – which I would recommend every trader does. If you look at historical charts back to 1929 or even 87 when I was a young teenager, I cananot say whether the patterns and/or behaviour was the same as they are since I have been trading (later 90’s). For example, I went long QQQ at 100.22 with a stop of 97.9. This is not because I am bullish, it is just that when price halts with oversold and divergent conditions my experience tells me it is not a time to go short unless support breaks on volume, this does not mean that a bounce is certain or of significant size, but because support was not violated there are market participants that are more likely to be buyers at a time like this. Even if for a short time…..Another time I could decide not to take the trade at all…..

Why would you want to try to make a computer do this? You have something better to do??:)

J

Not preaching any style, but computerized trading is what I do full time.

I mentioned the other day how this rebound(if you can call it that), looked totally differently on the intraday charts compared to previous rebounds of the last 7 years.

It keeps resonating within me something that John said over 12 months ago and that is that once the second chamce had come snd gone and the waterfall declines had begun, bounces would be short and shallow and fail to find any traction.

And that is exacly how this appears to me at present, like I said particularly in the intraday charts.

The BTFD appears to be well and truly dead and those playing the rebound trade could be in for much more than they bargained at some point.

It does indeed have that character at the moment Allan. Just one thing: in 2008’s waterfall declines there was a neg feedback loop with economic and corporate domino developments. Might need something similar here to seal the waterfall deal (problems coming to light).

Thanks John. Indeed something to seal the deal could come anytime.

That aside. This looks very very tempting. How cheap can this get??

http://stockcharts.com/h-sc/ui?s=%24PALL&p=W&yr=5&mn=0&dy=0&id=p42300613594

Indeed, this is a distinct possibility so please ensure that you are using stops at all times in any case.

J

Of course, the market is not going to make it easy in terms of stopping at support and bouncing so that everyone who wants to can get in and ride the wave – so again in this scenario there are only really 3 options available to us:

1. Go long

2. Go short

3. Stay out

In my experience, “waterfall declines” occur when there is catastrophic stress in the market, and/or fear due to that or other serious developments. It doesn’t happen out of thin air where everyone just decides one day to sell. So, from my point of view and experience, price action will dictate and either hold or break through support. If the 1850 and 1820 breaks on good volume I will be stopped out before that and I will normally wait to see whether the break is a fake – and then go from there. As a trader, I am not going to sit around and wait for 4-10 years hoping for waterfall declines to make some money:) – I try to make money whichever way the market seems to be going on a “swing basis”. That is to say I rarely have positions that are open for less than a few days, and quite often for weeks or months.

There are reasons why markets never go in a straight line, whether you decide to try to profit from this or not is up to the individual….

imho

J

A wise approach

I was out most of the day, but what a weak bounce, and the subsequent falls must be of concern to bulls.

I think we’re at that point now where everyone will sell due to a variety of fears. Down to 1700 ES within days maybe?

My query to the board today please: Any E-wavers (Peter_) like to show a chart of HUI long-term for me/us please? It’s broken a long-term support level today, even as gold holds up. I am sniffing capitulation again, possibly as the broad markets decline imminently. Time to deploy capital…..? How many capitulation can there be in a bear market?

Also, Allan, I have read and seen that at the gold bottom back in 99-2000, it was miners that lead gold upward. With miners falling, do you reckon they will drag gold back down, or is it a false break-down maybe? I feel the next month or two will see the bottom in both gold and its miners anyway, just pondering the moves that may lie ahead. One certainly needs patience in these gold miners, and in gold.

Gold miner index got bad apples dragging and distorting… http://barestbodkins.blogspot.co.za/

These are the better performing gold miners, with Harmony way out in front and wildly volatile.

1 Harmony

2 Sibanye

3 Goldfields

4 Anglogold

5 Agnico

GM as I have mentioned before my best leading indicator for gold, better even than the XAU or HUI is the ASX gold sector which is currentlly in a massive basing pattern with many individual miners already having broken upward months ago.

If it had only been a few miners that had moved I wouldn’t be so convinced that this was a base pattern and not a continuation pattern, however there are many many miners that have moved significantly off their lows and are in the beginning of bull moves.

The problem with the ASX gold ndx is that it is heavily weighted with a few majors that are currently holding it down as they have not quite shifted up gear yet, but it will break out of its base pattern.very soon once these begin to move as well.

Thanks Peter_ and Allan.

I will take my junior miner positions soon….I am expecting gold & its miners to have their final lows within 2 months, as equities have a final (weak) rally. I could be wrong and miss the bottom. We will see.

Mad as this sounds, we are heading towards 15,500ish on the DJIA before this thing reverses. However when it does reverse it will retrace a HUGE amount and MAY even challenge new ATH.

I’m back in Blightey but too tired to post a chart. Hope to do that sometime in the next day or so.

The chart requires 15370 or less to confirm the bear. SPX has now signed up to join with Europe on this project. We look for Nasdaq and Dow as essential partners to ensure success, but how can they refuse such an invitation? Once everyone has joined up there will be a preparation phase and possibly a delay waiting for promises, but the interest will increase and then we will be on our journey into the bowels of the dragon that must be slayed.

Peter_ according to the IG charting service the intraday low on the 24th August’15 was 15253. However since the drop to ‘whatever’ on 24th August was a 3 waver then all I am expecting is a Flat or Expanded Flat before it reverses. As it currently stands both the rise to the early Nov high and the drop from there are also 3 wavers. So at least on the DJIA the triangle interpretation that Alphahorn was talking about is still alive. However I believe the current down wave is ‘b’ of ‘B’ with another UP (‘c’ of ‘B’) to come AND THEN…. a final 5 waves down ‘C’ which will convince everybody that the Bear has arrived.

I know this is hard to follow without a picture so I’m hoping to have one soon.

CFD chart I presume. EW best applied to underlying, being the basis. Futures can also generate different highs and lows that can give conflicting counts at critical junctures. Best EW results (and all indicators) arise with instruments that are always enjoying high numbers of competing traders.

So far the failed ending diagonals (many indexes, many of which are quite imperfect) have played out. But with dramatic failures of these patterns where they constitute the entire 5th primary we are in uncharted territory where small chance exists that nothing will surprise. However I will eat your hat if we see any new ATH in at least the next 3 years.

Sorry but I’m holding on to my HAT for dear life. It’s gone miserably cold in Blightey and I am NOT giving up my hat to ANYONE FOR ANY REASON.

However I would not at this point rule out an ATH during this year. If it doesn’t happen by then then I suspect you’ll be spared from attempting to eat my hat.

Good read

http://www.evergreengavekal.com/for-what-its-worth-3/

This comments section is hard to find with the new design.

It’s the same as before isn’t it? I think it’s called ‘nested threads’?

What do you think is different out of interest?

The whole site has been redesigned for starters.

There seems no link to this comments section that is obvious.

I only found it as John put a link in a comment somewhere.

And so the Fed selloff continues with no sign of reversal……..they gambled and lost!

Always and ever impotent:

The gold and silver markets are the only markets I can think of where demand rises and prices get hammered. Not just plateau or slump….but get HAMMERED!….but that’s all just normal market behaviour right?……….

http://www.business-standard.com/article/markets/gold-import-bill-up-12-reaches-35-bn-in-2015-116011600181_1.html

Strange lights in the sky! Sell, panic!

http://www.telegraph.co.uk/news/science/space/12107960/Five-planets-to-align-in-spectacular-celestial-show.html

Some time in 2005 it last happened, wonder what the date was, and whether markets did anything unusual then?

Crash today maybe?

The Dax tested the August low this morning.

Watching the $USindex for imminent drop to kick start $gold

http://barestbodkins.blogspot.co.za/

Peter………..lol

Britain has produced the greatest number of comedy duos and comedians in history IMO

It appears that psychoanalgesia is best performed using the hypnoreflexogenous protocol. I think I should try that approach.

Finally all happening. Only thing missing: golds acceleration – coming next.

Yes John absolutely. As in 2001 it took a little while for gold to warm but once it did….well the rest is history!

I can’t help but think that if this gets bad, really bad, that US rates go negative. If that be the case then what will those “gold haters” say that over the years have rubbished gold for not paying a “dividend”?

Let’s see how they feel about gold when having to pay the banks to park their $$$$$$$!!!!!!

This is gonna be fun 😉

Hi John great site

With gold it seems to be following the property cycle (Philip J Anderson)

Gold reached a high at the bottom of the property cycle which was 4 years after stock market crash. 2011.

If this is so then around 2018 give or take a year gold should rally as the property cycle takes a breather.

Then it could go back down and as the second part of the property cycle will peak at 2025.

2025 gold will go up again.

Just a guess.

Here’s some stuff

http://www.phillipjanderson.com/videos/

Everyone seems to think the miners lead the metals; and I can’t argue with that assertion based on history. FWIW, I wanted to report my observation that on August 26/31 in 1976

when gold bottomed at circa $101, the miners bottomed at the same time. Correct me if I am

wrong, but I don’t see that the miners led the metal when a new bull phase began.

Speaking of targets, I set a target for this correction back on June 7th, see: See my post from June 7th here: https://alphahorn.wordpress.com/2015/06/07/weekend-update-139/

we are approaching my 1820 target now. Whether or not that level holds is the key to the next 18 months of trading, in my opinion. https://alphahorn.files.wordpress.com/2016/01/spx-daily10.png?w=640

I hate to be a party pooper here but the action since early Nov does NOT feel ‘waterfallish’. The 24th August action would be a much better fit.

All I am suggesting is that everyone keep open the possibility that we are near a ‘bottom’ with quite a BIG surge upwards.

At least on the DJIA it just looks like either a ‘Flat’ completing OR part of a Flat. The thing with ‘Flats’ is that they retrace ALL the way back to their origins.

Here(DJIA) and elsewhere I see a falling double zigzag after the diagonal so far, with this the last leg of it. Expecting baseline zone bounce, with most of those indices that show diagonals being beyond that point already. But not holding breath due to the abnormal (never been seen before) nature of the fail pattern across so many examples. My gut goes for 50% of the waterfall move from 1st Jan is now in.

Peter_ do you have a target for this bounce? Since I’m calling for a ‘Flat’ I can only say that it will come close to the recent highs although that is just ONE of the possible outcomes. It could of course carry on much further…..hence my call for a possible challenge to the ATH.

The ONLY thing that worries me about this decline….is that it’s not over. My trend line from the 13 Jan intraday low to the 15th Jan intraday low has not been violated and since this is an Ending Diagonal I’m expecting it to go beyond the trend line (a throw over).

FWIW: SPX 1900 then ranging to 1860 for some degree of indicator resets with upcoming full moon having a say for commence of next downleg. The delayed action of commercial selling will meet with the bounce expectations from the specs. The ATH I look for is with the volume for the upturn bringing the reconnect of mega bankster leverage for a few months to levitate all the dead cats in prep for the global funeral march into 2017. But no expectations of any sustainability above SPX 1900.

Thx Peter_ I could live with the first half of that scenario. I’m not much of a ‘long term’ guy. I tend to ‘look after the pennies’ and have found that the ‘pounds generally follow’.

As bearish as I am on the bigger picture I feel a bounce coming….a BIG bounce. The Davos World Econoimic Forum has a surprise or two up its sleeve I suspect.

Tom demark was on at noon today w/ Dow down 550 points and stated he thought we were at an interim low with a 5-8% reflex rally imminent then lower lows. we rallied 400 dow points after he was on. https://www.youtube.com/watch?v=hQE23n_hEm4

An “Intermediate” rally in Energies and Stocks is underway. If it last for longer than five trading days then it might have legs and be a Medium or Long Term rally.

Nic’s back, hello Nic!

Seems only a week or two ago you were predicting the same stuff, but from $35 oil?

Guess that weird system you advised JH to read about is to blame eh?

I think you’ve suffered (yet another) big credibility gap down.

Good call!

It wasn’t really a call was it, more of an observation of what was already happening, followed by an ‘if this, then that’. He’s not as confident as he was a few weeks back, for obvious reasons.

I would be very careful with the energy sector at this point, a lot of stresses building up there. If they start rallying without crude flying 4% in one day then the case would obviously be stronger, but I am staying away from that sector for now. I think we will see 20usd crude before the summer……either way, I have been trading CRU both ways a bit recently and although profit has been made I am not sure it has been worth the risk…..:)

I am keeping an eye on 5 refiners though, that could be an interesting short when the time comes…..

Good luck though as alays.

J

What about stocks? Which of the three options?

I think lower prices ahead but we go up and sideways for a week or two……I am looking for something around 2000 on SPX potentially…….

Just my 2 cent guess…..

J

I am looking for a meltdown today and maybe early tomorrow to mark tradable lows.

Have a hunch we rally into next Wednesday’s fed announcement, and then sell off. Low maybe first few days of February.

All certainly possible. Pre-FOMC rallies are common. However, I like to see more capitulation, rather than the weak activity yesterday.

If that is true the next Mercury will be a low again Mecury max elong west 6/2 ?

“theplanetstoday”.com has interactive planet positions. You can see Merc. position at any time in future.

I think we had some tradable lows just recently….

False break for $USindex it seems. Chart now untidy. Sleepwalkers sometimes bump into things.

Just gone short FTSE100 via 3x ETF, 40% position.

Probably just a day trade.

I see descending trendlines and lateral resistance on FTSE at this level, and also on ES.

Moe thinks a triangle before lower:

Hey GM, did you take some @%@%&*% profits at all or what? You could have retired a couple of days ago????:)

J

I got out of my shorts on 7th January jeger, I did report it here, I was still on holiday, think it was a 21% gain, having missed previous gains I felt happy closing the positions (a tad too early with hindsight).

The new position is now trapped, as it can only be traded during UK market hours. A sell-off before Monday’s open would be welcome.

I will retire when gold is subject to ECB GOMO in a few years!

Good to hear Gm. Good weekend to all.

J

Ok here are some ‘pictures’ to go along with the narrative I’ve been spouting. Bare with me on this one (…or not) because it does get convoluted.

The first one below shows the action since the August down wave. On that chart, I believe, that the late August low was wave A. The subsequent up to early Nov high is wave a of B. The next wave down from there is wave b of B. I’ve tried to break down this one further into it’s constituent parts.

http://postimg.org/image/fp2rj3ond/

The little blue square at the bottom right of the above chart I have then enlarged into the next one. That shows an Ending Diagonal with it’s trend line. However as you’ll notice the last down wave didn’t get near to the trend line which is RARE (and therefore makes it marginally ‘suspect’)

http://postimg.org/image/kgrcrr6wt/

The action since then and into this morning is clearly a ‘Leading Diagonal’ as shown by the red count.

The MAIN thing I’m trying to explain here is that wave B is itself made up of 3 huge waves. My REASON for saying that is that both wave a of B and b of B are in 3 waves.

So….what does that mean in terms of what may come next? I believe that we have a wave c of B to come which will reach the early Nov highs at least. Thereafter we’ll have the ‘waterfall’ wave which will be wave C down. Depending on whether wave c of B just reaches the Nov high OR it goes much higher we will then know whether wave C will just reach the August lows or go much lower. i.e. just a Flat or an Expanded Flat.

In the VERY NEAR TERM… since the red count is a Leading Diagonal then I’m expecting a drop to near the start of that wave i.e. towards the recent lows BUT NOT going past them.

If nothing else this exercise has highlighted to me the need for a better charting service!!

If anyone’s got any questions then please do ask.

Hehehe!! Please DON’T BARE with me. However, if you want, do BEAR with me.

Whilst methods of counting may differ, the compass needle indicates we are on the same planet.

Ugh!! The rules on this new site seem to be that if you post more than 1 chart then it goes into ‘awaiting moderation’. The previous one allowed 2.

So I’m going to split my post up. John H, please may I request that once the 2 posts are shown that you delete the composite post. Thanks and apologies for the extra work.

Ha!! it seems to have gone through.

as anticipated. we have hit 5% retracement from the 1.20.16 bottom. what a counter trend move in oil. managed to back money on $nflx put spreads today despite all the green

buying some NRG for my 12 month holdings. otherwise in cash going into huge earnings next week for amzn fb baba biib aapl

if we follow the 2008 road map (see northman trader) we may have a signficant retracement up to 2/5/16 bradley turn date and hit the 61.8% breakdown point of around 2000 on spx.

http://northmantrader.com/technical-charts/

PALS next week:

Mixed, no clear direction. Guess we rise into Wednesday Fed Meeting and sell off after.

Or will we keep rising till Feb 7?

Look at bradley and alphee

http://www.alphee.com/exe/srv_stock_dyn.exe?T4_NATAL_DATA_SEARCH_TOWN=&D3_NATAL_DATA_TOWNS=SPY+-+SPDR+Trust+Series+1%2C&B1=Calculate+Dynamic

Could be, thanks!

i think we rise until next bradley turn date of 2/5. w/ fang releasing, hopey changy in the market, counter trend 15% bounce in oil. and spiral targets 1995 on the futures contract in early feb. chinese new year 2/6/2016. year of the monkey

http://screencast.com/t/u7VIhpqw

Wedge to break Monday? Trend-line intact. But potential IHS bottom at 1860 (per Moe).

Good explanation here of why the dollar is likely to be squeezed higher (Eurodollars):

http://www.alhambrapartners.com/2016/01/21/tsunamis-runs-and-rubles/

It’ll collapse eventually, but first the big squeeze.

Hey GM

Most wioll be watching this, I know I am:) I have a half weight long from earlier at 1905 and a new one undeclared from 1858 (just fyi). I do believe we need to take a look at 2000-odd over the next week or so, but will set stops well in profit just in case.

Good luck all!

J

The USD is in a mega bear market since topping in 1985. For the last three decades it has been making lower highs and lower lows.

We have just made another lower hgh and double-top. Get ready for a collapse in the USD. The US is the most indebted nation in history and has massive unfunded liabilities.

Yes, agree re the mega-bear Allan, but let’s see what comes next, a higher high looks more likely for a year maybe.

What did you think of Snyder’s thoughts?

I see Delta points turning with the full moon and inversions bring a down market to new all time lows with the snow.

“I see Delta points turning with the full moon and inversions bring a down market to new all time lows with the snow.” – John Li

So lower than 666 on SPX? What time frame?

Obviously not Dow Jones Lows since inception. I am looking at 5 years as “all-time”, which would be true for stocks like FB that IPOed in 2012.

It seems https://solarcycles.net/portfolio/targets/ is now the best entry to this site ??

Remove Targets from that link and you have the new home page. The first picture on that home page is the latest post where the discussion will be held.

No that doesn’t work. It has to be as I said.

My short has a tight-ish stop, which I may loosen a little depending on Sunday night futures action.

It now seems to me that literally everyone has called the bottom, and that we’re going to bounce up to various levels.

Hmm, I’m not so sure.

Yet to see any panic, bulls still complacent.

Well, clearly it was some sort of bottom which is why shorts cover and go long. A tradeable bounce of 5-10% is very important to making money when trading:D How high we bounce is ofc anyone’s guess.

J

Just watched Star Wars online….zzzzzz, so dull.

A blast from the past….

https://solarcycles.net/2012/05/22/cycle-inversion/

Comment from Kent is interesting within that thread.

Night all.

Full moon: December 25th, market started crashing within 2 trading days.

New moon: January 10th, brief mall rally.

Full moon: tonight, rally on Friday, will it continue on Monday, or will inversion take it down, as per Kent’s comment in the link?

Hot for download – Making a Murderer – now threatening to murder Netflix shorts.

Snow melting, rain due before Fed.

SPX 1922.4 – mmmm

Viable, do you think?

https://pugsma.files.wordpress.com/2010/06/pug-sp-500-monthly-eod-1-15-161.jpg?w=1024&h=615

Assuming this happens, what would come after the C3 top in 2028 Peter_? Thanks.

Both counts disregard the probability of the recent failed primary 5th via full ending diagonal. Since that fail mode was echoed loudly across many major bourses I have adopted its message to be heralding systemic seismology with waterfall to A at pugsma C2 moving C2 towards the 9th planet.

2050 in next two weeks. Any thoughts?

I am looking for 2000-2040 and if seen I will probably start to layer out my calls and longs. We have some work to do to get there though!:)

J

Asia opened up, Fed moved rate announcement to Friday. Blizzard in NYC and Washington is over. Maybe ES will dig its way out of the 1900 level back to 2030 by Friday.

Valley is this your astrological opinion or personal opinion? Just above you were saying new lows by the first week of Feb?

Bloomberg still shows FOMC announcement on Wednesday

I guess that Friday announcement was incorrect. PALS is on the negative side this week. However, if the Fed meeting was changed, and my anticipation is market would sell off after the Fed meeting, I thought that this week might offer a good long opportunity. So I loaded up long at 1885 on the spx. I will stay in this position into Friday anyways as last few days of January into February first is usually bullish seasonally. Also, there are several high probability up moves in mid February, March, and into April 15. So if I get some up side, will switch back to PALS, yet if market stays below 1900 will stay fully invested on seasonals alone.

I did read some local Fed talk postponed — was it Atlanta? Regardless, that might have been what you saw.

My trading pal insists the Fed meeting announcement won’t be until Friday. Can’t find that online though.

well, looking at 2008 we are still in correlation if so we could go up till friday Jan 29 /feb 1 and after that sell off in 3 days to a higher low..

let’s see what will happen.

Now the pictures have labels when you scan them. Before, they didn’t. Now I can make sense of it.

Surely it would be better to have the labels showing all the time whether scanned or not !

Got you. I preferred the ‘hidden’ text as the site is now so simple. But anyone else got feedback?

John

I had the same problem without the text shown for about 30 seconds after you launched the new layout. However, if you are looking to attract new users it may be beneficial to put a bit more info on the home page…..

Imho

J

Thanks Jeger

It’s reasonably intuitive on my laptop, but it looks different – and not intuitive – using my tablet…

My introduction to your new format was via my tablet, and I never figured it out… I eventually just gave up, honestly…

After trying it again from my laptop, it took a minute, but was much easier to understand and navigate…

Thanks,

Barry

Ok thanks Barry

GM says:

January 22, 2016 at 10:34 pm

http://screencast.com/t/u7VIhpqw

Wedge to break Monday? Trend-line intact. But potential IHS bottom at 1860 (per Moe).

————————————-

Shake that Booty

I think that one of the best markets to “buy the dips”, for the next two years, will be American Natural Gas as it channel trades higher for 2016 and 2017.

Latter this year I will be looking to begin “buying the dips” in Crude and Silver. (Yes, that is correct, Allan, I did say Silver).

I suspect that not only are there long term fundamental changes in the –American– NG market but, also, there are fundamental near term changes too. I suspect that Americans are becoming “shut in-s” for many different reasons and that they are keeping their homes warmer than usual with some of the savings from low Gasoline prices which helps to explain the record NG “burn” rates in 2016 so far:

http://www.eia.gov/naturalgas/weekly/?src=email

US exports of NG to Mexico increasing radically. In 2017 USA expected to be a net exporter of NG for the first time since 1955:

https://www.eia.gov/dnav/ng/hist/n9132mx2m.htm

Everyone expecting the bounce to continue: therefore it fails. No more buyers, sellers now in control again, expecting bottom to be re-tested shortly.

Beta Gamma Delta Inversion with the snow and full moon to new lows the next new moon.

Lol, nice parody, =)

Well here is a big optimist I stick to his opinion new highs in April LOL..

If the energy sector rebounds we will see a major reversal..

http://www.mahendraprophecy.com/latest-news.php?id=1031

Mahendra Sharma, love him on Kitco.com videos, =)

FWIW – I added some long exposure to SPX at 1862, with a stop somewhat below the LOD – tighter than I usually like but lets see…..

J

I have covered all my stock shorts and I am looking to go long. Delta’s S+P 500 eighteen point Long Term points have been unusually accurate over the past year and its L-7 as a low is now due. It is possible that its six point Long Term rotation L-3 is also a low instead of a high and could be coming in with L-7.

At this time I think that long “American” Natural Gas is the best trade.

Same here. I am covering my shorts right now. Even though SPY is up, IBB is down quite a bit. My model doesn’t like FOMC meetings.

Thanks John for the link to this Mahendra fellow. I would just remember that no one can predict the future, no one. Whether what he is selling is useful or not, I don’t know – possibly, but I don’t think I am going to find out for the reason I stated….:) If he wasn’t so sure, and did use words like “should or could happen” I would actually be more inclined to take a look…..

Isaacson, just taking a look at the price action for NG – I don’t see a compelling reason to go long or short at this point. Reading your posts above I am not quite clear why going long is a good idea? Keeping homes warm….meh……but increasing exports to Mexico could be interesting to monitor, allowing for flat price change and of course also demand and what the supply/demand picture is in Mexico. I don’t normally trade too much NG, so if you have any further data that can be shared I would take a look.

J

In addition, one would need to consider the USD before taking a position in a commodity such as NG. My view on the USD is well known, up up and away for a year or so I reckon. Down with commodities therefore.

I closed my shorts this morning, my lie-in cost me dear, but still a handy 2% profit banked, so can’t grumble.

Currently unsure what will happen next, but nice to see gold doing OK.

Suspect a rise to FOMC, and a good shorting opportunity at that point.

well played, there is no such thing as a bad profitable trade in my book!

J

Absolutely.

Big swing from negative to positive today. Could be the start of a more sustained rise. Shorts all closed for me although I missed the majority of the drop.

You should be able to feel the effect of that consumer confidence tablet surging through your algorithm, unless it is another fake from the far east side.

The rally in the Canadian Dollar could be a signal from Mr. Market that the lows in the Energies is in. A rally in the Energies would increase the odds of a broad market rally in stocks.

The Industrial Metals, Copper and Silver, have broken out to the upside today. This is more evidence that the Bear Market in Commodities is over.

As of today I am going to consider that the Bear Market in Commodities is over and, therefor, to start “buying the dips” in Commodities.

This is also causing me to consider changing my opinion of Delta’s stocks six point L-3 as a low instead of a high. Both L-7 and L-3 are due in January and if they are both coming in together as lows then it increases the odds that Super Long Term point 7 is coming in early and stocks are on their way to new ATHs and beyond. This is a major change of opinion about the markets for me.

More correctly Richard, you made the exact same declaration a few weeks ago.

Back then oil was at c. $34, and subsequently plunged to $27/8.

So, let’s see if you have more luck this time?

I suspect you’ll be proven totally wrong once again, as I think industrial commodities have much lower to go.

Good luck.

NG could rally:

http://www.houstonchronicle.com/business/energy/article/Natural-gas-headed-up-6783289.php?t=55e8c33ce3

The USA is no where near self sufficiency in Energy:

http://peakoil.com/consumption/the-myth-of-us-self-sufficiency-in-crude-oil

This ‘bottom’ in ES looks very different to the previous two plunges, both of which had very swift recoveries, with plenty of ‘uumph’ behind them.

This time, no uumph, chopping around, unable to gain much headway to the upside.

A sign that the bulls are exhausted, and there are now more bears at these levels?

Hard to see ES 2000 being reached, maybe 1950 though.

I would say possibly no more bears right now, bulls still scared so indecision prevails:D

J

I am still a bear. I jest but still believe new swing lows. Got out of IBB at the 10am lows this AM, and will short in the next day or two again.

Oh I realize it could be confusing because I said “Same here” above.

I read “I have covered all my stock shorts…” and I tuned out the rest of the message when I said “Same here”.

This week PALS is mostly negative, and this continues into next week. Fed meeting acts as price magnet most times, which is why I went long Monday at lows. After Fed announcement, I will be lightening up my spy long position. Shorting so far below the 50 day moving average rarely pays off especially from late January until April 15.

April 15, tax day, in US acts as one of the most stable price magnets there is for the spy, regardless of selling in January or February, market tends to retrace into that day. That is another reason I want to buy dips, cause if market continues lower, I hope to be able to exit higher by that day.

Was surprised to read this valley. I thought you were day trading?

Surely you would sell the rips on down days (like in 2008 and 2000), and only start to buy the dips nearer April 15th? Hard to trade Feb and March based on something weeks and weeks away.

Good luck.

I focus on day trading the e mini. Yet in another account I swing trade the spy. Helps to have both short term and medium term perspective. If short term bet goes awry, exit. If medium term swing trade goes awry, remain in if seasonals are compelling in direction of trade.

From my perspective we have recently carved out some sort of bottom, obviously it is not clear whether it is a pause in the selling or an intermediate or long-term bottom, but personally my view is that one either trades these set ups on the long side or one stays out – going short near a support level is not good trade in my eyes. I dont know if the PALS system takes into account recent price action is the reason for mentioning this, if the system says “buy” then thats what you do? I thought this system was a short-term swing system – positions over a matter of a few to several days – not day trading?

In any case, all the very best of luck to all. FWIW, I am considering closing part of my SPX longs over the next hour or 3 if we cannot regain at least 1900 in that sort of timeframe – but it is going to be difficult to trade this week well I suspect….

J

I agree jeger, but if the game has changed (to bear) the risk/reward of shorting here with a tigh-ish stop could be attractive. Hence I think one needs to either have a view on that, or sit it out.

If I could trade US times (as opposed to only UK times) I would be shorting now. But maybe tomorrow will allow an entry. Likewise, gold has the potential to pop up to $1200, if it can creep over $1120ish. Much to be decided today/tomorrow.

I just closed my gold longs, think a pullback likely – can always reenter later.

J

Taking some profits on my IBB shorts from the open. Can always reenter later. 🙂

The geriatric force shall awaken to tea and waffle, meanwhile the rest of planet x will partake of a free vote where the early pollster results suggest a broken trampoline is imminent.

well the QQQ is not participating in this bounce today…..

The time has come to “buy the dips” in:

1st: American Natural Gas

2nd: American Heating Oil

3rd: West Texas Intermediate Crude.

And maybe, just maybe, the American S+P 500/DOW stock indexes.

Over the past several days, intra-day, has Copper been leading WTI Crude and, thus, the S+P 500/DOW stock indexes higher? Could it be that WTI Crude is not leading American stocks higher but that Dr. Copper is?

Who is the Leader of the Pack: Copper, Crude, or the Canadian Dollar?

I know, I know – its Dr Who

ES was at 1899 close on 22nd Jan, it’s 3 points higher now. Go bulls.

IBB is where the action is…it is down every day since Jan 22nd.

I agree that 1950 is possible — I think FOMC is quite dovish. More sunspots recently too.

Exited longs before Fed announcement on “strength”. Will reload tomorrow morning if mid 1800s is reached.

Right agian Valley do you think we have one more wave up above 1900 before turning down again?

Target 1930 next few days. Facebook had good earnings. McDonalds has all day breakfast.

Thanks that is what I need I kept my AEX calls the Oil rally caught me by surprise..

The bradley,spiral and Alphee are still up into next week (middle or end)

PALS suffers from far south lunar declination, and post perigee next week, seasonals are ok, and new moon lead up week is good usually. I am fairly certain we rally into Friday. I am doubtful about next week.

What a rollercoaster.. the Dax went from plus half a procent into minus 2,7pr..

This is the latest from Mahendra maybe it will be a positive guide..

Click to access 28_january_2016_trend_for_metals,_energy,_grains,_nifty,_stocks_&_rupee.pdf

Hi Valley sold my longs this morning I hope you will see your SP 1930.

I think B.O.J saved the day.

What are you plans for next week we have Sean spiral date Feb 5 Bradley Feb 3-5 and Mercury Feb 6

Good job, John. I also sold my long position mid morning today, and rolled to smaller position that expires next Friday.

Latest NYSE margin is out

http://www.nyxdata.com/nysedata/asp/factbook/viewer_edition.asp?mode=table&key=3153&category=8

What an annoying day. I am suffering from not waiting to lose money.

Hi John

I know what you mean – a tricky week. Stay safe and see what tomorrow brings.

J

Thanks! I was up a ton, wanted to let it ride, lost a ton, didn’t want to be down on the day, and then up four tons *if* I had not gotten out.

One of these days I will profit from a FOMC day whilst there is blood flowing through my veins.

John/Scott/et al , I follow Bradley quite a bit, and it did well in getting the Nikkei bottom in 1992 for example. But why all the excitement for the 2/5/16 date?

There are many Bradley dates, but that one is only significant for the middle terms.

http://bradleysiderograph.com/2016-turn-dates-sp500/

John Li

I look for the bradley dates on Time Price the Helio and Geo version

The last Helio version was Jan 19 .. bottom …well the 20th was a big bottom next top Feb 3 or 5

Or a bottom don’t now?

Has the look of a intermediate bottom

http://stockcharts.com/h-sc/ui?s=%24SPX&p=W&b=5&g=0&id=p25218494857

Can anyone spell “v-o-l-a-t-i-l-i-t-y”? I added a bit more SPX long exposure at 1877, again with stops fairly tight. I got stopped out of my QQQ long last night for a 0.2% profit……and closed my gold longs yesterday as shared here. Still long soy, corn, gdx and POT. and short UPS which looks like it will be stopped out at break even very soon…:)

J

VIX still pretty low, can go higher

i just closed my GDX longs, the price has been capped by a descending trrendline for some time and as there may be a reaction I will take the profit now. If it breaks out I will re-enter.

J

One tranche long QQQ @ 100.87 – close to support……(?)

J

Did you get filled? If so congrats. Futures are up due to Japan QE

Market thoughts: